KEY MESSAGES:

- World’s Muslim population, estimated to be 2 billion currently is expected to increase to 2.8 billion in 2050. A by-product of this demographic dynamic will be the rapid creation of wealth across the Islamic world, which will underpin the continued expansion of the broad market for Islamic finance.

- The global Islamic wealth pool is estimated to be worth about US$11.9 trillion. Of this total, however, as much as US$9.65 trillion of wealth owned by Muslim individuals, institutions and governments is estimated to be held outside the global Islamic financial services industry.

- Many high-net-worth individuals (HNWIs) throughout the Islamic world are comfortable with wealth management offerings from providers of conventional financial services, which is in part a reflection of the availability of a wider range of products in conventional asset management than in its Shari’a-compliant equivalent.

- Increased depth and diversification in the sukuk market has significant implications for the Islamic wealth management industry, because there are clear signals that investors in the Muslim world are developing an appetite for the longer-term stability of fixed-income markets in preference to equities.

Recent trends in the evolution of the global wealth management market have been mixed. In 2015, the global asset management industry recorded its worst performance since the 2008 financial crisis1. The market picked up in 2016 marginally.

Worldwide, assets under management (AUM) rose by just 1% in 2015 to US$71.5 trillion from US$70.5 trillion, which was a disappointing showing compared to the average annualised growth rate of 5% between 2008 and 2014. BCG attributed 2015’s muted growth in AUM to tepid net inflows twinned with the generally negative and turbulent performance of global financial markets. The end of the 2016 figures were even gloomier, as the global AUM stood at US$69.1 trillion.

Other recent analyses, meanwhile, reported that AUM in the asset management industry have even been declining. According to research published in October 2016 by Pensions & Investments (PI) and Willis Towers Watson, assets managed by the world’s largest 500 managers fell in 2015 for the first time since 2011. This analysis reported that total AUM were down 1.7% to US$76.7 trillion at the end of 2015, compared to US$78.1 trillion the year before.2 In a nutshell, everything is not honky dory in the global asset management industry.

By contrast, the narrower wealth management industry has continued to expand and prosper. In a White Paper on the Global Wealth Market published in May 2015, Datamonitor fore-casted that by the end of 2018, the assets of high net worth individuals (HNWIs) will surpass US$40 trillion, an increase of over US$18.5 trillion since the end of 2014. “During the same period,” the report added, “the assets of the affluent population as a whole will increase to almost US$99 trillion. The forecast rate of 23.7% growth for 2014-2018 is slightly lower than the 26.5% recorded in 2010-2014.”

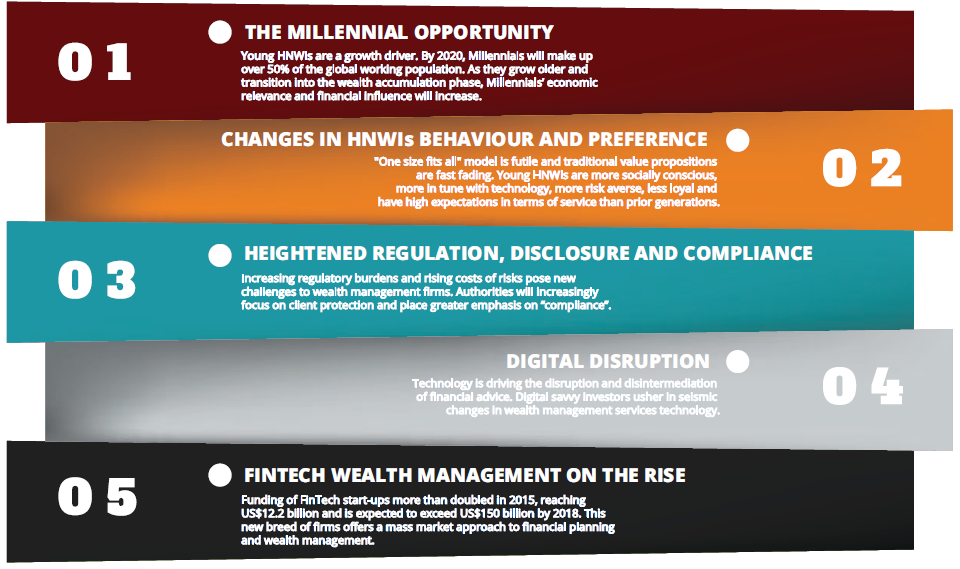

It is not just this growth outlook which suggests that the current environment may represent an unparalleled opportunity for wealth managers at a number of levels. A recent survey of more than 2,000 individual clients and 60 wealth management senior executives3 revealed that the global wealth management industry is undergoing an “unprecedented level of change”. There are several drivers behind this transformation, ranging from shifting demographics and investor preferences to competitive threats from the FinTech world described as “digital disruption”.

