KEY MESSAGES:

- Although Islamic FinTech is still very new, it is a huge opportunity for Islamic finance to expand and engage more segments of society, and even be adopted by communities without access to traditional banking.

- In the context of financial inclusion, FinTech holds tremendous potential. These solutions are challenging old business models as they are provided with greater speed, accountability, and efficiency at a cheaper cost.

- As Islamic crowdfunding platforms grow, a wider range of Muslim-focused wealth management services may also be provided, guiding the community to invest in platforms for investment, as well as waqf and zakat.

- To support FinTech developments, the authorities have provided a regulatory regime that aids innovation while ensuring security as well as the infrastructure needed to drive the adoption of new technologies in the form of a regulatory sandbox.

The past couple of years have witnessed a rise of FinTech wealth management solutions. Banks and other institutions are giving their customers mobile and web apps with customised dashboards, allowing them to see fluctuations in their investments in real-time. Some platforms allow investors to track and mimic specific indices or other investors, to achieve the results of the best portfolios.

One way FinTech is disrupting wealth management is the rise of robo advisors that are algorithm-powered, virtual fund managers with potentially enhanced capabilities, at a fraction of price. It should be expected that since conventional fund management is being disrupted, then Islamic funds are next in line. Islamic wealth management has much to gain from the services available through digital platforms and FinTech. Crucially, a swift response is necessary to stay relevant in this digital age.

For the Islamic wealth management industry, Shari’a screening and compliance services are important value adding features. But much more must be done to create greater attraction, especially for Millennials. Although Islamic FinTech is still very new, it is a huge opportunity for Islamic finance to expand and engage more segments of society, and even be adopted by communities without access to traditional banking. Conversely, not moving into FinTech may very quickly cause the industry to lose ground and market share to conventional finance.

Unique Opportunities for Islamic Finance

There are numerous factors that point to a much greater opportunity for Islamic FinTech, compared to conventional finance. This is true at the most fundamental level. Here’s a quick overview of these factors:

Financial Inclusion and Increased Market Share

Islamic finance, while is growing strongly, is hardly inclusive, leaving out and bypassing large groups and communities of people. Statistically, 71% of Muslims are unbanked, compared to the world average of 62%, according to the Global Findex Database. Financial inclusion remains a major issue in many countries where Islamic finance has gained a footprint. Pakistan and Indonesia – two of the largest Muslim countries, are good examples of countries where Islamic finance has gained some significant market share but at the same time the number of unbanked Muslims is still relatively high. In the context of financial inclusion, FinTech holds tremendous potential. These solutions are challenging old business models as they are provided with greater speed, accountability, and efficiency at a cheaper cost. Embracing FinTech would undoubtedly help Islamic finance achieve the scale, access and outreach needed to serve this large segment of unbanked Muslims. Hence, adopting FinTech will potentially improve access to Islamic finance and help boost the industry’s market share.

Another area that FinTech companies are tackling is access to credit. In most developing countries where the vast majority of the population is unbanked, it can become a challenge for individuals and businesses to get a loan. In particular, credit history can be a huge road block for people that have never dealt with a financial institution before. FinTech companies (such as Lenddo) are providing an alternative way for banks and financial institutions to assess one’s creditworthiness. Instead of using traditional data to determine whether an individual is a good payer or not, they used social networks and other data such as Facebook, LinkedIn, Google, Yahoo and Twit-ter to prove one’s identity and creditworthiness.

Lack of Products

Islamic retail investment options are greatly lacking in many countries, both in Muslim and Muslim-minority countries. For example, EthisCrowd.com allows for ordinary Muslims to invest directly into social real estate development projects and earn a profit – first-time investors can start with only S$250. There is also a severe lack of financing options for SMEs and startups. P2P Platform KapitalBoost.com has successfully run pilot campaigns to finance 26 businesses from Singapore, Malaysia and Indonesia, with half already giving successful payouts, over its 1.5-year history.

