KEY MESSAGES:

- While today total assets in the Islamic finance system worldwide are measured as high as US$2.293 trillion, and expected to grow to US$4.3 trillion by 2020, the assets in Shari’a-compliant mutual funds barely reach US$53 billion, or just under 3% of assets in Islamic finance today.

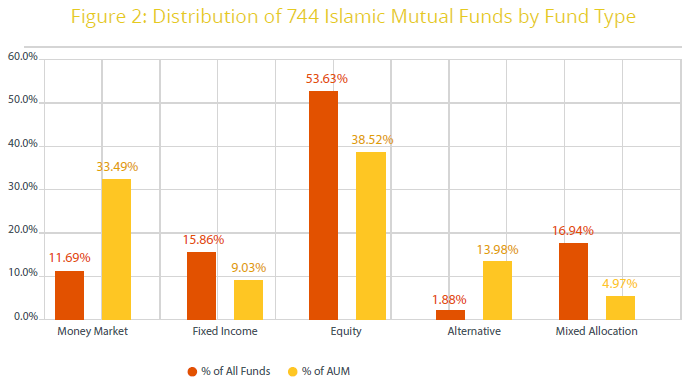

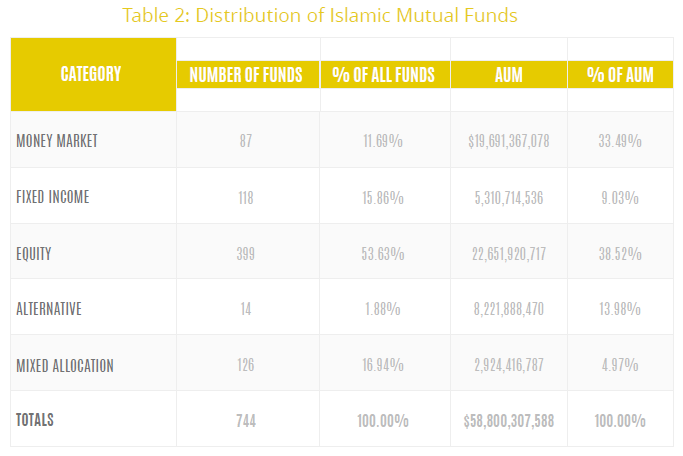

- There is evidently a predominance of Islamic equity mutual funds, with 54% of the 744 funds dedicated to this asset category, and 38% of AUM.

- Islamic money market funds (aka, murabaha or commodity finance funds) comprise 12% of all Shari’a-com-pliant mutual funds, yet a whopping 33% of Islamic fund AUM.

- Among the 744 mutual funds in the universe of Islamic mutual funds, 63% had a track record of 5 years or more, and comprise 76% of all Islamic mutual fund assets under management. This gives evidence that the preponderant weight of Islamic mutual funds is in those with established histories, a key ingredient to professional and regulatory acceptance.

Many individuals and institutions save money for future spending. That is true regardless of spiritual identity. People of all faiths habitually save for their futures. In all developed and many developing economies the savings of individuals and institutions are largely channelled through one or another type of asset management entity. An individual can walk into a local bank or go online and purchase mutual funds. A university endowment or family foundation will have a Board of Trustees establishing an investment plan, and hires professional asset managers to implement that plan. Pension funds and insurance companies employ investment professionals internally or on an outsourced basis to manage their assets. Almost all have investment goals that must be achieved through security selection and asset allocation, the core functions of asset management.

Asset management in more developed areas of the world, and many developing, is a well-established business with hundreds of thousands, and perhaps millions, of employees and tens of trillions of US dollars equivalent in assets under management. It is by and large a secular business. While socially responsible and ethical investing have become new important trends in the last decade, they are generally not by themselves spiritual.