5 KEY WEALTH MANAGEMENT TRENDS FOR 2017 AND BEYOND

With opportunities to generate alpha increasingly elusive, and with margins under pressure and uncertainty still prevailing about the regulatory outlook, it is small wonder that asset managers and their clients across the world are re-evaluating their strategies. As a consequence, it is estimated that four out of 10 clients are currently open to switching wealth managers under the right circumstances. This represents a US$175 billion to US$200 billion global revenue opportunity for those firms willing to make strategic investments to deliver a superior client experience, while others may find themselves at risk of losing a substantial portion of their business.

Potential for Islamic Wealth Management

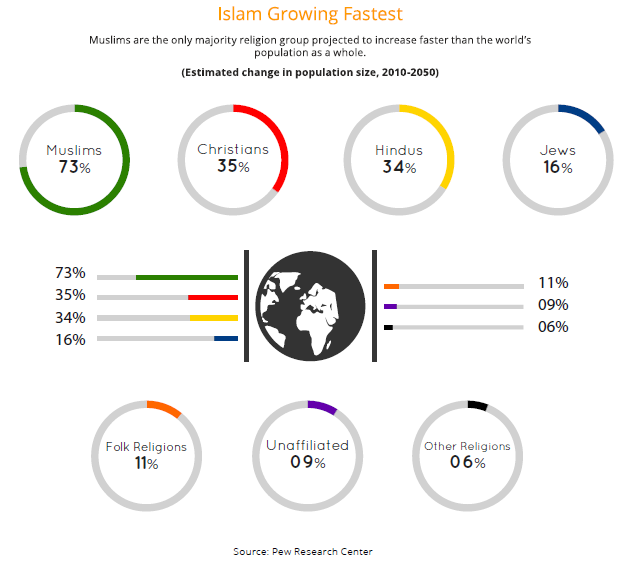

While there is abundant room for further growth in the global wealth management industry, there are several reasons why the Islamic niche of the industry is expected to outgrow conventional wealth management over the coming decade. One of the most fundamental of these is the demographic profile of the global Muslim population. According to the Pew Research Centre, while the world’s population is projected to grow 35% in the coming decades, the number of Muslims is expected to increase by 73%, rising from 1.6 billion in 2010 to 2.8 billion in 2050. In 2010, Muslims made up 23.2% of the global population. Four decades later, according to the Pew forecasts, they are expected to account for about three in ten of the world’s people (29.7%)4. Much of this projected growth is attributable to the fact that Muslims have the youngest median age (23 in 2010) of all major religious groups, seven years younger than the median age of non-Muslims (30).

One by-product of this demographic dynamic will be the rapid creation of wealth across the Islamic world, which will underpin the continued expansion of the broad market for Islamic finance. Projections on the growth of Shari’a-compliant finance vary, but according to Global Islamic Finance Report 2017, it is expected to grow to US$3 to US$4.3 trillion by 2020. More specifically, the Datamonitor analysis forecasted that demographics and economic growth will be especially supportive of the growth of the wealth management industry in countries with majority or fast-expanding minority Muslim populations. Over the next few years, one of the world’s fastest-growing wealth management markets, according to the Datamonitor projections, will be Pakistan, which will expand at a 10.27% compound annual growth rate (CAGR) between 2015 and 2018. This will be eclipsed by the projected CAGR of 10.62% over the same period in Nigeria, where Pew forecasted that 58.5% of the population will be Muslim by 2050, up from around 50% today.

Why is Islamic Wealth Management Underdeveloped?

