Given the success of IBF and the growing prominence of Islamic banks and financial institutions, there is an emerging interest in ranking the countries where IBF exists with a degree of significance. GIFR has been publishing Islamic Finance Country Index (IFCI) since 2011, which ranks about 40 countries in terms of their significance and potential with respect to IBF. Apart from this specific interest, there has also been a general interest in ranking countries in the OIC block in terms of their Islamicity.

Country leadership in IBF has different dynamics than the leadership of cities in this field. While the former may very well be driven by the market size (e.g. population and the economy size in terms of GDP), the latter is largely determined by other factors like international linkages and financial infrastructure.

Luxembourg, for example, is emerging as an important city in IBF despite being a small country in terms of population. As a move to strengthen its position as the leading European domicile for Islamic investment funds, the Luxembourg Supervisory Authority for the Financial Sector (CSSF) has signed MoUs with a number of supervisory authorities with a strong Islamic finance background, such as the Dubai Financial Services Authority, the Central Bank of Bahrain, the Securities Commission Malaysia and the Qatar Financial Centre Regulation Authority. Nicosia, the capital of Cyprus (a country with a population of only 1.2 million), has also declared its intention to set up an Islamic hub to spur economic growth and recovery, following Luxembourg’s successful €200 million sukuk debut in September 2014.

“Unless there are new incentives introduced, or a credit crunch affects conventional banking and finance, development of IBF in the cities like Singapore, Hong Kong, Nicosia and Luxembourg is likely to remain rather opportunistic or event-driven.:

Other financial centers that are angling for a share of Islamic finance business and subsequently positioning themselves as CoE in IBF include Singapore and Hong Kong, but with limited success. Singapore has been nurturing its ambition to become a regional finance centre for IBF by leveraging its capabilities and credentials in wealth management, project financing and trade financing. While Singapore received some early attention by Islamic financial institutions, the stronger neighbouring Kuala Lumpur has proven to be a more credible and reliable jurisdiction due to its comprehensive and internationally competitive Islamic finance ecosystem.

The Hong Kong Monetary Authority (HKMA) recently demonstrated its commitment to develop Hong Kong as an Islamic finance hub, particularly in the capital markets segment, by way of a $1 billion sukuk in 2014. However, the city is still far from achieving its status as a CoE in IBF.

There are multiple factors that must be taken into account when deciding whether a city merits to be recognized as a global center of excellence (CoE) for IBF.

Islamic financial advocacy is perhaps the most important factor in this respect. Any city’s claim to be a global hub for IBF must be adjudged against its advocacy role in owning and promoting IBF. While there have been talks about the likes of Singapore and Hong Kong aiming at attracting Islamic capital and aspiring to be a global hub for IBF, the financial authorities and governments in these countries have done little to achieve this objective. The implicit strategy in such cases has been to show some initial commitment to IBF but proceed only if there has been meaningful response from the financial institutions involved in IBF. This is naturally an opportunistic approach, which may not work in most cases.

Financial infrastructure conducive to IBF is the second most important factor for assessing a city’s claim to be a global CoE for IBF. Any city can claim to be a CoE for IBF but without developing an enabling environment it cannot attract serious players in the Islamic financial services industry. For example, Kuala Lumpur succeeded in attracting a number of global players in IBF largely because of developing a one-window solution (i.e., Malaysia International Islamic Financial Centre (MIFC)) to facilitate entry of foreign Islamic investment banks and asset management companies. Neighboring Jakarta, on the other hand, has yet to attract an Islamic financial institution of repute because it has failed to adopt a completely rule-based regime for entry of foreign Islamic financial institutions.

Vibrancy of capital markets and the size of stock exchanges in such countries are important factors in making them Islamic financial hubs. Therefore, it is not surprising to observe that a number of cities are joining the race to attract listing of sukuk on their stock exchanges.

Qualified and competent personnel for IBF are key to development of a progressive Islamic financial community. This is why availability of human resources and institutional endeavours for talent development are crucial factors for a successful CoE for IBF. While the likes of Dubai have established themselves as a CoE for IBF, they have so far not been successful in indigenously producing qualified IBF personnel. However, they have managed to attract some of the most qualified and experienced Islamic bankers and finance experts. This is owing to the income tax exemption for those working in such countries, which has helped them to bring the required human resources from other countries.

