Introducing

The conceptual development of Islamic insurance or takaful, has only gained momentum in several Muslim countries after the development of Islamic banking in the mid-1960s. The huge influx of petrodollars from the late 1970s provided strong impetus to the development of insurance companies in the Middle East. The Islamic Insurance Company of Sudan, licensed in 1979, was regarded as the first takaful company in modern history. By 1985, takaful companies were established in the UAE, Malaysia and Bahrain. The takaful industry has been expanding by tapping into large Muslim markets worldwide.

Size, growth and regional trends of takaful

In recent years, takaful has emerged as the fastest grow- ing segment of Islamic finance. It is flourishing in Africa, Asia, Europe and North America. It is estimated that there is a worldwide Muslim population of 1.6 billion with nearly 22 million Muslims live in industrialised countries. The Muslim population is primarily concentrated in the Middle East, Northern Africa and South and East Asia. About 300 million Muslims live as minorities in other countries, with the largest number of Muslims living in India (157m: 13%), China (40m: 3%) and Ethiopia (40m: 48%). Given their fast-growing economies and insurance sectors, India and China are potential markets for Islamic insurance.

Muslim countries have lower insurance penetrations than the emerging market. Muslim countries accounted for US$ 3462 billion (22%) of emerging market GDP in 2007. This is equivalent to an average GDP per capita of US$ 2600, which is only slightly below the average GDP per capita of emerging countries (US$ 2700 billion). In 2007, 11% of emerging market insurance premium was written in Muslim countries (US$ 45 billion), indicating a low level of insurance penetration, compared to that of the emerging market.

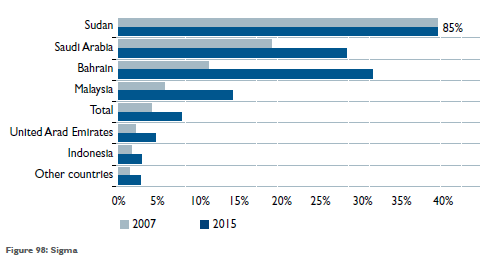

There has been an unprecedented growth and expansion in takaful services and products. By January 2009, there were 162 takaful companies and takaful windows in operation worldwide, of which nearly half are to be found in the GCC countries of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE. For the past four years, takaful industry recorded an outstanding growth at 26% (adjusted for inflation). Takaful has exceeded the growth of the conventional market by 11%. In the long term, takaful growth is expected to be solid given the positive outlook in the petrodollar economies, and de- spite the current financial crisis. Until 2015, the takaful industry is expected to grow at 17% per year to US$ 7 billion, which is faster than the conventional market. Takaful’s market share in Muslim countries is expected to rise from 4% in 2007 to 8% in 2015. See Figure 98

Takaful contributions have grown from US$ 1.4 billion in 2004 to over US$ 3.4 billion in 2007. In 2007, Saudi Arabia remains the largest takaful market in the GCC with contributions of US$ 1.7 billion, while Malaysia re- mains the largest takaful market in South-East Asia, with contributions of US$ 0.8 billion.

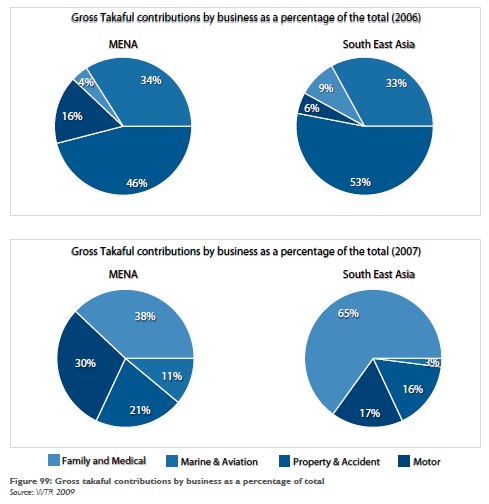

Takaful comprises general insurance, as well as life, medical and health, and accident and education plans. General takaful makes up the majority of business in the Middle and Far East markets, with property and accident insurance accounting for approximately half of the underwritten business. Health takaful is a rapidly growing sector in the GCC, as health insurance is increasingly being made compulsory in GCC countries. Life takaful penetration at present, lags far behind general and health takaful, as Muslims tend to have greater inhibitions when it comes to life insurance. At present, gross takaful contributions from life insurance in these two regions amounts to less than 7% of total written business. However, with the development of innovative family takaful products and the increasing education of Muslims as to why family takaful is Shari’a-compliant, it is reasonable to assume that life takaful will grow substantially.

