Introduction

For decades, conventional banks have used standard pre-packaged software systems to meet their every-day operations. Shari’a-compliant banking has added to the requirements made on traditional banking systems, and technology vendors now compete to develop and provide the best-of-breed Islamic banking software. The nature of Islamic banking requires easy-to-use software capable of accommodating complex banking operations that include different levels of liquidity, leverage, credit risk, profitability and efficiency requirements. Only the largest of banks have the ability to develop software internally to accommodate specific banking functions. The vast majority find it cheaper to purchase a package, than to modify an existing one to meet their specific needs.

Evolution of Islamic banking systems

The early days of Islamic banking operations relied on manual software systems with a simple variety of products to offer. The features and functionality of subsequent systems came by way of customized developments made by software firms at the request of their clients. Islamic banking transactions were carried out using these customized frameworks provided by developers of interest-based solutions. This led to a form of integration with the core banking system available at the parent bank. At this stage, investing in a complex Islamic banking system which would handle day-to-day operations with optimum efficiency was not viable. However, with the startling growth of Islamic banking practices, new start-up software houses entered the market and quickly catered for specific Islamic banking needs.

Today’s Islamic banking software products originate from three sources:

- Customized software developed to a customer’s preference and expectation. This software development is tailored in stages and is an expensive undertaking with many complications.

- The adaptation of traditional banking packages to accommodate the Islamic functionality. The customer experience of this type of software has been poor due to unethical banking practices, lack of data integrity and delay of operations with increase in operational costs.

- Software products that are designed from scratch to cater for the Islamic banking industry. They can accommodate an innovative mix of products and services enabling banks to offer a competitive range of Islamic financial products and services.

