A non-academic investigation into the networks that control Islamic financial institutions

“Shari’a scholars are too damn powerful,” “We must make Shari’a scholars more accountable,” “Islamic banking industry is hostage to a small group of Shari’a scholars”… These are echoes of conversations that many of those who are involved in IBF must have heard at various conferences, seminars and discussion groups. Shari’a scholars have been subject to a lot of scrutiny and criticism, mostly unduly, and their role in IBF has in the past been misunderstood by many. For example, it took the UK government quite a few years to appreciate that Shari’a scholars serve as advisors to Islamic banks and financial institutions and that they have no executive role in the business on an operational level.

Once, there was a serious attempt (hopefully unintended!) by a small consultancy company to destroy credibility of Shari’a scholars. The so-called “social network” approach adopted therein certainly managed to dint the credibility of Shari’a scholars. Admittedly, it also brought a lot of genuine issues to the forefront of policy debate on Shari’a governance. But… the question remains. Who controls IBF? To the disappointment of many (the likes of http://www.shari’afinancewatch.org), This chapter is not a who’s who of the people on the sanction lists drawn up by America and the EU. It is also not a guide to the so-called Islamic caliphate that seems to be emerging in parts of Iraq, Syria and the neighbourhood.

IBF has in fact emerged as an Islamic capitalistic movement, which fits well in the Western capitalism. This is one of the reasons that it failed to earn patronage of the likes of Hafiz Al Asad (father of the current president Bashar Al Asad of Syria), Muammar Gaddafi, Saddam Hussain and other leaders in the Muslim world, with inclination towards socialism. Interestingly enough, IBF initially failed to get traction from most of the governments in the Muslim world. It was only after some heavyweight Western financial institutions showed their trust in IBF that some governments in the Muslim world started accommodating IBF in their regulatory regimes.

If it is not Al-Qaeda or its remnants or Shari’a scholars who are controlling IBF, then who is behind the global movement of IBF? Is it the global Islamist movement that controls IBF or does the center of power lie somewhere else? Is it actually a legitimate question to ask after all?

If all the above are not central to IBF, then who else? Is it the Saudi royal family? Are the ruling families of UAE and other countries in the GCC area the ones controlling Islamic financial institutions? Are there some other invisible hands behind the growing global Islamic financial services industry? Is there a dotted line between Islamic financial institutions and the global terrorist networks? Where are most of the assets under management of Islamic financial services located? To understand all these issues, it is important to look into a number of phenomena, mechanisms and processes:

- Shareholding composition of some of the largest Islamic banks in the world;

- Regulatory bodies for Islamic financial institutions;

- Affiliations of the Shari’a scholars involved in IBF;

- Attitudes of terrorist groups towards IBF; and

- Involvement of non-Muslims in IBF.

WHO OWNS ISLAMIC BANKS?

There are three categories of owners of Islamic banks:

- Governments;

- High Net Worth Individuals (HNWIs) and families; and

- General public.

- Governments

Until recently, only a few governments outside the GCC region have adopted a friendly approach towards IBF. The governments and ruling families in the GCC have supported and in most cases have set up Islamic banks and financial institutions in the region. Oman has been an exception, being the last of the six-nation GCC member countries to introduce IBF. Up until May 2011, the sultanate had refused to offer IBF saying that it preferred a more universal banking approach. However, the steady outflows of capital into neighbouring GCC countries had that the Sultanate of Oman rethink their economic growth strategy. The Islamic Banking Royal Decree 69/2012 issued by Central Bank of Oman sets out the regulations of both Islamic banks as well as Islamic windows operating in the country. The Islamic banking regulatory framework makes reference to various guidelines of IFSB. A notable provision under the framework, which is related to Shari’a governance, is limiting Islamic scholars to three-year terms on Shari’a boards. The framework also requires Islamic banks to hire three additional scholars to fill three other required positions: Shari’a compliance officer, Shari’a advisor and Shari’a auditor. To date, Oman has issued licenses for two standalone Islamic banks – Bank Al Izz and Bank Nizwa which are primarily focused on retail Islamic banking and six Islamic windows. In 2013, Bank of Muscat, Oman’s biggest bank by assets, was licensed to offer Shari’a-compliant services through its Islamic window, Meethaq. However, many proponents argue that the growth of IBF in Oman has been slower than expected citing the limited number of Shari’a-compliant products and services currently allowed by law as one of the challenges facing IBF. For example, Islamic banks and Shari’a-compliant financial companies are not permitted to make use of commodity murabaha financing structures, which are commonly used by many Islamic banks worldwide, to manage balance sheets on a short-term basis. As a result of this ruling, most Islamic institutions rely primarily on wakala to meet their funding needs.

