Introduction

It is frequently noted by many research houses, academic studies and in-house publications of global institutions that the Islamic finance market has witnessed exponential growth, particularly in its principal markets of Asia and the Middle East. All agree that Islamic assets are now almost at the US$2 trillion mark, of which 73% resides in Islamic banking. Furthermore, it is the only segment of the global banking market that has demonstrated growth over the past decade.

Concomitant with this development, there has been a shift in the Muslim demographic towards the young and relatively well-educated in the traditional markets where Islamic banking has taken root. This is combined with the emergence of an affluent middle class with higher disposable income levels than previous generations. Many in this group, typically referred to as the mass affluent, move rapidly into the HNW segment and are far more aspirational in their outlook. This has resulted in an ever-increasing demand for Shari’a-compliant investment products.

Wealth managers focusing on the key markets of many OIC member countries, particularly in the GCC and increasingly in Asia, have been inundated with requests for products that are reflective of this demand. According to our estimates, the HNW market in the GCC alone is US$2.33 trillion in wealth (see Chapter 1). Consequently, many wealth managers are using this opportunity to incorporate ethically designated conventional portfolios that comply with Shari’a precepts.

Interestingly, this has afforded wealth managers the opportunity to market Shari’a-compliant products as part of a wider ethical portfolio to a broader client base and not just Islamic investors. As is the case in the banking or wholesale market, where conventional institutions are now active market participants in syndicated murabaha or sukuk transactions, so too it would appear that Shari’a-compliant offerings will, in time, be part of the mainstream of products offered to the mass affluent and the HNWIs.

Currently wealth management activities globally are usually undertaken by banks, private banks, investment boutiques and independent financial advisory firms. Many Islamic banks have drawn on this pool of talent to resource their own nascent wealth management operations in the hope that locally based Islamic wealth management expertise will evolve over time, negating the need to avail expertise from abroad. As shown in Chapter 1, the global Muslim population reached 2.04 billion in 2014, with the majority living in Southeast Asia, the Middle East and North Africa. Middle East and African private wealth increased 11.6% to US$5.2 trillion in 2013. This increase came as Middle Eastern economies, particularly in the GCC bounced back, driven by higher oil prices and increased government spending on infrastructure projects. About 18% of households in Qatar (the richest nation in terms of per capita income) hold more than US$1 million in investable assets.

In the Far East Asia, Labuan has emerged as the most credible contender for the top slot in Islamic wealth management.

Ironically though, 70% of GCC-based wealth is invested abroad rather than in the region, which presents a major opportunity and a challenge for Islamic wealth managers. The growth of Islamic wealth management as a business can be regarded as a logical extension of the overall development of the Islamic market, predominantly in the GCC but increasingly in Asia as well as Europe. In Europe, for example, London and Switzerland now compete with Luxembourg in the wealth management sector. In the Far East Asia, Labuan has emerged as the most credible contender for the top slot in Islamic wealth management.

In the GCC, although Saudi Arabia is viewed as the largest market for Shari’a-compliant offerings, Dubai is fast becoming a centre for wealth management activities. In the Asian region, Singapore is competing for this position, targeting specifically the HNW Muslim markets of Malaysia and Indonesia. However, Labuan remains the leader in this niche field. Many of these jurisdictions have important attributes, such as well-developed regulatory frameworks, no capital controls and easy liquidity access in a multi-currency environment. However, before we proceed to discuss liquidity options for wealth managers in the Islamic space, it may be worthwhile to understand what wealth management in general involves and ascertain how the current Islamic market is addressing this important and growing segment.

The primary purpose of any wealth management portfolio is, first and foremost, to provide clients a plan to ensure a level of capital and income accumulation in the long term in line with their lifestyle aspirations and expectations. Furthermore, the wealth manager, working together with accountants and lawyers, provides guidance on estate planning so as to ensure a degree of security for the next generation within a cultural context and in keeping with Shari’a precepts should this be a requirement of the client. Hence, the role of wealth managers is to provide investment ideas and facilitate the development of a portfolio that optimizes occasionally competing and conflicting goals in terms of liquidity, risk and return criteria, risk profiling and currency diversification.

Unlike conventional wealth managers who benefit from a variety of tools to mitigate some of the risks associated with investing in the longer term, IWM involves developing an Islamic universe in light of restrictions imposed Shari’a precepts to ensure that what is available is Shari’a-compliant when constructing an optimal portfolio for their clients. The typical portfolio of many HNW clients in the Islamic space usually contains a variety of investments in property and private equity, which tend to be longer term and largely illiquid, and murabaha investments at the shorter term, liquid end.

