A CASE STUDY OF EMS

In the US$3 trillion Islamic financial system, there are two main types of due diligence and monitoring. The first type is the spiritual monitoring; meaning the offering, products and services, are Shari’a compliant and its typically done via the entity itself or with an outsourced Shari’a consulting firm or a Shari’a advisor. Secondly, the secular monitoring; meaning the availability and viability, take and traction, and comments and testimonials. This area is a weak link for the Islamic finance industry. To grow the space from the potential to the actual by, say, 2030 or 2050, especially on financial inclusion, there needs to be more transparency via capturing the conversations and sentiments from the serviceable addressable market on the social media and web.

Put differently, the digital listening from social media and web is the need of the hour for the customer, beyond surveys and focus groups, for the benefit of the more informed to make decisions on investing, purchasing and/or financing.

Court of Public Opinion

Social media sites like Twitter have made public opinion matter more than ever. The opinion is a form of collective due diligence and monitoring that often goes to one’s intuitive decision-making to buy, invest or finance.

[Yes, fake news/posts, bots, partisan points, groupthink, etc., i.e., the ‘noise’ must be acknowledged, and reduced, but will not be eliminated].

A targeted community’s reaction, from ‘views to likes to comments to shares,’ matters to both the offering institution and potential customers to follow up to iterate or engage and keep scrolling, respectively. For example, an influencer, be on YouTube or TikTok, their opinion often matters on product sales and loyalty.

Another example, user testimonials (review) of a product on, say, ecommerce platforms like US based Amazon6 or Indonesia’s Tokopedia, matters on halal product sales, as both platforms have halal (food) products. Thus, the collective opinion brings more insights than any one person or even the advertisement of the sponsoring entity, hence, many of us read the comments to an article or post more seriously than the article itself.

Islamic Economy and Finance: B2C Play

Now, if we take a step back and reflect about IsBF, and by extension halal food industry, takaful and Islamic FinTech, it’s about B2C play10. A distinct value proposition of IsBF should primarily be about people, and about the inclusion by providing alternatives without charging a Shari’a Muslim premium.

[It should be noted the Islamic economy is for all of the humanity, and not just for Muslims, as ethical/social impact offerings are universal themes].

The Islamic finance industry has been trying to demystify Islamic finance, for decades as the financial literacy12, including awareness of Islamic finance, is low in the Muslim-majority countries (the OIC block), as high levels of the unbanked14 and undocumented are prevalent therein.

For example, there are many on-line and off-line courses/training programs on Islamic finance, including a dedicated Islamic finance university, INCEIF, in Malaysia. Thus, awareness, education and availability are key ingredients to grow the Islamic economy – not only faster – but also to more places and people.

Summary of the Chapter

In this chapter, we will explore the importance of a startup eco-system in the Muslim world, which are emerging or frontier markets18, and showcase a ‘secular’ due diligence and monitoring framework for Islamic offering, so that interested investors/partners/consumers are able to view the sentiment – from the court of public opinion.

We cover applications of Artificial Intelligence (AI) to the social media networks, and web coverage of an entity (via keywords, displayed by sentiment analysis19) in time series candlestick. We also highlight the role of influencers and show a heatmap knowledge grid (a balance score card) on important stakeholder metrics.

Finally, we show applications of Emerging Markets Startups (EMS) – a new AI-powered due diligence and monitoring tool – to a sampling of adjacent consumer/customer areas: Islamic crowdfunding, small and medium enterprises (SMEs), startups and stock exchanges, media, country tourism, and Islamic social finance.

Importance of Startup Ecosystem in Muslim Majority Countries (OIC)

Many of the 57 member countries of the OIC are part of the emerging markets (EM), including three – Saudi Arabia, Turkey and Indonesia – which are part of the G2021. The leaders like Crown Prince of Saudi Arabia, Mohammad Bin Salman, are ‘disrupting’ their respective economies towards a future built on the foundation of technology.

Thus, many eyes, ears and (risk capital) wallets are focusing on the global growth opportunities in the EM because of demographics (growth), demand (consumerism) and dollar (investments) opportunities in Indonesia, Saudi Arabia, Nigeria, Egypt, Pakistan, Bangladesh, Turkey, etc., as the prominent B2C players, led by transaction-oriented FinTechs and ecommerce platforms. And many of the startups are at an early seed stage, with the attraction of the 20 to 100 times returns.

