The Islamic financial risk management market to date is less prominent in comparison to the progress made in areas such as Islamic banking and sukuk, and there is recognition amongst the Islamic community of a legitimate need to protect investors against market volatility. This has led to Shari’a acceptance of a sphere of financial risk management products which have been developed along the established murahaba and wa’ad structures. Bespoke products based on these structures are currently offered by some financial institutions, although the number of players is still limited and it is expected that there is market appetite to absorb more entrants. The number of financial institutions who continue to refine Islamic financial risk management products sug-gest that the industry is now a recognised sector of the financial markets, particularly amongst Middle Eastern investors, with further in-roads being made in South- East Asian markets such as Malaysia and Singapore: all of which suggest that this emerging market will eventually be capable of offering an extensive range of increasingly sophisticated services.

Islamic financial risk management products – the challenge

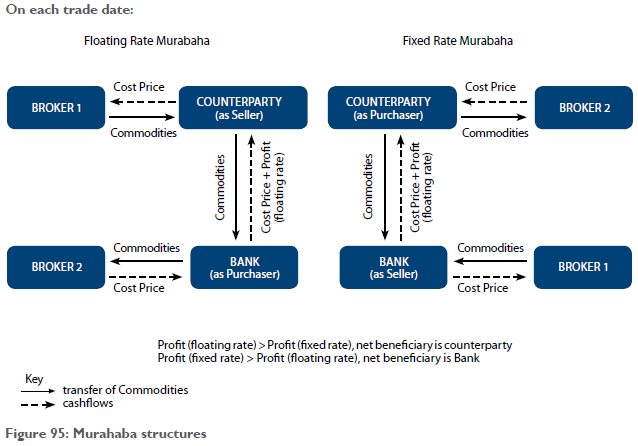

Until recently, it had been the opinion of Shari’a scholars that financial risk management products (also commonly referred to as “hedging arrangements”) would fall into the prohibited categories of speculation (maisir) and uncertainty (gharar) and could not therefore be marketed as Shari’a-compliant products, nor used in conjunction with Islamic financings.

However, in line with the increasing sophistication of Islamic finance, some Shari’a scholars have taken the view that Islamic investors should be able to enter into certain arrangements in order to gain protection against a genuine exposure or liability (rather than solely for speculative reasons), provided that the financial risk management product itself is structured in a Shari’a- compliant manner.

Thus, the challenge for the Islamic financial risk management industry is developing a set of products which, on the one hand, are compatible with the principles of Shari’a whilst on the other, satisfies the needs of the financial institutions and potential investors who are already familiar with the established conventional derivative products which form an intrinsic and lucrative component of their day-to-day transactions, and which are documented by standard-form agreements.

Structuring Islamic financial risk management products

- General issues to consider

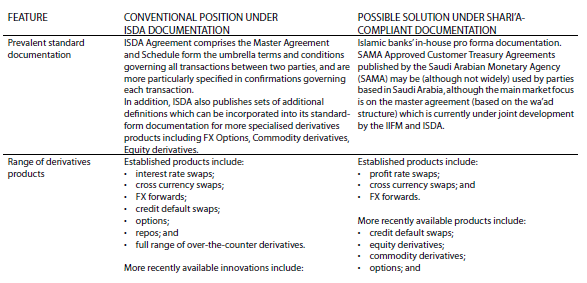

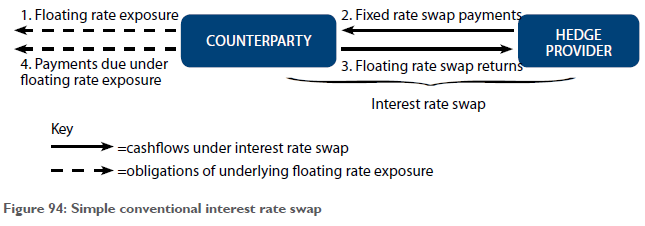

- Commercial objective of conventional products Although the demand for Islamic financial risk management products is largely driven by investors in the Middle East or Middle Eastern investors based abroad, most of the products offered to date by Western banks are replications of conventional products in a Shari’a-compliant manner. As such, a logical starting point to structuring an Islamic financial risk management product is to understand the commercial purpose of its conventional counterpart. Taking the case of a simple conventional interest rate swap by way of an example (see Figure 94 below).