International linkages are important drivers of IBF growth. For example, while London may not be able to compete with the likes of Kuala Lumpur and Manama in terms of detailed regulations for IBF, it certainly is a meeting point for financial institutions, including Islamic, from around the world. International linkages are determined not only by the geographical locations but the ease with which people can travel to and from such cities. London and Dubai are on top of the list of the cities important to IBF in terms of international linkages.

Business of airports, as a measure of international linkages, is an interesting parameter, as this may suggest that IBF is linked with economic growth – although it is hard to determine causality of the relationship.

However, the link between a busy airport and economic growth in its catchment areas is increasingly becoming the focus of academic research. Richard Green, a business and public policy professor at the University of Southern California, sees a correlation between busy airports and economic growth. GIFR’s in-house research discovered a positive correlation between air passenger traffic and IBF activities, as discussed below in the context of 10 CoEs in IBF.

Although advocacy and regulation are linked, it is important to treat it as an independent factor in categorizing of financial centre as a hub of IBF. The cities and jurisdictions (e.g., offshore financial centres) that have no favourable regulations for IBF cannot become Islamic finance hubs.

The following ranking considers these five factors in determining leadership roles of the top 10 Centres of Excellence in Islamic Banking and Finance.

- Advocacy

- Infrastructure

- Human Resource

- Linkages

- Regulation

TOP 10 CENTRES OF EXCELLENCE IN ISLAMIC BANKING &FINANCE

The following the top 10 Centres of Excellence in Islamic Banking and Finance:

Kuala Lumpur – Malaysia fl. Manama – Bahrain

- Dubai – UAE

- London – United Kindom

- Doha – Qatar

- Kuwait – Kuwait

- Karachi – Pakistan

- Riyadh – Saudi Arabia

- Jakarta – Indonesia

- Istanbul – Turkey

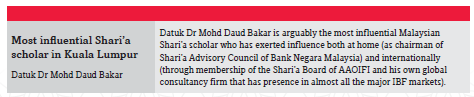

KUALA LUMPUR – MALAYSIA

| Aggregated Points: 84/100 | |||||||||

| Advocacy | 19 | Infrastructure | 15 | Human Resource | 18 | Linkages | 14 | Regulation | 18 |

| City Fundamentals | |||||||||

| Population | Number of passengers passing through Kuala Lumpur International Airport (annually) | The tallest building in the city | |||||||

| 1.67 million | 35 million | The Petronas Twin Towers (1,483 feet; 452 metres) |

Undoubtedly, Kuala Lumpur is the global capital of IBF, with numerous industry-building institutions like Islamic Financial Services Board (IFSB), International Islamic Liquidity Management Corporation (IILM), International Centre for Education in Islamic Finance (INCEIF), International Islamic University Malaysia (IIUM) and International Shari’a Research Academy for Islamic Finance (ISRA). The key to Kuala Lumpur’s success as a global centre of excellence for IBF is the staunch support of the government and the role that the central bank – Bank Negara Malaysia – has played in the promotion and development of IBF nationally as well as internationally.

There are 16 full-fledged Islamic retail banks, 11 takaful companies, and over 220 Islamic investment funds with offices in the city. Bursa Malaysia has over 70% of the listed stocks as Shari’a-compliant. Its Suk al-Sila’ has emerged as the largest commodity murabaha platform outside London, which is being used by local and foreign Islamic financial institutions for liquidity management and other related transactions. Kuala Lumpur also boasts the largest Islamic fund market, commanding nearly 28% of the total global number of Islamic funds.

Kuala Lumpur remains as the world’s largest sukuk market, accounting for about two-thirds ($41.7 billion) of outstanding global sukuk issued, where about 47% of primary sukuk issues globally in 2014 domiciled from here. Kuala Lumpur also stands out as the only sukuk market with global outstanding sukuk above $100 billion. The city’s credential as a sukuk hub was further solidified with the introduction of the Islamic Financial Services Act (IFSA) which came into force on 30 June 2013. Kuala Lumpur also offers a well-defined Shari’a governance framework that ensures uniformity and harmonization of Shari’a interpretations.

Malaysia International Islamic Financial Centre (MIFC) remains the only financial center in the world, which exclusively focuses on IBF. Other financial centres in the Islamic world the likes of the Dubai International Financial Centre (DIFC) and Qatar Financial Centre (QFC) have only marginal emphasis on IBF.