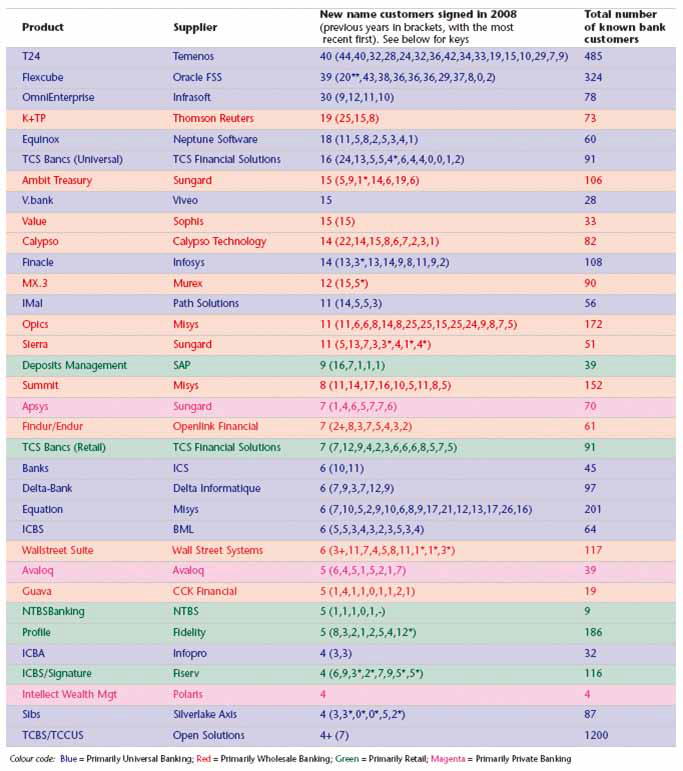

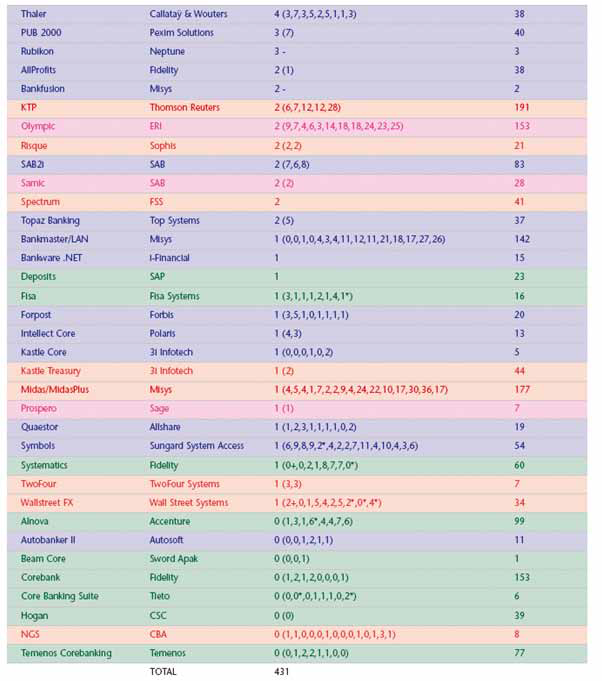

The banking systems market

The overall banking systems market is made up of several hundred vendors. Some of these vendors sell locally, some regionally and some internationally. The international vendors total around one hundred. There is an Annual Sales League Table that tracks the sales of each vendor over the previous year. The table below shows that two vendors, Temenos and Oracle Financial Services Software (I-flex, as was), both banking software companies, dominate the market and have done so for at least the last five or so years. These two vendors each have around twice the number of sales (about 40 each sales of both Islamic and conventional banking systems, although, Islamic sales makeup a small fraction of this total. Excluded from those figures are large regional vendors that operate exclusively in China, Russia (around 76 deals) and the US (estimated 400+ sales), although international sales have been included in the figures.

Islamic sector

The current size of the Islamic banking systems market is estimated to be about US$ 85 billion. Around 15-20 vendors claim to offer Shari’a-compliant banking systems. It is estimated that there have been just over 200 combined sales of Islamic banking systems to Shari’a-compliant organizations over the years.

The relative size of the Islamic banking systems market can be gauged by looking at the sales figures for Path Solutions, an Islamic banking software company. This vendor’s primary product is a Shari’a-compliant banking system (iMal) now present in more than 18 countries around the world, stretching from the UK through Africa with major accounts in Libya, Algeria, Sudan and Iraq to reach Malaysia and Hong Kong in Asia. It is regarded as the largest selling vendor of Islamic systems, notching up eleven new sales in 2008, and 12 new deals in 2009, among them the first Islamic Credit Union in the world located in Hong Kong: Amwal Credit Union, that was established on May 27, 2009. This puts it in tenth place overall in the league table, bringing its total estimated (installed) user base to around 72 bank customers (to date). There does appear to be some regional variations in sales preferences. While some vendors seem to enjoy sales in all of the Islamic regions, others may have a slightly more regional sales appeal.

Market participants

There are many specialist vendors that operate purely within their home country. New vendors are entering the market and older vendors are leaving (for example, the Misys systems will at some point be replaced by the company’s latest Bankfusion product). Path Solutions, the vendor with the largest user base, has built its iMal system from scratch as Shari’a-compliant. Other vendors include Infopro Sdn Bhd and Microlink Solutions Bhd which are Malaysian companies. Both are widely used within the Malaysian region and have now branched into other regions.

Nevertheless, the bulk of the market is made up of conventional system vendors that have modified their systems to meet Shari’a requirements. These vendors include the giant US-based Fidelity National Information Services and Sungard Financial Systems, which have products that claim Islamic functionality. From amongst the other leading conventional banking packages that have been mentioned, Oracle FSS’s Flexcube package is used at Shamil Bank in Bahrain. The vendor’s Indian development centres have been able to produce Islamic banking modules, which add to the significant functionality that it had already developed for its parent company, Citibank. The system is also used at other banks in the Middle East including Dubai Islamic Bank. Temenos, with its Islamic offering of T24, has been adopted by some significant Islamic banks including Al Salam Bank in Bah- rain, Bank Islam Malaysia and Meezan Bank in Pakistan.

Misys is a well-known name in all of the Islamic regions, and has widely promoted one of its older systems, Equation, as being Shari’a-compliant. The Islamic Bank of Britain, the UK’s only Islamic retail bank, uses the Equation product as does Al Baraka, Sharjah Islamic Bank and a cluster of banks in Qatar. The product has possibly the largest user base other than Path Solutions.

In addition to the pure Islamic system vendors and the modified conventional system vendors, there is a third group that sits somewhere between the two. This third group is made up of independent organizations often based in Muslim countries, which supply a conventional banking system that has been permanently modified to accommodate the Shari’a requirements. One of the vendors in this third group is International Turnkey Systems (ITS). This Kuwait-based company has taken the Phoenix system (under agreement from US supplier).

Harland Financial Solutions) and modified it to sell into Islamic banks. ITS has assembled a range of products for Islamic banks, some sourced from other suppliers (such as the NetEconomy anti-money laundering and fraud prevention package) and some developed in-house, such as its front-end system, IBS Islamic.

