I recently came across an article that alluded to the potential downfall of the financial technology (FinTech) industry and referring to the various developments as another bubble.

This came as a stark surprise as the industry has been propelled to grow and the discussions around its potential has been making headlines for over two years now, in particular, the role it can play during and post-COVID-19. This came at a time when Wahed Invest – a robo-advisory firm headquartered in the United States secured a US$50 million Seed B funds from Wae’d at Aramco, giving mixed feelings.

Through this brief article, the aim is to describe various developments within the Islamic FinTech industry and the future potential of these for the growth of the Islamic banking and finance industry. At the same time, it is important to highlight the challenges and opportunities that the sector offers, as well as stress the need for enhancing capacity and awareness at all levels.

Role of FinTech

In my humble opinion, FinTech aims to enhance efficiency and quality in the ways financial services are delivered. Although the word itself is new, its roots are found in the 19th century when the first electronic fund transfer took place in 1918, while a more recent innovation is the advent of the ATM machine by Barclays in 1967.

Since then, leveraging the internet and through enhancements in computer technology, various developments have taken place in different parts of the world well before the coining of the term FinTech. To relate with the banking industry, making payments using bank cards, mobile and internet banking has significantly improved the availability of timely information from the comfort of home or on the go, courtesy of the ease of internet availability.

Developments in Islamic FinTech

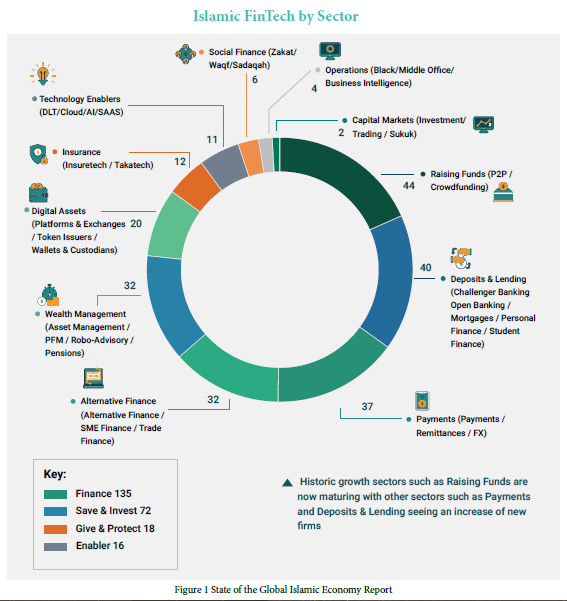

In line with the global FinTech industry, Islamic FinTech has also grown significantly in different parts of the world from the U.S. to Indonesia across MENA. As such, it has become the fastest-growing segment of financial technology among the Organization of Islamic Cooperation (OIC) countries. According to the Global Islamic FinTech Report 2021, there has been an upswing in Islamic FinTech, with 241 companies currently in the market (see the figure below). The size of the Islamic FinTech market was estimated to be US$49 billion in 2020 (representing 0.72% of the global FinTech industry), and is estimated to grow to US$128 billion by 2025 (based on estimated transaction volumes) – CAGR of 21 percent.

The top markets for the development of Islamic FinTech include Saudi Arabia (US$ 17.9 bn), Iran (US$ 9.2bn), United Arab Emirates (US$ 3.7 bn), Malaysia (US$ 3 bn) and Indonesia (US$ 2.9 bn). These markets represent 75 percent of the global Islamic FinTech industry.

Among the non-OIC countries, the UK leads the Islamic FinTech in terms of countries offering Islamic finance-based technology, while Islamic FinTech hubs are developing, with Dubai, London, Malaysia, and the Gulf, all being contenders. As such, several countries have also set up specific centres for the promotion of FinTech – this includes the likes of Bahrain, which has set up Bahrain FinTech Bay, DIFC FinTech Hive in UAE and AIFC FinTech in Kazakhstan.

Technology driving the FinTech growth

The underlying, enabling technologies that are driving the growth of FinTech include artificial intelligence (machine learning, big data), distributed ledger technology (blockchain, tokenization), security (biometrics, identity verification) and cloud. In the past the emphasis on underlying technologies in the past has been rather limited compared to the current technologies driving the FinTech developments.

