Introduction

In the past few years, the world has been affected by a number of incidents that have played significant roles in shaping current financial markets. Global market focus has shifted towards the Asia Pacific ex-Japan region, in light of its robust development, particularly within the Islamic asset management industry. This chapter will bring to light several factors and trends in the markets, indicating that the direction wealth management will take in this region will be a continuous, upward one.

Asia Pacific – The new asset management Jewel

In the recently released Capgemini and Merrill Lynch Global Wealth Management’s 2011 Asia-Pacific Wealth Report, the number of high net worth individuals (HN- WIs) in the Asia Pacific region increased by 9.7% to 3.3 million in 2010, overtaking Europe for the first time and only lagging behind North America. The report also indicates that the amount of investible assets held by HNWIs in the Asia Pacific surpassed Europe as well, enjoying a 12.1% growth to hit USD10.8 trillion by the end of last year.

The case for including the Asia Pacific as a viable, long-term, sustainable option in wealth management has never been more compelling and this readily accepted by global fund managers.. While Japan remains the largest HNWI market in the Asia Pacific — accounting for a little over half of the entire HNWI population and over 60% of wealth in the Asia Pacific– its dismal stock market performance and economic slowdown have seen it grow slower than other markets. China has outperformed Japan, experiencing a 12% growth in HNWIs and is currently experiencing a shift in investments from real estate to equity, with equity currently taking up to 42% of total Chinese HNWI holdings. Robust growth of HNWI in Australia and India has also been recorded.

Most global investors tend to regard exciting and dynamic market activity in “Asia” as just occurring in China or India. In truth, there are already developed markets in Australia, New Zealand, Hong Kong and Singapore. Within the Asia-Pacific region as well, the potential of several countries within the Association of South East Asian Nations (ASEAN) cannot be dismissed. Out of the 10 countries in ASEAN, six – Malaysia, Indonesia, Thailand, the Philip- pines, Singapore and Vietnam – have stock exchanges.

Long-term investment opportunities now abound in Asia Pacific ex-Japan, due to the rapid development of its economies. This is evidenced by population growth, rapid urbanization, large-scale industrialization and consistent GDP growth. This has outpaced Europe and the United States, whose purchasing power parity declined in 2009. A fast-developing Asia Pacific market continues to lead the global economic recovery notwithstanding the World Bank’s auguries that the region’s growth will weaken as trade slows; China alone has a forecasted growth of 8.4% in gross domestic product (GDP) for this year¹.

In contrast, global economic growth is currently losing its momentum. The United States, whose frozen and arguably regressive monetary policies are in a gridlock, is a prime example. Ongoing debt crises continue to beleaguer Europe. On the other hand, helping to offset the decline is a well-positioned Asia Pacific market that is now enjoying a rebound in credit growth, even as corporate and consumer confidence continues to strengthen. , Central banks in the region remain vigilant of inflationary risks, which may result from un-tempered economic growth.

Islamic asset management in Asia Pacific ex-Japan: The low-hanging fruits

The leap forward for Islamic asset management from its relative infancy came about through two factors: the consistent surge of crude oil and natural gas prices since 2008 and the continuously depressed dollar.

It was the surge in oil prices which spurred investors, flushed with petrodollars and eager to leverage on its liquidity. They began to shift their focus from the United States to the Gulf Corporation Council (GCC) nations, and subsequently to the Asia Pacific. Delving into new markets, investor demand rose for a slew of products that were both original and innovative, including those that are compliant with Shari’a principles.

Saudi Arabia and Malaysia have been quick to capitalize on this emerging sector and are now jointly recognized as world leaders in Islamic finance development. These countries played a crucial role in upgrading awareness, first on Islamic finance itself and subsequently on Islamic asset management. While these two nations have led the charge towards the growth of the sector, other countries have quickly followed suit. Today in the Asia Pacific, the Islamic asset management industry has grown immensely in many countries including Malaysia, Brunei, Singapore, Japan, South Korea, China and Indonesia.

