Post-COVID Policy of Bank Indonesia

Relevance of Moral Values and Halal Sectors in an Islamic Economy

The performance of Islamic economy sector and Islamic financial institutions during the pandemic has created a renewed sense of it being the source of economic growth for Indonesia. Consequently, policymakers in Indonesia are reviewing the role of Islamic economic sector in mitigating pandemic-induced unemployment and poverty. Moreover, the ability of Islamic finance and economics to solve socio-economic problems through the application of its unique principles must also be reviewed with sympathy.

Islamic economic has two essential characteristics: moral values and halal products. The former concerns zakat, prohibition of interest and gambling, including unhealthy speculative behaviour. The latter concerns the provision of healthy products for the community and environment-friendly production processes. Zakat, sadaqa and waqf are the instruments used for the implementation of moral values. These principles of Shari’a increase the purchasing power of the financially broken recipients to meet their basic needs. They are also used to provide business opportunities to underprivileged communities. In a similar vein, the of prohibition of interest and gambling prevents the misallocation of resources, expedites financial intermediation, and enhances productivity and economic activities.

As argued in other chapters of this report (e.g., Chapter 5) Islamic social finance can contribute significantly to the development of not only national economies but also has relevance to global development agenda, if the Islamic economic and financial principles are put into practice correctly in the development of the real sector. Different models of Islamic social finance discussed in this report highlight that Islamic social finance impacts both the supply side and the demand side of the economy. Moreover, moral values and halal products develop and encourage social harmony and ecological conservation. Thus, Islamic social finance offers a complete package for economic development.

Indonesia is aware of the potential of the Islamic social finance in achieving sustainable economic growth and prosperity. Therefore, Indonesia is seriously encouraging the development of Shari’a-based economic applications that include Islamic commercial finance, Islamic microfinance, Islamic social finance, and the halal sectors. The Islamic commercial finance sector comprises Islamic banks, insurance, capital markets, pawnshops, and financing companies. The Islamic microfinance sector has more than 4,000 Islamic microfinance institutions following different business models. The Islamic social finance sector comprises more than 500 Islamic social fund Institutions.

“In Indonesia, t]he Islamic commercial finance sector comprises Islamic banks, insurance, capital markets, pawnshops, and financing companies. The Islamic microfinance sector has more than 4,000 Islamic microfinance institutions following different business models. The Islamic social finance sector comprises more than 500 Islamic social fund Institutions.”

The halal sector in the country has made a foray into Muslim fashion, halal cosmetics, halal food and drinks, and Muslim-friendly tourism. The Islamic economic applications used in the halal industry complement the Islamic economic practices in the financial sector.

Indonesia’s Islamic finance serves almost every segment of society: medium-large business groups, micro-small enterprise groups, and poor groups through commercial finance, microfinance, and social finance sectors.

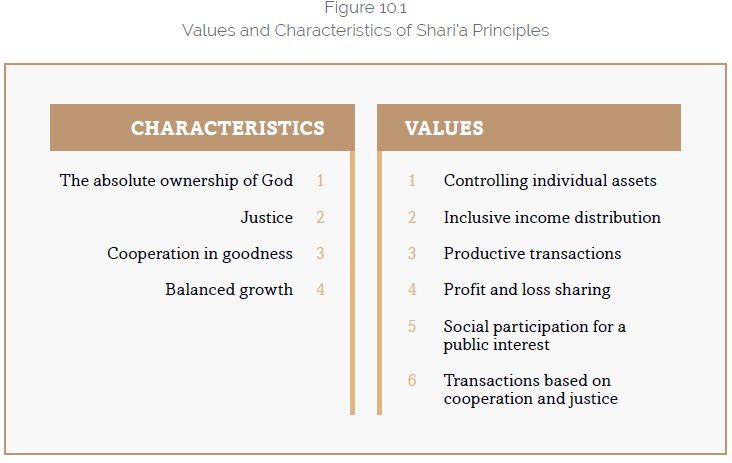

The Islamic finance sector must support productive economic activity in the real sector. Both are carried out on moral values and Shari’a principles embodied in four values and six characteristics, given in the Figure 10.1.

Based on the values and basic principles, Islamic financial instruments are unique and, at the same time, superior. As stated earlier, it is pertinent to note that the scope of Islamic finance is not limited to Islamic commercial finance, but it also encompasses Islamic social finance, such as zakat,sadaqa, and waqf.

