Introduction

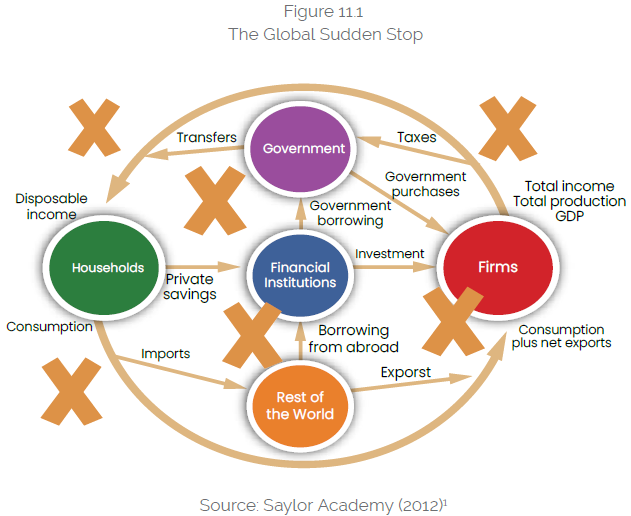

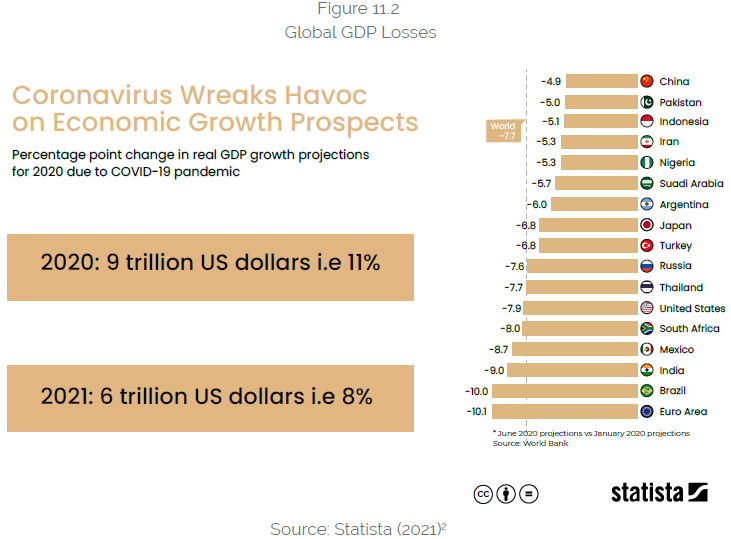

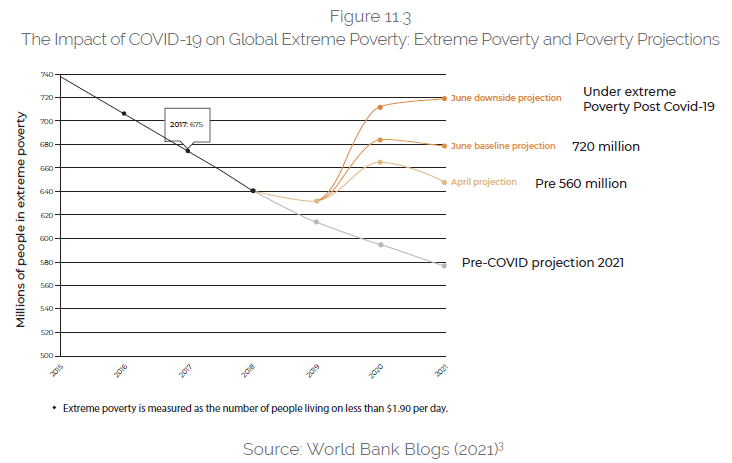

When the world is facing twin hazards: health and exacerbated economic uncertainties, desperation is surging to either come out or adjust to the new normal of COVID-19. The occurrence of Black Swans accompanied by Green Swan’ events in times of SDGs and technological disruptions in an intensely globalized multipolar world has turned uncertainties with ambiguities. Moreover, the interest-bearing financial system appears to have proven fragile again, with economies and businesses collapsing in new kinds of ways, exacerbating and repeating systemic and idiosyncratic risks. Figures 11.1 – 11.3 show the intensity of the economic upheavals amidst the pandemic.

