This chapter discusses the importance of takaful in putting together wealth management solutions. These solutions are explained at two levels; one for wealth managers advising their clients, and the other, takaful companies as clients seeking the right Shari’a-compliant avenues to invest.

The chapter assumes that the reader is aware of how takaful is structured and differs from conventional insurance in terms of eliminating or minimizing maisir (gambling) and gharar (semblance to game of chance and uncertainty), the basis of tabarru’ (the act of donation of contributions for collective benefit of participants), how interest or riba is dealt with, and the various models of takaful that are followed in different jurisdictions ranging from separate or combined contracts of wakala and mudaraba to waqf and cooperative Islamic insurance models.

A common fallacy is when takaful, or for that matter an Islamic wealth management solution, is seen merely as “a product” through conventional screens. Instead, the starting and end points ought to be about a system that is deeply rooted in what is good for society as a whole. It is therefore essential that in discussing takaful solutions for wealth managers in the context of Islamic finance, it is put in the context of ethical dimension of what wealth is all about and how it needs to be protected within the bounds of the ethical dimension.

Another point to bear in mind for wealth managers is that it is not just for individuals and businesses that they need to consider takaful solutions for protecting and preserving wealth, but in a wider role to find investment solutions for funds generated by takaful companies in Shari’a-compliant assets.

The ethical dimension comes from a set of principles and doctrines, which defines the purpose of existence of people making up the society and the relationship between the Creator and society. This is encapsulated in a code of conduct that differentiates between the spiritual and material life, and for the latter, it is about the toil and struggle made for a productive labour to earn a just reward. This reflects the social justice of rewards to be commensurate with our genuine toil on the one hand and knowledge and understanding that we seek and aspire for, that gives us the ability to work and excel.

The dimension of social justice and equality lies firstly in the fairness of opportunity to generate wealth according to our ability and then to share it through our social responsibilities, including zakat which is an integral part of the act of wealth sharing and its distribution.

The creation and use of wealth has strong ethical social dimensions. When life ends, all ends, but the sum total of our wealth remains behind, and gets shared or needs to be shared.

The drivers of wealth creation in the ethical dimension of Islamic finance are, among others, the following:

- The use of money as “real and tangible” capital and not “potential” capital, recognizing the time value of money and economic values devoid of interest or riba;

- Ways in which borrowers and lenders share financial risks and rewards based on 1 above;

- Economic activity built on fairness and productivity that does not harm society and environment;

- Transactions that avoid speculative dealings, hoarding, and extreme uncertainties; and

- Contracts that must have clarity and transparency.

Wealth that gets created, driven by the above parameters, upholds social responsibility. The returns that are generated out of this economic activity have positive benefits for the society through promotion of healthy business environment and ambience.

The utilization of wealth for the overall benefit of society requires us to look at the inherent risks that can destroy wealth and therefore how these risks ought to be managed. This provision of financial security and protection is why takaful must be

an integral part of the thought process on wealth preservation.

Takaful plays an important economic and social role as it is structured on the principles of cooperation for people and businesses. It is a mechanism for sharing inherent financial risks within pools of specific risks built from contributions of those seeking financial protection and managed on sound scientific techniques by the wakeel, i.e., the takaful provider.

At the business level, takaful promotes trade and economic activity and contributes to capital formation by collecting takaful contributions in building capital to back risk. Takaful solutions help businesses to manage complex risks associated with global supply chains. With financial protection of takaful, businesses need not keep large precautionary capital reserves. They can free their resources for more productive use.

At the people level, takaful minimizes financial dependence of individuals on families and communities in case of adverse events. The social dimension of takaful extends to poor families and communities who lack means to protect their meagre livelihood sources.

Takaful, like insurance, works well in protecting the insured only when risk pools are large as it is the law of large numbers that provides value in return for smaller contributions of individuals and businesses. The sum total of the pooled contributions becomes large and gets invested as reserves and provisions for future claim payments. Reserves pertaining to general takaful are for one-year contracts and therefore invested generally in more liquid assets compared to family takaful contracts that are about long-term protection and savings. There is usually a long lag between when contributions are pooled and invested and when the insured events occur, triggering claims payout.

The utilization of wealth for the overall benefit of society requires us to look at the inherent risks that can destroy wealth and therefore how these risks ought to be managed. This provision of financial security and protection is why takaful must be an integral part of the thought process on wealth preservation.

These reserves are invested in capital markets for a long period and therefore family takaful risk pools are much better prepared than other types of investor categories (banks, services, institutions) to ride out short-term financial market fluctuations.

