FinTech and Future of Islamic Financial Thought Leadership

Introduction

Islamic Finance is the answer to the malaise of traditional finance. With its principles guided by Shari’a – particularly no Riba (no interest), profit & loss sharing model, wealth equality – Islamic finance can fix what’s broken in traditional finance, as long as it is followed and implemented to its true spirits.

For the last few years, Islamic finance is on a growth trajectory that’s outpacing the traditional finance. Its growth is spurred by adoption by not only Muslims in Muslim-majority countries, but also by people from other faith and from developed countries like UK, Canada, Australia, and US and others. Islamic finance is now not just a religious fervour, it has matured into a financial system that can withstand financial downturns and market crashes, thanks to its core principles embedded in fairness, trust, transparency and equality.

Despite this growth, Islamic finance industry hasn’t grown to its true potential.

Listed below are the few reasons why Islamic finance is lagging behind the traditional finance industry:

• Lack of awareness and knowledge of Islamic finance even within Muslims.

• Lack of trust amongst Muslims due to the dubious adoption by many Islamic financial institutions, particularly by so-called Islamic banks, wherein many traditional finance instruments (thereby not free from Riba) are wrapped around the label of Halal and Shari’a compliant and sold to unsuspecting customers.

• Hesitancy to adopt new technology and digitalisation by Islamic scholars and resistance to evolve.

• Lack of access to capital for small and medium size companies that are looking to raise funds in a Shari’a-compliant way, to grow their business.

It may sound harsh, but we need to be self-critical and look inwards for the solution. The solution lies in looking forward, taking futuristic and bold steps, and adopting new ways including adoption of technology to achieve the potential that Islamic finance is capable of.

The Problem

Traditional finance is a cancer eating everyone from within.

The core focus of traditional finance is wealth creation through any possible means, as long as it benefits the individuals. The wealthy and powerful control the narrative of economic growth, and they retain most of the wealth.

As has been widely reported, the world’s top 10% richest own 76% of the world’s wealth and the same 10% corner 52% of the world’s income.1 During the peak of COVID-19 pandemic years, the wealthy became wealthier and the poor became poorer. Today many countries are struggling economically due to high inflation. And the inconsiderate money printing on-demand, without backing of any economic activity, didn’t help either. The system is rigged in favour of the wealthy as history has shown that the wealthy who have been known for wrongdoing haven’t been held accountable; at least not enough to deter them in future. By creating money out of nothing, fractional reserve banking has proven to be detrimental to the society at large. When one argues the ills of capitalism, no article/discussion/argument goes without the mention of the global financial crisis of 2007-08. After millions of people suffered due to this great recession, many started questioning the traditional finance system.

Moreover, traditional finance is rooted in debt-based financing, which is not only exploitative and damaging, but also morally corrupt.

US sovereign debt today stands at an astounding $30 Trillion, and it has always climbed only up and up without dropping for close to a century! And the US government will pay a staggering $5.4 Trillion only in interest over the next 10 years.

Islamic Finance for everyone

Islamic Finance follows the tenets of Shari’a, which proposes and encourages, a society that thrives on equality, including wealth equity, generating and accumulating wealth, but without dealing in usury and interest, sharing risks thereby providing a level playing field to all the parties involved in any financial transaction, and avoiding speculation (gharar) and gambling (maysir). It also emphasizes that money has no intrinsic value and can only be used as a medium of exchange. And once can’t make money out of money, without the backing of real assets.

If you look at the principles of Shari’a without the prism of the religion, it becomes clear that these principles are based on sound economics and is a catalyst for equality and an equitable society.

Islamic Finance: Missing in spirit

Islamic finance is the panacea for the ills of traditional finance. It avoids the pitfalls of capitalistic mindset that’s prevalent in traditional finance. Its core principles provide ways for generating and sharing wealth across all strata of the society.

But why don’t we see the ideal result of wealth equity and economic prosperity that should have ideally been enabled by Islamic finance?

Turns out, as sound as the principles of Shari’a may be, the practitioners of Islamic finance have not been true to their words when it comes to the implementation of these principles in spirit.

Islamic banking industry is a great example. In order to grow aggressively and keep pace with the competition – in this case, the traditional banks – many Islamic Banks indulge in offering instruments that may look Shari’a compliant, but in effect are weakly complaint to Shari’a. Commodity murabah’a is one such example from among a few others which represent the same instruments with unconvincing compliance to Shari’a but which have been certified as Halal and permissible by many Islamic scholars. Today, if you study the financial statements of many Islamic banks, majority of their assets are loans or debts!