In terms of activity and visibility of IBF, Kuala Lumpur offers the best example of advocacy of IBF. With numerous conferences, seminars and workshops held on a frequent basis, Kuala Lumpur has established itself as a global centre of excellence for IBF.

In a nutshell, in Kuala Lumpur, a comprehensive and sophisticated market place has evolved through continuous, focused and collaborative development for over 30 years.

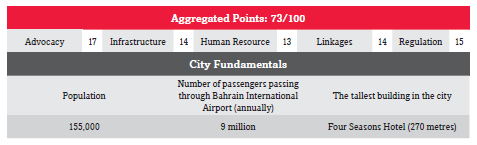

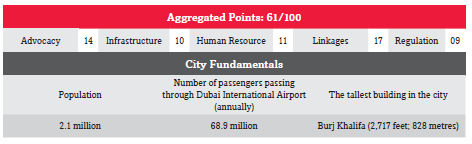

MANAMA- BAHRAIN

Bahrain – once the unchallenged leader in IBF and the financial capital of the Middle East – has slipped to second position in terms of its global standing as a centre of excellence in IBF. With the likes of Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), General Council for Islamic Banks and Financial Institutions (CIBAFI), International Islamic Financial Market (IIFM) and the Islamic International Rating Agency (IIRA), Manama remains central to the global developments in IBF. The government’s commitment to IBF is crucial for the leadership role of Bahrain in the global Islamic financial services industry.

With 6 Islamic retail banks, 15 Islamic investment banks (and two branches of foreign Islamic investment banks), 8 takaful companies (and four additional offshore takaful operators), and 12 Islamic asset management firms, Manama remains a vibrant CoE in IBF.

With reference to advocacy of IBF, the government and central bank have provided full support to IBF and takaful. Manama is host to numerous international conferences, seminars and workshops in IBF with the annual AAOIFI-World Bank Conference on Islamic Banking and Finance as one of the major events in the global IBF calendar.

With a comprehensive and sophisticated environment, Manama remains central to all the major developments in the global and regional IBF markets, particularly in the Middle East region. Along with numerous success stories, Manama has also witnessed some anti-developments in the last couple of decades. A number of financial institutions have either completely relocated to neighbouring countries (e.g., Dubai) or have significantly reduced their presence in the city. These include USB (which set up Noriba Bank in Manama later to shut it down) and Citibank (which rather enthusiastically set up Citi Islamic Investment Bank in Manama later to relocate its Islamic investment banking business to DIFC). Similarly, Liquidity Management Centre was not able to achieve its initial objective of establishment, and the KL-based IILM has now emerged as a better international institution assisting IBFIs to manage their liquidity.

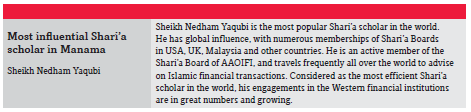

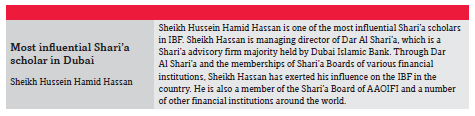

DUBAI – UAE

Dubai is aggressively pitching itself as a global capital of Islamic economy. It boasts having the best infrastructure for the financial services industry and linkages to the global Islamic economic routes. It has established a number of industry-level bodies like Dubai Islamic Economy Development Centre (DIEDC) and Dubai Centre of Islamic Banking and Finance (DCIBF). The DIEDC was established to bolster Dubai’s global leadership in Islamic economy in seven areas – Islamic finance, halal food, Islamic travel, fashion and arts, pharmaceuticals/cosmetics and media/recreation. Like in Malaysia, the key support to Dubai as a center of excellence for Islamic finance and economy comes from the government. The UAE is planning to set up a federal Shari’a Board to standardize Islamic rulings on Shari’a-compliant transactions, and Dubai is expected to play a role in such an establishment.

Dubai is a huge success story of IBF. It has seven full-fledged Islamic banks and almost all the conventional banks offering Islamic financial services through a window-based model. There are several takaful and re-takaful companies operating in the city. Islamic asset management business is also in existence in the city as well as in DIFC. DIFC has attracted a number of Western financial institutions that also offer Islamic financial services. Although Dubai experienced a debt crisis in 2009, it has since made a promising recovery and has been chosen to host the World Expo 2020, fuelling once more the growth of IBF.