Kuala Lumpur-based Silverlake is a supplier of an Islamic core banking system (Siibs) that enjoys some degree of success mostly in the Asian region, but also outside of that area. The origins of the conventional version of the system seem to have a common source with the Siibs system offered by the US-based John Henry Associates. Nevertheless, the system has been extensively enhanced by Silverlake and now offers separate modules to accommodate a fairly wide range of Islamic processing.

The use of one Islamic banking package in a bank does not preclude the use of another for different purposes. The Bank of London and the Middle East, for example, use Path Solutions for their core Islamic processing, but have chosen an Oracle FSS-supplied front-end for its specialist wealth management arm.

Around the regions

The main regional markets in the Islamic banking world naturally follow the concentration of Islamic banking services, and are made up of the Middle East, Malay- sia and Indonesia, the African nations, Asia Pacific/South East Asia (Singapore, Hong Kong) and the Pakistan/ India/Bangladesh region. There are some variations be- tween each region as to what is considered acceptable and what is not. Malaysia and Indonesia are generally regarded as the most liberal with regards to the acceptance of new products. Conventional banking is prohibited in Pakistan’s banking system, as is the case in Iran. In terms of the domiciled vendors, Malaysia and Indonesia represent most of the Asian Islamic systems vendors that include, as mentioned, Infopro, Microlink and Silverlake. The Singapore-based developer System Access that created the Symbols system has now been absorbed into the US-based Sungard Financial Systems group as Sungard System Access, but it still maintains its Singapore operation.

India is also well served with package vendors for both conventional and Islamic banking, and is home to some of the largest names in the industry. Of the many resident vendors in that country, 3i Infotech, Infosys Technologies, Infrasoft, Polaris Software, Tata Consultancy Services (TCS) are known to have Islamic users of their systems. Pakistan has its own internal vendors, but is represented internationally by Autosoft Dynamics, and Bangladesh is home to Leadsoft.

