A global survey on knowledge of Islamic wealth management amongst individuals and their attitudes towards it – demand side analysis – and practices of Islamic wealth management – supply side perspectives.

Edbiz Consulting conducted a global survey of knowledge, attitudes and practices of Islamic wealth management to assess demand for Islamic wealth management services, and to compare such demand with supply of such services, with a view to identify demand-supply gaps.

Methodology of Survey

A detailed questionnaire was designed to capture various aspects and levels of knowledge and understanding of Islamic wealth management amongst the respondents who were drawn from a database of 10,000 contacts from the address book built by Edbiz Consulting (“Edbiz database”) over a period of 15 years by its employees during their professional careers in Islamic banking and finance (IBF). As the contacts in the Edbiz database are expected to have some kind of affiliation with IBF, it is fair to assume that the respondents had some prior knowledge of IBF, if not of Islamic wealth management. Thus KAP study assesses knowledge and understanding of Islamic wealth management amongst those who have prior exposure to IBF.

It was decided to send out questionnaires to 5,000 contacts randomly selected from the Edbiz database. After repeated reminders, we were able to generate response from 100 respondents. In addition, we had 50 responses through structured interviews with the industry practitioners to capture the supply side situation.

Data Description

Admittedly, the sample was highly based in favour of the male, as there was almost no representation from the female (98 out of 100 respondents were male). Similarly, all the respondents happened to be Muslims.

The sample was also highly educated, as all the respondents had at least a masters degree. Respondents came from all management positions, from the lower middle management (13%), middle management (21%), upper middle management

(44%), and top executives like CEOs, CFOs and CIOs were 22%.

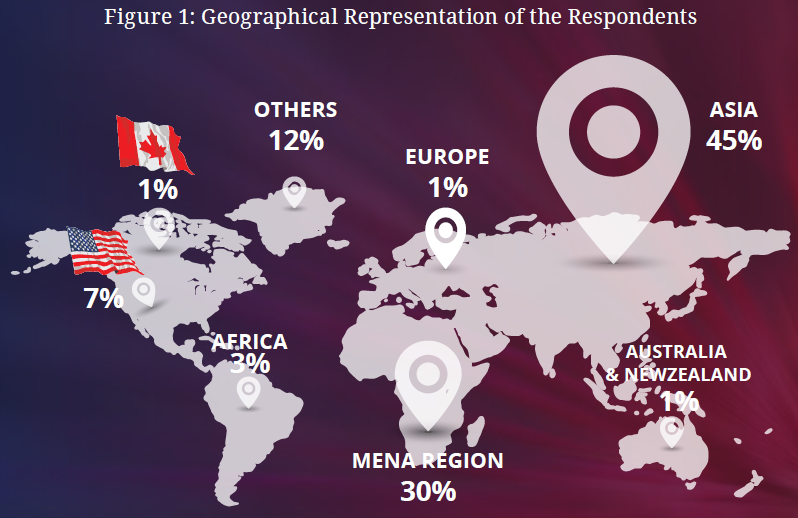

Although our intention was to draw our sample from all over the world with equal proportions, majority of the respondents came from Asia and MENA. About one-fourth of the respondents came from other regions.

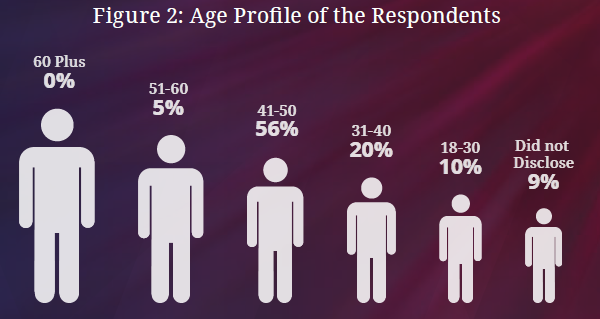

Majority of the respondents came from 41-60 age bracket (61%). There was none from the 60+ age range, which was primarily due to the choice of the universe of the database that contained only those in full-time job or economically active. 30% of the respondents were either 40 years or less; and 9% decided not to disclose their age.

