In Capital Markets Post COVID-19

Background and Milestone of Sukuk Negara

As a country with the largest Muslim population in the world, Indonesia has an encouraging record of sukuk issuance. The journey started in 2002 when the National Shari’a Council, the Indonesian Ulama Council (DSN-MUI), released a fatwa on Shari’a bonds. PT Indosat issued the first Shari’a bond in 2002 to finance its business expansion. The term sukuk, which is also referred as Islamic bonds in Indonesia, came into use in 2006 when the Capital Market Supervisory Agency – Financial Institutions (BAPEPAM-LK, now Indonesia Financial Service Authority/OJK) issued regulations regarding the issuance of Shari’a securities.

In 2008, through the Ministry of Finance, the Indonesian government took part in developing the sukuk market and issued Sovereign Shari’a Securities (SBSN) or Sukuk Negara after enacting Law Number 19 in the Year 2008. The main objective behind launching sukuk was to finance the state budget deficit and raise capital for projects listed on the state budget. Accordingly, three securities companies took part as the selling agents of the government to float the issuance on 26 August 2008 through the Islamic Fixed Rate (IFR) series in the domestic primary market via a book-building method.

After the debut issuance, the government continued developing several formats of sukuk instruments using various issuance methods, both in the domestic and international market, from 2008 to 2013. Retail Sukuk, Hajj Fund Sukuk, Islamic treasury bills, and projects-based sukuk were introduced in the domestic market.

In addition, the government has been using regular auction, green-shoe options, private placement, and book-building issuance methods. Sukuk Negara Indonesia (SNI) series was introduced in 2009 for the international market using standalone documentation. Intending to issue sukuk regularly, the government decided to establish in 2011 the Islamic GMTN Program for its global sukuk issuance. Once it had established benchmarks and infrastructures for the Sukuk Negara, the government started focusing on increasing the share of its sovereign sukuk in proportion to its conventional bonds in the domestic market during 2014-19. In 2016, as part of the continuous development of innovative financing instruments, the government introduced a non-tradable saving sukuk for retail investors. Going forward, online retail sukuk was also introduced in 2018.

Due to the largest share of SNI issuance across several fields and areas, along with the introduction of green sukuk, the Indonesian government has been recognized internationally as the most prominent sovereign sukuk issuer in the US dollar. In 2020, the government introduced the Primary Dealer System of Sukuk Negara and the Waqf Sukuk. The idea was to dovetail Sukuk Negara with Islamic social finance through the Cash-Waqf Linked Sukuk scheme.

Sukuk Negara Structure

The development of various Sukuk Negara structures is essential primarily to provide flexibility for the government in issuing and managing Sukuk Negara. Therefore, the sukuk structure has been developed with several aspects, including compliance with the Shari’a principles, the available underlying assets, acceptance of the structure in the domestic and global markets, and the needs for the issuance and management of Sukuk Negara.

In addition, Sukuk Negara’s structure is to abide by Article 3 of Law Number 19 of the Year 2008, which states that Sukuk Negara might be issued under Shari’a contracts, such as ijara, mudaraba, musharaka, istisna’ and any other contract that does not contradict with the Shari’a principles.

The government developed four sukuk structures based on ijara contracts. The first is the ijara sale and leaseback structure. It is a well-known structure that uses tangible leased assets as the underlying collateral for the sukuk. In this case, state-owned assets are used as underlying collaterals in the form of land and buildings. Since it represents ownership of tangible leased assets, the Sukuk Negara using this structure is tradable in the secondary market. This is in accordance with the AAOIFI Shari’a Standard Number 17 (4/2/5) on the tradability of leased tangible assets.

The second is the ijara al-khidamat structure, in which case the underlying asset’s services are used, namely Hajj services. The Sukuk Negara that uses this type of structure represents ownership of services available in the future (certificates of ownership of described future services), referring to the AAOIFI Shari’a Standard No. 17 (3/2/4). This type of Sukuk Negara is non-tradable.

The third is the ijara asset to be leased structure used to issue Sukuk Negara to finance the government projects. Therefore, it is categorized into types of sukuk that represent ownership of tangible assets promised to be leased (sukuk al-milkiyya al-maujudat al-mau’ud bisti’jariha), as referred to in AAOIFI Shari’a Standard Number 17 (3/1).

Finally, the fourth is the wakala structure. Sukuk wakala is a partnership-based sukuk. In AAOIFI Shari’a Standard Number 17 (3/6/3), it is referred to as investment agency sukuk representing projects or activities managed on wakala basis through an agent to manage activities on behalf of sukuk holders.

