Rizq

A LEADER IN ISLAMIC DIGITAL SPACE IN THE UK

PETER TREBELEV

Co-Founder & Head of Growth

SHAHID AMIN

Chief Executive Officer

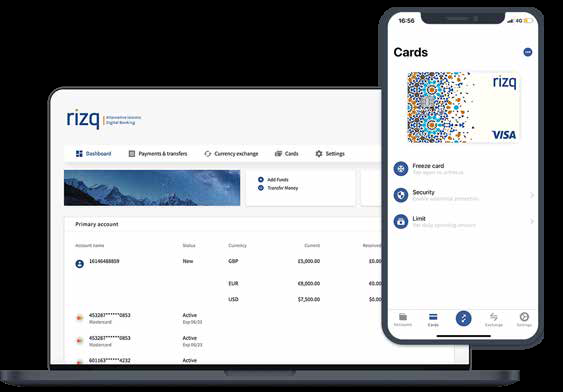

Since 2004, when the first fully-fledged Islamic retail bank – Islamic Bank of Britain (now renamed as Al Rayan Bank PLC) – opened its doors for customers in the UK, a number of Islamic financial institutions have emerged in the country. Rizq is the first Islamic FinTech in the UK, which is being seen as an institution with a lot of promise in the digital space in the UK.

In this interview, we talk to two of the officers of the project to gain insight into the vision and mission of Rizq to assess its viability and future prospects.

HOW DID THE IDEA OF SUCH A DIGITAL BANKING SERVICE EMERGE, ESPECIALLY IN A COUNTRY LIKE THE UK?

PT: We, the founders, have deep associations with FinTechs, having worked in challenger banks previously and having always wanted to create a project of our own. We saw how underserved the Islamic market is, even though Muslim population is circa 3.5 million in the UK (and it is also a very young population which is growing) – and hence, it seemed to us that there is an opportunity.

More broadly, the peculiarities of the market – such as the amount of money that is remitted – made it more exciting.

The UK government is also one of the only European governments that is truly supporting Islamic finance; this is evident with a new sukuk issued in 2021, to the sum of half a billion pounds. After reflecting on all of this, plus carrying out some first-hand research which indicated that a majority of those surveyed would switch to Islamic banking if given a convenient option, we decided to go for it!

WHEN YOU LAUNCHED RIZQ, DID YOU THINK IT WOULD BE SO POPULAR OR THAT IT HAS A BIG ENOUGH CUSTOMER BASE TO BE SUSTAINABLE?

PT: In short, yes! Bringing niche products to communities within our society that are underserved is a proven way of building a business that sticks around. Plus, calling a 2 billion population community ‘niche’ is a bit of a stretch. The UK is just the start, and whilst the market here is big enough to make Rizq sustainable, there is much more we can do, hence, expansion to the EEA at some point makes total sense. It is a similar market in many ways, with hugely untapped opportunities. On the flip side, we also want our customers to gain value from our marketplace and remittance models. As they use these services, we generate revenues from our partners. This is the ideal model, where customers get great products and services and we generate revenues to continue to build and grow our business.

HOW IS RIZQ CHANGING THE BANKING LANDSCAPE IN THE UK IN PARTICULAR, AND IN THE WIDER MARKET IN GENERAL?

PT: Rizq was the first UK-based Islamic digital banking product to come to market at the end of 2020. When you are the first, you get a great first-mover advantage and set the pace of development. Since we started, a number of new Islamic neo-banking brands have popped up, but the majority are yet to launch.

We see competition as a great thing for the market, as it brings innovation and fabulous services to the customer; all the while these are people sharing the same passion for developing ethical financial services. It also shows to investors that the opportunity is seen by many, and not just by Rizq’s founders. Having options grows consumer confidence, too. More broadly, we feel that the UK is just the start for everyone; and the international stage is big enough for all to share!

‘’THE UK GOVERNMENT IS ALSO ONE OF THE ONLY EUROPEAN GOVERNMENTS THAT IS TRULY SUPPORTING ISLAMIC FINANCE.’’

THE CURRENT PANDEMIC HAS CHANGED HOW WE VIEW THE WORLD. FINANCIAL SERVICES ARE COPING WITH A NEW NORMAL. IN SUCH UNCERTAIN CIRCUMSTANCES, HOW IS RIZQ GOING TO COPE WITH THE AFTERMATH OF COVID-19?

PT: The company was incorporated in February of 2020, and so Rizq is a business born out of lockdown. As a team, we have persevered through a wide range of complexities which were a direct bi-product of COVID-19 – and hence, we feel that we’re pretty well-equipped to face the aftermath, too. COVID did also prove to us that consumers are managing their finances from the comfort of their homes. Hence, we hope that consumers have changed their behaviour towards the widespread adoption of digital-first brands.

HOW HAS YOUR EDUCATION AND PREVIOUS EXPERIENCES SHAPED YOU AND ASSISTED YOU IN YOUR CURRENT ROLE?