It’s not just Islamic banks alone. Even among the general Muslim population, the fervour for adherence to Shari’a-compliant financial transaction is found lacking. How many times have you seen Muslims reacting to riba-based finance in the same way as they react with shock to food that’s not certified as Halal?

Islamic Finance: Playing catch-up

Islamic finance is relatively young compared to traditional finance. Whereas traditional finance is few thousand years old, formal adoption of Islamic finance started only fifty years ago. Even though it has the advantage of starting relatively late, it has been playing catch up with the traditional finance. Rather than being bold and innovative, it has just been a follower. It’s not just because Islamic finance had to work within the same regulatory environment as the traditional finance and had to compete against it, but also due to hesitancy of the leaders to take bold steps and bring about the change that the traditional finance lacked. What is required is a paradigm shift in Islamic finance, in its adoption, in its implementation (Maqasid-al-Shari’a, as per the objectives of Shari’a) and bring innovation to encourage the wider adoption of Islamic Finance globally.

The Solution Today, every part of our day-to-day lives is getting reshaped thanks to the development of new technologies. From 1990s – when people had to use slow and noisy modems to connect to internet with crawling speeds – to today where even the smallest of devices are interconnected and being used by billions across the world for instant communication. The smartphone, in particular, has changed the social patterns of people with the explosive growth of social media.

So, the landscape of both traditional and Islamic finance is being reshaped by innovation, thanks to the maturity of technologies like Artificial Intelligence (AI), Augmented Reality & Virtual Reality (AR & VR), Blockchain & crypto, Internet of Things (IoT), and Advanced Robotics to name a few.

Of particular interest is the adoption of Blockchain and the crypto technology, particularly by the FinTech companies that are propelling the growth of the finance industry. Combined with AI and IoT, Blockchain technology has the potential to disrupt not just the financial industry but also other business areas including healthcare, education, energy & utilities, retail, tourism, sport, lifestyle, manufacturing, supply chain, logistics and more. Blockchain can revolutionise the Islamic finance industry through the adoption of smart contracts and decentralization.

Transforming lives using Technology

Before we look at how technology can transform the lives of people, let’s look at why we need a transformation in the first place. Islam proposes the concept of life after death, which is eternal, and we all will be judged for how we lived our lives in the current world. During this life Shari’a shows the way and acts as a guide to our way of life. We need to understand the objectives of Shari’a. We need to understand the end, not just look at the means to the end. Muslims are advised to keep this in mind while living their daily life and every action they take.

In the context of wealth management, Shari’a proposes a world which is equal, moral, fair, and trustworthy; where wealth creation is done in an ethical way and is made accessible to everyone. Traditional finance encourages capitalism and individual profits at any cost, irrespective of the impact on the social fabric of the society. Islamic finance on the other hand strongly encourages and enables equality, fairness, and trust. Islamic social finance (zakat and sadaq’a) play a significant role is addressing the wealth inequality.

Technology creates a level playing field

In a world, where things are changing at the speed of light, technology is playing a central role in changing and disrupting the global business environment, more so in the finance industry.

Today, thanks to technology, the access to financial services is instant and global. This has created a competitive environment for the financial institutions, where they’ve to compete hard for customer attention, acquisition, and retention.

Technology has enabled the digital transformation at a rapid pace, and this has given an opportunity for the financial institutions to expand globally and get access to global customers. Today you can open a bank account in ten minutes with a smartphone and without leaving the comfort of your home. You can transfer cryptocurrency to anyone in the world within a minute. Digitalisation of financial industry has opened up new avenues for the financial institutions to offer new value-added services. thereby increasing their revenue through new business models.

On the customer’s side, technology provides an equal opportunity to the world’s population to get access to financial services that were unimaginable even a decade back. The lines are blurred between developed, developing, and under-developed countries when it comes to the access to financial services. I can go out on a limb and say that some of the developing and underdeveloped nations are embracing innovative technologies, particularly financial services, that aren’t available in developed countries!

Thanks to the FinTech companies, today there’s hardly a need to carry cash in your wallet/purse, as you can pay through your smartphones to buy a coffee or an expensive car from a showroom.

Building trust in the global village through Islamic Fintech

The transformation is required not just at the technology level, but also in the perception of what benefits Islamic finance provides compared to traditional finance. What will it take to enable the trust between two unknown parties to conduct a financial transaction, across the globe? How can the fairness be ensured when you do business with someone who is thousands of miles away and you don’t even know how they look like or where they live?