Asset managers deal with decision constraints on a regular basis. A client can be an individual or institution and give instructions to invest in assets of type “A” but not in assets of type “B.” Some investors—such as the Methodist Church, the California State Employee Retirement System, the Norwegian Sovereign Wealth Fund, or the Bill & Melinda Gates Foundation—provide specific constraints on their asset managers, usually involving the avoidance of investments involved in controversial businesses such as weapons, petroleum, gambling, or others considered anti-social, non-humanitarian, or somehow defined as unethical or not socially responsible. So, adding constraints to security selection is not new; rather it’s been around for decades.

A Slow Evolution

Modern Islamic finance can be said to have begun in 1975 with the foundation of Dubai Islamic Bank, and continued in 1977 with Kuwait Finance House. Both institutions, and since then dozens more, are primarily retail banks. Retail banking in the Islamic sense means the same as with conventional banks: deposit-taking institutions that serve individual customer needs such as payment systems (debit cards or checking accounts), short-term credits, credit cards, auto loans, and the like.

After a period of maturity nearly all the retail Islamic banks established parallel corporate banking services to serve business and government customers. For these customers they established Islamic payment systems, inventory finance, equipment finance, letters of credit and guarantee for exporters and importers, and the usual list of services provided to companies and agencies. Corporate banking turned out to be identical in Islamic finance to conventional corporate banking in terms of service, reliability and cost.

In 1998-99 the world’s first Islamic investment banking institutions appeared, with Arcapita and Gulf Finance House in Bahrain raising an estimated US$30 billion from investors through 2007, and issuing close to US$3 billion in sukuk for their own balance sheets. The world’s first global sukuk (Islamic bond) was issued in early 2001 by the Malaysian government, and was soon followed by more from the Dubai, Bahrain, Saudi and Indonesian governments. Sophisticated legal counsels created Shari’a-compliant share purchase agreements, mortgage loan agreements and long-term asset financing contracts that became widely accepted by Shari’a scholars. By 2014 even the UK, Hong Kong, South Africa and Luxembourg governments had issued sukuk, indicating a highly legitimized form of Islamic investment banking was achieved.

Shari’a-compliant trading and brokerage banking was established in the Islamic finance space with the likes of Mubasher, a highly popular independent Saudi brokerage and clearing house for regional and some international shares, while throughout the 2000s banks in the Saudi and Gulf region set up numerous Shari’a-compliant brokerage units, often in separately capitalized investment divisions, all with the same level of service and cost as their conventional counterparts.

Narrow Base

In short, these four pillars of Islamic banking—retail, corporate, investment and brokerage & trading—all rapidly advanced over the last 40 years to become legitimate financial service providers for their respective clientele, equal in nearly all senses to conventional financial service providers. Absent, however, is the fifth pillar of banking, Islamic asset management. Compared to the other four areas of banking, Islamic asset management has barely moved. While today total assets in the Islamic finance system worldwide are measured as high as US$2.293 trillion, and expected to grow to US$4 trillion by 2020, the assets in Shari’a-compli-ant mutual funds barely reached US$53 billion, or just under 3% of assets in Islamic finance today. Compare that to the approximately equal amounts in US mutual funds and assets in US commercial banks (about US$15 trillion each, meaning mutual fund assets are approximately equal to 100% of banking assets) and the disparity of Islamic assets under management to Islamic finance assets becomes more acute.

There may be multiple causes for the retarded development of Islamic asset management. Certainly the advances in the other four categories of Islamic banking were swift and widespread. From near zero levels in 2000, sukuk outstanding worldwide now surpass US$300 billion, Islamic mortgages in the United States are said to exceed US$3 billion, while Shari’a-compliant assets in the Malaysian banking system are quickly approaching 30% of all assets.

We consider here Islamic asset management as a unique and separate function of Islamic finance. Perhaps the retarded development of Islamic asset management is due to the lack of adoption of conventional asset management methodologies. Perhaps too there are cultural or social issues involved.

