KEY MESSAGES:

Islamic estate planning, which makes up a part of Islamic financial planning, is not well-developed and needs further enhancement and improvement for it to flourish so that every Muslim can benefit from it.

For Muslims, beyond the provision of advice on Islamic law of inheritance and bequest, Islamic estate planning calls for proper planning on the disposition of personal property and assets. Several factors have been identified to contributing to the current scenario, ranging from awareness, knowledge and cost implications.

It is a common misperception amongst Muslims that the rules of inheritance are the sole and inevitable mode of wealth distribution. Other key instruments of Islamic estate planning are takaful, wasiyya (will-writing), hiba, waqf and trust, which can be used to accommodate the laws of inheritance.

A major impediment to the development of waqf is the lack of financial resources to revive the regeneration of productivity of the waqf assets. Waqf funds itself are not sufficient to manage the waqf assets since the assets are not fully utilised to generate income.

Islamic estate planning is an important aspect of wealth management and financial planning. Currently, Islamic estate planning, which makes up a part of Islamic financial planning, is not well-developed and needs further enhancement and improvement for it to flourish so that every Muslim can benefit from it. The important components of Islamic estate planning include hiba, wasiyya, waqf, takaful and fara’id (Islamic law of inheritance), among others. This chapter discusses some of the major issues pertaining to these components and offers recommendations to resolve them.

An Overview of Islamic Estate Planning

Islamic estate planning refers to the allocation of wealth carried out by a person during his lifetime and its distribution upon his death in accordance with the principles of Islamic law. As such, estate planning aims to distribute wealth in a way that offers financial sustainability and satisfaction to entitled beneficiaries. The estate becomes more relevant when family members of the person are in financial need or suffering from disability.

To this end, estate planning also has the following objectives:

- To protect the rights of the family members of the person

- To prevent any disputes among the legal heirs, beneficiaries and creditors

- To save time and costs in applying for the distribution of estate

- To put the assets under waqf that is properly managed for the benefit of the Muslim community

- To prevent any possible claims which could arise after the death of the property owner

- To ensure the rights of the spouse or children from an unregistered marriage to the deceased’s estate.

In Malaysia, for example, there are currently more than one million cases of estate dis-putes amounting to RM38 billion, where distribution was not properly managed by legal heirs and are waiting to be heard in courts. This shows that planning for estate distribution is very significant, failing which could result in huge losses.

Issues in Islamic Estate Planning

Estate planning amongst Muslims is not widely practiced and in some countries it is almost totally neglected by Muslims. While many are of the view that estate planning only applies to wealthy individuals with millions in assets, in reality this couldn’t be further from the truth.

For Muslims, beyond the provision of advice on Islamic law of inheritance and bequest, Islamic estate planning calls for proper planning on the disposition of personal property and assets. Several factors have been identified to contributing to the current scenario, ranging from awareness, knowledge and cost implications.

Ignorance

The low level of awareness of Islamic estate planning has prevented its widespread application in the society. Many individuals are not aware of the availability of Islamic estate planning to facilitate their wealth management needs. To this end, the amount of unclaimed assets amongst Muslims exemplifies the lack of awareness of the importance of estate planning as well as apathy or ignorance in following or carrying out the procedures of asset distribution.

Lack of commitment

Some parts of the society may be aware of Islamic estate planning but are not committed towards applying it for their wealth management needs. Perhaps this is because they do not have full understanding of the importance of estate planning in a person’s lifetime.

Cost implications

Other parts of the society may be aware of Islamic estate planning but have concerns in seeking estate planning advice due to its cost implications. Therefore, they tend to avoid it altogether to save costs, thus missing out on the opportunity to manage their property.

Misperception of estate planning

Some individuals in society have a wrong perception of estate planning, whereby they do not regard it as a part of the teachings of Shari’a. They place little importance on it, as the concept of tawwakul (trust in God) is largely misunderstood by the people. While the majority of Muslims viewed that estate planning is not necessary as the Islamic Law of inheritence already ensures the redistribution of wealth and that share for heirs is already provided for within the law.

Estate Planning Instruments and Related Issues

It is a common misperception amongst Muslims that the rules of inheritance are the sole and inevitable mode of wealth distribution. Other key instruments of Islamic estate planning are takaful, wasiyya, hiba, waqf and trust, which can be used to accommodate the laws of inheritance. Each of the instruments are briefly explained in the following section. Using these instruments, estate planning can be prepared for two elements of time, covering planning during the lifetime and planning upon death.

