During the last decade, Islamic finance has raised its competitiveness and coverage vis-à-vis conventional finance, through Shari’a-compliant product innovation to widen the scope of its offerings to previously unchartered areas. An indirect target of this endeavour was greenfield growth in Islamic financial services. Many international reports had highlighted the role that Islamic finance could play to enhance financial inclusion in countries with dominant Muslim population3. Nevertheless, according to the Global Financial Inclusion Database (Global Findex), only 6 percent of unbanked people cited religious concerns as their main reason for not having a bank account.

For some authors5, these results would seem to be very encouraging to introduce Islamic finance in countries with dominant Muslim populations. However, it is necessary to make sure that all the unbanked people with religious concerns are interested in Islamic finance. It goes without saying that being sensitive to the Shari’a dimension and adhering to anti-Riba practices does not automatically mean the acceptance of the Islamic finance Model. Then, investors shall measure the potential demand for Islamic financial services to justify the launch of Islamic financial institutions. If the potential is not sufficient, the project shall be aborted, or the business model shall target other segments of customers to be profitable without focusing solely on unbanked people with religious concerns.

From another perspective, other people could find the results daunting and would not justify the introduction of Islamic finance. Nevertheless, a World Bank Survey6 focused only on people who do not have a bank account and having a bank account does not mean that the customer would necessarily have access to all the other financial services especially since, in many countries, having a bank account is obligatory in order to receive a wage or to create and run a business. Therefore, among people who have already a bank account, there are self-excluded people in terms of financing, savings and insurance for religious concerns. From the perspective of Islamic financial institutions (IFIs), this segment could be very interesting.

Measuring the impact of the introduction of Islamic finance is important when it comes to financial inclusion and competition with incumbents. The measured impact can significantly define the strategies and approaches to adopt Islamic finance.

FINANCIAL INCLUSION FROM THE CONVENTIONAL FINANCE PERSPECTIVE

Financial inclusion: the main concepts

Financial inclusion is the proportion of individuals and firms that use financial services. It covers:

Lack of access (i.e., people are not able to use financial services); and

Self-exclusion (i.e., people have access to financial services but choose not to use them generally because they do not need these services or they do not trust financial institutions or because it’s not in line with their religious beliefs).

The lack of access could be due to the expensive cost of using financial services, limited geographic coverage or low income. Many solutions and products have been developed around the world to lower the cost of financial services. These include M-PESA, WeChat Pay, and AliPay etc.

For the self-exclusion issue, Islamic finance and financial literacy seem to be the main solutions to include more people in the financial system. Nevertheless, in some contexts, the informal finance can be the main reason of self-exclusion12. Indeed, people would use cash rather than financial services because of their preference for more privacy and less control, especially when it comes to taxes.

FINANCIAL INCLUSION LEVELS AND IMPACTS

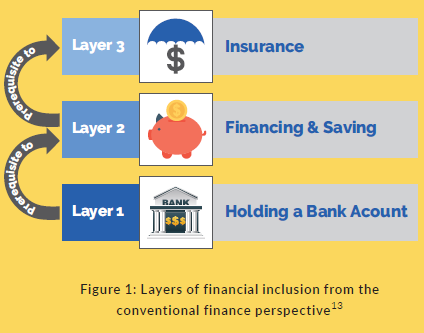

A typical approach to measuring financial inclusion is based on account ownership data, since in conventional banking, the first step to access other financial services is to own a bank account. Otherwise, the customer would be excluded from the whole system.

Indeed, having a bank account improves the possibility of access to credit, insurance services and savings. Therefore, the main challenge in terms of inclusion is to increase the proportion of people that have a bank account.

Having no access to financial services is a costly affair. Indeed, a person with no access to a bank account would have to go to every retail establishment and stand in line to pay his/her bills and may even have to pay extra fees for paying in cash.

ACCOUNT OWNERSHIP AND ITS IMPACT ON DEVELOPMENT

The experience of mobile money accounts in East African countries revolutionized the concept of financial inclusion. Operators such as M-PESA contributed in increasing the consumption levels and lifted 194,000 Kenyan households out of poverty. It offered the unbanked people the possibility to send money back to their home villages faster, more cheaply and more securely which increased the stability of revenues especially when times get tough.

