In Part 1, Rizwan Rahman explored the Mondragon Cooperation model and argued that its socialist principles could benefit capitalistic enterprise and community empowerment. In this concluding part, the principles and structure of the Mondragon model are used as a benchmark to create a blueprint for improving the value proposition of Islamic finance. In the process, one can see similarities between the philosophies of both concepts.

Islamic and finance as initially conceived was revolutionising global appeal and unique selling points in the industry is here to stay as it has global appeal and a unique selling point sharia compliance at

nevertheless the same time is here to st, the industry is here to stay as it has global appeal and stay selling point sharia compliance. at the same time and for its survival the industry has to be mindful of the criticism especially the form versus substance argument.

Nevertheless, the industry is here to stay as it has global appeal and a unique selling point: Shari’a compliance. At the same time, and for its survival, the industry has to be mindful of the criticisms, especially the form versus substance argument that endlessly plagues the very foundations of the industry. It needs to realise that its fundamental and original goal is to meet the needs of the community, and not focus solely on profits. Learning from the model of the Mondragon Cooperation, synthesising profits and community alleviation is very possible, whilst still remaining decidedly and symbolically Islamic. We, therefore, explore the lessons that can be learned from Mondragon, its similarity to the teachings of the Prophet Muhammad and how these lessons can be applied in the modern world. In these next few pages, we offer a plan for improving Islamic finance but do not argue for a re-haul and removal of the current system. This would be counterproductive for the industry and will destroy the good work that has already taken place.

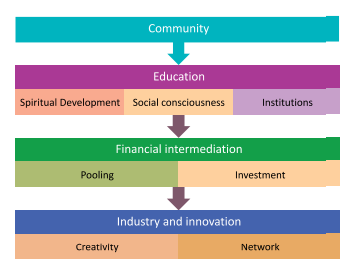

In summary of the process, a community needs to be educated in developing their spiritual composition and sharpening their technical skills through the creation of pedagogical institutions. This provides the backbone in galvanising members to work together by raising capital that can be donated into the pool which is used for investment. Investment is then put into the development of ideas for commercial organisations and their eventual creation. These commercial organisations along with other institutions such as banks and schools should be linked in a broad network where each party supports the other. We now proceed to expand the framework further.

Community

A community will be made up of individuals who create their own social organisations such as families, religious institutions and grassroots organisations including social services and sports centres. Father Arizmendi, founder of Mondragon Cooperation entered a community in which there was a church. This was the centre point. He then integrated himself with the people and the social organisations that were already present. He organised communal events bringing the community together. Having these foundations in place made it easier for him to teach the people. Similarly, the Prophet entered into a community that had institutions in place, such as the Ka’aba, as well as strong tribal and family ties. However, there were no mosques, though it can be argued that the mosque stems from the Ka’aba as it was a house of worship. From the religious institution and the cultural normative, the Prophet built his mission.

The church in Mondragon was the cornerstone from which these ideas and institutions were developed. Today, mosques are present in predominately

Muslim communities. At the very least, hundreds, and in central mosques, thousands attend Friday prayers. Imams have a responsibility to impart both the consciousness of Allah and act in accordance with the Shari’a to congregants. A dynamic imam can galvanise communities if he goes beyond preaching spiritual prerogatives. Islamic finance institutions need to have a greater relationship with mosques. Today, the relationship is tenuous (if it

exists at all) with mosque committees expressing suspicion of Islamic finance and its objectives. Improving relationships does not mean the mosques should have a say in the activity of Islamic financial institutions but mutual support would benefit both parties.

Education

Spiritual development

Any society is founded on cultural norms, customs and values that are rarely codified but understood. The legal and political framework of a society reflects certain values. Father Arizmendi was a Catholic priest, primarily in the community to assist spiritual growth. The Prophet’s fundamental objective was to grant his community the recognition of Allah. In doing so certain values were refracted from the notion of Tawheed (Figure 2). The Prophet became the exemplar of these values and from whom his community was to learn. Building role models is therefore important as well as aphoristic stories to convey the importance of values.

