After the Global Financial Crisis (GFC) almost a decade ago, many extraordinary transformations have taken place in the global financial system. A novel coronavirus, referred to as COVID-19 pandemic, is the new “black swan” in town. Both the speed and magnitude of this pandemic spread engulfing the whole world has been greater than the GFC.

The crisis has not discriminated borders, races, ranks, and faiths. From “flattening the curve” to “herd immunity” and “social distancing” to “prudent distancing”, almost everything has been tried and tested. One of the many worrying issues around COVID-19 was the spread of pseudoscience, recommending everything from giving up ice cream to drinking bleach, and being caught up in the hysteria and the continuous stream of bad news.

In such circumstances, writing on IsBF has been dispiriting. Fear of the unknown remains dominant, as the menace of this unprecedented economic and human crisis of this proportion unfolds. This pandemic is not only a threat to the global financial system bringing dramatic economic effect bigger than the GFC but also underlies long-lasting psychological implications.

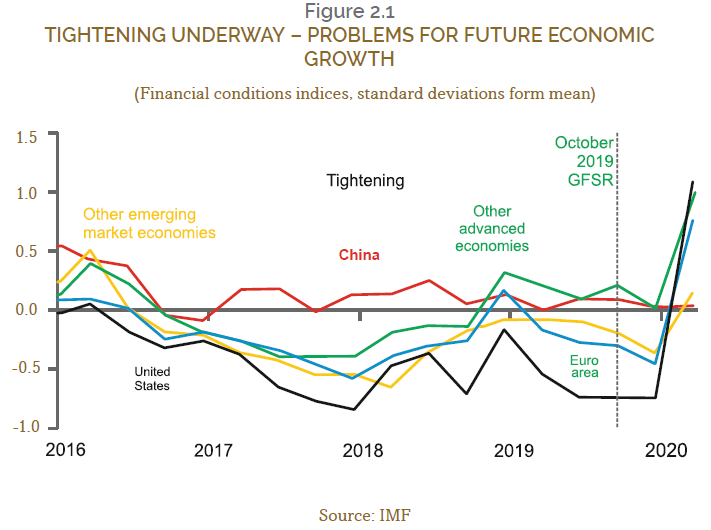

Who would have thought two quarters ago about this pandemic, which has shattered everything? There are challenging times ahead for countries and financial institutions as financial conditions are tightening (see Figure 2.1). Global financial markets continue to crash, many airlines are still grounded due to the cancellation of thousands of flights and countries imposing a ban on travel. Crude oil prices dropped to the lowest in 18 years. Sharp increase of uncertainty in financial markets worldwide widened the credit spreads broadly across markets. Currencies have been hit hard against the US$. Significant policy rates cut and open-ended quantitative easing have resulted in global bonds yield declining. Business confidence is falling off a cliff as cross-border trade has been disturbed that provides critical streams of foreign exchange. All of these conditions bring negative implications for businesses which will ultimately impact the financial sector as well as the fragile gig-economy.

The question is: how long shall we face a recessionary outlook? The IMF Managing Director, Ms Kristalina Georgieva confirmed during the Opening Remarks at a Press Briefing on March 27, 2020, that “we have entered a recession – as bad as or worse than in 2009”. This continued till the end of 2020. One can certainly concur with her that “a key concern about the long-lasting impact of the sudden stop of the world economy is the risk of a wave of bankruptcies and layoffs that not only can undermine recovery but can also erode the fabric of our societies”. While the G20 reported fiscal measures totaling some US$5 trillion or over 6% of global GDP, the question remains: is it enough?

Financial sector, including Islamic finance, is certainly going to be impacted because of the above conditions. In this context, the following key questions must be addressed:

- What is the potential impact on Islamic banks?

- How can Islamic banks measure the impact with stress testing?

- How to navigate through this tough time?

- What should be the role of various stakeholders such as regulators and standard-setting bodies for Islamic finance?

Potential Impact and Implications for Islamic Banks

The COVID-19 brings a range of potential implications for all types of financial institutions. Being a part of global finance, Islamic finance is no exception as it continues to operate in a similar economic and financial environment. It brings various credit, market, liquidity and operational risks implications proportionate to the size of an Islamic bank, complexity and nature of the dominant portfolio (e.g., real estate, financing-driven, financial investment) and the economy in which it operates.

Let us briefly look at what kind of implications the COVID-19 brings to Islamic banks through a balance sheet approach.

First, the significant decline in domestic and global economic activity brings huge business disruptions. This brings an important implication for sovereign central banks when their rating is downgraded due to the ongoing domestic and global economic outlook, taking into account both monetary and fiscal measures, and their likelihood to honor their debt obligations. This indicates impacts of rating migrations (downward; e.g. AAA to AA) of counterparties (banks, corporates, SMEs, and PSEs) under the standardized approach, which ultimately has an impact on the funding costs as well as Risk-Weighted Assets (RWAs) in capital adequacy.