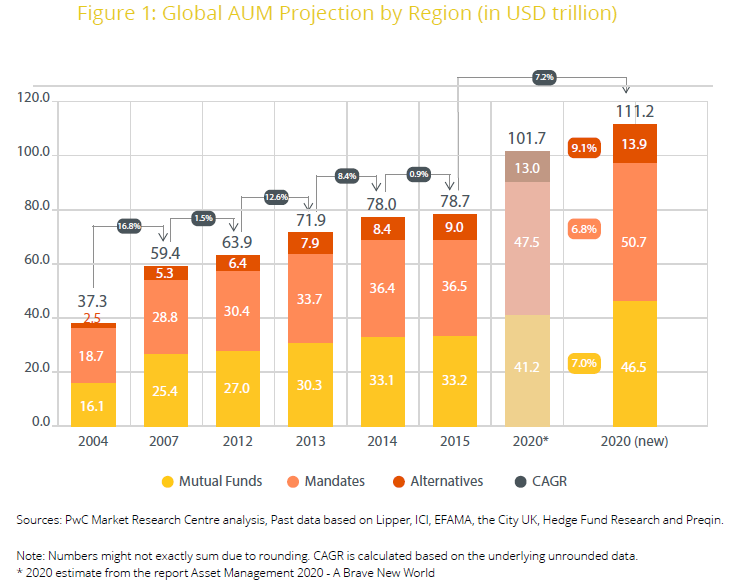

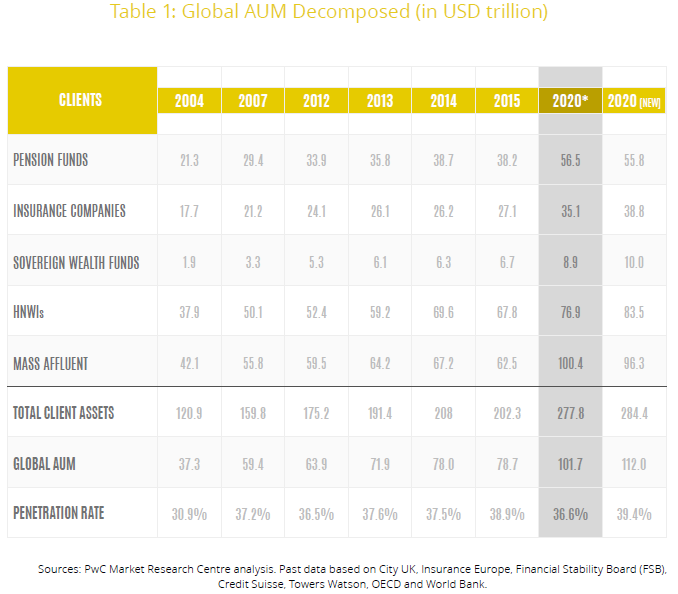

Size & Nature of Global Assets under Management

The asset management industry comprises around US$78.7 trillion in professionally managed assets worldwide (Figure 1 & Table 1). According to PwC, the global investable assets for the asset management industry will increase to more than US$100 trillion by 2020, with a compound annual growth rate of nearly 6%. We know intuitively that much of this managed wealth is owned by individuals and institutions (institutions often acting on behalf of individuals, such as pension funds) in developed economies. Before the publication of Islamic Wealth Management Report 2016 (IWMR), the industry analysts found it difficult to put an exact number on the global size of assets held by Muslim HNWIs, institutions and governments. The estimate for 2017 is US$ 11.9 trillion, as mentioned in Chapter 1.

Pension funds and insurance companies play an equally powerful role as intermediaries in the real economy by investing in tens of trillions of dollars and their equivalents in other currencies in stocks, bonds, other credit vehicles, hedge funds and private equity. They also universally have the same general objective of mutual fund investors, maximizing return while minimizing risk through the application of Modern Portfolio Theory (MPT). But, pension funds and insurance companies have special asset-liability management issues. They are constrained in their portfolio allocations by regulators insisting on extremely prudent investments to insure future liabilities (pension and insurance claims) are paid. And, they are captive in the sense that no single individual can enter into and benefit from the investment strategy of a pension fund or insurance company. They represent specific investor groups and only those groups.