It is not just the demographics of the global Muslim population that will drive continued growth of the market for Islamic finance in general and Shari’a-compliant wealth management in particular. Both markets are widely regarded as underdeveloped relative to their potential. Based on an estimated size of US$2.293 trillion in 2016, for example, the Islamic finance assets still represented just about 2% of the total global financial market worth US$127 trillion5. The global Islamic wealth pool, estimated by Islamic Wealth Management Report to be worth about US$11.9 trillion. Of this total, however, as much as US$9.65 trillion of wealth owned by Muslim individuals, institutions and governments is estimated to be held outside the global Islamic financial services industry.

The reasons for relative underdevelopment of Islamic wealth management industry are well understood and have been widely documented. One of these is that it cannot be assumed that there is a direct link between the size of the global Muslim population and demand for Shari’a-com-pliant financial services. This is because many high net-worth individuals (HNWIs) throughout the Islamic world are comfortable with wealth management offerings from providers of conventional financial services, which is in part a reflection of the availability of a wider range of products in conventional asset management than in its Shari’a-compliant equivalent. Historically, the lack of diversification available for Islamic investors in local as well as international markets was regarded as a function of the restrictions on permissible investment instruments under Shari’a law. As well as ruling out exposure to any companies involved in proscribed areas such as arms production, alcohol sales or gaming, the prohibition on the charging or receipt of interest payments (known under Islamic law as ‘riba’) effectively put the entire conventional financial services industry off limits to most Shari’a-compliant funds. This in turn dramatically reduced the universe of listed equities and equity-based investment funds open to Muslim investors.

Over the next few years, one of the world’s fastest-growing wealth management markets will be Pakistan, which will expand at a 10.27% compound annual growth rate (CAGR) between 2015 and 2018.

A number of other restrictions imposed by Islamic law also narrowed the range of opportunities accessible to investors committed to observing Shari’a-compliant financial rules. The prohibition on interest payments meant that opportunities to diversify into conventional fixed-income instruments were limited. The Quranic ban on ‘gharar’ (defined as speculation) and on trading in products that an investor does not physically own, meanwhile, has traditionally been a stumbling block to the development of derivatives, structured products and Islamic hedge funds. This in turn has sharply reduced opportunities available to investors to protect themselves from falling prices and volatility in a way that is compatible with Shari’a guidelines.

The global Islamic wealth pool is estimated to be worth about US$11.9 trillion. Of this total, however, as much as US$9.65 trillion of wealth owned by Muslim individuals, institutions and governments is estimated to be held outside the global Islamic financial services industry.

As a result of these multiple restrictions, asset and wealth management in the Islamic finance universe has been overwhelmingly long-only equities-based. A by-product of this has been that the market for Islamic investment funds has been vulnerable to macroeconomic uncertainty. This has been evident over the last 12 months. According to data published by the MIFC6, even though the market for Islamic funds is expected to grow by more than 5% per annum to reach US$77 billion by 2019, challenging macroeconomic conditions and volatile market conditions drove a notable recent decline in the number of Islamic funds in 2015. Beyond restrictions on the range of products available to Muslim investors – which have inevitably had an impact on the performance and liquidity of Shari’a-compliant investments – there have been a number of structural shortcomings that have slowed down the growth of Islamic wealth management, especially in the Middle East. For example, the fragmentation of markets in the resource-rich GCC has hampered distribution of financial products. This is one reason why the mutual fund market in the Middle East remains very underdeveloped compared to the US and Europe.

Another reason that has been advanced in explaining the relative underdevelopment of the Islamic wealth management sector is a so-called trust deficit, (see chapter 3 for further details)7. Almost half (48%) of respondents to this survey on the Knowledge, Attitude and Practices (KAP) of the industry indicated that they had never used any Islamic wealth management products and services. The reasons they gave included lack of understanding, shortage of trust and preference for managing their own financial affairs. The survey also found that 18% of industry practitioners and experts believed convincing Muslim HNWIs to invest in accordance with Shari’a-compliant rules was “very difficult”.