The Islamic Law of Inheritance

The Islamic law of inheritance governs Muslims on the division of estate after death. It is a complete and comprehensive system for the legal heirs that outline the portions of each rightful beneficiary and the non-rightful beneficiaries.2 The Islamic law of inheritance is derived from three sources of Islamic law – Quran, hadith, ijma, and ijtihad of companions. There are about 36 verses in the Quran related to the Islamic law of inheritance, thus showing the importance it carries in our life. Two of these verses from the Holy Quran are produced on page 74-75.

“From what is left by parents and those nearest related. There is a share for men and women, whether the property be small or large, a determined share”

(Sura Al Nisa 4:7)

“God (thus) directs you as regards your children’s (inheritance): to the male, a portion equal to that of two females: if only daughters, two or more, their share is two-thirds of the inheritance; if only one, her share is a half. For parents, a sixth share of the inheritance to each, if the deceased left children; if no children and the parents are the (only) heirs, the mother has a third; if the deceased left brothers (or sisters), the mother has a sixth. (The distribution in all cases is) after the payment of legacies and debts. Ye know not whether your parents or children are nearest to you in benefit. Those are settled portions ordained by God; and God is all-knowing, all-wise”. (Sura Al Nisa 4:11)

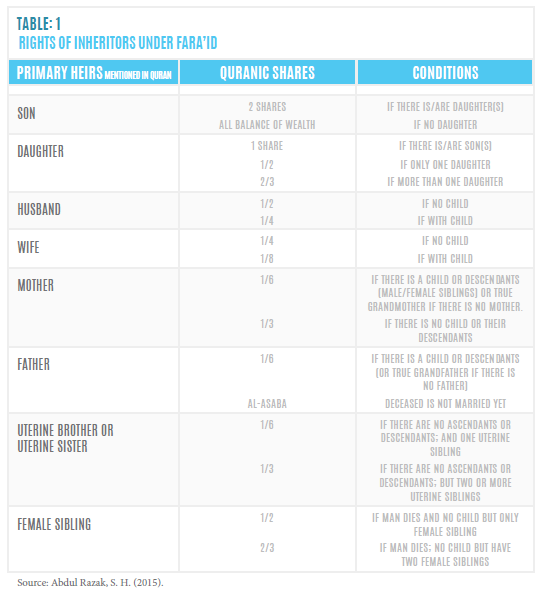

Meanwhile, verses 11, 12 and 176 of Sura Al Nisa give specific details of the rights of inheritors, which are applied by Muslim jurists. These are shown in Table 1.

The objective and spirit of fara’id can also be best understood through a hadith narrated by Sa’ad bin Abi Waqqas. The Prophet s.a.w. said: “It is better to leave your heirs wealthy than to make them beg from people with their hands. Whatever you spend on maintenance (nafqah) is sadaqa, even the morsel you put in your wife’s mouth.” [Hadith narrated by Imam Bukhari and Muslim].

This is one of the objectives of the law of inheritance as a form of wealth planning to ensure justice, and that the family members left behind can continue to live their lives as per normal; as well as to protect them from oppression after the death of their loved one. While the Quran and hadith are primary sources of Islamic law, ijma’ and ijtihad are considered as the secondary sources. Ijma’ is consensus of Muslim scholars on Islamic law whilst ijtihad refers to the use of legal reasoning to make juridical decisions, which is the main instrument of interpreting the Divine message and relating it to the necessities of the Muslim community in its aspirations to attain justice, salvation and truth.

There are some responsibilities that must be fulfilled in terms of claims and obligations before distribution of the estate upon death of the estate owner. If distribution is done before the fulfilment of these responsibilities, the right and claims of the other parties may be denied, leading to dispute. These responsibilities are as follows:

• Settlement of burial expenses

• Payment of debts including income tax

• Payment of zakat, unfulfilled hajj, and other obligations (like religious donations)

• Claims against the estate including vows, hiba and trust

• Wasiyya (legacy bequest)

• Fara’id Distribution

Wasiyya

Wasiyya literally means to direct, to order or to instruct someone to do something either in the lifetime of the maker of the wasiyya (testator) or after his demise. However, it is commonly used to refer to what is to be done after death, i.e. an act of giving away property during the lifetime of the testator but becomes effective on his/her demise. Within this context, wasiyya can be translated as a will or bequest. In the event of the testator’s death, the execution of wasiyya is only permissible after payment of funeral expenses and upon the settlement of the deceased debts.