Optimistically speaking, the pandemic-induced ambiguities have given way to another new normal: an opportunity to unify to work as one nation. The magic lies in collectively facing and making a new kind of financial risk-taking and management model. For this new undertaking, the Islamic economic paradigm of trade and risk sharing, as provided in Quran 2:275, could be a suitable framework. However, what seems apparent is that the current Islamic banking and finance practice have for 40 years missed the opportunity to brand and assert itself as a risk-sharing entity. The only lens that had been used to view Islamic banking and finance has been religiosity and Petro-dollars-driven paradigm. But the current dynamics present the opportunity for Islamic banking to fine-tune and reframe its practices according to its true spirit of risk sharing. Instead of replicating risk transfer and risk shifting, the recommended Version 2.0 of Islamic finance, awash in technology, has more to offer to fulfill its Maqasid al-Shari’a mandate in a new normal world, in what may be called as a halal tayyab way. The said paradigm shifts can be termed a ‘Quad-faced Paradigm Shift’ or ‘Quad-Paradigm,” with the following to offer:

i. The multipolar economic world; ii. Technological Disruption a.k.a. FinTech; iii. SDGs orientations; and iv. The ESG, Climate Change impacts/risks on top of the pandemic catastrophe.

The Multipolar Global Economy

It is being anticipated that from 2025 onwards China and a few other countries will emerge as a new economic block. The prerequisite for inclusion in this block would be the size, dynamism, dominance, and forwarding and backward linkages in trade and investment of a country. The primary rationale for this fast-developing consensus is the present unipolar regime that the US dominates. It is under ever-increasing debt stress exacerbated by the pandemic, and now doubts linger on its sustainability. This has led to a shift in global growth from developed to emerging market economies. Consequently, there would be a new global economic order with new drivers and sources of global trade and investment flow. Likewise, there would be a move from the international reserve currency structure from a unitary to a multicurrency regime. The trend towards this shift has started emerging already. Hong Kong, Pakistan, and other similar countries are leading the global growth, notably post-pandemic. The recent move by China and Pakistan to use local currencies for mutual trade is another piece of evidence. Moreover, these economies have been a significant source of cross-border mergers and acquisitions. As a result, over the years, the value of emerging market corporations has increased from US$123 billion to over US$500 billion by the end of 2020. Moreover, at the same time, their borrowing costs have been reduced. Hence, it will be the first time emerging markets could shift roles from borrowers to creditors.

Obstacles to the emergence of multiple growth poles

The emergence of multiple growth poles in the global economy has potential benefits, the most important of which is greater resilience of emerging and developing countries to survive shocks similar to what was triggered by the 2007/2008 crisis. Additionally, more significant trade and investment opportunities, out-of-the-box solutions by the emerging markets of the South and low-income developing countries, the game-changing dynamics of the China-Pakistan Economic Corridor (CPEC) under the One belt One Road (OBOR) initiative can be enormously helpful and effective in accelerating growth, development and poverty reduction in the post-pandemic world. There are, however, significant obstacles to overcome. These include, among other things, the architecture and governance of global finance. As is further evidenced by the pandemic-ridden economic situation, the former is woefully inadequate in providing the infrastructure for financial inclusion, progression, risk management, supervision, and regulation to a balanced growth of global finance. Moreover, the existing structures are non-representative and suffer from a high democratic deficit. They make policies, impose standards, codes of conduct, and international best practices on the rest of the world without adequately representing them.