In Saudi Arabia, however, the support for IBF has been implicit and it is only of late that the government has started acknowledging the existence of IBF. The three main areas (in addition to Islamic banking activities) that the Saudi government is focusing on to ensure future growth of IBF are project finance, Islamic asset management and Islamic socially responsible investing (SRI).

However, further development of IBF is hampered by the lack of clear laws, as there is no regulatory regime designed specifically for Islamic finance. Although the two regulatory bodies, Saudi Arabian Monetary Agency (SAMA) and the Capital Market Authority (CMA), have the authority to implement Islamic financial regulations, their responsibilities however exclude monitoring the Shari’a compliance of Islamic financial services and products offered by domestic banks. Since Saudi Arabia does not have a central Shari’a board, the Shari’a board of each Islamic banks are free to make independent decisions. This has in some cases resulted in a situation where a financial product was ruled as Shari’a-compliant by one Islamic bank but deemed otherwise by another.

Outside the GCC region, Malaysia is an exception where the government has taken an unambiguously strong and favorable approach to the development of IBF. Almost all other governments in the Muslim world are at best indifferent to IBF and in some cases hostile towards its development. Admittedly, there are countries that have started showing interest in the development of IBF, for example, the newly elected government in Pakistan. It must, however, be emphasized that there is nothing sinister about this changing attitude towards IBF of the governments in the Muslim world. Similarly, it is only recently that the government in Turkey has started realizing that IBF provides a great opportunity for it to attract Islamic capital from other parts of the Muslim world.

Arguably the strongest opponents of IBF in the Muslim world, the likes of the regimes of Muammar Qaddafi, Saddam Hussain and Hosni Mubarak, are no more relevant, but still there exists strong resistance to the introduction of IBF in most of the countries included in the Organisation of Islamic Cooperation (OIC). The opposition has largely come from the authoritarian regimes and, in case of democratic countries, from the bureaucracy.

Two notable countries where government-level support exists for IBF are Iran and Sudan. Both these two countries are isolated from the global Islamic financial services industry primarily because of the ongoing economic sanctions by USA and other allied countries.

Iranian banks account for about 40% of total assets of the world’s top 100 Islamic banks. Bank Melli Iran, with assets of $45.5 billion came first, followed by Saudi Arabia’s Al Rajhi Bank, Bank Mellat with $39.7 billion and Bank Saderat Iran with $39.3 billion. Iran holds the world’s largest level of Islamic finance assets valued at US$489 billion, which is US$150 billion more than the next country in the list, i.e., Saudi Arabia. Six out of ten top Islamic banks in the world are Iranian.

“It is also worth mentioning that Bangladesh is perhaps the most under-rated country in the world, although it has over 20% market share for its Islamic banks – double of the comparable figure for Pakistan, which has been one of the most talked about and most frequently cited country in the global Islamic financial services industry. Although industry observers and analysts refer to Al Rajhi Bank as the largest Islamic bank in the world (excluding Iran), Islami Bank Bangladesh has escaped attention. With nearly 300 branches and about 12,000 strong staff, it has one of the largest Islamic banking networks in South Asia.”

Why government support has not been forthcoming for IBF? Although a number of factors may have contributed to the lack of support for IBF by Muslim governments in the past, it is however currently by and large a bureaucratic problem. It is no more seen as a political threat, which was erroneously the case in the past. Introduction of IBF requires substantial changes in legal frameworks, taxation laws, banking and financial regulation, and property rights. The bureaucracy in these countries finds it a daunting task, and hence is unwilling to change the status quo.

If someone has to pick five governments supporting IBF, weighted by their global significance, the following list will emerge:

- Malaysia

- United Arab Emirates

- Bahrain

- Kuwait

- Qatar

Interestingly, all these five countries are very small in terms of population. Their significance and influence in the politics of the Muslim world is rather limited as well. None of the above countries has a population more than 30 million. While Malaysia has the highest population in the above group, it is notable that the Muslim population therein is only about 60% of the total population in the country. The governments of the countries with the largest Muslim populations are at best indifferent if not hostile to IBF.