Bringing the principles of Islamic finance and technology can enable this. With the help of technology, we can build and automate the principles in a way that makes it seamless, easy, and trustworthy for everyone to use.

Islamic FinTech can help achieve this objective.

The ethos of Shari’a and Islamic finance focuses on trust, fairness, equality, and risk-sharing. Unlike traditional finance, where the lender always has the upper hand, Islamic finance provides an equal platform for both parties, through trust and risk-sharing. Today, the true implementation of Shari’a has been diluted by none other than Islamic banks, who mimic the traditional banks with instruments mimicking riba-based offering. This can be avoided by Islamic FinTech wherein they can develop products that adhere to principles of Shari’a and offer risk-sharing options out of the box. Today, technologies like Blockchain and smart contracts exist that can enforce adherence to Shari’a principles. It also offers transparency and trust between the parties.

Building competitive advantage over traditional finance

It’s not just enough to digitalise our way of living and assume that everything will be fine. From a long-term perspective, we need to look at not only bringing more Muslims under the fold of Islamic finance, but also everyone globally; invite people from all faiths, who are disillusioned by the traditional finance and are looking for an ethical alternative. As the only morally fair alternative to the traditional finance, Islamic FinTech can play a significant role in fostering the competitive advantage for the Islamic finance industry.

Propelling Islamic Economy through Islamic FinTech

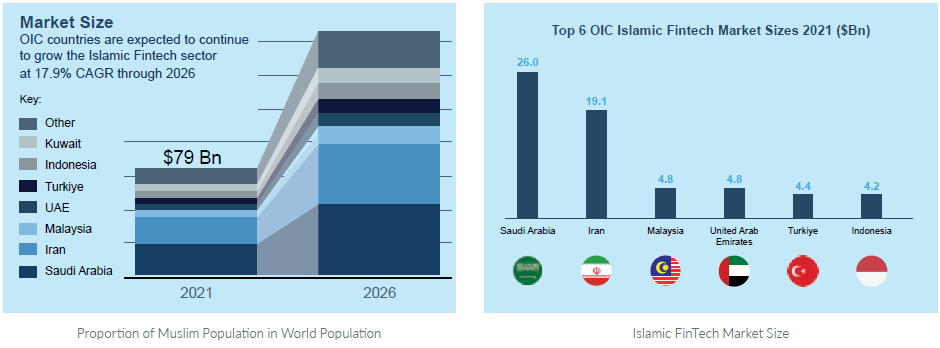

Along with the developments in technology, the adoption and growth of Islamic finance has outpaced the traditional finance industry. The Islamic FinTech market size in the OIC was $79 Bn in 2021 and is projected to grow at 17.9% CAGR to $179 Bn by 2026.

This is due to multiple reasons:

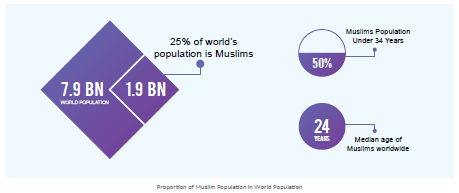

• The population of the Muslims globally is around 25% of the world’s population.

• As per age demographics, they are young and thanks to the internet and smartphones, they have access to financial services on their fingertips.

• These youngsters are much more financial savvy than their previous generation, and they prefer to conduct their financial transactions, wealth acquisition and management, in a Shari’a-compliant way.

In addition to this, the adoption of Islamic finance by people from other faiths has also increased significantly in countries like UK5, Canada, Australia, and US. It provides them an alternative to traditional finance, which they no longer consider as fair or just.

Islamic FinTech Landscape

As per the Global Islamic FinTech Report-2022, Islamic FinTech industry is poised to grow faster than their counterpart.

• The Organisation of Islamic Cooperation (OIC) countries’ Islamic FinTech transaction volume was estimated to be $79 billion in 2021, accounting for 0.8 percent of worldwide FinTech transactions according to the same report.

• The Islamic FinTech market size is anticipated to reach $179 billion by 2026 at a CAGR of 17.9% compared to the overall global FinTech industry, which is expected to develop at a CAGR of 13.5% over the same time period.

Islamic FinTech industry is still in its infancy and its size is just a fraction of traditional FinTech.

But it’s not small by any means. Today, there are close to 400 Islamic FinTech startups globally; and the numbers are growing rapidly. With a market size of $79 Billion in 2021, projected at $179 Billion in 2026, and 375 Islamic FinTech(s) globally, the Islamic FinTech sector is showing signals of maturity.

