Introduction

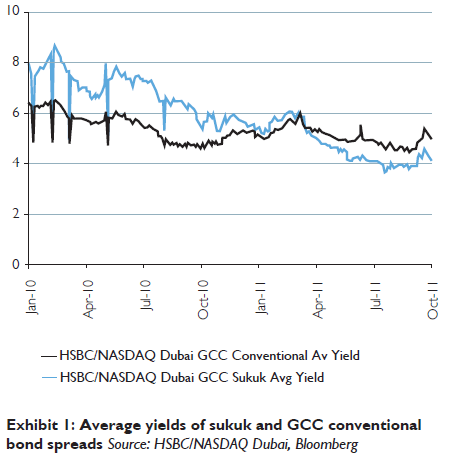

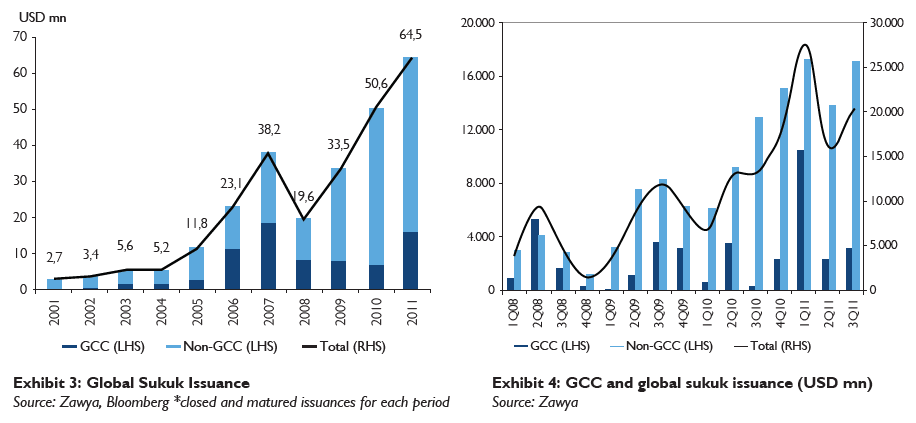

Even though the ongoing global economic crisis has continued to make for a challenging environment for the Islamic capital markets, they have increasingly regained their footing over the past year. This has been largely due to the macroeconomic health and strong performance of economies with large Islamic financial sectors, led by Malaysia and the Gulf region. Moreover, the industry is still going through the expansive phase of its development, generating new products and structures, often from a low base, and entering into new jurisdictions. The sector has very clearly benefited from its principles-based approach, combined with clear progress towards addressing the stress points that emerged earlier during the crisis in the form of default-type situations. Moreover, there is far greater consensus about acceptable sukuk structures, which has helped eliminate and even reverse the risk premium that disadvantages especially GCC sukuk issuances vis à vis conventional bonds during much of the crisis. As a result, even though equity markets have been repeatedly hit by the global uncertainty, the sukuk market has made impressive headway and 2011 is already an all-time record year. Encouragingly, the process has seen important elements of innovation and the spread of the industry to new markets.

Resilience In Crisis

Even though the Islamic capital markets have not been spared from the effects of the global crisis, their resilience has been underpinned by a number of factors, the most important of which are:

- The principles-based, in-built protection from excessive leverage. Even though some Islamic institutions ran into difficulties because of excessive exposure to housing market bubbles in markets such as Dubai – partly a reflection of the still limited availability of shari’a-compliant assets – major excesses were avoided

- Even though the industry has made impressive progress in recent years, it remains relatively young. New growth has materialized partly thanks to the introduction of new products in previously un- or under-ser- viced market segments and the growing penetration of Islamic finance into new jurisdictions, Indonesia be- ing the most notable success story

- Islamic finance is primarily concentrated in dynamic emerging markets characterised by a high degree of macroeconomic stability and technocratic policy-making, as well as demographic dynamism and strong growth prospects. These economies have little in common with the economic malaise and structurally driven stagnation of the West and this has allowed the continued expansion of financial services virtually across the board, including conventional and shari’a-compliant finance alike

- In many countries, Islamic finance has benefited from a significant degree of government support. The case of Malaysia is the most obvious one as the government has deliberately fostered the industry through bespoke regulation, a centralized Shari’a Board, sukuk issuance by the government and a number of government-related entities, and encouragement to institutions to invest in sukuk. Similarly in Bahrain, the Central Bank has been a strong advocate of Islamic finance. Indonesia has effectively adopted elements of the Malaysian model. Even in other Gulf countries, governments and central banks have issued sukuk in recent years, thereby stimulating additional issuance by corporates. However, there is greater resistance to government sukuk issuance in the Gulf where macroeconomic stability has been prioritized after the repayment of large government debt burdens as a result of low oil prices in the 1980s and 1990s. For instance, Saudi Arabia’s public debt to GDP ratio peaked at 119% and the government has said it would not resume government bond/sukuk issuance before the level falls below 10%, a point likely to be reached this year.