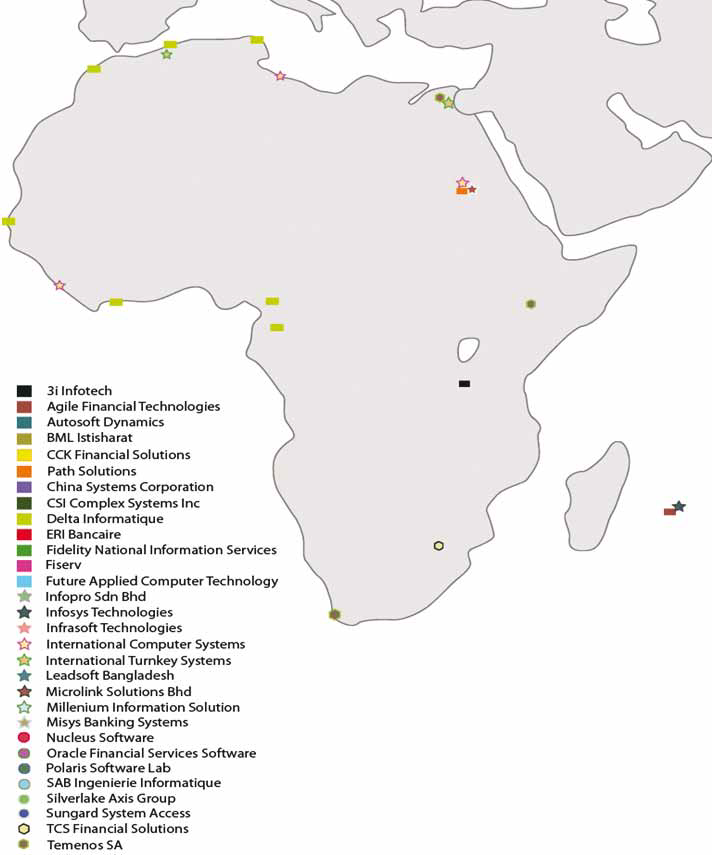

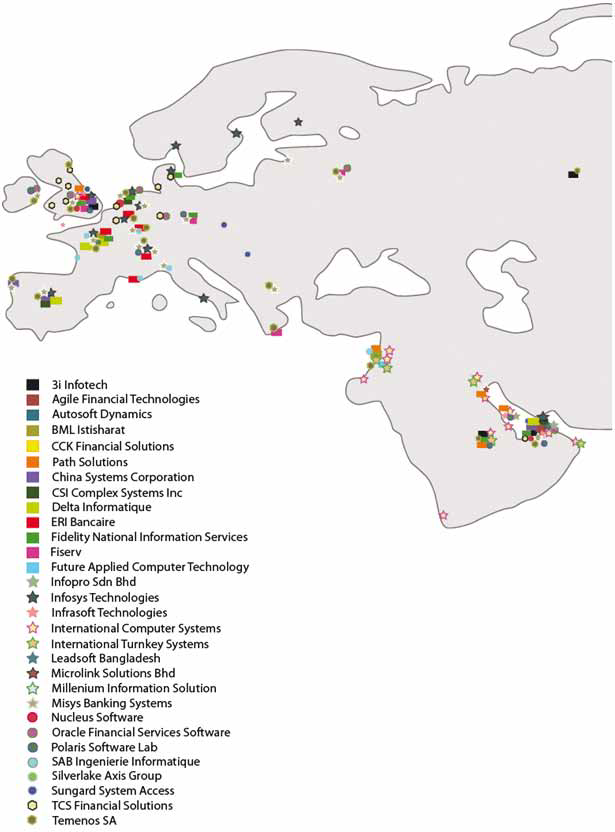

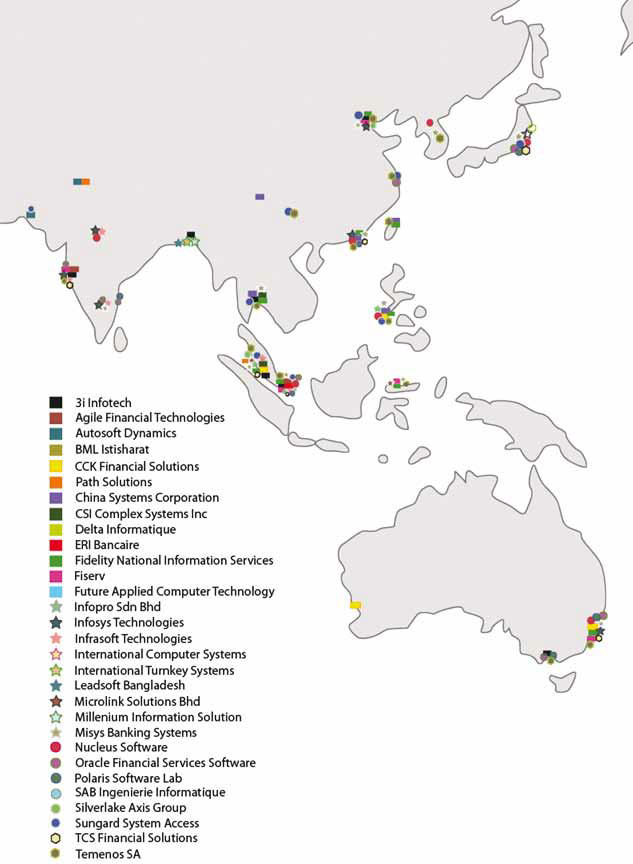

The Middle East has its share of specialist vendors. As well as Path Solutions and International Turnkey Systems, there are vendors such as BML Istisharat and representative offices of most of the major vendors. International Computer Systems (London) Ltd. despite having its head office in London, has a major development centre in Jordan for easy access, as all of its Islamic customers are located in Middle Eastern countries. London is also home to Misys; Geneva-based Temenos also has a major operating unit in that city as does ERI Bancaire. The section below provides a visual representation of the worldwide distribution of the different banking software providers’ existing sites by geographical area. Mapping density shows the highest concentration of firms which provide Shari’a-compliant systems to an estimated US$ 1 trillion Islamic banking industry.

Types of Islamic institutions needing Shari’a-compliant systems

Stand-alone Islamic institutions

Specifications of Islamic banking software

The progression of the Islamic financial industry has in turn had a positive impact on the Islamic banking software market. New products are being launched in the market and existing products are regularly upgraded. Also, as new accounting standards are continually introduced by industry regulators, the Islamic banking industry tries to keep abreast with the development of new robust, state-of-the-art Islamic banking software that al- lows it to meet challenges with great ease and efficiency.