Sukuk wakala is expected to provide an alternative to Sukuk Negara to gain flexibility in the use of contract, utilization of state-owned assets, optimization of potential underlying assets (such as procurement of goods and services), tradable in the secondary market, as well as widely accepted in domestic and international markets.

Shari’a Approval of Sukuk Negara

As a regular issuer of Islamic capital market instruments both nationally and internationally, the Indonesian government must obtain Shari’a scholars’ permission before issuing a Sukuk. For domestic issuance, the Indonesian Ulama Council (MUI) permission is necessary, but for international market launch, approval from both MUI and some internationally acclaimed Shari’a scholars is obtained.

MUI is a religious institution with the jurisdiction to give fatwa on Islamic finance and economics. MUI’s skills in ensuring conformance between Islamic laws and Islamic financial institutions in Indonesia is highly crucial. The purpose of setting up the National Shari’a Council (DSN-MUI) by the MUI was to address fiqh muamalat. The permission to DSN-MUI to give fatwa was granted on-demand from Islamic financial institutions.

DSN-MUI has so far issued five BSN-specific fatwas relevant to the Sukuk Negara issuance and the various Sukuk Negara structure that include sales and leases, ijarah assets for leasing, and wakala. Additionally, the DSN-MUI also provides Shari’a opinions on each SBSN issuance. To date, DSN-MUI has given 24 Shari’a opinions on Sukuk Negara.

Development of Sukuk Negara

The Indonesian government issued Sukuk Negara in 2008 to expand alternative financing sources for the state budget and to develop Islamic financial markets. Since its 13 years journey, the Sukuk Negara has developed remarkably in volume and strength at national and international markets. These achievements have resulted from continuous effort and development of Sukuk Negara as an active, profound, and liquid sukuk market.

Sukuk Negara has been arduously supported and enhanced with a legal framework, structure, underlying assets, methodology of issuance, categories of instruments, a market, and an investor base, both domestic and international.

a) Consistent Growth in Sukuk Negara Issuance (2008 – August 2021)

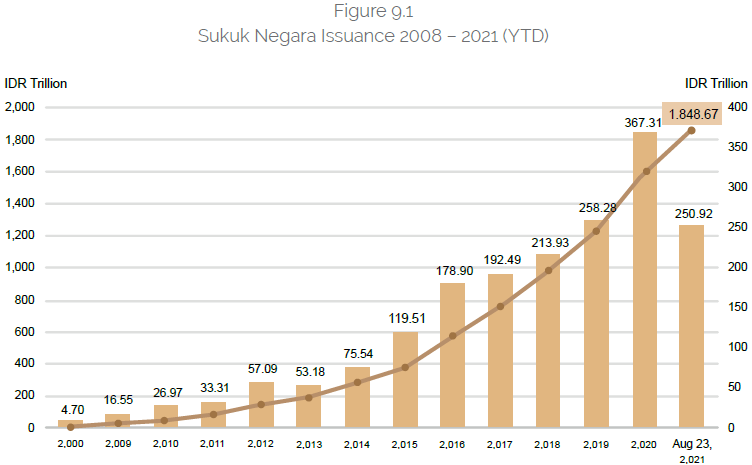

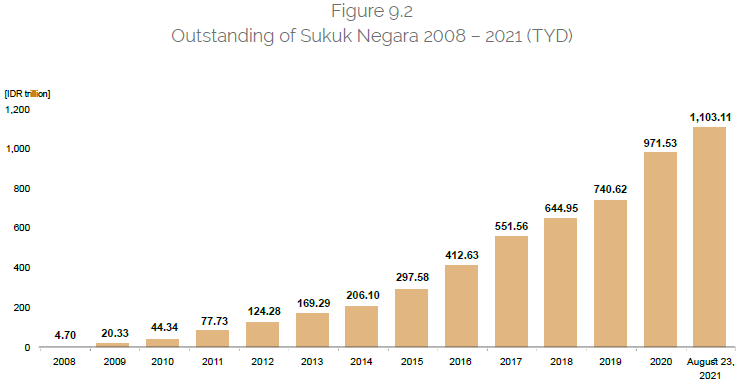

Since the enactment of Law Number 19 the Year 2008 on Sovereign Shari’a Securities, Sukuk Negara issuance has reached IDR1,848.67 trillion, using various issuance methods (auction, book building, private placement), both in domestic currency (IDR) and foreign currency (USD). This growth shows the instrument’s role in financing the state budget deficit, infrastructure projects, and the development of Islamic financial markets (see Figures 9.1 & 9.2).