A prime example of a successful startup story is Alphabet Inc., better known as Google. The search giant launched as a startup in 1997 with US$1 million in seed money from FF&F. In 1999, the company was growing rapidly and attracted US$25 million in venture capital funding, with two VC firms acquiring around 10% each of the company. In August 2004, Google’s IPO raised over $1.2 billion for the company and almost half a billion dollars for those original investors, a return26 of almost 1,700%.

However, the challenge with startups in the EM is around information/data: often lacking to missing to inadequate to outdated to irrelevant, especially at the pre-seed/seed stage. And, it is these collective startups, at this early stage of their life cycle (pre-seed to seed), that governments view as vital enablers in their aspirations for building a Knowledge-based economy as part of their 20XX Visions.

The startup ecosystem, as per the insights from startup nations like Israel and Singapore, is about adding to and diversifying the GDP, addressing youth under/unemployment, attracting VC firms and overseas startups (demographic carrot being dangled), and exporting services, etc.

For example, emerging/frontier markets countries in Africa, with 20 as part of the OIC, have realized that the aid has placed them in huge debt, and expectations of trade have not been met in lifting citizen incomes and expanding business opportunities. Consequently, many African nations have now realized that they simply cannot afford more Chinese loans and must instead boost exports to China. In recognition of the need to address the imbalances, or at least stop them getting worse, China announced a shift in strategy in November – ramping up the agricultural exports – however, it is one of the few options. Many African countries have to rebalance their trade relationships with China and earn the hard currency they need to service mountains of debt, much of which is owed to Beijing.

Thus, the startup ecosystem has become a reality within the great continent of Africa, with four major recognized tech hubs, Nigeria, Egypt, Kenya and South Africa, and they are sparking other countries, from Ghana to Rwanda, to harness the power of the local talent.

Thus, the private sector is not the only interested stakeholder for jump-starting the local startup ecosystem; we see international lending agencies are doing their part for raising the profile of the EM. For example, the UNDP’s Accelerator Labs31, which has 91 labs in 115 countries, is taking a data-driven approach to better understand and contribute to the local startup ecosystem disruptions.

As a result, as discussed below, EMS becomes an important stakeholder in contributing to the building and expanding of the local startup ecosystem in Muslim-majority countries by capturing AI-powered sentiment analysis with display in time series candlestick as an important risk-reducing due diligence and monitoring tool.

Islamic FinTech Startups & Sentiment Analysis

Investing in startups is an extremely risky asset class and investing in another country, especially in the EM at an early seed stage, exacerbates the risk. Hence, due diligence and monitoring (DD&M) is paramount. The below risk/reward graphic captures venture investing in the context of other asset classes, and there are websites dedicated to Startup Graveyard.

Today, information about startups is coverage-centric: one may subscribe to databases, read (tech) media articles, Google research, attend tech events, get invited to demo day, ask colleagues, etc., but it still requires DD&M.

If you think about it, angel/venture capital investing starts with looking at the team (chemistry/execute), disruption (like friction/inclusion), unfair comparative advantage (moat), addressable market (growing), timing (riding trend), etc., but also extends to an important element of ‘gut feel.’ The gut feel, often an intangible, may include examining social listening, social network analysis, of the startup to better understand chatter and ensuing engagement whilst understanding the need for ‘noise reduction’.

[It should be noted; the gut feel becomes a less weighted decision-making tool as a startup moves from seed to series stage, where the focus is on the financial modeling, as more data is available].

The challenge with social listening is the requirement to showcase it across time series and human interventions on ‘reducing noise’ of irrelevant and misinformation.

The challenge with social network analysis is the emphasis on showcasing past linkages, as it does not show present engagement/traction of the startup.

Application of AI to Islamic Economy Verticals

As stated above, the Islamic economy verticals are B2C centric; it is about the interested masses dispersed globally.

For example, at every Islamic finance/halal industry event, many of the speakers refer to the demographic attraction: A population of 2 billion Muslims residing in the 57 OIC countries plus nearly 250 million in Muslim-minority countries, like India, Germany, France, UK, US, etc., and Islam being the fastest growing religion, where Muslims will represent 25% of the world population by 2030.

[It should be noted, the total addressable market is not the obtainable market, as the Muslim market is about 15-20%, or 400 million, still a respectable ‘niche’ capture that is the fastest growing market].

The common denominator in the Muslim market is generally faith-led demographic-centric capture, be it for:

- Islamic banks, like the largest Islamic bank, Saudi-based Al Rajhi Bank or the leading Islamic FinTechs, such as, Wahed Invest or ALAMI Sharia.