Constraints from a Shari’a perspective in terms of asset allocation strategy together with limitations on the use of hedging or leverage techniques to enhance yield, present Islamic wealth managers with challenges over and above those experienced by their conventional counterparts. This, it should be said, is more prevalent in the fixed-income area rather than in equities in the Islamic space. However, there have been promising developments in this regard both at the client and institutional level.

Funds

In the global wealth management arena, the major component of many portfolios tends to be investments in a variety of funds to reflect diversification, liquidity, return criteria and risk tolerance. Perhaps not surprisingly, in the Islamic sector, where as was previously alluded to, offerings have been in relatively illiquid real estate or private equity-type investments. Hence, Islamic wealth managers found that investment in funds as an asset class offer similar characteristics to those of a portfolio in the conventional space, i.e., liquidity, diversification and risk tolerance.

Whether targeted at the mass affluent, the HNWIs or indeed a Family Office (which is increasingly becoming the focus of wealth managers and institutions), there are now a plethora of Shari’a-compliant funds, which have grown in tandem with the Muslim wealth market. Initially established to tap into the institutional Islamic market and to provide much-needed scale, diversity and liquidity; this asset class has now gravitated to the wealth management space as banks, both conventional and Islamic (using their asset management arms), have begun to increasingly focus their attention to this segment.

According to the Islamic Financial Services Board (IFSB), Islamic assets under management (AUM) grew at a CAGR of 9.4% for the period from 2008 to 2012. In 2013, despite a challenging global macroeconomic environment, the sector posted a 10.2% increase over the previous year. Total AUM of Islamic funds are estimated at US$73.7 billion distributed across approximately 1,000 funds. Although this represents less than 5% of global Islamic assets, it nonetheless demonstrates the enormous growth potential of this market.

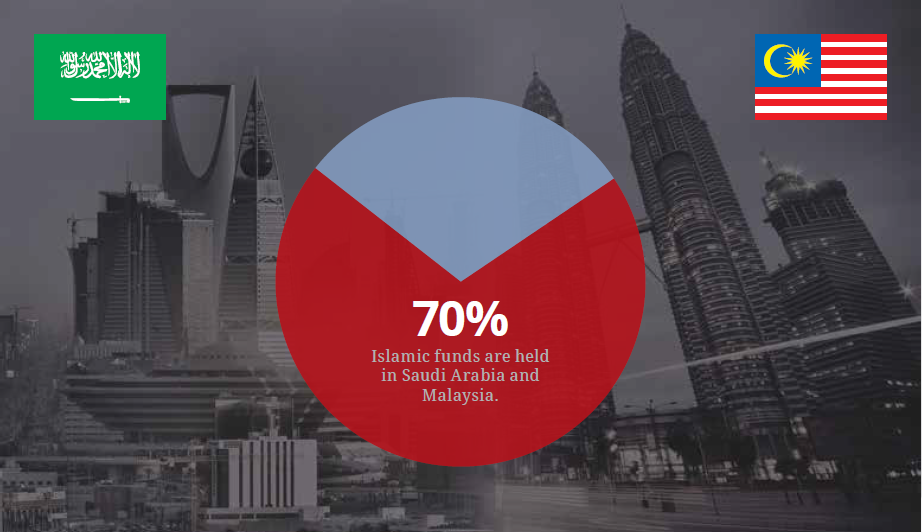

Additionally, 2014 saw the lowest number of liquidated funds since 2008. Total size of new funds launched increased to US$2.27 billion from US$1.52 billion in 2013, representing a 49% rise. In the MENA region alone, 23% of sukuk issued have been “converted” to sukuk funds, which are then sold or traded within the market. By domicile, almost 70% of Islamic funds are held in Saudi Arabia and Malaysia. Approximately 40% of funds outstanding are domiciled in these two jurisdictions due in part to an accommodative regulatory environment and a propensity to issue in local currency complimented by a large investor base, particularly in Saudi Arabia. Additionally, the admission of foreigners to trade on the Saudi Stock Exchange is viewed as a game changer. It is the hope of the Saudi authorities that within the next two years, they will join Qatar and the UAE as part of the MSCI index. The Saudi Stock Exchange (the largest and most liquid in the region) considers most of its stocks and funds toBy domicile, almost 70% of Islamic funds are held in Saudi Arabia and Malaysia. Approximately 40% of funds outstanding are domiciled in these two jurisdictions due in part to an accommodative regulatory environment and a propensity to issue in local currency complimented by a large investor base.

By domicile, almost 70% of Islamic funds are held in Saudi Arabia and Malaysia. Approximately 40% of funds outstanding are domiciled in these two jurisdictions due in part to an accommodative regulatory environment and a propensity to issue in local currency complimented by a large investor base.