An Underdeveloped Takaful Sector

In the GCC, in particular, this deficit also appears to extend to another underdeveloped area for the more efficient long-term management of Muslim wealth, which is the life takaful (Shari’a-compliant insurance) market. Although there is a relatively sophisticated family (life) takaful sector in Malaysia; inefficiencies in distribution, lack of differentiation between Islamic and conventional insurance, and a shortage of long-term investment opportunities have combined to impede its growth in the GCC. Data published by A.M. Best indicated that while life assurance accounts for 64% of total gross written contributions (GWC) in Malaysia, the share of family takaful in the Middle East is just 12%8.

Closing the Gap?

There are, however, a number of indications that recent developments in the Islamic financial services are more supportive of growth in the Shari’a-compliant wealth management industry than it has ever been. This may explain why the private banking and asset management industry in the GCC is attracting a rising flow of investment from global investment managers, many of which have been establishing joint ventures with regional banks. In terms of product availability, Islamic wealth management is closing the gap on the conventional industry in a number of ways. In the equity market, for example, the increased diversity of products available to investors is being driven by liberalisation, most notably in Saudi Arabia. A more active IPO market is increasing supply and diversity in the Saudi equity space, while the rising participation of overseas investors is injecting more liquidity.

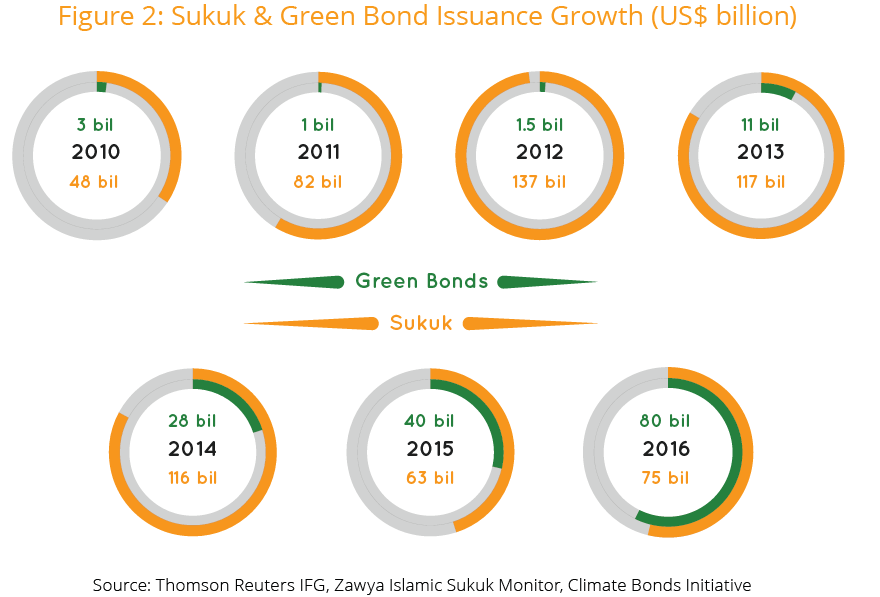

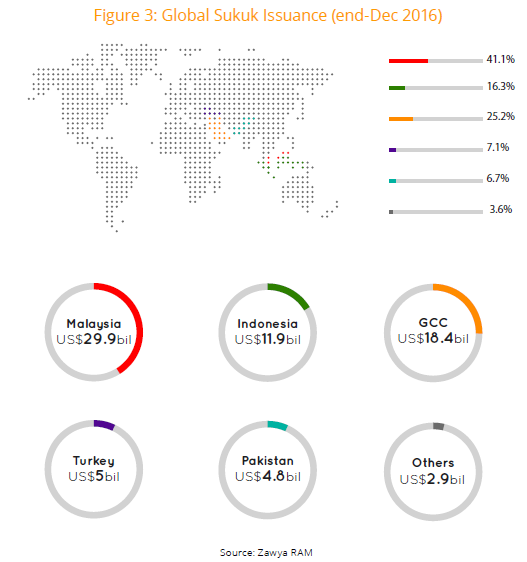

Saudi Arabia is also a conspicuous example of a Middle Eastern market that has seen a dramatic increase in supply in its fixed-income market over the last 12 months. This mirrors a key trend in the evolution of the global Islamic capital market during the last 10 years, which has been characterised by growing maturity, depth and diversification of the market for sukuk, Shari’a-compliant financial certificates that are similar to conventional bonds. Although issuance in the global sukuk market declined in the first half of 2016, commentators are enthusiastic about the longer-term potential for the market. The good news is that there have been serious efforts from all stakeholders, including the Islamic Development Bank (IDB), the Islamic Financial Services Board (IFSB), and the Account and Auditing Organisation for the Islamic Financial Institutions (AAOIFI) to enhance the ingredients of standardisation in an attempt to develop a vibrant and sound Islamic finance sector. Collectively, these will contribute to the popularity and acceptance of sukuk issuance.