- Halal food led by multinationals, such as, Nestlé, and SMEs like Saffron Road.

- Modest fashion, led by Modanisa

- Halal/Muslim travel led by CrescentRating

- Halal pharmaceuticals, such as, Halal pharma and vitamins/supplements led by Noor Natural Wellness.

- Muslim media/entertainment led by Alchemiya

The verticals of Islamic economy are led by Islamic finance (as the largest) to halal cosmetics (as the smallest). Across the spectrum of verticals is the need for a better understanding of the sentiment and engagement, over time, of customers, both existing and potential ones. This will allow for deeper insights for the offering companies, provide a broader range of opinions by users of the products and services, allow for potential investors to understand traction over time and encourage media for deeper coverage.

Thus, for Muslims (or those interested) in the Islamic offering, they want more than website testimonials, media-placed advertisements or presentations (workshops) at conferences/webinars. They want to see a bigger picture of sentiment reach and engagement of the compliant offering, and, one pathway is the chatter found on social media and the web.

The conversations are the peer review of the interaction with the brand, services/products, and they are viewed as more credible than the institution’s advertisements and campaigns. For example, it is common for Islamic bank websites to have testimonials of customers, as they are seen as more authentic and credible than glossy advertisements placed in magazines/newspapers or social media platforms.

But glowing testimonials may not be enough, as they come across as selective and biased to many users who want to see/read a variety of opinions, much like a judge/jury not relying on one expert witness’ testimony.

To capture and structurally lay a more comprehensive set of conversations from social media/ web about the various Islamic economy verticals, the time has arrived to apply 4th Industrial Revolution (4IR)48, a vertical of AI49.

AI to Capture Sentiment Analysis

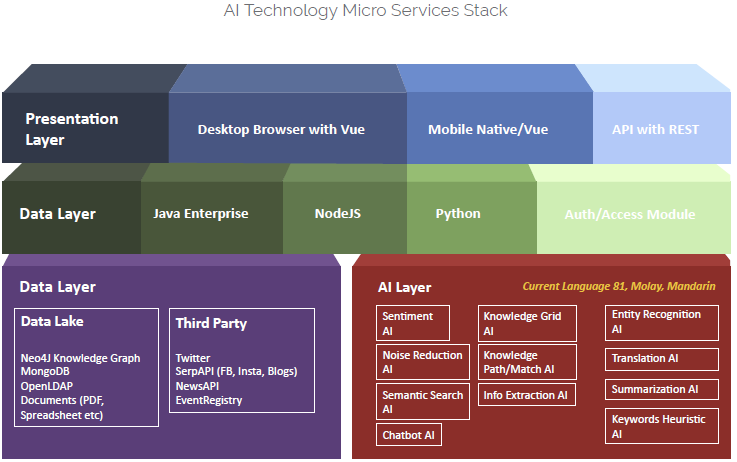

The explanation of the technology stacks below comprises four technology layers used by EMS for sentiment analysis.

- Presentation Layer

- Logic Layer

- Data Layer

- AI Layer

The presentation layer is what the end users experience when interacting with EMS. Either a user uses a browser or mobile app, it will go through a frontend framework called Vue. The REST API stack is useful for other applications to interact directly with EMS.

The logic layer runs in three programming languages from Java, Nodejs and Python. Python is mainly used to interact with AI models in the AI layer, The data layer has two components:

- Data Lake

- Third-Party Data

The data lake consists of different types of databases used to house internal data. Internal documents in the format of PDF, excel spreadsheet, and Word are also supported.

Third-party data are from the web and social media sites such as Twitter, Facebook, LinkedIn, other websites, forums, blogs etc. EMS retrieves third-party data through customs API provided by the platform owner, such as Twitter. The AI layer consists of several AI engines as listed below:

- Sentiment AI Engine: This engine is responsible to score a post or an article as positive, negative or neutral.

- Knowledge Grid AI Engine: This engine is responsible for classifying an article or a social media post under a topic or a grid important to a company and its founders. There are several grids of topics covered for a company and the founders for the company.

- Noise reduction AI Engine: This engine is crucial to filter irrelevant and misinformation articles or social media posts, and this is an on-going process to address ‘noise reduction.’

- Entity Recognition AI Engine: This engine is responsible to identify people, groups, organizations and locations from a web article or a social media post, and links these entities to a large knowledge graph.