- A Counterparty has an exposure to a floating rate (e.g. interest payments on a financing which is referenced to LIBOR).

- The Counterparty enters into an interest rate swap with a Hedge Provider in order to manage its debt servicing costs so that, in consideration for a fixed rate payment, it will receive a floating rate return which matches the payment obligations under its floating rate exposure.

- On scheduled payments dates (which may match the payment dates under the floating rate exposure) under the interest rate swap, the Hedge Provider pays to the Counterparty an amount equal to the sum required by the Counterparty to discharge its underlying payment obligations.

- The Counterparty applies the returns from the inter- est rate swap to discharge its payment obligations under the floating rate exposure.

When structuring an Islamic profit rate swap, the same hedging protection for the Counterparty would be achieved through agreement between the parties that, on certain dates, one party will be obliged to enter intoa commodity trade with the other, for an amount equal to the difference between a fixed rate and the relevant floating rate. Please see the section on “Prevalent Islamic Structures” for further examples of Islamic profit rate swaps.

- Addressing Shari’a aspects

Prevalent Islamic structures

In general, Islamic financial risk management products are structured as a series of synthetic commodity trades which occur on each scheduled payment date to replicate the periodic swap payments due under a conventional hedging transaction. This feature of trading on scheduled payment dates has made the conversion of an otherwise conventional financial risk management product, into a Shari’a-compliant one, that is more commercially palatable due to its perceived similarity to a conventional swap product.

- Murahaba structures

The most common Islamic structure used in the current marketplace is the murahaba structure, whereby periodic swap payments are enabled through a commodity trade by way of a murahaba agreement, so that those commodities (the cost price of which represents the notional amount under a conventional hedge) can be sold for a known profit, and the payment of such cost price plus profit can either take place at the same time or deferred until a later date depending on the form of murahaba structure adopted. In the Islamic finance industry, a murahaba is broadly understood to refer to a contractual arrangement be- tween a financier (the seller) and a customer (the purchaser) whereby the financier would sell specified assets or commodities to the customer on spot delivery and deferred payment terms. The deferred price which the parties agree to at the time of the murahaba contract would typically include the cost price at which the financier had purchased the commodities, plus a pre-agreed mark-up representing the profit generated by the financier’s involvement in the transaction.

The same characteristics of a murahaba transaction can be adapted for use as the base structure in the context of an Islamic financial risk management product. A number of such products have appeared in the market place with varying degrees of success. By using murahaba trades occurring on each scheduled payment date, the hedging bank and the counterparty would be ex- posed to the ownership risk (even if only briefly) of an underlying asset, thus justifying the profit made by either party.

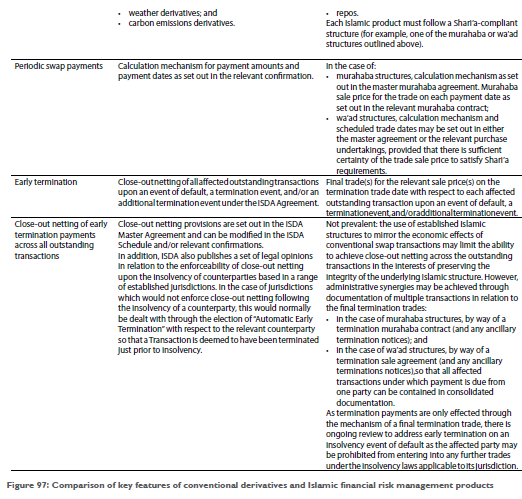

A description of the two main murahaba structures, illustrated by way of an example a profit rate swap, is set out below.