IBF is very visible in the marketplace and a number of corporates and government-linked institutions frequently issue sukuk many of which are actively traded on the Dubai International Financial Exchange. There are a number of auxiliary services available to support IBF. Although there is a lack of local talent available for IBF, but Dubai has attracted a large number of expatriates from around the world to serve the Islamic financial services industry. The establishment of DCIBF is part of the government initiatives in developing talent to support the growth of Dubai as an Islamic finance hub.

Dubai has developed its international linkages impressively, which are also helpful for the development of a vibrant IBF sector.

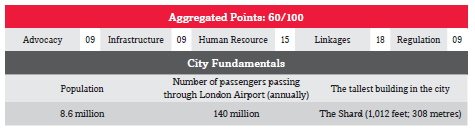

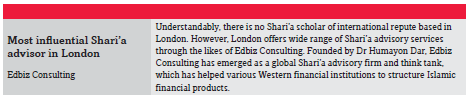

LONDON – UK

Among the financial centers outside the Muslim-majority nations of the Middle East and Asia, London is the focal point for the development of Islamic finance in the West and ranks number four as the center of excellence for IBF. London is the only city in the Western world that is regarded as a serious contender for the Islamic finance hub. With numerous industry-building initiatives like Institute of Islamic Banking and Insurance, Islamic Bankers Association and UKTI’s lead role in the promotion of London as a hub of IBF, London remains central to developments in the global Islamic financial services industry.

London has been famous for its role in the commodity murabaha transactions that are conducted on the London Metal Exchange (LME). London became the first financial center outside the Islamic world to issue a sovereign sukuk1 when the UK government issued its first sovereign sukuk of £200 million in 2014, which was hugely over-subscribed. It is expected that it will pave way for a vibrant secondary market for sukuk trading on the London Stock Exchange. To date over $38 billion has been raised through 53 issues of sukuk on the London Stock Exchange. London is also home to the largest cluster of Islamic investment and wealth management banks outside the Muslim world. At present, there are five such banks operating through their offices in London. In terms of support services to the global Islamic financial services, London offers unparalleled services through a large number of law firms, consultancy companies, and Shari’a advisory firms.

In terms of visibility of IBF, London still lacks behind other CoEs in the Muslim world, but there is an impressive awareness of IBF in the city, especially in the financial sector. The tallest building, The Shard, was partially financed through an Islamic financial transaction. Islamic finance was also used to fund other London’s landmarks such as the Olympic Village and redevelopments at Chelsea Barracks and Harrods. The last Olympics, held in London also attracted interest of a number of Islamic financial institutions from the Middle East.

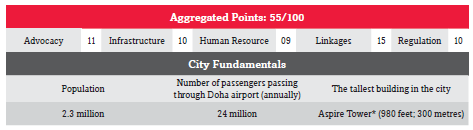

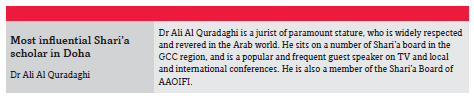

DOHA – QATAR

Doha is the fifth center of excellence for IBF. Home to the Qatar Financial Centre, Doha has a huge potential to play an influential role in the global development of IBF. The decision of the Qatar Central Bank in 2011 to disallow operations of Islamic windows of conventional banks in Qatar was a revolutionary step, which has influenced thought process at other central banks as regards the regulatory treatment of IBF.

In 2013, Qatar Exchange and Al Rayan Investment launched the Al Rayan Islamic Index. The index, which is the first exchange-sponsored Shari’a-compliant index in the region, is intended to support the creation of Shari’a-compliant exchange-traded funds (ETF) by Al Rayan Investment and ultimately accelerate the development of the Islamic asset management industry. There are five Islamic banks (4 local and 1 foreign bank with a representative office), and five takaful companies in Doha. There is also a limited number of Islamic investment funds domiciled in Doha.

Islamic finance in Doha is expected to receive a major boost with Qatar winning its bid to host the 2022 FIFA World Cup. Massive investment in infrastructure projects in preparation for the World Cup will boost Islamic banking and the sukuk market as a direct result of high demand for corporate credit to finance government infrastructure and investment projects.

Qatar Faculty of Islamic Studies offers qualifications in IBF to local as well as international students. At present, local qualified personnel are in short supply in Doha but the city is managing its demand for human resources by way of attracting highly skilled foreigners. IBF is visible in the city, with branches of Islamic banks and takaful companies conveniently located in the downtown and shopping malls.