Indonesia, for example, is a secular country constitutionally; its government finds it difficult to patronise IBF officially. In the recent past, changes in certain laws have allowed Indonesia to use sukuk as a capital market instrument to raise funds for the public sector. The Central Bank of Indonesia, Bank Indonesia, has been accelerating reforms with the latest being the establishment of the Financial Services Authority or Otoritas Jasa Keuangan (OJK) as the supervisory body of all financial institutions including Islamic banks and cooperatives. In an effort to increase the market share of Islamic banking to 15% of the market by 2023, OJK had revised the Islamic banking rules involving asset quality and capital adequacy. Other rules involve the separation of Islamic business units from their conventional parents as well as rules addressing how to

turn a conventional bank into an Islamic bank. The government had recently announced a number of plans to quadruple the amount of sovereign sukuk issued to fund infrastructure projects aimed at fostering the growth of IBF as well as to increase the number of domestic Islamic banks from the current 11 to 25 by the year 2023.

Pakistan, which is constitutionally an Islamic republic, has for long resisted demands for transforming its economy and financial sector in commensurate with the Islamic economic doctrine. Similarly, despite having captured the market share of about 20%, Bangladeshi Islamic banks are growing through a market-based approach rather then an explicit government support. The politics of IBF in Turkey (with secular constitution) remains complex, despite the recent sympathetic approach by the government. Due to political sensitivities in the country, Islamic banks in Turkey do not describe themselves as such instead they operate under the moniker of participation bank. Although the government had in the past taken a more conservative path in terms of the development and promotion of IBF, the Turkish government has made important strides in recent years to raise participation banking market share from the current 5% to 15% by 2023. The growth of IBF in Turkey was given a boost with the passing of a new sukuk law in June 2013 that introduced new types of structures. The country’s tax law was also revamped to allow for the issuance of certain types of sukuk with double taxation.

Egypt, despite being the birthplace of modern IBF, has also been careful in its treatment of IBF. Although Islamic banking in Egypt dates back to 1961, the IBF industry has not been fully developed as compared to the GCC countries mainly because monetary authorities have put undeclared reservations on the establishment of fully-fledged Islamic banks. Despite some keen interest shown by the Central Bank of Egypt to develop IBF in recent years, progress has been slow.

Malaysia

The Malaysian government is by far the most committed advocate of IBF in the world with longstanding efforts in the development of Islamic financial services industry. The backbone of Malaysia’s continued leadership in IBF is the strong commitment and support of the Malaysian government and the catalytic role of Bank Negara Malaysia in developing a comprehensive Islamic financial system. The involvement of royal families in Malaysia have further spurred the development of the industry beyond it shores. A notable royal figure is HRH Sultan Nazrin Shah of Perak (GIFA Laureate 2012) who serves as Financial Ambassador for the Malaysia International Islamic Financial Centre (MIFC). Members of the royal family of Negeri Sembilan are also actively involved in IBF through their shareholdings in the Bahrain-based Ithmaar Bank.

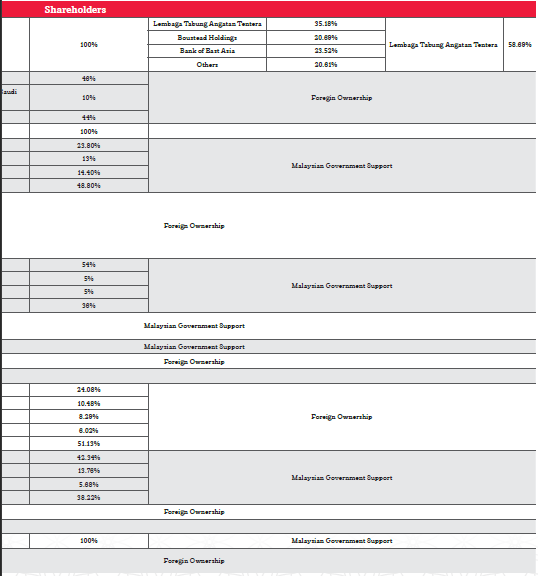

The government of Malaysia has direct and indirect shareholdings in a number of Islamic financial institutions. Through its stakes in these institutions, the government has successfully deepened and institutionalized Islamic finance activities in the country. Two notable government investments are as follows:

Tabung Haji: Tabung Haji (Pilgrims Management and Fund Board) is the oldest example of a successful modern Islamic financial institution. Established in 1963, the prime objective of Tabung Haji was the mobilization of funds from Muslim savers for their pilgrimages to Makkah. Today, it has emerged as an influential player in the Islamic financial services industry, with significant shareholdings in Bank Islam and a number of other Islamic financial institutions.