The value of outstanding Sukuk Negara both in the domestic and international markets as of August 23, 2021, is IDR1,103.11 trillion, or around 19% of the government’s total government securities (SBN).

Sukuk Negara has been available for different target investors and financing purposes. The Project-Based Sukuk (PBS) significantly dominates the issuance size.

In 2020, the total issuance of Sukuk Negara was IDR367.31 trillion, or 42.20% higher than total issuance in 2019 (IDR258,31 trillion). From the total issuance in 2020, IDR331.65 trillion (90.29%) was issued in the domestic market, and USD2.5 billion (9.71%) was issued in the international market.

The Sukuk Negara issuance in 2020 increased significantly due to the mounting needs for microfinancing in a COVID-19-affected world. In addition, as the state budget deficit widened in 2020 due to pandemics, Sukuk Negara issuance increased by 42.2% compared to IDR258.28 trillion in 2019.

To handle health and economic recovery during the pandemic, the government developed the National Economic Recovery Program (PEN) in 2020-2021 with an allocated budget of IDR699.43 trillion and IDR744.75 trillion, respectively. Financing the state budget through Sukuk Negara is an option the government exercises to accelerate the national economic recovery program. Whereas the Project Financing Sukuk is the most strategic fiscal instrument issued for the development of infrastructure and service facilities.

b) Domestic Secondary Market Performance

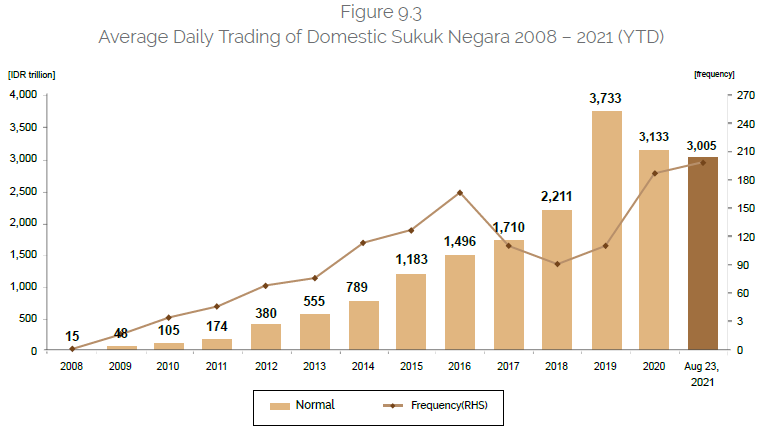

In terms of the management of Sukuk Negara, the availability of supply of tradable instruments is one aspect that supports liquidity in Sukuk Negara. Therefore, the government continues to increase the share of tradable Sukuk Negara year on year. As the number of tradable Sukuk Negara issuance increases, so does the trading volume of Sukuk Negara in the secondary market. As shown in the chart below, Sukuk Negara’s secondary market performance has increased steadily over the years. The average daily trading of Sukuk Negara in 2020 was IDR3.13 trillion from 187 transactions. Meanwhile, until August 23, 2021, the average daily trading of Sukuk Negara reached IDR3.00 trillion from 197 transactions (see Figure 9.3).

Prospects of Sukuk Negara • Rapid growth of Islamic finance industry assets in Indonesia

During the COVID-19 pandemic, Indonesia’s Islamic finance industry assets grew 22.71% (YoY) to IDR1,801.40 trillion from the previous year’s IDR1,468.07 trillion. Those assets come from Islamic banking (33%), Islamic non-banking (7%), and Islamic capital market (60%). It shows that Islamic finance has had the resilience to survive the pandemic and makes a real contribution to the national economy. (Indonesian Islamic Finance Development Report, LPKSI-OJK, 2020).

• Larger potential investors: Islamic and Conventional

Despite the impact of COVID-19, investors are emphasizing the long-term growth prospects. Investors’ confidence in the country’s growth potential through Islamic finance can be gauged from the amount of investment Indonesia received in 2020, which was at the tune of 25 percent of the total investment. Other than Islamic investors, many conventional investors have also chosen Islamic financial instruments as part of their investment portfolio.

• Potential demand vs limited supply

That the demand for sukuk issuance, both in domestic and international markets, is growing is reflected, among other things, in the high amount of funds available to the Islamic financial institutions despite limited Islamic financial instruments.

• Strong support from authorities: establishment of National Committee for Islamic Economy and Finance (KNEKS)

The government of Indonesia has established a National Islamic Finance and Economy Committee known in Indonesia (KNEKS) to lead, coordinate, and synergize the Islamic economy’s stakeholders’ efforts. The President of Indonesia, His Excellency Joko Widodo, chairs the committee. The key functions of KNEKS are to strengthen, expand, and develop the Islamic economy to support national economic development.

