Introduction

The global market for Islamic financial services, as measured by Shari’a-compliant assets, was estimated to be USD1.1 trillion at the end of 2010 according to the Global Islamic Finance Report 2011, up 32% from 2007’s USD758 billion. Meanwhile, the Islamic fund market was reported to be USD58 billion in 2010, up 7.6% from 2009. Clearly, the growth of Islamic banking has been one of the most important developments in global finance over the last decade.

Key centres of Islamic finance are concentrated in Malaysia and the Middle East, including Bahrain, Ku- wait, Saudi Arabia, and the UAE. Islamic finance is also expanding rapidly in Asian countries such as Bangladesh and Pakistan. Western nations looking to attract Islamic finance are attempting to make it easy for practioners to establish operations. Countries such as Australia, France and the UK are among the countries looking to develop opportunities for Shari’a-compliant investors.

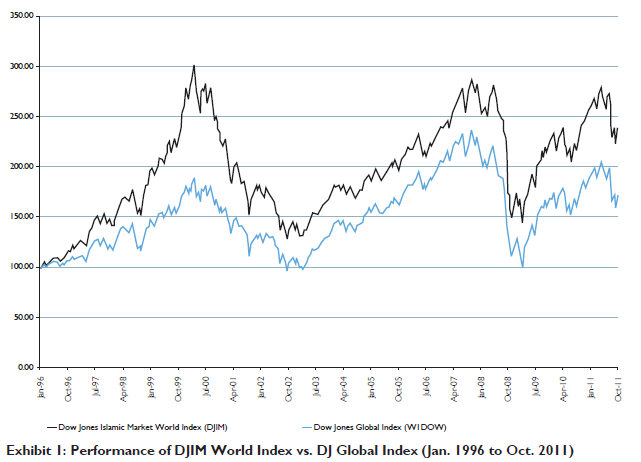

Interestingly, the rise in demand for Shari’a-compliant products is coming from both Muslims and non-Muslims. Though Islamic banking institutions were bruised during the financial crisis, they suffered far less than those in the conventional banking system, which saw high-profile institutions collapse and suffer massive outflows of assets. Because Islam prohibits the use of interest-bearing debt, Islamic banks were buffered from the financial crisis. In addition, since the 1999 launch of the Dow Jones Islamic market Indexes, there is now evidence that Shari’a-compliant indexes outperform their conventional counterparts over the long term. This has lead conventional investors to look closely at the Shari’a-compliant investment philosophy.

The evolution of Shari’a compliant indexing

While the first Islamic banks were established in the Middle East in the 1970s, it would take another 10 years until Islamic equity funds were brought to market. Surprisingly, the first Islamic financial products were launched in the U.S., followed by Singapore, South Africa and Malaysia before finally appearing in the Middle East.

Islamic funds were created as a result of strong demand by Muslim investors, who asked fund managers to create financial products that comply with Islamic investing principles – and they did. Swiss private banks were among the first to realise the potential of Islamic finance and did not want to miss the opportunity. These banks created tools for Muslim investors to gain exposure to the global equity market through their Islamic global equity instruments. However, without any alternatives, funds were benchmarked against conventional indexes such as the S&P 500, the FTSE All-World Index, or the MSCI Emerging markets Index. For obvious reasons, none of these indexes provided a fair or satisfactory comparison. (Embedded within some of these indexes, for example, were industries and companies with high-leverage ratios – a financial situation that is inconsistent with Shari’a principles.) By the mid-1990s, Islamic financial institutions including DMI Group and Faisal Islamic Bank, started to build their own internal measurement gauges against which Islamic equity instruments could be benchmarked.

