In the last two decades Environmental, Social and Governance (ESG) and Shari’a-compliant investing have been the two fastest-growing areas of finance and showed resilience during the global financial turbulence especially when compared to the near-collapse of other investment categories.

The growth of ESG and Shari’a-compliant investing is mostly demand-driven. Both these approaches are generating avid interest across global financial markets, driven by institutions that are increasingly Common Ground While conventional finance has always been driven by the effort to maximize risk-adjusted returns, Islamic and ESG investors have an additional goal to ensure that financial market activity is compatible with investors’ ethics. Both sets of investors not only seek financial returns but economic sustainability.

ESG has become an established investment approach for global investors, stemming from a growing realization among investors that the incorporation of such criteria into the investment process to reduce devotion more resources to them. They both aim to create real value to the economy by providing real jobs that complement real growth of businesses, leading to sustainable economic development.

We believe ESG and Shari’a-compliant investing share many similar features and commonalities. In addition, we envision that these two very important investment methodologies could build on each other’s success when integrated into a single umbrella, given how they both have transparent structures.

The purpose of Shari’a-compliant investing is to improve living conditions and well-being, establish social equity, and prevent injustice in trade relations. In its application, waste and excessive consumption are deemed unacceptable. These elements closely resemble those of Socially Responsible Investing (SRI): keen focus on sustainable development, creation of wealth for society, and improvement in the quality of life.

Both ESG and Shari’a-compliant investment approaches demand that the businesses chosen for investment are socially useful, non-detrimental to humanity, and comply with humanist ethics. Both practice ethical exclusions as part of their investment rules, and their common list of forbidden sectors include alcohol, gambling, tobacco and weapons – businesses that are condemned or deemed harmful for man and society.

Although the principles of Islamic finance date back several centuries, its practice in modern financial markets has only been recognized in the 1980s, and it took until the start of this century for it to gain a meaningful share of global financial activity. By most estimates, the total volume of Islamic financial assets has grown by 15% to 20% annually in the last two decades, and now exceeds US$1.65 trillion.

Similarly, ESG coalesced as a recognized investment strategy in the 1980s, and only gained significant size in the last two decades especially after then United Nations Secretary-General Kofi Annan announced the United Nations Principles of Responsible Investing (UNPRI) in 2006. The total volume of assets held by explicitly ESG investors is estimated to have increased by more than 30% since 2005, and now exceeds US$21.4 trillion.

From Negative Screening to Impact Screening

Often called ‘negative screening’, the most common strategy of ESG is the very clear avoidance of businesses that fail to meet investors’ ethical and moral standards. In the last decade though, ESG investors have actively explored positive ‘impact screening’ techniques — an active search for businesses that have proven their beneficial social or environmental impacts. This proactive approach also negates criticism directed towards ‘green-washing’: impact investors are looking to fund efforts that achieve specific and measurable change, and do not rely on marketing themselves as environmentally friendly when in fact their environmental, social and governance criteria are not very strict.

Negative screening ensures that Shari’a-compliant investors do not invest in activities or structures prohibited by Islam, but these investors do not necessarily have an opportunity to support activities they believe in. The concept of development in Islam has three dimensions – self, earth and society – and all three dimensions assign heavy responsibility (or lack of it thereof) on individuals and society. If balanced development is defined as progress, positive or impact screening could open up many new doors for the Islamic investor by uniting investments that generate measurable positive social impacts.

When ESG is integrated into financial analyses, various ethical criteria are brought into the mainstream financial industry, and they help close the gaps between conventional, Islamic and ethical investments.

Based on a confluence of research, performance and demand in this field, at SEDCO Capital, we are not only Shari’a investors but also ESG-compliant. In July 2014, SEDCO Capital became the first Shari’a-compliant and first Saudi Arabian asset manager to be a signatory to the UNPRI.

In public equity SEDCO Capital have launched four ESG/Shari’a-compliant funds with AUM of more than US$550 million. In private equity, among other responsible investment activities, SEDCO Capital are the Shari’a advisor to a Brazil-focused timberland fund, which emphasizes sustainable development of commercially managed timberland in Brazil. In real estate, SEDCO Capital are the anchor investor in India’s leading sustainable green research complex in Bangalore.