Values-driven

The inclusion of social-impact and human stories are a key force of attraction, and creates virality for P2P crowdfunding campaigns. This is evidenced by the strong organic growth of the community-focused Islamic crowdfunding platform LaunchGood. com in the US.

FinTech Disruption?

In a Forbes article dated nearly a year ago titled, “FinTech Trends: Wealth Management and The Rise of Robo Advisors”, the author explains the rise of robo advisors in the wealth management industry. Robo advisors are computer programmes that help users to invest and manage their funds. Robo advisors create value by providing similar services as investment advisors or fund managers at lower costs and greater speed. Most importantly, a positive user experience makes investing ‘fun’ through interactive and user-friendly interfaces. Very quickly, such experiences will become the new norm.

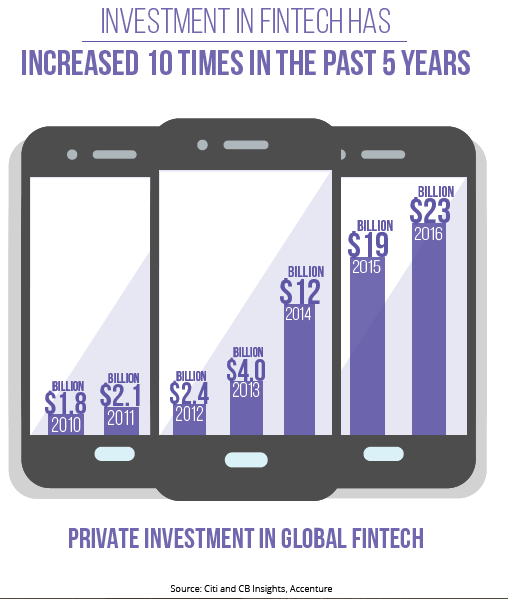

Major institutions have taken serious heed of the current and potential future disruption of FinTech on the banking and wealth management industries. The response can no longer be one of wait-and-see. In the banking industry, one of the most proactive adaptors to the rise of FinTech is Citibank. A Fortune article explains the following, “The most wrenching period for the big banks is almost certainly yet to come. In March, Citigroup’s own research department put out one of the direst assessments yet. The 112-page report, titled “Digital Disruption,” was produced for the bank’s investment clients and reads like a Jerry Maguire manifesto.

The gist: radical change is coming. Citi says that FinTechs have nabbed US$9 billion in business so far, a small percentage of what banks bring in each year. But in just four years, the Citi analysts predict, FinTech revenues will leap more than 10 times, exceeding US$100 billion. By 2023, FinTech will account for 17% of consumer-banking services in North America, or US$203 billion.”

In August of 2015, wealth management giant BlackRock acquired FutureAdvisor, a robo-advisor platform with US$600 million under management in 2015. The move was intended to attract the mass affluent who want high-quality financial advice without the high prices that senior brokers charge. Another target segment is Millennials – a crowd that prefers digital mediums rather than dealing with brokers and advisors.

The acquisition should come as no surprise to those who have been following the news. Bloomberg published an article in May 2016 with the provocative title, “Robots Will Strike Asset Management Firms First”. It states, “According to a survey from the CFA Institute, Wall Street is getting a bit worried about FinTech replacing its jobs. The majority of respondents, which included more than 3,000 chartered financial analysts around the world, view asset management as the industry most at risk from disruption by financial technology. Fifty-four percent of respondents said the sector would feel the biggest changes, followed by banking, securities, and insurance.”

The writing on the wall seems to clearly indicate that wealth management is even more prone to disruption than banking. The same survey found that for banking only 16% is at risk of disruption.