- Semantic Search AI Engine: This engine is responsible to provide knowledge instead of just information after performing a search. Notice that knowledge is information, which is actionable in the context of the user.

- Info Extraction AI Engine: This engine is responsible to provide watch terms based on thousands of articles or social media posts related to a company or the founders.

- Knowledge Matching AI Engine: This engine is responsible to match the knowledge from two subjects, for example, how two companies from two different sectors are similar.

- Summarization AI Engine: This engine is responsible to provide extractive summary from an article. The AI engine will provide, at the most, four sentences of summary, no matter how long the article is.

- Translation AI Engine: This engine is useful for translating all related posts or articles into one language no matter the types of languages used in the original source. For example, a Japanese investor may want all the analysis in the Japanese language, although the original source may be in Malay, English or Arabic.

- Keyword Heuristic AI Engine: This engine is responsible for generating important keywords from a single keyword about a company or the founders. The generated keywords will be passed to a third-party data provider to get more meaningful results.

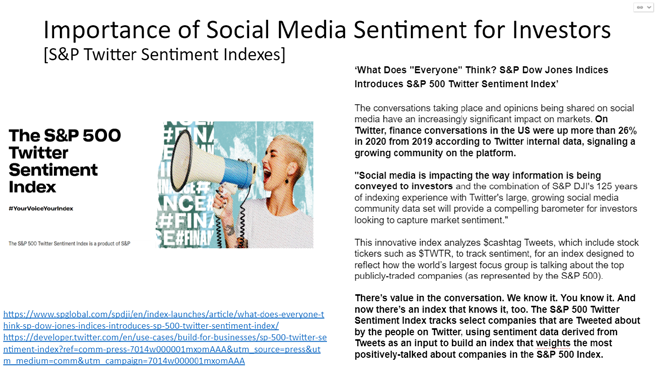

Now, it’s time to apply EMS engine AI to social media networks (Twitter) and web to a leading Islamic FinTech startup, Takaful operator and two Islamic banks for better understanding of the sentiment captured over time series. We opted for Twitter, over Facebook, Instagram and LinkedIn, at stage one, for startups sentiment capture, curation, cleansing and display, as an increasing number of users rely on this platform for financial information.

Below is an EMS presentation slide on ‘importance of social media sentiment for investors.’

Importance of Social Media Sentiment for Investors

From Coverage to Data-Driven AI

Many investors (or curiosity seekers) begin their search on startups by viewing startup database websites, like Crunchbase50 or Tech in Asia,51 and will undertake additional diligence by reading articles, asking colleagues/friends, financial modeling, etc. This established approach has worked well in the past.

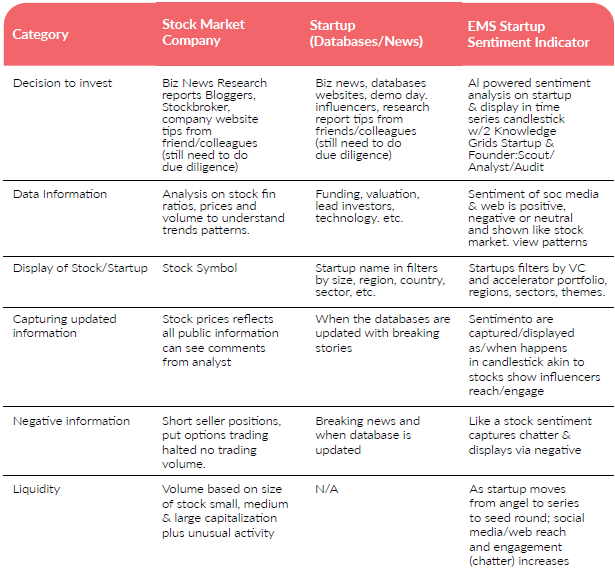

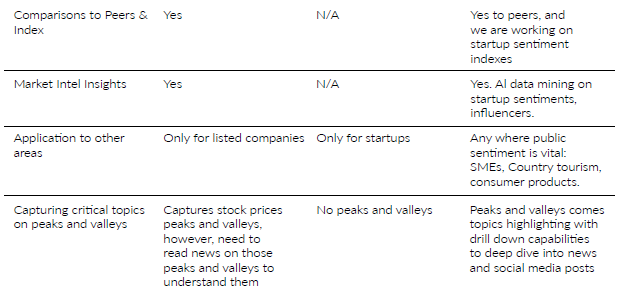

Below is a comparison matrix on key issues of publicly listed companies, startups in database and EMS sentiment analysis, and it can be found at the EMS Comparison page.

