I shall be starting this article with a story. Mr Amzad is an Industrialist. He has been running his business for almost 20 years alongside engaging in banking with a conventional Bank. This Bank has no Islamic banking window. One fine morning, Mr Amzad approached the Manager of the branch to take over his entire liabilities to an Islamic Bank.

The reason he decided not to engage in banking with any conventional Bank was to avoid interest-based transactions. The customer was enjoying a sizeable loan facility from the branch. If he leaves the branch, the bank will lose a remarkable income. The manager approached the Head Office to know whether the Bank has any plans to open an Islamic banking window or not.

The Head Office authority received such kind approaches from most of the branches frequently. As a result, they started to think about opening at least one Islamic banking window to retain their customers who do not wish to engage in Riba-based banking.

Such incidents were a common occurrence in almost all conventional Banks in Bangladesh. As a result, banks that had still not considered Islamic windows are now more serious about opening them. The purpose is to retain the existing Shari’a-loving customers, while also attracting new customers to help grow their business.

This is, indeed, the reality of the banking sector in Bangladesh.

If we recall the time around 1983, only one bank launched Shari’a-based banking in Bangladesh. Under the noble leadership of Mr M. Azizul Huq, a group of true lovers of Islamic banking joined this venture, relinquishing all current facilities of the conventional bank. Mr Huq was entitled to early retirement from the state-owned Sonali Bank after a few days. However, he did not do that. Instead, he considered working in Islamic banking as an opportunity given by the Almighty Allah. He believed if he died without accomplishing his mission, he will have no answer to Almighty Allah.

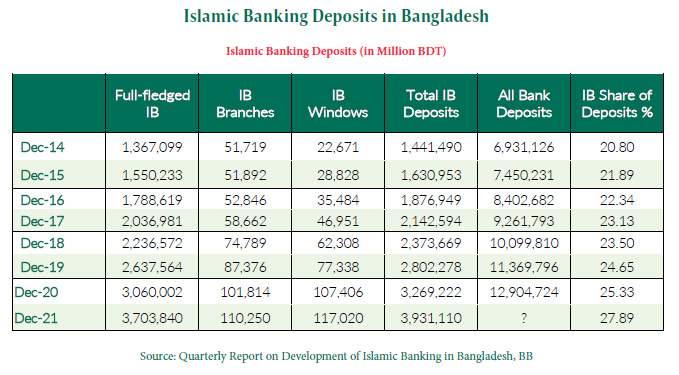

His other companions also pursued the path he followed. The sacrifice of Mr Huq and his companions did not go in vain. Today, 10 full-fledged Islamic banks, 9 full-fledged Islamic banking branches, and 14 Islamic banking windows are operating in Bangladesh. More windows are launching soon as the Eastern Bank and the NCC Bank have already received permission from the Bangladesh Bank to open their Islamic banking windows. This trend reflects the opportunities for Islamic banking in the country.