There are Shari’a rules that must be observed with regards to wasiyya or will writing in order to ensure its compliancy with Shari’a. Two principal restrictions are placed by Shari’a on wasiyya. First of all, the bequest is not allowed to be made in favour of legal heirs, so that those who are not eligible under the fara’id laws could also receive the property. For example, if a testator wishes to give his property to non-heirs such as foster children, he may choose to create a will. This rule is derived from the hadith which Abu Imama reported: “I heard the Prophet say: Allah has already given to each entitled relative his proper entitlement. Therefore, no bequest in favour of a legal heir”.

Secondly, the quantum of the bequest must not exceed the one-third limit of Islamic law of inheritance. This is meant to protect the interests of the legal heirs. This limitation on wasiyya is based on Saad bin Abi Waqas’s narration that the Prophet (pbuh)“…came to visit me in the year of the farewell pilgrimage when I was afflicted with a severe illness. I said to him: ‘O Prophet, you see how ill I am. I have property and no heir except my daughter. Shall I then give away two-thirds of my property as alms?’ He replied, ‘No.’ I said, ‘A half then?’ He still said, ‘No.’ I then asked, ‘A third?’ He replied, ‘A third.’ And a third is much. It is better that you leave your heirs rich than you should leave them destitute, begging from their neighbours.” However, if the testator wants to give more than one-third of the property after his demise, consent of the lawful heirs is required.

There are several concerns related to the implementation of the wasiyya including testacy and intestacy, which may have implications and bring legal challenges and difficulties to the property owner. Testacy refers to the condition of leaving a valid will. In this case, the property which was left by the deceased is provided for in a will and an executor6 was appointed by the deceased before his death to distribute the property according to his wishes. The chosen beneficiaries may or may not be his family members, which in the English Law are also called heirs. All properties movable and immovable must be stated in the will; otherwise, they will become intestate estates or properties.

When a person dies without leaving a will, then his estate would be distributed according to the laws of intestate. Civil laws of intestacy, a common feature in western countries, would decide who inherits the estate, which may be very different from the Islamic law of intestate succession. For Muslims, Shari’a law provides rules on how the intestate’s estate shall be divided among the deceased’s beneficiaries, which is referred to as fara’id.

Hiba

Hiba or gift, according to Islamic law, is an act of granting ownership of a property to someone else during his lifetime without any reprisal or consideration. Since hiba is made during the lifetime of the donor, when the donor dies the property does not constitute as part of his estate. This is contrary to the division by means of inheritance whereby distribution or transfer of ownership only takes place after the death of the property owner.7 As hiba is considered as a gift, anyone can be a recipient of hiba. But unlike wasiyya, hiba is not limited to one-third of the inheritance intended for the non-beneficiaries. Hiba should, however, be settled on the heirs or non-heirs during the lifetime of the donor so that the property is not subjected to fara’id.

It should be noted that the exchange of gifts is encouraged under Shari’a principles. The Prophet (pbuh) said, “Exchange gifts among you and thus strengthen mutual love with each other.” He had also said, “Give presents to one another, because a present removes grudges.” He also said: “If anyone seeks to take back a gift he is like a dog who returns to its vomit. An evil example does not apply to us.”

Although hiba is not compulsory, it is deemed as a good instrument to be used to satisfy financial goals. In the context of wealth management, hiba is regarded as a tool to facilitate the movement and transfer of wealth from one party to another. Hiba, as the third dimension in estate planning structure, complements fara’id and wasiyya. For a hiba to be valid, certain requirements under Islamic law must be met.

Although hiba is not compulsory, it is deemed as a good instrument to be used to satisfy financial goals. In the context of wealth management, hiba is regarded as a tool to facilitate movement and transfer of wealth from one party to another. Hiba, as the third dimension in estate planning structure; complements fara’id and wasiyya. For a hiba to be valid, certain requirements under Islamic law must be met. For example, the donor must be the sole and genuine owner of the property intended for hiba, while the donee can be anyone (either Muslim or non-Muslim) so long as the donee is capable and has the authority to own property, either accountable (mukallaf) or non-accountable. In the case where the donee is not an accountable person such as a minor or disabled, then the hiba is to be given to a guardian (wali) or a trustee on behalf of the donee.

