The COVID-19 Pandemic has changed every part of our lives. Before the pandemic, the financial sector was not an active advocator of technology, although the sector continued keeping pace with technological advancements and used the latest gadgets and software in routine business activities. However, the pandemic changed the way we handled things. Interconnectivity and interdependence made lockdowns a living hell. From supply chain disruptions to unemployment, it was a crisis all the way. As a result, we entered into ‘Firefighting Mode,’ and everybody-governments, businesses, health professionals, and even the common man were forced to learn to adapt to what has been called the ‘New Normal,’ for survival.

The economies were severely affected during the COVID-19 pandemic. Businesses struggled to survive. The yield curves and profitability graphs started going down. The commodity prices touched the lowest point in the latest history. The future seemed highly gloomy, and it looked as if the world would once again get into dark ages. Fortunately, that time is now behind us. The world is in the ‘Recovery Mode’ finally.

Islamic banking and finance is a relatively new sector in the financial market, yet it has already faced two worst financial crises of 2008 and 2020. By definition Islamic banking and finance adhere to the principles of Islamic economic jurisprudence and is ideally meant to serve Muslims, however ironically, unlike the conventional financial institutions, the Islamic financial market has been least affected by the pandemic-induced economic disruption. As per the latest report by Moody (the US-based credit rating agency), the Islamic banks will thrive post-pandemic due to adequate liquidity and capital in South and Southeast Asia. Thus it can be safely said that Islamic banking is here to stay.

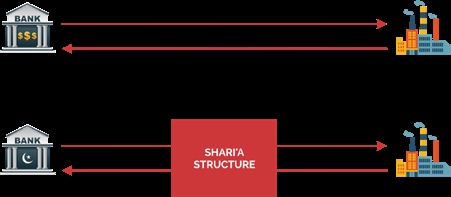

The Financial Gurus are evaluating the future role of tech companies and financial institutions. Questions are being raised whether financial institutions will take over tech companies, as many tech firms have already started offering payment gateways and payments solutions, or the tech companies will be taken over by the financial institutions. As this debate goes on and each sector struggles to take over the market share of the other, one essential factor is generally overlooked: The prohibition of “Riba” and other similar Shari’a restrictions and rulings. As a result, many Muslims are still not part of the financial system because of the unavailability of shari’a-compliant financial solutions in their respective territories.

The pandemic taught us how to use resources effectively. For example, previously, we would travel long distances for a signing ceremony or attend a meeting. Now the same could be done through video conferencing, thus saving time and resources. Similarly, today financial products are available at a click of a button, thus enabling us to use our bank accounts in the comfort of our homes and offices.

As per IFSB Working Paper Series on Digital Transformation In Islamic Banking published by Islamic Financial Services Board, more than two-thirds of the Islamic banks are at various stages of digital transformation. Therefore, it is high time for us to think along innovative lines and enable Islamic banking and finance industry to enter the “Re-Boot Mode” successfully.

In this respect, I would propose taking a mixed approach of capitalism and socialism under Shari’a guidance. This may not seem practical today, but it holds future prospects. For example, when Steve Jobs announced a touchscreen smartphone with drag, drop, and zoom options, people considered it implausible, and now it is a standard feature.

Therefore, I suggest that we start thinking about ‘Borderless Islamic Financial Institutions’ (BIFI), which should be offered to Muslims and anyone seeking ethical financing. In many non-Muslim majority countries Islamic financial system has been adopted for this reason. The question is, why borderless banking and is it even practical? According to myself, the answer is YES! It is very much attainable. This concept shall be based on the electronic Islamic financial intermediary platform based on the peer-to-peer funding and deposit model.

In order to make Islamic banking and finance available to the vast majority of Muslims across the globe, there is a dire need to have a digital platform that can be based on either “waqf” or any other shari’a-compliant method.

The proposed platform will connect willing investors/depositors with people who require funding for business or personal needs. All the products and contracts will be Shari’a-compliant backed by fatwa and would also fulfill regulatory requirements of both peers’ territories. Initially, the investment may come from governments or developmental institutions in the form of grants or funding. For example, in September 2021, the Islamic Development Bank (IsDB) announced US$1.2 billion as part of its effort to support the post-pandemic economic recovery among its member countries. Such initiatives would help the proposed model.

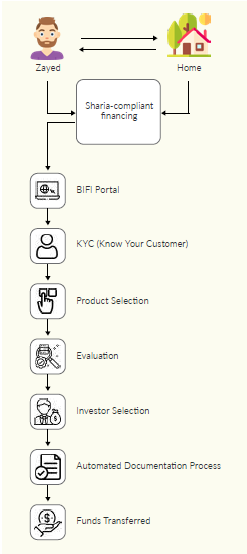

Let us now understand the proposed model with an example. If Zayed wishes to buy a house in Canada but he has no shari’a-compliant financing options, he may get Islamic financing via this platform. He would login to the platform, where he will first complete his KYC (Know Your Customer), a mandatory Compliance Requirement. Then he will pick a product from the dashboard. Each product will have its investors registered with the platform. The platform will have a scoring and risk-rating model to give firsthand information to the investors before they make any financing decisions. Any deviation would be diverted to the pool of experts for final assessment.

Upon selecting a product, Zayed will select the investor willing to give him money based on Ijarah or any other shari’a-compliant model. An automated documentation process will initiate when both parties have agreed on a contractual relationship, including security documentation. Once all agreements and legal documentations are prepared via Smart Agreement, the funds will be transferred to Zayed’s account.

‘’IT IS HIGH TIME FOR US TO THINK ALONG INNOVATIVE LINES AND ENABLE ISLAMIC BANKING AND FINANCE INDUSTRY TO ENTER THE “RE-BOOT MODE” SUCCESSFULLY.’’

Moreover, the platform will also provide pool funding whereby more than one investor could invest in any project on an agreed ratio. The system will automatically calculate the profit or loss and share the statement with the pool investors.

Now let us discuss the territory and currency risk of the proposed model. The answer to this could be found in FinTech. The world is moving towards crypto-assets and Non-Fungible tokens. Furthermore, the platform would initially only offer limited currencies. Later on, it may offer gold-based cryptocurrency and its unit price will be derived from international gold prices. This proposed cryptocurrency would help society to come out of dealing with non-existent cryptocurrencies. Also, gold has always been considered an authenticated medium of exchange.

My proposal above is drawn from the synthesis of an ever-changing world and the world’s prompt response to the COVID-19 Pandemic. It is essential to understand that it is the best time to introduce innovative financial products to Muslims at their doorsteps. The time has arrived to enable the re-booting of Islamic banking and finance.