Khazanah Nasional Berhad: Malaysian sovereign wealth fund, Khazanah, has been instrumental in promoting IBF in the country as well as outside Malaysia. As the investment holding arm of the government, Khazanah has spearheaded the development of the Islamic capital market through its various sukuk issuance with a number of landmark portfolios in the sukuk marketplace. It also has significant shareholding in Fajr Capital, a Dubai-based Islamic private equity firm, which in turn has 40% stake in Bank Islam Brunei Darussalam.

Furthermore, both Bank Negara Malaysia and Securities Commission Malaysia are pro-actively promoting Islamic finance through MIFC initiatives. Since its establishment in 2006, MIFC has been playing a lead role in bridging and strengthening the relationship between East Asia and the Middle Eastern, West Asian and North African regions.

Malaysia is the host country to two major global initiatives in IBF – the Islamic Financial Services Board (IFSB) and the International Islamic Liquidity Management Corporation (IILM). The IFSB is the global body set up to develop regulatory and prudential guidelines for institutions offering Islamic financial services. The primary objective of IILM is to issue Shari’a-compliant financial instruments in order to facilitate more efficient and effective global liquidity management by Islamic financial institutions.

Malaysia’s competitive advantage in Islamic finance is continually strengthened by the operational environment of a progressive regulatory and supervisory framework. The enactment of the new Islamic Financial Services Act 2013, which was built on its earlier Islamic Banking Act of 1983, lay the foundation for a comprehensive regime to promote a robust and resilient Islamic financial system in Malaysia. The Act, which is an omnibus legislation, has been hailed as the world’s first comprehensive legal framework in Islamic finance. It also codifies Shari’a governance in the legislation.

As a move to address the growing criticisms over the integrity and conflict of interest as well as excessive salaries of Shari’a scholars especially those who sit on multiple Shari’a boards, the Association of Islamic Scholars (ASAS), a Malaysian-based association, is set to start Shari’a board accreditation processes, which will require scholars to sign a voluntary code of ethics.

United Arab Emirates

Although the UAE government has not been involved in official advocacy of IBF, the governments and the ruling families in the country have invested heavily in Islamic banks and financial institutions. It is only recently that the government of Dubai has officially announced to make Dubai as a centre of excellence for the global Islamic economy. Seven pillars were identified in building Dubai as the capital for Islamic economy: Islamic finance, halal industry, tourism, digital infrastructure, arts, knowledge and standardization. The Dubai Islamic Economy Development Centre (DIEDC) was established in December 2013 to spearhead strategies to advance the vision of making Dubai the “Capital of Islamic Economy”. Winning the bid to host the 2020 World Expo in Dubai saw the revival of the construction and infrastructure projects, which had taken a back seat when the global financial crisis caused Dubai property prices to crash by more than 50%.

Dubai holds the distinction of hosting the oldest Islamic commercial bank in the world, namely Dubai Islamic Bank. Abu Dhabi, the more dominating emirate in the federation has its own flagship Islamic bank, namely Abu Dhabi Islamic Bank (ADIB). In addition to these two Islamic banks, a number of other Islamic banks and financial institutions are operating in the UAE. Almost all these initiatives have royal patronage, although the Central Bank of the UAE does not seem to treat Islamic banks any different from their conventional counterparts. Hence, Islamic banks despite having shareholdings from the ruling families do not enjoy any preferential treatment. This is primarily due to the fact that most of the conventional banks are also either owned by the state governments or members of the ruling families.

Through these Islamic banks and financial institutions, governments in the federation of UAE play an influential role in the global Islamic financial services industry. For example, Dubai Islamic Bank now operates as an international conglomerate with investments in Pakistan (Dubai Islamic Bank Pakistan), Jordan and Sudan, etc. Founded in 1975 as the first commercial Islamic bank, DIB was established under the vision of His Highness Sheikh Rashid bin Saeed Al Maktoum and His Excellency Haj Saeed bin Ahmed Al Lootah (founder and chairman of SSLootah Group of Companies).

