INTRODUCTION

Since the start of modern Islamic finance during the 1960s, the industry has been growing at a considerable pace, transforming from a niche to a global market. Ethical basis of the industry is attracting clients both from Muslims and non-Muslim jurisdictions, ensuring recognition as a serious alternate to the conventional banking industry. Shari’a, the guiding principle of Islamic finance, distinguishes this industry from conventional finance and hence Shari’a-compliance is its main thrust. However, there is no universal consensus on interpretation and implementation of Shari’a, the derived law from primary sources of Quran and Sunna. This elucidates Shari’a scholars as strategic leaders of IBFIs, as ensuring Shari’a compliance is their core responsibility. Shari’a scholars are also the source of confidence in Islamic financial industry for the demand side that includes both capital providers (shareholders) and users that are dominantly faith sensitive. Therefore Shari’a scholars are involved with all institutions dealing with Islamic financial services though the intensity of involvement may vary across and within jurisdictions. In this background, this chapter discusses the role and significance of Shari’a scholars in the overall functioning of IBFIs.

SIGNIFICANCE OF SHARI’A SCHOLARS IN ISLAMIC FINANCIAL INSTITUTIONS

The emergence and sustenance of Islamic finance over the last four decades is primarily driven by the demand originating from the Muslims who have to adhere to the prohibition of riba, which is one the central tenants of their religion. Other factors along with this faith-driven demand have contributed towards making this industry as one among the fastest-growing sectors (Grais & Pellegrini, 2006). Hence conducting activities in conformity with Shari’a is the distinctive feature of IBFIs, which also explains why the role of Shari’a scholars/board is crucial for these organizations as they are responsible for ensuring their Islamicity. The role of Shari’a scholars in the development of IBF can be traced to fatawa during the late seventies and eighties when the pioneer institutions like Dubai Islamic Bank, Kuwait Finance House and Faisal Islamic Bank started operations of Islamic banking. Large institutions including DMI Trust and Albaraka Group and few relatively small entities like independent Shari’a board of Jordan Islamic bank were the main sources of fatawa during the decade of the eighties (Siddique 2006). Since then the work of Shari’a scholars has been a guiding force in the growth of Islamic finance industry by establishing its legitimate foundations of adherence to Shari’a. The certification of Shari’a compliance by Shari’a scholars has proved to be an effective marketing strategy for IBFIs. However, with increasing breadth and depth of Islamic finance across the globe, the role and responsibilities of Shari’a scholars have also evolved.

GOVERNANCE OF SHARI’A SCHOLARS IN IFIs

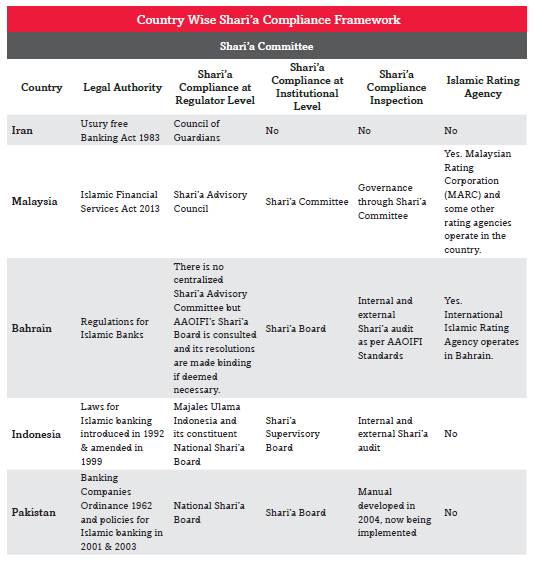

Shari’a is an extra layer in overall operations or governance of IBFIs. However, there is no standard model that is currently being followed around the globe. Every jurisdiction has its own customized model for ensuring Shari’a compliance in IBFIs. However, there are broadly two levels in every model; one at institutional level and second at regulatory/supervisory front. In order to understand the strategic role of Shari’a scholars in the development of IBF, the following sections will discuss the role and responsibilities expected from Shari’a scholars at institutional and regulatory levels.