Finally, one of the obstacles in the way of global economic recovery and the emergence of multiple growth poles is the critical structure of global finance, which is overwhelmingly dominated by debt-creating flows. As the 2008/09 financial crisis and fallouts of pandemic suggested, this structure is putting a great deal of burden and stress on the recovery and growth of the global economy. Perhaps, the stresses and financial shocks of recent months in global economies and post-pandemic breakdowns are signs of regime uncertainty, driven by a regime of interest rate based finance. The question arises whether there is such an alternative to the present dominant global financial system that could sit well the prospects of ‘Economic Multipolarity.’ Perhaps a more practical alternative would be to step back from targeting the interest rate mechanism and focus on the incentive structure that has rendered the interest rate-based debt financing such a destabilizing force in the global system. This can be accomplished by reorienting the system from relying on risk transfer to shifting it to risk sharing – the essence of Islamic finance.

Risk-sharing Finance Regime as an Alternative

Risk sharing – the essence of Islamic finance – has several desirable characteristics that endorse it as an ideal method of financing. Classical Arabic lexicons of the Quran define contracts of exchange (al-bay’) as contracts involving exchange of property rights in which there are expectations of gains and probability of losses. These sources define al-bay’ as “mubadalati al-maali bi al-maal.” In English, this can be rendered as “the exchange of one set of property rights claim for another.”

By entering exchange contracts, parties improve their welfare by exchanging the risks of economic undertakings, thus allowing division of labor and specialization. Since in verse 2:275, the contract of exchange (al-bay) appears first and the prohibition of riba after that, it can be argued that requiring contracts to be based on exchange constitutes a necessary condition and “no-riba” the sufficient condition of existence of an Islamic financial system. Together, these conditions constitute the organizing principle of that system. Therefore, the necessary condition (al-bay’) and sufficient condition (no riba) must be met for a contract to be considered Islamic. A careful consideration of all the permissible contracts that have reached us reveals them to be risk-sharing contracts. Therefore, the instruments designed to empower them financially must also be risk-sharing in nature.

Research has demonstrated sizeable potential welfare benefits of risk-sharing. However, analyses of the pre-crisis data show a fast-growing, debt-creating process in the global financial system with increasingly tenuous links with the growth of the real economy. Although equity portfolio and foreign direct investment flows were growing faster than debt-creating flows before the global crisis, their magnitudes were not significant enough to make a dent in the low level of risk sharing coefficients in the empirical studies. For example, one study showed that even in the fast-growing East Asia-10 countries, the coefficient of risk sharing was minimal, and some were negative (Indonesia and Malaysia). Increased debt-creating flows, a characteristic of financial globalization in the run-up of the 2007/2008 crises, do not improve risk sharing, as they either transfer or shift risk. More importantly, risk shifting or risk transfer financial transactions led global finance toward decoupling from actual sector activities with the growth of the former outpacing that of the latter by double-digit multiples, intensifying the risk of “sudden stops”. Thus, even the emergence of a multipolar global economy may not improve risk sharing across the globe. Perhaps the most important reason for this situation is the reliance on global finance on debt-creating flows.

Risk Sharing as ‘Value Preposition’ of Islamic Finance

It can be argued that the notion of risk sharing could be framed as the value proposition of Islamic finance. The system is predominantly equity-based, where actual savings are placed in the real sector, such as private or public projects. A key feature of the dynamics is that the Islamic financial system is protected from un-backed credit expansion since banks do not contract interest-bearing loans or create and destroy money. It is thus assumed that, in an Islamic bank, there will be a maturity match between deposits and investment (with no need for asset and liability management). Short-term deposits may finance short-term trade operations, with banks purchasing merchandise or raw materials and selling to other companies; liquidity is replenished as proceeds from sales operations are generated. For longer-term investment, longer-term funds are used. Hence, there is greater interdependence, and a close relationship between investment and deposit yields since banks primarily accept investments based on profit-loss sharing. The funds to the enterprise are also provided on the same basis.

The dynamics would also, in turn, translate into a coordinated asset/liability maturity structure, as well as value matching. In addition to the prospect of instantaneous equilibrium between the asset and liability sides of the financial/banking system, there would also be asset/ liability risk matching. While the individual financial institutions engaged in investment activities face the given risks, in and of themselves, these are not systemic and do not impact the overall stability of the financial system, as this system is immune to speculative mania, liquidity expansion, and instability of returns. The latter is assured via the same coordinated asset/liability value or maturity structure of the institutions. If asset prices decline, so will the liabilities, unlike what happens in a system dominated by interest-based debt contracts.