In the modern world, spiritual development is considered quirky and quixotic. Yet with the plethora of psychiatrists and self-help books, it still maintains its importance but in a different guise. The history of Islam testifies to the importance of a spiritual framework, starting with prayer and accommodating rituals and recitations. The science of tasawwuf focused on removing bad qualities of a person, and institutions such as guilds and sufi lodges were created to assist a person in purifying themselves. The industry would gainsay the notion that spiritual development is not within the sphere of concern but the institutions that prop up the industry (schools, universities) have a culture and do convey values. This culture and values are extenuated by the workplace. Corporate governance imparts values, and Islamic financial institutions have to be aware of the role they play in affecting a person’s comportment. Unfortunately, this is being forgotten. What has to be stressed is that spiritual development concerns the individual and not the community but by individual improvement, there will be community improvement.

Social Consciousness

A fundamental lesson that can be taken from Mondragon is community unity and the importance of imbuing this within members. Arizmendi emphasised the importance of helping each other, especially as the community at the time was in the grips of poverty. In Islam, the concept of the ‘umma’ is central to the religion’s strength. The oft-repeated hadith, “The similitude of believers in regard to mutual love, affection, fellow-feeling is that of one body; when any limb of it aches, the whole body aches,” highlights the importance of having social consciousness.

An important point is that Father Arizmendi tackled the challenges of a localised community; the Prophet Muhammad first built up his local community. In the modern world, the global village has broadened the definition of the community, and Muslims appear to take on the pains of other Muslims around the world. However, this is a weakness of the Muslim consciousness resulting in an arbitrary and nonplussed activity. The first point of change is the local community, then the surrounding communities and then those who are further away. It was a point that the Prophet understood as his mission grew from Medina. It is something Father Arizmendi understood with his parish, Mondragon. Islamic finance institutions have to consider the local community needs first, which will differ according to location and socio-economic status. There has to be greater inter-community linkages. Western institutions have understood the importance of social responsibility and Islamic institutions need to learn from this. In Figure 3, the governing principles of Arizmensndi’s cooperative are reproduced, this time showing how the Prophet had similar principles to encourage social consciousness.

Institutions

Schools and universities are the foundation of a person’s knowledge of the world, both in terms of technical knowledge and philosophy. It is within the school that citizens are influenced and, to some extent, moulded. Every educational institution indoctrinates, and the best ones align with the norms of society. Arizmendi’s first creation was a technical school that taught values and provided skill sets. As the Mondragon Cooperation grew, a university was developed. The Prophet taught his community values and law. It was up to his community to build from his teachings, and they certainly did creating educational systems that created philosophers, lawyers, scientists, etc. Technical skills on the other hand were a societal concern, and not a religious concern, though the Prophet encouraged people to work and not be aesthetical monks. It was part of their religious duties.

Madrasas represent the conduit through which the Prophet’s teachings are disseminated but many of them today suffer from a disconnection with greater society. More needs to be done to change the pedagogy of madrasas to account both for spiritual and technical education.

Financial intermediation

Pooling

Banks and governments are the best institutions to accumulate people’s money and distribute it to the private sector. Due to the fractional reserve system, banks have access to all the cash earned by individuals who choose to deposit. This is a significant pool of income they can use. As mentioned in Part 1, Arizmendi ascribed the failure of cooperatives to a lack of credit and/or lack of innovation. He, therefore, requested donations from the community, which created a pool of income to invest in commercial ventures. The Prophet used to rely on his community to donate for large-scale ventures such as poverty alleviation and military activity. Zakat was a religious duty, a form of compulsory tax, while sadaqah was voluntary. The more zakat given and sadaqah donated, the larger the pool. However, the quantum depends on the largesse of the community. A more selfish community, the less the donation. Cash can also be extracted from deposit accounts that are guaranteed by the banks.