1. What are the Drivers behind the Boom in Fintech?

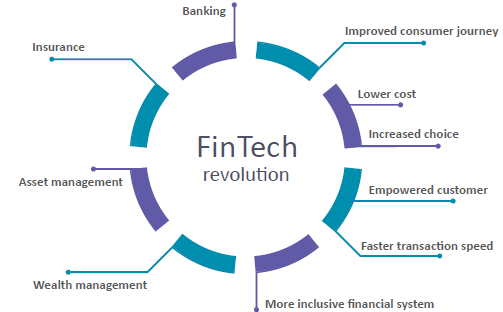

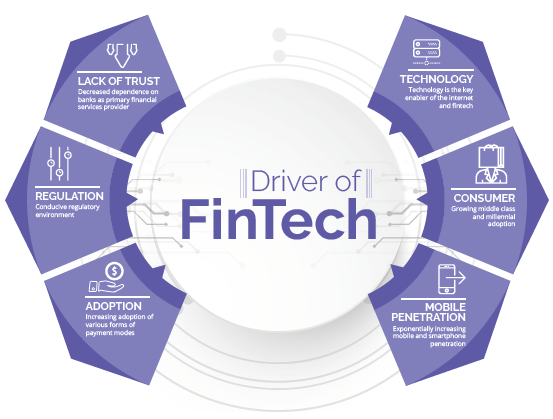

Changing consumer behaviour and preferences Changing consumer behaviour and attitudes are playing a key role in the FinTech revolution as technology is facilitating the shift of control away from corporations to customers. Consumers are embracing new technology at a rapid rate, more engaged with the digital platforms, and they are increasingly less loyal to their financial institutions and demanding greater levels of personalisation, convenience and immediacy. The rising tide of Gen Y and Gen Z will drive future trends and developments. Their preference for digital experience has fuelled the demand for digital financial products and services.

2. Lack of Trust in Traditional Banking.

The global financial crisis of 2008 has motivated customers to shift to technology platforms. Since the banking crisis, the sturdiness of banks has been cast into doubt. The increasing frequency of scandals, combined with concerns about infrastructure and reliability, and the increase of automated processes have all served to erode trust and undermine the rep-utation of banks. According to a research conducted by Neopay, of the 2,000 ‘Millennials’ polled, one in three said they would trust a technology company, such as Google or Apple, with their e-money transactions whilst just 47% have had face-to-face contact with someone from their bank. This suggests younger consumers no longer consider traditional banks as the only option for managing their finances with more and more opting to handle money digitally through e-money channels. Furthermore, the prevalence of social media in Millennials’ everyday life, has given to the emergence of a ‘review community’, whereby customers are more inclined to place their trust in the opinion of a stranger. These review communities are shaping customers’ opinions of financial institutions more than the information provided by the institution’s own website.

The global financial industry has been undergoing transformational changes following the global financial crisis of 2008. FinTech companies have focused on innovative products for financial and insurance services such as digital currencies and blockchains and mobile payments.

3. Supporting policy and regulatory environment

Policymakers and regulators, increasingly aware of the potential of the FinTech sector in transforming financial services, are focusing on the need to provide a conducive regulatory environment and ecosystem to support new technologies. To support FinTech developments, the authorities have provided a regulatory regime that aids innovation while ensuring security as well as the infrastructure needed to drive the adoption of new technologies in the form of a regulatory sandbox. Such a regulatory sandbox has the potential to encourage and support the design and delivery of new financial products and services that benefit consumers and businesses. With a regulatory sandbox, FinTech innovators can overcome regulatory uncertainty, manage regulatory risks during the testing stage and reduce the cost and time to market.

4. Technology is accelerating the pace of change

Technology adoption is occurring much more quickly than before and is now in place to substantially transform financial services. Barriers to entry for digital disruption are also falling quickly because it is now cheaper or easier to commence a technology start-up, with the advent of open-source software and low-cost development tools.

5. Consumer adoption of mobile banking

Consumer adoption of mobile banking has surged as consumers shift away from the conventional ways of performing financial transactions to digital platforms and mobile devices. Factors contributing to the adoption of mobile banking are related to convenience, access to the service regardless of time and place, privacy and savings in time and effort. Financial technology companies have become acutely aware of this shift and as a result have been adapting to consumer demands for more mobile-friendly financial services. In recent years, more and more banks have released mobile apps to allow their customers to handle their finances without the need to walk into a brick-and-mortar store or even use their computers. Furthermore, developments such as the Internet of Things (IoT) and the maturing of artificial intelligence and robotics in the longer term will have a significant impact on delivery of banking and financial services products and services, and redefine the customer experience.