Apart from providing the above ingredients of financial resilience and stability, the risk-sharing-based Islamic finance would better serve financial inclusion, poverty reduction, and shared economic prosperity via efficient resource allocation. The objective of efficient resource allocation is central to the growth and stability of any financial system, allowing financial resources to receive their actual opportunity cost. Unfortunately, in an interest-based debt system, the financial resources appear not to be receiving their opportunity cost. This has led to the misallocation of financial resources through financial repression, a term coined in the 1970s. Risk sharing (Islamic finance) corrects this inefficiency. Repression occurs when the prices of resources do not reflect their opportunity cost. It was thought, in the 1970s, that developing countries suffered from financial repression since the governments and directed lending administered interest rates. Consequently, the price of financial resources did not reflect the actual opportunity cost of financing. As a result, the mantra that developing countries needed to “get the prices right” became the cornerstone of the financial liberalization movement later enshrined in the Washington Consensus. Liberalization meant removing barriers on prices of all resources to achieve their opportunity cost, defined as the subsequent best alternative use of a resource.

However, the opportunity cost of financial resources was an exception since its opportunity cost was not the subsequent best use of funds in the productive sector of the economy but the market rate of interest. Hence a distortion in the use of financial resources was created because of what James Tobin termed “deviation between market valuation of capital and its replacement cost.” Tobin further argued that this deviation is policy-induced since the monetary policy had a significant impact on the market rate of interest, meaning that, just as in developing countries, the market rate of interest in advanced economies was also administered, leading to financial repression.

The phenomenon of financial repression created a wedge between return to equity, reflecting the rate of return to productive activities and the rate of interest. Islamic finance avoids this inefficiency, given that the rate of return to finance would be the real sector-driven where financial resources are ultimately deployed. Immediately, the system renders a tight coupling between the financial and the real sectors, and the financial sector is found fulfilling its real aim, i.e., serving the real sector. It will hence be the returns to the real sector driving the economic outcomes. In this sense, Islamic finance is genuine financial liberalization. Data reveals that, globally, the average rate of return to the real sector is about 15% to 20%, a sizable multiple of the rate of interest ranging from negative to zero to 5-7 percent.

Given the importance of credit in the current financial and economic model, if credit supply is constrained by increasing its price, i.e., increasing interest rates, then a reverse of the above dynamics is achieved. High-interest rates lower investments, which lowers consumption, leading to a build-up in inventories and lowering growth in national output. The fallout is an increase in unemployment. Suppose the decline in employment is more pronounced, consumption and investment decline further, affecting the national output. If this decline continues for more than two consecutive quarters, then an economic recession is upon us. The dynamics help recall Keynes’s criticism of capitalism. In the article published in Economic Journal Symposium in 1932 written by Keynes, he explicitly associated two “evils” to capitalism. First is capitalism’s inability to create full employment, and second is its ability to create highly skewed income and wealth distributions, both of which he attributed to the interest rate as “the villain of the piece.”

It can be observed that the economic functioning will be in complete contrast if the same is driven by the rate of returns to the real sector. The one-to-one mapping of both the natural and financial sectors would increase investments, consumption, employment, and hence economic growth in direct proportion with the increase in the returns to the real sector. As a result, credit growth is tied closely to the expected growth rate of the real economy. Equilibrium in an Islamic economy thus structured will be stable, and the rate of return to the financial sector will be fully aligned with the profit rate in the real sector of the economy.

Multiple influential scholars, in the past, proposed reforms that would abolish the current financial system and replace it with an equity-based investment system. Among the most celebrated proposals along these lines was the plan formulated in the University of Chicago which called for 100% reserve money and an equity-based investment system. Irving Fisher claimed the following advantages for this plan: (i) Much better control of a significant source of business cycle fluctuations, sudden increases, and contractions of bank credit and the supply of bank-created money (ii) Complete elimination of bank runs. (iii) Dramatic reduction of the (net) public debt (iv) Dramatic reduction of private debt, as money creation no longer requires simultaneous debt creation.

