KEY MESSAGES:

- Islamic REITs have tremendous potential to be developed as a thriving global wealth management product since it is structured on tangible real assets, which provide stability as the investments are channeled to the real economy.

- The success of Islamic REITs in Malaysia and Singapore gives weight to the assertion that Islamic REITs have strong prospects to be launched in global markets as a lucrative alternative real estate investment product.

- Islamic REITs are in early stages of development in most countries of GCC and hold significant potential for growth as interest in the region’s property soars with investors looking to diversify their geographical investment footprint. The potential is driven by strong real estate sector fundamentals such as demographic profile, expected implementation of mortgage law, and economic diversification.

- With declining oil revenues, financial managers in the GCC, in particular, are forced to look further afield for asset classes that meet their long-term business investment needs, and Islamic REITs offer the best fit to the issue.

Despite gaining momentum as a viable alternative channel for Shari’a-compliant investments, Islamic Real Estate Investment Trusts (REITs) remain a relatively underdeveloped asset class in the Shari’a-compliant universe. Globally, the market capitalization for REITs was around $570 billion at the end of 2009, a 2010 Ernst & Young (EY) study said. Islamic REITs play a small role, with Asia serving as the predominant hub for Shari’a-compliant trusts. Since the first Islamic REITs was launched in Malaysia back in 2006, this asset class has registered encouraging growth not only in Malaysia but has gained traction in other parts of the Muslim world, in particular the Gulf Cooperation Council (GCC) countries. The popularity of Islamic REITs demonstrates investors’ interest in diversifying their pool of assets and investments in an alternative real estate investment product. With declining oil revenues, financial managers in the GCC, in particular, are forced to look further afield for asset classes that meet their long-term business investment needs, and Islamic REITs offer the best fit to the issue.

What are REITs?