Finally, by 1999, a suitable alternative was provided as Dow Jones Indexes, seeing that Islamic finance was a growing market lacking proper benchmarks, created the Dow Jones Islamic market Index – the very first Islamic financial index. With Dow Jones Indexes’ new benchmark serving as the catalyst, other providers followed suit, providing healthy competition as well as unprecedented access to the Islamic fund market for investors. Shari’a-compliant funds have flourished over a short period of time, and it would not be mistaken to conclude that Islamic indexes have played a central role to their development. According to Morningstar, the number of Shari’a-compliant funds reached 700 by year-end 2010 – up more than three-fold from 2003. Ernst & Young, meanwhile, estimates the value of these funds has grown to USD58 billion in 2010 from USD20 billion in 2003. Equity funds make up 40% of total investments; with fixed income 16%; real estate and private equity 13%; with cash, commodities, and other asset classes accounting for the balance.

Islamic indexes have changed the way the industry does business, offering transparency, low-cost solutions, standardisation, and, most importantly, investibility. They have also helped with product development, best-practice, rules-based methodology and aid with risk management.

Index design and development

Shari’a-compliant indexes differ from their conventional counterparts in at least three ways; Shari’a supervisory boards establish invisibility guidelines and monitor the process; the guidelines are then applied to the universe of securities; and finally, purification rules are set to “cleanse” any impure profits from securities-paying dividends.

- Shari’a supervisory boards

One crucial aspect of index construction is Shari’a law, with decision-making about compliance provided by well-respected and financially savvy Shari’a scholars. In order to be included in an index, companies must meet Shari’a guidelines for acceptable products, business activities, debt levels, and interest incomes and expenses. It is up to each index provider to develop its own screening methodology – however, Dow Jones Indexes took the critical extra step of establishing an internal Shari’a Supervisory Board to provide qualified advice on compliance. This decision has been crucial with respect to consistency issues: a revolving-door policy, in which scholars jump and jump off of various Boards of Directors is unhelpful, particularly when the Board is expected to opine on important new developments.

Screening

One area in which there is little room for debate is screening. Shari’a-compliant instruments, and Shari’a in- dexes, generally prohibit investment in alcohol, pork, tobacco, weapons, gambling, pornography, certain leisure and entertainment businesses, as well as conventional financial systems.

Each index provider, however, approaches screening in its own way¹:

- The Dow Jones Islamic market Indexes do not include companies involved in alcohol, conventional financial services (banking and insurance), pork-related products, entertainment, tobacco, weapons and defence;

- FTSE Shari’a Global Equity Index Series also prohibits alcohol, tobacco, conventional finance, pork-related products and non-halal food production, packaging, or processing;

- MSCI Islamic Index Series prohibits distillers and vintners, banks and insurance companies, aerospace and defence companies, casinos and gaming, hotels resorts, cruise lines and restaurants, as well as broadcasting and satellite movies, and tobacco;

- S&P Shari’a Indexes prohibit alcohol, advertising and media (with the exception of newspapers), financials, gambling, pork, pornography, tobacco, and companies involved in the trading of gold and silver as cash on deferred basis; and

- The Russell-Jadwa index goes one step further, prohibiting the inclusion of companies involved in stem cell/human embryos and genetic cloning.

However, this is only part of the picture. The Dow Jones Islamic market Indexes prohibit any involvement in the activities mentioned, while the FTSE Shari’a Global Equity Index Series allows companies to be included if the income on their total interest and non-compliant activities does not exceed 5% of the company’s total revenue. Similarly, the MSCI Islamic Index Series only prohibits companies who derive more than 5% of their revenues (cumulatively) from any prohibit- ed activities, as does S&P. Like Dow Jones Indexes, the Russell-Jadwa Shari’a Index prohibits non-compliant companies from inclusion.

For Dow Jones Indexes, the exclusion of companies that are non-compliant is important. It is the only way, we believe, to ensure that an index is truly Islamic, and that the index remains pure.

Screening is also not always a straightforward process. What happens when an index provider prohibits breweries from being represented in an index, but then approves a supermarket which sells alcohol, or prohibits non-halal meat producers, but then includes McDonalds? It is not enough to have quantitative screening of stocks. We believe it is necessary to include a qualitative function that goes deeper. For Dow Jones Indexes, this involves an in-house research team that looks qualitatively at company information on an ongoing basis. The team examines many sources and considers how each company’s revenues are broken down. The real work is in looking closely at the so-called “grey areas”.

