KEY MESSAGES:

- As one of the four pillars of financial inclusion, takaful products can make a significant positive difference in the lives of vulnerable individuals by helping house-holds mitigate shocks and improve the management of expenses related to unforeseen events such as medical emergencies, a death in the family, theft or natural disasters.

- The promotion of an inclusive financial system has been an important national agenda of many countries. Many researches suggest that the access to takaful services is an important strategy for poverty reduction. However, the poor and low-income households are often ignored and inadequately serviced by the private insurance/takaful market and schemes because the premiums/contributions are unaffordable.

- To ensure that the public have access to financial security, the introduction of micro takaful products was outlined as a salient agenda under the BNM’s Financial Inclusion Framework 2011. In this regard, Skim Simpanan Pendidikan Nasional Plus (SSPN-i Plus) is a product that strategically promotes financial inclusion by providing a cost-effective and commercially sustainable micro takaful product, which enhances the social security net of the society.

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance or takaful – delivered in a responsible and sustainable way. In the context of takaful, this is a critically important tool for not only reducing poverty, but also for helping those who have emerged from poverty to manage their risk and avoid falling back into poverty. As one of the four pillars of financial inclusion, takaful products can make a significant positive difference in the lives of vulnerable individuals by helping households mitigate shocks and improve the management of expenses related to unforeseen events such as medical emergencies, a death in the family, theft or natural disasters.

However, there is a persistent takaful gap, particularly in developing countries. With significant technological advancements over the past decade, the design, selling, and servicing of takaful products have improved significantly. These changes provide an opportunity to give poor people more access to takaful and to improve financial inclusion. This chapter highlights the features of SSPN-i Plus in Malaysia, examines the attractiveness of the product to the depositors and its role in advancing financial inclusion agenda specifically in ensuring savings and takaful products become more accessible to the underserved segment of the society.

A Case Study of Malaysia

The takaful industry in Malaysia is growing at an average rate of 12.4% annually for the past 5 years. Yet, further growth is crucial given that there is still a vast proportion of population uninsured, let alone the number of those that have protection but still underinsured (the combined life insurance and family takaful penetration rate in Malaysia is only 56%, of which 90% are under-insured). An insurance or takaful plan is important to provide financial cushion in case of emergencies or income loss, where many Malaysians are revealed to be ill-prepared to cope with unexpected expenses and loss of income according to the Survey on Financial Capability and Inclusion Demand Side conducted by Bank Negara Malaysia (BNM) in 2015. About 76% of the survey’s respondents are found to be facing difficulty in raising even RM1,000 during emergencies while only 6% of the respondents are confident to be able to meet six months of their financial obligations after an income loss.

To ensure that the public have access to financial security, the introduction of micro takaful products was outlined as a salient agenda under the BNM’s Financial Inclusion Framework 2011. In this regard, Skim Simpanan Pendidikan Nasional Plus (SSPN-i Plus) is a product that strategically promotes financial inclusion by providing a cost-effective and commercially sustainable micro takaful product, which enhances the social security net of the society. The product, which was jointly developed by Perbadanan Tabung Pendidikan Tinggi Nasional (PTPTN) and Hong Leong MSIG Takaful (HLMT), aims to cultivate the behaviour of saving and subscribing to takaful protection among the society since a young age. Any individual who opens SSPN-i Plus account stands to benefit from accumulation of savings and simultaneously receives a basic form of takaful protection which covers among others, Death and Total Permanent Disability benefit, Critical Illness benefit and Daily Hospital Allowance under attractive packages starting from as low as RM30 per month.

An Overview of SSPN-i Plus

SSPN-i Plus draws inspiration from the highly successful Skim Simpanan Pendidikan Nasional (SSPN-i) introduced 13 years ago. A new and improved SSPN-i Plus was introduced in June 2015 where the product offers a savings plan with a wide range of takaful protection under six different packages. The Shari’a-compliant scheme is offered based on the wakalah (agency) contract, where the customers (hereafter termed as “depositors”) appoint PTPTN as agent to manage their deposits for investment purposes while HLMT is appointed as an agent to manage the takaful fund. Any Malaysian below 65 years old is eligible to participate in and benefit from the SSPN-i Plus. Optimal benefits can be obtained for people with children or dependents since SSPN-i Plus offers immediate temporary relief in the event of financial difficulty against risk such as death or critical illness of the family breadwinner.