• Project financing sukuk: progressing preparation and availability

Project financing sukuk has also shown significant progress. In 2013, the allocation of project financing Sukuk was only IDR800 billion, while in 2020, the value increased significantly to IDR27.35 trillion. The number of government institutions initiating the project financing sukuk is also increasing. In 2013 there was only one institution today they are nine. In 2020, 730 projects were implemented by 606 works units.

d) Challenges to Sukuk Negara • Buy and hold behaviour

The tendency to buy and hold by sukuk investors makes the mechanism for transferring ownership of sukuk inefficient. Therefore, it leads to slow market growth and exposes sukuk investors to higher liquidity risk.

• Higher yield expectations and price discovery mechanism

On average, the yield of Sukuk Negara is still higher than its conventional counterparts, such as the government debt securities or Surat Utang Negara. This resulted in a higher cost of issuing Sukuk Negara. In addition, investors in Sukuk Negara tend to require a liquidity premium, as Sukuk Negara is considered less liquid than Surat Utang Negara in the secondary market.

• Market infrastructure development

Because of the rising need to finance the state budget and development of infrastructure, a complete market set-up is in calling to support Sukuk Negara. Therefore, the organization of market infrastructure followed by best practices is required.

The increasing issuance of Sukuk Negara. In addition, the diversification may make the management of Sukuk Negara flexible and boost issuance.

Innovation in Sukuk Negara

1. Green Sukuk

a) Background

Indonesia is committed to combating climate change and is the signatory of the Paris Agreement (2016). The timeline and percentage reduction in greenhouse gases have been delineated in the Nationally Determined Contribution (NDC) document, according to which the country will strive to reduce greenhouse gas (GHG) emissions up to 41% by 2030.

With the support of the United Nations Development Program (UNDP), the Ministry of Finance has also implemented the Climate Budget Tagging (CBT) mechanism to monitor and track government expenditures incurred on climate change mitigation and adaptation activities. The CBT mechanism allows the government to assess the financing needs to achieve the GHG emission reduction target, which comes to IDR3,461 trillion (US$247 million) from 2018 to 2030, or about IDR254.4 trillion (US$17.55 million) annually.

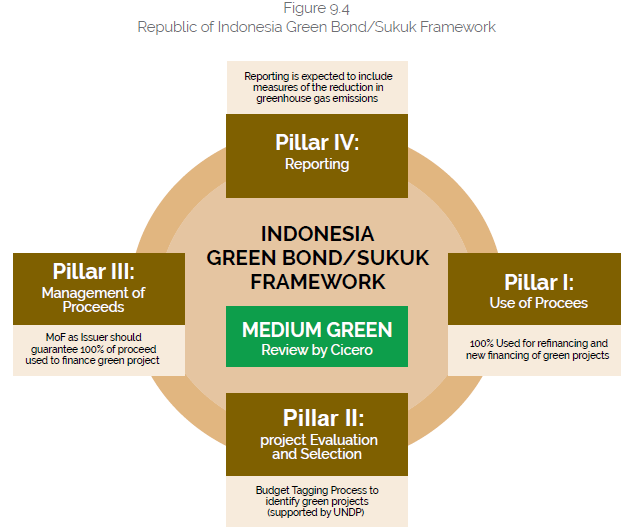

The Indonesian government started green financing initiatives in 2017 with the Green Bond and Green Sukuk Framework (Figure 9.4). The Framework was developed based on the Green Bond Principles (GBP) and intended to facilitate the issuance of green bond or green sukuk to finance projects supporting low emissions and to adopt climate-friendly activities. This also includes the biodiversity sector. The Indonesia Green Bond and Green Sukuk Framework received acclamation from CICERO and obtained a “Medium Green” shade, which is an assurance that the listed sectors have met the requirements and are in line with the national vision of carbon emission reduction.

b) Global Green Sukuk

Indonesia successfully issued the world’s first Sovereign Green Sukuk worth USD1.25 billion in the international markets in 2018. The proceeds were used to finance renewable energy, resilience to climate change, sustainable transport, energy and waste management, and energy efficiency projects. It also supports the achievement of SDGs, particularly SDGs 7 (Affordable and Clean Energy), 8 (Decent Work and Economic Growth), 9 (Industry, Innovation, and Infrastructure), 11 (Sustainable Cities and Communities), and 13 (Climate Action). After receiving a positive response from the international markets, the government launched the second $750 million Global Green Sukuk in 2019. It made Indonesia the first country to issue Green Sukuk for two consecutive years. Keeping to its commitment to sustainable financing, the government issued the third $750million Green Sukuk in 2020 with a tenor of 5-year (see Table 9.1).