Rather than exclude all supermarkets, for example, Dow Jones Indexes will include certain Gulf Cooperation Council region supermarkets and hotels that do not serve or sell alcohol. Companies in the grey area undergo an internal review – they are also considered by the Quarterly Review Group. The information is then forwarded to Dow Jones Indexes’ Shari’a Board for an opinion. Once a year, the group goes through each of the 65,000 securities that the indexes consider. On top of this, there are “watch lists”, on which are companies that have the potential to be of concern.

Dow Jones Islamic Indexes also sets up news filters to monitor company information on a daily basis to ensure that a company which might be compliant one day, but not compliant another, is then prohibited.

Regular, qualitative scrutiny is particularly relevant when it comes to company debt. A stock may have a portion of Shari’a-compliant debt, for example, which would not be apparent from information downloaded from a data vendor. This is often the case for companies in the Middle East.

Screening also applies for debt ratios. Dow Jones Indexes excludes companies with:

- more than 33% total debt divided by a 24-month average market capitalisation, and

- companies with more than 33% cash and interest-bearing securities divided by a trailing 24-month average market capitalization.

Accounts receivable must also be less than 33%.

A debt-to-market capitalisation ratio better captures the “new economy” economies, service-orientated companies, or companies that rely on larger amounts of goodwill. Debt-to-market capitalisation is also more dynamic: it captures market-sector rotations. As it is market-value based, it is subject less to manipulations, as debt-to-market assets is an accounting treatment.

The methodology also provides a faster accuracy of the health of a company. For example, companies like Enron, WorldCom, Tyco, and Global Crossing were all in the Dow Jones Islamic market Index, but as their accounting issues came into the public domain, their market capitalisations were negatively impacted. Since they violated the debt-to-market-cap screen, they were removed from the indexes at the next quarterly review.

Dividend purification

Index providers also have different approaches to dividend purification, a ratio that has developed over time in which a certain proportion of the profits earned through dividends (which corresponds to the proportion of inter- est earned by the company), must be given to charity. Shari’a Scholars have different opinions about purification. For the Dow Jones Islamic market Indexes, dividend purification is not an issue because the indexes do not allow non-compliant companies to be included. For FTSE, appropriate ratios stand at 5%, while MSCI Barra applies a “dividend adjustment factor” to all reinvested dividends.

Performance: Shari’a-compliant indexes vs. conventional indexes

When Dow Jones Indexes launched the Islamic index family in 1999, it was difficult to assess the performance. It was clearly a niche market with growing demand, but no one would have guessed that Islamic indexes would outperform conventional indexes over the long run.

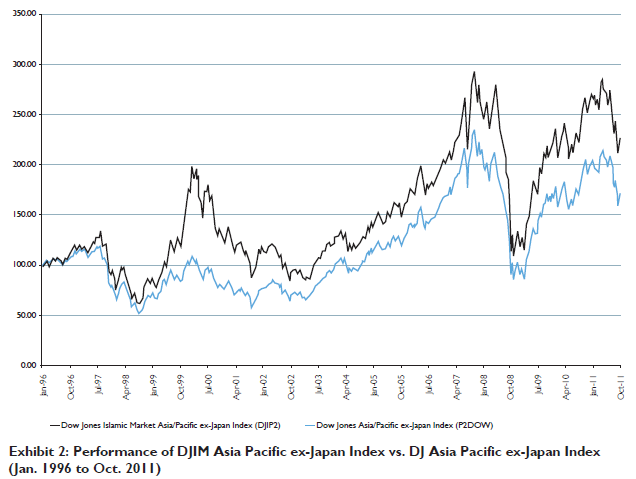

As you can see from Exhibit 1, the Dow Jones Islamic market World index has outperformed the Dow Jones Global Index by a significant margin. When compared to other markets and regions, the Islamic indexes still outperform conventional indexes (see Exhibit 2). Across nearly every region, Islamic in dexes perform better over the long run. This can be attributed to two main factors: first, Shari’a-compliant screens remove all highly leveraged companies, which tend to be more volatile; they rise faster in bull markets and fall faster in bear markets. Thus, the extra volatility is removed; second, Shari’a-compliant screens tend to result in indexes that are overweight in certain industries — such as healthcare, technology, oil & gas — while, at the same time, are underweight in such sectors as financial services, insurance, entertainment, media and hospitality.