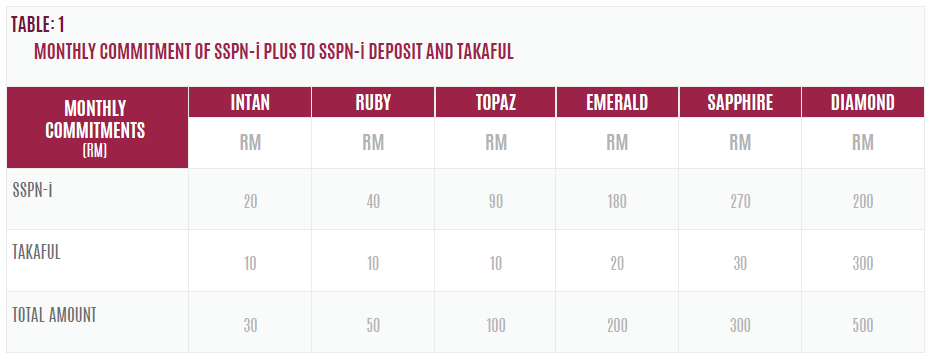

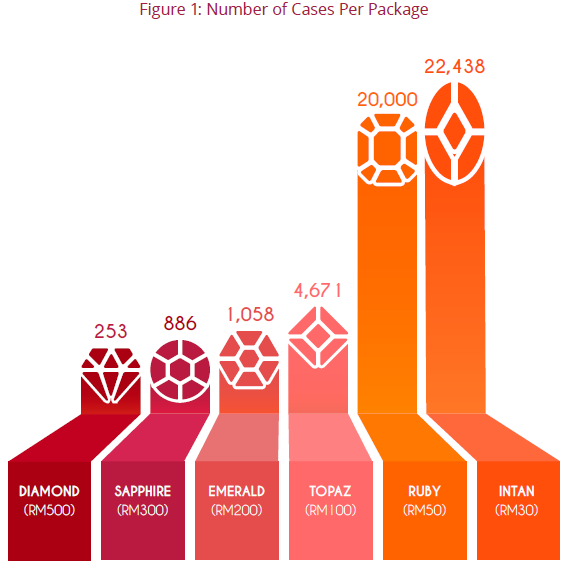

The SSPN-i Plus scheme is offered to depositors under six different options or packages, with the monthly deposits ranging from as low as RM30 per month to as high as RM500 per month. Each package has two components, namely savings and takaful contribution as shown in Table 1.

Why SSPN-i Plus?

The product has experienced exponential growth and take-ups due to the following features which provide value additions to the depositors:

Takaful Benefits

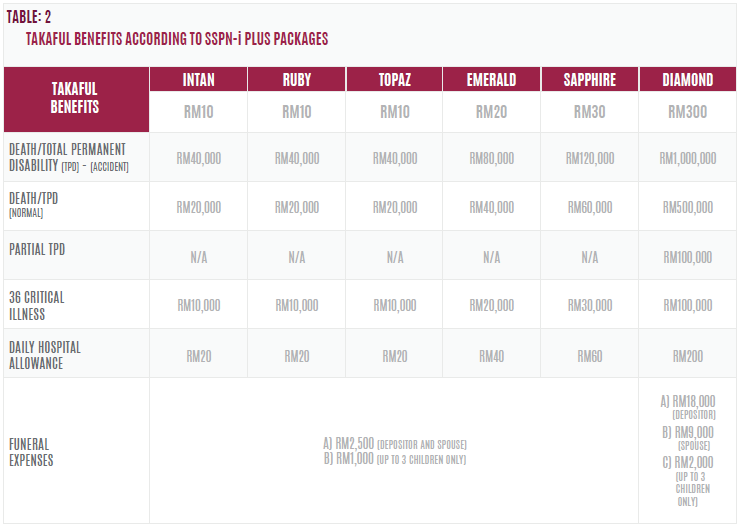

The main advantage of SSPN-i Plus as compared to the basic SSPN-i account is the takaful protection, which is offered according to the packages opted by the depositors.

For example, for those who chose to commit RM50 per month under the Ruby pack-age, RM40 of it will be deposited with SSPN-i, while RM10 will be accepted as a takaful contribution. The coverage enjoyed includes death and permanent disability, 36 critical illnesses, daily hospital allowances and funeral expenses which is also applicable to a spouse and up to three children. Most importantly, the availability of takaful benefits and the amount of participant’s contribution offered under this scheme is not determined depending on the participant’s age, gender and risk classification. As a consequence, this makes takaful to become much more accessible and affordable to all segment of the society regardless of age, gender, type of job, etc. Takaful benefits attached with different packages are compared in Table 2.

