27th March 2014, National University of Computer & Emerging Sciences, Islamabad-Pakistan

Demand for Islamic banking and finance (IBF) is growing significantly around the world. With that it is important to educate the suppliers (Islamic financial institutions) as well as consumers on different aspects of IBF.

Edbiz Consulting launched the Islamic Finance Access Programme (IFAP) precisely to educate and train people on IBF. Edbiz have been organizing IFAPs on a quarterly basis for the last four years. The recent IFAP was organized in Islamabad on the topic of “Shari’a Compliance for Branch Level Staff” and was the 2nd in Pakistan.

The IFAP was hosted by National University of Computer and Emerging Sciences, (FAST-NU), and was sponsored by Financial Accreditation Agency (FAA) and Path Solutions.

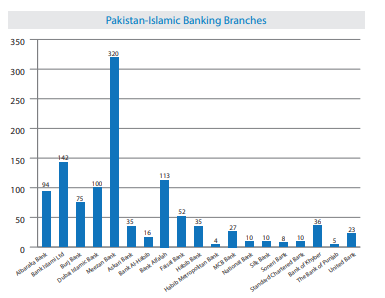

The registration desk was opened sharp at 8:00 am. There were approximately 80 attendees with representation coming from leading Islamic banks in the country including Meezan Bank Ltd, Al Baraka Bank, Bank Islami, Habib Metro, Burj Bank, UBL Ameen, Dubai Islamic Bank, Faisal Bank, Bank Alfalah and many more.

The Welcoming Address was given by Dr Aftab Maroof, Director of the Campus of FAST-NU Islamabad. He emphasised that we should spend our life in accordance with Shari’a rather than creating our own laws and trying to justify our own subjectivities. If we would spend our life in such a way then it would result in success in both this life and the hereafter. He stressed that the industry could not simply replicate conventional banking and that we have to define a pure Islamic model of banking.

The next session was given by Mr Muhammed Hanif, associate professor at FAST-NU for accounting and finance. He presented on the topic “Frontiers in Islamic Finance”. With 28% of the world’s population being Muslim (approximately 2 billion), the potential market for IBF is vast. To increase demand, more needs to be done to show the seriousness of transacting with interest. This is the foundation of modern conventional banking. He added that conventional banking led to the financial crisis as the financial products were not backed up by real assets. Islamic banking is asset-based financing, and if practised correctly, obviates the obliqueness and complexity of the conventional financial markets.

IBF encourages equity financing which limits or removes the avenues for the practice of the fundamental prohibitions in Islam such as interest, gharar (uncertainty), maysir and qimar (speculation). If the investor is seeking profits then he should also bare the losses that could occur. Mr Hanif further stressed that Islamic banks have to follow the Shari’a stipulations (khiyar) for sales and purchases. Mr Hanif enumerated five:

- An Islamic bank cannot claim an additional amount from a customer in case of default.

- Islamic banks cannot service depositors with a predetermined return.

- Islamic banks cannot avoid Shari’a compliance in their operations by arguing the non-conduciveness of the existing legal framework.

- Islamic banks cannot utilise speculative products such as futures and forwards.

- IFIs cannot extend loans except by qard hasan.

Mr Maroof then sketched a history of IBF. He started with reference to the objection of the receipt of interest from banks by Syed Abul Aala Maududi. The first Islamic financial institutions (IFI) to set up were Tabung Haji in

Malaysia and Mt Ghamr in Egypt. In 1973, the conference of Foreign Ministers of OIC took place resulting in the establishment of IDB, which opened its doors in 1975. In Iran, the revolution in 1979 led to the announcement that the financial sector would be completely Islamic. In Pakistan, the Council of Islamic Ideology Issued a comprehensive report on the “Elimination of Riba from the economy” which underpinned Zia-ul-Haq’s drive to Islamise the economy. However, the political optimism for an Islamic economy fell rapidly over the years until the 2000s.

Finally, Mr Hanif discussed the challenges faced by the industry and offered possible solutions. Challenges include:

- The use of Kibor as a benchmark for profit rate.

- Selling shares at par value of IFI in house financing.

- Purchasing sukuk at par value at the time of redemption.

- Charging a financial penalty in case of default by customer.

- Use of third-party guarantee of capital in case of sukuk.

- Use of time value-based computer software in calculation of instalments.

- The lack of profit and loss sharing products.