Demand-driven results speak for themselves. Global investment houses today continue to aggressively develop products to meet the needs of a multifaceted investor community. Boutique investment companies are also be- coming an increasingly popular business model for global houses in capturing market share in different countries.

In tandem with the growth of these investment houses is the rising level of overall investor appetite. Greater demands for product diversification have never been stronger, as institutional fund managers are heeding the call from clients to provide new investment exposures in their portfolios. As such, the number of Islamic asset managers and the amount of total assets under management has multiplied tremendously. This is most welcomed in the industry as it helps to promote new talent, better product quality and greater competition.

In the present day, a plethora of Islamic investment solutions are available in the Asia Pacific. The region’s Islamic capital markets space is diversified and rapidly maturing. It has been reported that for many, the Asia Pacific holds the lion’s share of the global market in financial products such as Islamic derivatives and exchange-traded funds. Currently, Islamic financial investment products available in Asia Pacific are equities, sukuk, derivatives and swaps (for both profit rate and cross-currency), unit trusts, exchange-traded funds, real estate investment trusts (REITs) and commodity funds.

The evolution of Islamic asset management can be observed in two ways – structure and the market. Structurally, we have first seen the management fees for Islamic products (especially for equity funds) increase, as a result of industry-supporting mandates. Due to this, we have also seen more active management approaches with the hiring of more analysts. Looking at how the industry has grown in terms of the market, there has been greater trading turnover and diversification, as investments continue to spread across different industries, sectors and geographical boundaries.

Another indicator of Islamic asset management’s growth is the continuously growing demand for Shari’a advisors. Larger investment banks, especially those with an extensive range of Islamic funds, tend to have an internal team of advisors. However, with more and more non-Islamic institutions entering the market, it is a common practice to seek Shari’a compliance via third-party experts and specialized consultancies like the San Francisco-based Ideal Ratings, Inc.

Conventional asset management in India and China has progressed out of its nascent phase and continues to develop. With a high potential for returns, these areas can no longer be ignored by Islamic asset managers. Out of approximately 1.3 billion Muslims in the world, approximately 138 million reside in India and 30 million in China²; both countries are growing markets for income and wealth. Therefore, the demand for Islamic products will not only be driven by the sheer number of people, but also by the wealth and appetite they have for greater investment options.

The real global challenge for Islamic asset management players, from a real-life marketing standpoint, is to manage expectations and mitigate common misconceptions held by investors. Retail investors tend to be more concerned with image risks and are consequently hampered by the mistaken notion that a Shari’a-compliant investment is something that is associated with faith-driven decisions, and more egregiously, terrorism. On an institutional level, investors are comparatively more sophisticated, weighing decisions on investment performance.

As of September 2010, global Islamic assets hit USD1.3 trillion, with an impressive average growth rate of 15 to 20 percent per annum. Takaful contributions also re- main on the rise, registering at USD7.2 billion, and this is expected to reach USD11.2 billion by 2012, with a 13 percent per annum growth rate. These are clear indicators that Islamic assets are sustainable options for the investor for both the short and long term. More so, the figures underlines the fact that the industry will continue to be taken seriously, be it by long-term investors or new ones who are looking to diversify their portfolio.

Comparable risk-return: Islamic and conventional Asia Pacific ex-Japan indices

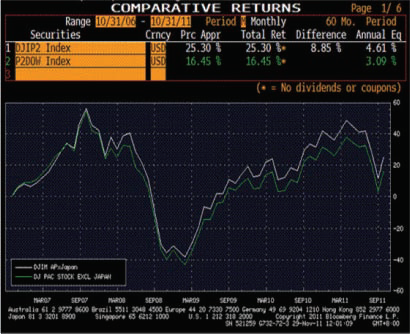

Over a period of five to ten years, Islamic indices have yielded comparable returns to their conventional counterparts. For the six-year period from December 2005 to December 2011, the Dow Jones Islamic market Asia Pacific ex-Japan Index outperformed its conventional index counterpart, the Dow Jones Asia Pacific ex-Japan Index, 30.95 percent to 22.65 percent, a cumulative outperformance of 8.30 percent.

