Life is never dull in the cut and thrust of global financial markets, but life is about to get even more exciting as we begin to exit the post-crisis low rate environment that most of the world has been enjoying for a number of years now.

Geopolitically, over the past 5 years the world has also witnessed a proliferation of regional conflicts, some of which have blown up to impact on the global stage and affected markets. One commentator recently pointed out that conflict are springing up at a faster rate than they are being solved which is unusual.

In addition, there has been a precipitous slide in oil prices, which is now being accompanied by falls in other key commodities. Social issues plague nations almost everywhere across the globe with Eastern European ‘Balkanisation’ being repeated elsewhere be it Kurds looking for autonomy, the Basques or the Scots.

Against this backdrop, the global economy has limped along and is slowly showing signs of improvement. Low-interest rate medicine is still the prescription of the day. The crucial questions that we face today are what happens next and how will this affect the investment landscape and wealth management.

As we move toward the final months of 2015, we see challenges surfacing already in the shape of lower oil/commodities in general, uncertainty in China and impending rises in US rates. The latter is one of the most important (and indeed talked about) events of the last few years.

Globally, it is worth noting that not all countries are on equal footing. Japan remains mired in a super-low growth environment and continues to battle against the destructive powers of deflation. Europe seems only recently to have realised that quantitative easing (QE) is the answer and have embarked on this path in earnest. Whilst initially the money multiplier seemed broken as banks failed to lend and liquidity went into real assets, there have been signs that this is changing and that European fortunes are slowly turning.

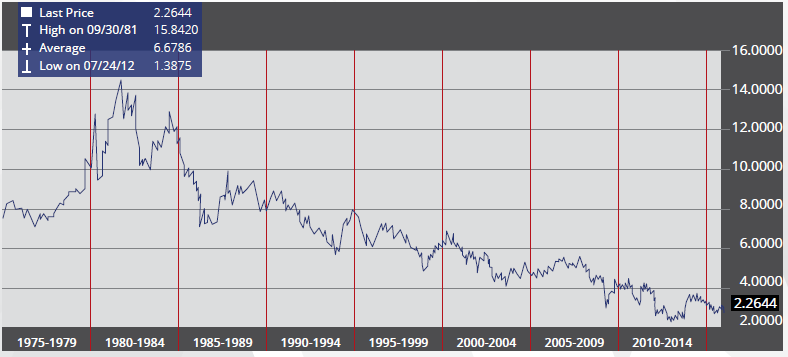

It is in the US that we believe the most important change is occurring and this will have a profound effect on prices, behaviours and wealth management. We are no longer talking about if rates will rise but when. During Q4 2015 or Q1 2016 looks likely according to market consensus which will mark the end of a bull market in bonds that one could argue from the chart below (which shows the 10-year Treasury yield) has lasted for 34 years.

During Q4 2015 or Q1 2016 looks likely according to market consensus which will mark the end of a bull market in bonds.

At its peak in 1981, the bond market yield sat at around 16% and the bond market structure was such that the duration (sensitivity to interest rate changes) of a portfolio was 4 and the yield 17%.

This is a crucial point as rises in interest rates were partially compensated by current income such that bonds usually looked OK even when rates rose (as a reminder of bond math, if the US curve rose by 1% in 1981 over a year you would lose approximately 4% in capital and gain 17% in income leaving you net 13%). Over the last three decades we have seen global bond holdings become the darling of the investment world as rates have come down and produced solid returns for pension funds, insurance companies and sovereign wealth funds alike. However there is a problem. Rates are now looking like they will head higher and the bond markets have changed. Current income now stands at 2% and duration at 7. This means that for the same 1% rise in the curve, investors will lose in the region of 7% as bond prices fall and are only partially compensated by the income of 2%. So the same 1% move in rates in 1981 that left you up 13%, would today leave you with a loss of 5%.

We believe that the multi-decade love affair with bonds will start to fade. It will take time for the numbers to feed through but fast forward a few years and a low to negative return environment will start to feed through to investment and asset allocation models. It is likely that volatility of rates will also increase meaning that asset allocators will be looking at output that is less favourable for traditional fixed income. Underlying clients will naturally be disappointed at sub-par returns and will look for solutions. For many it is simply not an option to buy equities as the need for relative stability and income will remain. We believe that we will see the rise of an asset class that has been on the margin of the investment world and under-allocated to. Increasingly badged ‘alternative credit’, this asset class provides the all-important income demanded by clients with relatively low volatility (in some cases much lower than traditional bonds). The icing on the cake is that they have no negative interest rate sensitivity in that they are priced off LIBOR rather than fixed rates. The catch? They tend to be less liquid which will affect the way that they are managed and offered by asset managers to investors.

Two clear examples of alternative credit are trade finance and loans, both of which are able to be produced in a Shari’a-compliant format. The former is ostensibly commodity financing and the latter has been around for a number of years on the margins of investment world in the form of ijara, for example.

So How Do These Two Investment Areas Work?