| 1st Issuance | 2nd Issuance | 3rd Issuance | 4th Issuance | |

| Issuance date | March 2018 | February 2018 | June 2020 | June 2021 |

| Volume | USD 1.25 Bio | USD750 Mio | USD750 Mio | USD750 Mio |

| Tenor | 5 years | 5.5 years | 5 years | 30 years |

| Yield | 3.75% | 3.9% | 2.3% | 3.55% |

Despite the COVID-19 induced uncertainty, Indonesia successfully issued another global green sukuk worth USD750 million, with a 30-year tenor and a yield of 3.55%. It was the first-ever 30-year tenor green sukuk launched in world history. Some of the other features of this green sukuk are its lowest yield spread over US Treasury and coupon, oversubscription rate of 4.55 times, and attracting around 57% of global green investors. This issuance manifests Indonesia’s commitment and contribution to sustainable financing and its capacity to attract foreign investors towards Shari’a-based sustainable financing.

c) Retail Green Sukuk

Innovation has not been carried out only in the international markets but also in the domestic markets through the issuance of retail green sukuk of IDR1.46 trillion and savings sukuk of IDR5.4 trillion in 2019 and 2020, respectively (see Table 9.2).

| 1st Issuance (ST006) | 2nd Issuance (ST007) | |

| Issuance date | November 2019 | November 2020 |

| Volume | IDR 1.4 Trillion | IDR 5.4 Trillion |

| Tenor | 5 years | 2 years |

| Yield | 6.75% (Floating with floor) | 5.5% (Floating with floor) |

Domestic Green Sukuk (Retail)

d) The retail green sukuk was also the world’s first retail green sukuk issued by any country to individual investors through online subscription. Through the savings sukuk (ST) series, the retail green sukuk reached more than 24,000 individual investors from all provinces in Indonesia; the majority (50% on average) is millennial. In accordance with the Green Bond and Green Sukuk Framework, the proceeds have been used to fund national projects in the state budget. The issuance of green bonds/green sukuk could serve as a benchmark for issuers in the corporate and private sectors.

“Through the Savings Sukuk (ST) series, the Retail Green Sukuk reached more than 24,000 individual investors from all provinces in Indonesia; the majority is millennia.”

e) Green Sukuk Issuance Process

The Preparation Phase

Ministry of Finance, through the Directorate of Islamic Financing, prepares the implementation of the green sukuk on the annual financing strategy. Data from the Fiscal Policy Agency (BKF) and the underlying asset of Indonesia Sovereign Sukuk are used in the preparation process. Furthermore, the Ministry of Finance established a working group for the development of green sukuk reports. The team comprises the Ministry of Finance Internal Team (Fiscal Policy Agency, Directorate General of Budget, Directorate General of Budget Financing, and Risk Management), National Development Planning Agency (BAPPENAS), Ministry of Environment and Forestry (KLHK), and related line ministries. The timeline and work plan are also developed for the Annual Green Sukuk Report.

The Issuance Phase

The green sukuk is launched when the Green Sukuk/Bond Framework is ready, and the selection of the projects and allocations of the proceeds have been finalized. For a successful launch, an effective marketing strategy and awareness campaign are run in collaboration with the Joint Lead Managers (JVMs). The awareness campaign combines social media (in the case of retail issuance), videoconference, and other electronic platforms.

The Green Impact Report Phase

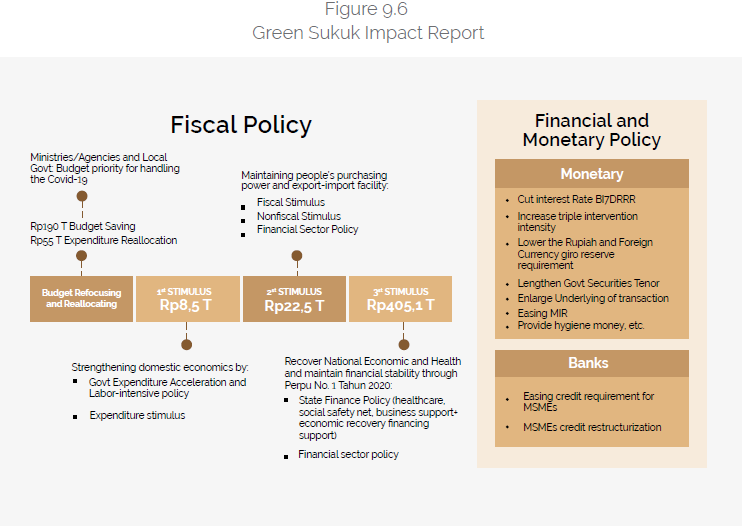

The government is required to issue the Green Impact Report every year (see Figures 9.5 & 9.6). It contains a brief introduction of all the green projects to be financed, the allocation value, and the estimated emission reduction benefits. Lastly, an independent institution reviews the report for an impartial assessment. So far, the government has issued three green sukuk reports. The reports were reviewed by KPMG (2019), PWC (2020), and EY (2021). All of them received applaud for adopting a suitable green sukuk issuance framework.