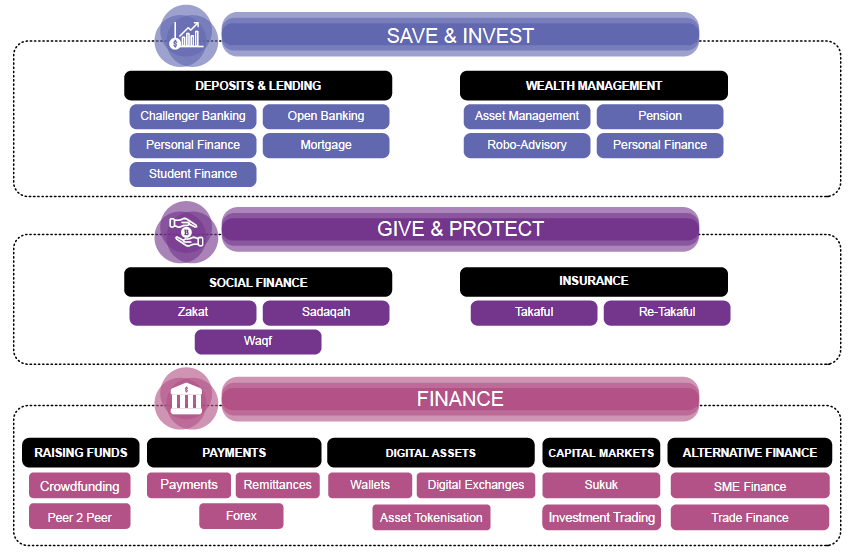

The following image shows the landscape of the Islamic FinTech, categorized in three broad areas. This may not be the exhaustive classification, but most of today’s Islamic FinTech are part of this.

Blockchain: An introduction

Technology innovation changes the way we live, and the advancement of technology is happening at a rapid pace. What a smartphone can do today was done with twenty separate devices couple of decades back! As the power of technology is growing, the time to get access to it is reducing.

Blockchain is one of the new kids on the block. Blockchain came into prominence in 2008, with the publishing of a research paper on Bitcoin by its pseudonymous creator Satoshi Nakamoto. Since then, the popularity and its adoption have progressed at an astounding pace.

Blockchain is a Distributed Ledger Technology (DLT). Though there are many ways to implement DLT, Blockchain happens to be one of them. Blockchain is a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network. Simply put, Blockchain is a decentralized public ledger system that facilitates records of business transactions between two parties, which is transparent and immutable. This is particularly useful for financial transactions as Blockchain can facilitate transfer of funds globally, in the form of crypto, without intermediation, securely and transparently.

What are the advantages/benefits of Blockchain?

- Decentralization

Blockchain is a network of computers (also called nodes) spread across the world where the data (record of transactions) is stored in a synchronized way. This ensures that the control and decision-making are not under one individual or group. This way, it not only creates redundancy but also maintains the fidelity of data that’s stored in Blockchain. Blockchain enables sharing of data within an eco-system of business where no single entity is exclusively in charge of the system. - Transparency

Due to the decentralized nature of Blockchain, all the transactions recorded can be viewed transparently by anyone. Anyone can use Blockchain explorer; explore it to see all the transactions happening on Blockchain, in real-time. All transactions on Blockchain are recorded, which are immutable, and are time-stamped. This enables anyone to view the history of a transaction and eliminates any opportunity of manipulation. - Trust

Because of the decentralized nature and transparency, Blockchain creates the trust between two parties who can engage in business dealings without intermediaries. Any documentation that’s required for the business transaction is also stored in Blockchain, or at least the access to the document can be provided.

Taking one specific example, using Blockchain, you can transfer funds to anyone in the world and the other party can be confident that when you say you have transferred, it’s visible for them to verify the transfer. - Speed and Increased Efficiency

Have you tried to transfer funds from your bank account to someone who lives in a different country? Not only it takes days, sometime weeks, to transfer but it also comes at a high cost of transfer. Moreover, in the case of a delay, the bank on each side blames the other one for delay. There’s no transparency of activities during this transfer and you are at the mercy of the banks to get the transactions completed, at their convenience. Blockchain removes the intermediation, excessive paperwork and reduces the time to transfer with the visibility of the transfer all the time. And it’s instant. So, not only you save time, but it comes at greater transparency and reduced overhead. - Smart Contracts

Though the concept of Blockchain and distributed ledger technology existed much before Bitcoin in 1990s, Bitcoin is the first implementation of Blockchain technology. When Bitcoin was released, it was used only for transfer of bitcoin through its network. Smart contract changed the Blockchain landscape and made it more powerful, capable, and useful. Suddenly, with smart contract, the utilities of Blockchain increased dramatically. With smart contracts, the capability of Blockchain goes beyond transfer of cryptos.

