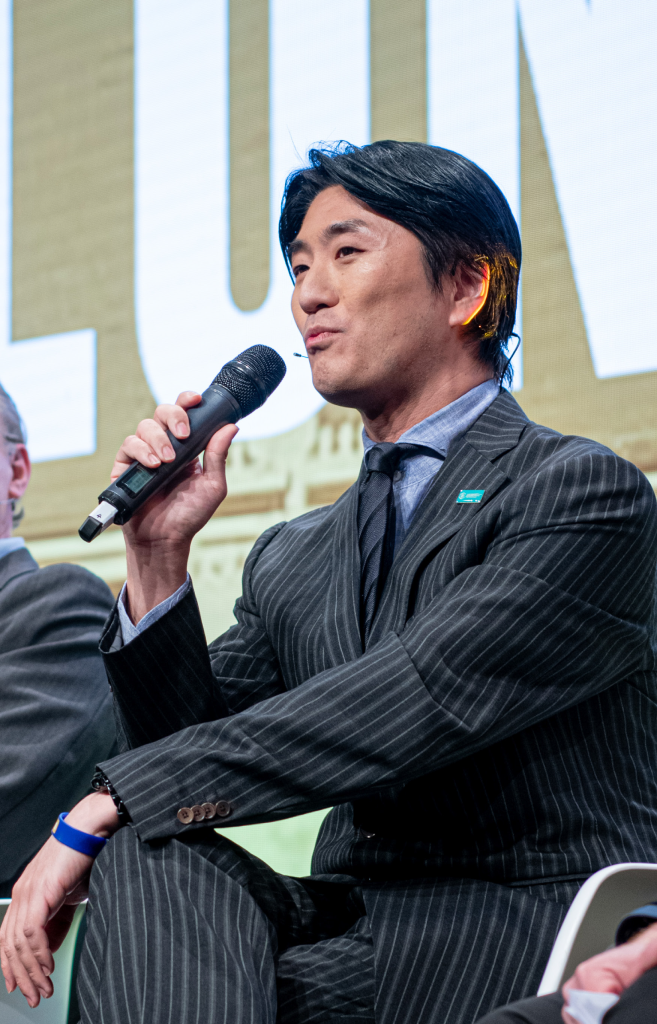

MASUMI HAMAHIRA

EXECUTIVE ADVISORISLAMIC BANKING WINDOWMUFG BANK (MALAYSIA) HONORARY TREASURER GRAND COUNCIL CHARTERED INSTITUTE OF ISLAMIC FINANCE PROFESSIONALS (CIIF)

We shall start with your life-long employer – Mitsubishi UFJ Financial Group (MUFG) – where you have spent 21 years. Is it owing to your Japanese heritage or is there something unique about MUFG that stopped you from looking around for opportunities?

I have been happy and proud to work for MUFG since I joined in 1999 owing to Mitsubishi Group heritage, namely “Sankoryo”. Mitsubishi UFJ Financial Group (MUFG) is a part of the larger Mitsubishi group.

The various Mitsubishi group companies are incredibly diverse and involved in a vast range of businesses. Yet, despite this great diversity, group companies have maintained one common philosophy that continues to underlie their activities, even after more than 150 years. That shared philosophy is capsulated in a creed articulated by the fourth president of the Mitsubishi organisation, Koyata Iwasaki, in the 1930s.

Today this philosophy is referred to as the “Three Principles” (called “Sankoryo” in Japanese). Although more than 80 years have passed since the philosophy was codified, the spirit and values of Sankoryo are still alive and current in the Mitsubishi group companies, both in their business dealings and their activities aimed to help society.

• “Shoki Hoko” – Corporate Responsibility to Society

Striving to enrich society, both materially and spiritually, while contributing towards the preservation of the global environment.

Commerce is a public undertaking and one requiring corporations to take responsibility for many of the interests affecting the countries in which they operate. This philosophy has been the cornerstone of Mitsubishi’s management policies right from its beginning. In order for a corporation to create sustainable prosperity, it must operate in a manner that is conducive to achieving this goal for the greater society.

• “Shoji Komei” – Integrity and Fairness

Maintain principles of transparency and openness, and conducting business with integrity and fairness.

President Koyata was known to have repeatedly cautioned Mitsubishi managers against focusing blindly on profits and losing sight of the Group’s adherence to high standards of ethical behaviour amid unprecedented competition, urging them to respond to competitors’ unscrupulous business practices with integrity and forbearance. He reminded them often of the importance of meeting the expectations of their customers and the public by exhibiting high ethical conduct in all their transactions. He was also well known for his observance of cultural differences around the world and the local customs of the communities in which Mitsubishi conducted business.

• “Ritsugyo Boeki” – Global Understanding through Business

Expand business, based on an all-encompassing global perspective.

At the outbreak of the Pacific War, President Koyata made a bold statement about friendship between international business partners now separated by war, “We count many British and Americans among our partners. They have undertaken many projects with us and so should peace come again, they will once again become good and faithful friends.”