The risk-sharing DNA of takaful means the surplus is distributed amongst the insured population when there is sustained profit streams (i.e., when total claims paid over a period of time after allowing for expenses and future reserves are less than the total contributions paid for that period, plus an element of investment return on invested assets). This “surplus sharing” is one of the characteristics of the system of takaful; it is one of the main differentiating features of takaful from conventional insurance, the latter operating on the basis of “risk transfer”.

By accumulating large pools of capital invested in real assets and Islamic financial instruments, takaful industry fosters capital formation. Takaful assets are not like assets of other Islamic financial institutions. Ideally these need to be matched in size and maturity on the liability side that ranges from liquid and semi-liquid secure assets to equities, real estate, sukuk and other longer-term Shari’a-compliant instruments.

The risk consideration for wealth managers would be the types of risks affecting wealth, income and livelihood of HNWIs, shareholders, directors, partners and proprietors of SMEs, entrepreneurs and owners of businesses. These risks generally fall in the following categories:

- Business Risks: Risks to physical assets and activities that affect wealth of an individual or a business, like property, transportation, business, construction, engineering projects, trade etc.,

- External Risks: Professional and third party risks (law suits etc.) affecting businesses, projects and trade, and

- Personal Risks: Health and life risks and associated liabilities of wealth utilization during prolonged life spans in retirement and estate planning for unsettled debts, inheritance taxes and duties at death. Such planning is so critically important during our lifetime when we have the ability to find solutions instead of leaving behind problems after death that adversely affect dependents and others.

Takaful solutions to cover such risks are divided into three categories:

a. General takaful, for protection of physical assets;

b. Protection & savings, for risks at individual level in case of death and disability; and

c. Medical expense protection, for sickness and ill health.

It has to be said that takaful industry is still evolving, and a comprehensive solution may not be readily available from a single takaful provider, especially for businesses where large capacity is needed to insuring, for example in sectors such as oil, energy, and aviation etc. However, there are underwriters for “special risks” entering the Shari’a-compliant space now. Many such risks that are not offered by takaful companies directly can be arranged through such special risks underwriters.

Some of the takaful solutions for preserving wealth are described as follows:

a. For Businesses and Public/Private Industrial and Infrastructure Projects

Financial protection is needed for risks to physical assets and loss of income resulting from damage to these assets. Takaful products that provide protection for such risks are for motor, property, trade, shipping, engineering, construction, operations of businesses in manufacturing, industry and agriculture and protection of infrastructure projects such as rail, roads, dams, energy etc. It also covers third-party risks, professional indemnity, business interruption, terrorism, cyber hacking etc.

This is the most critical segment concerning businesses and how it affects wealth of business communities and national economies. The risks covered here are easier to understand (compared to risks for individuals), protecting essentially the physical assets, business projects and associated activities.

Despite this being the most developed segment in takaful, there is a huge gap within the Islamic finance industry, where new projects worth billions of dollars funded on a Shari’a-compliant basis get insured conventionally through global relationships of financiers, international brokers and insurers/reinsurers.

This is to the ultimate detriment of Islamic finance itself as a whole. We stand to lose out collectively if we fail to include takaful in business financing deals of Islamic finance and infrastructure projects. With this half-hearted support, takaful industry will not be able to build capital formation to the same extent that exists in the conventional financial services industry and insurance.

Islamic wealth managers and investment bankers have a part to play in helping to bridge this gap. They need to address such issues at the time of putting together Shari’a-compliant financing terms of such projects; to insist protection through takaful coverage. One genuine reason to go for conventional insurance by lead managers is the lack of capacity of takaful companies to underwrite large risks and inferior security of some takaful providers, being new and still going through a process of stabilisation and financial maturity. On the other hand, if takaful companies are never invited to tender for such projects, they will never be able to move forward and find ways of harnessing their resources and capital in building capacity and financial security.