- Ambiguity relating to salam and istisna modes of financing.

Following a brief overview of the IFAP and a coffee and networking break, Dr Humayon Dar took to the podium. His lecture topic, “Seventy Times: Some General Tips for a Successful Career,” was an informative insight into how to succeed in the IBF industry. He said the most important thing is we should know what we want to do and we should enjoy our work. We should try to be the first to reach the office, and try to be proactive, interactive, exhibit positive behaviour and ensure we persist in working hard at the workplace. It doesn’t matter whether you are right or wrong, you need to have the courage to get the task done and to the highest quality. This is generic advice, and any industry employee needs to have that passion in their mind. However, the IBF industry is unique. Most IBF professionals are committed to the cause of IBF, but this is not enough. Far too often, their professional lives are entirely different from their personal lives. There is an added onus on a person in the Islamic finance industry to be ethical and moral in both their professional and personal lives. For a non-Muslim, any disparity can be accepted as the norms of Islam are not the norms he or she subscribes to. For a Muslim, on the other hand, the values of Islam are meant to be shared.

Mr Hanif believes that solutions to these problems lies through well-educated and trained human resources which can be achieved by such IFAP training programs. He ended his presentation by saying that IBF is the only hope for the future of the financial industry.

By working in the IBF industry one should not be smoking or drinking alcohol and should maintain good morals. Dr Dar stressed that there is no doubt that the IBF industry is primarily a business phenomenon, i.e., it does not have a hidden political or religious agenda, but it cannot be denied that the IBF industry has its own, unique set of values embedded in its fibre.

Following Dr Dar, Amir Khalil ur Rehman, ex-Islamic Corporate Head of Islamic Banking services at Askari Bank, delivered a lecture on the topic of “Answering FAQ’s in Islamic Banking”. The objectives of his presentation were to increase the general level of awareness. He started by distinguishing between Islam and Shari’a. He explained that Islam is the religion and Shari’a is the law. The way to live your life and the approach towards practising is given by the Shari’a. He commented that there is no standardization in the IBF industry and this is perhaps indicative of the divergence of opinion between different schools of thought. This is clearly reflected by the difference of opinions between the Binori Town and Dar ul Uloom where opposing fatwas can confuse people who are following these institutions for religious guidance. Harmonisation is required to minimise this confusion.

Mr Rehman then responded to some frequently asked questions. Many people are not convinced about the Islamicness of IBF and wonder if IBF is in fact Islamic. This is a common question, but it is flawed. IBF is an industry based upon Islamic sources. It is immediately different to conventional banking and finance and there is a clear distinction between haram and halal when comparing these two industries.

People pose questions about the permissibility of fixed returns worried that it may look like interest. However, fixed rental income and a fixed profit on sale transactions are accepted by scholars. Many have also expressed concern about returns being the same as conventional banking and financial institutions. This is acceptable according to the Shari’a.

A larger problem is that people are unable to see beyond the change of context between pre-modern times and contemporary times. Thus since banks were not addressed in classical fiqh books, there is anxiety that there is no concept of banks in Islam. This is true, yet it does not mean our efforts to create an authentic Islamic banking and finance sector should be wasted. The bank is good for the public, so we should attempt to create an Islamic version. Mr Rehman concluded with an elucidation of all the different types of contracts used in IBF and their differences to conventional banking.

Following Mr Rehman, there was a presentation by Path Solutions on “Shari’a Compliant Technologies” which was followed by a lunch break. The first session following this break was by Dr Amat Taap, CEO of FAA. He explained to the attendees the importance of standardization of qualifications in the IBF industry. He mentioned that standardization is very important for talent development. We need to know what kind of courses is required to develop the talent in IBF and how the content can be tailored to produce optimal results. While there are many courses and qualifications around the world, there is still a need to develop global standards in the IBF industry through which the lack of supply of Islamic finance professionals can be overcome in the emerging market. He said that the FAA is working to produce a framework for globally accepted standards. He added that we should create learning standards which should be for all levels – lower, intermediary and higher– focused on sectors such as takaful, capital markets, and Islamic banking.

The last session was presented by Dr Dar on “Understanding Shari’a Compliance in a Product Cycle”. At the end the chief guest HE Rashad Daureeawo, High Commissioner of Mauritius to Pakistan gave the closing speech and distributed the certificates to the attendees. Overall the feedback was very good for the event and all the attendees expressed interest in attending the next IFAP.