Even with the most transparent investment policies, the large size and specific nature of these institutional investors make their asset management profiles less appealing for what we are trying to achieve here in discussion of Islamic asset management (although, of course, Shari’a-compliant pensions and insurers, or takaful, may substantially benefit from applying Islamic asset management to their investment strategies and processes). To gain a more specific identity of Islamic asset management we examine mutual funds to achieve our understanding of what is possible. At the same time, mutual funds are the “common man” investment, meaning the outcome of this research may have greater utility for more persons, in particular Muslims.

Mutual funds, by nature, are the most democratic vehicle for individuals and many institutions to place their savings. They offer advantages to investing that few individual investors could hope to achieve on their own without mutual funds.

The Role of Mutual Funds

Mutual funds play several roles in asset management. First, they are the investment vehicle of choice for many individual investors, and not only in developed economies. Most individuals cannot hope to gain the benefits of investment diversification by themselves due to the complexity and barriers for individual access to global capital markets. Mutual funds offer a portal into sophisticated, professional asset management with low entry amounts. As stated by the International Monetary Fund, “Financial intermediation through asset management firms1 has many benefits. It helps investors diversify their assets more easily and can provide financing to the real economy as a ‘spare tire’ even when banks are distressed. The industry also has various advantages over banks from a financial stability point of view.”

Few investors choose a single-asset-class portfolio. Professional investors diversify investments across multiple asset categories: Cash, Fixed Income,3 Equity and Alternative Investments. Most professional asset managers achieve diversified portfolios through MPT, optimizing risk and return to achieve investment objectives. By analysing, filtering and selecting mutual funds an individual investor can hope to achieve an optimized portfolio.

Mutual funds—numbering over 79,000 worldwide and managing more than US$33 trillion in assets—play an important role in achieving diversification and portfolio optimization for many individual and a good number of institutional investors6. Mutual funds, by nature, are the most democratic vehicle for individuals and many institutions to place their savings. They offer advantages to investing that few individual investors could hope to achieve on their own without mutual funds. Further, absorption of mutual funds into an economy is considered an indication of that economy’s strength and sophistication. Developed economies have much higher ratios of mutual fund AUM to GPD than less developed economies. Mutual funds do play a significant role in the markets in which they invest, whether money markets, fixed income, equities, or alternative investments. Mutual funds are invested across all asset categories, and given the current US$33 trillion value of AUM in mutual funds worldwide, one may conclude their role in capital markets is not insubstantial.

Notes on the Historic Development of the Islamic Mutual Funds Industry Ernst & Young annual reports on the Shari’a-compliant mutual funds universe estimated 150 such funds in 2000 and 400 in 2006. Today our count of this universe results in 744 funds, indicating a growth of almost 400% in the previous 15 years. Islamic mutual fund assets under management were estimated by E&Y at US$39.5 billion at the end of 2006, while our measurements today indicate almost US$58.8 billion, for a total 9-year growth of 49%. For comparison, assets under management of US mutual funds from 2006 through 2014 grew 52%7, a nearly identical rate of growth, meaningful until one considers the former is part of a spectacularly fast-growing sector—Islamic finance—while the latter is from a highly mature market. What is interesting is that Islamic mutual funds industry was born sometime in the mid-1990s and today many of the funds founded in the industry’s infancy are still around. What is not so clear is the historic evolution of these funds and their assets under management.