Income Tax Relief of Up to RM12,000

The depositors can enjoy an income tax relief on the contributions to SSPN-i Plus of up to RM12,000 annually, which is derived from up to RM6,000 relief from the amount of saving in SSPN-i account and up to RM6,000 relief from the takaful contribution. However, the income tax relief for the portion saved under SSPN-i account is only applicable to parents or legal guardians who open an account for their children/child as the beneficiary. Working parents with separate tax submissions and separate SSPN-i accounts dedicated to the same beneficiary (the same child) can also enjoy a tax relief separately up to the maximum of RM6,000 to each parent per year. Meanwhile, parents with a joint taxation but own a separate SSPN-i account each, are only eligible to obtain up to the maximum of RM6,000 of tax relief combined.

Savings Guaranteed by the Government and Takaful by PIDM

For the ultimate peace of mind, the savings portion under SSPN-i is fully guaranteed by the Malaysian government. This is provided for in Section 11 of Perbadanan Tabung Pendidikan Tinggi Nasional Act 2007. Similar to all other takaful certificates in Malaysia, the takaful benefits agreed with the SSPN-i Plus depositors are guaran-teed by Perbadanan Deposit Insuran Malaysia (PIDM) under the Takaful and Insurance Benefits Protection System in the event that the takaful operator failed.

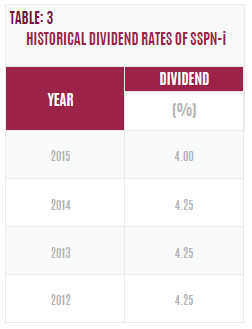

Yearly Dividend

Another perk of SSPN-i Plus is its competitive yearly dividend rate or profit bench-marked against banking institutions’ fixed deposit rates. Furthermore, this dividend income is exempted from income tax (see Table 3).

Cabutan Wow

The depositors of SSPN-i Plus are also eligible to participate in Cabutan Wow! SSPN-i Plus Lucky Draw, and stand to win over 300 amazing prizes worth RM1.5 million. This initiative reflect the commitment to foster the culture of savings particularly among parents who are preparing their children’s higher education.

Condition on Application of PTPTN Financing

Beginning 1st January 2012, students who wish to apply for PTPTN education financing to fund their studies at Polytechnics, IPTA or IPTS are required to have an SSPN-i or SSPN-i Plus account with a minimum amount of outstanding deposit as determined by PTPTN.

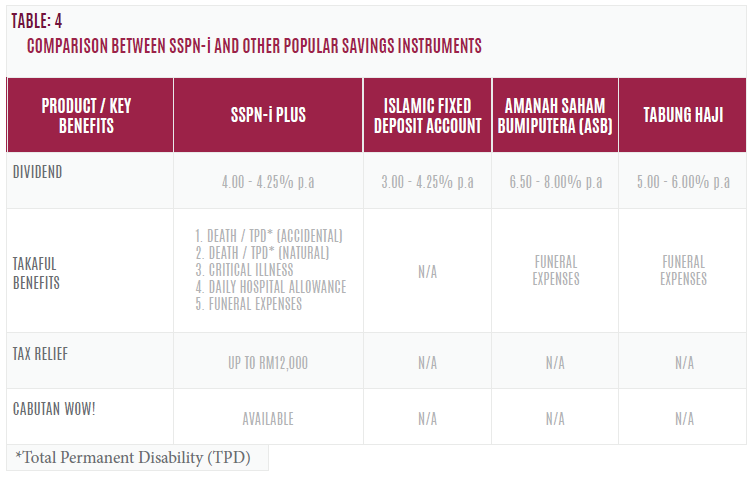

Differences between SSPN-i by Plus and Other Popular Saving Instruments

Individuals’ savings, particularly by Muslims are usually channelled to several Shari’a-compliant saving instruments, namely Islamic fixed deposits accepted by Islamic banking institutions, Amanah Saham Bumiputera (ASB) managed by Per-modalan Nasional Berhad (PNB) and Wadi’ah Savings accepted by Lembaga Tabung Haji. Table 4 shows the differences between SSPN-i Plus and the other popular savings instruments in Malaysia.

To summarise, SSPN-i Plus is currently the most comprehensive savings plan which is not only guaranteed by the government but is also Shari’a-compliant, offers takaful benefits and is eligible for tax rebates of up to RM12,000 per year. Furthermore, depositors will be automatically eligible for the lucky draws with more than 300 prizes worth RM1.5 million a year.

Differences between SSPN-i Plus and Takaful Education Product

Table 5 shows key factors distinguishing SSPN-i Plus from a takaful education product in the market. Unlike many other takaful protection plan, the takaful benefits and amount of contribution of SSPN-i Plus are fixed under the six packages which ease the understanding and inclusion of the public. In addition, medical underwriting is not part of the requirement to subscribe to this plan.