Second, when central banks are relaxing the policy rate to boost the sluggish economy, the return on investment for placement with the central bank as well as lending to government by banks will attract low investment return. In such a situation, the new financing will also attract low return, and existing financing will be affected by the non-payments due to closure of businesses and people being unemployed for a certain period. Thus, pushing up non-performing financing (NPF) and depleting the provisions. The NPF has implications for expected credit losses (ECL), write-off, and liquidity. This will bring a drag on the profitability of Islamic banks, which will consequently affect the retained earnings, and capital buffer subsequently.

Third, as global financial markets crash – especially, when in developed markets investors sell-off and in emerging markets when investors pull out billions of USD investment – there is an impact on local stock exchanges, bringing negative consequences to financial investment and Shari’a-compliant instruments. Both yields and value of an investment will go down significantly and will have an influence on the investment income of Islamic banks. Furthermore, real estate investment will be having a downturn and a correction in market valuations due to a decline in demand and relocations.

Lastly, the value of foreign liabilities (FX) surges sharply due to the depreciation of the local currency. The FX market has shown significant volatility. On the other hand, the structural investments by the Islamic banks in their subsidiaries and affiliates can also bring negative implications due to the disruption of business, domestically and abroad. It has also been pointed out that the prolonged depreciation of several emerging markets’ currencies from 2017 towards Q3-2018 led to a decline in the dollar value of assets.

Measuring the Impact and Implications – Stress Testing and Reverse Stress Testing

Now let us address how the impact can be measured. Similar to the GFC, the COVID-19 pandemic has put significant emphasis on the role of stress testing within risk management.

Stress testing should form an integral part of the overall governance of the Islamic banks. The ultimate responsibility for the overall stress testing programme is with the board of directors (BOD).

Just like medical unpreparedness has been exposed by this pandemic, similarly, banks will be exposed by not having in place a pandemic scenario that is a “low-frequency – high-impact event” which may not be reflected in historical data” or “fat tails event” in their stress testing. Such an event can have catastrophic consequences.

Two quarters ago, the above scenario may not be envisaged by the risk management team and given due consideration due to its plausibility, but now this is a reality.

Islamic banks should include in their stress testing not only the worst-case scenarios but it should also be complemented with reverse stress testing (i.e., striking off a whole business line and estimating whether the Islamic banks can survive). The macro model should not only capture significant drop in macroeconomic variables such as GDP due to significant drop-in business activities in various economic sectors causing unemployment, among others, but also should include spillover effect through trade, tourism, travelling, hospitability, etc. In particular, Islamic banks must pursue a more thorough analysis of risk transmission and contagion mechanisms (including “ripple and reinforcing effects” from a primary stress scenario extending to other markets or products) and also reflect better risk correlations which may vary in stressed conditions.

Severity is to be understood in the light of the specific vulnerabilities of the respective Islamic banks, which might not be equal to the perspective of the total economy. A simple country- or region-specific macroeconomic stress scenario may be less relevant to some Islamic banks’ risk profile than others – for example, if they have a specific industry exposure which is countercyclical, or if their risks are primarily international and less impacted by national scenarios. Deployment of stress testing should be proportionate to the Islamic banks’ size of balance sheets and the extent of their interconnectedness.

A reverse stress test induces an Islamic bank to consider scenarios beyond its normal business settings and highlights potential events with contagion and systemic implications. Therefore, reverse stress testing starts from a known stress test outcome (such as breaching regulatory capital ratios, or a liquidity crisis) and then asking what events could lead to such an outcome for the Islamic bank. As such, reverse stress testing complements in an important way the existing stress testing framework. It requires an Islamic bank to assess scenarios and circumstances that would put its survival in jeopardy, thereby identifying potential bank-wide business vulnerabilities.

Other than conducting reverse stress testing, Islamic banks should include the following key factors in their stress testing exercise (for details, see IFSB-13):

- Significant decline in domestic economic activity;

- Significant deterioration of anchor macroeconomic variables (e.g., oil) or sectors (e.g., tourism, real estate, recreation, etc.);

- Impacts of rating migrations (i.e., historical default experience of IBs of counterparties within specific rating classes (AAA, AA, A, etc.) of different counterparties (retail,

corporate or sovereign) under the standardized approach and its impacts on RWA in capital adequacy;

- Adverse shifts in the distribution of default probabilities and recovery rates;

- Policy for determining and allocating provisions for doubtful debts;

- The forced defaults (due to cash flow shortages) and planned defaults (higher probability of default by counterparties and loss given default);

- Fluctuations in values in tradable, or marketable, assets (including Sukuk);

- Equities (stocks) (including those in liquid and/or non-liquid markets);

- FX fluctuations and volatility arising from general foreign exchange spot rate changes in cross-border transactions;

- Severe constraints in accessing secured and unsecured Shari’a-compliant funding;

- The ability to transfer liquidity across entities, sectors and borders taking into account legal, regulatory, operational, and time zone restrictions and constraints; and

- Liquidity reserves and regulatory required ratios (such as LCR and NSFR).