Asset Allocation for the “Typical” Muslim Investor

We look now at the distribution of Islamic mutual funds within classic asset categories in an effort to see if there is skewness in the types of funds that have been produced to date by Islamic fund providers, where here we’ll define skewness in comparison to the US mutual funds market. While not a good measure, since other mutual fund markets can be quite different, we can at least have one comparison among developed mutual fund markets. There is evidently a predominance of Islamic equity mutual funds, with 54% of the 744 funds dedicated to this asset category, and 38% of AUM. Is this “normal”? In terms of AUM, the U.S. mutual fund market has 56% dedicated to domestic and international equities8, so while the ratio of funds is similar, the variance of AUM ratio is significant.

More variance is visible when comparing other asset categories. There are 118 Islamic mutual funds in the Fixed Income category (where “Trade Finance” is sometimes added in this text due to the occasional appearance of funds that invest in sukuk as well as trade finance, rare in conventional bond mutual funds), comprising 16% of all funds and nearly 9% of AUM. In the US market AUM in bond funds comprise 22% of all mutual fund AUM, a variance of about 250% more than we see in the Islamic mutual funds market. Even more graphically, Islamic money market funds (aka, murabaha or commodity finance funds) comprise 12% of all Shari’a-compliant mutual funds, yet a whopping 33% of Islamic fund AUM. In comparison, U.S. money market funds account for only 15% of American mutual fund assets. Equally striking, the loose category Alternative Investment funds accounts for 2% of all Islamic funds and 14% of AUM, yet in the U.S. market this category has an 8% share of assets. As we’ll show below, however, this can be highly misleading. Alternative funds in developed markets are highly heterogeneous, while the Alternative Investment category in Islamic mutual funds is quite concentrated (see Figure 2 and Table 2 below).

The category Mixed Allocation is more difficult to define, as this is sort of a “grab bag” of mutual fund investments and investment styles. Drilling down into the fact sheets of many of these funds is illustrative. One might invest in up to 99% Shari’a-compliant equities when the manager sees an opportunity, or up to 99% cash and fixed-income instruments if the manager feels valuations are under threat. Many such funds exist with various limits on fixed income (murabaha, sukuk and deposit assets) and equities. Some of them have announced disciplined to make best efforts to keep within certain bands, for example not to invest more than 40% or 80% in equities, with the balance in fixed-income securities. These mirror the portfolio strategy funds common among major asset managers.

Track Record

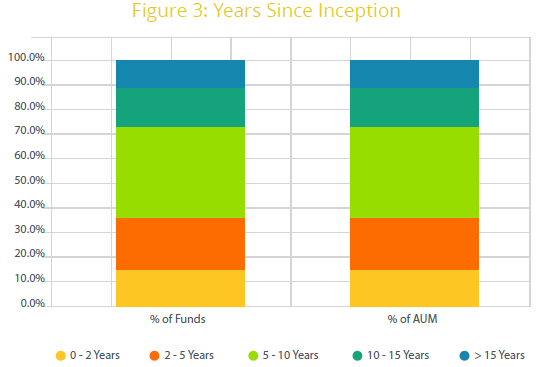

An important distinction for asset managers is a mutual fund’s history, or track record. A fund with a longer track record will provide more data that will display the consistency, or lack thereof, of the fund manager’s skills in managing assets through measurements of price and price volatility, plus assets under management. A bit surprisingly, it was discovered that among the 744 mutual funds in the universe of Islamic mutual funds, 63% had a track record of 5 years or more, and comprise 76% of all Islamic mutual fund assets under management. This gives evidence that the preponderant weight of Islamic mutual funds is in those with established histories, a key ingredient to professional and regulatory acceptance (see Figure 3).