SSPN-i Plus a Possible Avenue to Increasing Financial Inclusion

The promotion of an inclusive financial system has been an important national agenda of many countries, including Malaysia. Many researchers suggest that the access to takaful services is an important strategy for poverty reduction. However, the poor and low-income households are often ignored and inadequately serviced by the private insurance/ takaful market and schemes because the premiums/contributions are unaffordable. SSPN-i Plus addresses the issue in several ways. The first is by providing the means for saving and affordable protection particularly to the lower income group from as low as RM1 per day.

The takaful benefits under SSPN-i Plus are generally less expensive than an individual policy coverage offered by insurance companies or takaful operators since the contribution is not determined by the individual’s age, gender and risk classification. This in turn provides financial assistance against unexpected future financial loss, which ultimately avoids a person from falling into the poverty pit during adverse situations and encourages mutual cooperation via the spirit of tabarru’ (donation).

Additionally, the participants are also not subjected to a medical underwriting in order to obtain a coverage since the takaful operator providing the takaful benefits pools the risk of all depositors or participants to adequately price the risk. Furthermore, in ensuring sustainability and efficiency, SSPN-i Plus also uses a cost-efficient and innovative business model via affiliated distribution channels and technology-driven processes such as online submission and e-certificate. The cost savings from such measures are subsequently translated to a lower takaful contribution with higher protection value for the takaful participants.

Figure 1 reflects the number of SSPN-i Plus cases that are subscribed by depositors based on the six packages from the period of 1st January to 31st December 2016. The most popular package during that period was Intan package, followed by Ruby package.

Increasing Takaful Penetration and Financial Protection Gap

Malaysians should be aware that financial protection is also as important as accumulating savings. Currently, the combined insurance and takaful penetration of 56% is still relatively low compared to other developed countries according to a research study undertaken by Life Insurance Association Malaysia (LIAM) in 2013. Besides, up to 90% of the life-insured Malaysians are under-insured, which could result in inadequate protection to the family members. When something bad happens to them, the money that they can spend on their family probably will only last for a year or two. The amount was far below the takaful industry’s rule of thumb, in that, an individual especially the breadwinner is suggested to have takaful protection which equals 10 times his annual income. With higher sum assured protection, it could at least guarantee the family’s livelihood for the next 10 years.

SSPN-i Plus is the game changer the takaful industry needs to increase takaful market penetration rate and to closing the takaful protection gap among Malaysian due to its unique features and attractive advantages. SSPN-i Plus made its debut on June 2015 and has since captured more than 53,000 depositors for its capability of combining savings and takaful protection into one dynamic and comprehensive package at affordable prices with accumulated deposits of more than RM18 million.

Enhancing Reach via Digital Platform

In May 2016, PTPTN officially launched its Ejen Online (EO) programme where affiliated business partners or online marketing agents can assist those wishing to join the SSPN-i Plus scheme. The EO model by PTPTN was the first of its kind in Malaysia and worked through a network of agents without the need to set up physical branch infrastructure to strengthen its community outreach. This innovation benefitted PTPTN in terms of cost savings in expanding its network and has also changed the way people perceive SSPN-i Plus product. Instead of walking into a typical PTPTN’s branch to perform transactions, customers now have the option to open SSPN-i Plus account directly from PTPTN’s website or through any EO located all over Malaysia.

As a result, approximately 20% – 25% new account openings have been registered through EO since this programme was launched. Through this EO platform, PTPTN can promote other products to customers in the future. The EO will receive up to 25% commission and other incentives upon opening SSPN-i Plus account successfully. By meeting a targeted number of new accounts, EO will also be in the running for the “Best PTPTN Online Agent Award” and win travel package and cash prize. Through this model, the public will be able to start saving with ease through online transactions or via EO. PTPTN’s EO does not need to have capital or involve in cash transaction, and their working hours are flexible while training is provided. Furthermore, in ensuring sustainability and efficiency, SSPN-i Plus also uses cost-efficient and innovative business models via technology-driven processes like online submission and e-certificate. The arising cost savings from such innovations can subsequently be translated to lower takaful contributions, or higher protection value for the takaful participant.

Going forward, there are plans to allow existing customers of SSPN-i Plus to perform deposit transactions through the MEPS network and POS Malaysia. This is testament to the fact that PTPTN is taking innovative steps to encourage Malaysians to open SSPN-i Plus account by introducing models that work for low-income earners as well. Working towards a vision that encompasses financial inclusion for the poor, this sales strategy beyond PTPTN branches will not only ensure economic sustainability but also increase the overall stability of the financial system.

Conclusion

In a nutshell, SSPN-i Plus is an ideal financial product for the younger generation aspiring to excel at higher education levels with added peace of mind as their education costs are technically taken care of. It is a product that better reflects the realities of today and the future, taking into consideration of the ever-rising living costs. Through this scheme, it enables takaful to become more easily understood by the public and accessible to all segment of the society whilst maintaining the benefits.