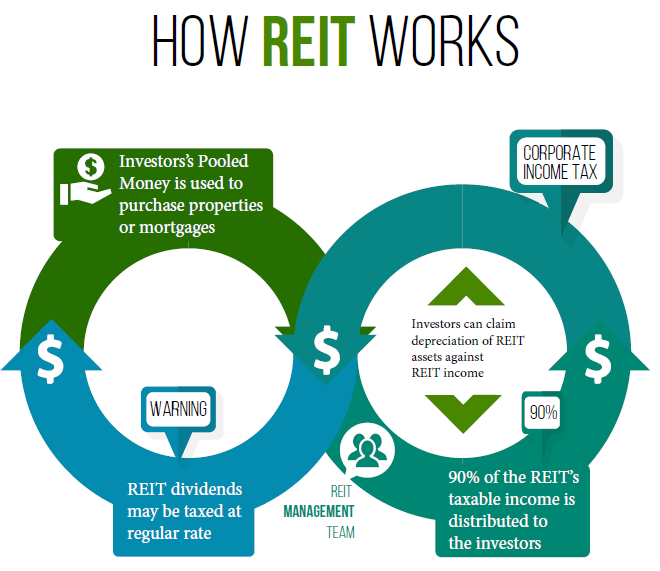

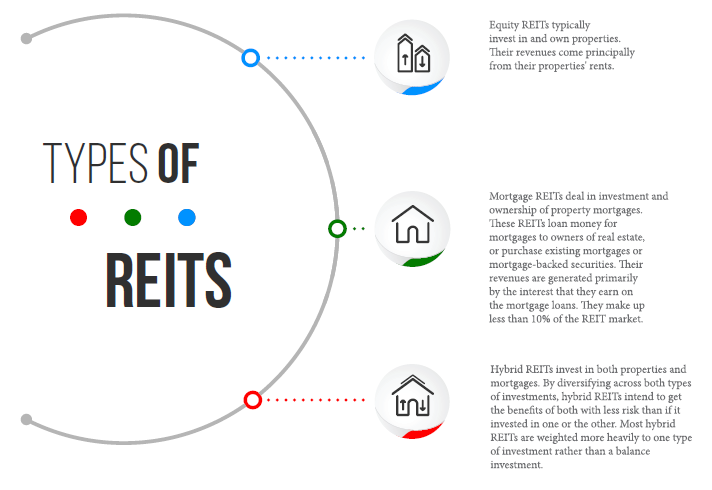

The Real Estate Investment Trust or REIT is a company that owns and in most cases manages income-producing real estate or related assets including office buildings, shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and mortgages or loans. Unlike the typical real estate companies, a REIT does not develop real estate properties with a view to resell them later. Instead, a REIT buys and manages properties primarily to operate them as part of its own investment portfolio. In general, REITs make investments by buying, managing, selling, and leasing real estate; purchasing shares in publicly listed real property companies, by investing in debt securities in real estate property companies.

REITs have increasingly become a popular alternative investment option over the past several decades. Over time REITs have demonstrated a historical track record providing a high level of current income combined with long-term share price appreciation, inflation protection and prudent diversification. How does REIT works? Investors invest in a REIT by purchasing units of the trust, similar to shares of a common stock. In return of their investments in REITs, shareholders earn a share of the income produced through real estate investment, without actually having to buy or finance property. Hence, REITs provide opportunities to hold stakes in high-grade real estate which may otherwise have been difficult or impossible for a retail investor to hold.

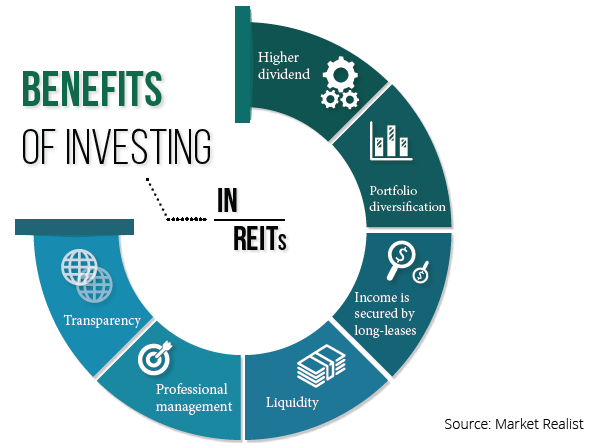

What makes them particularly attractive for investors is that REITs typically pay out all of their taxable income as dividends to shareholders. In turn, shareholders pay income taxes on those dividends. Hence, REITs are to real estate what mutual funds are to equities and bonds. REITs also provide the benefit of easy liquidity, which means that investors can buy and sell their units (if publicly traded), which is not possible with physical real estate. Even in the case of non-listed REITs, the units can be exchanged over-the-counter (OTC) market.

REITs provide efficient and convenient way to invest into real estate market, even in small lots for small investors, while providing diversification benefits with low liquidity risk and typically offer investors high yields as well as a highly liquid method of investing in real estate. Furthermore, investments in real estate through REITs have lower risks involved compared with a direct investment with a developer.

Another advantage of REIT is that it is a combination of two different types of returns – regular income and capital appreciation. The income is generated mainly through a periodic cash flow– for instance, rental income from a house/commercial property; while the capital appreciation comes by way of increase in value, as in the case of price appreciation of a stock or in the value of a real estate property owned by REIT. Listed REITs are publicly traded like common stocks on various exchanges. To make it competitive for investible funds in the capital markets/stock exchanges, a listed REIT, would also have the features of efficient entry/exit for the investors, while providing long-term funds to the real estate entities.

CONVENIENT ENTRY AND EXIT

Since REITs are listed on an exchange, investors can make short-term bets on commercial property markets and, to an extent, transform investments in commercial properties as liquid.

LOWER TICKET SIZE OF INVESTMENT

REITs allow even small investors to purchase commercial assets; this is particularly beneficial for individual investors who prefer to have exposure to the real estate sector in their investment portfolios.

TRANSPARENCY

Many countries have a regulating body which has strict framework and guidelines for REITs under which they operate, and is also being adopted by more and more countries, with evident interest in REITs.

REGULAR INCOME AND CAPITAL GAINS

A REIT is required to distribute a significant portion of its net income to avoid taxes. In addition to regular income, REIT investors also benefit from appreciation in the value of the underlying property.