You are perhaps the only Japanese who has shown persistence and commitment towards Islamic banking and finance. Our readers would like to learn how you encountered Islamic banking and finance and what impressed you so much that you have spent the last 9 years of your career specialising in this niche.

The core value of Islamic finance, namely Maqasid Al-Shari’a attracted me the most.

The mission assigned to me when I was posted to Malaysia was to expand the Islamic banking business for MUFG. Because of that, naturally, I had to learn and understand the Islamic way of life, which is the foundation of Islamic finance. I was very surprised to notice that there are many similarities between the Islamic way of life and that of the Japanese, especially from the ethical point of view.

Since most of the readers are professionals in Islamic finance and familiar with the ultimate objectives of Shari’a or the Maqasid Al-Shari’a. Safeguarding religion, intellect, wealth, life and lineage are the pillars to the ultimate objective of Shari’a, which is to achieve justice.

On the other hand, the Japanese culture is very much ethic-oriented and believe in ethical values that are very similar to the objectives of Shari’a. In Japan, the promotion of dignity, knowledge, trustworthiness, social rights and social justice is very much emphasised.

When we look back at the history of Islam, we can see that when the companions of the Prophet had to migrate from Mecca to Medina, they lost their wealth and social status. However, the people of Medina were willing to share their wealth, houses, and other provisions, and a public sharing system was introduced that later on allowed for the prosperous growth of their civilization. Even back then, people were helping those in need while some even gave all of their wealth to charity to ensure that the Maqasid Al-Shari’a are upheld.

In 2011, Japan was hit by an earthquake. It was one of the worst natural disasters that had ever-hit in history of Japan. Through the media, people around the world were touched by how the Japanese strived to overcome the tragedy. Driven by their strong ethical values, from the early stage, people responded very quickly by donating food, clothing and other necessities from all over Japan to the affected areas.

Being a part of the Islamic finance industry in Malaysia has proven to me that people are all the same, despite their differences in cultures or religions, there is a great common ground in human attribute that is, we all do care.

You are an accomplished Islamic finance expert in Islamic banking and finance. Would you like to share our readers with the details of your key roles in award-winning deals? What cultural and technical challenges this posed to come up with the structures acceptable to your bank, Shari’a scholars, regulators and other parties involved?

Fortunately, I have been involved with multiple award-winning deals such as the first Islamic Project Finance with Wakalah, the first Wakalah Syndicated Corporate Financing, the first Auto Finance Securitization, the world’s first Japanese Yen Sukuk and the first Sukuk placement to Japanese investors etc. While handling these deals, the major challenge faced was to make sure that there is harmonisation between the Japanese Banking Act and the objectives of Shari’a.

A key solution for these challenges is the Wakalah structure, which is globally acceptable not only in Asia but also in the GCC countries because of its innovative nature and flexibility.

“Safeguarding religion, intellect, wealth, life and lineage are the pillars to the ultimate objective of Shari’a, which is to achieve justice.”

Islamic FinTech is in vogue. You have shown interest in developing technology-based Islamic financial products. Don’t you think that technology is being over-emphasised in Islamic banking and finance?

I think it is true that Islamic FinTech is in vogue, as this is the global direction that the Islamic finance industry is moving towards.

First, there is the Central Bank Digital Currency (CBDC) initiative, namely “Central Bank to assess the potential case for Central Bank Digital Currencies” released by the Bank of England on January 21, 2020. The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share the experience as they assess the potential cases for CBDC in their home jurisdictions.

I foresee this initiative will lead to innovation by other central banks as well who supervise Islamic finance in the Asian and GCC countries.

Secondly, similar to other mainstream markets, the Islamic finance industry is also moving fast to leverage FinTech such as Blockchain and Green financing in their strategies. We have seen recent developments in Islamic finance market where FinTech companies are starting to establish Centres of Excellence in relation to AI innovation.

Through the optimisation of Islamic finance with Blockchain and AI, customer satisfaction can be enhanced with higher quality service at lower costs. Also, the Islamic finance industry can make further progress in the financial inclusion by optimising micropayments technology under Blockchain etc.

What, in your view, could be the most innovative application of Blockchain technology in Islamic banking and finance?

I believe Blockchain with Distributed Ledger Technology will contribute to the further development of Islamic Finance. The major difference between internet and Blockchain is, you can only send ‘information’ through the internet and not ‘value’, although the internet technology has developed a lot.

Thanks to the invention of Blockchain technology, you are able to send value. Let me share an example for the understanding of Blockchain in the case of passport. You are able to send your passport information via the internet but not the original passport. This, on one hand, ensures that you have the soft file of passport, while on the other hand, your counterparty will face difficulty in proving that the soft file of the passport they received is in fact legit.

If the government starts to register passport on Blockchain in the future, you would be able to send your original passport through Blockchain. In another word, your original file of passport will no longer be with you after you send your passport through Blockchain and your counterparty can prove that they hold your original passport thanks to the verification by Blockchain.