A recent IMF paper titled “The Chicago Plan Revisited” studied the claims made by Fisher and others in favour of the Chicago Plan’. By embedding a comprehensive and carefully calibrated banking system model in a DSGE model of the US economy, they found robust support for all of the claims made supporting the proposed plan. Moreover, others have also proposed similar lines suggesting “limited purpose banking,” which would essentially transform all financial intermediaries with limited liability into mutual fund companies, with a single regulatory agency taking care of the regulatory and supervisory roles. Such banking would maintain a close link between the real and the financial sector, where the former will drive the latter.

It is often claimed that risk sharing, or Islamic finance, increases risks in the economy. However, there appears to be a conceptual confusion in cognition of the justification for finance. If finance is conceived as intermediating and facilitating the link between the demand for finance emanating from the real sector and the supply of finance, then there must be a close link between the fundamental and financial sectors of the economy. In this case, risks are taken in the real sector. The modality can be risk sharing, risk transfer, or risk shifting when it comes to financing.

However, the overall risk of the activity seeking financing does not increase. The exception is when finance is decoupled from actual sector activities during the run-up to the recent crisis. For several years during the 1990s, observers, including Hans Tietmeyer, the then President of Bundesbank, warned in international fora that “financial decoupling” was increasing the risks in global finance.

The continuation of a debt-based financing regime will not necessarily allow the benefits of emerging multipolarity to accrue to the world economy. However, the new system can be more effective with a new regime of financing. Indications are that almost all emerging countries in Asia are actively considering risk sharing via Islamic finance as a possible alternative. Quite a few are leveraging Malaysia’s first-mover status in education, workforce training, and instrument innovation in Islamic finance to introduce their brand of the risk-sharing method of financing. If these efforts succeed, the benefits of emerging multiple growth centers will be buttressed further with more excellent stability and resilience in supporting financial transactions through enhanced risk sharing. Even now, risk sharing could be an effective alternative to the debt-based ways and means of helping European countries facing sovereign debt crises. For example, Eurozone could issue long-term securities with payoffs based on the GDP performance in these countries. Similarly, China could buy Italian GDP-based securities rather than the consideration reportedly being given to purchasing Italian debt. This type of risk-sharing instrument has been proposed by some analysts for some time now.

Another suggestion has been that central banks purchase equity shares to stabilize the equity markets. While the modern time potent example is Silicon Valley, USA, come COVID-19, another fresh round of discussion is happening in Europe to resort to risk-sharing based finance. The same in the form of a public-private partnership (PPP) equity Sukuk or a European pandemic equity fund (EPEF), all citizens would participate in the common risks and potential rewards of broad-based participation in Europe’s industry post-crisis. This would be akin to a pan-European sovereign wealth fund of hopefully substantial proportions. Perhaps the present pandemic intensified regime uncertainty has created a valuable opportunity to seek alternatives to the debt-based finance regime, offering new normal solutions in new normal times and reaping the desired benefits of multipolarity. The same holds for the consideration of the second form of the overall Quad Paradigm Shift.

The Significance of Financial Technology for a New Age FinTech Islamic/ Halal Finance

In recent times, the impact of globalization and financial innovation has swept through the world in magnitude unprecedentedly, altering the very fabric of financial and economic behaviour. Automation and mechanization have already disrupted the traditional financial means to meet ends. The same carries roots to societies’ overall mental, behavioural, and social fabric shifts, as supported by Figure 11.4. It is not easy to imagine a world without the Internet or mobile devices that are now central to daily routines. Consequently, the digital disruption/revolution has brought a paradigm shift, transforming how customers access financial products and services. This has not only created user flexibility but also with it reduced transaction costs. The flexibilities that have consequently called time on the traditional ‘business as usual approaches’ result from the intersection and constant penetration of technology-driven finance. This could be termed as the ‘new age innovative//automated financial order’– it is called FinTech. World Bank (2016) predicts that automation is threatening jobs by, for example, by 69%, 77%, and 85% in India, China, and Ethiopia, respectively.