Similarly, ADIB has in the recent years expanded into Egypt and UK. It has very aggressive plans to acquire assets around the world, especially in the MENA region. Al Hilal Bank, another bank owned by the government of Abu Dhabi, has already expanded beyond its shores, establishing its first branch outside of the UAE in Kazakhstan and has the potential to become a global leader in the Islamic financial services industry. The Al Hilal Bank Kazakhstan is the first Islamic bank in Kazakhstan, which was the first former Soviet country to introduce Islamic finance in 2009.

Bahrain

Bahrain government has for long used its financial sector strategy to promote and develop IBF in the country to attract foreign capital. Bahrain has the largest concentration of Islamic financial institutions in the world with 32 Islamic banks and takaful and re-taakful companies. As a host to a number of key industry-building organizations that are dedicated to advancing Islamic finance policy and regulation such as AAOIFI, IIFM, IICRA, IIRA, CIBAFI and LMC. Bahrain remains relevant to the global Islamic financial services industry, although some other players like Malaysia, UAE and now Qatar are gradually claiming the leadership turf.

Bahrain has also been influential in terms of its advocacy role in the global Islamic financial services industry. Long before any other country, it patronized the World Islamic Banking Conference (WIBC), arguably the largest annual gathering of practitioners of IBF in the world. Through such initiatives, the government of Bahrain succeeded in integrating the economy of Bahrain with the other economies in the GCC region.

A notable development in the country’s Islamic finance is the announcement by the Central Bank of Bahrain to set up a National Shari’a Board that will help strengthen oversight of the Islamic finance industry. The central bank will also be introducing Shari’a governance rules and making it mandatory for banks to have an independent external Shari’a audit.

Recently, Bahrain has seen consolidation in its Islamic banking sector, a rare phenomenon as local shareholders are often not willing to relinquish their control in these institutions. The National Bank of Bahrain and Social Insurance Organization Asset Management Company (a local pension fund) bought a 51.6% stake in Bahrain Islamic Bank whole Al Salam Bank merged with BMI Bank through a share swap deal. A three-way merger between Elaf Bank, Capital Management House and CAPIVEST had resulted in a new entity Ibdar Bank.

Kuwait

Kuwait has played a visible role in the Islamic financial services industry on a global scale, spearheaded by Kuwait Finance House (KFH), which has direct presence in a number of countries, most notably in Bahrain (KFH-Bahrain), Turkey (Kuveyt Turk) and Malaysia (KFH-Malaysia). Apart from Kuwait’s role in setting up Islamic banks, it has been involved in setting up other firms that are now offering their services to Islamic banks and financial institutions. Most notable of such an investment is in International Turnkey Systems (ITS), which is a global player in the Islamic financial technology.

The government of Kuwait has brought Islamic banking and finance into the mainstream by allowing non-ruling families to freely set up Islamic banks and financial institutions and in some cases by directly investing in the industry. For example, the government of Kuwait holds almost 50% of shares in KFH – one of the oldest Islamic banks in the world – through Kuwait Investment Authority (24.08%), Public Authority for Minor Affairs (10.48%), Awqaf Public Foundation (8.29%) and Public Institution for Social Security (6.02%). Kuwait Investment Authority also owns the largest stakes (24%) in Warba Bank, which was established by virtue of an Amiri Decree in 2010.

Through such institutions, the government of Kuwait attempts to influence developments in IBF in other major markets.

Qatar

The government of Qatar has in recent years been aggressively acquiring Islamic financial assets around the world. Through Islamic financial institutions, it has made major investments in a number of countries, including Pakistan (e.g., Pak-Qatar Takaful), UK (e.g., Al Rayan Bank UK), and a number of countries in the MENA region. All Islamic banks in the state of Qatar have direct or indirect patronage of the royal family. The Qatar Investment Authority, the country’s sovereign wealth fund, is a key shareholder in Qatar Islamic Bank, Qatar International Islamic Bank and Masraf Al Rayan Bank, which have presence in multiple jurisdictions and are deemed as global players in the Islamic financial services industry. For example, Qatar Islamic Bank has a presence in Malaysia through its majority shareholdings of 66.67% in Asian Finance Bank. Qatar Holdings and Barwa Real Estates (government-controlled entities) are the main shareholders of Barwa Bank, the youngest Islamic bank in the country. Islamic finance in Qatar is set to flourish in the run up to several upcoming large-scale infrastructure and construction projects including the development of stadiums and hotels for the FIFA 2022 World Cup which Qatar will be hosting, the Doha Metro and the Hamad International Airport. It is expected that the sukuk market will experience significant growth as both government and private sector organizations issue sukuk in order to fund these new infrastructure projects. Islamic banks in Qatar are set to issue sukuk to raise the necessary funds in preparation for the implementation of Basel III regulations and tighter oversight by authorities.