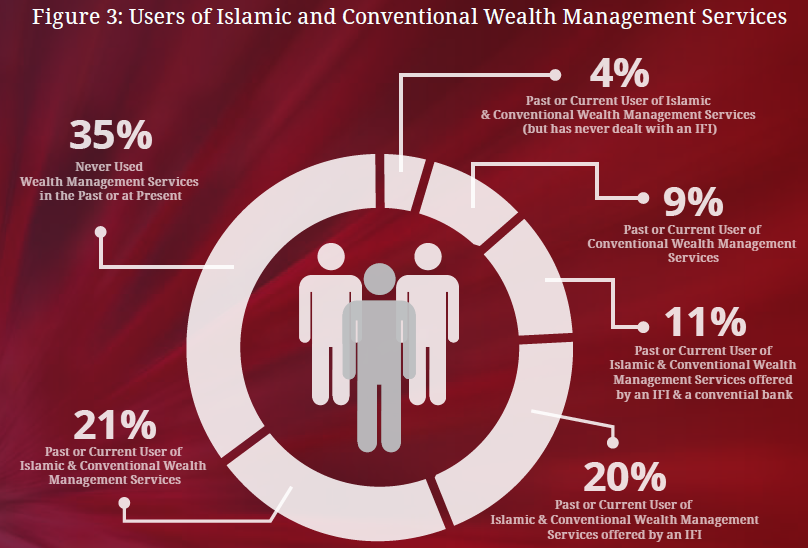

It is interesting to note that 35% of our sample had never used Islamic wealth management services at the time of the survey or before that in the past. Another 13% of the respondents had never used the wealth management services offered by an Islamic financial institution (IFI), although 9% of them had used Islamic wealth management services offered by a conventional bank. This means that almost half of our respondents (48%) had never used wealth management services offered by an IFI. Only one-fifth of the respondents can be categorised as purists, i.e., those who only used Shari’a-compliant wealth management services offered by an IFI. More than one-third (35%) of the respondents happen to be floaters, i.e., those who used Islamic and conventional wealth management services offered by Islamic and conventional wealth managers. Apparently, these respondents chose wealth management services only if they happen to be comparable in terms of their risk-return profiles and were indeed agnostic to whether such services were Shari’a-compliant or not. This is an important observation, as more than half of those (nearly 54%) who used wealth management services fall in this category. 9% of the users of wealth management services never used Islamic wealth management services.

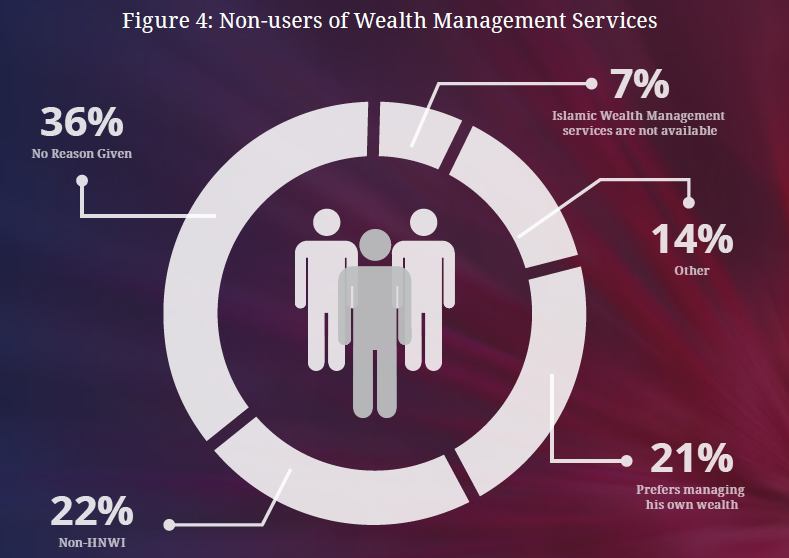

Further analysis of those who never used wealth management services reveals that only a fraction of them (7% of 35; or 5% of the total sample) possibly do not use wealth management services purely for religious reasons. Some of them either had too little wealth to hire services of a wealth manager or preferred to manage their wealth by themselves. However, a significant proportion did not give any particular reasons for their lack of demand for wealth management services.

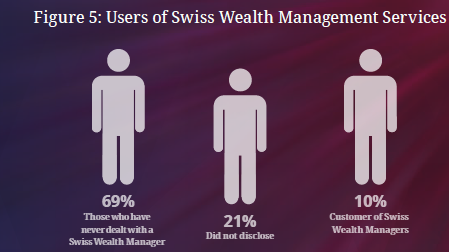

In our sample, there were not very many respondents who disclosed that they had ever used wealth management services by wealth managers like Swiss private banks. A vast majority (69%) had never dealt with a Swiss private bank or a wealth manager. It happens to be the case that all those who used wealth management services by a Swiss bank had dealt with only one bank, that is, Credit Suisse.