ACCESS TO LOANS AND ITS IMPACT ON DEVELOPMENT

Having an account means having a credit record, which makes it possible to get micro- or nano-loans when needed. Having access to micro- or nano-loans can inspire companies to find solutions for daily problems.

ACCESS TO INSURANCE SERVICES AND ITS IMPACT ON DEVELOPMENT

The mobile money account gives an opportunity to unbanked people to get access to insurance services. In Zimbabwe, based on its Econet experience, farmers were offered Index insurance for their crops that would pay out automatically to a mobile phone account without the need to put in a claim if the rainfall index drops below a certain level (The Economist, 2018). Such innovations can help farmers in periods of drought and avoid deep crisis effects.

FINANCIAL INCLUSION FROM ISLAMIC FINANCE PERSPECTIVE

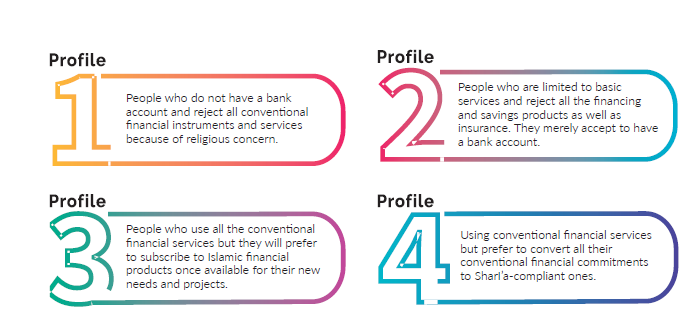

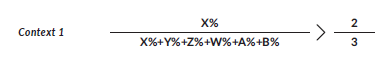

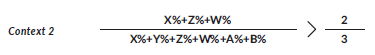

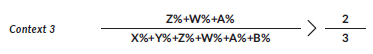

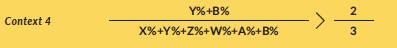

Most analysts and researchers adopt the approach of conventional finance regarding financial inclusion and consider Islamic finance as a complementary tool to attract self-excluded people with religious concerns. Nevertheless, the levels of financial inclusion in Islamic finance are not organized in the same way. Indeed, four profiles of people exist:

HOW TO ASSESS THE IMPACT OF INTRODUCING ISLAMIC FINANCE ON FINANCIAL INCLUSION?

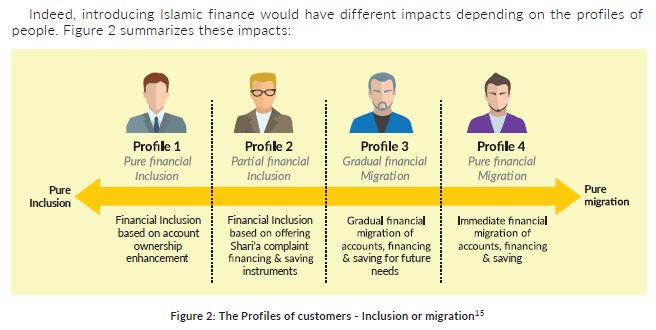

In countries willing to introduce Islamic finance, the main argument is that it will enhance financial inclusion, bringing more funds to the banking system, which will constitute a real opportunity for investors and the whole economy. Nevertheless, the impact can be different. Indeed, instead of financial inclusion, introducing Islamic finance can create financial migration. Each impact (migration or inclusion) has a suitable strategy to be adopted by investors and financial authorities.

It is worth noting that although Shari’a compliance is an important factor for moving to an IFI, research16 showed that pricing and proximity of branches and quality of services are also critical to the decision function. Thus, the proportion of people who are migrating to IFIs would depend on factors other than Shari’a compliance.