Shari’a law also prescribes conditions for the property or item to be given away as hiba, such as it must be lawful, it must have value according to Islamic law, its ownership is transferable, it exists during the time of hiba and it is not connected to the donor’s property that cannot be separated such as a crop or building on a land.

Takaful

Takaful is an Islamic concept that grasps on protection and distribution of property. Takaful gives benefits to consumers in the form of wealth protection and also has a key element in risk management and can be understood as a discipline that enables an individual or organisation to deal with any uncertainty to protect assets or resources. Originated from the Arabic word kafala to mean joint guarantee, takaful is based on mutual cooperation, responsibility, assurance, protection and assistance between groups of participants. Hence, the cornerstone of takaful is to protect the interest of contributors or participants during their life and their inheritance upon their death.

However, different opinions and views have been put forth by scholars in deciding the benefit of takaful to the nominee named in the beneficiary form. The concept of hiba is applied in various family takaful products, such as takaful education plans. In this plan, for instance, a takaful participant will make hiba of the takaful benefits to his child to finance the cost of his education in the future. Upon death of the takaful participant, all takaful benefits will become the rights of his nominated child and will not be distributed amongst other legal heirs of the deceased according to fara’id. Nevertheless, if the takaful partici-pant is still alive when the takaful certificate matures, the benefit will be surrendered to him.

The question that arises is whether the takaful benefits can be given solely to the child as a nominee, or should be distributed based on the fara’id rules to other beneficiaries from the legal heirs upon the death of the takaful participant? The issue has arisen due to two different views regarding nomination. Some opined that takaful benefits are the wealth of the deceased takaful participant; thus becoming a part of his estate that must be distributed to the legal beneficiaries based on the fara’id. Accordingly, only legal heirs can become nominees. Others viewed that the takaful participant can give takaful benefits to the nominee as hiba. Therefore, he needs not to be a legal heir.

However, scholars have diverse opinions on whether takaful benefits qualify to be a subject matter of hiba or they are only available upon the death of the takaful participants. Accordingly, some argued that the takaful benefits are considered as bequest (wasiyya), which should not exceed one-third of the deceased estate minus the expenses and debts.

BOX 4.1

Application of Hiba in Takaful: Malaysian Case Study

The Shariah Advisory Council (SAC) of Bank Negara Malaysia has issued two resolutions on the application of hiba in the context of takaful. The SAC, in its 34th meeting dated 21 April 2003, resolved that:

- The takaful benefit may be made as hiba because the objective of takaful is to provide coverage for takaful participants. Since the takaful benefit is the right of takaful participant, the participant is at liberty to exercise his right in accordance with Shari’a;

- Since the hiba by the participant is a conditional hiba, the status of the hiba will not be transformed into a bequest;

- Normally, takaful benefit is attached to the death of participant and maturity of takaful certificate. If the participant is still alive when the takaful certificate matures, the participant will receive the takaful benefit. However, if the participant passed away before the maturity date, the hiba will be effective;

- Participant is entitled to revoke his hiba which was made before the maturity of takaful certificate, because a conditional hiba will only be completed after delivery (qabd);

- Participant is entitled to revoke his hiba which was made to certain individual and deliver the benefit to another person, or terminate his participation in takaful if the nominated recipient passed away before the maturity date; and

- Takaful nomination form shall clearly mention that the status of nominee is as beneficiary, if it is intended by the participant as hiba.

The SAC, in its 52nd meeting dated 2 August 2005, resolved that the concept of statutory protection as practised by conventional insurance may be applied in takaful industry in the following manners:

- Payment of takaful benefit will neither become part of the estate of the deceased (takaful participant) nor subject to the deceased’s debt;

- The takaful participant may appoint a responsible trustee for the takaful benefit.

However, the government-owned trustee will be the trustee for such takaful benefit in the following situations:

- There is no appointed trustee;

- Nominee is incompetent to enter into a contract; and

- The parents had predeceased the nominee in the event the nominee is incompetent to enter into a contract.

Once the trustee received the takaful benefit, the takaful company is deemed to be released from all liabilities relating to such takaful benefit (BNM, 2010, p. 88).