The GCC, Malaysia and Sudan are the top three markets for takaful while the Indian Subcontinent, Indonesia, Egypt and Turkey, remain the least penetrated Muslim markets. Nevertheless, the future of takaful looks very promising as many countries have shown great interest to develop takaful in congruent with the rapid growth of Islamic finance worldwide.

Takaful and ta’min

It should be noted that not all Islamic insurance companies use the word takaful. For example, in Sudan, the term al-ta’min al-ta`awuni al-islami (Islamic co-operative insurance) is used while in Saudi Arabia the word al- ta’min al-ta`awuni (co-operative insurance) is utilized instead of takaful. This inconsistency is obviously caused by the word ‘insurance’ itself which translated into Ara- bic language as ta’min rather than takaful. In this regard, Ajmal Bhatty argues that takaful is the correct term to use as it encapsulates the meaning of Islamic version of insurance. While insurance is not permitted under the Islamic law, takaful is legally valid.

Article 2 of the Malaysian takaful Act 1984 defines takaful as follows:

‘Takaful means a scheme based on brotherhood, solidarity and mutual assistance which provides for mutual financial aid and assistance to the participants in case of need whereby the participants mutually agree to contribute for that purpose’

AAOIFI defines Islamic insurance, without highlighting the term takaful, as follow:

‘Islamic insurance is a process of agreement among a group of persons to handle the injuries resulting from specific risks to which all of them are vulnerable… involves payment of contributions as donations and leads to the establishment of an insurance fund that enjoys the status of a legal entity. The resources of this fund are used to indemnify any participant who encounters injury…The fund is managed by either a selected group of policyholders or a joint stock company that manages the insurance operations and invests the assets of the fund, against a specific fee.’

In the definition of a takaful undertaking, the IFSB and International Association of Insurance Supervisors (IAIS) further add that practically, it consists of a two-tier structure that is a hybrid of a mutual and a commercial form of company – which is the takaful operator.

From these definitions, it is clear that takaful should be purely based on mutual help amongst the participants. Each of them would voluntarily make contribution to a fund which will be used later to pay compensation for the ill-fated members.

Generally, takaful and conventional insurance share the same objective, and that is to help those who are afflicted by calamity. In fact, this idea was reflected in various schemes of mutual help and assistance whenever a catastrophe or misfortune struck a person. Therefore, insurance was initially not a business for profit-making but a way to help the needy on a gratuitous basis. However, both mutual insurance and takaful differ in terms of the management of the fund. While mutual or co-operative insurance is obviously owned and managed by its own members, takaful on the other hand could also be operated by a joint stock company. Hence, it is argued by some scholars that takaful, in essence, may not be purely mutual. In fact, almost all takaful operators worldwide have resorted to being either shareholder-based or a commercial entity instead of a pure co-operative or mutual organization. Perhaps, the typical drawback of mutual organizations (in which it can only obtain resources from its members and cannot raise equity capital for further expansion) has caused this tendency.

In a general sense, a takaful company could be seen as a commercial entity aiming for profits rather than being a purely mutual institution. This arrangement may not, however, render takaful invalid like commercial insurance. This is mainly because a takaful company only acts as a mediator who manages the participants’ fund and receives remuneration for its services. It has no rights towards the takaful fund (established by the participants) and does not take responsibility for its deficiency. To be specific, there are at least two distinct contractual relationships involved in takaful; firstly, tabarru`at (voluntary donation) a contract amongst the participants and secondly, wakala (agency) or/and mudaraba (profit-sharing) contract(s) between the participants and the operator. Therefore, it is obvious that mutuality in takaful is pre-served in the former relationship, but not in the latter. In line with the above, takaful as a whole, could be seen as combining several contracts; namely tabarru (voluntary donation), wakala (agency) and mudaraba (profit-sharing). The combination may differ according to different business models adopted by takaful companies, as highlighted next. Nevertheless, tabarru` could be considered as the primary contract or foundation in any takaful model, since it is the essence of Islamic insurance. The variation of combination is then subjected to the preference of either wakala or mudaraba (or both) by the companies who manage the participants’ fund.