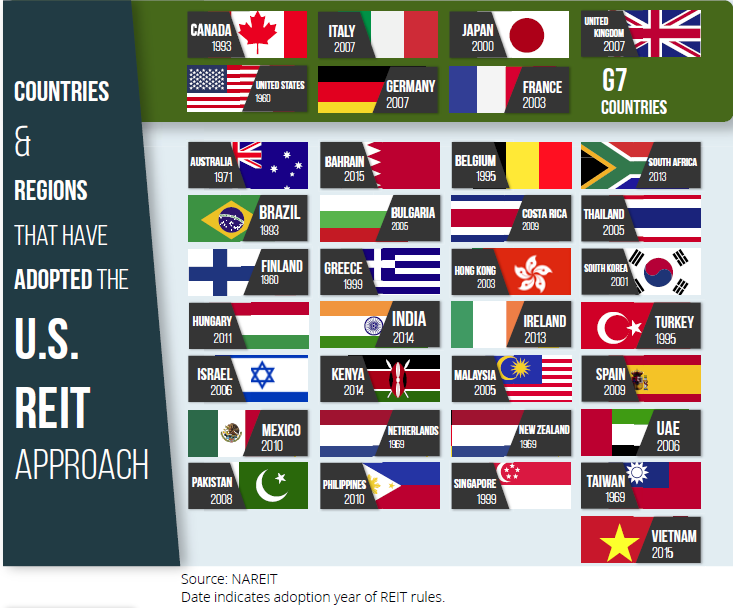

REITs emergence on global scene

REITs have their origin in the US in 1960 and since then have assumed a very significant role for funding real assets in the US and Europe. Later became an important part of Far-East-ern financial markets the likes of Hong Kong, Korea, Singapore, Australia and Malaysia. As reported in REIT.com, the REIT industry in the US has flourished extensively in the past few years, rising from ALL REITs market capitalisation of US$1.5 billion in 1971, to US$138.7 billion in year 2000, dropping to US$191.6 billion in a post-subprime crisis of 2008. The market capitalisation of ALL REITs as of August 31, 2016 crossed US$1 trillion.

The super growth shows that investors are looking for the promising aspects in REIT, especially in terms of hedging against inflation while generating regular income stream. US REITs collectively own nearly US$3 trillion of real estate assets. Over two decades, US-listed REITs have delivered their shareholders a compound annual return of 10.4%, higher than S&P 500’s at 8.2% p.a. There has been a voluminous increase in average daily dollar trading volume to US$6.6 billion in August 2016, from US$2.2 billion in August 2006.

As of July 31, 2016, the FTSE EPRA/NAREIT Global Real Estate Index included 482 stock exchange-listed real estate companies in 38 countries around the globe. Of the US$1.6 trillion in equity market capitalisation represented in the Developed Markets index, 76% originated from REITs. The Index included 149 publicly traded Equity REITs and listed property companies from 15 emerging markets across the Americas, Europe, the Middle East, Africa and Asia. While the US remains the largest listed real estate market, the listed real estate market is increasingly becoming global. The growth is being driven, importantly, by the appeal of REITs.

Emergence of Islamic REITs

Islamic REITs are specialised asset classes, augmenting Islamic wealth management practices globally. This collective investment scheme has underlying exposures in the real estate sector, which fits well with Shari’a principles that emphasise on real-sector and asset-based investments. The key feature of Islamic REIT is that the incomes and fund management of the Islamic REIT must observe the principles of Shari’a. Hence, Islamic REITs engage in acquisition and leasing of real estate (including tenancies and sub-tenancies), where the activities and operations are Shari’a-compliant.

What sets apart Islamic REIT from a conventional REIT is that the latter can only invest in properties whereby tenants operate in businesses that comply with Shari’a principles, including the guidelines on Shari’a-compliant permissible assets for Islamic REIT. Hence, the Islamic REIT fund must be structured and run in a manner that is consistent with Shari’a as well.