The basis of this ruling, as clearly mentioned in the Shariah Resolutions, is as follows:

The aim of takaful benefit is to provide coverage for participant or nominee (hiba recipient). Since the status of takaful benefit, which is treated as gift (hiba) will neither be a bequest, be a part of the deceased’s estate nor others, the takaful benefit is identical to the statutory protection as practised by conventional insurance. Therefore, any takaful benefit nominated to husband/wife, child or parents (if husband/wife or child had predeceased the policyholder at nomination time) shall not be annulled, changed, surrendered and charged without the consent of the nominee. In addition, since statutory protection protects the interest of the nominee and does not contradict the concept of hiba ruqba (a gift which puts death of either the hiba provider or recipient as the condition of hiba), this concept may be applied in takaful industry (BNM, 2010, p. 88).

Waqf

Throughout the Islamic history, waqf as an instrument has played a great role in wealth management and in contributing to social welfare. In Shari’a law, waqf or endowment, means a permanent dedication or giving away of property for any purpose recognised by Shari’a, whether purely religious or charitable. There are indirect provisions that indicate the use of waqf, such as:

“O you who believe! Spend of the good things which you have (legally) earned, and of that which We have produced from the earth for you.”Al-Baqarah, 2:267.

“By no means shall you attain al-birr (piety, righteousness – here it means, Allah swt’s reward, i.e., paradise), unless you spend (in Allah’s cause) of that which you love; and whatever of good you spend, Allah knows it well.” in Ale Imran, 3:92.

The Prophet (pbuh) always endorsed waqf and encouraged its practice as part of wealth management and planning for the hereafter. According to the Prophet (pbuh), “When the sons of Adam die, their deeds come to an end, except charity with enduring benefits, their knowledge which benefits others and their virtuous sons, they pray for them (bless them).”

Generally, waqf is divided into two types from the perspective of its purpose – specific waqf and general waqf. A specific waqf is normally created for the purpose of security in the interest and welfare of family members and close relatives. Upon the creation of this type of waqf, the beneficiaries along with their generations will be entitled to the benefits of the waqf property. However, upon the death of everyone, the waqf property becomes general waqf for the benefit of the poor and needy in the society.

A general waqf, on the other hand, is created for the purpose of the public and is meant for the interest of the society such as the poor, orphans and others. This type of waqf is initially targeted at the general interest of the community. It can be created in the form of mosques, schools, hospitals and other utilities that benefit society and bring prosperity and welfare to the public.

Issues and Challenges in Waqf Practices and Development

Historically, waqf funds have been used to finance various developments in many Muslim countries. It was in fact the main provider for the development of these countries’ education and healthcare systems. However, the function of waqf as an effective tool for socio-economic development has declined in modern times. Colonialism and government interventions in effected Islamic countries are among key reasons behind its decline. Others have criticised the rigid legal (fiqh) doctrines for stagnancy of waqf including supremacy given to the deed, i.e., mutawalli can only act according to the stipulations incorporated in the waqf deed and the irrevocability of the waqf. They expounded that the contemporary inflexibility of waqf doctrine as a more likely reason for the waqf’s decline.

Most waqf properties are not being used productively or are lost, hence remaining largely untapped. Despite the huge potential and significant role of waqf in social and economic development, waqf faces various obstacles and challenges that hinder its development.

Waqf is also faced with the issue of negative perception by today’s modern society who perceived it to be very narrow, unmodern, non-economic, anti-social, and revolving only in religious matters.

Considered as a modern way of financing waqf assets, cash waqf has become increasingly popular, particularly because of its flexibility which allows distribution of the potential benefits of waqf to those in need.

Financial constraints

A major impediment to the development of waqf is the lack of financial resources to revive the regeneration of productivity of the waqf assets. Waqf funds itself are not sufficient to manage the waqf assets since the assets are not fully utilised to generate income. The collection of waqf revenue is another challenge faced by waqf institutions. In most cases waqf revenues are insufficient to bear the operational costs due to the waqf institution having no self-generating income and the unproductive delay in the earning of waqf properties.