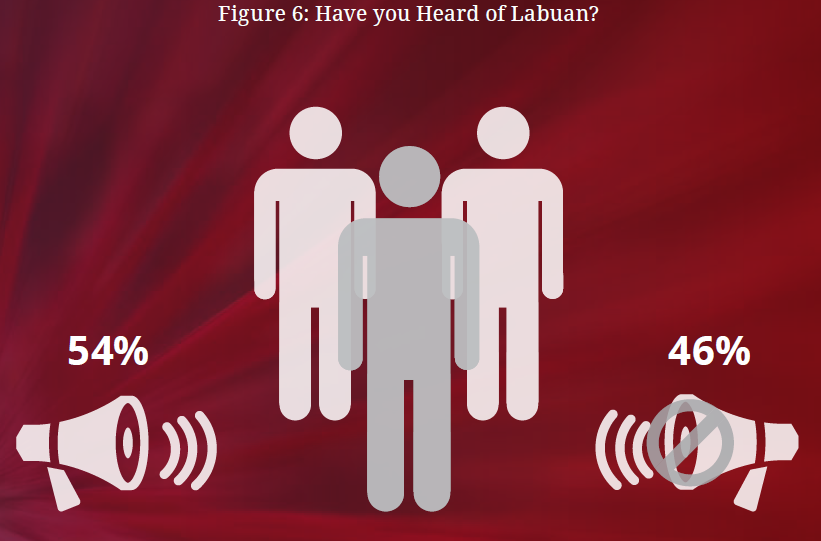

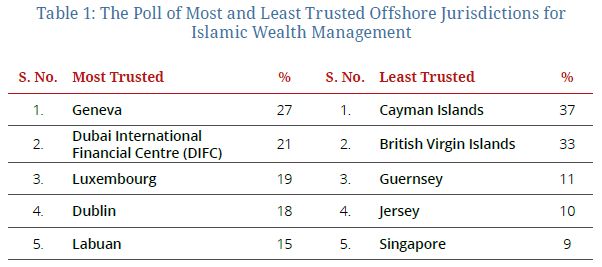

Although only a fraction of our respondents use offshore Islamic wealth management services offered by Swiss banks and financial institutions, 54% of them have heard of Labuan and it being a centre of excellence for Islamic management. Labuan is regarded as the leading Islamic wealth management services provider. In a follow-up telephonic survey, the respondents were asked to rank their perceptions of the most and least trusted offshore jurisdictions for Islamic wealth management. The poll was topped by Geneva with 27% respondents revealing their preference for it as the most trusted offshore jurisdiction for Islamic wealth management. Interestingly, 15% of the respondents considered Labuan as the most trusted offshore jurisdiction for this purpose. Cayman Island was revealed to be the least trusted offshore jurisdiction (see Table 1).

It must be noted that all those who voted for DIFC as the most trusted jurisdiction were located in the GCC, and those who showed their preference for Labuan came from Malaysia. This indicates that there is a definite local bias in case of these two jurisdictions, which may imply that there is a need to further market these two jurisdictions beyond the regions in which they are located.

Furthermore, all those who preferred Labuan as the most trusted jurisdictions ticked sukuk, Islamic wealth management structures, conventional wealth management structures, takaful, Islamic banking, ijara and Islamic funds as the services for which Labuan is known.

Why GENEVA remains the most trusted jurisdiction for Islamic wealth management despite the apparent failure of Islamic wealth management in Switzerland?

It is not surprising that Geneva tops the trust chart of Islamic wealth management. However, it is curious that Islamic wealth managers based out of Geneva and other cities in Switzerland have failed to attract any meaningful business from Muslim HNWIs and UHNWIs. Faisal Private Bank is an obvious Geneva-based casualty in Islamic wealth management. There are other swiss conventional banks (e.g., Credit Suisse, J. Safra Sarasin, and Allianz Global Investors, etc.) that have attempted to tap the Islamic wealth but have not met any meaningful success. Many industry observers believe that such players have faced a distribution puzzle for selling into Islamic market, despite having a jurisdictional advantage.