As part of the strategy to further develop Islamic finance in Qatar, the authority had recently announced the introduction of a Shari’a-compliant variation of the deposit insurance framework. However, since 2011 the Qatar Central bank prohibited the operation of Islamic windows at conventional banks. Further legislative revisions made in 2013 had resulted in clear legal distinction between Islamic finance and conventional finance.

- HNWIs and Families

The following HNWIs and families are the movers and shakers of the global Islamic financial services industry:

- Prince Mohammed Al Faisal

- Sheikh Saleh Kamil

- Sheikh Sulaiman Bin Abdulaziz Al Rajhi

Looking at the above list, one is inclined to conclude that Saudi Arabia holds the key to the global Islamic financial services industry, as all the three individuals are in fact Saudis. As mentioned earlier, however, IBF is much more than just being a Saudi phenomenon. A number of countries, and the HNW industrial families therein, own and control Islamic financial institutions. For example, Randeree family, a UK-based South African family holds shareholdings (albeit small) in Islamic financial institutions in UK, Pakistan, South Africa and the South East Asia. There are numerous other such families that are influential in the global Islamic financial services industry. In this article, we shall restrict our focus to the above three HNWIs.

Prince Mohammed Al Faisal

If someone has to trace a royal connection in the global Islamic financial services industry, the buck goes back to no other than the late King Faisal Bin Abdul Aziz Al Saud whose eldest son Prince Mohammed Bin Faisal Al Saud played a pioneering role in developing IBF as a pan-Islamic phenomenon.

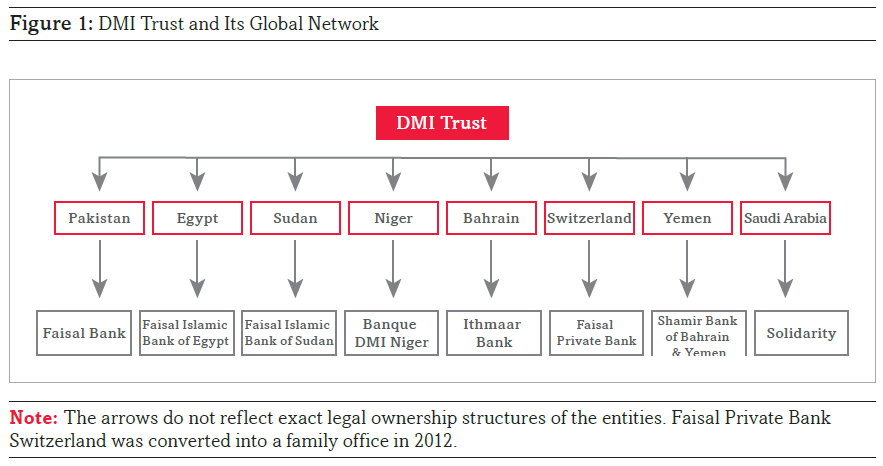

In its first phase of development, IBF benefited from the support and patronage of the likes of Prince Mohamed Al Faisal, the founder of Dar Al Maal Al Islami (DMI) Trust – technically a trust but in effect a holding company. Founded in 1981, it has an extensive network stretching over four continents, with well-integrated regional subsidiaries enabling it to respond to local business needs and conditions. Based on this geographic structure, the DMI Group and associates act as a financial bridge between the world’s leading financial centres and Islamic countries.

The Group comprises three main business sectors: Islamic banking, Islamic investment and Islamic insurance.

Islamic banking is exercised in different forms: commercial and retail banking in the Gulf region and other parts of the world; fund management and financial services in Switzerland and Jersey. Islamic investment companies are located in Bahrain, Egypt and Pakistan. There are also associated Islamic insurance companies based in Bahrain and Luxembourg, providing services to the Islamic communities in the Middle East and Europe.

The Board of Supervisors of DMI Trust directs and oversees the business of the Group. DMI Administrative Services S.A., located in Geneva, Switzerland, provides assistance to the Board of Supervisors, in particular in the areas of legal and financial control, audit and risk management and information technology.