In this context, an Islamic banking software system ought to have the following features:

- The most obvious characteristic of Islamic banking systems is that the system should not calculate interest. Ideally, even the wording of interest should not appear on any screen or report. (If the interest programs do have to be shipped as part of the system, then the interest rates should be set to zero at the global level).

- AAOIFI-certified, which means that the system must abide by AAOIFI standards with regards to business contracts, fiscal implications, Islamic products’ workflow and Islamic operations.

- On the deposit side, the system has to cater to the different types of deposit products including: wadia, mudaraba, reverse murahaba, and musharaka-based deposits. It additionally has to handle profit sharing be- tween the depositors/investors and the bank.

- On the financing side, it has to cater to the different types of financing instruments including: murahaba, musharaka, musawama, ijara, salam and others. It should entail the upfront recording of unearned profit, or the daily accrued profits upon transfer from the funding to the financing account, based on the profit scheme adopted by the bank.

- It has to also consider the computation of the selling price, rebates for early termination, grace period, non-capitalisation of charges and so on.

- Incorporate rigorous risk management and sound capital adequacy requirements and offers a centralised view of cash, liquidity and risk across the entire institution.

- Has different information-capturing features; i.e. captured information must fit the Islamic product type.

- Has workflow system. By using workflow, the bank can assure its Shari’a Advisory Board, that each transaction is processed in exactly the same authorised manner each time.

In addition, regulatory compliance is becoming another necessity for banks, as governments seek to improve transparency, particularly in more progressive Islamic banking markets. The need for improved access to real time data is stronger than ever before. Proven banking software enables linkage of important data and analysis required under Basel II.

Other factors perceived to be important include:

- Solution scalability, which allows customers to grow as their business evolves, without any system restriction and with minimum disruption to their banking operations.

- Solution flexibility, i.e. fully parameterised to reflect the client’s own operational procedures.

- Client-centricity: a client-focused application with a consolidated view of client data is very often the most significant pre-requisite in order to achieve strategic objectives.

- Fully-fledged Islamic institutions

Fully fledged Islamic institutions like conventional banks, need some form of automated processing to handle routine tasks associated with banking activities in a cost-effective manner. Not all of the processing within a bank is sensitive to the Shari’a. It is commonplace to find conventional systems processing in defined areas such as incoming/outgoing payments, fraud detection and anti-money laundering, regulatory reporting and maintaining data warehouses, teller and branch automation, general ledger and many of the other support areas within the bank.

Shari’a-compliant banking is needed for the Islamic account processing and monetary transaction postings regardless of whether these accounts and transactions are retail investment accounts held by individuals, or the full management of a sukuk issue in a capital markets environment.

In an Islamic bank, however, each new transaction process requires the approval of the bank’s Shari’a Advisory Authority, and once granted that transaction must always be processed in the same way. The documentation that is produced and the checks needed to execute the transaction properly can be controlled by workflow systems.

- Islamic windows

Conventional banks operating an Islamic window can be problematic from a systems’ perspective. In this case, the bank is offering conventional banking to some clients and Islamic banking to others. Some of the support and transaction processing functions take a double blow – tellers and branches must maintain the segregation of funds, transactions must be processed by the appropriate computer system and general ledger entries must be kept separate. The bank will in effect have a dividing wall between its conventional processing and its Islamic processing – hence the term ‘Islamic window’, a separate area dedicated to Shari’a-compliant banking.

In general terms, operating an Islamic window will require the bank to operate two computer systems – a conventional system and an Islamic system.

Maintaining strict segregation and ensuring that there is no co-mingling of funds means that only smaller operations find this form of banking, practical. A small, high-service-level private banking operation, for example, which deals in high-value low volume business, could operate in such an environment should it accept in- creased overhead costs of running parallel but separate systems. Similarly, a specialised corporate banking institution may be able to keep its Islamic financing transactions and supporting business documentation quite separate from its conventional financing. High-volume operations generally find it more convenient to create separate subsidiaries.

- Islamic subsidiaries

Creating separate Islamic subsidiaries may help solve the segregation issue, but it has inherent problems, for example, when combining financial results and footings from the conventional business and the Islamic business into one group statement for regulatory reporting or for annual statement production. The accounts themselves can be notionally merged to create a combined picture of the group, but care and examination is needed when moving funds around the group for inter-company funding. The Shari’a Advisory Board of the Islamic institution will need to verify that any co-mingling at a group level is of an acceptable amount, and is absolutely essential for group operations.