Legal constraints

In addition to the rigid fiqh doctrines of waqf, a country’s law may add another layer of legal complications. For example, local law may constitute a constraint against the establishment of waqf by its citizen or the law of a non-Muslim country may also constitute a constraint against receipt of waqf by the targeted beneficiaries. In Malaysia, for example, matters relating to the administrative affairs of Islam or Islamic law are placed under the jurisdiction of the State Government. This implies that the administration of Islamic affairs, including waqf, is governed through various state laws or enactments. Thus resulting in differences in interpretations, procedurals of promulgating fatwa or legal rulings in relation to waqf practices.

Shortage of expertise and management skills in waqf

The shortage of technical expertise and professionals in developing waqf continues to hamper the development of the waqf sector. Waqf should be managed with qualified, knowledgeable and professional managers who are well acquainted with Islamic as well as country laws. In some cases mutawalli or waqf managers are found to be unqualified or unaware of the ways in which they can utilise the scheme to generate revenues to be distributed to beneficiaries. Similarly, the wealth of methods to raise funds have not been fully utilised by waqf institutions. Studies on waqf management in Malaysia observed that most of the waqf officers do not have training or competency in investment analysis, project management, property valuation or any experiences that related to the development and management of waqf assets.

Undeveloped and unproductive waqf land

Waqf properties mostly include mosques, religious places, Islamic schools and cemeteries. Thus, very few waqf lands generate income. Underlying reasons for the state of idle or undeveloped waqf lands include ambiguity in the status of waqf land development, inefficient management, types and location of the waqf land, lack of financing of the waqf itself and lack of an effective business model for waqf land development. However, there are circumstances where waqf assets located in commercial and strategic areas could not be developed due to specific conditions imposed on the waqf assets, namely specific waqf. Such cases render waqf assets to be unproductive in generating returns from economic activities.

Unregistered waqf estates

Another constraints faced by the development of waqf is unregistered waqf lands or properties. Without the land title or legal ownership, development to waqf assets cannot be done accordingly by the waqf administrator. In some cases, waqf administrators fail to maintain a comprehensive and reliable data on waqf lands, subsequently causing most waqf lands to be unidentified and not developed effectively.

Lack of awareness on waqf

Lack of awareness and knowledge of waqf have hindered the development of the waqf sector. For instance, most are unaware that the establishment of waqf is not limited to real estate only. Cash waqf, for instance, can be used to develop productive economy, a potential tool for society empowerment. Considered as a modern way of financing waqf assets, cash waqf has become increasingly popular, particularly because of its flexibility which allows distribution of the potential benefits of waqf to those in need. For example, in Bangladesh, the Social Investment Bank Limited (SIBL) issues cash-waqf certificates to collect funds from the rich and distributes the gains of the managed funds among the poor.

BOX 4.2 Legal Issues in Waqf: A Case Study of Malaysia

The jurisdiction of hearing cases related to waqf: In Malaysia, waqf is categorised as a trust and subjected to the Trustee Act 1949, which only allows the High Court to hear any cases related to trusts. This means all cases related to waqf fall within the High Court’s jurisdiction. However, it is known that the High Court has unlimited civil jurisdiction in all matters other than matters involving Shari’a law. Therefore, waqf has to be regulated according to Shari’a rulings, which by this virtue is not recognised by the High Court.

The jurisdiction of Shari’a courts on waqf: In Malaysia, the jurisdiction of Shari’a courts falls within the power of the individual states, and can be found in the Islamic affairs enactment laws legislated by each state. This contradicts the objective of Islam, which provides that all laws, including waqf, should be enacted in accordance to the Quran and Sunnah, and can only be determined by the Islamic affairs enactment laws although they may be against what was stated in the Quran and Sunnah and other sources of Shari’a.