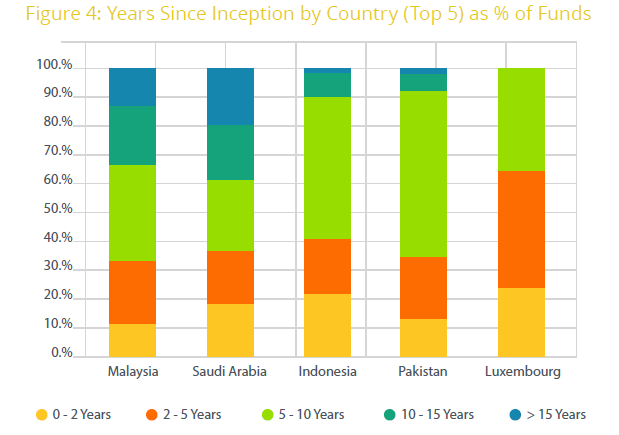

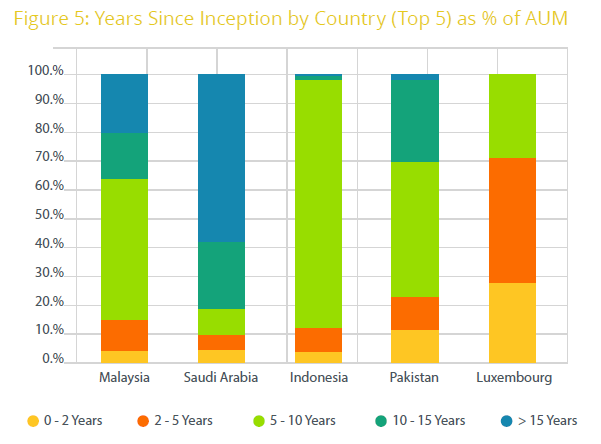

It was discovered, too, that while only 11% of all Islamic mutual funds had been around for 15 years or longer, they comprised 35% of all Islamic mutual fund assets under management. These 81 veterans of the industry enjoyed average assets under management of US$254 million, a figure which combined with track record indicates a relatively large pool of large, historic funds. This dispersion of track record and AUM can be more clearly envisioned in Figure 4 and 5.

Among the top five countries for Islamic mutual funds (Malaysia, Saudi Arabia, Indonesia and Pakistan), there is evidence of the historic evolution for the creation of these securities over time. In terms of number of funds, both Malaysia and Saudi Arabia display maturing mutual fund industries, while relative newcomers Indonesia and Pakistan are filling the gap with substantially more fund production in the “less than 10 years” category than their more mature rivals. In fact, the evidence indicates the greying, or aging, of the Islamic mutual funds industries in both Malaysia and Saudi Arabia, perhaps because most available product gaps were first filled ten years or more ago.

The evidence also points to the maturing of Saudi mutual fund assets under management, and to a lesser extent also in Malaysia, and the younger nature of assets in the Indonesian and Pakistani markets. And, measuring top-five by AUM adds Luxembourg to the list, where more than 70% of Islamic funds have five or less years of track record, a relative newcomer compared to the other four.

Conclusion

There is an understudied yet large and historic global market for Islamic mutual funds. Little has been written about this market and there is paltry academic research. Yet the potential utility to Muslims (and non-Muslims who wish to achieve the same goals) of Islamic mutual fund investing into globally allocated, optimized portfolios is presumably very large.

There is still much to learn about each of the asset categories in Islamic mutual funds requires, in particular determining if there are geographic biases among issuers of Islamic mutual funds. Do Saudis create and manage more equity funds, while Malaysians more fixed-income funds? Are mutual fund families in the UAE more likely to outsource non-local fund management than those in Saudi Arabia? Why are the large majority of existing Islamic mutual funds issued in just two reference currencies, the US dollar (and the dollar-linked currencies of the GCC region) and the Malaysian ringgit? Is there space for distributing these funds in other currencies via additional share classes, or would home-grown mutual funds better meet domestic savings needs?

Certainly the above revelations are barely scratching the surface of the Islamic mutual funds market and the subsequent construction of sharia-compliant, optimized portfolios in the Income, Balanced and Growth strategies typical in the asset management industry. Comparing the academic research in this sector to that done on conventional asset management is like comparing a mouse to an elephant. The mass is thousands of times greater in the latter. But, with each small step a better platform is constructed for the next level of research.