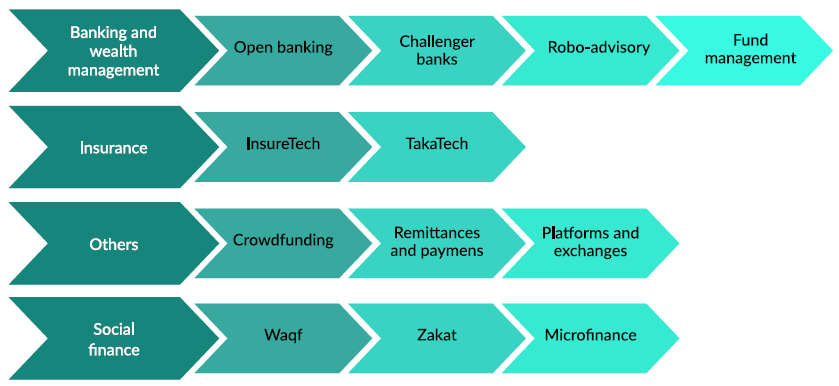

As such, with the help of these technologies, various FinTech-based services have emerged in different sectors as presented in the figure below. This includes existing developed organisations that wish to further grow its client base – an example of this can be Meem – a Shari’a compliant retail banking arm of the Gulf International Bank or Nomo launched by Bank of London and Middle East (BLME). Similarly, Abu Dhabi Islamic Bank has launched Amwali digital bank, which is the first global Islamic bank designed to empower youth.

At the same time, there are budding entrepreneurs entering the FinTech sector to offer cutting-edge solutions, addressing an existing gap or offering solutions to conduct activities in a more efficient and effective manner. There are many examples of this trend, the prime ones include Wahed Invest, an important robo-advisory organisation assisting in wealth management and Ethis – a regulated crowdfunding platform headquartered in Indonesia, which are assisting individuals and communities to develop and flourish.

Regulators and standard-setting organisations supporting the growth.

To cater for the global demand, the industry’s regulators and policymakers have been providing an enabling environment through the development of the needed infrastructure in the form of regulations, FinTech sandboxes (driving FinTech innovation and collaboration) and Suptech. Similarly, standard-setting bodies, such as the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) has been closely following the

developments in the industry and has developed a comprehensive strategy and formed a large working group committee to develop standards in FinTech. The first standard that AAOIFI is developing is on Islamic crowdfunding, which at present is in the public consultation stage. Additionally, there are three other projects in the pipeline including FinTech, smart contracts and digital banking.

While there has been growth in the FinTech space, there has been a lot of hollow noise around it, which jurisdictions, institutions and individuals are using to stay relevant. We have come across numerous such examples whereby activities are conducted (virtual and physical events) just as a marketing stint or because it is in fashion with little substance to a cause or product.

If we are to look at the application of FinTech based activities in the real sense, we will realise how little of it has been put to use. For example, if one asks, how many Islamic banks and financial institutions has deployed blockchain? – The answer is, only a handful of institutions (such as the DIB and ADIB). One of the reasons for this trend could be that institutions are not confident and comfortable with the challenges associated with change integration with the existing technology.

This raises the question that, whether the FinTech is just an in-fashion topic? As within the global Islamic banking and finance industry, this periodic trend of a topic is not new, I have taken a note of this drift ever since I joined the industry. The trend at the time was Islamic social responsibility, a year later it moved to the Halal industry, after some time it was the sustainable development goals, followed by women empowerment and the latest, being FinTech. I am not against all these trends or movements; rather, I believe that all of these concepts and models should remain in fashion at all times. Yet, the more important point is to focus on the underlying product and filling the industry gap, which is in the best interest of the industry.

Below, are the highlights of some of the important initiatives and opportunities that can be further scaled through FinTech.

FinTech offers stakeholders an opportunity to bring forth a change and innovate. More importantly, to innovate responsibly as per the letter and spirit of the Shari’a. For long we have been benefiting from the products that are Shari’a compliant in letter, but deep down perhaps there is no economic activity – and thus the spirit is missing. A prime example is the Commodity murabaha (tawarruq) – a Shari’a compliant product, though not among the preferred products – the alternative to it has not been available in the industry. We have witnessed a FinTech-based innovative product – IFIN, which has the potential to replace Tawaruq based transactions. Similarly, we have witnessed the first sukuk issuance (based on mudharaba) on blockchain in 2019, issued by BMT Bina Ummah on Blossom’s SmartSukuk platform. The sukuk is based on a variable rate as per the actual profit rather than a fixed payment. After the success of the initial sukuk, the issuer and the sukuk platform are working on issuing additional sukuk for a large amount and longer tenure. If products like those are further developed, where investors and other stakeholders understand the incremental value (through risk sharing), they are creating vis-à-vis conventional finance, it will further enhance the stakeholders’ confidence within the industry.

Similarly, for the Islamic social finance institutions, there is a huge potential through the right use of FinTech. At present, we are generally sceptical when it comes to giving our zakat and sadaqa to some organisations either online or in our neighbourhood. This is due to the fact that there is no way one can observe where those funds are being utilised – the trust is usually vested on the organisation or the person itself. Although from the giver’s perspective, he has attained the reward for it, yet if they end up in the wrong hands, then the funds have made little difference to the lives of those in need. To cater for this, imagine if there is a system that can keep track (using blockchain-based technology, where the chances of corruption are minimal) of our zakat payments, and the impact it is making on the lives of the receiving hand. It will certainly enhance the confidence and motivate stakeholders to contribute wholeheartedly in future. This is already being practised in the conventional space (including for charitable causes). Similarly, organisations responsible for Awqaf can also leverage the blockchain-based technology and develop a platform that assists in the recording and institutionalising waqf assets, nationally and globally. This will further assist in ensuring that the waqf assets are utilised in an efficient and effective manner, which are an important component of the Islamic economy.