DMI Trust is an institution that creates, maintains and promotes Islamic financial institutions. Asset management is one of the Group’s core business activities. Primary success of the business lies in the strategy that it invests clients’ funds prudently along with the principal shareholders’ funds with the objective of earning secular returns, although the businesses and transactions are Shari’a-compliant. Given the depth of its investors’ base, DMI has devised a comprehensive range of Islamic financial instruments to channel investors’ funds into viable Shari’a-compatible operations and investments.

Through DMI Trust, Prince Mohammed developed a network of Faisal Banks in different parts of the Islamic world, notably in Pakistan, Egypt and Sudan (see Figure 1 for a comprehensive picture of DMI’s business interests in the world). After a lot of restructuring of the group and a series of mergers and acquisitions, Faisal Bank brand has lost its significance in mainstream IBF, although the founding shareholders in the DMI Trust continue to hold interests in a number of Islamic banks, most notably Ithmaar Bank of Bahrain.

Although Prince Mohammed Al Faisal’s visibility in IBF has decreased following the restructuring of the DMI Trust, there is no doubt that his vision and strategic thinking remain central to the development of institutions owned by the DMI Trust. He is most widely revered in the Muslim world, and is treated with due respect in the Western world. Although after 9/11, there were attempts to tarnish his image, people like Richard A. Debs, an advisory director at Morgan Stanley and vice chairman of the United States-Saudi Arabian Business Council, think, “Prince Mohammed has been unfairly persecuted and attacked. I just don’t see the connection between Islamic finance and Islamic extremism.”

Based in Bahrain, Ithmaar Bank is now the flagship institution of DMI Trust, which holds interests in a number of banks and non-bank financial institutions in a number of countries. In February 2013, Ithmaar Bank merged with one of its Bahrain-based associates, First Leasing Bank, increasing its capital to US$758 million.

“The new face of The new face of DMI Trust is Prince Amr Mohammed Al Faisal, a son of Prince Mohammed Al Faisal. DMI Trust continues to hold interests in 55 Islamic banks and financial institutions around the world, although Ithmaar Bank is now the new face of the business. DMI Trust is Prince Amr Mohammed Al Faisal,”

Sheikh Saleh Kamil

Another influential personality in IBF is Sheikh Saleh Kamil, founder and Chairman of Dallah Al Baraka Group that owns Al Baraka Banks in Bahrain, Pakistan, Bangladesh, with strong presence in other OIC countries Jordan, Tunisia, Sudan, Turkey, Egypt, Algeria, South Africa, Lebanon, Syria, Iraq, Saudi Arabia, Indonesia and Libya. It also pioneered Islamic banking in UK, although after the collapse of Bank of Credit and Commerce International (BCCI), the UK operations were voluntarily wound up by the group.

Interestingly, like his other peer, Prince Mohammed Al Faisal, Sheikh Saleh Kamel chose to operate outside his native Saudi Arabia. This was supposedly a deliberate pan-Islamic strategy to benefit from the vast market of the OIC comprising 56 countries. Through global institutions like CIBAFI (see below) and Islamic International Chamber of Commerce and Industry (based in Karachi), which Sheikh Saleh Kamil helped set up, he continues to play a lead role in the development of Islamic banking and finance, in particular, and Islamic businesses, in general.

Sheikh Sulaiman Bin Abdul Aziz Al Rajhi

The largest Islamic banks by size are arguably the Iranian state-owned banks. Outside Iran, Al Rajhi Bank is the largest Islamic bank in terms of assets under management and market capitalization. The principal shareholders of the bank are the Al Rajhi family, which is an influential industrialist family in the Kingdom of Saudi Arabia.

Although Sheikh Sulaiman Al Rajhi has now retired from all of his businesses after donating his personal wealth, Al Rajhi Holding continues to play a dominant role through his sons. Outside Saudi Arabia, the family owns Al Rajhi Bank in Malaysia, and a number of companies (industrial as well as financial) throughout the world.

BOX 11: SEDCO CAPITAL – PRUDENT ETHICAL INVESTING PIONEERED BY A LEADER IN ISLAMIC ASSET MANAGEMENT

In the last two decades, Environmental, Social and Governance (ESG) and Shari’a-compliant investing have been the two fastest-growing areas of finance and showed resilience during the global fiscal turbulence, especially when compared to the near-collapse of other investment categories. The growth of ESG and Shari’a-compliant investing

is mostly demand driven. Both these approaches are generating avid interest across global financial markets, driven by institutions that are increasingly devoting more resources to them. They both aim to create real value to the economy by providing real jobs that complement real growth of businesses, leading to sustainable economic development.