2. Cash Waqf Link Sukuk (CWLS)

Through the Ministry of Finance, Ministry of Religious Affairs, Central Bank of Indonesia, and Indonesian Waqf Board (BWI), the Government of Indonesia is committed to supporting the development of Islamic social finance in Indonesia. The waqf development program was launched among other initiatives through Cash Waqf Linked Sukuk (CWLS) during IMF-World Bank annual meeting held in Bali on October 14, 2018. CWLS was designed to develop asset creation waqf to finance various social activities in society. It is implemented to facilitate the waqif so that he/she can invest their funds in the safe and productive investment instrument. The objectives of CWLS are as follows:

- To consolidate the cash waqf and other social funds for supporting productive waqf through various social project/activities managed by nazir (waqf assets manager)

- To support the National Shari’a Finance development, especially cash waqf industry, to strengthen the national financial ecosystem

- To support Shari’a banking role as the collector of cash waqf (LKS-PWU)

- To become part of Indonesia’s financial development and innovation program, particularly in social investment

- To become part of investor and government bonds/sukuk instrument

In CWLS, the waqif provides a certain amount of funds, either for permanent or temporary use for social purposes, through a waqf manager (nazir). The waqf manager invests the cash waqf in sovereign sukuk mainly issued for public projects like road construction, public markets, healthcare, education, etc. During the CWLS tenor, the waqf manager receives a return on sukuk in a discount or coupon. The waqf manager uses the return to finance tangible projects like construction or the development of newly-asset waqfs such as healthcare clinics, Islamic boarding schools, and other social infrastructures or intangible things like empowerment programs for low-income societies. On the maturity date, the CWLS principal redemption is paid by the government to the waqf manager, which in turn is returned 100% by the waqf manager to the waqif (in case of temporary cash waqf) or further invested in other social programs (in case of permanent cash waqf).

CWLS Issuance Milestones

The first issuance of CWLS, named SW-001, was printed on March 10, 2020, by BWI as nazir. It was also officially launched on October 21, 2020. The return of CWLS series SW-001 was used to develop Retina and Glaucoma Centre at Achmad Wardi Ophthalmic Hospital, Serang, Banten. In addition to that, its return was also used to do free cataract surgery of the poor at Achmad Wardi Hospital, targeting 2,513 patients in five years. Between October 2020 and March 15, 2021, a total of 1,927 patients were treated. The majority of patients were from Serang due to the proximity of location and easy transit access. The second issuance of CWLS was issued on November 26, 2020, in the retail market under series SWR-001 with a 2-year tenor and a fixed return rate of 5.5% per annum.

Its proceeds reached IDR 14.91 billion. The return shall be used in programs that have a social and economic impact on the community, such as education, healthcare, agriculture, farming, and Small Medium Enterprise (SME) empowerment program. Although the total issuance was not substantial, the CWLS SWR-001 series drew 1,041 Waqifs during its first issuance, out of which 1,037 were individual waqif.

The government introduced the third CWLS, under the SWR-002, series in the first quarter of 2021. The SWR-002 offered a return of 5.57% per annum with a tenor of 2 years and accounted for IDR24.14 billion – a 62% increase compared to SWR-001. This series is the first CWLS that can be purchased online specifically for individual waqif. The SWR-002 reached 591 waqif in all Indonesian provinces. The 588 individual waqif amounted to IDR15.66 billion, and three institutional waqif amounted to IDR8.48 billion. Having observed the real output of CWLS (SW-001, SWR-001, and SWR-002) and the social programs/projects implemented under nazir, it is expected that the CWLS will continuously develop and attain a positive response from society. Therefore, cooperation and collaboration from all related parties are expected to achieve productive waqf, primarily through CWLS in the future.

3. Project Financing Sukuk (PFS) / Project-Based Sukuk

The issuance of Sovereign Sukuk (SBSN) exclusively for project financing has become an effective and novel source of project financing in Indonesia. The Project Financing Sukuk was developed in 2013 to finance the government infrastructure projects earmarked in the state budget. In addition to that, it also financed to improve the existing infrastructure with the limited state budget funding.