With respect to Islamic asset allocation; equity funds, money market and sukuk funds account for approximately 65% of total allocations with an almost equal spilt between them. It is often difficult to differentiate strictly between sukuk funds and Islamic money market funds as there is often a co-mingling of these two asset classes. Whilst historically, Islamic investments were directed towards Shari’a-compliant equity funds, there is now a discernible change with more than half of all current outstanding funds being either in sukuk funds or, more broadly, Islamic money market funds. In the current climate of low oil prices, there is an ever-increasing risk-aversion culture among investors.

This year, for the first time, money market funds have overtaken equity funds. Other significant asset classes include both commodities and real estate. From a wealth manager perspective, and since liquidity challenges are more apparent in the fixed income space; investments in a sukuk fund can contribute to diversification of a portfolio.

This year, for the first time, money market funds have overtaken equity funds. Other significant asset classes include both commodities and real estate. From a wealth manager perspective, and since liquidity challenges are more apparent in the fixed-income space; investments in a sukuk fund can contribute to diversification of a portfolio. This is because such funds are typically structured to satisfy investor appetite for broadening geographical exposure, liquidity, and accessing investment-grade paper.

The investment parameters of each fund are clearly defined in the fund prospectus and will typically target a minimum investment of 70% to 80% of total fund assets in sukuk paper. The remaining fund assets will be invested in cash equivalent structures (such as murabaha) in order to provide fund managers with the liquidity profile sought by the underlying investors.

The fund prospectus will also define the maximum and minimum percentage exposures permitted for each underlying risk asset class, i.e., AAA/AA rated paper etc., as well as the level of exposure to different geographical regions and the nature of the issuers. This is to ensure that investors understand the levels of risk exposure that will be assumed in advance of committing to investment. Sukuk funds have benefitted with regard to investment flows as they offer what many investors perceive to be a safer investment. With the increase in demand for sukuk, more sukuk-specific funds are and will be launched, given their geographical diversification across new markets.

Although sukuk funds were able to recover following the financial crisis in 2008, producing alpha returns throughout 2009 and demonstrating resilience since then; performance has been reflective of that offered by the fixed-income conventional markets. As more countries and corporates issue sukuk, this will increase availability and access to the HNW market in terms

of tenor mix, geographical spread and yield profile. The sukuk market has become the fastest-growing segment of the wider Islamic finance market, having witnessed an annual growth rate of more than 40% between 2005 and 2012.

The last two years have seen strong, consistent sukuk issuance statistics, with sovereign issues continuing to dominate the landscape. Of particular note is the ever-increasing number of non-Muslim countries entering the sukuk market, some for the first time. In 2014, the UK became the first European country to issue a sovereign sukuk, closely followed by Luxembourg. Other new entrants to the market included Hong Kong, Senegal and South Africa.

The variety of jurisdictions declaring an interest in sukuk issuance will undoubtedly add to the diversification of this form of financing away from the GCC and Southeast Asia. However, the markets like Malaysia will remain central to the development of the sukuk market. Turkey has capitalized on the changes made to its local regulations with each of the participation banks having entering the market with sukuk. Also looking to make their debut in the sukuk market are no less than five additional African countries; namely Tunisia, Morocco, Mauritania, Nigeria and Kenya.

In Asia, reports suggest that Indonesia, Malaysia and Hong Kong may soon be joined by the Philippines and South Korea as potential issuers of sukuk. All of these developments are taking place against a background of tightening monetary policy across global markets and an apparent softening of appetite for emerging market investment in general. The ever-improving regulatory framework to support Islamic finance coupled with increased issuance of sukuk by sovereigns has now provided the meaningful benchmarking that was previously lacking.

Furthermore, the rolling issuance by Malaysia’s International Islamic Liquidity Management Corporation (IILM) of high-quality, short-dated sukuk have served to further expand the universe of options for Islamic wealth managers. From an Islamic wealth management perspective, sukuk funds, being an offshoot of the continuing general issuance of sukuk, are beginning to offer Islamic investors increasing diversification in terms of geography, volume, tenor, currency and value. This trend will continue and, more importantly (given the diverse jurisdictions of issuance), provide the much-needed liquidity that may have eluded investors in the past. This provides investors with a more balanced and diversified portfolio of Islamic assets.

The markets like Malaysia will remain central to the development of the sukuk market.

Islamic wealth managers have additional layers of “screening” to consider on top of the normal risk and compliance parameters. Shari’a compliance is paramount and because of this additional challenge, Islamic wealth managers at times feel somewhat at a disadvantage in comparison to their conventional counterparts.