Another promising development for this market is the decision by JP Morgan to include a number of sukuk in its flagship Emerging Markets Bond Global Diversified Index, which is widely expected to bolster demand from conventional investors and support liquidity in the market. Perhaps more important, index inclusion is also expected to be an impetus for structural improvements in the sukuk space, with index providers likely to demand increasingly high governance standards as a precondition for inclusion. While cross-border institutional flows from conventional and Islamic investors alike will be one growing source of demand for sukuk, another will be retail investors. Indonesia, for example, has been prioritising the sale of sukuk targeted at domestic retail investors, which will help support the government’s aim of increasing the share of sukuk issuance from about 13% of total government issuance in 2015 to at least 50% over the next 10 years.

Another reason for the positive longer-term outlook for sukuk issuance is the high funding requirements that are likely to be created in areas such as the GCC as a result of depressed oil prices. Standard & Poors (S&P), for example, has estimated that weak energy prices will mean that the GCC will have some US$560 billion of funding needs between 2015 and 201910. If only a modest share of this total is raised in the sukuk market, it will have a significant impact on issuance volumes and liquidity. Increased depth and diversification in the sukuk market has significant implications for the Islamic wealth management indus-try, because there are clear signals that investors in the Muslim world are developing an appetite for the longer-term stability of fixed-income markets in preference to equities. Higher issuance volumes twinned with more diversity in the sukuk market also has important implications for the global takaful sector, which has a pivotal role to play in underpinning continued expansion in the broader Islamic wealth management industry. This is because a deeper sukuk market will provide enhanced opportunities for institutions to manage their longer-dated assets and liabilities more efficiently.

SRI – A Driver for Islamic Wealth Management?

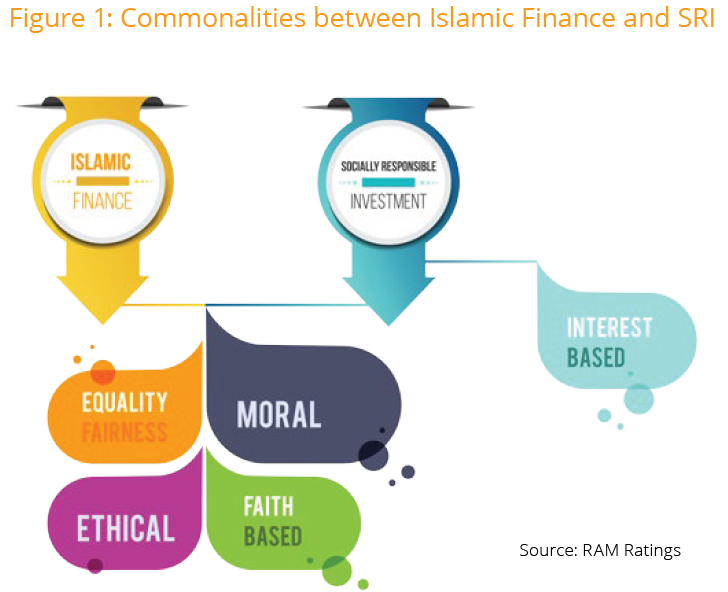

Another potential driver of growth in the sukuk market is the growing conviction that there is a clear overlap between Islamic financial tenets and socially responsible investment (SRI), which is becoming increasingly appealing to HNWIs across the global investment community, irrespective of their religious beliefs (see Figure 1). This overlap is not just a reflection of the Quranic prohibition of investment in a number of industries that are increasingly regarded as socially taboo in non-Muslim as well as Muslim-majority countries. It is also a function of the structure of Shari’a-compliant investment instruments, many of which are based on real asset ownership.