Takaful Models

In general, there are two main models for commercial takaful companies, namely: profit-sharing (mudaraba) and agency model (wakala). Basically, in a pure mudara- ba model, participants’ pool of funds would be considered as capital to be invested by takaful operators (which play their role as entrepreneurs) and when there is profit, it will be shared between both parties according to a pre-agreed ratio. This model, which allows for sharing of only the investment return, was found to be commercially too challenging for nascent operations. As a result, the model has been modified by takaful operators in Malaysia (currently known as the modified mudaraba model) to allow them to share in the investment return on the contribution pool and also in any underwriting surplus.

Over the years this model has been found to be challenging and many takaful operators are moving towards the wakala or modified wakala model. Variants of the wakala model, pioneered by the GCC countries have become the most popular operating model for takaful operators. In the wakala model, the operator acts as an agent for the members (participants). The operator, in return for an agency fee, manages the members’ claim fund. In the pure wakala model, the operator has no further claim on the investment return or the underwriting surplus. However, in the modified wakala model, the operator may share in the investment return as well as the underwriting surplus with the participants. This practice is currently deemed as necessary for incentivising the operator to perform optimally.

Another model which is pioneered by Pakistan is called the waqf model. This model is actually focusing on the tabarru` aspect of the takaful arrangement. The management and operational aspect of the takaful fund may still use the wakala and mudaraba contracts. In brief, under this model, the operator will set off the waqf fund by contributing a ceding amount of donation and then will invite the participants to jointly contribute to this fund. Any participant who contributes to the fund will be considered as a member of the takaful scheme as well as a beneficiary of the waqf fund. In essence, the waqf fund will be used to pay claims and benefits to the participants in accordance with the waqf terms.

The following shall give brief descriptions of each model of takaful as implemented by many takaful operators worldwide:

- Mudaraba model

By the principle of mudaraba, the takaful operator who acts as an entrepreneur or mudarib will accept payment of the takaful contributions (premium) termed as ra’s-ul-mal from takaful participants acting as sahib-ul- mal. The contract specifies the share of profit (surplus) from the operations of takaful managed by the takaful operator is to be distributed between the participants as the providers of capital and the takaful operator as the entrepreneur, in accordance with the principle of mudaraba. The sharing of such profit (surplus) may be in a ratio 5:5, 6:4, 7:3, etc. as mutually agreed between the contracting parties. The Shari’a committee approves the sharing ratio for each year in advance. The operator is entitled to a fixed percentage of an investment profit, if any.