6. Adoption of various forms of payment modes

The widespread adoption of mobile devices such as smartphones and tablets has steadily fostered fin-tech resulting in a number of innovations within the mobile payment landscape. A number of innovations have emerged leveraging mobile devices and connectivity to make payments simpler and more valuable including peer-to-peer payments, digital-only banks, and mobile wallets such as Apple Pay and Android Pay.

Fintech Wealth Management Innovations

Large conventional banks have already aligned with current trends, by launching investment apps to help customers stay up to date on markets they have invested in, some even with insights from experts on macroeconomic and global developments. Such apps allow customers to view the status of their investments, receive alerts on markets changes, and info on how these may impact their investments.

In Islamic finance, such innovations have only just been introduced. One of the few available examples is Arabesque, which is the world’s first “ESG quant fund”. It was developed by professors, subject-matter experts and top professionals, working together to develop the next generation in asset management. The technology integrates environmental, social, and governance (ESG) data with quantitative investment strategies. The fund holds firm to Islamic finance ideals and refrains from any derivatives, securities lending, shorting, or leverage, while still outperforming 95% of its conventional peer group. According to recent update from Arabesque its minimum investment for the retail share class is now only US$100.

One of the signature features of robo-advisors is that they require minuscule fees and resources compared to traditional fund advisors, and can thus lower down minimum investments. Some, like online investment advisor Betterment, have no minimum balance requirement and tailor their services to beginner-level investors. Some platforms even lower their fees as client investments grow. Thus these FinTech platforms are able to achieve scale through making their apps free and having very low minimum investments. Once again the Islamic finance industry can learn from conventional FinTech.

In September 2016, Wahed Invest announced the launch of its robo-advisory investment services in the USA. Wahed offers a unique portfolio investment service that is fully automated. According to their press release, “The Wahed platform analyses thousands of securities worldwide to create portfolio allocations with the highest growth potential for its clients. The firm is registered with the Securities and Exchange Commission (in the USA), and is continually monitored by its Ethical Review Board.” This is a significant breakthrough for the Islamic finance industry. However accessibility to these services still remains an issue. Wahed has performed very well for its initial investors during the Beta period, and has made its service more accessible by, according to the founder, recently lowering the minimum investment to US$500.

To truly open up investment opportunities to the global masses, such business models and products with low minimum investment amounts are needed. With smaller investment denominations, a large pool of investors needs to be activated to raise significant volumes. Another emerging model for investment that can also facilitate small investors is crowdfunding.

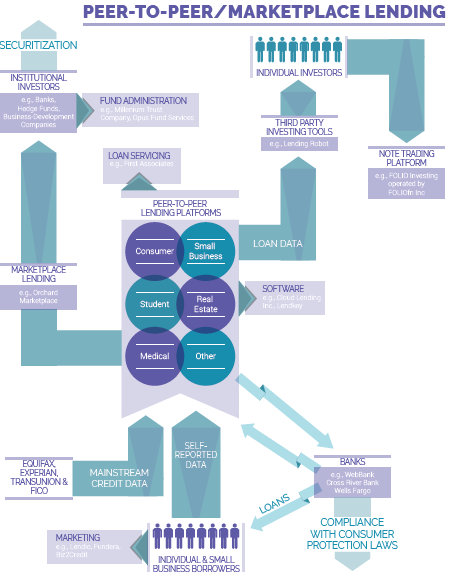

Wealth Management’s Foray into P2P Crowdfunding

Lending or investment-based crowdfunding is commonly referred to as peer-to-peer financing or P2P. In mature P2P crowdfunding markets such as the US, wealth management and investment firms have been active in engaging in and investing with leading platforms. The two giants Black Rock and Vanguard have stakes in platforms Funding Circle and Lending Club, respectively. This attraction to crowdfunding is driven largely by the low-return environment for bonds and other ‘traditional’ investments. According to an index from investment bank Liberum, crowdfunding in the US offers a one-year return of 6.21%. There are now investment trusts that serve as a conduit for mainstream asset managers to invest in crowdfunding deals.