This outcome could be partly attributed to the screening process. To qualify as a Shari’a-compliant stock, there are strict parameters for financial ratios which include:

- debt to total market capitalisation or debt to total assets

- receivables to market capitalization or receivables to total assets

- cash to market capitalization or cash to total assets.

Shari’a-compliant stocks must adhere to these financial ratios and assure that cash reserves are productively used and the company is sufficiently liquid to absorb financial shocks. Due to such screenings, Shari’a-com- pliant companies are comparatively better capitalized and more liquid than their conventional peers. When a global financial crisis occurs, in both theory and practice, they are less exposed to de-leveraging, excessive solvency and liquidity concerns – and therefore more ‘desensitized’ against price declines.

Islamic indices can be expected to keep pace with, or even outperform, conventional index counterparts should fundamentals lead an economic recovery. In September 2010, the Dow Jones Asia Pacific ex-Japan Index had six banks ranked in its top ten constituents; while Dow Jones Islamic Markets (DJIM) Asia Pacific ex-Japan Index’s top ten constituents had a balanced mix of manufacturing, telecommunications, mining and technology.

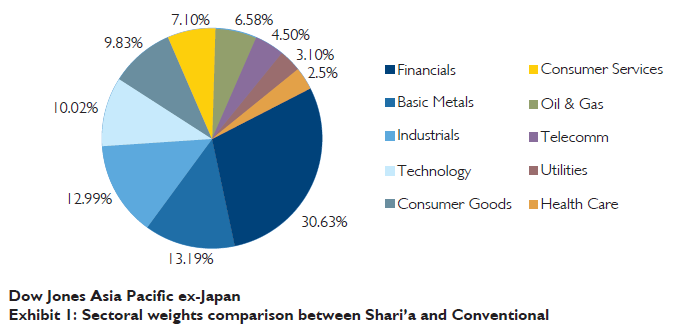

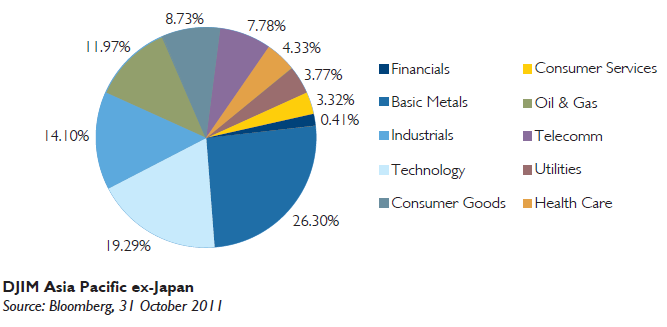

Looking at industry weightings in the widely used DJIM Asia Pacific ex-Japan index, the customary emphasis on financials in conventional indices is replaced with substantial weightings in the “clean” and “new economy” industries of technology, telecommunications and health- care. A deeper sectorial examination reveals there are significant weightings in the booming sectors of software and hardware, mobile telecommunications as well as pharmaceuticals and biotechnology.

As of October 31, 2011, four of the constituents of the top ten companies in DJIM for Asia Pacific ex-Japan index were also in the top ten Dow Jones Asia Pacific ex-Japan list. At the same time, the total number of DJIM Asia Pacific ex-Japan constituents have grown since the past year, coming up to slightly under half of that of the conventional market, at 41.2 percent. Ho ever, there is still room for both new entrants as well as greater market capitalization. The total market cap

for Dow Jones Asia Pacific ex-Japan is at USD4.28 trillion, while the total market cap for DJIM Asia Pacific ex-Japan is only at USD1.8 trillion, or 42 percent of the total conventional market. Country-wise, Australia has the most number of Shari’a-compliant constituents, at 25.4 percent, followed by Taiwan, India, South Korea, China and Hong Kong.