- Murahaba structure #1

At the outset of a hedging transaction, the hedging bank (the “Bank”) and the counterparty (the “Counterparty”) would enter into a master murahaba agreement setting out the commercial terms governing the future mura-haba transactions which will occur periodically between the parties throughout the term of the swap. These terms would include matters such as the scheduled trade dates, the fixed rate to be used for calculating the murahaba profit, the floating rate to be used for calculating the murahaba profit, the assets to be traded, and the cost price of those assets (see Figure 95).

On each scheduled trade date, the Bank and the Counterparty would each enter into two murahaba agreements:

- The Floating Rate Murahaba Agreement: following its purchase of the specified Commodities from a third party broker (“Broker 1”) for a Cost Price which would be equal to the notional amount of the hedging transaction, the Counterparty would sell-on the same Commodities to the Bank for a price which would be equal to the Cost Price plus a Profit calculated by reference to the floating rate which is the subject of the profit rate swap transaction. Following its purchase of the Commodities, the Bank may sell-on the same Commodities to a third party broker (“Broker 2”) for a price equal to the Cost Price; and

- The Fixed Rate Murahaba Agreement: following its purchase of the specified Commodities from a third party broker (“Broker 1”) for a Cost Price which would be equal to the notional amount of the hedging transaction, the Bank would sell-on the same Commodities to the Counterparty for a price which would be equal to the Cost Price plus a Profit calculated by reference to a fixed rate. Following its purchase of the Commodities, the Counterparty may wish to sell-on the same Commodities to a third party broker (“Broker 2”) for a price equal to the Cost Price.

Following the parties’ parallel entry into both the Floating Rate Murahaba Agreement and the Fixed Rate Mu-rahaba Agreement on each trade date, the net result of the murahaba trades is the difference between the Prof- its calculated by reference to each of the floating rate and fixed rate. As in the case of a conventional interest rate swap, the party who is “in the money” (or the net beneficiary) will be determined depending on whether the floating or fixed rate has generated a greater Profit amount.

In common with the risks inherent in any murahaba structure, the parties are exposed to the following:

- Commodity risk: this arises out of each party’s ownership of the Commodities as the market value of the Commodities may fluctuate or the Commodities may become damaged during the period of a party’s ownership. In order to mitigate such risks, the period of Commodity ownership is often minimised to as short a period of time as possible (which could be as brief as a few seconds), cash settlement for each commodity purchase transaction is used instead of physical settlement to minimise the risks of damage to the Commodities during transportation, and the Counterparty would often provide an indemnity in the event that the Bank suffers any losses due to its ownership of the Commodities. These mitigation techniques may not be acceptable on all murahaba transactions as some Islamic institutions view these as undermining the principles of Shari’a, which requires the parties to assume full owner-ship risk; and

- Execution risk: this arises because Shari’a principles prohibit the parties from agreeing to a future sale in which the delivery of an asset and the payment thereof are both deferred to a later date. As a consequence, this murahaba structure would require the delivery of the Commodities to occur on the same date as each of the Floating Rate Murahaba Agreement and the Fixed Rate Murahaba Agreement, which in turn depends on both parties’ willingness to enter into the murahaba contracts on each trade date regardless of whether they are the net beneficiary.

- Murahaba Structure #2

The entry into Commodity trades on each trade date not only exposes each party to the ownership and execution risks outlined above, but also attracts brokerage costs. Typically, the brokerage fees would be payable by the Counterparty, but unlike a simple commodity murahaba in a straightforward financing transaction, the Counterparty would be liable for two sets of brokerage fees due to the parallel murahaba arrangement.