Non-permissible activities or businesses for REITs are:

• financial services based on interest;

• manufacture or sale of non-halal products or related products;

• serving, distribution and manufacture of alcohol products;

• weapons or defense;

• hotels and resorts;

• entertainment activities that are non-permissible according to Shari’a;

• manufacture, sale or distribution of tobacco-based products or related products; and stockbroking or share trading in non-Shari’a-compliant securities.

However, an Islamic REIT is permitted to own (purchase) real estate in which its tenant(s) operates mixed activities that are Shari’a permissible and non-permissible on the condition that the fund manager performs some additional compliance assessments before acquiring real estate with mixed activities.

Malaysia became the pioneer in the development of the Islamic REITs, with the introduction of the world’s first guideline for Islamic REITs in November 2005 by the Securities Commission Malaysia and the launch of the first Islamic REITs in July 2006, namely Al-Aqar KPJ REIT. Since then 3 other Islamic REITs have been listed on the stock exchange. Following the success in Malaysia, Sabana Shari’a-compliant Industrial REIT was listed on the Singapore stock exchange in 2010. It was 2.5 times oversubscribed and saw heavy investor interest from the Gulf Cooperation Council (GCC). Since then, its portfolio has grown to include 21 quality industrial properties in the country and is now the world’s largest listed Islamic REIT by total assets. It also became the world’s first Islamic REIT that has been well accepted by investors in the GCC countries2.

The first country in the GCC to launch an Islamic REIT was Kuwait back in 2007, followed by Bahrain and UAE. The growing awareness of Shari’a-compliant products provides significant opportunities, and is expected to drive the demand for Islamic REITs. Another milestone in Islamic REITs was achieved with the launched of the Al Salam Asia REIT Fund, by Bahrain’s Al Salam Bank, in 2014. Dubbed as the world’s first Asian REIT fund, the REIT will invest in a portfolio of Asian properties.

Malaysia: Pioneer of Islamic REITs

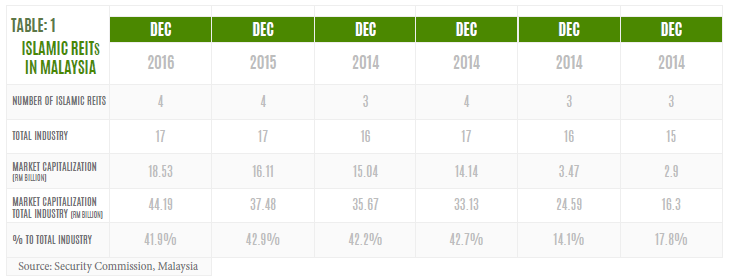

Currently, there are sixteen Malaysian REITs listed on Bursa Malaysia, of which, four are Shari’a-compliant, namely Axis REIT, Al Aqar REIT, KLCC REIT and Al-Salam REIT. As depicted in Table 1, as of June 2016, the share of Islamic REITs to total industry was 41.7% with market capitalisation of RM17.12 billion3. Malaysia was the first country to promote Islamic investment instruments focused on property, with the Malaysian Securities Commission issuing the world’s first guidelines for Islamic REIT in 2005. The guidelines among others included the utilisation of real estate assets and the financial facet of operations.

Box 5.1 Malaysia’s Guidelines on Islamic REIT

Guidelines for Islamic Real Estate Investment Trusts were issued on 21 November 2005. These guidelines as outlined by the Syariah Advisory Council (SAC) of the Securities Commission were to facilitate the establishment of an Islamic REIT). These guidelines must be read together with the Guidelines on Real Estate Investment Trusts (revised on 28 December 2012).

• Non-permissible rental activities must not exceed the 20% benchmark based on the total turnover or area occupied.

• Not permitted to own real estate in which all the tenants operate non-permissible even if the percentage based on turnover/floor area is less than the 20% benchmark.

• All forms of investments, deposits and financing must comply with the Shari’a principles;

• Must use the takaful schemes to insure its real estate.

• The Manager must engage a Shari’a advisory panel of 3 scholars or company approved by the Securities Commission.