The term “Smart contract” was coined by Nick Szabo in 1994. He referred smart contracts as “a set of promises, specified in digital form, including protocols within which the parties perform on these promises.” A smart contract is a self-executing software code, which resides on Blockchain, and is a set of terms of contract that’s required to conduct business between the parties. This software code is executed when the terms in the contract are met. It’s self-executing because it doesn’t require manual intervention by the parties conducting the business transaction. As per the contract written in the code, the moment any of the contract condition is met, the smart contract executes and carries the instructions mentioned in the code. The smart contracts are also distributed, meaning they are also replicated across the nodes of the Blockchain and just like the data stored in Blockchain, smart contracts are immutable, and once deployed, the code cannot be changed by anyone. By eliminating manual intervention and without the need of intermediaries, a smart contract on a Blockchain can make conducting business more efficient and economical with no conflicts, and without delays. It also reduces the chances of fraud as the contract and the data are immutable and the contract execution is self-managed by Blockchain. With smart contracts, everyone can now use it, not just for crypto funds transfer, but also use it to conduct real business transactions on Blockchain. Now you can use it for finance and accounting, supply chain, shipping and transport, contract management, invoicing, and payments, and much more.

Blockchain: A natural companion to Islamic finance

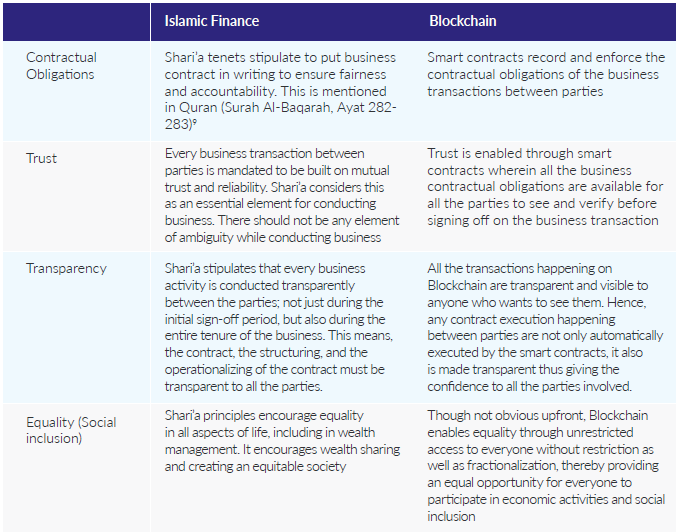

One of the significant benefits of Blockchain, beyond its technical capabilities is that core fundamental principles of Blockchain resonate well with Islamic finance and the tenets of Shari’a.

As you can see from the table below, many of the tenets of Shari’a are implemented and already built-in in Blockchain.

This makes Blockchain an ideal technology platform to develop innovative Islamic FinTech solutions that are socially inclusive, trustworthy, transparent, and available globally.

Applications of Blockchain in Islamic finance

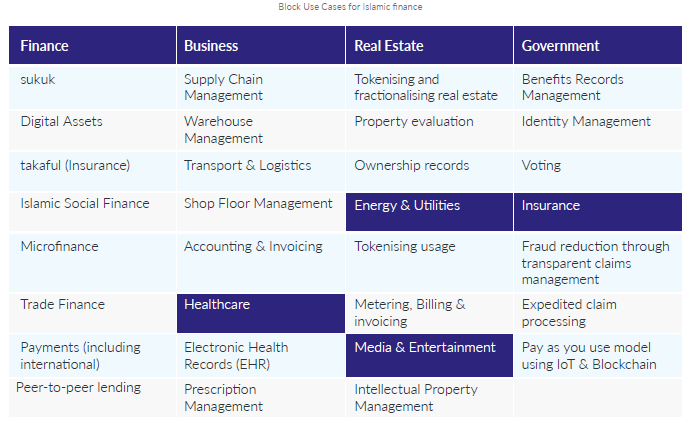

As the Blockchain technology is maturing and adoption is increasing, it’s becoming clear that Blockchain can be used in different functions of the real-world businesses; it’s not just confined only to finance. Below table depicts a non-exhaustive list of potential use cases of Blockchain.