To streamline the mechanics set out in Murahaba Structure #1 above, Murahaba Structure #2 would involve the parties entering into the same parallel murahaba agreements at the outset. However, only one Fixed Rate Murahaba Agreement would be entered into for the duration of the entire profit rate swap because the total Profit for the entire transaction can be calculated at the outset by reference to the fixed rate, and payable by way of instalments over a number of deferred price payment dates which coincide with each scheduled trade date under the Floating Rate Murahaba Agreements. This arrangement would still allow a comparison to be made between the Profit calculated by reference to each of the floating rate, and the fixed rate to determine which party is the net beneficiary on a periodic basis.

Although Murahaba Structure #2 does not negate the need for fresh trades for the Floating Rate Murahaba Agreements, the fixed rate murahaba trade at the out-set would help reduce: the overall brokerage fees payable by the Counterparty over the life of the swap transaction; any ongoing commodity risks with respect to the Commodities which are the subject of the Fixed Rate Murahaba Agreement; and the overall execution risks as only the party which is the net beneficiary on a trade date would be exposed to the risk that the other won’t execute the relevant Floating Rate Murahaba Agreement. However, if the purpose of a profit rate swap is to provide hedging protection for an amortising financing arrangement, this Murahaba Structure #2 lacks the flexibility for adjustments of the notional Cost Price during the life of the swap, precisely because the deferred price (hence the relevant Profit) under the Fixed Rate Murahaba Agreement has already been determined at the outset.

- Wa’ad structure

Following the completion of the first Islamic profit rate swap of its kind in November 2007, the wa’ad structure has quickly become the preferred structure choice by financial institutions and that to be used in the proposed standard-form documentation currently under development by the International Swaps and Derivatives Association and the International Islamic Financial Market. Please see the section on “Prevalent standard documentation” below for further details.

In Arabic, “wa’ad” is broadly understood to mean a promise which, although a moral obligation, can be interpreted under most legal systems to be a legal obligation. A promissor would grant the promissee a unilateral and irrevocable promise to enter into a trade on a specified schedule of proposed future trade dates for a specified price for the purchase of commodities (similar to a put option). Such a promise would be documented by way of a purchase undertaking from the promissor.

The same characteristics of the wa’ad structure can also be adapted for use as the base structure in the context of an Islamic financial risk management product through the granting of parallel purchase undertakings by each of the Bank (as promissor to the Counterparty) and the Counterparty (as promissor to the Bank) so that each party would be obliged to enter into a trade for the relevant Commodities on the same trade dates. The pair of purchase undertakings cannot be linked in any way for the purposes of Shari’a compliance, but they would share similar terms such as the proposed trade dates, commodities to be purchased, and the notional Cost Price of the Commodities. As with the parallel murahaba structures, the Profit would be calculated by reference to a floating rate in one of the purchase undertakings, and a fixed rate in the other.

The key aspect of each promise turns on the conditions attached to its exercise by the promissee, which mirror those in a conventional hedge in the way it determines which party benefits on a trade date. In the context of a profit rate swap, which party is determined to be “in the money” would depend on whether the fixed rate or the floating rate is higher. Only the party who is “in the money” (because the Profit element, as calculated by reference to the floating rate or fixed rate, of the trade under which they are a promissee is higher) would be able to exercise the purchase undertaking in which the promissor is the party who is “out of the money”. That promissor would then be required to purchase the relevant Commodities and pay to the promissee an amount equal to the Cost Price + Profit. The net result of the trade mirrors that of the parallel murahaba arrangement as well as that of a conventional interest rate swap transaction.

The wa’ad structure quickly found favour in the Islamic financial risk management market as it goes some way to address the inherent risks with the murahaba structures. The ownership risks associated with every commodity trade is minimised in this structure as one trade would take place on a scheduled trade date (rather than two parallel trades under the murahaba structures). This also has the added benefit of lowering the overall brokerage fees payable by the Counterparty due to the reduced number of Commodity trades. Execution risk, on the other hand, is resolved because the party who is “in the money” on a trade date is the one who is in control of exercising the relevant purchase undertaking to require the other to enter into a trade to purchase the relevant Commodities at the pre-agreed Cost Price plus Profit. The wa’ad structure has been used for Islamic financial risk management products beyond profit rate swaps, as its flexibility also makes it suitable for cross-currency swaps and FX options.