Al-Aqar Healthcare REIT, formerly Al-Aqar KPJ REIT, was launched in 2006 with investments in hospitals and other buildings related to the health tourism industry. Its portfolio comprises a number of hospitals tenanted by one of Malaysia’s largest healthcare providers, KPJ Group, which runs specialist hospitals conducting permissible activities according to Shari’a. The Al-Aqar REIT sets many milestones including the world’s first listed Islamic REIT, Asia’s first healthcare REIT and a benchmark for the development of Islamic REITs in Malaysia, as well as the region. The second Islamic REIT, Al-Hadaharah Boustead REIT, was listed on the main board of Bursa Malaysia in February 2007 but was delisted in 2014. It owned and invested in plantation assets comprising plantation estates and palm oil mills.

In December 2008, AXIS REIT – the world’s first Islamic industrial/office REIT was introduced. AXIS REIT was originally established as a conventional REIT in 2005 but was restructured in 2008 as a Shari’a-compliant REIT in accordance to the Islamic REIT guidelines. With the introduction of the KLCC REIT in 2013, this became the world’s first Shari’a-compliant stapled REIT. Sta-pled REITs are investment vehicles which include two or more separate entities ‘stapled together’ to trade using a single new financial instrument. In the case of KLCC REIT, the REIT is stapled to shares of KLCC Property Holdings Bhd (KLCCP) who owns Kuala Lumpur City Centre’s three prime assets: Petronas Twin Towers, Menara 3 Petronas and Menara ExxonMobil. The fourth REIT is the Al Salam REIT, which was listed in 2015. The REIT has a diversified portfolio ranging from office buildings, shopping malls, college buildings, warehouses and food and beverages retail outlets.

Growth and Prospects of Islamic REITs in the GCC and Middle East

Islamic REIT is in early stages of development in most countries of GCC and holds significant potential for growth as interest in the region’s property soar with investors looking to diversify their geographical investment footprint. The potential is driven by strong real estate sector fundamentals such as demographic profile, expected implementation of mortgage law, and economic diversification. Above all, in view of the declining oil revenues leading to declining state funding, the growing demand for residential real estate is expected to promote market-based financing instruments like REITs.

REITs have demonstrated a historical track record providing a high level of current income combined with long-term share price appreciation, inflation protection and prudent diversification.

Islamic REITs hold significant potential for growth in the GCC as interest in the region’s property soar with investors looking to diversify their geographical investment footprint.

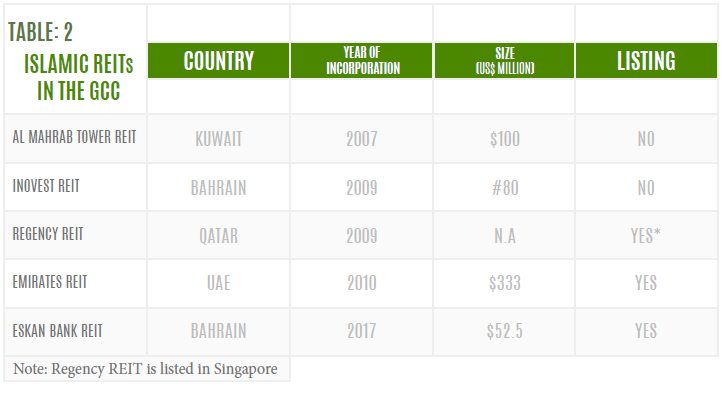

At present, the REIT’s market in the GCC is still in a nascent stage. There are only 5 Islamic REITs in the whole of GCC (Table 2) and only Emirates REIT and Eskan Bank REIT are listed in the GCC. It took some time for the Middle East to jump on the bandwagon after numerous attempts to introduce REITs were met with muted response. The earliest REIT to be launched in the GCC was the Arabian Real Estate Investment Trust (AREIT), launched by HSBC and Daman in 2006. It invests in prime commercial properties throughout GCC region. It is a private placement and is not listed on any stock exchange. However, a Kuwait-based REIT, Al Mahrab Tower REIT was the first Islamic REIT launched in the GCC, which has funded several real estate projects including the Al Safwa Towers in Makkah.