While the financial sector makes up 30.6 percent of the Dow Jones Asia Pacific ex-Japan market, the case is the opposite for the Shari’a-compliant market – in DJIM Asia Pacific ex-Japan, only 0.41 percent of the equities belong in the financial sector. There are greater weightings in some sectors in DJIM Asia Pacific ex-Japan as compared to Dow Jones Asia Pacific ex-Japan (Exhibit 1): basic materials (26.3 percent vs. 13.19 percent), technology (19.29 percent vs. 10.02 percent), industrial (14.1 per-cent vs. 12.99 percent), oil and gas (11.97 percent vs. 6.58 percent), telecommunications (7.78 percent vs. 4.50 percent), healthcare (4.33 percent vs. 2.05 percent) and utilities (3.77 percent vs. 3.10 percent).

Even in the case of “black swan” incidences, Shari’a-com- pliant equities are not completely immune to extreme changes, but they can indicate a tendency to more successfully absorb shocks that arise from these events.

To help illustrate this, Exhibit 2 shows the DJIM Asia Pacific ex-Japan index over the past five years ending October 2011 yielded total returns of 25.3 percent, out-performing its conventional counterpart by a respectable 8.85 percent.

Shari’a-compliant investment tools actually allow for derivatives (that are not associated with speculation, uncertainty or gambling and therefore, haram) to be hedged with proven, compliant-backing assets. This counters the largely mistaken notion that Shari’a-compliant investing offers limited hedging capabilities. In this sense, accepted financial tools allow the Islamic asset manager to manage costly exposures to risks.

Investor awareness: mindsets are pivotal

It is often said that the biggest hurdle in Islamic asset management is educating investors who are unfamiliar with Muslim philosophies and jurisdictions. The mindsets and education levels of investors are still too varied, which necessitates that industry players, proponents and regulators make a concerted effort to raise the level of awareness about the industry. By achieving this, the outlook of not only Islamic asset management, but universal asset management as a whole is transformed for the better. Here, we will address different situations in various economies in order to better track the development of Islamic asset management in the respective countries.

- Malaysia

. Malaysia recognized early, the importance of education and the development of high-quality professionals in Islamic finance and asset management in strengthening the industry, and took proactive steps to address them.

Malaysia is an established leader in developing human capital for Islamic finance, and has established institutions that help to cater to both local and international demand. They include:

- Securities Industry Development Corporation (SIDC) which provides information and training for capital markets to locals and professionals,

- International Centre for Leadership in Finance (IC- LIF), a leadership and development programme for financial institutions and corporations,

- Financial Sector Talent Enrichment Programme (FSTEP), a centre for training in investment, conventional and Islamic banking, insurance and Takaful,

- Islamic Banking and Finance Institute Malaysia (IBFIM) which provides training and consultancy in Islamic Banking, Takaful and Capital Markets, and

- International Centre for Education in Islamic Finance (INCEIF), a global university that offers certification and post-graduate courses, with cross-border recognition.

Malaysia also has the most number of Islamic fund products, with an estimated 184 different funds as of 2010 and an estimated USD5.1 billion worth of assets under management5 while its Islamic capital market stood at RM1.05 trillion. In the same period, it retained its pole position as the global leader in sukuk issuance, with 72.5 percent of global issuances (or USD31.57 billion of a total of USD43.56 billion) in 2010, out of which 57 percent was private issuances while the remaining 43 percent was public6. As of 2010, there are 16 Islamic fund management players in Malaysia, as well as 17 local Islamic banks, and four international ones.

The growth of the Malaysian Islamic asset management industry has been spurred by legal and regulatory policies, while being supported by its tax framework. Islamic fund management in Malaysia is licensed under the Capital Markets and Services Act (CMSA) 2007, which deals with Ringgit and non-Ringgit management of retail and institutional investors, including establishing and distributing funds. Fund management players are issued an Islamic Fund Management Company license if they meet the requisite criteria: a strong record and geographical presence, good compliance, internal audit and risk management capabilities, brand value, and expertise in the markets underlying the financial soundness of the funds.