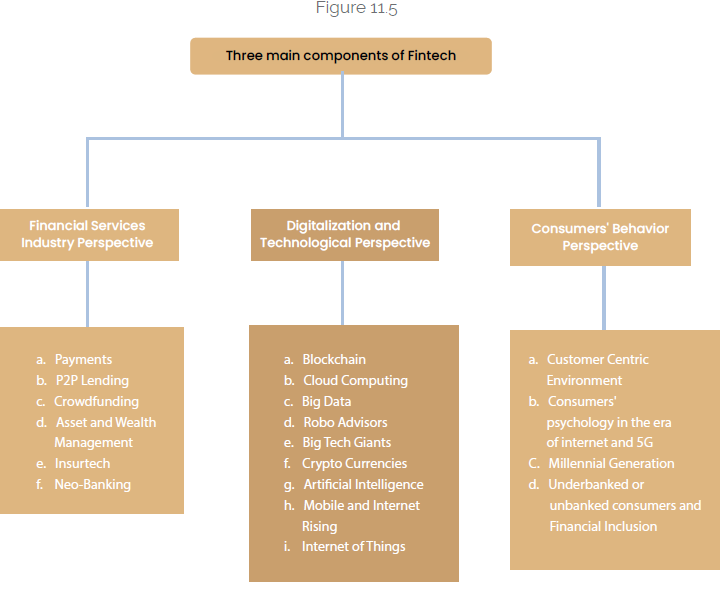

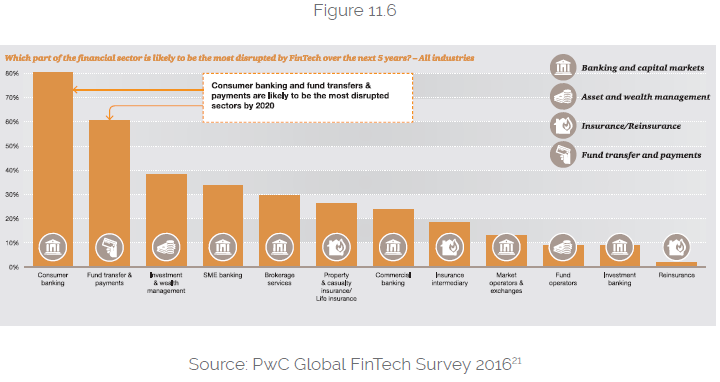

As such, FinTech and Islamic FinTech are gaining significant momentum and disrupting the traditional value chain. Funding of Islamic FinTech start-ups more than doubled in 2018/19, reaching over $12b. If technology-driven financial innovation is set to lead the fundamental transformations in economic behaviour/growth, not only resorting to novel and adaptive marketplaces but understanding and implementing the same as an ecosystem is crucial. Figure 11.5 below highlights the main ecosystem components of the FinTech financial sector.

“If technology-driven financial innovation is set to lead the fundamental transformations in economic behaviour/ growth, not only resorting to novel and adaptive marketplaces but understanding and implementing the same as an ecosystem is crucial.”

The raison d’être for enhanced and affordable financial flexibilities is the possibility of transacting without intermediation. This has helped neutralize the traditional business model frictions between the surplus and deficit units. Consequently, there is a clear orientation from a ‘financer-intermediator-entrepreneur’ towards a ‘financer-entrepreneur’ model (see Figure 11.6). P2P lending, crowdfunding, angel investing, mobile banking, Airbnb, On Deck, Funding Circle even e-bay are prime examples.

These not only have created better opportunities for financial inclusion but have tended to improve the overall social fabric via improved trusteeship and risk sharing. FinTech can play a more significant role in the Islamic finance industry specifically to improve products, processes efficiencies, cost-effectiveness, increase distribution, Shari’a and other compliances, catering better financial inclusion. Consequently, this builds the case for Islamic financial institutions to be more agile and receptive to adapting and adopting FinTech solutions. FinTech and digital technology could allow Islamic finance to reach out further and quicker (and possibly cheaper) without building a physical presence and distribution channels. Such are inferences for Islamic finance to adopt FinTech aggressively.