Project Financing Sukuk (PFS) has raised IDR145.84 trillion since its first inception in 2013.

It has covered the financing need of 3,447 central government projects spread over 34 regions in Indonesia. These projects are associated with transportation, roads, bridges, education, religion, national park, water resources, agriculture, and research laboratories. There has been a steady increase in the number of projects, highlighting PFS as a significant source of project financing tool. During the COVID-19 pandemic, Project Financing Sukuk became a strategic fiscal instrument to recover the national economy. As a result, in 2020, the PFS disbursement reached 90.96%. It is an indication that the PFS has successfully maintained its performance during the pandemic, but it has also contributed to the economic recovery through financing projects in the real sectors.

The achievement of PFS projects compared to other financing resources encouraged the local industry participation in labor-intensive sectors. In addition to that, the government also issued a discretion policy tool to execute projects affected by COVID-19. PFS, a strategic fiscal instrument, serves as a reliable alternative source for national infrastructure financing during a a pandemic and expectedly post-pandemic to bolster economic growth.

4. Retail Online Sukuk Negara

Since 2009, through the Ministry of Finance, the government has regularly issued retail SBSN to individual investors of Indonesian citizens. As a result, since 2009, the government has managed to issue Sukuk Retail worth IDR243.45 trillion, comprising as many as 473,434 investors. To increase financial inclusion and address the rapid change of information technology, the government initiated a breakthrough in the retail SBSN by introducing an online system in 2018.

Now investors could buy retail sukuk through the distribution partner interface that connects in real-time with the-SBN. The implementation of the e-SBN is a manifestation of the government’s commitment to provide safe and easy investment alternatives to the individual investor and to meet the financing needs of the state budget. E-SBN has also been instrumental in expanding the domestic investor base. The online distribution platform becomes very important when we face mobility restrictions to prevent the spread of COVID-19. The investor registration process, ordering transactions, and payments of SBSN Retail are integrated into one system integrated with the State Revenue Portal.

Through E-SBN, registration and order forms no longer have to be filled in and signed manually. Then, the payment process previously made through debiting or depositing cash can be done now through over the counter (teller), ATM, internet banking, EDC, mobile banking, electronic wallet (e-wallet) bank transfer, virtual account, e-commerce institutions, and FinTech companies. Access to this payment service is 24/7, with the capacity to deposit 1,000 transactions per second. In addition, investors who successfully pay for the billing code receive the NTPN code as proof of ownership of SBSN retail online. The E-SBN also supports the National Non-Cash Movement (GNNT), which aims to increase public awareness of using non-cash payment facilities for financial transactions. SBSN Retail series consists of three tradable retail sukuk and six Sukuk Tabungan with a total issuance of IDR74.06 trillion and 192,736 investors. The average participation rate of young people (millennial) has also increased from the previous 30% to 39% of total investors.

Sukuk Negara and Economic Recovery Program

COVID-19 has changed many things. The year 2020, which opened with hopes for global economic recovery, turned out to be a challenging year for many countries in the world. After being declared a pandemic on March 11, 2020, by WHO, COVID-19 has become a real threat that affects the health sector and disrupts other aspects such as social, economic, and financial.

The COVID-19 pandemic has created a snowball effect from a health crisis to a substantial economic crisis. From quarantine to social restrictions, life has come to a standstill due to declining consumption, delayed investment, and hampered foreign trade activities. Governments responded with swift policy priorities, focusing on fiscal policy and the state budget to compensate for the economic and health care costs.

Various responsive policies have been implemented in all regions in Indonesia. Policies such as budget refocusing, economic recovery programs, government regulation substitute for law (Perppu), and the implementation of the burden-sharing scheme. Along the way, various adjustments are made to respond to a highly dynamic and often unpredictable situation. Improvements continue to be made based on the results of policy evaluations to ensure the achievement of outputs and sustain the country. It was possible because of synergy between the Central and Regional governments’ state institutions, legislative bodies, supervisory and audit associations, and the community.

a) The Rising Financing Needs

In response to this extraordinary event, the government uses the state budget as the main instrument for intervention in fiscal policy. Moreover, the government gets the assistance of related institutions such as the Financial System Stability Committee (KSSK), which also consists of Bank Indonesia (BI), the Financial Services Authority (OJK), and the Deposit Insurance Corporation (LPS), to jointly coordinate in bringing the country out of the COVID-19 induced economic crisis.