In Malaysia, total foreign ownership for fund management companies is allowed, and companies have been accorded income tax exemptions until 2016. Furthermore, Malaysia also offers comparatively relaxed levels of investor permissiveness – all assets may be invested abroad. Islamic fund management companies that are licensed under CMSA are eligible to tap into a seed fund. To address any human capital challenges, there are no restrictions on the employment of expatriates in this field, and immigration procedures for Islamic finance and fund management professionals and their immediate family members are hiccup-free. In addition to that, Malaysia also allows cross-border recognition with other jurisdictions to facilitate cross-border marketing and distribution of Islamic funds.

As for regulations, the Securities Commission of Malaysia has mandated various prerequisites for an Islamic financial system to run in parallel with a conventional financial system. These include appointing Shari’a advisors at the company and fund/portfolio levels and electing a designated Shari’a compliance officer to whom the task of reporting any non-compliance issues and other developments falls upon.

Tax neutrality has been accorded to Islamic finance instruments and transactions. There is no additional stamp duty and tax payment incurred in the usage of Islamic products; therefore, this reduces the costs of doing business via Islamic finance. Until 2015, tax deduction on expenses incurred on the issuance of Islamic securities is permitted. Additionally, through the Malaysia International Islamic Financial Centre (MIFC) initiative, fund management licenses are offered to financial institutions, allowing them to conduct business in Ringgit and non- Ringgit denominations. Malaysia has also signed various cross-border agreements with other capital markets around the region, namely Hong Kong, the United Arab Emirates, South Korea and Australia.

On sukuk regulations, the Malaysian parliament in 2010 passed new provisions that now require the judiciary to refer and lead all Shari’a matters involved in any court dispute arising from Islamic financial transactions, giving sukuk market players a confidence boost upon the validity of Islamic financial contracts.

- Singapore

Singapore certainly does not suffer from a dearth of financial products, though both players and regulators have noted that the majority of these are not yet compliant to Shari’a principles. The Shari’a-compliant instruments and products already available range from retail-based unit trusts funds to exchange-traded funds and REITs, and from equity and property funds (targeted for institutions) to sukuk. MAS Executive Director Tai Boon Leong recently noted that while the frequency and size of these instruments are low and smaller than their conventional equivalents, the deals underscore the fact that there are no regulatory or market impediments to their origination in Singapore.8

The Monetary Authority of Singapore (MAS) has been implementing a series of regulatory reforms to widen its growing presence in the international capital market. MAS works with the island nation’s Inland Revenue Authority and the Ministry of Finance to ensure that Shari’a-compliant products are not held at a disadvantage to conventional products when it comes to taxation. To offset higher start-up costs and facilitate Islamic finance’s growth, it has introduced a 5 percent concessionary tax rate for qualifying Shari’a-compliant lending, fund managing, takaful and re-takaful activities. There are also additional tax benefits including exemptions from qualifying funds and investment structures such as mudaraba, musharaka, istisna and salam, if they are managed by Singapore-based fund managers. Its regulations have since aided the formation of the largest Shari’a-compliant REIT in the world, the Sabana REIT which was launched in late 2010.

Singapore is already an established wealth management hub. Tax incentives for Islamic asset managers in Singa- pore include non-double taxation for funds constituted in Singapore, thanks to the island nation’s extensive network of treaties with other countries. Furthermore, fund managers in Singapore also enjoy a 10 percent concessionary tax rate on fee income.

The approach taken is to accommodate Islamic banking products within its existing regulatory framework and level the playing field. This helps to ensure that Islamic and conventional financing are operating within a uniform context, equally exposed to both the strengths and risks within the same market. In 2010, a circular was issued on Shari’a compliant framework for sukuk issuances, allowing independent bodies to provide Shari’a endorsement (instead of obtaining it directly from the regulator).

However, in 2008, Hong Kong Monetary Authority CEO Eddie Yue declared that Hong Kong is well-positioned to be an Islamic finance and wealth management hub with its freer economy, having no foreign exchange controls and no tax on offshore income, capital gains, dividends, estate or sales. There is also free movement of capital, talent and goods and virtually no barriers to entry or obstacles to mobility for financial and human capital locally or from overseas.