Shari’a Advisor/Committee at an Institutional Level

At an institutional level, there is a wide scope of role of Shari’a scholars/boards have a wide role ranging from involvement in establishment of IFIs, developing products and ensuring Shari’a compliance of processes, setting up of Shari’a-compliant policies and regulations, to harmonization with international and local standards and adoption of global best practices along with parting training to the staff. This is pertinent

to mention that in addition to their advisory role Shari’a scholars work as supervisors/auditors for IBFIs. This expected role signifies the sensitivity of this position making eligibility criteria crucial for confirming adherence to Shari’a principles in these institutions. In general, there is a consensus on having eligibility criteria for being a Shari’a advisor, however, understandably this varies from institution to institution and across jurisdictions though all broadly cover areas like education/awareness of fiqh al muamalat, knowledge and experience of banking and finance, legal rulings, etc. AAOIFI’s definition of Shari’a scholar as given below is quite comprehensive.

| “Specialized jurists, particularlyin fiqh al muamalat and Islamicfinance, entrusted with theduty of directing, reviewing andsupervising the activities related to Islamic finance to ensure they are in compliance with Shari’a rules and principles. The views of the Shari’a advisor shall be binding in the specific area of supervision. “ |

The expected role and the eligibility criterion set forth in the definition speak of the authority and autonomy of the Shari’a advisor’s position in an IBFI. This reflects the huge responsibility that Shari’a scholars have to take on as well as their critical importance in operations of IBFIs.

Therefore AAOIFI standard requires a minimum three members in a Shari’a board at an institutional level, however, across jurisdictions this practice is not uniform.

The expectation of being Shari’a-compliant also desires IBFIs to establish a comprehensive department of Shari’a compliance and create a close link between Shari’a department and other departments to ensure that not only all products and processes are in line with Shari’a principles but ensure that practitioners also completely understand the relevant rules and steps in transactions and execute these in true spirit. This signifies the importance of independence for Shari’a advisors along with the Shari’a review/ audit. Though different jurisdictions adopt various measures to ensure Shari’a compliance, IFSB and AAOIFI both have issued standards for effective Shari’a compliance in IBFIs (see Box 14 for brief on Shari’a-related standards of IFSB and AAOIFI).

Shari’a Advisor at Regulator/Central Supervisor Level

.Regulators of IBFIs bears huge burden of responsibility of guaranteeing Shari’a compliance by these institutions. This necessitates the seting up of a Shari’a advisory board at the regulator/central supervisory level. This should ensure development of legal and regulatory framework for smooth functioning of Islamic finance, developing products and structures for government or regulators’ incentive schemes for industry and Shari’a supervision of institutions offering Islamic finance. The central Shari’a advisory board should also work as a final authority in case of any disagreement between Shari’a department and management of an IBFI. Hence, the four important components of independence, authority, competency and consistency as identified by IFSB need to be met in order to establish a Shari’a committee/board at regulator level. Along with Shari’a scholars, Shari’a board/committee may also have members who are not specialized in fiqh al muamalat but have got expertise in other aspects of Islamic finance like legal, accounting and taxation etc. The fatwa and rulings of the Shari’a Supervisory Board should be binding on the IBFIs.

“Four important components of independence, authority, competency and consistency as identified by IFSB need to be met in order to establish a Shari’a committee/board at regulator level. Along with Shari’a scholars, Shari’a board/committee may also have members who are not specialized in fiqh al muamalat but have got expertise in other aspects of Islamic finance like legal, accounting and taxation etc.”

CHALLENGES FACED BY IBFIs IN SHARI’A COMPLIANCE

Lack of Shari’a Scholars

Given relatively young age of Islamic finance and peculiar requirements for Shari’a scholars, Islamic finance is faced with a demand and supply gap of Shari’a scholars as there are not many institutions that presently offer training in this specialized area. Sporadic efforts are being made across jurisdictions, however, there is a dire need of a multi-pronged strategy to address this challenge. The strategy should focus on ensuring regular supply of Shari’a scholars by creating strong linkages between knowledge of fiqh al muamalat and finance.