Although the global equity markets have been repeatedly hit by the crisis, the sukuk markets have re-grouped and recovered and are now experiencing relatively steady and robust growth which has already clearly taken the industry beyond the prcrisis levels. A growing number of investors now seem to view quality sukuk as a safe haven at a time of global economic uncertainty. At the same time, the market saw important instances of innovation. National Bank of Abu Dhabi and Abu Dhabi Islamic Bank in August executed the first-ever Islamic equivalent of a repo transaction with a collateralized murabaha deal. This represents a potentially very significant departure to- wards improving the mechanisms for liquidity management for Shari’a-compliant institutions by using their sukuk holdings. The one-week maturity deal was valued at USD20mn. Another important event in the financial services sector was a MYR750mn (USD254) wakala bil istithmar sukuk in August by Kuwait-based Gulf Investment Corporation, the second instalment of its 20-year MYR3.5bn (USD1.18bn) MTN program which has now reached a total of USD550mn. The issue had a profit rate of 4.9% and was sold to about a dozen investors. In general, wakala sukuk is gaining popularity, in large part because the structure is considered Shari’a-compliant in both the GCC and Malaysia. An estimated USD5.3bn of the sukuk issued this year has been at least partly wakala, up from USD1.8bn during the corresponding period last year.

Even more importantly, Saudi Aramco Total Refining and Petrochemical Co. (SATORP) launched the first-ever project sukuk in the Gulf. The USD1bn issuance was originally mooted in 2006 and will be used to fund a 400,000 bpd refinery in Jubail. This was an important departure in terms of laying the foundation for project sukuk in a region contemplating a massive infrastructure pipeline. Saudi Arabia alone has, according to MEED estimates, more than USD630bn worth of projects underway. The SATORP offering was only open to Saudi investors. The issuance was oversubscribed 3.5 times and priced at 8-month SAI- BOR plus 95 bps. The musharaka structure will generate profits from capital contributions of the partners in line with the project business plan.

Finally, marking the closure of a troubled chapter for the GCC sukuk markets, the Dubai-based property developer Nakheel in August completed its debt restructuring. It immediately issued an AED3.8bn ijara sukuk as the first tranche of its planned total of AED4.8bn, part of a restructuring deal which pays trade creditors 40% in cash and 60% via the sukuk. The issuance was marred by speculation that the assets supposedly underpinning the issuance were not accurately represented and allegedly included an un-reclaimed sea bed. Nakheel was forced to write off USD21bn due to the property market correction in Dubai. A number of trade creditors have been keen to sell the sukuk so as to raise cash and it has been trading at a discount with yields in excess of 16%, up from an initial 13-15%. The sukuk pays a 10% annual return over five years.