Navigating These Challenging Times – The Role of Various Stakeholders

As per the IFSB PISIFIs latest data, we should bear in mind that Islamic finance is facing these challenges from a position of overall strength. However, this should not stop Islamic banks taking into account the above stress testing to ensure their continuity and sustainability. In particular, it is worth noting that the global Islamic banking and finance industry has for the last few years been experiencing decline in growth rate, which should have implications for the stability of the industry in the wake of an exogenous shock like COVID-19. The reasons for this monotonous growth are given in Chapter 1. With this trend and the ongoing deterioration in global economic and financial conditions, growth in the Islamic banking sector is certainly being threatened by the devastating effects of COVID-19 outbreak.

Role of Islamic Banks

We should bear in mind that unless one is unable, it is very reprehensible delaying to pay one’s debts. Taking into account the above implications for the Islamic banks arising out of their balance sheet; the Islamic banks have provided relief to the customers (individuals, companies, SMEs) adversely affected by the COVID-19, in line with their respective central bank instructions.

In terms of classification and provisioning standards (e.g., rescheduling, refinancing or reclassification), Islamic banks also observe Shari’a rules and principles, which do not allow to refinance debts based on renegotiated higher markup rates; however, debt rescheduling or restructuring arrangements (without an increase in the amount of the debt) are allowed. This is what most Islamic banks have done during the ongoing crisis.

Furthermore, the Islamic banks should continue paying compensation in appreciation of the banks’ employees for their work during the holidays or when working remotely.

To fulfil the Maqasid al-Shari’a, Islamic banks should divert all of their CSR activities and budget in a fund established by the government or by other organization(s) fighting for the COVID-19. Subject to the respective SSB’s approval, the Islamic banks can pay the zakat to this fund for the COVID-19.

Central Banks – Regulators’ Response and Needed Measures to Support IBs

Both the governments and central banks have come forward in Islamic finance jurisdictions to provide monetary and fiscal stimulus packages and instructions respectively. These measures have provided breathing space to the banking sector and the overall economy during the lockdown period.

It is commendable how various central banks (e.g. BNM, CBK, CBUAE, QCB, SBP, and SAMA) have announced several regulatory, supervisory and administrative measures in support of efforts by banking institutions to assist individuals, small and medium-sized enterprises and companies to manage the impact of the COVID-19 pandemic.

These measures include, among others, moratorium and/or restructuring of financing facilities for a certain period, special discounts to essential sectors for exports, liquidity facilities to banks via various tools under open market operations, procedures to ensure swift and efficient operations, uninterrupted access to financial services to the general public, prioritizing working remotely within the banks’ business continuity plan, and disinfection of vaults and currency notes.

Other than deferring the implementation of the Basel III and its equivalent IFSB regulatory standards for Islamic banks, the regulators should also allow the Islamic banks to drawdown from their regulatory reserves built during the periods of strong financing growth and their capital conservation buffer of 2.5%.

The regulators can also allow Islamic banks to operate below the minimum liquidity coverage ratio (LCR) and Net Stable Funding Ratio (NSFR) of 100% for a certain period. In this context, Islamic banks could be given a timeline to restore their buffers within a reasonable period after January 2021 to comply with the original requirements.

Moreover, the regulators may also provide some relief to the Islamic banks in terms of NPF threshold for the year 2020 and selected write-offs for genuine cases being adversely affected during the COVID-19 pandemic.

The supervisory haircut on collateral values could also be reviewed by the central banks to provide some relief to the Islamic banks in terms of calculating the minimum regulatory capital ratio for the year 2020.

Lastly, regulators can also put restrictions on dividend distribution by Islamic banks until the NPF issues are resolved and all the regulatory requirements are restored.

Role of Standard-Setting Bodies – IFSB and AAOIFI

The role of standard-setting bodies for Islamic finance such as the IFSB and AAOIFI is pertinent to look at, given the recent developments at their respective counterpart, the Basel Committee and the IFRS.