As we proceed to compliment startup coverage and expand on social listening, we look at several layering levels of understanding startup engagement. If we apply AI to the startup’s social media network and web, and showcase a data-driven sentiment analysis displayed in time series candlestick, we are actually showing the startup like a listed company.

For a publicly listed company, its price (hence, value) fluctuates daily based upon a variety of factors, and index providers, like Nasdaq, S&P Dow Jones Indices or MSCI, create indexes that are an important stakeholders in the functioning of the capital markets.

For example, a stock analyst at the respected Wall Street firms may have to buy, sell, or hold recommendations based upon research on, say, earnings, and it may/will move the stock.

For startups, their social media/web (marketplace) have users/followers and they provide ‘real time’ chatter and capturing it via sentiments – positive, negative, or neutral – allows the startups/stakeholders to better understand engagement value. The sentiment engagement moves over time – and, as a metric – it may validate the ‘gut feel’ on whether to invest or not.

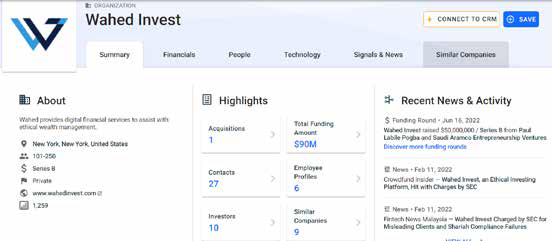

Below is a leading Islamic FinTech startup, Wahed, as covered by Crunchbase, Wahed Invest

– Crunchbase Company Profile & Funding, (as of June 26, 2022). It shows the needed and relevant information about Wahed from a variety of optics for investors.

Wahed Invest – Crunchbase Company Profile & Funding

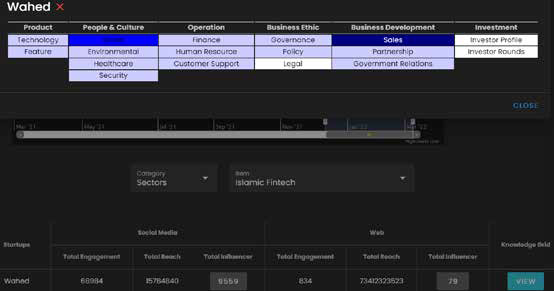

The figure below displays Wahed’s sentiment indicator at EMS61.

Wahed’s sentiment indicator at EMS

Here are several observations:

First, Wahed, a private startup company, can now be ‘viewed’ as a publicly listed company. The sentiment analysis, displayed in time series candlestick shows a bandwidth of movement over time. The sentiment may be positive (above 0.75), negative (0.00 to 0.25) or neutral (0.25 to 0.75). The spikes are linked to product launches, breaking news, coverage in major mainstream media (and ensuing syndicate carry), etc. A visual of a candlestick in time series allows a user, be a potential customer or investor, or even media, to understand trends/patterns, i.e., peaks and valleys. It should be noted that red candlestick often means fewer conversations for that day compared to the previous day, and not necessarily negative conversations.

Second, Wahed is a social media player over the web – which makes sense – as the bulk of its client base, nearing 200,000 Wahed Investors are young people. One interesting observation is on liquidity: As a startup moves from seed to series, its daily sentiment volume increases, and, as a listed company moves from small-cap, mid-cap to large-cap, its trading volume increases.

Third, we have included the tech-heavy Nasdaq index, as it’s a leading indicator for the state of the technology sector, including privately held startups, their funding/funding rounds.

Fourth, there is a display icon of the Founder’s Profile, as discussed below, it becomes an important element of due diligence for investors entrusting millions of dollars on his/her integrity, vision, leadership skills, and execution.

Finally, the bottom of the above image shows elements of our innovative Knowledge Grid heatmap, akin to a balanced scorecard,64 on key issues as captured by the sentiment volume. The darker colors represent greater sentiment. For any startup, the reach and engagement of posts on social media sites (like Twitter) provide deeper insights than assembling a focus group, or undertaking a survey with sample size challenges and margin for error issues. Furthermore, startups want to understand their ROI, on campaigns, and sentiment analysis and conversion provides a good proxy of the return.

Due Diligence and Monitoring on Founders

One of the important takeaways from the implosion of the two high-profile US-based startup unicorns, Theranos and WeWork, is the need for due diligence and monitoring of startup founders.