Hong Kong’s great attraction is its geographical and political positioning as a gateway for investors to access mainland China. It introduced its Islamic indices in 2007. Having Islamic funds offers greater variety to the retail market and underscores the versatility of its asset management industry. In 2010, Hong Kong’s fund management activities hit USD1 trillion, up 18.6% from 2009.

Hong Kong’s administration continues to acknowledge the potential of Islamic asset management and finance as a whole, reiterating its stand to support and develop the industry within its boundaries. In the government budget of 2010 to 2011, it stated plans to submit a tax liability proposal to create a level playing field for Islamic financial and conventional asset management, including making changes or clarifications for stamp duty, profits tax and property tax.

As of December 2010, total registered AUM (both conventional and Islamic) in Singapore was at USD1.1 trillion, registering a growth rate of 16 percent per annum. Over 80 percent of total assets under management were sourced from outside Singapore, with 51 percent invested in equities. Bonds constituted 16 percent, collective investment schemes were at 8 percent, cash and money markets at 12 percent and other alternate investments took up the remaining 13 percent. In the first quarter of 2010, Shari’a-compliant assets under Islamic management hit USD52 billion.

- Hong Kong

Hong Kong has attempted to keep pace with the developments in Singapore and to set itself up as a regional Islamic financial and asset management hub. It has lagged behind Singapore’s progress though it has proactively stepped up measures to address this.

The Hong Kong Securities and Futures Commission- authorized Hang Seng Islamic China Index Fund was first introduced in 2007. It tracks the Dow Jones Islamic market China and Hong Kong Titans Index, and comprises the 30 largest Shari’a-compliant companies with their primary operations in Hong Kong and mainland China. In 2007, Hong Kong’s Arab Chamber of Commerce and Industry also launched the Hong Kong Islamic Index (HKII), a basket of 78 Shari’a-compliant companies listed on Hong Kong’s stock exchange. These companies are largely mainland and Hong Kong property and manufacturing players with low debt and little of their income earned from interest.

Hong Kong is home to over 300,000 Muslims but many residents remain largely unaware of Islamic traditions and habits of life, and there is a keenly felt shortage of financial experts schooled in Shari’a principles.10In the following year’s budget (2011 to 2012), the government aims to enter into double taxation-avoiding agreements with more trading and investment partners in order to induce growth of its Islamic asset management business. This will be implemented in line with developing an Islamic financial platform, and will be featured in promotional efforts, as Hong Kong’s administration plans to send delegations to stage roadshows in Mainland China and overseas markets to promote its strengths in 2012.

In February 2011, Hong Kong instituted measures to implement a new programme for foreign-invested equity investment enterprises in Shanghai, which experts believe will be a catalyst to attract Islamic investment funds. Furthermore, in October 2011, Hong Kong financial secretary John Tsang stated that the government was currently working on a bill to facilitate a level playing field for sukuk and their conventional counterparts with respect to tax liabilities, and will conduct a second round of consultations with major market players on the relevant details of Hong Kong’s legislative Islamic proposal in the first quarter of 2012.

Currently, Hong Kong has a shortage of professionals and Shari’a advisors, so the main challenge lies in its ability to attract the kind of talent that will build Islamic finance. However, its long history of dealing with structured products (Shari’a products are all structured, in principle), and thus, its workforce’s experience and supportive regulations already in place can be easily capitalized upon, thereby granting it an intrinsically advantageous position.

- Australia

Australia is a country in which Islamic finance has the potential to thrive, due to its stable and transparent financial system, comparatively sound macroeconomic fundamentals, and well-established regulatory framework. special interest and political groups, the law has yet to be passed.