PT: Having worked in FinTech for a while, we got some exposure to what’s required from a tech, compliance, finance and operational side – however, nothing can quite prepare you for being a founder. There are more intricacies, pressures, and pitfalls that one can think of – and, one can only experience them by becoming a founder. Our CEO Shahid, who is a seasoned vet of the finance and banking industry, has been of massive help here – his background is 20 years in banking and specifically 13 years in Islamic banking alone. The beauty of this is that experience of banking coupled with the dynamism of FinTech creates the perfect model for solid regulated products that are innovative, fresh and exciting.

OUR READERS WOULD LIKE TO LEARN HOW YOU ENCOUNTERED ISLAMIC BANKING AND FINANCE AND HOW HAS YOUR CAREER PROGRESSED IN THIS NICHE.

SA: In Britain, Islamic Banking has been around for 40 years. Through this time, the industry has not evolved much – and grown out of what the customers need and want. Importantly, to be able deliver financial products and services that are Shari’a approved, a deep understanding of how banking, liquidity, transaction management and regulation works is needed. This really can only be done initially by working in conventional banking environments. Through this experience, we understand how regulation works, how products and services must meet minimum regulatory requirements and how interaction with customers must be done. But this is not enough, and customer experience and relevance to lifestyle also have to be at the forefront of the mind!

Accompanying this, working in different territories that have a large Islamic banking market, such as the UAE and Saudi Arabia, you get a better understanding of Shari’a-based financial services and products. There has also been an evolution within Shari’a-based banks in the products and services – specifically, they tend to be more in tune with the needs of today’s customers. Customers are now more and more demanding of banks to be ethical in their dealings, and so as a modern Islamic bank challenger, we have factored this into our products and services.

WHAT ARE YOUR PLANS FOR THE FUTURE AND THE EXPANSION OF RIZQ?

‘’IN BRITAIN, ISLAMIC BANKING HAS BEEN AROUND FOR 40 YEARS. THROUGH THIS TIME, THE INDUSTRY HAS NOT EVOLVED MUCH – AND GROWN OUT OF WHAT THE CUSTOMERS NEED AND WANT.’’

SA: Rizq is currently launching our business account proposition, as we estimate that there are circa 100,000 Muslim-owned SME’s in the UK that do not currently have a convenient offering that also has ethical values in mind. Most business owners, like retail customers, want the ease of use at a fair price. Rizq has developed a business account app and is trialing it at the moment. Alongside this, we are building focus on the lifestyle element of Rizq app, to also

*Global Islamic Finance Report 2021 further grow the retail customer base. As always, the Rizq team is innovating and will constantly bring new services and products to market.

DO YOU THINK THAT ISLAMIC BANKING AND FINANCE HAS THE POTENTIAL OR CAPACITY TO OFFER A GLOBALLY RELEVANT FINANCIAL SOLUTION TO THE POST-COVID WORLD?

PT: Definitely. Islamic finance has been growing at a phenomenal pace, with estimated ranging from 6.54% to 14.84%.*

COVID has highlighted how the global financial system had to adapt to closed branches and high streets with a strong shift to an online presence. The Rizq banking app showed that we are able to operate successfully, even when the majority of the economy came to a stand-still.

Furthermore, the UK aims to be the capital of Islamic finance in the Western world (as well as the top FinTech hub in the world), meaning that Rizq is very well placed to succeed and export its expertise to other countries in the developed and developing worlds where there is a willing population but a lack of service providers.

Ultimately, Rizq operates in a regulated world and financial service regulation is some of the toughest around – which stagnates innovation somewhat – but rightly so, as it is there to protect the consumers. Rizq is operating in this environment, and making positive strides for Islamic finance to deliver products and services that the customer really wants.

THE WORLD IS FAST BECOMING ORIENTATED TOWARDS THE USE OF SOCIAL MEDIA. WHAT ROLE CAN SOCIAL MEDIA PLAY IN CREATING AWARENESS AROUND ISLAMIC FINANCE?

PT: social media is a critical channel for any organisation, especially one that targets the younger demographics.

We believe that Muslims who have a large following and a loud voice can leverage this for educational purposes, primarily focusing on translating the messages and the benefits in a simple language. In the era of highlighting social problems and developing a better understanding of different communities, we see social media as a positive influence – however, as with anything, even a positive tool can sometimes be used for harm. It fully depends on the content producer, and what people choose to consume.

LAUNCHING A START-UP DURING AN UNPRECEDENTED PANDEMIC IS NOT AN EASY FEAT AND RIZQ WENT ON TO WIN THE BEST EMERGING ISLAMIC FINTECH INSTITUTION AT THE GLOBAL ISLAMIC FINANCE AWARDS. HOW WILL THIS ACHIEVEMENT DEVELOP RIZQ AND SHAPE YOUR PERSONAL FOCUS AND YOUR PROFESSIONAL COMMITMENT?