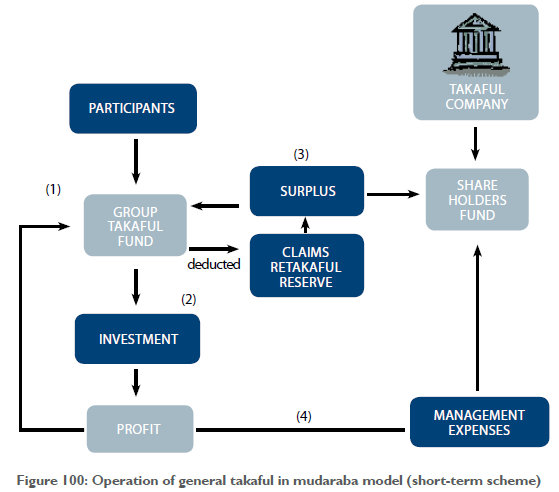

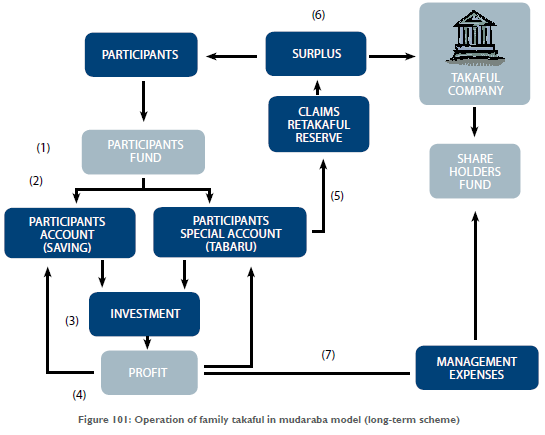

Generally the risk-sharing arrangements allow the takaful operator to share in the favourable investment performance of both the participant’s takaful fund and the participant’s investment account. However if there are losses in the participant’s special account, the takaful operator provides an interest-free loan (qard al-hassan) that has to be repaid when the participant’s special account returns to profitability and before any future surplus is distributed. Therefore, the takaful operator must be both prudent and active in investing the takaful funds to gain profits because their main income is generated from a certain ratio of such investment profit. Of course, when investing the funds, the instruments used should be Shari’a-compliant. The mudaraba contract is cancellable, and upon cancellation all cumulative capital plus profit must be returned to the capital provider (participants) after deducting administrative expenses. Figures 100 and 101 illustrate the mudaraba model for a short term and long-term takaful operation which demonstrates the mechanism of general takaful and family takaful respectively.

Explanation:

- Participants pay takaful contributions which form a group takaful fund.

- The fund will be invested in Shari’a-compliant investments. The profit, if any will be shared among participants and takaful operator on basis of the agreed ratio.

- At year-end, the surplus (after deducting claims, retakaful and reserve) will be distributed to the participants and takaful operator on the agreed ratio.

- Shareholders will utilize the investment profit and surplus to cover management expenses.

Explanation:

- Participants pay takaful contributions which form a pool of participants’ fund.

- Participants’ fund are divided into; (a) participants’ account which is meant for saving, and (b) participants’ special account, also known as participants’ risk account which is based on tabarru’ concept. The amounts allocated in these two accounts are based on the agreed percentage decided upfront in the contract.

- The fund in both accounts will be invested in assets, such as government Islamic instruments, Islamic private debt securities and equities, fixed assets and fixed deposit accounts.

- Investment profit, if any, will be shared among participants and the takaful operator on the basis of the agreed ratio.

- Amounts in participants’ account will be paid to the participants upon death, or delivery or maturity of a takaful scheme. Amounts in participants’ special account will be used for paying claims, retakaful and reserve.

- At year-end, the surplus will be distributed to the participants and takaful operator on the agreed ratio.

Shareholders will utilize the investment profit and surplus to cover management expenses

The mudaraba model for takaful is rapidly losing ground as the takaful model of choice. This is due to the current trend among takaful operators which are inclined to adopt the wakala model. The mudaraba model is suitable for shorter-term products, such as one-year renewable products, like motor insurance in which the sharing of surplus happens earlier than that in long-term business. Another challenge for takaful operators adopting this model is their direct exposure to the ups and downs of business since they share profits from investments.

In Malaysia, of the nine takaful operators at the time of writing, only two practice the mudaraba model; namely Takaful Malaysia (STM – Malaysia) and Takaful Nasional (Malaysia). Another company that practice takaful based on mudaraba is Takaful International (Bahrain).