Technology Areas

It needs to be emphasised that Blockchain technology alone is not the answer for developing innovative solutions for Islamic FinTech. There are other cutting-edge technologies too, which can play a significant role in pushing the boundaries of Islamic FinTech and other areas too. In fact, Islamic FinTechs can do well by combining some of these latest technologies to disrupt the current finance industries, both Islamic finance and traditional finance. Including Blockchain, they are:

- Blockchain

• Simple smart contracts

• AI enabled smart contracts

• Metaverse - Internet of Things (IoT)

- Artificial Intelligence (AI)

We could also include technologies like cloud computing and big data to this list. But today they are already mainstream and are embedded in the technology landscape of the companies, particularly FinTech.

Financial Applications on Blockchain

- sukuk

In Islamic capital markets, sukuk is the most important and popular instrument. Sukuk is a financial certificate through which the investors gain partial ownership on the obligator’s (issuer) assets until the sukuk matures. Sukuk enables the businesses to raise capital without diluting the equity.

Sukuks have become popular in the Islamic finance world since 2000, with Malaysia being the first country to issue sukuk, followed by Bahrain. Sukuk represents aggregate and undivided shares of ownership in a tangible asset as it relates to a specific project or a specific investment activity.10 But today sukuk has multiple challenges: - a. High ticket size

- b. High barrier to entry for investors

- c. Highly intermediated

- d. High cost of operationalisation

- e. Lack of transparency

Blockchain can address these challenges:

a. High ticket size: Today’s sukuks are issued with upward of $100 Million, thereby depriving smaller companies (SMEs) to raise capital through sukuks. But with Blockchain, the issuance size can be brought down to as low as $100,000.

b. High barrier to entry for investors: Due to the high cost of issuance, the entry point for an investor is also prohibitive to an extent that retail investors are unable to participate in investing in sukuk. Today, the majority of the investors in sukuks are large financial institutions.

Blockchain enables fractionalization. This means that the face value of the sukuk can also be brought down to as low as $100. This removes the entry barrier for small investors.

c. Highly intermediated: Today, the sukuk issuance process is complicated due to multiple intermediaries. This is also one of the major factor for the inefficiency in issuing sukuks.

Thanks to smart contracts in Blockchain, many of the activities conducted by intermediaries can be automated and managed through smart contracts, thereby reducing the number of intermediaries, and increasing the efficiency.

d. High cost of operationalisation: Due to high intermediation, the cost of sukuk issuance also is very high today.

The issuance of sukuk through Blockchain can result in huge cost saving to the issuers.

e. Lack of transparency: One of the shortcomings of today’s sukuk process is the lack of transparency from the obligors to share the necessary information at the right time.

With the help of Blockchain and the integration with Internet of Things (IoT), business related data is made available on Blockchain for the investors to see on a real-time basis. Today, most businesses publish their business performance on an annual basis, wherein with Blockchain, business performance (key performance indicators – KPIs)11 can be shared with investors even on a daily basis.

Qiam, an Islamic FinTech startup, does exactly that, where they tokenize the sukuk on Blockchain and all the sukuk activities including yield calculation, disbursement, business performance are captured and made available for investors on a just-in-time basis.

- Digital Assets (Asset Tokenization)

Asset tokenization is the process of representing physical and digital assets on Blockchain. It divides the ownership of the asset into digital tokens, and these tokens act as shares and proof of ownership of the asset. These digital tokens now can be used for trading, buying & selling, thereby enabling economic value transfer between parties.

“SUKUK ISSUANCE CAN BE DISRUPTED WITH THE HELP OF BLOCKCHAIN AND IOT.”

Real estate is one of the best use cases of asset tokenization. Take an example of a large real estate property that costs $100 Million. This type of asset is usually accessible only to institutional investors. But with tokenizing the property, the same property can be split and represented in small size of $100 each. Now these tokens can be traded on Blockchain, with participation from even small investors. Imagine if the property generates income through rentals. With the help of smart contract, each individual token holder will automatically get a share of the rental in proportion to their investment. This is just one of the simplest example of how tokenising assets through Blockchain can enable opportunities to generate income that wasn’t possible before.

Blockchain technology can democratise investment in a wide variety of assets, both physical and digital:

• Real Estate

• Art work

• Infrastructure Projects

• Lifestyle (jewellery, clothes, lifestyle accessories)

• Commodities

• Intellectual Property (IP)

• Healthcare (patient data)

• Sports (memorabilia, tokenising players!)

The following figure depicts an example of how real assets can be tokenised and benefit.

