A MAN SHALL NOT DESERVE BUT (THE REWARD OF) HIS OWN EFFORT

(Qurān: 53:39)

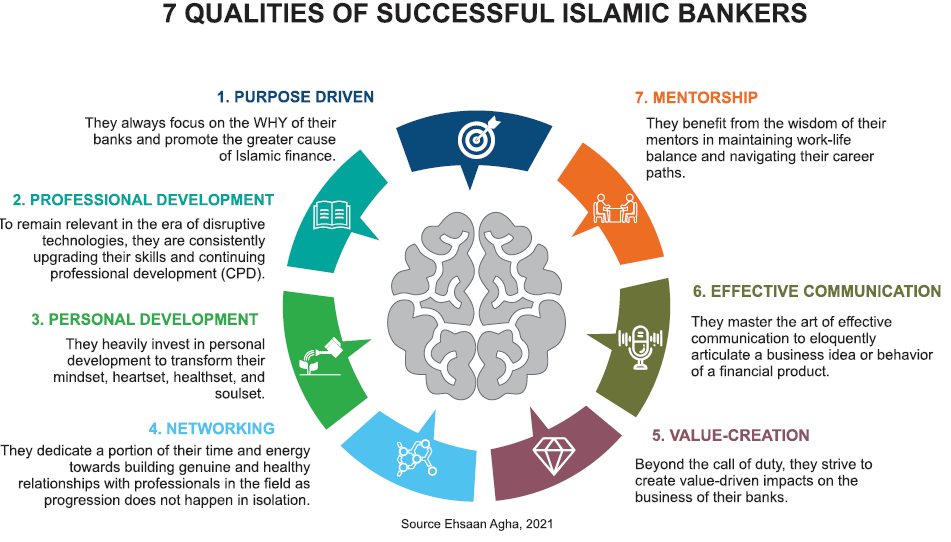

Success is a multifaceted achievement that varies in its form and accomplishment from individual to individual. However, every success story leaves behind footprints that allow us to understand the common patterns in the journey of success. I have been on a quest to explore why some Islamic banking professionals climb the ladder of success faster than others, and what makes them at the top of an organization’s hierarchy and shining stars in the Islamic banking industry.

Whenever I get a chance, I ask a few of them and have realized there are a few non-mystical secrets behind their successful career. The first part of my observations is published in Islamic Finance Review as an article entitled “The Three Skills of Successful Sharī’a Advisors”. In this article, I will highlight the common personality traits of successful Islamic bankers that I have observed over the years.

- Purpose Driven

For more than five decades, researchers have been identifying various leadership theories and frameworks to train successful leaders. Recently, the focus has shifted to developing purpose-driven leadership. Academics argue that an executive’s most important role is to be a steward of the organization’s purpose. Psychologists describe purpose as the pathway to greater well-being, while business experts consider it as a key to productivity and exceptional performance (Craig & Snook, 2014). John Mackey, CEO of Whole Foods Market once said, “Just as people cannot live without eating, so a business cannot live without profits. But most people do not live to eat, and neither must businesses live just to make profits”. Like any other profession, a career in Islamic banking can be broadly classified into three categories:

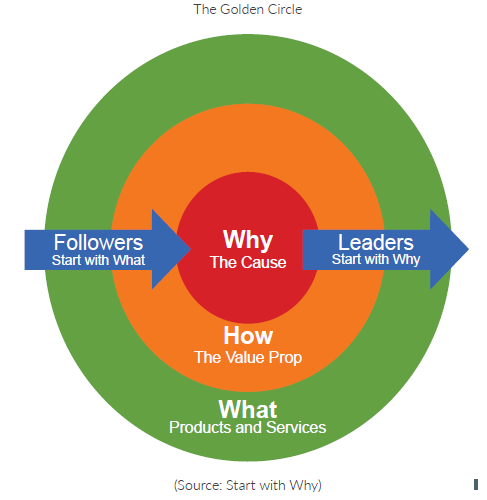

WHAT: Career at this stage deals with the result produced by the bank i.e., products and services offered to the customers, and the income generated.