Scope of packaged Islamic systems

An Islamic bank will need to select a package that best meets its functional requirements and which is most closely aligned to its type of business. Some vendors that have been mentioned, Temenos, Oracle FSS, Path and Silverlake, for example, provide systems that are universal in nature. They can therefore generally cover the requirements of retail banking, wealth management and private banking, treasury and interbank transactions, corporate banking and some capital markets processing. Other systems, such as Equation, are better known for their retail capabilities. Others, such as ERI, provide specialist wealth management systems that cater to HNW individuals and their investments, while the likes of Reuters (now Thompson-Reuters) has been traditionally strong in treasury operations and dealing rooms.

The process in choosing a system can take several months, and possibly involve many of the bank’s departments as well as its Shari’a Board, and external consultants to guide the bank and ensure an impartial selection.

The below are the minimum requirements for a Shari’a- compliant software to perform properly:

Retail banking

- Branches automation for Islamic products

- Retail Consumer Finance tools according to Shari’a

- Murahaba

- Ijara

- Musharaka

- Mudaraba

- Salam

- Istisna’

– Project Financing

- Transparency in the utilization of funds and their profit generation

- URIA management according to Shari’a standards and regulations

- Profit declaration of the utilization of funds according to their investment in Shari’a-compliant products

- Profit distribution to customers based on a proper analysis to the profit percentage/amount to be distributed taking into consideration the equalization of profit and Mudarib fees retention

Wealth management

- Portfolio and funds management and private banking solutions and offerings

- Investment products according to Shari’a rules

- Products tailoring based on the Shari’a regulations, re- striction of investment according to the portfolio model

- Bank/FI supporting tools for decision-making. This helps in products selection and offerings investment opportunities to high-net-worth clients

- Vertical customer relationship management according to clients appetite in Islamic product offerings

- Maximization of profit according to the investment selection sectors and products

- Proper and accurate incentive and management fees for the portfolio manager

Asset management

- Portfolio management

- Bank/FI supporting tool for decision making to help in products selection and offerings investment opportunities to the clients portfolio managed by the company

- Proper risk management for the investment opportunities

- Proper follow-up on the portfolio valuation based on Cost to Cost and Mark to Market

- According to the portfolio valuation, the profit distribution takes place

- Proper and accurate incentive and management fees for the portfolio managers

Treasury

- Cash and Liquidity management according to Shari’a

- Placement and borrowing of the funds in Shari’a-com- pliant institutions against an interest-free relationship

- Proper Risk management for investment and currency position management

- Hedging of products for profit maximization and risk factors mitigation

- Vertical and sophisticated limit management

- Proper and accurate reporting tools to help on decision making

Audit and risk management

- All products offered shall be monitored from a risk management perspective:

- Market risk

- Operational risk

- Credit risk

- Ability to adapt swiftly to Basel II requirements

- Proper Assets and Liability management

- Exposures identifications and analysis

- AML management across all deals done

- Audit all activities of the financial institution as per the Shari’a regulations and internal policies and procedures

- Audit according to AAOIFI

Current trends in Islamic banking

Systems built using J2EE and Service Oriented Architecture one of the latest trends. Another groundbreaking technology is delivery of software-as-a-service (SaaS), considered as the biggest and most accessible platform for technology business innovation. SaaS is a web-based model of software delivery where the software firm provides maintenance, daily technical assistance and support for the software provided to its client from specific locations. This in turn reduces time and costs spent on support and maintenance. Another technology in the growth pattern is the N-Tier multi-interfaced system architecture, which caters to the requirements of distributed online/real-time banking business automation. The N-Tier architecture is designed to be reliable, scalable and efficient enough to adapt to new environments while also reducing maintenance cost.

Most areas of banking from a processing point of view remain just the same for both Islamic and conventional banks. An Islamic bank is still a bank – which must meet the same basic level of demands as any other member of the industry. For example, regulatory reporting formats are dictated by the regulator of a particular country. While those formats apply to all banks in that country they were originally developed with conventional banking in mind. One difference in functionality may be that in an Islamic bank, the general ledger charts of accounts on which the reporting is based, are set out differently to those of a conventional bank. Work is therefore needed to convert the raw accounting data into a more conventional format prior to creating reports for the regulators (there are particular differences, for example, around the use of some liability accounts).