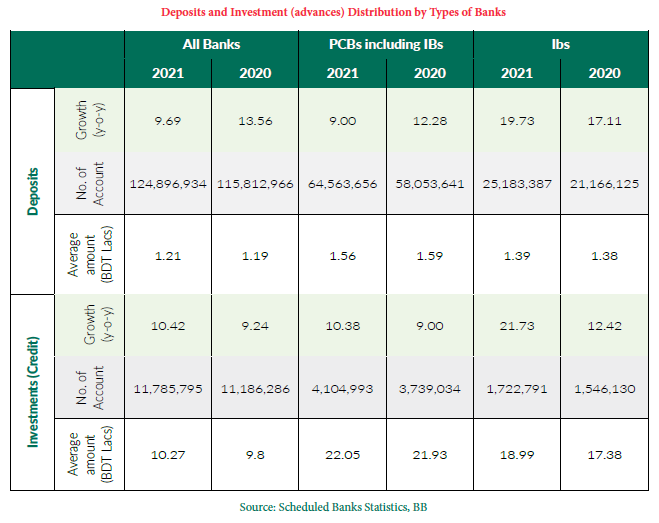

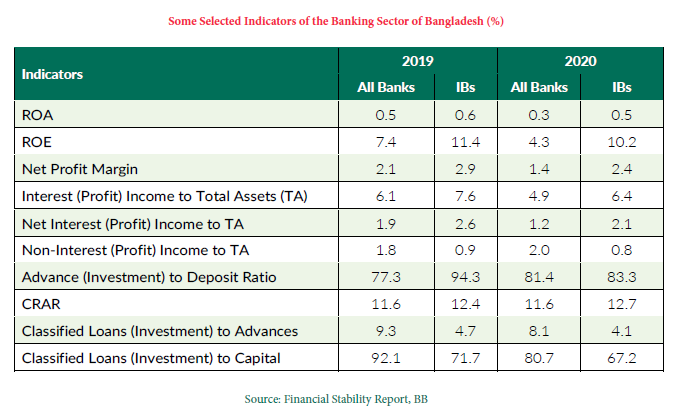

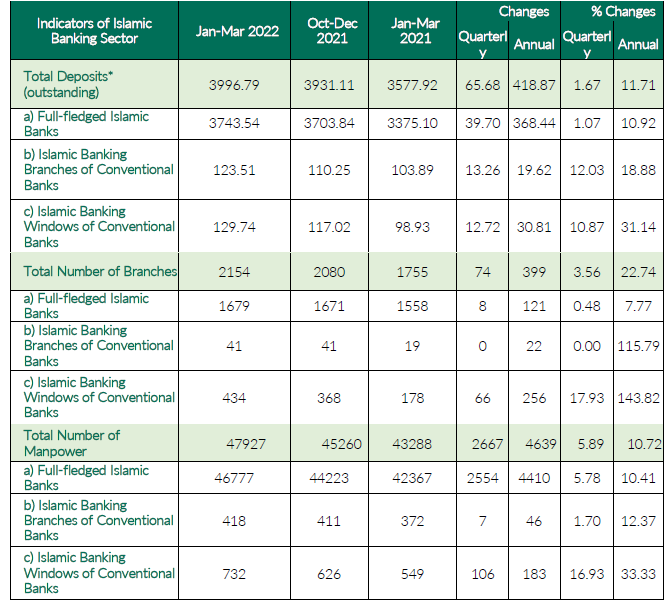

Let us have a look at the relevant data of the Central Bank of Bangladesh.

Considering different parameters, it can be said that the Islamic banking industry in Bangladesh is performing better compared to the general banking industry of Bangladesh. The return on assets (ROA) of IBs is 0.6 in 2021 which was 0.5 in 2020. On the other hand, the ROA of the overall banking industry is 0.5 in 2021, which was 0.3 in 2020. Similarly, the return on equity (ROE) of IBs is much higher than that of the overall banking industry. Most importantly, the asset quality of IBs is much better than the overall banking industry of Bangladesh.

Dr M. Mahabbat Hossain, a researcher of Islamic banking and an assistant professor of the Bangladesh Institute of Bank Management (BIBM) identified some prospects for Islamic banking in Bangladesh. According to him, at present, both the Government of Bangladesh and the Central Bank of Bangladesh are positive about the growth of Islamic banking in the country. Capital market instruments such as sukuk are in abundance, a pool of Islamic finance professionals has been created, which is increasing day by day, discussions on Islamic banking and finance are a regular occurrence, and most of the conventional banks are providing or planning to provide Islamic banking services. Some conventional banks are trying to completely transform into the Islamic banking framework. Of course, these are all encouraging signs.

