This article is an attempt to observe the patterns and get insights from the Islamic banking data of Pakistan for the past 5 years. Based on the data of more than 20 Islamic banks operating in Pakistan, we try to answer a series of some engrossing questions from the data, (2017 to 2022), and attempt to show the results through using data visualization.

In order to increase outreach of Islamic financial services in the country, the central bank of Pakistan – State Bank of Pakistan (SBP) allows to provide Islamic banking services in the following three ways:

• Full-fledged Islamic banks

• Islamic standalone branches of conventional banks

• Islamic windows set up in conventional branches

We have gathered the data on all these three business models of Islamic banking to see the trends for the last five years. While there are a number of dimensions to analyze the data, we shall restrict this article to the number of locations (branches and windows etc.,) and the deposit size.

Although there are only 5 full-fledged Islamic banks out of around 22, it is still believed that people prefer to use Islamic financial services offered by a full-fledged Islamic bank instead of approaching the Islamic branches or windows of conventional banks. The Shari’a Governance Framework (issued by SBP) is the same for all Islamic banks irrespective of their business model but the perception of general public is different when it comes to Islamic branches and windows.

We used the deposit size and growth as a proxy for public demand towards Islamic banks. Using the data available with us, we tried to see whether the afore-said business models has an impact on deposit size and growth of an Islamic bank.

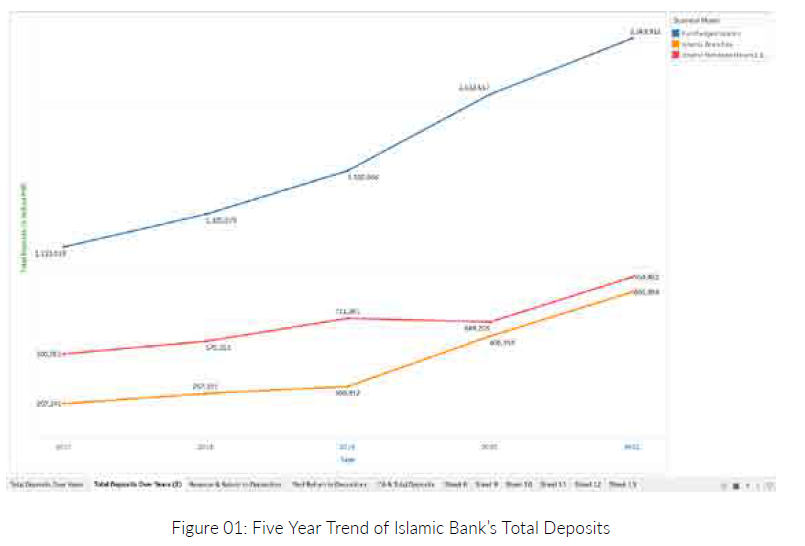

The chart on next page demonstrates that total deposit of full-fledged Islamic banks remained much higher than other two models in last 5 years. One argument here could be that the number of branches of full-fledged Islamic banks are greater than the Islamic branches and windows of conventional branches.

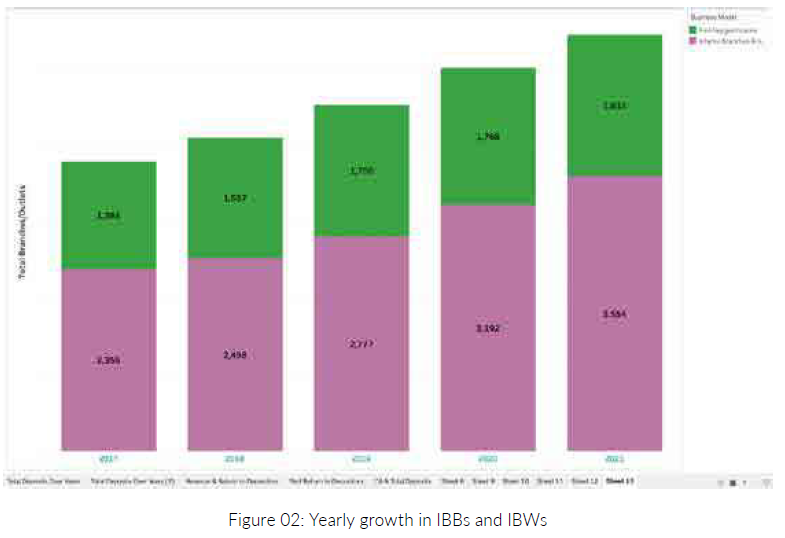

However, it is interesting to note that the data does not accept this hypothesis. The combined number of Islamic branches and windows is greater than branches of full-fledged Islamic banks in all five years. So, the data proves that it is the not the number of business locations that is fueling the deposit growth of full-fledged Islamic banks compared to other business models.

During 2020, massive growth rate was shown in total deposit of full-fledged branches despite the CoVID and decrease in profit rates. One possible explanation could be that almost all industries were shut down and there was no significant demand. As a result, companies and individuals preferred to keep their deposit in banks.

Significance of IBWs:

Another insight that we get from the above chart is that IBWs have played a great role in attracting deposits for conventional banks which offer Islamic financial services too. The total deposit of banks having IBWs are higher than those working with Islamic branches only (there is a dip in total deposit during 2020 because Bank Alfalah closed all its 121 IBWs and continued with Islamic branches only).

The above chart supports our hypothesis stated above that the number of locations is not the main factor behind attracting more deposits to full-fledged Islamic banks. On the contrary, the number of outlets of full-fledged branches are less than other two models; whereas combined deposit of IBBs & IBB+IBWs are less than combined deposit of full-fledged branches.

We can see in above chart that for each year the number of branches of full-fledged Islamic banks is less than those of two other business models combined. For example, in 2019, total number of IBBs and IBBs plus IBWs were 2,777 and total deposit were Pkr. 1,020,093 (million). On the other hand, total number of full-fledged outlets were 1,706; whereas total deposit was Pkr. 1,582,866 (million).

So, it is evident from the data that more numbers of outlets of Islamic branches and windows are not enough to outperform the full-fledged Islamic banks in terms of deposit mobilization.

Conclusion

The data for the past five years shows that:

- There is an increased demand for Islamic banking

- The growth after 2019 is much faster than previous years

- Full-fledged Islamic banks attract more deposits despite having less branches

The Federal Shari’a Court has recently given its verdict to eliminate riba (interest) from the country within five years. The conventional banks shall have to convert their operations to Shari’a-compliant practices. The data also supports this and shows that people are more interested in and have higher demand for full-fledged Islamic banks.

Limitation:

Banks which were excluded in each year due to non-availability of data:

2017 – Silk Bank, Sindh Bank, Summit Bank

2018 – Sindh Bank, Summit Bank

2019 – Silk Bank, Summit Bank

2020 – Silk Bank, Sindh Bank, Summit Bank

2021 – Silk Bank