Speaking at the World Energy Summit in Abu Dhabi in January 2015, Sean Kidney, CEO of the Climate Bonds Initiative, commented that “the asset-focused nature of all sukuk makes it a good fit with the green bonds concept, which is also asset-focused”.11 This mirrors a broader belief that growth in demand for asset-based investments is likely to continue against the back-drop of fiscal uncertainty, supporting further increase in the popularity of Shari’a-compliant instruments among Muslim and non-Muslim investors alike. Given the strong underpinning of Islamic finance upon SRI, green financing is likely to make headway within the Islamic finance industry in the coming years.

As both the sukuk and the green bond segments develop, it is just a matter of time before sukuk market investors and conventional SRI investors are drawn to investing in green sukuk. With the dire need to finance enormous infrastructure and renewable energy projects amidst falling oil prices, green sukuk provides a very plausible investment solution.

This is especially true for the GCC and Middle East region where there is increasing demand for energy supply and subsequently, energy financing. Green sukuk has the potential to facilitate and increase broader participation in the sukuk market by conventional investors who are looking for ethical and socially responsible investment. The growing trend toward green sukuk or SRI sukuk are mainly due to the growing awareness of investors toward ethically and socially responsible investment and the stricter capital requirements for banks to finance infrastructural projects. Figure 2 shows the potential growth of green sukuk.

More Products Needed

Nevertheless, while the growth in the sukuk market is encouraging, if Islamic wealth management is to flourish, it is essential that practitioners and their advisors explore a broader repertoire of products such as Shari’a-compliant exchange-traded funds (ETFs), real estate investment trusts (REITs), private equity funds and liquid alternatives. This is because in an environment of subdued growth, low inflation and depressed commodity prices, investors will no longer be able to rely on long-only exposure to traditional asset classes as a means of generating returns. More specifically, as Datamonitor noted in its 2015 White Paper on the Global Wealth Market, alternative asset classes are a crucial source of diversification for HNWIs. According to Datamonitor, “traditional asset classes such as bonds, deposits, equities and mutual funds account for only around two-thirds of the average HNW portfolio. This means alternative investments are important, including non-liquid investments like property.”

Harnessing Growth Opportunities in Islamic Wealth Management

The clear potential for growth in the Shari’a-compliant wealth management industry is attracting the attention of policymakers in a number of Islamic finance hubs as well as regional and international private banks and asset management groups. Malaysia has made no secret of its ambitions to strengthen its position as Southeast Asia’s dominant centre for Islamic finance in general and Shari’a-compliant wealth management in particular. In a keynote address at the 12th World Islamic Economic Forum (WIEF) in August 2016, Malaysian Prime Minister Datuk Seri Najib Razak said that the country had identified Islamic wealth management as a “new growth area”. In the same address, Prime Minister Razak noted that Malaysia’s Islamic capital market had more than tripled in size over the last 10 years, to RM1.7 trillion. Malaysia continues to be the global leader in the sukuk market, commanding 52.6% of the global sukuk outstanding at the end of 2016, while total assets under management of Islamic fund management industry therein remain the world’s second-largest.

Given the strong underpinning of Islamic finance upon SRI, green financing is likely to make headway within the Islamic finance industry in the coming years.

Malaysia continues to be the global leader in the sukuk market, commanding 52.6% of the global sukuk outstanding at the end of 2016, while total assets under management of Islamic fund management industry therein remain the world’s second-largest.

The Malaysian financial services sector has responded constructively to the government’s push to promote Islamic wealth management. In September 2016, for example, the Kuala Lumpur Stock Exchange opened the world’s first end-to-end Islamic exchange platform, named Bursa Malaysia-i. At the launch of this initiative, Bursa Malaysia’s CEO Tajuddin Atan explained that the introduction of the new service was designed to provide “a conducive marketplace for Shari’a-compliant investing and to help further strengthen the products and services offered by the Islamic capital market.”

Leading asset managers are also supportive of Malaysia’s ambitions in the wealth management arena. When it launched its new Shari’a-compliant ASEAN Megatrend Fund in April 2016, for example, RHB International Asset Management announced that this was aimed at complementing the government’s efforts in “developing and growing the Islamic finance marketplace with the aspiration to position Malaysia as a key player.” Significantly, RHB is reported to be planning to follow the launch of the Megatrend Fund with a range of Shari’a-compliant products offering investors exposure to private equity, real estate and sukuk, as well as equities. The roll-out of these new funds, which may also be made available to investors in Brunei, Indonesia, Singapore and the Middle East, is part of RHB Group Asset Management’s long-term agenda of increasing the share of Shari’a-compliant assets from 8% of the total today to 25% by 2020.