In the following year, Qatar established Regency REIT, which became the first REIT established in the state of Qatar and the first cross-bor-der Shari’a-complaint REIT to be listed on the Singapore Stock Exchange. The REIT’s property portfolio includes residential, hotels and office properties located in Qatar. Although the Qatar Stock Exchange suggested that more could be on the way, Islamic REITs is still struggling to attract interest in the country. Bahrain saw the launch of the Invest REIT in the following year. This Shari’a-compliant REIT has an estimated market capitalisation of US$80 million.

Regulations have permitted REITs in DIFC since 2009, but the onset of the financial crisis, and the subsequent property crisis, delayed any substantial progress in this area. Therefore, it was only in 2010 that the first REIT in the UAE was set up. The Emirates REIT, founded by Dubai Islamic Bank and Eiffel Management at the end of 2010, now has a portfolio value of US$742 million as of September 2016 with a market capitalisation of US$333 million. Listed on Nasdaq Dubai, Emirates REIT is claimed to be the world’s largest publicly listed Shari’a-com-pliant REIT both by total assets and by market capitalisation. It generated property income in the first nine months of 2016 of US$36.3 million, an increase of 22% from US$29.8 million in the same period in 2015. The Emirates REIT owns nine properties in Dubai, whereby 61% of its income is generated from commercial assets, 21% from education assets and 11% from retail assets. In January 2017, Eskan Bank REIT was the first REIT to be listed on the Bahrain Bourse. This Shari’a-compliant REIT had a US$52.2 million offering, which represented 72.9% of the trust’s total size.

The steadily improving real estate sector together with improvement in investor sentiment, growing awareness for the REIT investment structure, and increasing significant appetite among institutional and retail investors for exposure to income-producing real estate in the Middle East, is likely to spur demand for REITs in the region. However, most GCC countries do not have any clear regulations in place for both conventional and Islamic REITs and their listing. Lack of proper regulatory framework for listing and operation of REITs is still a major hindrance for the development of REITs in the region. Only Emirates REIT and Eskan Bank REIT are in the listed space across the region.

At present, only Bahrain, Dubai, Kuwait and Saudi Arabia have regulations governing REITs in some form or another. REITs in Bahrain are governed by the Bahrain Financial Trusts Law 2006. However, following the issue of REIT listing regulations by the Bahrain Bourse in May 2015, Eskan Bank Realty Income Trust became Bahrain’s first listed REIT.

The Eskan REIT, which was listed in January 2017 consist of two income-generating and unleveraged properties owned by Bahrain Property Musharaka Trust. In Dubai, the DFSA (Dubai Financial Services Authority) issued the regulatory framework for fund management which includes the framework used for REITs registered and listed in Dubai. In this framework, REITs are required to be “closed-ended” as well as being publicly traded. The regulation of the REIT is required to distribute 80% of audited net income to unit holders whilst the REIT’s leverage is restricted at 70% of total assets value. Another parameter is that REITs are not allowed to invest more than 30% of total assets in ‘property under development’.

Box 5.2 Key Regulations of REITs in Bahrain

• REITs in Bahrain are governed by the Financial Trusts Law No. 23 of the year 2006, Volume 7 of the CBB Rulebook and the REIT Listing Rules issued by Bahrain Bourse.

• All REITs must be authorised or registered with the Central Bank of Bahrain.

• The REIT should hold a minimum of two real estate properties comprising at least 80%of the net asset value (NAV).

• Up to 20% of the REIT’s NAV can be invested in the development of existing properties. This implies that properties under development cannot exceed 20% of the fund’s value.

• REITs are not allowed to invest in undeveloped land or mortgages

• Minimum value of the REIT must be US$20 million.

• The REIT can leverage to a maximum of 60% of its NAV.

• The REIT must distribute a minimum of 90% of its audited net realised income.

Box 5.3 Key Regulations of REITs in Dubai

• REITs in Dubai are governed under the DIFC Investment Trust Law in 2006.

• REITs can only invest up to 40% of their total assets in assets other than real property.

• REITs with 100% foreign share ownership are restricted to certain designated areas in Dubai.