- Wakala model

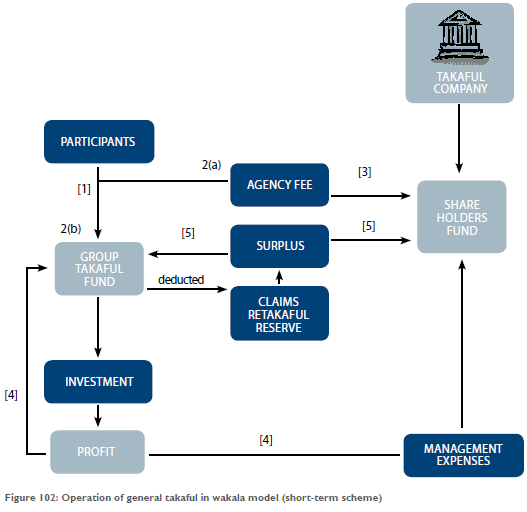

The wakala model has become increasingly popular. Wakala is a contract of agency. Based on this principle, participants remain the actual owners of the takaful fund, and the takaful operator acts as an agent for the participants to manage the fund for a defined fee. As an agent, the operator is entitled to remuneration (agency fee) and commission (management fee). The surplus of participants’ funds investments goes to the participants. The agency fee rate is fixed annually in advance in consultation with the Shari’a committee of the company. Management fee which is related to the level of performance is given as an incentive for good administration and governance and of the participants’ fund. Figure 102 and 103 below illustrate the mechanism of short-term and long-term takaful in a wakala model.

Explanation:

- Participants pay contributions under the takaful scheme.

- The contributions are divided into; (a) Agency fee, and (b) Group takaful fund. The division is made based on the agreed ratio between takaful operator and participants in the contract.

- Agency fee which consists of agency commission and administration expenses will be channelled to the shareholders’ fund.

- The group takaful fund will be invested and any income or profit will be returned to the group fund. Takaful operator will be entitled to a performance fee for managing the investment on behalf of the participants.

- End of year surplus (after deducting claims, retakaful and reserve) will be distributed to the participants and takaful operator on the agreed ratio in the contract.

- The group takaful fund will be invested and any income or profit will be returned to the group fund. Takaful operator will be entitled to a performance fee for managing the investment on behalf of the participants.

- End-of-year surplus (after deducting claims, retakaful and reserve) will be distributed to the participants and takaful operator on the agreed ratio in the contract.

- The shareholders will use the agency fee to cover management expenses.

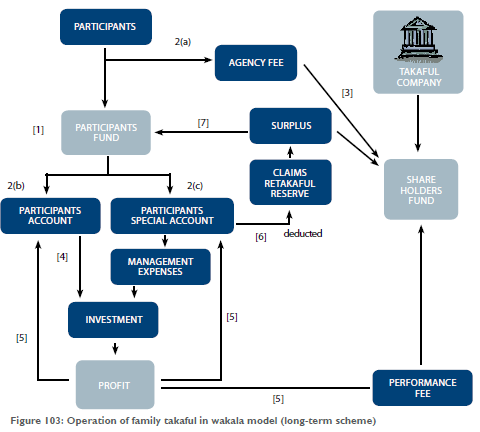

- Participants pay contributions under the takaful scheme.

- The contributions are divided into; (a) agency fee, (b) participants’ account, and (c) participants’ special account or risk account. The division is made based on the agreed ratio between takaful operator and participants in the contract

- Agency fee which consists of agency commission and administration expenses will be channelled to the shareholders’ fund.

- The contributions are divided into; (a) agency fee, (b) participants’ account, and (c) participants’ special account or risk account. The division is made based on the agreed ratio between takaful operator and participants in the contract

- Participants’ account and participants’ special account (after deducting management expenses) will be invested in Shari’a-compliant asset investment such as, government Islamic instrument, Islamic private debt securities and equities, fixed asset, fixed deposit account and investment account.

- Investment profit, if any, will be returned to the participants. Takaful operator will be entitled to an agreed ratio of performance fee for managing the investment on behalf of the participants.

- Amounts in participants’ account will be paid to the participants upon death, delivery or maturity of the scheme. Amounts in participants’ special account will be used to pay claims, retakaful and reserve.

- End of year surplus (after deducting claims and retakaful) in participants’ special account will be distributed to the participants and takaful operator on the agreed ratio in the contract.

- The shareholders will use the agency fee to cover management expenses.

This model is widely used in the present days, for example Bank Aljazira in Saudi Arabia (2001) and Takaful Ikhlas in Malaysia (2003). In fact, Bank Aljazira was the pioneer in the Middle East introducing takaful Ta’awuni based on the wakala model.

