Islamic banking is growing fast. According to Global Islamic Finance Report-2020, total global assets of Islamic finance in 2019 stood at US$2.77 trillion, out of which 75% or equivalent to US$1.823 trillion comes from Islamic banking.

Islamic banking has been equally popular in non-Muslim countries like the USA, UK, Singapore, etc.

In Bangladesh, a significant number of people have taken to Islamic banking. According to the Central Bank of Bangladesh, the total size of the banking sector as of June 30 2021 was BDT11905.16 billion, in which the share of Islamic banking was BDT3279.43 billion—27 percent of the total asset. The share is expected to increase to 35% by 2025. Despite this success, the criticism against Islamic banking is getting louder with each passing day. There could be two reasons behind it. One is that it is criticism for the sake of criticism. Another reason could be that those criticising it may have experienced unethical practices and have thus grown agnostic against Islamic banking and finance.

After careful observations into the matter, it has been found that both the asset and liability side of Islamic banking is responsible for creating this negative portrayal. And if want to do away with the criticism, we will have to make amendments on both sides. In this article, I have focused on the asset side only, particularly Bai-Murabaha (some people call it Bai-Muajjal also). This Shari’a-compliant mode of financing has been under much criticism lately. It is a debt-based financing model, entailing a lengthy procedure for approval. Unfortunately, because of some Islamic banking practitioners’ wrong attitude, this Shari’a-compliant instrument is being regarded as non-Shari’a.

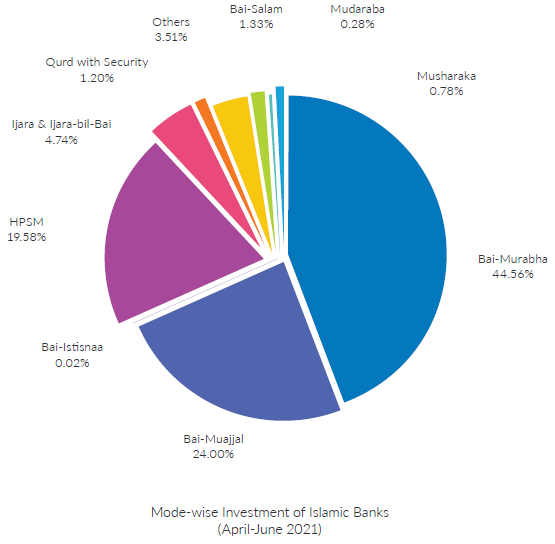

If we look at Bangladesh, 70% of total investment /finance is done using Bai-Murabaha, which is 90% of the total working capital. It is evident that despite criticism, this model is still popular among the people. Let us discuss the issue for clarity.

Why is Murabaha criticised?

Murabaha is successfully applied when all the sale components comply with the principles of buying and selling as enunciated in Shari’a. First the product should be in existence, second the seller have ownership on it, third seller have either physical or constructive possession on it, fourth before selling the buyer and seller must agree on sales price, fifth the product should be handed over to the purchaser. Unfortunately, many bankers avoid most of the steps, which creates Shari’a non-compliance risk. Some other primary reasons behind murabaha’s criticism are as follows:

1. Cash is credited to the customer account instead of suppliers’.

2. Misuse of buying agent concept

3. Buying and selling procedures are not Shari’a-compliant

4. Fake documents are created to deceive Shari’a auditors

5. No actual transaction occurs, but cash is transacted nonetheless.

Islamic bankers sometimes credit the customer’s account to expect the customer to purchase the goods on their own. In reality, however, the customers sometimes misuse the funds. Therefore, no buying and selling occur between the customers and the bank. As a result, the customer fails to find any difference between conventional and Islamic banking.

Usually, in this kind of transaction, the Islamic banker considers the customer as buying agent. However, to swap the customer as buying agent, specific Shari’a rules would have to be followed, such as:

- An agreement would be made between the bank and the customer, stipulating all terms and conditions.

- The buying agent will procure goods with the money received from the bank.

- An agreement would be made between the bank and the customer, stipulating all terms and conditions.

- The buying agent will procure goods with the money received from the bank.

- The bank will confirm the buying of the goods either through physical or constructive verification.

- Later on, the goods will be sold to the customer through the murabaha receivable account (profit + markup).

- When the bank gives funds to the buying agent, it should not be done through murabaha investment/murabaha receivable account. Instead, a murabaha purchase account will be created to reflect the purchase and possession of the goods.

- In most cases, it has been seen that when the bank engages buying agent and disburse the amount, they create murabaha investment/receivable account, which suggests that the sale has been completed, whereas the product is yet to be procured. As a result, the profit earned from such transactions becomes a completely non-Shari’a complaint.

Sometimes, deviation from Shari’a occurs because of a non-conforming attitude. Generally, what happens is that the bank lends money to the customer without verifying the quotation. Whereas, to ascertain the varsity of the supplier and the customer, the bank is duty-bound to run a verification check on the quotation. The bank should also send its team to the customer’s premises to verify the product’s existence. In most cases, banks miss this important step, resulting in a dubious murabaha transaction.

Sometimes, customers produce fake documents, and if Shari’a auditors fail to verify the documents, the transaction creates illegal income, which goes against the interest of the investment account holders, i.e., mudaraba depositors. Submission and acceptance of fake documents nullify the core concept of Islamic finance, and we know, without actual transactions, bai-Murabaha cannot be justified. The question is why such deviations occur.

The answer could be derived from the following pointers:

1. The banker may not have sufficient Shari’a financing knowledge, particularly concerning murabaha.

2. The banker does not care about Shari’a compliance.

3. The formalities related to Shari’a compliance make customers uncomfortable.

4. The bankers want to make money in the name of Islamic banking.

Because of these issues, people have started saying that murabaha is a non-Shari’a-compliant product and is less perfect than mudaraba and musharaka. The reality, however, is that murabaha is a hundred percent Shari’a-compliant product; it is the malpractices of bankers and customers, which have caused damage to its reputation. It also shows the weakness of sharia auditors who allow malpractices to happen.

Murabaha/musawama is an appropriate model for buying and selling. For example, if we want to purchase a laptop, we do not tell the seller to make a mudaraba/musharaka agreement and then buy it. Instead, we directly bargain with the seller and buy the laptop, paying the amount instantly or transferring it to the account, which falls under murabaha or musawamah.

However, mudaraba/musharaka is an entrepreneurship contract or mode of financing. Islamic bankers should gauge Shari’a compliance in all forms of transactions, whether mudaraba, musharaka, murabaha, musawama, istisna, ijara, etc. That is the only way to remove misconceptions about Islamic banking.