b. For the Well-being of Individuals and Families

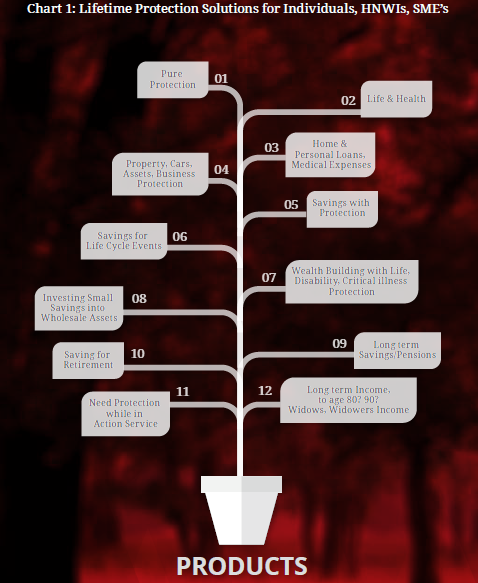

The key driver for seeking a solution is “family protection”. Chart 1 illustrates takaful products, addressing risks that might affect our ability to save due to disability or death, solutions for building a savings fund for life-cycle milestones (funding for education, wedding, hajj and retirement), longevity risk of having to dip into one’s life savings from living longer than expected (pensions annuity products), and paying for medical expenses for sickness and major illnesses.

A pure protection policy on its own provides an amount of money (sum insured) to cover business liabilities or a hedge against erosion of personal wealth. This availability of funds at the time of dire need helps the dependants to continue the lifestyle they had become accustomed to as the insured, the main breadwinner, passes away or suffers a debilitating illness or injury impacting his or her ability to earn. The proceeds from such products also have the additional attraction of being exempt from taxes in tax jurisdictions.

The amount to be insured has to be commensurate with wealth to be protected. This financial underwriting is essential in justifying the amount of cover genuinely needed to avoid misuse and fraud. An example of estimating sum to be insured can be assessed along the following lines.

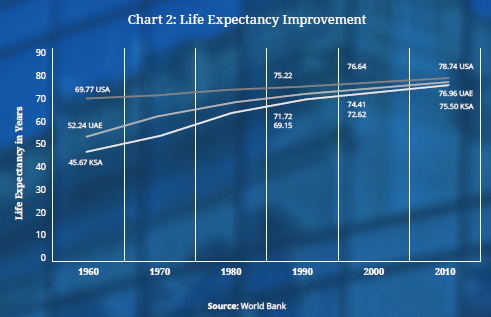

The magnitude of one’s worth is based on one’s ability and capacity to generate and build wealth during one’s lifetime; our lifetime is linked to average life expectancy according to the conditions in places where we spend most of our lives.

Chart 2 illustrates how our average life spans have improved over the years from 1960 to 2012 for USA (69.8 to 78.7 years), UAE (52.2 to 77.0 years) and Saudi Arabia (45.7 to 75.5 years), an improvement of 9 years in USA, 25 years in UAE and 30 years in Saudi Arabia over a period of 50 years.

Consider a 35-year old high net worth individual or an SME business partner in the UAE with monthly tax-free income of just over AED150,000 (equivalent to US$0.5 million) per annum. The life expectancy in UAE is around 77 years. His earning capacity from business is to earn US$0.5 million per year for at least until retirement and then to make provisions to have a means of enjoying same level of income for another 15, 20 or more years. Considering average number of years is 42 from age 35 to age 77, the total earning ability (the worth) would be around US$21 million. To this can be added an average increase for each year based on growth of future earnings and inflation. An increase of around 2.5% for each year can add another US$14 million to arrive at potential worth of US$35 million. This is of course hypothetical but gives a ballpark figure of what one should aim for in making provisions. No doubt, several factors affect the ability to generate this worth. What amount can be the right amount to insure will be a function of financial and medical underwriting as well as Shari’a considerations of the element of unknown in such assessment.

While there is a good range of products available for protection, savings and medical expenses, the development of good Shari’a-compliant annuity products is hampered due to limited availability of long-term, secure income, and marketable instruments such as sukuk. A good generous pensions provision by the GCC governments has been one factor of why private pensions have lagged behind, but this is fast changing due to demographic and economic shifts taking place in these countries, including the end-of-service unfunded liabilities in the private sector of the growing expatriate population.

Small and Medium-Sized Enterprises

A segment that would be of particular interest to wealth managers is that of SMEs.

The SMEs are exposed to great business risk if they do not have protection against loss of a key person within their business enterprise. This is in addition to the normal protection that their businesses need in protecting their physical assets (premises, stock and vehicles).

What the SMEs also need to protect is the human asset on which their business depends so much, and if left unprotected it can potentially ruin their business in future. Such “key persons” (like business owners, managing directors, CFOs or sales managers) have skills and expertise that make them invaluable to the business and therefore difficult to be replaced. Their absence becomes the biggest challenge to the profitability of the business and even to its very existence. Their loss can adversely impact the surviving business partners’ ability to pay out business liabilities and sustaining continuation of the business.