In late 2011, Australia’s first licensed Islamic wealth manager Crescent Wealth announced the country’s first Islamic Australian equity fund, the Crescent Australian Equity Fund (CAEF). It pioneered new opportunities within its superannuation industry and offered investors greater choice in socially responsible investing. Crescent Wealth also announced its plans to launch three additional funds – international equity, property and income funds, which together will form Australia’s first Islamic superannuation option.

Crescent Wealth estimated that Islamic funds in Australia will grow to as high as A USD13 billion in funds under management by 2019. At present, there isn’t a large amount of choice or variety for Islamic investments in Australia, though the industry has recognized the high potential of the market. Its superannuation funds, as at September 2011, totalled at A USD1.25 trillion.

In 2008, the Australian government recognized that its financial services sector offered great opportunities for Islamic banks and financial institutions to do business in the country or to export their products to Australia. The Johnson Report14 made two specific recommendations on Islamic finance: to remove the regulatory barriers that hampered the development of Islamic finance products in Australia and to have the Board of Taxation conduct an enquiry into whether Australian laws needed to be amended to ensure that Islamic financial products have parity of treatment with conventional products. It was tasked to report by mid-2011 the recommendations for the state- and territory-level laws to become inclusive and positive in developing the Islamic financial services sector.

Comparatively speaking, Australia has a long way to go – much of the proposals and legislation to develop the sector is tabled at the state government levels. Victo- ria takes the lead here, having reformed its property stamp duty to allow Islamic finance for residential properties. This step showed that the state has recognized the profit-sharing principle and allowed agreements to avoid non-Shari’a compliant terms.

- South Korea

South Korea’s government and financial institutions have shown an interest in Islamic asset management. How- ever, the procedure of setting up new, supportive regulations has been hampered due to political power play.

Islamic asset management’s strongest boost comes from state-owned Woori Financial Group, which has developed Shari’a-compliant products with Malaysian-based Amanie Business Solutions Sdn Bhd and is said to be planning to incorporate an Islamic asset management company in Malaysia.

In trying to establish itself as an international Islamic capital markets hub, South Korea’s National Assembly (in 2010) was considering a bill to facilitate tax neutrality for the issuance of sukuk overseas in recognized Islamic financial centres. Due to pressure from various

- Indonesia

Indonesia, the world’s most populous Muslim nation, has also taken note of the exciting opportunities. Recently, it formalized its Islamic infrastructure by introducing new industry-supporting policies and continues to look into ways to modify its legislation to spur investor interest. Given the sheer size of the domestic Muslim investor market though, Shari’a-compliant companies have an adequate market without having to look towards cross-border expansion. Its population of over 242 million and its equity market cater to a growing appetite for new products15.

As at 2011, there are more than a dozen fund houses managing Shari’a-compliant funds in the country, serviced by financial institutions that provide other types of Islamic products16. It was also noted that most of them originated from Indonesia itself, which in turn has provided a good source of local talent that is able to develop Shari’a products locally and independently from other markets.

Compared to Malaysia, Indonesia’s entry into Islamic asset management has been more recent, and thus, their track record and asset sizes are comparatively smaller partly due to the focus on local investors. Indonesia, currently, has not designed a fully supportive tax framework to strengthen the industry, and there is still a ban on investing abroad, which hampers Islamic fund management players. Its capital market supervisory body, Bapepam, has revamped certain regulations in 2008, ranging from capital adequacy in Shari’a-based banking as well as the conversion from conventional to Shari’a-based operations. Indonesia’s potential for growth is monumental, with its improving capital markets regulations and legislation.

- China

While there are some 65 million Muslims in the country, China’s entry into Islamic finance has been relatively late. Up to 2010, there were no authorised Islamic banks until the China Banking Regulatory Commission gave the green light for a pilot trial for Islamic banking in the Ningxia Hui region. The Ningxia Bank has opened one Islamic affiliate so far.

The country’s entry into Islamic finance has been comparatively relaxed though it has expressed interest in the sector, particularly in tapping the Middle Eastern markets and catering to its Muslim population.

As for asset management, little can be found in the way of market players though foreign funds issued by various players around the region have made forays into the country, hoping to capitalize on its economic and wealth growth as well as its burgeoning investor appetite.