New Age FinTech Waqf Model for IsMF, Financial Inclusion and SDGs

Another key avenue where FinTech-driven Islamic finance version 2.0 could offer its out-of-the-box efficacy is via the social financial modes. While Islamic finance offers an array of such schemes, the potency of waqf in a post-pandemic environment could be a source of new Shari’a-compliant funds that can be dedicated solely for economic empowerment, entrepreneurial preferences, research and innovation enhancement. The same could be extended to assist cash-strapped governments who are gasping to address additional and new kind of covid ridden unemployment with numbers comprising of a novel foreign returned workforce going back to their home countries. FinTech-driven waqf funds could be used to extend financings and creating extra sources of employment.

The other dimension of a new age waqf will be “services waqf. With provision for Investment Risk Reserve (IRR) in case an investment suffers loss, the model can be operated via an online platform where surplus meets deficit as per suitability and best choices. The rest of business operations could be complemented/performed via AI and Robo advisory, Blockchain and smart Islamic contracts: support tools to configure a congenial eco-system. The envisaged FinTech waqf would not only essentially contribute but would also catalyze the attainment of UN SDGs’ desired financial inclusion, and economic diversifications for many countries. There can be two alternate ways in which this FinTech waqf model can be set up or structured.

Waqf funds/services from the government: State and local governments can choose to allocate certain amount of funds to setting up microfinance operations in certain parts of their areas. While this option might provide a steady stream of resources if ever implemented, it is highly unlikely that the State will give patronage to microfinance institutions in this fashion.

Waqf funds/services directly from the populace: Microfinance institutions can set up cash boxes and other donations for people to contribute their institutions. While one cannot determine a definite amount that this activity can generate, it can be a source of income that an individual organization can utilize at its own discretion.

Poised for Achieving UN SDGs

Many opportunities lie ahead for of Islamic finance version 2.0. For instance, new age waqf model, if properly utilized, can help in eradicating poverty via economic empowerment in post covid dynamics. It can initiate Islamic microfinance that currently makes for less than one percent of microfinance borrowers across the world. New age waqf can give the impetus to Islamic microfinance industry, enabling it to expand operations, which are often undermined by lack of funds/innovation. It will afford a new and extra opportunity for modern Islamic finance to meet the needs of customers who require cash instead of assets financing. Consequently, the utilization of Islamic finance version 2.0 in such ways could create a valuable opportunity to help meet the UN SDGs, the third component of the Quad-Paradigm Shift (please refer to the image on page 191).

Navigating Climate Change and Green Swans

The Islamic finance version 2.0 oriented multipolar and UN SDGs focused world shaken by the pandemic, offers respite to the universal and unprecedented challenge of the last component of the Quad Paradigm Shift, i.e., impact of climate change, both in scope and scale. The effects, also referred to as green swans, come in the form of normal and abnormal physical and transition risks and the risk of climate refugees. Economic experts are already talking about what is termed as Climate Minsky Moment by Mark Carney, former Governor, the Bank of England. Unlike pandemic, climate risk is an expected unexpected event. Climate risk can impose costs but measuring and predicting them requires probabilistic assumptions with significant tail risks. Climate risk is currently estimated to pose expenses in the tens of trillion dollars worldwide, although even this may underestimate the scope.

While the current pandemic was foreseeable, the unexpected systemic risk arising from the coronavirus economic collapse is a valuable baseline for comparison. Here, costs already top US$9 trillion globally and may exceed several tens of trillions of dollars—surpassing any earlier estimates of the economic fallout caused by a pandemic. Like a pandemic, climate change could cause a substantial external shock that acts on financial assets in a correlated manner. That is, driving losses simultaneously across a range of financial markets that usually do not behave the same way. And worse than a pandemic, climate change will likely cause successively greater external shocks and may result in irreversible damage to the planet and both natural and human productive capacity.