HOW: This refers to the mission statement of a bank. Bankers in this stage, deal with the process, procedures, and operations to run a bank.

WHY: It refers to the vision statement of a bank i.e., purpose. This is the leadership stage in the Islamic banking career. WHY is the raison d’etre behind WHAT an Islamic bank does and why it exists in the first place? Hence, WHY does not refer to profit maximization and money, which is the result, not a purpose.

The inspirational Islamic bankers always focus on the WHY of their banks and the larger picture by strategically thinking, acting, and communicating from the inside out (WHY, HOW, and WHAT) of the Golden Circle as introduced by Simon Sinek (2009). While the rest usually communicates the other way around (WHAT, HOW, and WHY) by focusing on WHAT unique products their banks offer, HOW much profit they make, and HOW efficient they are as depicted in the below diagram.

It reminds us of the story of a janitor working at NASA. During a visit to the NASA space center in 1962, President John F. Kennedy noticed a janitor carrying a broom. The President then casually asked the janitor what he is doing for NASA, and the janitor replied, “I am helping to put a man on the moon” (Carton, 2018). A seasoned Islamic banker displayed his inspiring WHY on his Twitter account as “an Islamic finance specialist who wants to make the financial system a source of mercy for humanity”. This reflects the prophetic cause of Muhammad (P.B.U.H) who was sent as a source of mercy for the world. No matter how large or small your role is in the bank, you are contributing to materialise the bigger goal.

Continuing Professional Development (CPD)

With the rise of FinTech in the fourth industrial revolution; automation, blockchain, artificial intelligence, and robot technology are disrupting demand and the nature of existing jobs and skills in the financial industry. According to the World Economic Forum Report (2020) on the future of jobs, various functions in the financial services sector are set to be significantly replaced by machine labor in the near future.

To remain relevant in the era of disruptive technologies, successful Islamic bankers are consistently upgrading their skills through continuous professional development (CPD). It makes them aware of the latest trends in the industry. As a career-long obligation for practicing professionals, CPD stands for an ongoing self-made process for professional skills development through formal training and informal learning on the job. For example, an executive Islamic banker said that a secret of his career growth is productive reading and writing. While reading compounds knowledge, writing develops thought leadership.

Personal Development

Successful Islamic bankers are committed to consistently growing themselves. Personal growth brings a transformation in their mindset, heart-set, health-set, and soul-set. While formal education taught them some technical skills and modalities, personal development instills compassion, mindfulness, and gratitude that enable them to build their brand.

The degrees and certificates brought them to the interview table, but personal growth keeps them climbing the ladder. They are always working on themselves to live to the fullest of their potential. They invest heavily in their personal development to build trust, integrity, and reputation which are the most valuable currencies in financial services. They passionately believe that success or failure is nothing more than a vehicle for their personal growth.

Networking

In a corporate culture, where the rules of human connections and personal interest are evolving at breakneck speed, successful Islamic bankers frequently invest their time and energy in building genuine and healthy relationships. They consistently nurture a personal network of authentic and transformational relationships with professionals in their field. Since they know progression does not happen in isolation, building a powerful network of allies becomes a trait of their personality.

Your network is your net worth. For your career growth, it is not only about “WHAT” you know (qualification and experience) and “HOW” you can do it (expertise). Your next move largely depends on “WHO” you know (networking). The quality of your relationship matters more than headcount. The networking guru and author of ‘Never Eat Alone’ Keith Ferrazzi beatifically articulated “Who you know is more important than what you know”. This can be further substantiated by the hiring statistics. According to jobvite.com, 40% of hires come from referrals while only 21% of hiring is done through career sites. Referrals get hired in an average of 3 weeks while other applicants take up to 7 weeks. Referrals get paid more on average than normal applicants.