Apart from minor differences, all banks Islamic and con- ventional need to make and receive payments. Customer information still needs to be maintained and customer centric views of relationships are important for customer service and marketing. Both set of banks must meet asset-liability management demands, although there are arguably less tools available to the Islamic bank to meet short-term liquidity management. ‘Know Your Customer’ and anti-money laundering requirements must be addressed by both conventional and Islamic banks as well.

It is arguable that while the conventional systems may claim a broader functionality, the Shari’a from-the-ground-up packages may offer ‘purer’ Islamic processing. However, since they are younger they may not offer as much functionality. It is also problematic as to how much of the functionality offered by a modified conventional system may be applicable to an Islamic bank especially in terms of transaction set, as many conventional transactions are not applicable.

But not for everyone

Not all vendors of packaged banking systems have developed Shari’a-compliant systems. Some have stood back either to see if this fledging market would even survive; or because the development needs of their client-base lie elsewhere.

Developing a Shari’a-compliant system can cause problems for vendors of banking systems. Unless the vendor has a development partner in the form of an Islamic financial institution that will assist in specifying requirements, they will not find it easy to come up with the human resources to enable a conventional banking system to be successfully modified to comply with Is- lamic processing, or to build an Islamic package from the ground up. This situation is compounded by the apparent lack of uniformity across the Islamic world, as to what is and what is not acceptable. The functionality developed by a vendor in one part of the world may not be applicable, or saleable, in another region.

The vendor also needs to consider the development cost aspects against sale returns. Vendors not only have to bear development costs, but also consider the ongoing maintenance costs. If two versions of the system are created, one conventional and the other Islamic, code changes will need to be tested against the conventional and Islamic version separately. This will be an ongoing expense that will grow as the Islamic version of the system grows in size and functionality.

In some cases, vendors and even banks themselves have overcome some of these maintenance problems by segregating the changes into special areas or layers of the system. At Dubai Bank, for instance, the Equa- tion system from Misys provides the core processing. When the bank decided to switch from conventional and become Islamic, the bank’s IT department built a new ‘layer’ on top of the conventional processing, to accommodate the new Shari’a-compliant processing needs. Other vendors use parameter settings to significantly change the way instruments are processed. Temenos for example, uses a ‘model-bank’ approach in its T24 product in which standard parameters can be set to invoke processing designed to meet Shari’a needs. ERI, although having built specialist processing for Islamic

instruments into its Olympic Banking System, is able to use the existing functionality previously developed for mutual fund processing, to accommodate profit distribution.

Future trends

Shari’a-compliant banking systems have been developed and the market is maturing. Vendors have proven that they can build and sustain their business by providing Islamic banking systems as their primary business offering. To protect market share, the leading conventional vendors have moved to create systems that claim to have more or less degree of Shari’a compliance. Institutions have shown, as is the case at Dubai Bank, that if a bank switches to Islamic practices, not every system in the bank needs to be thrown out.

This places on developers of Islamic systems the over-head of developing functionality that is not particularly Shari’a sensitive, while at the same time often burdening developers of conventional systems with two versions of software. One technical solution to this predicament is the much awaited Service Oriented Architecture (SOA) which, if implemented, will allow vendors to create individual ‘services’ (such as statement produc- tion, current account processing, unit fund pricing, etc.) and bundle them together in a fashion to suit the end customer. Work has been done at NBK in this respect, where the TCS Bancs system is being ‘dismantled’ into its component parts (or services) and ‘reassembled’ into the shape that NBK wishes to implement. Other vendors, including vendors of Islamic banking systems, are advanced in this respect and have to some extent implemented this technology.

As Islamic banking moves into mainstream conventional banks, new markets will open to vendors of Islamic systems if they are able to deliver discreet Islamic services and accounting procedures into existing computer systems.

Inter-bank market and platform

The industry needs to have Islamic banks more closely connected to each other not only in terms of products and strategy, but also in terms of bank to bank communications. This will not only aid liquidity management, but will also assist in forming international joint ventures and syndications.

Flexibility and market turmoil

The Islamic banking sector is currently undergoing significant internal reflection and even some reclassification. The recent ruling on tawarruq, the internal discussions on what constitutes Shari’a-compliant products, Shari’a-based products and Shari’a-acceptance all point to the need to have computer systems that have sufficient flexibility to avoid locking an institution into a closed avenue.

Of course, it is difficult to accurately predict where the industry will be in five years time. However, the bank can certainly protect its future if it has systems installed based on current industry standards developed by experienced vendors to adapt to different market cycles.