- Takaful (Insurance)

One of the biggest problem that insurance industry faces is insurance fraud and false claims. Like sukuk, takaful industry can be disrupted with the help of Blockchain. Though, there are many regulatory and legal hurdles that needs to be crossed before takaful on Blockchain can be widely adopted by the industry, it’s ripe for intervention.

As per CB Insights, these are the following applications of takaful on Blockchain.

a. Fraud detection & risk prevention: By moving insurance claims onto an immutable ledger, Blockchain technology can help eliminate common sources of fraud in the insurance industry.

b. Property & casualty (P&C) insurance: A shared ledger and insurance policies executed through smart contracts can bring an order of magnitude improvement in efficiency to property and casualty insurance.

c. Health insurance: With Blockchain technology, medical records can be cryptographically secured and shared between health providers, increasing interoperability in the health insurance ecosystem.

d. Reinsurance: By securing reinsurance contracts on the Blockchain through smart contracts, Blockchain technology can simplify the flow of information and payments between insurers and reinsurers.

e. Life insurance: Blockchain technology can take the burden of filing a death claim away from family members by replacing the manual process of filing claims with an automated system built on a Blockchain ledger.

f. Travel insurance: By automating claims, processes and efficiently sharing information between stakeholders, Blockchain travel insurance can save insurers time while reducing the burden on travelers.

In addition to this, with the usage of IoT devices in takaful, the insurers can get data from the devices (like automotive) which can help them in claims submission and processing. This again can reduce false claims and make the entire process transparent.

- Islamic Social Finance (Zakat, sadaq’a & waqf)

Wealth equality is one of the most important tenets of Shari’a. Unfortunately, the amount of wealth disparity that we see around the world is staggering.

Unfortunately, though these concepts of Islamic social finance are noble, however – it’s regretful to say – the implementation by the Muslim Ummah is anything but perfect. It has been widely reported that yearly global zakat collection is around $600 billion (a conservative figure). It may as well reach close to $1 Trillion yearly. But only $15 billion is traceable from Muzakki (contributors) to Mustahiq (beneficiaries). This inefficiency can be attributed to multiple factors, including a lack of transparency by zakat collecting & distributing institutions.

Blockchain can help streamline the process of zakat collection and distribution, in a transparent way without any intermediation. It eliminates mismanagement and willful corruption by unscrupulous parties.

Through smart contract, zakat collection and distribution can be automated wherein the contributors can directly send their contribution which until it reaches the beneficiaries, stays in the Blockchain (in the form of crypto). This way, even the intermediating institutions will not get access to funds, except for their fee that they are eligible to get as Amil (individuals or institutions who facilitate zakat collection and distribution).

“ZAKAT, SADAQ’A AND WAQF ARE WAYS THROUGH WHICH WEALTH REDISTRIBUTION IS ENABLED IN ISLAM.”

In order to remove mismanagement and fraud, the beneficiaries can be qualified through their KYC. This ensures that the contributed funds are reaching the intended beneficiaries.

Like zakat, sadaq’a contribution can also be made through Blockchain, which provides a transparent way of collection and distribution. Qiam, intends to build an end-to-end zakat & sadaq’a solution built on Blockchain. Contributions can be made using the mobile app, which ensures that only KYC-approved individuals are enabled to contribute as well as receive the zakat funds. The mobile app helps the contributors to calculate the zakat (based on Nisab) in a simple way wherein they enter their assets and liabilities, and the app calculates the zakat amount payable by the contributors. The contributor’s data is kept confidential and isn’t visible to anyone but the individual contributors.

- Microfinance

Microfinance is a facility which is provided to small companies which can’t raise funds through large financial institutions. This type of finance is also Shari’a based, which means, no riba is involved.

This can be enabled through Blockchain. Interested investors can transfer the money to microfinance institutions through the Blockchain, which provides the funding to the deserving small companies. The companies return the fund based on the structuring like mudarabah and murabaha. Some institutions provide Qard-al-hasan, which is a riba/interest-free loan to individuals. - Trade Finance

Trade finance provides the companies with the funds that are required to buy raw materials to build/make/manufacture their products. Most of the times, due to the accounts receivables, the companies don’t have the required cash to purchase the raw materials, and so, they depend on trade financing to fulfill their current shortage of cash. In order for the trade financing to work smoothly, data and information exchange between the parties has to happen in a transparent and timely manner. - Here too, Blockchain can play a significant role in streamlining the exchange of trade data. Smart contracts can remove the manual process of data verification, consolidation and data matching, thereby making the process more efficient and transparent.