‘…a person [Elizabeth Holmes] who at 19 years of age dropped out of college without a background in microbiology, chemistry, physics, mathematics, or any other subject of the physical sciences. Suddenly, almost miraculously she invented a machine that would revolutionize blood testing to determine all sorts of maladies. Convincing presidents, secretaries of state, military representatives, CEO’s and drug companies of this stupendous invention, she was off and running.

‘Sequoia India has announced new measures to drive better compliance across its portfolio companies, which include governance training for founders and senior management, implementation of whistleblower policies, and a more rigorous adoption of internal audits and controls. The new measures come in the wake of a few startups under Sequoia’s portfolio facing issues such as financial irregularities. One of its major portfolio firms in Zilingo, a Singapore-based fashion ecommerce platform that recently suspended its founder, Ankiti Bose, over allegations of financial discrepancies. Ashneer Grover, co-founder of India-based FinTech firm BharatPe, was also booted from his company earlier this year over alleged financial irregularities.

Sentiment Indicator – Wahed

The red flags with Theranos, and Wework were generally first posted on social media and, eventually, the mainstream media picked up the stories.

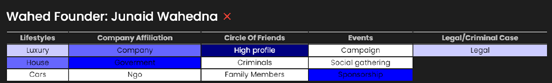

Knowledge Grid

The above figure is a reference to Wahed’s founder profile, Junaid Wahedna. The figure below shows his Knowledge Grid, and one can observe that he is a high-profile individual.

Post on High Profile

In showing the ‘High Profile,’ at the selected time, we see it’s positive.

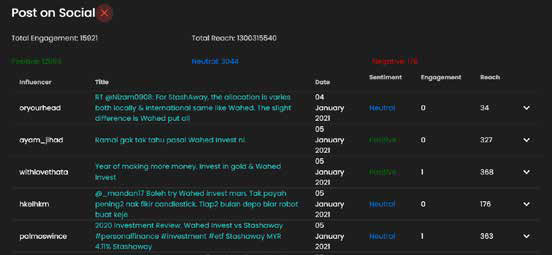

Influencers

The role of influencers72 on social media sites like, Twitter, cannot be emphasized enough, as they are gatekeepers to their community of followers. To budget-conscious/cash-strapped (early-stage) startups, maximizing return for each promotion dollar means lowering customer acquisition costs (CACs), reducing churn, and focusing on upselling loyal customers. Finding the right influencers (with reach and engagement) is the first challenge, accessing them is the second one, and retaining them for campaigns and selected posts is key. EMS is able to help with the first two challenges.

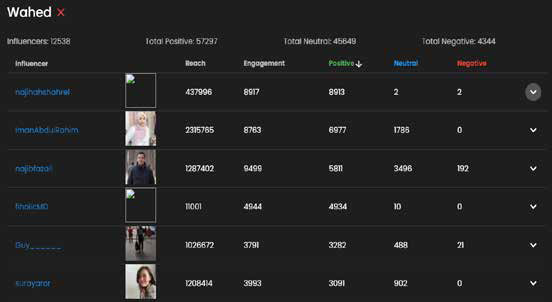

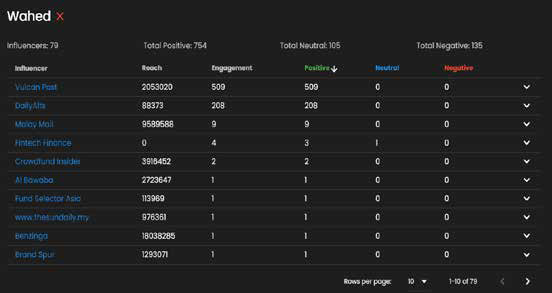

Below are the social media and web influencers (as of March 2022) for Islamic FinTech Wahed (and Indonesia-based ALAMI Sharia), for reach and engagement, as both are social media players for conversations, traction and customer acquisitions.

Social Media and Web Influencers – Wahed

Below is an image capture of Wahed’s social media influencers (12538), the sentiment is biased towards positive and neutral, and with an impressive reach/engagement ratio of sample influencers.

Below is an image capture of Wahed’s web influencers (79), sentiment is biased towards positive and neutral, and reach/engagement ratio of sample influencers.

Social Media Influencers – Wahed

Web Influencers – Wahed

Knowledge Grid

The Knowledge Grid (KG) is a heatmap matrix providing a deeper dive breakdown into the overall sentiment. Below is the KG of Wahed, and the darker colors of the heatmap represent more chatter/conversations; for example, ‘social’ under ‘People & Culture’ and ‘sales’ under ‘Business Development.’