In 2020, the government made an economic plan requiring excessive spending with declining revenues resulting in a budget deficit. Though at the start of the year, the government had announced a state budget with the lowest deficit since 2011. That changed, however, as COVID-19 struck. The budget deficit was first from 1.76% to 5.07% and later to 6.34%. The significant financing needs forced the government to shift its strategy from front loading to backloading. However, the government quite rarely does this because the backloading strategy has historically been risky.

b) Sukuk Negara Issuance Strategy to contribute to the National Economic Recovery

The target for Sukuk Negara issuance in 2020 was set to IDR367.82 trillion, an increase of 42% from 2019. Sukuk Negara forms 24% of the total government securities issuance. The issuance of Sukuk Negara in 2020 was the highest annual increase since 2008. Though the government has achieved its 2020 target, some strategies may support it further to enhance its performance:

- Implementation of the primary dealer system: A full implementation of the primary dealer system to increase the demand of Sukuk Negara liquidity in the secondary market.

- Become part of the Joint Agreement between Bank Indonesia and the Ministry of Finance regarding the issuance of government securities in the context of the COVID-19 pandemic as mandated by Law Number 2 of the Year 2020. In addition, the Joint Agreement regulates BI’s role as a standby buyer if the government securities auction target is not met.

- Improving public awareness.

- Increasing the frequency of issuance of tradable retail sukuk because the demand for tradable retail sukuk is greater than that of non-tradable.

- Adding innovative products like Cash Waqf Linked Sukuk

- Making regulatory adjustments and developing market infrastructure to increase the investor base.

c) Sukuk Achievements During the Pandemic

The performance of Sukuk Negara in 2020 during the pandemic has been remarkable and rewarding. Some of the achievements are listed below:

- As a result of the easing policy of the banking statutory reserve requirement and the macro prudential liquidity buffer, the demand for Sukuk Negara by Banks has been high, amounting to IDR110.19 trillion.

- Retail sukuk issuance recorded the highest mark in history in 2020 by fetching IDR37.81 trillion.

- In terms of yield, the global Sukuk Negara in 2020 recorded the lowest yield in the history of government securities issuance for five and ten years.

In short, no limitations caused by the pandemic stopped the government from developing innovative, innovative, and productive financial instruments. In addition, all the limitations caused by the pandemic did not stop the government from continuing to develop innovative instruments for the people of Indonesia, through the issuance of sukuk waqf and green sukuk.

During 2020, the government issued sukuk waqf twice through the CWLS series with private placement and book-building methods. The issuance of the sukuk waqf is a form of the government’s commitment to support the development of social investment and the development of productive waqf in Indonesia. Through sukuk waqf, the government facilitates cash waqf, both temporary and permanent, so that they can place their money waqf in safe and productive investment instruments. In addition, the issuance of CWLS is also an effort by the government to support the development of the Islamic financial market, especially the cash waqf industry. CWLS is also expected to create inclusive and sustainable economic growth, such as eradicating poverty, reducing inequality and increasing productivity.

The issuance of retail CWLS series SWR001 is a form of the government’s commitment to support the National Waqf Movement, assisting the development of social investment and the development of productive waqf in Indonesia. After the success of the issuance of sukuk waqf in private placement, the government again innovated to issue the retail sukuk waqf series SWR001 offered to individual Indonesian citizens.

“The 3G Best Green Initiative of the Year 2020 from Cambridge IFA was a testimony to the government’s excellence in using green sukuk.”

In addition to social investment, in 2020 the government issued green investment instruments twice as a manifestation of the government’s commitment to reducing the impacts of climate change. The first issuance was carried out in the international market amounting to USD750 million (5-year tenor). This issuance in the international market shows the government’s commitment, leadership and contribution in the global community regarding climate change financing. Global Green Sukuk issuance in 2020 is the issuance of green sukuk for the third time in the global market. This transaction is carried out in line with the government’s 2020 financing plan, including to accommodate the needs of the APBN in handling the impact of the COVID-19 pandemic as well as to strengthen Indonesia’s position in the global Islamic financial market and support the development of Islamic finance in the Asian region. The second issuance was carried out in the domestic market through the ST007 series with green format, which is the second retail green sukuk issued by the government after the first with ST006 which was issued in November 2019. ST007 is offered on November 2020 with a coupon of 5.50% (floating with floor).

In addition to the phenomenon of SBSN issuance, SBSN issuance in 2020 received appreciation from the world community by obtaining several awards, such as the 2020 International Islamic Finance Awards from The Asset Triple A, the 3G Best Green Initiative of the Year 2020 from Cambridge IFA, Best Green Bond from The Asset Triple A, and Largest Green Sukuk in 2020 from Climate Bond Initiative (CBI).