• Similarly, Islamic microfinance-based institutions can deploy these technology-based solutions to further enhance the transparency and accountability. Furthermore such solutions can be used to enhance credit scoring of the recipient of microfinance and for future financial assistance. Institutions like Akhuwat

– a microlending platform in Pakistan has been extremely successful in their activities. However, such institutions can leverage the growth of FinTech to further enhance its target audience, understand their needs and wants and offer products in line with it. This will further enhance their market penetration and client base, thereby making a positive impact on the society at large.

• FinTech based solutions can also be used by countries in the emerging markets, which are known to have high financial excluded population. In particular, for the Muslim majority countries like Pakistan, Indonesia, as well as those countries that have announced Islamisation of their economies including Libya, Iraq, and Somalia, FinTech based platform can play an important role in bringing people into the financially-included circle. For example, through the Knowledge, Attitude and Practices (KAP) study conducted by Edbiz Consulting commissioned by the State Bank of Pakistan, funded by Department for International Development (DIFD), it was found that Pakistan has more than 55 percent financial-excluded people in the country. Furthermore, it was found that of the 18 percent voluntary financially excluded population, 4 percent is due to non-availability of banking institutions, 8 percent due to lack of awareness, and the remaining were unconvinced with Shari’a compliancy of the Islamic banks. This is for a country which has 95 percent demand for Islamic banking among its households and 73 percent among its businesses. We believe that if Islamic FinTech based solutions are offered in catering for the growing and effective demand of Islamic finance, it will bring people into the financially-included bracket and benefit in different ways. Furthermore, from the policymaker’s perspective, this will assist in growing the Islamic banking market’s share, which has the potential to play an important role in achieving the target of converting the economy to one that is fully Shari’a-compliant, a target given by the Federal Shari’a Court to abolish Riba within five years from the whole economy.

As small and medium-sized enterprises are the lifeblood of the economy, it is interesting to note important FinTech based institutions have emerged aiming to fill the important funding gap. This includes the UK based FinTech Qardus, which is primarily providing working capital and other financing to SMEs in the country. Meanwhile, there are other players emerging like Lendo, a Shari’a-compliant lender based in Saudi Arabia, raised US$7.2 million to fund its SME marketplace platform.

Existing challenges

While FinTech offers various growth opportunities, it also raises various challenges for itself and existing banks and financial institutions, which if not catered for adequately, have the potential to derail the growth, bringing us back to square one. This includes:

• New customers and a different mindset: Within Islamic banking, there is a need to move away from a typical banking mindset to an investment mindset. The modern, tech-savvy stakeholder is more educated than ever, so there is a need to promote the risk-sharing culture within the industry and enhancing the perception issue.

• Expectations: The customer’s expectations have risen and as such, it is looking for more convenience and efficiency, without compromising on service quality.

• Efficient and agile structures: FinTech has increased challenges for existing institutions with its innovative operational models, led by digitisation and small capital base (regulatory requirements). Existing institutions need to incorporate new technologies into standard operating procedures, which itself (as mentioned above is a challenge).

Information security: Ensuring information security and privacy, data integrity, as well as, minimising cyber security risks.

In conclusion, I would like to reiterate the important role FinTech can play in addressing the growing demand base of the industry, as well as the solutions it offers. It is evident that FinTech needs to be promoted, since it offers solutions and further scaling of the businesses in various sectors.

However, it is important to ensure that the development is assisting the industry to move forward in enhancing its offerings as well as making it efficient for the stakeholders. The start-up FinTechs continue to face challenges relevant to capital and scalability. It is important that the venture funds and other tech funds continue to support the industry, which will provide meaningful returns and social benefit to the society at large.

Additionally, there is a need to further enhance awareness and understanding of the sector, which will help in the growth of the consumer base. At the same time, there is a need to invest in building and the development of human talent that can develop new technology-based institutions to continue to fill key industry gaps.

Lastly, policymakers and standard-setting bodies have to provide the needed infrastructure to help nurture and grow this important sector. There is a need for standard-setting bodies to offer guidance and standards in a timely manner, which will assist in better understanding and in establishing good

practices. Standard-setting bodies and regulators also have the opportunity to promote good governance practices with the integration of Maqasid-al-Shari’a, as the business practices and models are evolving, offering an opportunity to incorporate good governance-related changes. These standards developed by the institutions such as AAOIFI should be adopted globally by the regulators for the benefit of the local Islamic banking and finance industry.

Disclaimer:

This article is written by Dr Rizwan Malik in his personal capacity. The viewpoints expressed are the author’s own and do not represent the views of the organization he works for – Accounting and Auditing Organization for Islamic Financial Institutions.