Equities

Shari’a-compliant equities do not typically demonstrate the same supply and liquidity dynamics or attributes of the sukuk or murabaha market. As an asset class, equities provide sufficient depth that allows for the prospect of liquidity and risk re-profiling whether by geography, industry or region. Combined with Shari’a screening and well-developed indices around the world, this asset class has been a principal focus of the Shari’a-compliant investment space and can quite easily compete with conventional equities but with an ethical bias.

By virtue of the liquidity of stock markets around the world relative to sukuk or direct investments, there are numerous opportunities for further growth of this market for Islamic wealth managers if this is an asset class that suits the portfolio requirements of the investor. Returns can be generated by accessing pockets of growth within regions, sectors or themes.

The volatility inherent in listed equities can be managed through asset allocation or diversification. Although this asset class is easily accessed (with minimum structuring) and easily liquidated if there is an urgent cash requirement, most recent indications showed that Islamic investors have a proclivity for fixed income like Shari’a instruments rather than equity-based ones. Much has to do with the current economic environment, where low oil prices appear to have prompted investors to adopt a tentative attitude and remain in cash or near cash instruments. Undoubtedly, sukuk and murabaha funds have been the biggest beneficiaries of this stance.

Challenges and Opportunities

For wealth managers, the liquidity conundrum will continue to be a challenge. But as the asset pool widens and becomes more diversified and global in nature, so too will the options and tools available to Islamic wealth managers through constant innovation and Shari’a consultation. Currently, conventional wealth managers have access to sufficient hedging instruments and mechanisms to optimize a particular portfolio. In contrast, Islamic wealth managers have additional layers of “screening” to consider on top of the normal risk and compliance parameters.

Shari’a compliance is paramount and because of this additional challenge, Islamic wealth managers at times feel somewhat at a disadvantage in comparison to their conventional counterparts.

Despite this, IWM’s have successfully demonstrated that although Islamic wealth management activities and more particularly funds, suffer from a lack of scale, depth and track record etc., the lower leverage of a Shari’a-compliant portfolio translates into a portfolio with lower risk and volatility. This has resonance with both the Muslim wealth community as well as the conventional wealth market.

Passporting

A constant theme in the Islamic wealth management space has been the lack of uniformity in the interpretation of Shari’a-compliant investments across jurisdictions. This has been a major challenge for wealth managers offering a suite of products that may be Shari’a-compliant in one jurisdiction but not in another. In this sense, the concept of passporting is a welcome development to partly address this issue and to try and drive economies of scale through a wider investor base with a perceived access to liquidity.

Though still a novel concept in Islamic markets, passporting has taken root among ASEAN countries. In theory, Shari’a-compliant funds from Malaysia could be accessed in Thailand. Similarly, a fund created in Brunei could be accessed in Singapore. Should the fund passporting drive be extended beyond ASEAN, it could have profound implications in markets such as Hong Kong, where Shari’a-compliant investing has not yet grown despite their recent issuance of two successive and successful sukuk. Hong Kong’s position as a gateway to mainland China will dramatically change the dynamics of Shari’a-compliant investing in Asia. Passporting could have a similar impact, should the GCC decide to promote this form of cross selling. Hence passporting has considerable, positive implications for Islamic wealth managers and could provide access to much-needed additional liquidity across the globe.

Distribution Channels

Another issue that remains a concern for wealth managers is that of distribution channels. Currently, wealth management products are distributed through the wealth management arms of banks, private specialist banks and financial advisory firms. Few, if any, are distributed through dedicated Islamic wealth management boutiques. Operations of these boutiques are typically loosely partnered with private banking firms in the more mature markets of Europe, or focused around niche segments such as private equity or real estate. Part of the explanation for this is that Islamic wealth management has been a relative newcomer and it is hoped that over time, Shari’a-compliant boutiques will emerge offering a full spectrum of services serving the Muslim wealth requirements worldwide.

Conclusion

A well-diversified portfolio of Shari’a-compliant funds offers the best solution for Islamic wealth managers in terms of liquidity and risk return dynamics, these being two of the key criteria focused upon by Islamic wealth managers when attempting to construct a balanced portfolio. Accordingly, because of the pre-eminence of sukuk funds in terms of volume and accessibility across various jurisdictions, these funds are currently considered to be the most versatile asset class. Islamic wealth management is a relative new entrant in the Islamic space but as the mass affluent sector matures, Shari’a-compliant solutions will also evolve in tandem with this growth. Shari’a standardization across jurisdictions, training and retention of Islamic wealth managers, sufficient distribution channels and product innovation; all form part of the ecosystem that will enable the structuring of a well-managed Shari’a-compliant portfolio and facilitate the broadening of liquidity management solutions for this ever-evolving market.