A number of Islamic financial institutions in different countries (e.g., Pakistan and UK) are actually owned by the parent companies based in Doha. In this respect, Doha is a net contributor of capital to a number of other CoEs in IBF, most notably London and Karachi. Although the history of IBF in the city goes back to decades, its stature as a CoE in IBF is rather recent.

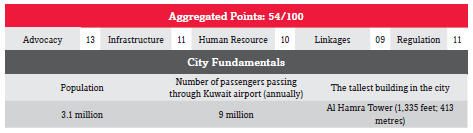

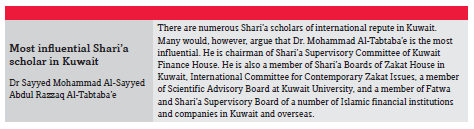

KUWAIT – KUWAIT

Although Kuwait City has been one of the strongholds of IBF since the 1970s when Kuwait Finance House was set up with the help of the government, Kuwait has always remained modest in its claim to the leadership in IBF. It marginally misses out the fifth position (losing to Doha) because of its conservative approach to international linkages and its rather passive approach to attracting foreign investors into the city. In fact, Kuwait has been a net exporter of Islamic capital, with investments in a number of Islamic financial

institutions all over the world. Kuwait Finance House (KFH), which is the largest Islamic bank in the country, has emerged as a global player in IBF through its shareholdings in a number of other Islamic financial institutions and cross border operations in Bahrain, Turkey and Malaysia as well as real estate and other businesses in Cayman Islands and Saudi Arabia. There are five Islamic banks and a branch of a foreign Islamic bank operating in the city of Kuwait. Another conventional bank is in the process of converting itself to a full-fledged Islamic bank soon. This makes the number of Islamic banks operating in the city more than the conventional banks. Similarly, there are 51 Islamic investment companies, compared with 44 conventional investment companies. The number of Islamic investment funds (54) also exceeds their conventional counterparts (52). There are 12 takaful operators in the city, which is also home to two leading players in Islamic financial technology, namely ITS and Path Solutions.

This is a clear indication that IBF in Kuwait is larger than its conventional counterpart, at least in numbers. It is expected that IBF will also exceed conventional banking and finance in terms of assets under management by 2020.

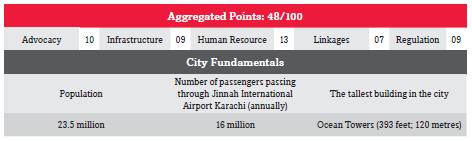

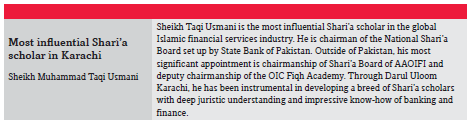

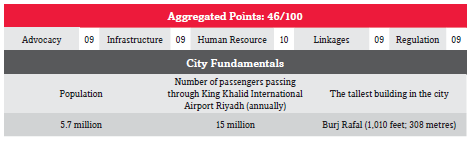

KARACHI – PAKISTAN

Karachi is the largest city in Pakistan and in fact the largest city in the Muslim world with a population of 23.5 million. It is home to the national financial center and is the business hub of the country with its population approaching 200 million. All the five full-fledged Islamic banks in the country are headquartered in Karachi which offers an excellent infrastructure of Shari’a architecture for Islamic financial institutions. The most important seat of learning for Shari’a studies related with IBF is Darul Uloom Karachi, although Jamia Islamia Binnouri Town and Jamiat ur Rashid are also important seminaries offering instruction in the jurisprudence of Islamic financial transactions.

With a heavy emphasis on Shari’a authenticity in Islamic banking in Pakistan, Karachi may very easily be considered as the global centre of excellence for Shari’a matters related with IBF.

There are five takaful companies operating from the city and offering their services throughout the country. The city has been marred with domestic political conflict for a several decades; had this been otherwise it may have been even sophisticated role as a CoE in IBF. With its strategic position and access to huge domestic population, Karachi has the potential to become the global CoE in IBF. It has to improve on its international linkages, as at present Karachi airport is not comparable with most of the other airports included in this chapter. Most of the 16 million passengers passing through Karachi international airport annually are Pakistani nationals.