We can see mostly positive/neutral sentiment under the ‘social’ category. We can see mostly positive/neutral sentiment under the ‘sales’ category.

Knowledge Grid – Wahed

Post on Social – Wahed

Post on Sales

Thus, for an interested user in an Islamic FinTech, like Wahed, their journey starts with a startup database, like CrunchBase or Tech-in-Asia, for the most recent snapshot information on funding, valuation, lead investors, etc., but much can happen between funding rounds. The sentiment analysis displayed in time series candlestick allows for understanding the recent engagement or lack of it. In being able to view Wahed like a startup, a user has the important visual and up-to-date understanding of the sentiment.

Another way of looking at it is, where ‘CrunchBase ends, EMS begins’ on due diligence and monitoring.

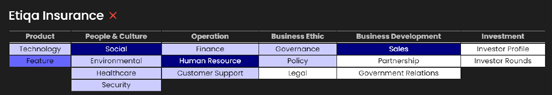

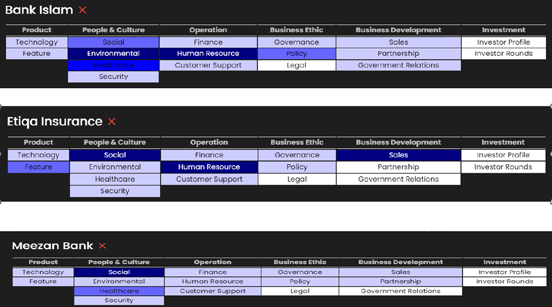

Islamic Banks and Islamic Offering on EMS

From Islamic FinTech to Islamic banks and takaful, we take a sampling of them: Bank Islam Malaysia Berhad, Etiqa and Meezan Bank (Pakistan), and, we generally observe an overall positive sentiment for these community-centric players.

It should be noted, for Bank Islam sentiment, the social media sentiment is not as robust as the web sentiment, and we observe the bandwidth of volatility is narrow. We have included the stock price of Bank Islam, and we are building a correlation metric of the sentiment to stock price.

Sentiment Indicator – Bank Islam

With Etiqa, we observe a sentiment bias towards social media over the web, regular and ongoing conversations, and the bandwidth of ‘volatility’ is generally narrow, meaning constant and consistent chatter.

The superior numbers on social media engagement and influencers for Etiqa clearly showcases where its audience base resides.

The Knowledge Grid of Etiqa shows a well-balanced set of stakeholders engaged in a variety of conversations for the takaful operator with greater audience interest in ‘features,’ ‘social,’ ‘human resource’ and ‘sales.’

Sentiment Indicator – Etiqa Insurance

Social Media Egagement and Ifluencers – Etiqa

Knowledge Grid – Etiqa

Finally, for the Pakistan-based Meezan Bank, we observe a robust social media and web presence. Being the number one Islamic bank in Pakistan, and in the top 5 list for overall banks, many Islamic banks may look at Meezan as a case model on effective reach and engagement on social media and web for customer acquisition and sentiment. Furthermore, we see the stock price of Meezan Bank and social media sentiment in somewhat aligned transitions.

Sentiment Indicator – Meezan Bank

We also wanted to compare the Knowledge Grid (KG) of the three banks, to see areas of overlap and learning areas, as shown below.

Comparison of the Knowledge Grid of 3 Banks

Few Observations on the Above Knowledge Grids

First, all the community-centric Islamic offerings focus on ‘people/culture,’ hence, we see the darker colors on the heatmap on ‘social,’ ‘environmental,’ ‘human resource,’ ‘customer support,’ and ‘healthcare’ etc.

Second, we see the two dedicated Islamic banks, Bank Islam and Meezan Bank, have a balanced approach with more colors on the KG, meaning there are conversations on the variety of concerned issues of those posting/commenting. Also we observe that Bank Islam has sentiment on ‘government relations,’ whereas Meezan Bank does not, implying the former is aligning itself to government mandates for community needs during the time period covered.

Third, all three have comments on ‘sales,’ as reaction to their offering and community activities; do not have sentiment on ‘legal,’ implying no pending suits/cause of action, as any legal case would be circulating; and ‘feature’ is an important area for community members.