I believe Blockchain can lead to innovative disruption in the Islamic finance industry too. The common agenda in the Islamic finance industry is the trading fee for commodity Murabahah transaction. Many Islamic banks and customers would like to decrease the trading fee of Commodity Murabahah transaction because it is the additional cost not in conventional finance. Central banks may introduce CBDC on Blockchain in the future, while the commodity exchange could introduce commodity token, the digital certificate of commodity on Blockchain. Thereafter, the Islamic finance industry could further reduce administrative costs with the application of Atomic Swap by which Islamic banks and customers could exchange CBDC and commodity token at the same time on Blockchain without the counterparty risk and complicated operation via the trusted third party.

Blockchain will help Commodity Murabahah transactions to be efficiently Shari’a-compliant, as Islamic banks cannot sell a commodity before owning it to comply with Shari’a. Therefore, they need to organise and record the sequence of the commodity transaction, which currently is a very manual and convoluted process; using Blockchain, we can enjoy the timestamp ledger function. It is very helpful for Shari’a review process as well because distributed ledger under Blockchain is immutable and traceable. Blockchain can be very suitable and efficient to Islamic finance. Nevertheless, there are some imminent challenges in the application of such technologies in Islamic finance that are still in the evolutionary stage.

“Blockchain will help Commodity Murabahah transactions to be efficiently Shari’a-compliant, as Islamic banks cannot sell a commodity before owning it to comply with Shari’a.”

What view do you take on the future of Islamic banking and finance to Western banks in the US or the UK?

Islamic economy is expanding because the Muslim population is steadily increasing from 20% to 25% of the world population. Actually, global markets like the US and the UK could attract big investors from the GCC and Asian countries, if they can organise their Islamic finance economy. In addition, local investors in the US and UK can also invest in lucrative opportunities in the local Islamic financial industry. The current challenge faced by Western banks is the lack of talent in the discipline of Islamic finance, locally.

Malaysia has for long established itself as a global player in Islamic banking and finance. However, now Indonesia is fast emerging as a recognised Centre of Excellence for Islamic banking, Islamic microfinance, takaful and Islamic capital markets. What is your view on the frontier Islamic financial markets?

Islamic finance market is expanding not only in Malaysia and Indonesia but also in the GCC and Asian countries such as Brunei.

One of the promising Islamic finance frontiers is the Islamic ESG (Environmental, Social, and Governance) transactions such as Islamic Green Financing and Islamic Sustainable Linked Financing, which are in line with Maqasid Al-Shari’a.

“Islamic economy is expanding because the Muslim population is steadily increasing from 20% to 25% of the world population.”

As a prominent specialist in Islamic derivatives and risk management solutions, what in your view is hindering the growth of Islamic investment solutions globally?

The issue is that there is a discrepancy in the supply and demand of talent in Islamic finance. Although it is not an easy task to increase the number of Islamic finance professionals, we need to make effort in collaboration with Islamic banks, professional bodies, universities and regulators.

In addition to your full-time job and other industry engagements such as Grand Council for Chartered Institute of Islamic Finance Professionals (CIIF), you are also pursuing a PhD at the International Islamic University Malaysia. What is your area of research and what motivated you to pursue doctoral studies in this field?

My research area is Wakalah sukuk, which contributes a lot to the development of the global sukuk market. I would like to bridge the efforts between the industry and academia, so that innovation could take place through mutual collaboration.

In addition, I hope to promote Islamic finance in countries where it is still not well recognised yet such as Japan and the US.

“One of the promising Islamic finance frontier is the Islamic ESG (Environmental, Social, and Governance) transactions.”

What are your career plans for the future? You have spent the last 20 odd years with MUFG. What would you like to achieve by the time you retire?

My dream is to make the world a better place through further alliances between the two industries, Islamic finance and Blockchain.

I would like to contribute to the development of Islamic Blockchain by taking up the role of a bridge between the Islamic finance industry and the Blockchain industry by utilising my experience for the development of new financial products and global network in various areas.

Would you like to give a message to the younger generation of Islamic banking and finance practitioners?

The key factor for the younger generation to become global leaders in the Islamic Economy in the next decade is to keep great passion and to update their knowledge in the new frontier area like FinTech and Blockchain.

For example, a “Patent war” is happening in Blockchain. Global giants such as

Alibaba, Mastercard and IBM as well as Blockchain companies such as nChain in the UK are rushing to apply a lot of patent in Blockchain so that they can secure the future huge global market and you can find those names in the Blockchain patent league table.

Another challenge in Blockchain that is very difficult is to handle private keys for big organisations with proper security and governance. Threshold signature technology, which is a simple and secure tool for private key management is in the process of being developed by smart startups such as Volt wallet at Hangzhou in China. This information is publicly available.

I believe if you are aware of these new trends and technological advancements, it will help your career development in the long run. Again, “please keep yourself updated” to become a future global leader in Islamic economy.

“The key factor for the younger generation to become global leaders in the Islamic Economy is to keep great passion and to update their knowledge in FinTech and Blockchain.”