There is still plenty of scope for innovation if Malaysia is to deliver on its potential as an Islamic wealth management hub by offering a broader product range. Although there are a number of Islamic ETFs and REITs listed in Kuala Lumpur, for example, the volume remains modest. As a paper published by Perintis E-journal in 2015 noted, even though I-REITs have been established for almost 10 years, only three I-REITs were listed in Bursa Malaysia as at 31 December 2014.

There has been great interest to develop Islamic REITs in Malaysia’s neighbouring country, Indonesia. In May 2017, the Financial Services Authority (OJK) of Indonesia announced that it is considering providing a legal basis for Islamic REITs in the third quarter of 2016, aiming at attracting more property investors, especially those from the Middle East.17 The Indonesian government has plans to provide an incentive for the Islamic REITs, equal to that of the conventional REITs as outlined in the ninth economic policy package launched in March 2015.

Progress in Dubai

In the Middle East, Dubai is committed to expanding its financial centre, with Islamic private banking, asset and wealth management all expected to play a pivotal role in supporting this growth by exploring a range of new Shari’a-compliant versions of conventional instruments. For example, the Fatwa and Shari’a Supervisory Board of the Dubai Financial Market (DFM) has recently published a draft paper on Hedging against Investment and Finance Risks.18 This outlines the DFM’s standard on hedging which forms a “point of reference for Islamic banks and financial institutions to safeguard their funds without violating the rules of Shari’a”.

As well as being committed to providing a growing repertoire of Shari’a-compliant investment funds for local investors, Dubai’s leading asset managers are also offering HNWI investors an increasingly international suite of products, often in joint ventures with overseas managers. A striking example came in October 2016, when Emirates NBD International and UTI International announced the launch of the Emirates India Equity Fund, offering investors exposure to Shari’a-compliant Indian equities. This initiative builds on Emirates NBD’s strategy of developing a portfolio of global funds in cooperation with partners such as Jupiter Asset Management.

Another growth area for wealth managers focusing on opportunities in the Middle East is the private equity market. According to the most recent annual report published by the MENA Private Equity Association, 2015 was a year of continued investment in the MENA region, with private equity and venture capital approaching levels of investment activity higher than in the days prior to the global financial crisis.

Increased investment in the private equity sphere is being driven by innovative players such as the Dubai-based principal investments firm, Fajr Capital, which is focusing on investment opportunities in the high-growth markets in the Organisation of Islamic Cooperation (OIC). As Fajr noted, “key Muslim majority nations are emerging as one of the main growth engines for the global economy. Our target OIC markets represent a distinctive investment opportunity: common values and cross-border regional trade flows, coupled with strong growth and high liquidity”.

Turkey is also attracting the attention of international and MENA-based private equity funds. Although some investors have been unnerved by political uncertainty in Turkey, the country’s compelling growth and demographic profile continues to attract private equity investors. In July, for example, the Dubai-based private equity firm, Abraaj Group, launched its first Turkey-oriented fund. This US$526 million fund is targeting medium-sized businesses, with a focus on consumer goods and services, health care, financial services, retail and logistics.

Conclusion: Holistic Wealth Planning and Management Offerings

While offering Islamic investment funds across a range of asset classes is a key pillar of the wealth management service offered by leading asset managers and private banks, the winners in this fast-expanding market will be those that are able to offer a more holistic Shari’a-com-pliant wealth planning and management package to Muslim clients. As the Labuan International Business and Financial Centre explained23, “The process involves the creation of wealth through (inter alia) a business, profession or trade and/or savings with financial institutions, the investment of the wealth created to generate returns, the protection of wealth through risk management, takaful and trusts, and the distribution of wealth through gifts (hiba), wills and trusts. The range of activities comprises financial analysis, Shari’a-compliant asset and securities selection, investment planning and ongoing monitoring of investments, as well as estate planning, tax planning and retirement planning.”