As the purchase undertaking given by each of the Bank and the Counterparty must remain independent of each other for Shari’a compliance reasons, the default or termination by a party under one purchase under- taking cannot trigger a cross default or termination of the other, so as to effect early termination of the whole swap transaction. However, the use of a master swap agreement which documents, amongst other things, agreed mechanisms which lead to the termination of both purchase undertakings have been accepted by Islamic scholars. On the basis of this, financial institutions are increasingly using swap documentation based on the conventional ISDA architecture (comprising a master agreement and transaction-specific purchase undertakings) which, over time, are developing into a familiar-looking umbrella agreement containing provisions on matters such as representations and covenants, events of default, termination events, and Shari’a-compliant termination payment calculations.

However, an ongoing challenge is dealing with termination on the insolvency of a party who is “out of the money” because Islamic scholars require any termination payments (the close-out amount) to be made as a sale price under a final trade, rather than as a “loss” payment. This would be a problem if, as is likely to be case, the insolvency laws of the jurisdiction which is applicable to the (defaulting) promissory, prevents an insolvent person from entering into the final trade.

Regulatory issues

Insofar as any Shari’a-compliant product has a derivative effect, an Islamic finance institution (IFI) that wishes to offer these services by way of business in a jurisdiction, such as the UK, which regulates futures, options and contracts for differences, would need to be authorised by the relevant regulator, such as the FSA, to undertake regulated activities. In the UK, for example, the FSA has required Islamic financial institutions seeking to offer derivative products to be regulated to offer commodity futures, commodity options on commodity futures, contracts for differences, futures, options, rights to or inter- ests in contractually based investments and rolling spot forex contracts. The issue for an IFI and, indeed, a regulator is analyzing a Shari’a-compliant product properly to determine whether it is analogous to a conventional product, such as a future, option or contact for differences such that it would be necessary to regulate it. In this respect, an economic analysis would usually be necessary and where the IFI or its advisers have determined that a Shari’a-compliant product (“S”) was intended to have the same economic effect as a conventional product (“C”) but that Shari’a required S to be structured differently to C, then the IFI would need to apply for a licence from the regulator.

In certain jurisdictions, such as the DIFC, this would, in addition, require the IFI to apply for an Islamic finance licence or, more accurately, an Islamic endorsement of its conventional licence where the IFI held the products out as Shari’a-compliant.

An IFI’s holding of a licence would have specific consequences, including the requirement to comply with conduct of business requirements, including requirements related to advertising and accepting customers, and requirements related to capital adequacy.

Key Islamic financial bodies and acceptance by Shari’a scholars

A summary of the key Islamic financial bodies is set out in the figure below. Although, with the exception of the IIFM, currently not all of them are actively participating in the Islamic financial risk management market, they are likely to have an increasing role in shaping the market into a more mainstream business line.

ISLAMIC FINANCE: THE KEY FINANCIAL BODIES

There are currently three principal industry bodies for Islamic finance:

Accounting and Auditing Organisation for Islamic Financial Institutions (“AAOIFI”): Established in 1991 in Bahrain, it has some 200 members including central banks and financial institutions spanning across 45 countries. AAOIFI prepares standards covering accounting, auditing, governance, ethics and Shari’a, as well as offering training to its members. Whereas there are currently no specific AAOIFI guidelines on Islamic derivatives, it is conceivable that any future AAOIFI statements will be influential in the direction of the market

International Islamic Financial Market (“IIFM”): Estab- lished in Bahrain by the central banks and monetary agencies of Bahrain, Brunei, Indonesia, Malaysia and Su- dan as well as the Islamic Development Bank in Saudi Arabia, it has a board comprising of a variety of public and private sector representatives drawn from its 46 members. The IIFM focuses specifically on capital and money markets. It launched the world’s first standardised Master Agreement for Treasury Placements in October 2008, to support standardised inter-bank commodity murahaba transactions. There is now a joint project between the IIFM and ISDA to develop an Islamic master swap agreement based on the wa’ad structure to facilitate transactions in Shari’a-compliant risk management products.