Types of Solutions for SMEs:

a. Protection for the Key Person

Loss of key person can hit the business with loss of profit, business disruption from reduced sales, and cost of recruiting and training capable resources in trying to bridge the gap. The solution is for the key person to take family policy that can also include additional risks of critical illness.

b. Protection for the Business

One major risk for SMEs is that if one of the business owners is diagnosed with a critical illness or dies, the business’ ability can be compromised to repay a financial debt or a personal guarantee and the business’ profitability is exposed to huge risk. The financing bank will normally want to secure its financing exposure and may require them to take control of the business assets to do that. This can adversely impact business’s sustainability. The solution is to take a business protection cover that provides liability protection, enabling the business to repay money owed if the key person dies or is diagnosed with a critical illness.

c. Protection for Partners

This is about how the surviving partners can be financially secure if a business partner or major shareholder dies. When that happens, the family of the deceased partner is likely to inherit his or her share of the business and the surviving partners may struggle to find the funds to buy out the family’s share. The “partner protection solution” allows surviving partners to keep control of the business, while providing the family of the insured key person with the much-needed financial security.

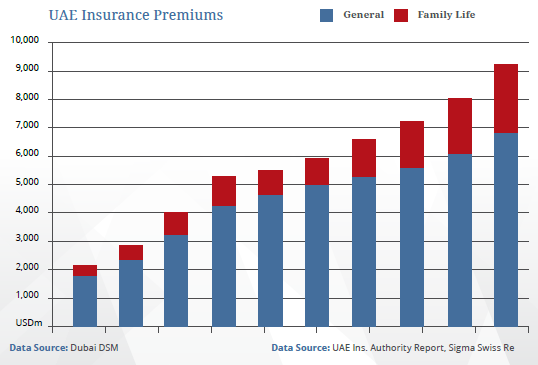

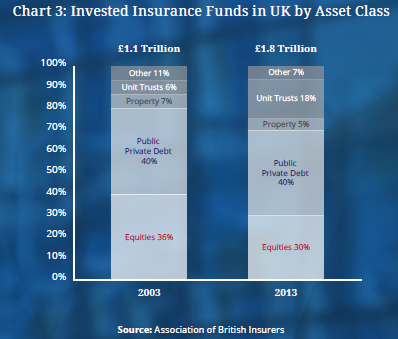

Chart 3 illustrates the importance of insurance industry to the investment world, making available huge amounts of money to be invested.

At the end of 2013, UK insurance market held £1.8 trillion of assets, of which £1.68 trillion (93%) was held by life companies selling long-term savings and life insurance products.

Approximately 45% to 50% of assets invested were in equities and unit trusts, 40% in public and private debt, around 5% in property and another 5% in alternative investments including liquid assets.

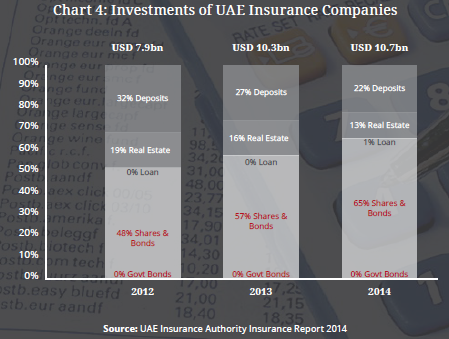

This reflects asset profile of a developed conventional insurance market dominated by reserves from long-term savings and life insurance, and also the free reserves (that are not needed to back insurance liabilities); the latter can be invested more freely but prudently beyond the statutory limits. Compare this with profile of insurance companies in the UAE in Chart 4. Investment in the real estate is much more pronounced and although it does not show split between shares and bonds, a large part of it would be in equities.

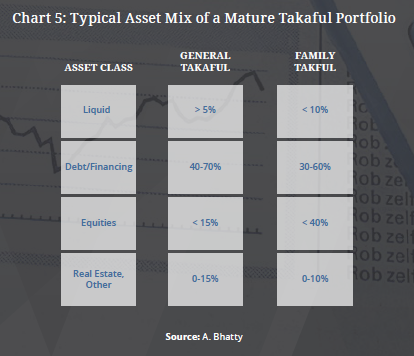

It should be noted that the above mix does not reflect mix of investment portfolios of individual insurance/takaful companies. That mix would be a little different with variations according to liability profile and how this impacts capital and reserves. Local regulatory investment limits also affect this mix. A range of asset mix is illustrated in Chart 5.