- India

Despite being the second most populous nation of Muslims, India’s growth in Islamic finance has been hampered by the nation’s political landscape. Shari’a-compliant asset management is allowed but companies are not allowed to offer banking services, as it falls outside the jurisdiction of the State Bank of India’s regulatory purview. The development of Islamic finance has been marked by setbacks. There are smaller instances of tri- umphs: Islamic investors can access Shari’a-compliant mutual funds, indexes and exchange-traded funds.

The Kerala state government has recently pledged full support of Islamic finance and is working towards approval from the Indian central government. Gulf investors are keen to expand into India, given its robust economic outlook (it achieved 8.7 percent GDP growth in 2010) and numerous opportunities for foreign investments.

The intrinsic appeal of Shari’a-compliant investments in India lies in its packaging. While it may face ethnic, religious or political hiccups in officially recognizing Islamic asset management as an industry, investors are drawn to the idea of choosing the more ethical option. In such a manner, Shari’a investments are not overtly marketed as compliant to Muslim standards, but rather as ethical and socially responsible investments.

The first Islamic brokerage firm in India was established in 2004, and currently, 9 asset managers including Reliance Asset Management (the country’s largest wealth manager), Kota Asset Management and Bajaj have been awarded licenses. However, until significant changes are made by regulators and a supportive framework designed, India will also remain a region still largely un- tapped by the Islamic investment market.

- Thailand

Thailand’s Islamic banking began in 1998 with the introduction of an Islamic window followed by the establishment of its first full-fledged Shari’a-compliant unit, the Islamic Bank of Thailand in 2003, following the enactment of the Islamic Bank of Thailand act the year before.

Long hampered by prohibitive tax structures for its capital markets, Thailand is still dilatory in constructing a supportive regulatory framework, though its revenue department has drafted a new trust law for capital market exemptions from land transfer taxes and registration fees. Other noted challenges faced by the industry are its differing economic regions, public acceptance and its rules and regulations.

While no official law has yet been passed on a conceptual level, this is the starting point for Thailand to clear the way for sukuk issuances. Thailand’s Securities and Exchange Commission has also begun regulatory amendments to facilitate Thai baht sukuk issuances.

- Brunei

Brunei’s sovereign monarch, Sultan Hassanal Bolkiah, actively supports the installation of a regulatory framework for Islamic finance, which has established a firm foothold in the Sultanate since the launch of its first Islamic bond, the USD111 million Short Term Government sukuk al- ijarah programme in 2006. Brunei was the first country in the world to bypass conventional capital markets and move directly into developing Islamic debt instruments. In the same year, Brunei introduced new laws for its insurance, banking, hire purchase and finance companies to further pro- mote Islamic banking.

While Brunei’s economy still relies heavily on its oil and gas revenues, the nation is starting to market itself as an Islamic financial hub and offshore financial centre. The Brunei Economic Development Board18 is tasked to look at long-term diversification plans for the economy and is focused on the growth and development of its financial sector – thereby making Islamic finance, and indirectly asset management a major national initiative. Industry players have moved into identified targets areas with latent demand, like Islamic wealth management, in order to gain access to the untapped liquidity in the country.

Conclusion

As Islamic asset management continues to spread over multiple geographical regions and across new customer classes, it is only a matter of time before Islamic asset management stands head-to-head with conventional investing. It is truly in the Asia Pacific ex-Japan region that the industry burgeons in a dynamic, un-prohibited manner with growing awareness and investor acceptance around the world. This is also the region with the greatest number of Shari’a-compliant investment opportunities.

The amount of products and instruments available in the market makes the investor spoilt for choice. The future development of Islamic asset management in the region is supported by various factors – an overall positive growth in its component economies, growing population and increasing wealth and increasing government support for the industry. The Shari’a-compliant investing approach has been proven to investors. This approach is able to form a balanced portfolio while reducing disparities and offer a socially and morally conscious alternative– thereby making it a valid and irresistible investment choice.