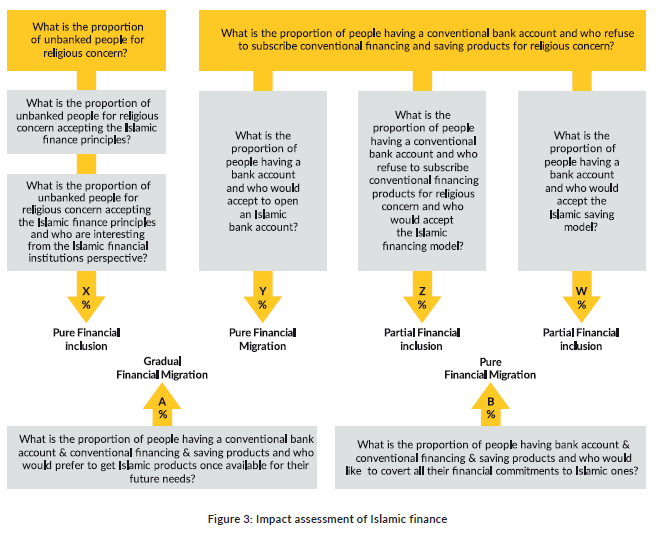

To assess the impact of Islamic finance on financial inclusion, a series of questions need to be answered. Some of these are as follows:

- What is the proportion of unbanked people with religious concerns?

- What is the proportion of unbanked people with religious concerns who accept Islamic finance principles?

- What is the proportion of unbanked people with religious concerns who accept Islamic finance principles and who may be interested in IFIs?

- What is the proportion of people having a conventional bank account and who refuse to subscribe to conventional financing and saving products on the basis of religious concerns?

- What is the proportion of people having a bank account, who would accept to open an Islamic bank account?

- What is the proportion of people having a conventional bank account who would refuse to subscribe to conventional financing products for religious reasons and would accept the Islamic financing model?

- What is the proportion of people having a conventional bank account who would accept the Islamic saving model?

- What is the proportion of people having a conventional bank account who subscribe to financing and saving products and would prefer to get Islamic products once they are available in the future?

What is the proportion of people having a conventional bank account who subscribe to conventional financing and products and would like to convert all their financial commitments to Islamic ones?

By combining the different proportions estimated, we can find four main scenarios.

In this context, introducing Islamic finance will bring more people to the financial system to open bank accounts and start subscribing to financial services. For such a context, introducing Islamic finance seems to present a real opportunity to include more people and to attract more customers. The appropriate strategy would be to recommend the introduction of Islamic finance to financial authorities and investors.

For such a context, introducing Islamic finance would represent an opportunity for banks which would invest to grant Shari’a-compliant financing to people who are not interested in conventional loans. The appropriate strategy in this context would be for financial authorities and existing banks to target underserved people in terms of financing and saving products

Introducing Islamic finance would cause a soft financial migration. Indeed, those who do not have conventional loans would subscribe to Islamic financing instruments and would convert their deposit and saving accounts to Islamic ones. Generally, those who are not interested in financing or saving products would not move their accounts to IFIs because they may not consider their existing conventional accounts as being Shari’a non-compliant and do not have a real incentive to migrate.

Moreover, in this context, people who are already using conventional financial services would prefer to deal with Islamic banks once available.

In this context, introducing Islamic finance would represent a threat and an opportunity at the same time. It would represent a threat for conventional banks since an important proportion of their customers would move to Islamic finance and concurrently an opportunity because they can attract underserved customers.

Introducing Islamic finance would cause a hard-financial migration. Even people who have financial commitments would ask to convert them to Islamic ones.

For incumbents, introducing Islamic finance in this context becomes a necessity rather than a choice because conventional banks are exposed to a significant migration threat.

CONCLUSION

Generally, researchers and analysts link the introduction of Islamic finance to financial inclusion. Nevertheless, from the perspective of Islamic finance, the issue of financial inclusion needs to be tackled in a different manner. Customers dealing with IFIs can be categorized into different profiles, starting with people that are self-excluded for religious reasons and thus do not use conventional finance products, and ending with people who use all conventional instruments but would prefer to convert their commitments to Shari’a-compliant ones once available.

In practice, introducing Islamic finance is not limited to financial inclusion. It could cause a financial migration from conventional to Islamic banks, but even this migration can take many forms and depends on many factors that need to be analysed deeply and carefully. In real experiences, people interested in Islamic financial products can have different profiles, and the proportion of each profile can define whether Islamic finance enhances inclusion or creates migration.

Finally, Islamic finance has to contribute to the efforts of financial inclusion. Indeed, it has to adopt the same mechanisms of conventional finance and adapt them to Shari’a principles. Moreover, Islamic finance can use Islamic institutions such as waqf (Islamic endowments) or zakāh (Islamic almsgiving) to have a wider impact on financial inclusion.