Academia, including institutions extending Shari’a education, should play their due role in this regard. There is also a growing demand for increasing quality of education and training through accreditation of these programs. By bridging this gap of a desired human resource particularly of Shari’a scholars for the industry, sustainable growth can be ensured in the long run.

Need for Co-ordination and Collaboration Between Shari’a & Other Departments

Synergy between Shari’a and other departments is a necessary condition for enabling the industry to fully utilise the potential of Islamic finance. Depending upon the model prevalent in the country, either Shari’a board at regulatory level or Shari’a board at institutional level can enforce this desired coordination and collaboration. IFSB Guiding Principles on Shari’a Governance suggest an efficient route of Shari’a compliance in IBFIs by making it a shared responsibility of Shari’a departments and management of said institutions. The enhanced coordination between Shari’a compliance and other departments can help in enabling the Islamic finance industry to be as efficient as its conventional counterpart in extending timely solutions and avoiding delays.

Shari’a Scholar Being Member of Multiple Boards

With the unprecedented growth of Islamic finance, the desired supply of qualified Shari’a scholars could not be met resulting in making Shari’a scholars as a scarce resource. Consequentially, limited numbers of qualified scholars are members of more than one board. This may result in affecting the quality of work due to paucity of time and is also a concern for confidentiality of an institution. Considering this as a challenge towards the credibility and sustainability of Islamic financial institutions, few jurisdictions have put restrictions on Shari’a scholars on joining Shari’a boards of multiple institutions. For example, Bank Negara Malaysia has restricted Shari’a scholars to sit on more than one Shari’a board in the same industry since 20101. Oman has followed the suit. Pakistan recently has introduced restrictions on Shari’a scholars through its Shari’a Governance Framework; restricting members of Shari’a board of a maximum three institutions and one institution for the Resident Shari’a Board Member (RSBM). This Framework has also instructed Islamic banks to include a confidentiality clause in the contract of Shari’a board members for maintaining secrecy and confidentiality of Islamic banking institution’s non-public information/ matters.

Shari’a Compliance and Viability of Products According to AAOIFI’s definition of Shari’a scholar, the individual in this role is desired to be an expert of Islamic law as well as to be conversant with IBF. This can help Shari’a scholars to assist in developing products that are not only Shari’a-compliant but also have economic value and are implementable. This is a challenging task for Shari’a scholars/boards to work with expert teams to develop Shari’a-compliant solutions, which are easy, feasible, viable and marketable. The emphasis on modern skills and advanced education for Shari’a scholars can really be beneficial in this regard.

BOX 15: STANDARDS OF SHARI’A COMPLIANCE BY INTERNATIONAL STANDARD SETTING BODIES

IFSB Principles on Shari’a Governance Systems for Institutions Offering Islamic Financial Services

In order to promote the stability and soundness of the Islamic financial system, the IFSB has developed Guiding Principles on Shari’a Governance. The standard clearly states that Shari’a Governance System refers to a set of institutional and organizational arrangements through which an institution offering Islamic financial services ensures that there is an effective independent oversight of Shari’a compliance. This Standard is aimed at facilitating and better understanding Shari’a governance issues, providing an enhanced degree of transparency in terms of issuance, and the audit/ review process for compliance with Shari’a rulings; and providing greater harmonization of the Shari’a governance structures and procedures across jurisdictions. These guiding principles are broadly divided into five parts;

Part I relates to the general approach to a Shari’a governance system. Part II deals with the area of competence, suggests various measures to ensure reasonable expertise and skill-sets in Shari’a boards, and to evaluate their performance and professional development. Part III aims at safeguarding the independence of Shari’a boards. Part IV focuses on the importance of observing and preserving confidentiality by the organs of Shari’a governance while Part V is about improving consistency in terms of the professionalism of members of the Shari’a board for enhancing their credibility and confirming their integrity through a set of best practices.

IFSB through these Guiding Principles clearly stipulates that Shari’a compliance is the shared responsibility of Shari’a board and management of the institution along with suggesting four necessary elements for Shari’a board:

- Competence;

- Independence;

- Confidentiality; and

- Consistency.