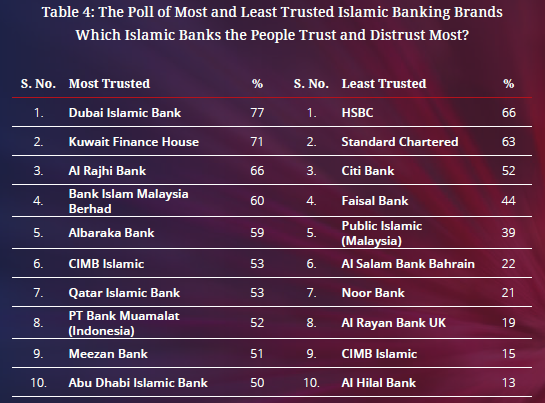

The offshore jurisdictions in Muslim-majority countries, on the other hand, should have home advantage, as most of the Islamic banks and other financial institutions find it relatively easier to distribute their Islamic financial products across different income brackets and wealth classes. For example, Dubai Islamic Bank (DIB) is the most trusted brand in Islamic banking (ISFIRE, November 2014). This can partially be explained with the help of its long history and visibility in the global Islamic banking market. DIB operates in multiple jurisdictions, including UAE, Pakistan, Jordan and Sudan, either as a direct DIB brand or through its subsidiaries or the companies in which it has substantial shareholdings. It also has its presence in DIFC. Other offshore jurisdictions like Labuan can target such players to operate their Islamic wealth management businesses from therein. The likes of CIMB and Maybank are obvious choices for Labuan but it has to expand its marketing campaign to include big Islamic players from other markets as well. In this respect, targeting the global players like HSBC, Citibank and other such players may not be a sustainable approach, as such banks are at best opportunistic and are first to exit whenever there is a sign of a slowdown in the Islamic financial services industry.

Knowledge of Islamic Wealth Management Services

Table 2 provides ample evidence that all the respondents were fully aware of the basic wealth management services (both Islamic and conventional). However, there is relatively less awareness of the Islamic wealth management services that are uniquely Islamic, i.e., banca takaful, inheritance advice, Islamic structured products, Islamic trusts or awqaf and Islamic foundations.

There is no doubt that Islamic wealth management remains at an early stage of development, and there is not sufficient awareness of it and the supply-side players amongst those who are interested in IBF. Almost 9 in 10 respondents reported that they had not heard of any Islamic private bank. Those who actually reported that they were aware of an Islamic private bank mentioned of Faisal Private Bank in Geneva, a bank that has for some time exited the market (see Table 4 for a list of the most trusted and the least trusted Islamic banks, according to a survey conducted by the London-based ISFIRE magazine).

Technical Note: The results are based on a total sample 1,011 respondents from the countries where the above-listed banks operate. In different categories, the number of respondents differ. For example, 77% of 323 respondents whose ranking included Dubai Islamic Bank (DIB) chose DIB as their number one choice in terms of the most trusted Islamic banking brand. The data are based on personal conversations with the respondents in informal environments. As part of our methodology, the respondents were not informed that their opinions will be counted as part of a poll.

Supply-side Perspective

Our global survey included 50 structured and semi-structured interviews with some of the leading practitioners and experts in the Islamic financial services industry. Most of the supply-side respondents presented a gloomy picture of the Islamic asset management industry in general and Islamic wealth management in particular. Summary of such interviews is given below:

25% of the respondents opine that Islamic wealth management will remain an activity on the fringe of Islamic financial services industry as long as sovereign wealth funds in the Muslim majority countries remain heavily invested in the conventional products offered by the mainstream financial institutions.

23% of the respondents observe that the governments in all the Muslim countries have followed a duality whereby they have ensured not to invest any meaningful wealth in Shari’a-compliant products while encouraging the private sector to go Islamic. This has not been helpful in developing a vibrant Islamic wealth management industry.

19% believe that there is no credible leadership in the Islamic financial services industry, which has a direct impact on the slow development of Islamic wealth management and private banking. “There is a definite trust deficit when it comes to managing wealth in a Shari’acompliant way.”

18% of the respondents were of the view that convincing Muslim HNWIs to invest in a Shari’a-compliant way was the hardest job. According to this view, “Islamic banking and finance is primarily a grassroots level activity; the wealthy is the least interested in IBF.”

15% of the supply-side respondents believe that absence or lack of regulatory framework for Islamic inheritance, awqaf and Islamic foundations was a major hindrance to the development of Islamic wealth management.

13% of the respondents believe that the lack of products for philanthropy in Islamic wealth management is a major reason for the relative smaller AUM in the industry.

50% of the respondents were of the view that all the above reasons were significant contributing factors to the relative slow development in Islamic wealth management.

Summary and Conclusions

The global survey suggests that Islamic wealth management industry, as a subset of Islamic asset management or on its own, has a long way to go. It remains highly underdeveloped. Islamic wealth management literacy is very limited on an individual, institutional and industry level. The institutions offering Islamic wealth management services remain small and have little appetite for research and development in the field. Without committing substantial resources, it will be difficult for any one player to tap into the Shari’a-sensitive Muslim HNWIs and UHNWIs who by and large remain customers of Islamic retail banks.

Islamic retail banks are the net beneficiaries of the customs of the Muslim affluent, HNWIs and UHNWIs who in most cases are not chasing returns but are rather content with parking their money in a Shari’a-compliant product, even if it does not offer attractive returns.