There is still a shortage of Shari’a-compliant assets that are ideally suited for insurance liabilities. An insurance/takaful company needs to be able to pay claims, but the claim incidence and magnitude of claim is not known at the outset. The security of the invested assets is therefore paramount.

In takaful, there is preference for assets with low-risk and secure returns of income and capital, including sukuk. Equities are essential to improve overall returns. For life takaful and pensions, equities become a focus to the extent of customer expectations built out of benefit illustrations for 5 to 20 years or so.

Established takaful companies, same as established insurance companies, provide long-term funding via the capital markets. They can also play a significant role in supplying long-term funding to governments for infrastructure projects, to private equity for innovation and direct financing to SMEs for development of businesses and economies.

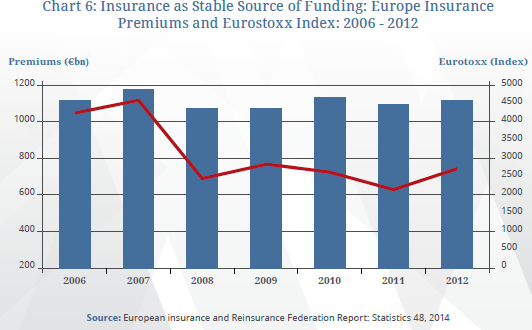

As takaful is still a small subset of insurance, takaful industry together with insurance, plays a stabilizing role in periods of market stress. In counter-cyclical times there remains continual flow of insurance premiums with predicable liability outflows, enabling them to hold or even buy assets that may be temporarily undervalued during the downturn of capital markets.

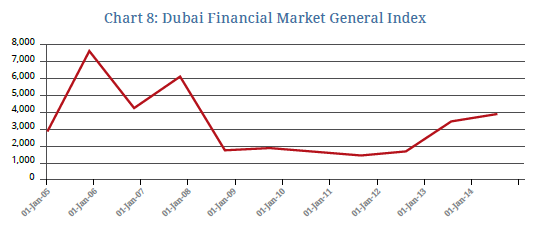

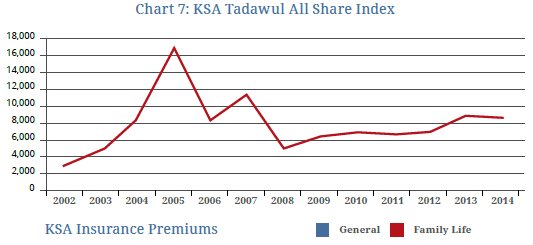

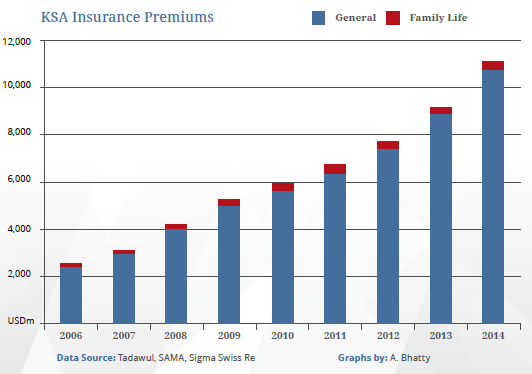

This is illustrated in Charts 6, 7 and 8, showing the position in Europe, compared with UAE and Saudi Arabia; the two major insurance markets of the GCC.

The Tadawul All Share Index in Chart 7 reminds us of the heady days of 2003 to 2005, with the roller coasters that followed well into 2008. But the insurance industry premiums and reserves continued to rise, although there have been several other factors, such as pricing inadequacies in the face of fierce competition, that weakened the ability of insurers to be as active in the capital market as the European insurers.

The UAE insurance/takaful market has shown similar trend but with much higher penetration in the life family protection market than Saudi Arabia.

Conclusion

Takaful industry has the capability of delivering superior performance compared to the GDP growth of a country, provided there are conditions conducive to its growth and development. This should be seen in the context of the fact that takaful growth has far lagged behind the growth of Islamic finance with the exception of few examples. Investors and entrepreneurs who have put together their capital into takaful ventures must do much more to support takaful growth. They need to orchestrate better, and demand better mobilization of the engines of Islamic finance in making protection through takaful, directly or indirectly, a must in any and all programs of Islamic wealth management. The current state of accepting conventional insurance solutions for Islamic finance needs an innovative disruption by the boards and management of both the takaful companies as well as Islamic banks and funding organizations.

The product solutions are there, and the Islamic finance industry needs to align its energy in demanding solutions from takaful companies if any are missing.