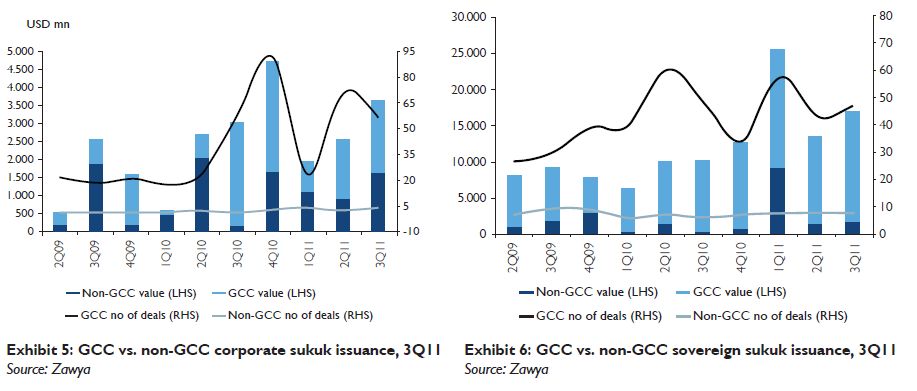

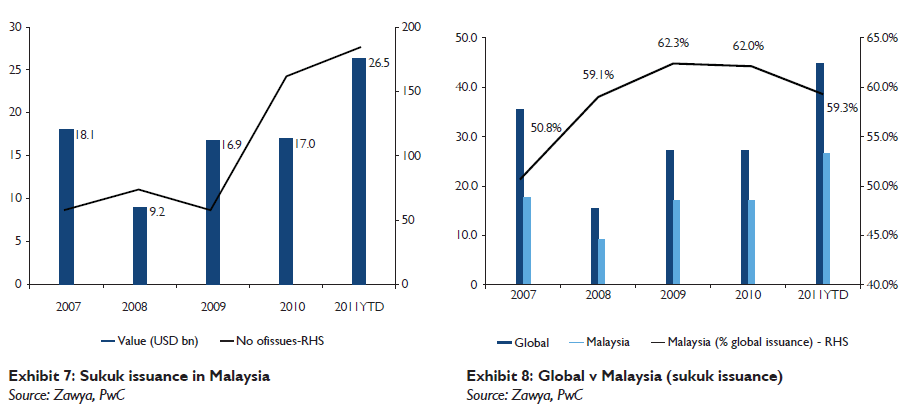

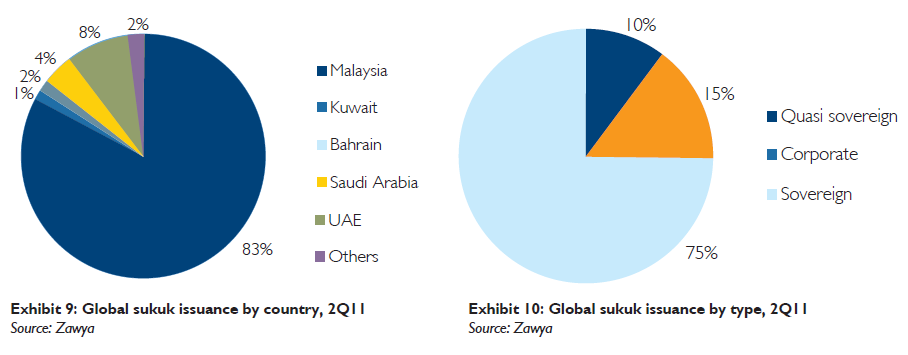

In spite of the impressive progress, the development of the sukuk market remains uneven. Malaysia is still by far the dominant jurisdiction, routinely accounting for up to two-thirds of global sukuk issuance. This state of affairs is explained by the relative maturity of the industry there but also quite clearly the important role of the government and of government-related institutions. Whereas GCC issuance is predominantly corporate sukuk, Malaysia’s dominance of the global sukuk market is closely matched by the global dominance of sovereign and quasi-sovereign sukuk which tend to emanate from Malaysia. The Malaysian government issued the third-ever sovereign sukuk in early July. The dual tranche USD2bn wakala sukuk marks a departure from the previous practice of five-year maturities. Here, one of the tranches has a USD800mn 10-year term, a first for sovereign sukuk issues. Malaysia’s first USD600mn ijara sukuk was issued in 2002. The second one followed in 2010. The issue was 4.5 times oversubscribed. Significantly, Middle Eastern investors accounted for 43% of the orders for the five-year tranche. Malaysia is planning to use some of the proceeds for a USD48bn mass-rail network in Kuala Lumpur. The Malaysian issue was rated A- by Standard & Poor’s and A3 by Moody’s.

Looking forward

There are strong indications that the rebound in sukuk activity will continue, even allowing for elevated global uncertainty. Project finance is a particularly important growth area in the Gulf and in an encouraging sign, the Saudi Minister of Finance Ibrahim al Assaf stated in Oc- tober that the Kingdom was studying the possibility of issuing government-backed sukuk for projects. Another opportunity exists in the area of mortgage finance after the implementation of the country’s mortgage law, potentially echoing the Malaysian Cagamas Bhd model. Across the sukuk universe, a number of issuers have relatively advanced issuance plans. But the global trends are particularly encouraging. Malaysian names have played a role in increasing the global remit of sukuk, most notably in terms of currencies. The Malaysian government investment company Khazanah Nasional Bhd in mid-October started taking orders for a Renminbi-denominated sukuk with a tenor of three years. Khaz- anah Nasional in 2010 made its first cross-border issue with an SGD1.5bn sukuk. The Kuala Lumpur-based International Islamic Liquidity Management Corp. plans to see USD200-300mn of short-term notes before the end of the year.