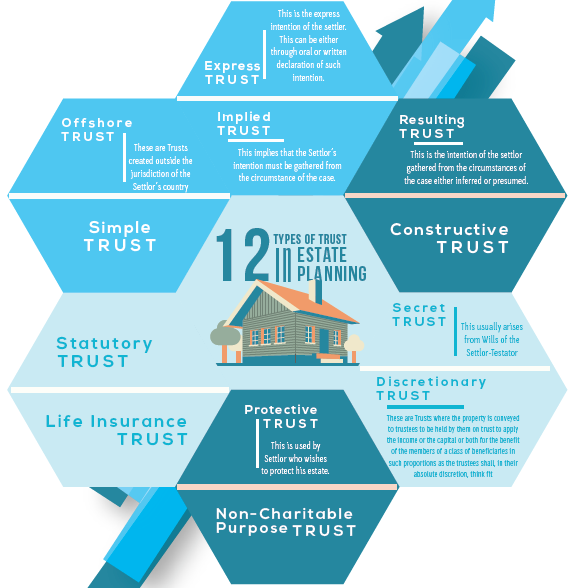

Trust

Trust is another vehicle in Islamic estate planning. Through the setting up of a trust, individuals can ensure the total protection of their asset(s) is preserved for their beneficiaries while in the safe hands of the trustee, who is a fiduciary who manages property and assets placed in a trust. A trustee may be an individual, a company or a public body and there may be a single trustee or multiple co-trustees. Once created, a trust separates the property’s legal ownership and control from its equitable ownership and benefits. Hence, and the trustee becomes the legal owners of the trust assets once the assets are transferred to them while the beneficiaries become the beneficial owners of the trust assets. A trust is usually governed by the terms of a deed of trust, which outline how the trust assets will be managed for and in the interest of the beneficiaries. To the effect, trust is made up of four parties:

- The Settlor: This is the person that sets up the trust fund

- The Trustee: This is the person that acts on the fund. This trustee is to look after the assets given to them by the settlor but they cannot benefit from it

- Beneficiaries: These are the people that the fund is set for

- Protector: These are those that are appointed to supervise the trustees and to protect the beneficiaries’ interests

For a Trust to be valid, some rules must be fulfilled. First is the rules against perpetuities, which prescribed a maximum period in which the interest of a beneficiary is required to vest, i.e. (a) the period of the lifetime of one or more of specified persons living when the settlement is created, and 21 years; or (b) A fixed period of up to 80 years. Secondly, the rules against inalienability refer to a principle that property must not be made non-transferable. The third rules are rules against public policy and defrauding creditors.

Shari’a law contains no prohibition on lifetime giving except on the deathbed or during a terminal illness. This clearly indicates that a person can willingly dispose one-third of his assets into a trust to a non-heirs. Shari’a scholars recognised that assets carved out of a pool of assets and vested in a trust and trustee can be considered as assets gifted inter vivos (i.e. during life), and would not form part of the estate assets upon the death of the owner of the assets or settlor. Under living trust, once ownership of assets is transferred to the trustee, those assets no longer belong to the settlor and hence, the Islamic inheritance rules do not apply to them, which simply means that other legal heirs cannot claim to be entitled to these assets. In this case, it is irrevocable unless the power of revocation is reserved when constituting the trust. The trust property will, however, revert to the settlor if the beneficiary pre-deceases the settlor.

But the concept of a living trust can be found to be inconsistent with the Shari’a concept of hiba in view of the settlor’s retention of control and enjoyment over the trust property during his lifetime. Transferability through hiba requires the rigid conditions regarding the ownership status of the hiba property, i.e. the need for actual transfer of property (qabd) as a requirement to ratify the transfer. Often in the case of self-declaration by a settlor as trustee, there is no immediate transfer of the possession of the property to the beneficiary especially if the beneficiary is a minor.

Conclusion

The components discussed earlier are very important aspects in Islamic estate planning as they facilitate a person’s wealth management and planning needs. These aspects should first be understood by financial planners to enable them to provide proper advice to their clients. However, some of the issues highlighted should be addressed and resolved to ensure proper implementation of Islamic estate planning. Awareness and education on wealth planning should be made a part of the education system in order to spread the knowledge of Islamic estate planning among the society. The findings can be briefly summarised as follows:

- The major instruments used in estate planning are hiba, wasiyya, waqf and fara’id.

- Estate planning is a very important aspect in wealth management and financial planning.

- These instruments have issues and challenges such as ignorance, lack of commitment by the public, cost implication and wrong conception of the estate planning.

- There are some specific issues related to these specific instruments such as the issues of Testate and Intestate are very much related to the wasiyya. As for the instrument of hiba, its issues are related to some aspect of takaful such as the MRTT and the Nomination which is also based on hiba under Takaful Scheme.

- As for the waqf, despite its importance and potential it still has some issues and challenges such as: lack of financial resources, legal constraint, shortage of expertise and management skills of waqf, undeveloped and unproductive waqf land, unregistered land and lack of awareness on waqf.

Awareness and education on wealth planning should be made a part of the education system in order to spread the knowledge of Islamic estate planning among the society.