Value-Creation

“In the hiring process, I have seen most of the candidates are looking for money. They are unaware of the secret that employers hire talent who can add value to the organization, not money seekers”, says Professor Humayon Dar, Director General of Cambridge Institute of Islamic Finance. An employee is an asset of a company and compensation is an investment in that asset. Therefore, businesses do not pay for the employees’ time spent on the premises, rather, the compensation is paid for the positive value created during that time. A banking career is subject to the risk of competition, mergers, and acquisitions in the industry. Your survival and retention in a specific position significantly depend on your ability to create value other than your job description. Islamic bankers who master the art of making an identifiable, noteworthy value-driven impact on the business of their banks, create higher chances of pay raises, promotions, recognition, and appreciation. The more you create measurable and positive outcomes through your actions, the more you increase your bank’s return on investment (ROI) on your retention.

Mentorship

“If I had not had mentors, I wouldn’t be here today. I am a product of great mentoring, great coaching”, says Indra Nooyi ex CEO of Pepsi. Bill Gates credited Warren Buffet for teaching him how to deal with tough situations and how to think long-term. Similarly, Zuckerberg praised his inspiring mentor, Steve Jobs. Steve Jobs used to go on a weekly walk with Bill Campbell, the Silicon Valley coach, who also mentored Google’s founders (Agha, 2019). Every individual carries the seeds of greatness within himself, but you need someone to identify the seed so it would be planted in an appropriate region and weather for optimal growth. A mentor is like a sculptor who analyses his mentee with a humble conviction that a unique and beautiful piece of art already exists within the stone, and his job is only to unveil it. A mentor sees an unexplored treasure of talent and skills in your DNA and helps you to navigate your deserved destination. A C-suit Islamic banking executive confirmed that mentorship from seniors helps him in getting guidance, motivation, keeping a work-life balance, and career counseling.

- Effective Communication

According to a 2016 LinkedIn survey, oral and written communication proficiency consistently topped the most sought-after soft skills among employers. Business executives sometimes hire consultants to coach them in sharpening their communication skills (Schaub et al., 2017). For that very reason, the skill of effective communication has a high demand in the Islamic banking industry. In the context of Islamic banking business, effective communication skills can be described as a two-fold process; first, comprehending the purpose and nature of a financial product/query, and second, eloquently articulating the Sharī’a principles, regulatory and risk requirements about the enquired case in an engaging and deliberated way without jeopardizing the sprite of Islamic law (Agha, 2020). In addition to the local language where the business operates, successful Islamic bankers are also fluent in international business languages such as English, French, etc. An Islamic banker who is skilled in intercultural communication will not only be able to work productively in the multicultural industry of Islamic finance, but can also appreciate differing values, beliefs, attitudes, and behaviours, to anticipate, act, and react in appropriate ways to produce the most effective results.

Conclusion

By analyzing the above qualities, it can be concluded that these personality traits together point toward two key principles of success. First is the Law of Resonance. Successful Islamic bankers attract people who resonate with their wavelength, and opportunities in resonance with their personas. As Dr Steve articulated, the universe does not give you what you want, it gives you what you demand with your actions. In other words, success is not about your dominant thought, it is about your dominant identity. For higher career success, you should change your personality to the frequency that vibrates your dream future. This is why Qurān says, “Allah will never change the condition of people until they change themselves”.

Second, attaining success is not simply a matter of luck. It is the product of a unique combination of skills, mindset, and effort. Qurān refers to this principle as “A man shall not deserve but (the reward of) his own effort” in this world and the world hereafter. The Prophet (P.B.U.H) used to pray, “O Allah, no one can withhold what You have given, and none can give what You have withheld, and no fortune can benefit anyone without your permission”. Despite being a critical factor in success, no formula can predict good luck. However, through consistent hardworking with the right mindset, you can increase your chances of being “at the right time and place with the right skills” to grab the opportunity.