The main issue in a pure wakala model is that the management and shareholders of a takaful company cannot share in the profits, because they merely act as an agent to the participants. However, they may be entitled to a fee based on their performance in the investment. Therefore, many takaful operators today attempt to adopt a combination of wakala and mudaraba or modified wakala model.

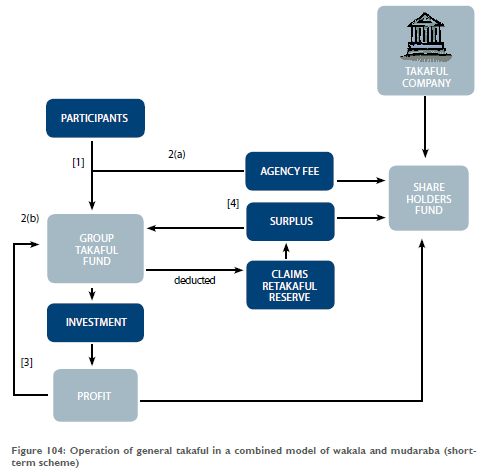

- Combination of wakala and mudaraba

This model basically combines some features in both wakala and mudaraba model. The wakala principle is applied in underwriting activities while mudaraba contract is used in investment of the takaful funds. Thus, takaful operator is entitled to agency fee for managing the fund as a wakil and a share of profit for managing the investment of the fund as mudarib.

Explanation:

- Participants pay takaful contributions which form a group takaful.

- The contributions are divided into; (a) Agency fee, and (b) Group takaful fund. The division is made based on the agreed ratio between takaful operator and participants in the contract. Agency fee which consists of agency commission and administration expenses will be channelled to the shareholders’ fund.

- The fund will be invested in Shari’a-compliant investments. The profit, if any will be shared among participants and the takaful operator on basis of the agreed ratio.

- At year-end, the surplus (after deducting claims, retakaful and reserve) will be distributed to the participants and the takaful operator on the agreed ratio in the contract.

- Shareholders will utilize the agency fee to cover management expenses to cover management expenses.

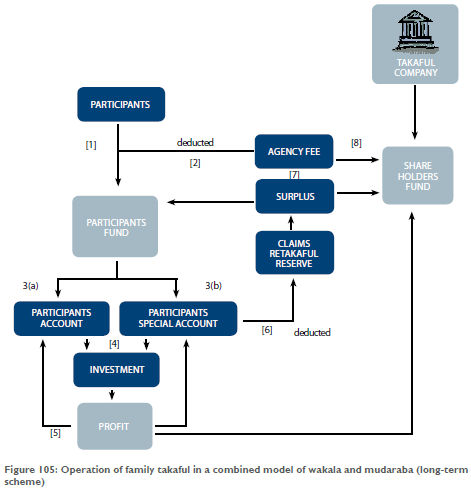

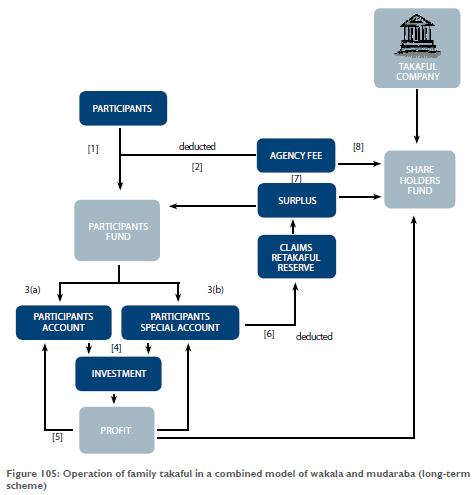

Explanation:

- Participants pay takaful contributions which form a pool of participants’ fund.

- Agency fee is deducted from the contributions. The fee which consists of agency commission and administration expenses will be channelled to the shareholders’ fund.

- The remaining amounts will be channelled into; (a) the participants’ account, which is meant for saving, and (b) the participants’ special account, also known as participants’ risk account which is based on the tabarru’ concept. The amounts allocated in these two accounts are based on the agreed percentage decided upfront in the contract.