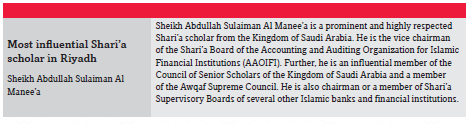

RIYADH – SAUDI ARABIA

Being capital of one of the wealthiest and most important Islamic countries, Riyadh stands tall in the list of CoEs in IBF. Ranked 46th in the list of the world’s 50 safest cities, Riyadh is also known for its excellent infrastructure – a basic requirement for financial sector development in a country.

World’s largest Islamic bank (outside Iran) – Al Rajhi Bank – is headquartered in Riyadh. All the four full- fledged Islamic banks in Saudi Arabia have operations in Riyadh (although Bank Al Jazira is headquartered in Jeddah). Similarly, the largest bank in the country (which has its retail banking operations in compliance with Shari’a) – National Commercial Bank – is headquartered in Jeddah, it has strong presence in the capital as well.

Many observers would argue that IBF has brought a lot of additional activity to the city that has traditionally been deemed an unexciting place to live and visit. Today, Riyadh is a vibrant city with a futuristic outlook. Given that IBF is expected to surpass conventional banking and finance by 2020, Riyadh will emerge as even a bigger CoE in IBF.

There are over 35 takaful operators in Saudi Arabia and all of them have their presence in the capital. In fact, Saudi Arabia is the largest market for takaful, accounting for more than three-quarters of the global takaful industry.

With Saudi Arabia as the only country in the world with the share of Islamic retail banking more than 50 percent, Riyadh can play an important role in the global development of Islamic financial services industry. However, the government support and its role in Islamic financial advocacy has been limited. If the government adopts an explicitly supportive approach to IBF, Riyadh can easily take over some of the CoEs included in this chapter. With improved access to the city (i.e., visa on arrival at the airport) and increase in international linkages by way of increasing air traffic can help the city of Riyadh to become one of the regional financial centers in the MENA region. IBF will certainly be an integral part of this futuristic vision.

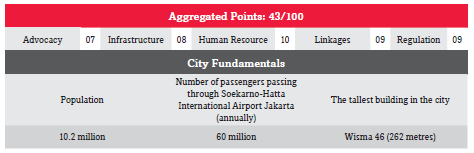

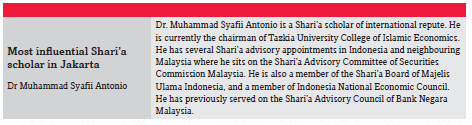

JAKARTA – INDONESIA

Jakarta, the capital of the world’s most populous Muslim nation, ranks at number 9 on the list of the top ten CoEs in IBF. Given the size of its domestic market, Jakarta has been a recipient of foreign capital right from the beginning when Bank Muamalat – the first full-fledged Islamic bank in the country – was set up in the city. Bank Muamalat is jointly owned by the IDB, Boubyan Bank of Kuwait, Atwill Holdings, National Bank of Kuwait and other smaller shareholders.

In June 2014, Dubai Islamic Bank (DIB) acquired a 24.9% stake in Bank Panin Syariah (BPS). The Financial Services Authority or Otoritas Jasa Keuangan (OJK) – the local financial regulator – has received a proposal from DIB to increase its stake in BPS to 40%. In a bold move to boost IBF, OJK is pushing ahead with plans to create a mega Islamic bank by merging three state-owned Islamic banks, namely Bank Mandiri Syariah, Bank Rakyat Indonesia and Bank Negara Indonesia.

This vibrant city is host to 11 full-fledged Islamic banks, 163 Islamic rural banks and 23 Islamic business units with combined assets of $20.1 billion. In a move to spur consolidation of the Islamic banking sector, the Islamic units of existing conventional banks are required to be spun off into separate entities by 2023.

Jakarta holds attractions to investors from other countries with much larger Islamic banking systems, especially those in Arab countries that continue to experience political and social unrest. For example, Al Baraka Islamic Bank, headquartered in Bahrain, chose Jakarta as one of 12 countries in which it operates through a representative office since 2008. The office serves as a base for Al Baraka to conduct research on local banks and their potential for acquisition and for assessing the business potential of Jakarta and also generates leads for other parts of the Al Baraka Group.