The above represents a time series (on-going), holistic (high level) and consolidated (dashboard) approach that benefits:

- The institutions that have an almost 360-degree understanding of engagement and issues, next stage to corporate clippings;

- The customers who can see a ‘balance scorecard’ on a variety of issues;

- The regulators who are able to keep a pulse on complaints that may arise and go viral before more confidence-eroding damage is done; and

- Media that can go deeper with stories on compliant offerings.

Application of EMS to Other Sectors

Islamic Equity Crowdfunding (IECF) is customer (retail investor) centric; hence, social media plays an important role in creating awareness and interest in pre-platform appearance and graduation from the platform. The Ethis Blog81 is a good resource for background information about Islamic crowdfunding.82 There are two main challenges for IECF:

First, some ‘historical’ information about the early-stage startup, including founders (which have social media handles before their startup handles) is important for would-be investors. It may make more sense to have a presence (small history) on social media as a way to engage the audience (feedback) and then apply to IECFs with their ‘story.’ This may make reaching the funding goals faster.

Second, upon graduation from the IECF platform, keeping a close eye on the startup’s sentiment, from campaigns to influencers to knowledge grid heatmap, will be important to navigate the next stage of development and funding.

The leading Islamic industry body, Bahrain-based AAOIFI83, continues to help the Islamic industry grow and develop with their exposure draft for IECF.

SMEs

SMEs – mostly non-publicly listed – are the backbone of economies, and more so in the emerging markets. The two studies, mentioned below, from the Harvard University and the World Bank Group,86 emphasize that access to finance plays a key role in their growth and development. Access to finance is about generating revenue from paying customers, and, as more of them are going online every day, SMEs are competing against well (VC) funded ecommerce platforms.

Thus, SMEs (and community banks87) are learning from startups on the importance of social media awareness, especially the ‘S’ in SMEs, in building awareness of their brand for customers, financing, partnerships, suppliers, etc. However, the ‘S’ often do not have resources to undertake ongoing campaigns and ensuing corporate clipping, hence, an EMS sentiment analysis becomes a viable option.

Startups & Stock Exchanges

The DNA of stock exchanges are listing of companies and financial products, hence, venture capital-funded startups have been one of the important feeders to exchanges like Nasdaq.

For stock exchanges, listing is key to their survival and their unfair advantage (moat) – and focusing on global trends, like startups from emerging markets – is like capturing low-hanging fruits. However, it requires monitoring of startups, as they move from seed to series rounds, and a way to tag and monitor such startups is by way of AI-powered sentiment analysis displayed in time series candlestick. Stock exchanges are not only an important stakeholder in a startup ecosystem, but, more importantly, can help contribute to an emerging market88 country’s aspiration for a knowledge base economy.

Startups & Media

Startups, be Islamic or otherwise, need to understand the important role of the media in their growth. Here is a summarized by-lined article:89

‘As a startup, one of the biggest hurdles you’re going to face is building an initial reputation. With zero customers, zero brand recognition and little in the way of capital you could use to bolster your image, you’ll have to rely on alternative outlets and inexpensive tactics to give you early traction…’

Thus, for a startup to tell their story to the media, mainstream to tech, as a ‘listed company’ via sentiment analysis in time series candlestick is about understanding various avenues of engagement. And engagement has a network effect, including getting on the radar of potential investors.

Country Tourism

Research by World Travel & Tourism Council90 shows that the sector’s contribution to global employment could reach more than 330 million, just 1 percent below pre-pandemic levels and 21.5 percent up on 2020, representing a massive 58 million more jobs.

Below is an image capture of Malaysia Tourism, focused on web sentiment and KG, from January to April 2022, and provides insights for the Ministry of Tourism on effectiveness of campaigns.

Sentiment Indicator – Malaysian Tourism

The KG shows robust conversations captured in a variety of areas linked to Malaysia Tourism, hence, providing almost a 360-degree feedback loop to situations like COVID-19 pandemic, and campaigns, etc. EMS application extends to many donation based/accepting organizations in the Islamic social economy – Finterra, from zakat, to waqf, World Waqf Day, to charitable donations for development and help for the humanity.

Knowledge Grid – Malaysian Tourism

Conclusion

For the Islamic economy to reach its potential, it must build access ramps for inclusion for the 100s of millions of the unbanked and undocumented. Fortunately, it has embarked on its digital journey, led by Islamic FinTechs and innovative Islamic financial institutions. But it’s only a start, as the favorable tailwinds of an audience base is increasing online every day.

Thus, social media is not only an important part of its reach story, but more importantly, understanding sentiment, engagement, influencers, and providing 360-degree solutions is a must.