Moving forward SEDCO Capital aspires to deploy Shari’a /ESG investment platforms across all our asset classes and investment strategies and take the total AUM under a combined umbrella of ESG and Shari’a-compliant investments to more than US$850 million.

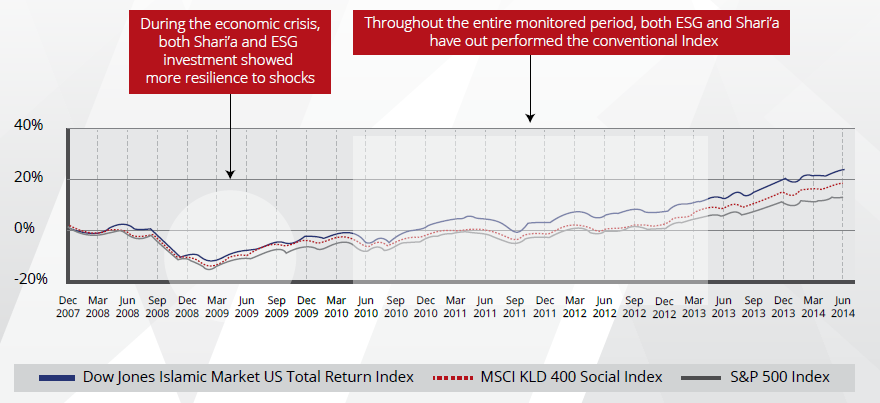

ESG and Shari’a-compliant investing merged — Prudent Ethical Investing (PEI) is a term created by SEDCO Capital that brings together the ESG and Shari’a-compliant methodologies under one umbrella. While these disciplines are responsible in nature, Shari’a adds the “Prudence” element into the equation, serving for calculated asset-backed financing risks and stronger long-term performance (see chart below). While it only allows up to 33% of capital, Shari’a-compliant investing made it possible not only to outperform the conventional index, but also to be more resilient to shocks and market fluctuations. An example has been seen a post-global financial crisis of 2008, where clearly under these conditions both Investment methodologies outperformed the conventional index.

Crossover and Convergence

Despite an obvious association between Islamic finance and ESG — in their history, figures, definitions, developments, methods and challenges — there has been very little or almost no formal interaction between the two. Although the financial community now concurs that the two are compatible, many people think that there cannot be natural links, because they do not employ the same expertise, or target the same clientele.

The ongoing success of Islamic finance and ESG may not seem correlated today, but financial experts, research centers, ratings agencies, non-governmental organizations (NGOs) and regulators can easily consolidate the two approaches to make it so much more cohesive as to be corroborative.

Islamic finance can easily adapt many methods used in ESG with broader concepts standing to be modified in order to adhere and conform to Islamic principles. Arguably, the most important aspect that Islamic financial institutions should look to learn from ESG is its familiar engagement with managers of companies and stakeholders to encourage them to embrace responsible practices.

Green development funds which specialize in specific infrastructure assets, and sustainability funds which invest in businesses involved in waste or water management may not have Shari’a-compliance at their core, but have the potential to hold vast appeal for Islamic investors. On the other hand, many Islamic funds already meet the strictest criteria of the ESG investor who remains unaware of or misinformed about Shari’a-compliant investing.

Values-based investing will be an industry game changer, as Islamic finance is not only seen as a veritable point of convergence between the East and the West, but also within and inside Islamic societies, in particular secularist movements in countries affected by the Arab Spring. Shari’a-compliant products that focus on producing specific, socially positive impacts could be another vehicle to bridge the gap between conventional and Islamic finance by attracting non-Muslim SRI investors into the Islamic finance market.

Greater acceptance of Islamic financial products among non-Muslims can only be spurred by the continued growth of ESG among conventional investors. As long as both approaches do not have any conflicts, they are not only compatible but also complementary, and the integration of ESG criteria offers additional ethical and financial value, notably by limiting risk.

All SEDCO Capital funds that are both ESG and Shari’a-compliant encourage best practices in governance and responsible investing, and above all, we hope these set an example for our peers in the Shari’a and non-Shari’a spheres, so that we all move equitably in the direction of sustainability.

ESG-Islamic crossover products will definitely make a market appearance if investors call for it, but the current level of compatibility suggests that eventually, there may not even be a need for separate products.