Bank Indonesia’s Post-COVID Policy Mix and the Role of Islamic Social Finance

The Islamic finance sector in Indonesia is still dominated by Islamic banking-based commercial financing instruments, financial markets, and capital markets (equity) relevant for financing large and medium-sized businesses, including corporations. However, in order to cater to a large number of small and micro businesses, Islamic microfinance is also playing a significant role. The magnitude of Islamic microfinance can be gauged from the number of SMEs served by Shari’a microfinance institutions and Shari’a savings and loans financing cooperatives/units. In addition to that, micro and small business sectors are also supported by revolving funds.

The Islamic social finance instruments are developed and strengthened to sustain economies of scale and limited cash flow of small businesses to cover legal and collateral expenditures. On the other hand, zakat is more focused on redistributing wealth to assist the poor in maintaining their purchasing power. In the long run, all these instruments are expected to achieve the Sustainable Development Goals (SDGs), such as reducing poverty, overcoming hunger, improving health and education, and reducing social inequality. Ultimately, Islamic social finance aims to reach people who cannot access other financing instruments for entrepreneurial ventures. This initial support usually reflects in multiplier economic effect as well as social and holistic inclusiveness.

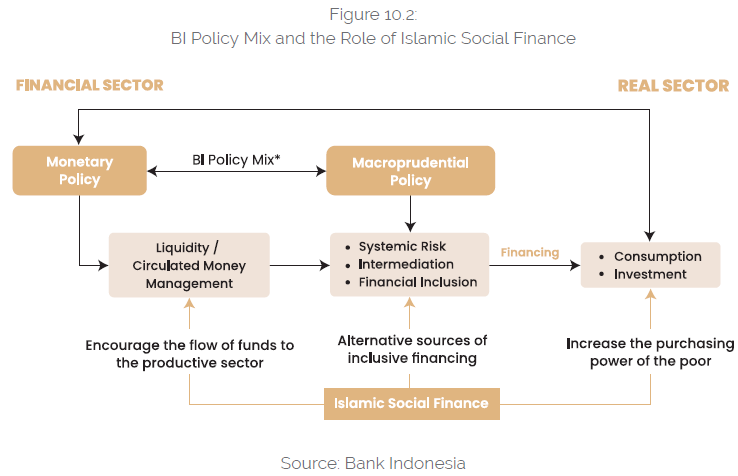

Due to the economic uncertainty caused by COVID-19, Indonesia developed the concept of complementary and mutually reinforcing relationships between monetary and macroprudential policy for economic growth and financial stability (see Figure 10.2). As a result, the Bank Indonesia policies – monetary, macro prudential, and payment systems – all are being used in an effective and integrated manner for both conventional and Islamic financial sectors, with a particular emphasis on Islamic social finance.

Monetary policy is directed to achieve stability in asset pricing (financial and housing) to ensure that an asset price bubble (which commonly builds up during economic upswings) does not burst and result into financial crises and economic recession. Moreover, monetary policy also affects the circulation of money in the economy according to the monetary target. Accordingly, the Shari’a-compliant monetary policy focuses on managing liquidity in the Islamic money market to facilitate real economic transactions and maintain price stability.

Macroprudential policy concerns regulation and supervision of financial services and focuses on systemic risks to maintain financial system stability. Its objective is to mitigate the pro-cyclicality of the financial system (time-dimension), resulting from systemic risks associated with interconnectivity among financial institutions, markets infrastructures, and payment systems (cross-section dimension).

The macroprudential policy encourages the intermediation of banking sector and promotes financial inclusion for financial stability. In this context, integrating commercial and social finance in Islamic finance will further support financial inclusion. Therefore, with Islamic social finance, the Bank Indonesia policy mix can be further strengthened. There are three ways that Islamic social finance can strengthen the Bank Indonesia Policy Mix:

- The flow of social funds to the needy is the flow of funds towards something productive, which increases the circulation of money in the economy.

- Islamic social finance broadens the alternative sources of inclusive financing that could fetch investment for working capital and return on it.

- It increases the purchasing power of the poor and bolsters economic growth and stability through sustained investment.

In corollary, Islamic social finance may bring economic prosperity and enhance social welfare through financial and economic stability. Furthermore, Islamic social finance can be a catalyst for real sector growth. From the implementation perspective, Indonesia has unique experience in employing Islamic social finance within its policy framework, thus providing holistic – from social to financial to growth – opportunities to attain inclusive, sustainable, and balanced growth and prosperity.