Jakarta is also home to Majelis Ulama Indonesia (MUI) or the Indonesian Council of Ulama – the premier body of independent Shari’a scholars who opine on the Shari’a matters related with IBF. The Shari’a governance model of MUI is unique, as it maintains independence of Shari’a advisory from the influence of banking and financial regulators.

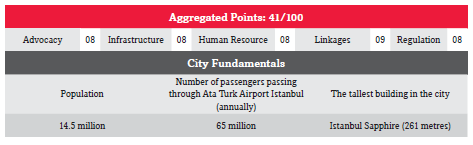

ISTANBUL – TURKEY

Istanbul is fast emerging as an important center of excellence for IBF. Situated on the crossroads of Europe and Asia, it is an ideal place for cross-continental business. As a growing trend and with attractive investment instruments, IBF is becoming a key factor for Turkey as part of İstanbul’s financial center project. As an emerging center of excellence of IBF, Istanbul has great future, although it currently stands in the bottom of the top 10 CoEs in IBF.

Istanbul can enhance its stature by uniquely positioning itself as an Islamic finance gateway to both Europe and Asia. The steps that would need to be undertaken in order to achieve this would involve the establishment of the legal and regulatory foundation to support and govern IBF.

Following the success of recent sukuk issuance by the government of Turkey, Istanbul can definitely establish itself as a global sukuk hub, as it already has much of the requisite infrastructure. İstanbul is ideally positioned for such a role geographically, situated between the East and West and overlapping with many time zones. What is needed is to build the right ecosystem with an enabling environment that includes sufficient state support.

Borsa Istanbul as the listing authority can streamline the listing process for international issuers. This would attract more issuers to list their international sukuk issuances on Borsa Istanbul, further increasing the volume of sukuk trading and their overall liquidity. Istanbul was chosen by the World Bank for the location of its first representative office in Islamic finance – Global Islamic Finance Development Centre (GIFDC). Located in Borsa İstanbul premises, the GIFDC is the result of the cooperation of the World Bank and the Turkish Treasury. Turkey has a great potential to become an important Islamic finance hub that may serve both the West and Asia given its young demographics and ongoing regulatory reforms. But with only four participation banks operating in the jurisdiction, Turkey faces a major supply-side constraint. This can in the long run limit its ability to develop IBF.

BOX 14: WHERE TO SET UP?

For any financial institutions contemplating to set up their Islamic financial operations, choosing a jurisdiction is an extremely important consideration and can be rather complex. Many European and American financial institutions have in recent times found it convenient to locate their Islamic businesses in Dubai. However, the choice is not a straightforward one, as various CoEs offer distinctly different benefits.

For Western financial institutions looking for an entry into the IBF market, partnership with a local financial institution is of paramount importance. For example, while many Western asset managers (e.g., Allianz Global Investors) have found it difficult to penetrate into IBF, some others (like Principal Asset Management) decided to partner with CIMB Group to set up CIMB-Principal Islamic Asset Management that has seen reasonable success in the Islamic asset management industry.

HSBC, for example, decided to relocate global operations of its Islamic business – under the Amanah brand – to Dubai after launching it in UK in 2004. However, it has since decided to close down its Islamic retail banking businesses in six countries, including the UAE. Although HSBC is still running its IBF operations in Malaysia (through HSBC Amanah Bank) and Saudi Arabia (through SABB), it has scaled down operations in Indonesia.

It seems as if Dubai is not a viable choice for HSBC for its IBF operations. Kuala Lumpur, on the other hand side seems to be a winner. Similarly, Gatehouse Bank, a London-based Islamic investment bank, decided to relocate its former CEO Richard Thomas to Kuala Lumpur where it opened a representative office. Many industry observers view this move as recognition of Kuala Lumpur as a more viable venue for IBF than London. This is substantiated by the existence and performance of foreign Islamic banks in Kuala Lumpur and London. While all the Islamic banks in London, with foreign ownerships, have to date struggled to win local business, Kuala Lumpur- based foreign Islamic banks have shown much better performance.

The competition for becoming a global CoE is dynamically fierce and growing. Once Bahrain was seen as an unrivalled global hub for IBF – but it has lost its attraction over the years. The likes of UBS and Citi, which opened full-fledged Islamic banks in Bahrain, have moved out of Manama to set up their IBF operations in Dubai. The two banks now register only marginal presence in the field of IBF at DIFC. The global hub for IBF is in search of a permanent home, although at present it is in transit at Kuala Lumpur.