Investment

Father Arizmendi created the credit union, Caja Laboral, which evolved into a large bank. From the bank, investment and credit were disbursed. In Islamic finance, the banks do the same but profit and loss mechanisms such as mudaraba and musharaka need to be supported more. The central problem for PLS schemes is a lack of information. Customers do not know where their money is being invested in. However, if banks have greater linkages with the community, information can be spread further. The internet and social media provide a tool to link people to the activities of the bank. If the remit of the bank is to invest in socially beneficial commercial projects and local businesses, fewer people will express discontent, and at the same time be aware of the flow of income. There will also be an inbuilt regulatory system of businesses in which banks invest. If businesses fail due to corruption or misapplication of funds, communities will be more aware and this would act as an incentive for businessmen not to transgress. Community censure can be a significant disincentive and has proven effective in smaller communities. Indeed communities have grown larger but with the improvement of communication technology, there is a way of managing numbers and distances as connectivity is instantaneous both audibly and visually. Debt finance instruments such as cards have more value for personal finance (buying houses, conducting renovations, etc).

Industry and innovation

Creativity

Education and investment were two of the core pillars of the Mondragon Cooperation. The final pillar was industry. As mentioned earlier, one of the reasons for the failure of cooperatives was the lack of innovation. Therefore, in Mondragon, there was an investment in research and development to build industry. While the historically Muslim world created impressive trade networks and established markets, it failed to embark on an industrial revolution. Today, the Muslim world has embarked on a course of industrialisation but more needs to be done in terms of investing in ideas for innovative products. In the so-called golden age of Islam (7th -12th century) one must wonder whether more investment in ideas that were being discussed at that time on aerodynamics, pneumatics, hydraulics, etc, would have led to an industrial revolution.

Network

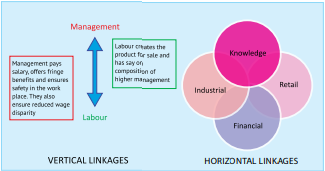

The value and success of a cooperative depend on people working together for the benefit of their own society. It requires personal linkages as well as institutional linkages. The Mondragon Cooperation is made up of institutions that fall under four categories: Knowledge, Financial, Retail and Industrial. Within each institution, there are vertical linkages and financial disparity is reduced between higher management and labour. Between institutions, there are horizontal linkages with institutions assisting the other in terms of helping those companies that are doing poorly and also investing in research and development. There are also overlaps. For instance, schools will create labour who will work in retail and will pay their salaries which go into banks and then be used to invest in the industry. Overall, internal relationships and external relations have to be strong. (Figure 4) In pre-modern Islamic societies, artisan guilds ensured both vertical and horizontal relationships. The Ottoman Empire was renowned for the number of guilds in cities such as Istanbul. They created a cooperative environment and helped individuals develop skills and prosper. Merchant guilds were also formed and this helped with long-distance trade. Agentive relationships were strong, with agents responsible for their principal’s goods, travelling long distances and not reneging from their responsibilities.

Today, there needs to be greater linkages between institutions in Muslim communities. Islamic financial institutions have to be linked to mosques, grassroots organisations, schools, universities, companies and social services such as healthcare. Figure 5 shows the potential linkages between institutions that need to be created. Starting from the mosque and grassroots organisations that provide purpose to communities, the community needs to create schools and universities for spiritual and technical knowledge. From community funds, financial institutions are established to invest in industry and innovation. Profits from industry are then ploughed back into financial services and/or education and/or the community. There is interconnectivity and cooperation between all the institutions.

Conclusion

This blueprint taken from the experience starting of Mondragon is based on two assumptions: no government involvement the starting point is a blank canvas with no institutions present. With regard to the latter, institutions are already in place. Madrasas, universities, grassroots organisations, etc have been previously established. Islamic finance has done much in the last 40 years to create a worldwide industry but it needs to do more to connect and assist predominate Muslim communities build and improving the institutions that will benefit their locality. The weakest linkage is between Islamic finance institutions and mosques and madrasas. Once there is greater connectivity, there will be an improvement in the Islamic finance proposition that accounts for both the spiritual and practical development of the Muslim community. This does not require a revolution but an evolution in thinking and practice.