One of the important developments in the sukuk market is its increasingly global remit. Indonesia is emerging as an important second hub for sukuk in South-East Asia. Indonesia had its first Islamic Treasury bill auctions in August, raising a total of IDR900bn (USD105.5mn) in two six-month issues. This made an important contribution to the growing universe of short-term sovereign sukuk issuers where other countries currently include Bahrain, Gambia, Brunei, and Malaysia. Indonesia’s first sovereign sukuk, USD 650mn, was issued in April 2009. Middle Eastern investors bought 30% of the issue which was backed by rent receipts from state-owned lands and buildings. The country is currently preparing a sovereign sukuk issuance of up to USD1bn. This would be used in large part to fund the country’s budget deficit 2.1% of GDP. Reflecting the strong foreign investor interest in sovereign paper from the region, Malaysia’s USD2bn sovereign sukuk in June was 4.5 times over-subscribed. Middle East investors subscribed to 42% of the USD1.2bn five-year tranche, highlighting the relative dearth of quality sovereign issues in the region.

In Turkey, the country’s Shari’a-compliant participation banks are showing strong interest in sukuk issuance. Kuveyt Türk recently launched a road show for a five-year USD350mn sukuk, Albaraka Türk has directed advisers to sell USD180mn outside of Turkey. The bank recently raised a USD350mn syndicated loan having originally planned for USD150mn. Also, Al Baraka Bank Egypt plans to raise EGP1bn from 10-year notes.

Ongoing efforts by a number of sovereigns elsewhere in the world to issue their maiden sukuk are being met with growing scepticism. Although the regulatory and institutional hurdles can indeed be considerable, many governments have reiterated their interest. The government of Jordan has indicated its plans to issue some USD 750mn worth of sukuk for its fiscal and infrastructure needs. Jordan’s Al Rajhi Cement made the first ever Jordanian sukuk issue worth JOD85.0mn

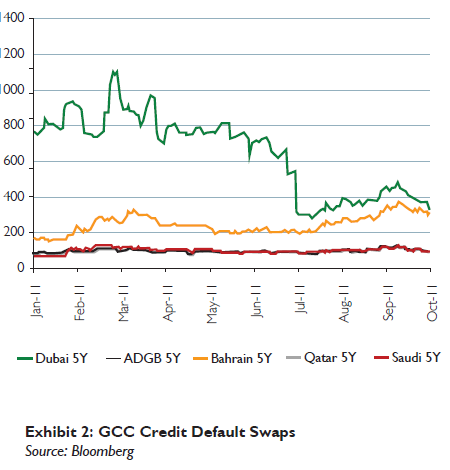

(USD120mn) in April. The Palestine Monetary Authority plans to raise USD50mn of Islamic debt this year and Egypt has shown growing interest in sukuk. Following Iran’s Mahan air issue in March 2011, Omid Investment Management Corporation is planning to make a similar issue. Nigeria is planning to become a hub of Shari’a-compliant finance in West Africa. South Africa is amending legislation to allow for Islamic finance while Australia is working on removing tax barriers on Shari’a-compliant products. The Egyptian regulators have approved in principle a law on sukuk while the Government of Jordan plans to sell as much as USD750mn in sukuk. A draft sukuk law is due to be presented to the parliament in August. The Kazakhstani parliament is due to approve a law on Islamic finance and the government is hoping to issue at least USD500mn in sukuk. Senegal is expected to come to the market with a USD200mn issue. Also, Nigeria wants to launch sukuk issues in the coming 18 months in the hopes of turning itself into a regional hub for Islamic finance. Other potential sovereign issuers include the Republic of Tatarstan in the Russian Federation and Thailand. Indonesia is planning gross issuance of over IDR200trn (USD23bn) this year, including a USD1bn global 7-10 year sukuk in the second half of the year. Fitch and Standard & Poors’ this year upgraded Indonesia to BB+, one level below investment grade. Also the Korea Development Bank is considering a sukuk, while the new Kuala Lumpur-based International Islamic Liquidity Management Corp intends to sell short-term sukuk before the end of the year. In spite of the progress being made, the market still faces some potential stress points as well. Dubai entities have an estimated USD16bn of publicly held debt maturing this year and more than USD30bn by the end of 2012, a sum that exceeds a third of the emirate’s GDP. These pressures are likely to be addressed through a combination of new issuance, some restructurings, spending cuts, and asset disposals. For instance, the emirate government has announced plans to cut transfers and subsidies by half to AED2.67bn. Examples of large asset divestments among government-related companies have included DP World’s sale of its Australian assets In December and the divestment by Borse Dubai of 50% of its stake in Nasdaq OMX. The largest Dubai redemptions due next year are a AED7.5bn bond by Jebel Ali Free Zone, a USD1.25bn bond by DIFC Investments, and USD500mn by Dubai Holding. All are likely to necessitate special arrangements with the likelihood of successful asset disposals highest in the case of Dubai Holding. However, market disruptions are generally expected to remain fairly minimal.