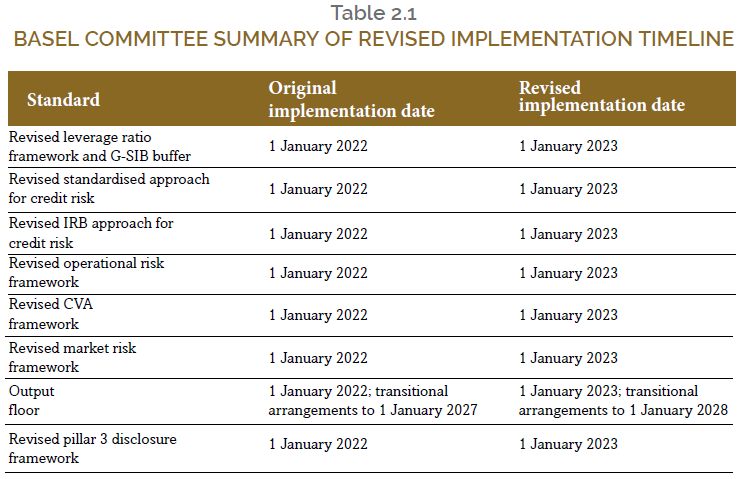

First, on the prudential side, the Basel Committee’s oversight body, the Group of Central Bank Governors and Heads of Supervision (GHOS) has endorsed on March 27, 2020, a set of measures including deferring Basel III implementation (see Table 2.1) to provide additional operational capacity for banks and supervisors to respond to the immediate financial stability priorities resulting from the impact of the COVID-19 on the global banking system:

- The implementation date of the Basel III standards finalized in December 2017 has been deferred by one year to 1 January 2023;

- The implementation date of the revised market risk framework finalised in January 2019 has been deferred by one year to 1 January 2023;

- The implementation date of the revised Pillar 3 disclosure requirements finalised in December 2018 has been deferred by one year to 1 January 2023;

Second, on the accounting side, on March 27, 2020, the IFRS has also issued a key statement on the expected credit losses (ECL) recognition and key steps to be taken by the banks in the light of current uncertainty resulting from the COVID-19.

It is worth recalling that IFRS 9 sets out a framework for determining the amount of ECL that should be recognized. It requires that lifetime ECLs be recognized when there is a significant increase in credit risk (SICR) on a financial instrument. Both the assessment of SICRs and the measurement of ECLs are required to be based on reasonable and supportable information that is available to an entity without undue cost or effort. The statement by the IFRS further indicates that in assessing forecast conditions, consideration should be given both to the effects of COVID-19 and the significant government support measures being undertaken. In this respect, several regulators have published guidance commenting on the application of IFRS 9 in the current environment.

In the above context of Basel Committee and IFRS, there is a certain role to be played by the IFSB, and AAOIFI. In particular, IFSB should review the Basel III equivalent standards implementation date, especially the latest document on Revised Capital Adequacy Standard (ED-23, which is still not yet published), and ensure the implementation date for new requirements as per the Basel III to provide a level-playing field to regulators.

On the other hand, the AAOIFI has issued FAS 30 (Impairment Credit Losses and Onerous Commitments), equivalent to IFRS 9 and it should provide some clarity and explanation on the ECL recognition for IBs during this time taking into account moratorium by regulators. The guidance from these bodies would be helpful to the supervisors regulating Islamic banks in their respective jurisdictions.

Conclusion

We are facing an extraordinary time with this COVID-19 pandemic. Though circumstances are unprecedented, lessons will be learned surely. In such times, both FinTech platforms for Islamic banks and RegTech for regulators are probably winners. As things normalize, economic engines would re-start, people will go back to work, and planes would take off. Pandemic like this may become “new normal” in future compared to a “black swan” event. Hence, Islamic banks should pursue agility and resilience. Islamic banks should include such pandemic in their stress testing for sustainability and business continuity.

On the outlook of Islamic finance, being cognizant of this challenge to have a view at this junction; if this pandemic is contained mid of this year; a partial rebound in 2021 could be expected before heading to 2022 for a full-scale rebound. A concerted effort is needed by international bodies such as IFSB, AAOIFI, IIFM, CIBAFI, and IsDB on a coordinated response to COVID-19 for the financial stability of Islamic finance.

While we will see more academic empirical studies moving forward on the actual assessment, Islamic banks should demonstrate compassion during these exceptional conditions. This compassion from Islamic banks’ BOD and senior management should be two-fold: towards customers by giving them some relief and grace period for their debt payments and selfless staff who are at the frontline and/or back office. It is not only time to be kind and compassionate with the staff, but also show kindness to their loved ones by allowing them to work at home with pay.

Islamic banks shareholders should be ready and well prepared for the remedial actions of the above stress testing including strengthening capital buffers. The Islamic banks’ BOD should also provide some flexibility to the senior management on the performance targets for 2020.

We should remember that difficult times need extraordinary measures. Together, with unity and resilience, we can all get through this.