- Peer-to-Peer Lending

As per a paper published by Mesut Pişkin Merve Can Kuş, Peer-to-peer (P2P) lending allows people with fund surplus to lend to people who need funds via online platforms. Those who need funds become able to choose the most suitable fund provider and lender. In this type of intermediation, banks are out of the equation, and online platforms bring together the ones in need with the ones with surplus funds.

Those in need of funding can communicate directly with the people they will borrow, while they become able to obtain funds at cheaper costs. Islamic P2P lending model, unlike conventional banking, is based on profit-loss partnership and requires a product of financing to trade as a physical good or service.

Blockchain brings the transparency to both parties, including the proof of Shari’a compliance.

Islamic FinTech & ESG

As the Islamic FinTech brings out Shari’a-compliant products and solutions, solving real business problems, they are also well positioned to champion the ESG (Environmental, Social & Governance) initiatives as ESG principles lends well to the principles followed by Islamic Finance (and thereby, Islamic FinTech).

Islamic FinTech’s product offering can provide impetus to ESG. For instance, let’s take example of sukuk issuance. Today, there are more and more ESG or Green sukuk are issued where the focus is one or all the elements of ESG. Specifically, the social and governance part is already enshrined in the Shari’a guidelines, which encourages risk management, transparency, ensuring rights managements to name a few. Hence, Islamic FinTech are at the forefront of highlighting and promoting ESG based initiatives.

Islamic FinTech: Design Thinking

We have covered how Blockchain and other technologies can help Islamic FinTech to provide solutions that are more ethical, transparent, equal and provides access to all. But we need to think beyond the obvious and look at what more can be done to promote the Islamic Finance to the world.

Imagine self-enforcing smart contracts that can validate proof-of-principle, compliance to Shari’a, and complete the transaction between two parties, without intervention. Tokenise fatwas on Blockchain, anyone?

Imagine AI enabled smart contract solving KYC, AML and provide robo-advisory. Through Machine Learning (ML), these smart contracts become better and better at detecting fraud and money laundering. AI is the logical evolution for smart contract. Instead of fixed self-enforcing rules, it can learn and be more adaptive.

Go beyond the obvious and challenge the status quo

Today, when we meet with the industry veterans and people with knowledge, what we hear is the number of challenges that Islamic FinTech will face; be it regulatory, license, jurisdiction, legal compliance, awareness, willingness to adopt and more!

What is required is, a collective effort to address these challenges and enable the Islamic FinTech to grow within and beyond the Islamic world. Islamic Finance is suitable, beneficial for the global population. It’s time we do our bit to invite everyone to adopt Islamic Finance and facilitate Islamic FinTech to cross the hurdles. Islamic FinTech has the potential to help boost the global economy.

Challenges

For Islamic FinTech to grow and thrive there’s no denying the fact that it will have to go through certain challenges. Compared to the traditional FinTech industry, Islamic FinTech has additional challenges in the form of regulation, jurisdiction, and AML.

Regulation

When it comes to Blockchain and crypto, most of the FinTech (both traditional and Islamic), don’t have a choice but to go to offshore locations to launch their companies and issue tokens.

But there is a silver lining, as UAE has announced VARA (Virtual Asset Regulatory Authority) which aims to create an advanced framework for virtual assets. We hope that it’ll pave the way for others to emulate and enable an open environment for Blockchain-based Islamic FinTech startups to grow.

Access to funding

As the Islamic Finance industry is just a fraction of the traditional finance industry, it’s not surprising that raising funds for Islamic FinTech is more difficult – more so – if the startup happens to be an Islamic FinTech building products using Blockchain.

But then, just like every startup founder, Islamic FinTech founders will have to hustle doubly hard to land funding. There’s no magic formula here.

Resistance to change

One of the hurdles for Islamic Finance to increase its adoption is the lack of awareness. Even today many Muslims don’t have the knowledge of how Islamic Finance works. In addition, many who do understand resist moving from traditional finance to Islamic finance. It could be due to comfort factor or the fear of unknown. This can be addressed only through hard campaigning through channels like social media to promote awareness.

Conclusion

As we head toward the future, technological advancement will keep on providing opportunities for us to grow, as individuals and as community. We need to have an open mind to adopt a way of life that’s ethical, fair, equitable, shareable, and socially inclusive. This is what Islamic jurisprudence chiefly emphasizes (Maqasid-al-Shari’a).

Islamic FinTech will play a pivotal role in enabling an equitable world where access to wealth creation is available to everyone, providing opportunities as a society to grow inclusively. Insha Allah.