• REITs must derive income from at least two types of tenants; whereby each type of tenant or lessee must produce 25% of the total income.

• The REIT must distribute a minimum of 80% of its annual net income.

• The REIT can leverage to a maximum of 70% of its NAV.

Islamic REITs have tremendous potential to be developed as a thriving global wealth management product since it is structured on tangible real assets, which provide stability as the investments are channeled to the real economy.

Although Saudi Arabia has recently issued regulations for the listing of REITs in January 2016, but it has yet to be formally launched. Qatar and Kuwait’s capital market authorities are also said to be working on issuing regulations for the development and listing of REITs. However, in Kuwait, the Capital Market (CMA) Law No.7 of 2010 allows for only equity REITs. One of the key characteristics of the Equity REIT under the CMA Law is that non-Kuwaiti citizens are allowed to indirectly invest in the real estate sector in Kuwait, which is generally not possible. In particular, the CMA Law, its directives and Decree No.8 of 2012 do not impose any restrictions hindering non-Kuwaiti citizens from investing in REITs.

The Capital Market Authority (CMA) of Oman is also finalizing a new draft on Real Estate Investment Trust (REIT) Fund Regulation including the listing of REITs. Although no specific REIT Regulation in Oman is in place, the existing Investment Funds regulatory framework allows for the setting up of any collective investment scheme, including the establishment of a conventional or Islamic real estate fund with some minimum requirements. This is evident by the launch of the Izdihar Real Estate Fund by Bank Muscat, which was listed on the Third Market of the Muscat Securities Market. Nonetheless, a specific REIT Regulation would not only provide further clarity to the market, it has the potential to act as a catalyst for more REIT issuances in the market.

A major advantage of investing in REITs is that tax benefits are not taxed. However, this advantage does not add much value to investors in the tax-free environment of the GCC. Although special tax treatment is not an incentive for Gulf investors to invest into a REIT, they can still benefit from the high dividends, especially with the expected recovery of the real estate sector in the UAE where rents are expected to record significant rise. Finally, there are limits or total restrictions in place for foreign ownership of real assets in GCC countries. Even in those GCC countries which have regulations for REITs, there are restrictions on foreign ownership of property. On top of this, restrictions on foreign investments in capital markets also pose challenges to the development of REITs in the region. Dubai market has 49% restriction on the ownership for REITs while in many advanced countries 100% foreign ownership is allowed.

Conclusion

Islamic REITs have tremendous potential to be developed as a thriving global wealth management product since it is structured on tangible real assets, which provide stability as the investments are channeled to the real economy. Real asset and tangible assets investments are also the preferred asset class among Muslim investors and institutions given its natural fit with the Islamic finance principles, which advocate link between the real economy and the financial sector. The success of Islamic REITs in Malaysia and Singapore gives weight to the assertion that Islamic REITs have strong prospects to be launched in global markets as a lucrative alternative real estate investment product.

The concept of REITs is not new in the GCC, but it is indeed very fresh in terms of its implementation and adaptability. In the past, REITs in the GCC have not fulfill their potential for several reasons. One such reason was the global subprime financial crisis of 2008. The financial crisis had a dramatic shift in investment perception and expectations of the investors around the globe, more so in the GCC. The crisis led to the need of diversified investment basket, rather than putting all the eggs in the same basket and investments in real estate is no exception. Investors realised the need of quick entry and exit, which was available in listed property instruments like listed REITs. From 2006, most of the GCC members were trying their best to formulate a regulatory framework, but when the crisis struck, it took with it any realistic chance of progression.

Hence, Islamic REITs are one type of investment that capital market authorities in GCC can focus to develop regulations and popularise it with clues and studies from countries such as Malaysia and Singapore. With huge appetite for Islamic investment products within the GCC region; High Net Worth Individuals (HNWIs) investors, as well as Government, owned entities such as pension funds, investment funds and sovereign wealth funds might invest in REITs to diversify their portfolio. Once Islamic REITs are popularised and listed in GCC exchanges, institutional investors such as takaful companies might also invest in Islamic REITs.