Islamic Financial Services Board (“IFSB”): Established in 2002 in Malaysia, it has 185 members across 35 countries including 43 regulatory authorities as well as the International Monetary Fund, the World Bank, the Islamic Development Bank and the Asian Development Bank. The IFSB aims to complement the work of the Basel Committee on Banking Supervision and the International Organisation of Securities Commissions to serve as “an international standard-setting body of regulatory and supervisory agencies” in relation to Islamic banking,capital markets and insurance. The levels of interest in the South East Asian markets could see more active involvement of the IFSB in the future.

Both the murahaba and wa’ad structures are now widely recognised as being acceptable in the context of Islamic financial risk management transactions, although as with any Islamic financing transaction, the party for whom Shari’a compliance is an issue needs to satisfy itself on a case-by-case basis that the proposed transaction structure has received the approval of its relevant board of Islamic scholars. This is customarily achieved by obtaining a fatwa for the proposed transaction. There is some expectation that the Shari’a approval process, as well as other administrative processes, may be streamlined following the publication of market standard Islamic derivatives documentation which would be used along the lines of the current ISDA Master Agreement and Schedule for conventional derivatives, in the form prescribed by ISDA. In the meantime, the key financial institutions who offer Islamic financial risk management products have tended to formulate in-house template agreements for each of the classes of products offered. However, murahaba structures are now becoming subject to increasing scrutiny as the ownership risk mitigation techniques (especially the scope of the indemnities granted by counterparties) adopted by some banks virtually eliminate any risk of entering into a transaction to the bank, thus calling into question what risk has been taken to justify the profit earned.

Availability of Islamic financial risk management products and future growth

Although the financial institutions at the forefront of the Islamic financial risk management industry have seen a substantial year-on-year growth in the trading of these kinds of Islamic instruments, there is also acknowledgement that the markets have taken a dip in momentum following general scepticism that derivatives trading played a role in destabilizing the global financial systems in the recent market downturn.

Currently, profit rate swaps and cross currency swaps form the vast majority of Islamic financial risk management products offered by the participating financial institutions, although other FX products, forwards, vanilla options and over-the-counter swaps are also available.

The inherent tangibility between a Shari’a compliant trade and an underlying commodity has also led to in- creasing focus on the development of futures contracts where the underlying commodity is physically deliverable. For example, some banks are developing futures products where the relevant derivatives index is linked to physically deliverable commodities. The Turkish derivatives exchange is expected to launch a Shari’a-com- pliant cotton futures product and is currently seeking to establish a licensed warehouse to facilitate delivery.

The development of Shari’a-compliant credit default options and repos is also ongoing and can be expected to appear in the markets in the near future. Meanwhile, whereas the Dow Jones Indices do not currently contain any Islamic derivatives indices, it already has some equity-based Islamic indices which it believes can form the basis of Shari’a-compliant contracts once a successful Islamic product has been launched.

The Islamic financial risk management market, although increasingly recognised, is still progressing in terms of volume growth and product innovation, and the favoured underlying Shari’a-compliant structures for each product are under constant revision and ongoing refinement. The replication of cashflows to those made under conventional swap transactions and the increasingly prevalent use of master agreements, together with transac- tion-specific purchase undertakings under the wa’ad structure, have lead to a documentation approach which is closer to that under the more familiar ISDA-style architecture. Banks are now looking at the other ISDA-style provisions such as termination events, events of default, early termination provisions, and calculation of close-out amounts which are approaching the same level of sophistication in Islamic financial risk management products as those afforded by their conventional counterparts. As the financial markets begin to recover, innovative thinking by bankers and lawyers in conjunction with Islamic scholars will continue to drive the development of this relatively new sector of the Islamic finance market.