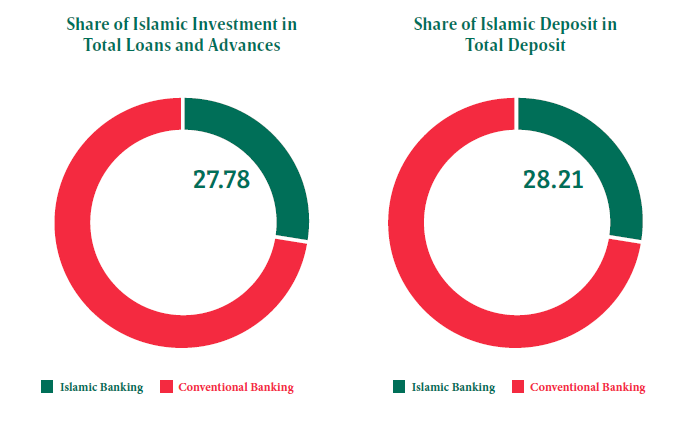

As per the Central Bank’s report on Bangladesh, the total Investment (loans & advances) of the Islamic banking sector in Bangladesh stood at BDT3606.49 billion at the end of March 2022, which went up by BDT72.01 billion or 2.04% and by BDT382.51 billion or 11.86% as compared to the end of December 2021, and the end of the same quarter of the last year respectively.

The share of the total investment of Islamic banks accounted for 27.78% of the total loans & advances of the whole banking sector. On the other hand, total deposits in the Islamic banking sector in Bangladesh reached BDT3996.79 billion at the end of March 2022 with an increase of BDT65.68 billion or 1.67% as compared to the end of December 2021 and BDT 418.87 billion or 11.71 % as compared to the same quarter of the last year. The share of total deposits of Islamic banks accounted for 28.21% of total deposits of the entire banking sector during the period under report.

From the above data, we can easily understand that about 28% of the total banking market in Bangladesh is captured by Islamic banks. About 90% population of Bangladesh is Muslim. 72% of the existing assets are still in the hand of conventional banks and most of the population is religious.

So, if the rest of the population, who are still under the umbrella of conventional banking, opt for Islamic banking as their primary choice, a revolution may occur. On the other hand, a lot of people in Bangladesh are still unbanked. This is mainly on religious grounds as they believe interest or Riba will damage their prayers as per the declaration of the Quran and the Hadith. Considering the devout attitude of people, it brings about an opportunity for the growth of Islamic banking. Thus, Islamic bankers must take the right actions.

Despite such a scenario, a lot of challenges are faced by the Islamic bankers. There are still a lot of myths and misconceptions surrounding Islamic banking.

Let us understand with a help of an example. Mr Ahmed is an Islamic banker. He attended a marriage ceremony. At his dining table, he was acquainted with a renowned person who asked about the banker’s line of work i.e., where he is working, and in which department. As Mr Ahmed stated that he is the Head of Islamic Banking at XYZ Bank, the person uttered ‘Oh, you are also doing business in the name of Islam!’. Mr Ahmed replied that yes, Allah has permitted business and forbidden Riba. But the person laughed at him reflecting his unconvincing attitude regarding the reply. This is an example of an attitude problem. Although Islamic banks of Bangladesh have no interest-based relationship with the Central Bank,

most people still believe that Islamic banks are somehow engaged in interest-based transactions with the Bangladesh Bank. Sometimes, people say that Islamic banks do not share the business risks with the customer. When customers and other people are asked about the contract the customers have with Islamic banks that depends on sharing of business loss, they do not want to realise it, reflecting the negative mindset of some people. This mindset must be changed through knowledge sharing and logical arguments.

Besides misconceptions, there exist malpractices of Islamic bankers. Some practitioners do not properly follow Shari’a rules. Sometimes they use the name of the Islamic banking contracts but don’t exercise its terms and conditions. On the liability (investment accounts) side, they offer customers a provisional rate, sometimes which becomes the final rate without giving proper evidence, justification or logic. This shows that the income of the customer or investment account holder is not tagged with the income of the investment fund. As a result, Sahib-al-Maal, the depositor, finds no difference between the Islamic banking deposit account and the conventional banking deposit account. The ame incidents are found on the assets side too.

ABOUT 90% POPULATION OF BANGLADESH IS MUSLIM. 72% OF THE EXISTING ASSETS ARE STILL IN THE HAND OF CONVENTIONAL BANKS AND MOST OF THE POPULATION IS RELIGIOUS.