- The fund in both accounts will be invested in Shari’a-compliant asset investment such as government Islamic instrument, Islamic private debt securities and equities, fixed asset, fixed deposit account and investment account.

- Investment profit, if any, will be shared among participants and takaful operators on the basis of the agreed ratio.

- Amounts in participants’ account will be paid to the participants upon death, or delivery or maturity of a takaful scheme. Amounts in participants’ special account will be used to pay claims, retakaful and reserve.

- At year end, the surplus (after deducting claims and retakaful) in participants’ special account will be distributed to the participants and takaful operator on the agreed ratio in the contract. Shareholders will utilize the investment profit and surplus to cover management expenses.

- The shareholders will use the agency fee to cover management expenses.

Explanation:

- Participants pay takaful contributions which form a pool of participants’ fund.

- The fund will be channelled into; (a) participants’ account, and (b) participants’ special account, or participants’ risk account which is based on the tabarru’ concept. The amounts allocated in these two accounts are based on the agreed percentage decided upfront in the contract.

- A waqf fund is formed which receives initial donation by the shareholders, followed by the participants which is obtained from the participants’ special account (tabarru’ account).

- An agency fee is deducted from the waqf fund. The fee, which consists of agency commission and administration expenses, will be channelled to the shareholders’ fund.

- The fund in both accounts will be invested in Shari’a-compliant asset investment, such as government Islamic instrument, Islamic private debt securities and equities, fixed asset, fixed deposit account and investment account.

- Investment profit, if any will be returned to the respective accounts on the basis of the agreed ratio.

- Accumulated amounts in participants’ account will be paid to the participants upon death, or delivery or maturity of a takaful scheme. Amounts in the waqf fund will be used to pay claims, retakaful and reserve.

- At year end, the surplus (after deducting claims, retakaful and reserve) in waqf fund will be returned to the same fund again.

- The shareholders will use the agency fee to cover management expenses.

This approach seems to be more well-accepted and favourable than the other models and is widely adopted by many newly-established takaful companies and international organisation, for example, Abu Dhabi National takaful Company.

- Wakala with waqf model

In addition to the earlier models, the latest model has emerged from Pakistan and was introduced by a renowned Shari’a scholar, Taqi Usmani. In this model, the shareholders of the takaful company will initially make a donation to establish the waqf fund. The fund needs to be invested in a Shari’a-compliant investment, and the returns will be used for the benefit of the participants. The tabarru’ fund from participants’ special account also becomes a part of the waqf fund. Therefore waqf fund consists of donations from the shareholders and participants seeking takaful protection. The combined amount will be invested and any profit earned will be returned to the same fund. Based on waqf principles the donors (shareholders and participants) would lose their ownership rights on their monetary contributions into the waqf fund. The monies eventually become the property of waqf fund which can only be used for the benefit of all participants.

The shareholders act as the owner of the waqf fund who delegate the authority to the operator to become the administrator of the fund whose function amongst others, is paying claims from the fund. The operator also undertakes the role of mudarib when it invests the waqf fund and is entitled to a certain percentage of the investment profit.

Conclusion

The growth of takaful, as mentioned in the preceding section has been remarkable, even considering the current boom in the entire Islamic financial system. However, the Muslim world is far from homogeneous when it comes to approaching Islamic insurance, and the operating models of takaful companies vary. There are currently four takaful models being operated world- wide which apply several forms of contract governing the relationship between participants and the takaful operator. Notwithstanding the remarkable growth of takaful over the last few decades, the development of the industry remains at an embryonic stage. This is particularly true especially when looking at the issue of retakaful or reinsurance. Like insurance, sound retakaful arrangement is a necessity. Although in a situation where retakaful is still inadequate to meet the needs of takaful operators, Shari’a allows them to deal with conventional reinsurers. Nevertheless at the same time, serious efforts ought to be undertaken, in particular by the takaful operators themselves to establish their own retakaful facility. But without sufficient number of players, it would perhaps be rather difficult for such retakaful operators to survive in terms of business support.