Similarly, IFSB’s Guidelines is on Risk Management recommend IBFIs to have adequate system and control for Shari’a compliance

AAOIFI Governance Standards

AAOIFI has also introduced a few new standards for oversight of Shari’a governance in IBFIs. These standards broadly cover Shari’a supervisory body (appointment, composition and reporting), Shari’a review, auditing and governance committee, independence of Shari’a supervisory board, statement on governance principles, corporate

social responsibility conduct and disclosure for IFIS.

Moreover standards on (i) stipulation and ethics of fatwa in the Institutional framework, (ii) code of

ethics, and (iii) audits are closely associated with Shari’a compliance in IBFIs.

Source:

“Guiding Principles on Shari’a Governance Systems for Institutions Offering Islamic Financial Services,” Islamic Financial Services Board, (December 2009).

Laldin, A. “Overview of Shari’a Governance in Malaysia and Globally,” International Shari’a Audit Conference & Workshop, (2011).

Conflict of Interests

Shari’a scholars are in a way regulators for ensuring Islamicity of products and processes of institutions while the major objective of management of institutions is to maximize the profitability of institutions, which is used as incentive for all staff to increase their productivity and contribution to the end goal. Therefore Shari’a scholars do have an indirect economic stake in the institutions they advise. This dual relationship of Shari’a scholars with financial institutions may cause a potential conflict of interest, which has in some cases been highlighted adequately and in some other cases exaggerated (Malkawai 2014). External Shari’a audit/review can be one check on this threat of compromise on Shari’a compliance. However, there are some institutions that neither have the capability nor the desire to conduct Shari’a audit, especially conventional banks and financial institutions involved in IBF marginally (Grais & Pellegrini 2006). In this regard, the example of Pakistan is worth mentioning where Shari’a inspection of Islamic banking institutions is conducted through a comprehensive manual, which was developed with the help of international experts in 2004.

Lack of Harmony & Standardisation

Standardization and harmonization of Shari’a interpretations may help in minimizing the negative impact emerging from the potential conflict of interest and can also work to underpin the wholesome development of this sector. This will also be beneficial for regulators/supervisors for the oversight of Islamic finance industry. A lot of work is under process for standardization of products and processes across and within jurisdictions. However, the process and pace of work is subjective to jurisdiction. The following points need special attention while relying on standardization for effective Shari’a compliance: Standardization is not simple and will take time; and

Even with Standardization, Shari’a scholars will be needed to ensure compliance as they are the experts of Shari’a.

Lack of Credibility

One of the challenges that Islamic finance industry faces is the lack of credibility in Shari’a-compliance of IBFIs despite the presence of Shari’a scholars/committee/board on an institutional level. Along with lack of awareness in many jurisdictions, incomplete disclosure of Shari’a decisions is one major underlying reason for lack of credibility. Increased disclosures, clear and transparent procedures for decision-making would help in strengthening and enhancing the confidence of stakeholders in the system. In this regard Malaysia is making significant moves as it has started consolidating rationale for their issued fatawa. The scholarly compilation of the resolutions emanated from various meetings of the Shari’a Advisory Council of Bank Negara Malaysia over the years from 1997 to 2009 by the Shari’a Advisory Committee (SAC) is aimed at increasing transparency on juristic reasoning in Islamic Finance. It is expected that this would positively impact the industry by escalating the acceptance of Shari’a decisions. Moreover, the introduction of punitive measures under the Islamic Financial services Act 2013 have been designed to act as deterrent to would-be Shari’a non-compliance offenders (Yussof, 2013). It is also worth mentioning that this kind of strict supervision will attract the confidence of masses in the credibility of the system.

CONCLUSION

Shari’a is the central pillar of Islamic finance and the role of Shari’a scholars is becoming more critical and of more strategic importance with the escalating growth of this industry. This on one hand calls for Shari’a scholars to equip themselves with advanced skills, ability of dealing and understanding dynamics of modern business and on other hand demands industry for collective efforts in order to increase the capacity of Shari’a scholars. Laying out of mechanisms and processes for effective Shari’a oversight in institutions offering Islamic financial services is imperative. Without addressing the challenge of desired supply of Shari’a scholars, sustaining the high growth momentum of the industry can’t be ensured as they are and will always remain the main agents of the industry.