Like the rest of the world, murabaha is the most used (currently 70% of total Islamic financing) financing method in Islamic Banking in Bangladesh. This contract requires the actual buying and selling of goods complying with Shari’a. But in some cases, there occur paper transactions only using a so-called buying agent.

Furthermore, where there were no buying agents, in the case of purchasing goods from a third party and selling the same to the customer, offer and acceptance (Ijab-Qabul) are not properly executed. As a result, it falls under Shari’a non-compliance risks, which invites non-permissible income (doubtful income) that ultimately goes to charity. The customer finds no difference between Islamic financing and conventional financing. Such kinds of malpractices occur mainly for two reasons: accomplishing profit motive and lack of knowledge of Islamic products and contracts. That should be eliminated for the sake of the real growth of Islamic banking.

The lack of skilled manpower is another major challenge for Islamic banking. As per the Central Bank of Bangladesh’s report till March 2022, a total number of 33 banks are providing Islamic banking services, out of which 10 are full-fledged, 9 are conventional banks having full-fledged branches and 14 are conventional branches having Islamic banking windows.

The banks that provide Islamic banking services use all their distribution channels using online facilities ensuring Shari’a compliance. But the problem is most practitioners are not properly acquainted with Shari’a principles of Islamic banking or finance. As a result, there is every possibility of distortion of Shari’a rules. Local banks should take proper steps to mitigate such problems.

In Bangladesh, every bank has a training institute, for employees who wish to undertake a vigorous training programme in Islamic banking. Our universities and colleges have a little initiative to teach Islamic finance. They are yet to consider it a vital subject. That said, Islamic banking is increasing in momentum every day. If banks, while conducting interviews for Islamic finance professionals or in recruitment advertisements, emphasises having knowledge of Islamic banking as a requirement for employment, the academia may take an initiative for offering a learning module in Islamic banking.

Department, Bangladesh Bank (The Central Bank of Bangladesh).

Customer awareness regarding Islamic banking practices is another vital issue for its growth. Sometimes, customers approach the bank to avail Islamic banking services, without awareness about the subject. While taking services from an Islamic bank, they tend to compare it with conventional banking practices. If any of these practices go against their interest, they start criticising Islamic banking.

It is a fact that Islamic banking has a lot of documentation to comply with Shari’a, but the customer considers it against their interest. They must understand how Shari’a principles have to be followed, how the product and services become Islamic, and how much effort a customer should have to make. For this reason, every Islamic bank should initiate customer awareness programmes. The truth is, some Islamic banks in Bangladesh including the Islami Bank Bangladesh Ltd has already taken this initiative. Hopefully, the rest will follow.

Journalists can play a vital role in creating public opinion regarding Islamic banking and finance. But sometimes it is found that they write some news, views and articles where the authentic terms and conditions of Islamic banking and finance are absent. In fact, Islamic banking is a system derived from the divine law.

Practitioners are responsible and accountable to implement the system. Because of their malpractices, the overall Islamic banking industry is targeted. Journalists should understand this reality and so does Islamic bankers, who carry a lot of responsibility to share authentic Islamic finance knowledge with the journalists.

The major difference between conventional and Islamic banking is that Islamic banking must follow Shari’a rules, it must avoid ‘Riba’ or interest in all kinds of financial transactions. In this case, the Shari’a Supervisory Committee plays a vital role. To ensure Shari’a compliance, every Islamic banking operator must have a Shari’a Supervisory Committee comprising Islamic Scholars and experts in Fiqh-al-Muamalat in particular.

If we consider our scenario in Bangladesh, it will be found that the shortage of Shari’a scholars having knowledge in Fiqh-al-Muamalat is acute. In our Madrasas (Islamic educational institutes), the importance of Muamalat attracts little emphasis. Some Islamic scholars consider Islamic finance as ‘Bid’ah’ (innovation in religion).

Some also propagate against Islamic banking. So, getting a sufficient number of scholars for the Shari’a Supervisory Committee is a tough job. The scholars who are currently involved in different Shari’a Supervisory Committees should take appropriate measures to develop sufficient scholars on Fiqh-al-Muamalat, who will represent the Shari’a Supervisory Committee in the future.