PT: Indeed, it has been incredibly challenging. There was a lot of panic around general well-being of course, as well as questions around VC fundraising drying up/being placed on hold, plus question marks around hiring, and dozens of other factors to consider. It was not as easy – however, on the bright side, the pandemic made us get comfortable with being even more digitally native than before (as a team, and as a country) – and showed us how resilient we can be in the worst of times. The award presented by GIFA is an incredible testament to the whole team and reinforces what is said above. We value this hugely, as it comes from a reputable organisation with a rich history. It also gives our customers and supporters the confidence to use more and more of our services, and to really start paying close attention to the Rizq revolution that’s happening before our eyes.

‘’THE AWARD PRESENTED BY GIFA IS AN INCREDIBLE TESTAMENT TO THE WHOLE TEAM. WE VALUE THIS HUGELY, AS IT COMES FROM A REPUTABLE ORGANISATION WITH A RICH HISTORY.’’

WHAT CAN WE EXPECT FROM YOU IN THE COMING YEARS? ARE THERE ANY INTERESTING PLANS IN THE PIPELINE, OR ASPIRATIONS THAT YOU WISH TO SHARE WITH OUR READERS?

SA: We are definitely working on a lot of exciting initiatives, especially on the product and marketing front. The focus is not solely finance – but also Islamic lifestyle on the whole. We are also going to be focusing on business banking, and the ancillary services you can imagine – as well as helping out other FinTechs that want to come to market in other locations. We want to make an impact in our customers’ lives with a best-in-class, ethically inclusive, financial ecosystem.

WOULD YOU LIKE TO GIVE A MESSAGE TO THE YOUNGER GENERATION OF ISLAMIC BANKING AND FINANCE PRACTITIONERS?

SA: The foundations have been laid and we are extremely thankful to our pioneers in both the theology and banking worlds who got together to develop viable products.

The new generation is the future of innovation, product development, and service delivery. It is vitally important that we have the next generation to come on board and work with our colleagues in regulatory agencies, conventional banks and governments to continually engage and discuss the ethical benefits of islamic finance. There is a lot of work still remaining – but remember, we build and innovate not for ourselves but for the betterment of all societies.

WOULD YOU CARE TO SHARE WITH OUR READERS, ESPECIALLY THE YOUTH, WHAT HAVE BEEN SOME OF THE CHALLENGES THAT YOU HAVE COME ACROSS IN YOUR CAREER AND HOW YOU OVERCAME THEM?

PT: I think the key to life is happiness, which, ultimately, can be found in different places for different people. A good place to start is focusing on doing the work that you love. If you do this, you will not work a day in your life – and, because you will be passionate, you will actually be very likely to succeed in the field that you choose (it won’t feel so much like work, hence you will commit more).

In terms of specific challenges, there are a few that come to mind. I’d say it pays to be prudent when selecting your leadership team primarily – but the same goes for all employees. Your organsiation will only be as good as the people that lead it and shape it. Ethics are most important, followed by intelligence, proactiveness, and hard work.

The other one that pops to mind is making sure that, whilst there is a grand vision and plan, you do not freeze and lose faith due to the seemingly monumental task. Break everything down into little tasks, and tackle them – while dealing with any problems that arise – one at a time. It is important to plan for scalability and the future from the start by getting the foundations in – but do not overburden yourself so much that you never get anything to market. Small steps forward are better than one big step (as it may never happen).

Lastly, I would also say that it’s imperative to learn how to sell and communicate effectively. You’ll be doing a lot of this, as a founder – with investors, teammates, partners, and other stakeholders.

AS A CEO HOW DO YOU MOTIVATE YOUR TEAM? PLEASE SHARE WITH OUR READERS SOME OF THE LEADERSHIP SECRETS AND YOUR LEADERSHIP APPROACH.

SA: A good CEO is only as good as the people they work with. Thoughtful leadership is the key to success. When I recruit, I look at the nature of the person and how aligned they are from a cultural perspective – and, of course, what skills they will bring to Rizq. I build a positive can-do organisation with a clear path lit up for all to follow.

On that path, it is my job to nurture staff and bring out the best in them so they can deliver their objectives. In today’s world, the hire-and-fire model doesn’t work. Social media will work against you, as will your employees – and having a demotivated team is horrible. It is far better to recruit talented people with passion, who will work as a team (if i give them the guidance and tools).

The second secret to success is personal experience. I have extensive experience in financial services, over a wide breadth of territories. Through this experience I learnt how to understand and deliver banking services. I also learnt from mentors about how to work with people of differing backgrounds, cultures, attitudes and abilities.

There is no shortcut to this experience (unfortunately), and ultimately I am thankful for all of my past working life which I use to assess the challenges that I face today.

‘’I THINK THE KEY TO LIFE IS HAPPINESS, WHICH, ULTIMATELY, CAN BE FOUND IN DIFFERENT PLACES FOR DIFFERENT PEOPLE. A GOOD PLACE TO START IS FOCUSING ON DOING THE WORK THAT YOU LOVE.’’