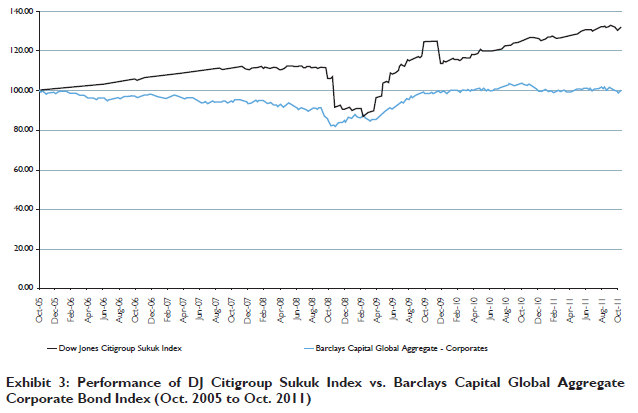

On the fixed-income side, Islamic finance still has not developed deep- enough capital markets to sustain the demand for Shari’a-compliant fixed-income securities. Nevertheless, the sukuk market has developed into a rapidly growing market and is a key segment in the burgeoning Islamic finance industry. In 2006, Dow Jones Indexes partnered with Citigroup to launch the first sukuk index, the Dow Jones Citigroup Sukuk Index, which measures US dollar-denominated sukuk issued globally and rated investment-grade or above. To date, the index has proven to perform better than its conventional counterpart; however, due to its small size and some liquidity issues, it has been more volatile than the conventional bond index (see Exhibit 3).

Future Outlook And Trends

Islamic indexes have always been at the forefront of developments in Islamic finance. They have helped shape the industry in many ways. For one thing, indexes have provided much-needed transparency. In a post-financial crisis world, this is crucial. Retail investors, particularly, put their trust in index providers and expect them to have completed due diligence on their behalf.

There are also investors who seek invisibility — every index provider claims to be the most “investible”, but it is not about the total number of securities, rather, it’s the Shari’a compliance of those securities that really matters.

One important development over the last three years has been that of Shari’a-compliant exchange-traded funds (ETFs). Though Islamic ETFs are a relatively nascent market, (globally, there are less than 15 Islamic ETFs), these products are poised for growth, attracting retail and institutional investors alike with their accessibility. The first Shari’a-compliant ETF was launched in Turkey in 2006, off of the Dow Jones Islamic market Turkey Index. Since then, there have been launches in many parts of the world, mostly recently in Saudi Arabia, where the Capital markets Authority approved the Kingdom’s first ETF in May 2011. The Falcom Saudi Equity ETF is listed on the Tadawul Stock Exchange.

Another important development has been the listing of Islamic funds in key fund domiciles. A number of Shari’a-compliant funds have been created as Undertakings for Collective Investments in Transferable Securities (UCITS) products, for instance. Funds are being launched on a country-by-country basis, developing infrastructure to support Shari’a needs. Luxembourg and Ireland started Islamic fund listings in 2007 and 2008, respectively. Asset managers continue to flock to the market, with some estimates suggesting there are now as many as 500 Islamic product providers worldwide. Now that Islamic finance has developed a solid track record, it will continue to be a dynamic and evolving industry. Index providers, both the larger and the regional, will continue to evolve and stay on top of these developments. Today is an exciting time for the industry as conventional finance begins to take a closer look at Islamic finance and see how it can learn from it. Time will tell if conventional finance develops some of the core principles of Islamic finance.