Trade Finance

Trade finance is an ideal alternative to traditional fixed deposits. They are essentially credit risk-based, income-driven products with extremely short tenors and low volatility. A trade finance portfolio is designed to offer clients an investment vehicle that behaves like a deposit, paying comfortably above the rates of 1, 3, 6, and 12-month bank deposits. The objective of the portfolio is to generate income whilst providing protection against rising interest rates and preserving capital, thus providing a hedge against macroeconomic trends. Trade finance transactions are resilient during economic turmoil and therefore rank as some of the lowest form of credit risk. Deals are often referred to as “preferred payment for essential goods”. As pricing is often in relation to LIBOR this nascent asset class provides a measure of protection in a rising interest rate environment and versus inflation. Displaying minimal correlation with other asset classes, trade finance products also offer important diversification benefits and thereby improve the risk/reward profile of broader fixed-income and multi-sector portfolios.

Historically, global commercial banks have leveraged off their presence in local markets and links with multinational manufacturers to dictate how the market has developed and how deals are priced.

The regulatory capital environment has changed. Opportunities are opening up for non-traditional players such as asset managers or non-banking institutions seeking to enter the sector. The volatile global economy and relatively low margins have led many banks to pause. Commercial banks are under pressure to pull back, and while the majority of small to medium enterprises may hold multiple banking lines, a preference for diversification is leading new players to set up non-banking lines such as the trade finance funds launched in recent years. Allocating to the trade finance asset class in a low-interest rate environment responds to GIB (UK)’s clients’ need for enhanced yield.

The Gulf and Asia are major players in trade finance, with significant opportunities especially in Asia leading to a surge of activity. These regions together generate around US$8 trillion of trade financing flows, and according to some estimates about US$2 trillion of that is in Asia, making it a massive and growing market. Islamic trade finance in particular is booming with new markets, new players and new products expanding its horizons and impressing its investors. In the

UAE, whether conventional or Islamic, trade finance is particularly popular with companies that import materials or have clients from outside the region. New players are moving into this fast-growing segment. For example in Indonesia, a country long targeted by foreign players for its natural resources and Islamic finance opportunities, the Islamic Trade Finance Corporation (ITFC) has joined with local players to boost the sector.

Loans

Loans are also an ideal alternative to traditional fixed-income investment classes. They typically offer a fixed spread over a base rate that changes periodically based on economic and market conditions. In contrast to most other fixed-income asset classes, senior loans typically pay a floating rate of interest plus an additional margin to compensate for credit risk hence can be considered as a longer-term inflation hedge. Loans also benefit from rising interest rates. Further advantages are principal protection through a preferred legal and structural or security ranking; priority repayment in the event of a default; higher average recovery rates, no duration risk as rates are set every three months and lower price volatility.

The Islamic market does need to do a number of things for these alternatives to be credible:

Supply side – The supply of assets to buy is still relatively scarce. Banks are still the main originators of Trade Finance and Ijara exposures and have historically wanted to keep hold of the asset. Going forward balance sheets will be examined more closely as the capital requirement of holding onto this exposure becomes more onerous over time. We have started to see on the conventional side already, banks getting in touch and looking to sell down loan exposure to free up balance sheets to get the all-important capital relief ahead of regulatory changes. Banks now prefer the ‘originate and distribute’ model rather than the more traditional model of originate and hold. Capital requirements hit Islamic and conventional institutions alike so we should see this phenomenon also appear on the Islamic side.

- Demand side – investors are still largely unaware of the benefits of these asset classes and the industry needs

to spend more time and energy to educate institutional investors and retail alike of the pros and cons. - Asset managers – most managers are simply not equipped from a process or expertise perspective to offer these products and much time and effort needs to be put in to improve buy side knowledge and expertise in order to match clients’ needs with suitable product suites.

The above asset classes will become more prominent as the next few years progress. Once rates have normalised and people return to bonds, there will still be a place for alternative credit as clients realise that there is now more than one solution for a clients seeking low volatility income provision, and crucially very low-interest rate sensitivity.

As a final word, we do not want to leave anyone feeling too depressed, our macro take is that now QE has been removed, the Federal Reserve will begin its tightening path in Q4 or at the latest Q1 2016. This tightening will be well-managed and gradual with the Federal Reserve highly sensitive to growth and inflation disappointments. While the emergency reasoning for a low-interest rate environment has been removed, the Federal Reserve is likely to continue to err on the side of caution, preferring to see more growth and a little inflation rather than preside over a slide back into a lower growth trajectory or deflation. The lessons learnt from the Japanese experience are still fresh in the minds of policymakers and also a bit of inflation would not hurt the US given the size of the stock of government debt.

What that means is that we do not expect an absolute bloodbath in the markets, but a period of indigestion is likely and sub-par returns will push investors toward alternatives. There is an old English proverb that says ‘necessity is the mother of all invention’ to which I will add ‘bond math does not lie…’

We believe that the multi-decade love affair with bonds will start to fade.