Meanwhile, the ‘opposite’ is happening in China, now the largest market for P2P globally, with 4,000 platforms providing funding of US$93.43 billion in 2015, according to Chinese regulators. In China, P2P platforms have aggressively expanded their variety and scope of investment offerings to transform into one-stop online wealth management platforms.

Two different significant trends are observed here as well as how P2P crowdfunding will increasingly become more important in the wealth management landscape. It is anticipated that both the trends identified in the US and China to also play out in the Muslim world, with finance and government institutions engaging and investing in as well as through P2P crowd-funding platforms. Malaysia’s regulators broke new ground when Securities Commission Malaysia issued 6 licenses for P2P financing in November 2016. This follows their issuance of 6 equity crowdfunding licenses a year earlier.

Experiences of crowdfunding platforms the likes of Ethis Ventures are solid evidence that crowdfunding is in itself a powerful wealth management tool, especially for millennials. Millennials are a different breed of new investors, with a strong distrust of mega-corporations and a natural attraction to digital marketplaces and platforms. The ‘uber-isation’ of retail services around the globe is powered by this sentiment – a growing preference for the decentralised provision of services. This resonates with funding marketplaces such as crowdfunding.

As Islamic crowdfunding platforms grow, a wider range of Muslim-focused wealth management services may also be provided, guiding the community to invest in platforms for investment, as well as waqf and zakat. A portfolio investment approach will also be in demand, to aggregate various campaigns with different risk-return profiles, duration, asset classes and geography. A whole new larger crowdfunding ecosystem may emerge, including mutual funds powered by crowdfunding and crowdfunding aggregators which will serve Muslims in a more comprehensive way.

There will be challenges and growing pains of course. Platforms are the gatekeepers of deals – deciding which campaigns get listed, and also curating the content of campaigns. Different platforms have differing standards of corporate governance and project screening and operate in different environments. The appeal of investing in real-world projects is also coupled with the inherent risks of investing in small businesses and projects. Proponents find value in this reality – this is truly the sharing of risk, as well as returns. Will we then reach a stage where there are robo-advisors for crowdfunding?

Human Touch Still Needed

All is not lost for fund managers. A report conducted by Salesforce suggested that the majority of millennials actually do prefer having an advisor. Results showed that 81% wanted their advisor to either manage their money completely independently, or collaboratively with them compared to 86% for Gen-X’ers and 89% for Baby Boomers.

It seems from some observations that even young first-time investors feel more comfortable consulting a real person for financial advice at certain stages. However, that does not mean that visits to brick-and-mortar branches is the way millennial investors wish to begin their foray into investments. Digital channels must be used to catch the interest of the digital generation. Through advertisement which is both graphical, educational and even entertaining, younger audiences can be attracted. Basic forms of engagement are through social media and inbuilt chat services within the company’s website.

Islamic wealth managers have the opportunity to ride the wave of these changes and go the route of industry leaders like Vanguard and Schwab who have made major adjustments in their strategies in response to the growth of robo advisors like Betterment and Wealthfront, to fit what younger investors are looking for. Vanguard and Schwab have recently launched robo advisor platforms of their own that include an option to interact with a human, if desired. They’ve slashed fees, and now offer a wider array of investment vehicles than the incumbent robo advisors.

Islamic investors have a unique worldview and investment values that cannot be inserted into algorithms. Islamic ethics of investment need to be understood from scholars and therefore their role remains critical. Technology can’t create an investing worldview from a person’s particular needs and goals, nor can it hold their hand and urge them to stay calm. These human qualities are still very valuable to investors young and old, therefore the optimal prospect for the future of Islamic wealth management seems to be the adoption of a good combination of the best of FinTech and human consulting.

Digital channels must be used to catch the interest of the digital generation. Through advertisement which is

both graphical, educational and even entertaining, younger audiences can be attracted. Basic forms of engagement are through social media and inbuilt chat services within the company’s website.