FinTech-led Islamic finance, inclusive of its social, financial modes, akin to the FinTech waqf, can naturally absorb the climate shocks’ intensity. Quran and Prophet’s – peace be upon him – traditions preempt, preserve and address climate change, signifying to preserve the environment, hence mitigating or avoiding climate change. Combine the Islamic prescriptions with the mitigation and adaptation approach, where mitigation tackles the causes of climate change, and adaptation tackles the phenomenon’s effects. Adaptation is crucial to reducing vulnerability to climate change. A successful adaptation can reduce vulnerability by building on and strengthening existing coping strategies, in this case financial strategies based on a sound and best-suited financial architecture and modelling in a multipolar world. The famous 2015 Islamic Climate Change Declaration stated this aptly, consistent with the Paris Accord.

Conclusion

One of the strongest arguments in favor of globalization and ensuing multipolarity was improved risk sharing that would result from intensified human interaction across the world. On the theoretical ground, this would mean expecting a much greater degree of risk sharing between and among economies – resulting from greater freedom of movement of resources, and hence, providing a significant source of consumption smoothing in the world economy. These developments were expected to lead to progress toward market completion, which means increasing the number of marketable securities to meet a large number of contingencies – a condition of optimal risk sharing posited in conception. Alternatively, at least, progress could have been expected toward the design and use of Arrow’s idea of having securities with pay-offs contingent on the performance of the underlying asset, for example, equity-based securities with close links to the real sector of the economy. Theoretical research and base models of Silicon Valley’s sustainable success have demonstrated sizeable potentials, real and welfare benefits of risk sharing.

It appears that the contribution of the present configuration of the Islamic finance industry to the growth of the real sector has fallen well short of expectations so far. Perhaps the main reason has been that the practitioners and financial engineers of this new asset class – growing within the conventional financial system – had to design instruments that resembled those prevalent in the host system without violating the “no-riba” sufficient condition. This meant creating instruments with a tenuous relationship to the risk-sharing essence. Consequently, the recommended FinTech-driven version 2.0 of Islamic finance offers to reframe Islamic finance practice as per its original submitted mandates that currently are in an automatic match to UN SDGs. Thus, the rising FinTechs, BigTechs, TechFins, and DeepTechs are nothing but a formal advent of what could be termed as digitization/atomization of civilizations. However, the question may appear plausible, and the potentials could soon glide towards disconcertion if and only if this innovative financial amplification is not understood, absorbed, and utilized via an ecosystem approach.

Currently, the pandemic-ridden global economy is already adjusting to navigate and adjust to a multipolar economic world that is grappling with mitigating black swans while bracing for green swans of climate change. Adopting technology orientations as mere fashion and not as a necessity/proactive need could virtually be the last nail in the coffin. Islamic finance losing a third-time-lucky, COVID-19-ridden opportunity to frame itself as a better, resilient, all-inclusive financial regime via its risk-sharing essence. The submission becomes more plausible via the assertion that the premier FinTech disruption models are nothing but a modern technology-oriented application of risk-sharing finance: the essence of Islamic Finance. Consequently, this strengthens the case for version 2.0 Islamic finance that is more agile and receptive to adapting and adopting FinTech solutions. With this as vision and ‘innovation, not renovation’ as mindset, a 2021 onward version 2.0 of innovative Islamic finance could be forecasted. The magic sauce for such an ecosystem would be to rely on innovative capacities of pure experts via structural support, unbundle to re-bundle a smart and automated version of Shair’a finance that is cost, user, and efficiency friendly. As submitted earlier, the adoption of, for example, Blockchain and mobile technology could help provide and promote Smart Islamic Banking Contracts (SIBCs) solution (adjustable to fine-tune with specificities of regions) and also intelligent data supply for customer risk profiling that accommodates pricing, and mitigating climate risks are among few instant solutions to be pursued. Concluding a transparent contract to finance Shair’a-based deposits/products could then be a mobile app work, with financial institutions smartly equipped to assess risks.