ESG has become an established investment approach for global investors, stemming from a growing realization among investors that the incorporation of such criteria into the investment process to reduce risk, drive performance, and identify investment opportunities can have a positive influence on the financial performance of companies particularly over the long-term. The purpose of Shari’a-compliant investing is to improve living conditions and well-being, establish social equity, and prevent injustice in trade relations. In its application, waste and excessive consumption are deemed unacceptable. These elements closely resemble those of SRI: keen focus on sustainable development, creation of wealth for society, and improvement in the quality of life.

Both ESG and Shari’a-compliant investment approaches demand that the businesses chosen for investment are socially useful, non-detrimental to humanity, and comply with humanist ethics. Both practice ethical exclusions as part of their investment rules, and their common list of forbidden sectors includes alcohol, gambling, tobacco and weapons – businesses that are condemned or deemed harmful for man and society.

SEDCO Capital states that ESG and Shari’a-compliant investing share many similar features and commonalities. In addition, these two very important investment methodologies could build on each other’s success when integrated into a single umbrella, given how they both have transparent structures.

The confluence of research, performance and demand convinced SEDCO Capital to be not only Shari’a-complaint but to also become recognised as ESG compliant by becoming a signatory to the United Nations Principles of Responsible Investing (UNPRI) in July 2014. This was a historical moment as SEDCO Capital is the first Shari’a-compliant and first Saudi Arabian signatory to the UNPRI.

To become a responsible investor, SEDCO Capital initially focused on three asset classes: public equity, private equity and real estate. Since its inception, SEDCO Capital has launched four ESG/ Shari’a-compliant funds with AUM of more than US$410 million. In the private equity asset class, it has become Shari’a advisor to BTG Pactual Brazil Timberland Fund I, LP, with the fund emphasizing the sustainable development of commercially- managed timberland in Brazil. In the real estate asset class, it has invested in India’s first Sustainable Green Building Research Park in Whitefield/ Bangalore. Moving forward, it aspires to deploy a fully Shari’a/ESG investment platform across all asset classes and investment strategies.

SEDCO Capital’s goal in getting involved in responsible investment is to reach and realize sustainability – sustainability in economies, societies, corporations and of course, for individuals. It is with this mind-set that it approaches its investments. Investing in a timber fund such as BTG Pactual Brazil Timberland Fund exemplifies this approach. Investing in this timber fund will have an effect on sustainability in three ways:

Indigenous communities will not be displaced;

That forests will be replanted in tandem with harvesting; and

That the biodiversity of rivers will not be affected due to deforestation.

“Leadership and Control in Islamic Banking and Finance

In this way sustainably will be assured. The same applies to the other SEDCO Capital funds that are ESG and Shari’a-compliant. Investing in this way encourages best practices in governance and responsible investing which it hopes sets an example for its peers in the Shari’a and non-Shari’a worlds so that all move in the direction of sustainability.

SEDCO Capital is a Saudi Arabia based asset manager and the world’s leading provider of Shari’a-compliant investment solutions. It offers a comprehensive range of services – including asset allocation and management, advisory, arranging, underwriting, and custody – to a range of clients, including institutions, HNWIs and family offices.

The team of professionals on board offer specialist experience of asset management and investment banking, having forged strong relationships with more than 100 global investment institutions.

SEDCO Capital is also the first fully Shari’a-compliant asset manager and the first Saudi asset manager to be a signatory of the United Nations Principles of Responsible Investing (UNPRI). It got there through its continuous commitment to innovation in the field to pave the way for the rest of the industry.

SEDCO Capital is an ethical, prudent, savvy investor with a long-term track record in Shari’a-compliant investing. Through its SEDCO Capital Global Funds available on a platform in Luxembourg, investors can now access thirteen investment funds with total assets under management of over $1.6 billion making it the largest Shari’a-compliant fund in the country and bringing its total AuM to $4 billion. Indeed, through this offering it provides one of the world’s largest and most diverse range of Shari’a-compliant funds, which offer investors quality and high performance unmatched in the market. Today four of these funds are both Shari’a and ESG (Environmental, Social and Governance) compliant.

As adherents to the principles of Shari’a investing, for over 20 years SEDCO Capital has prudently navigated its clients’ investments to deliver strong returns, even amid the challenges of the global financial crisis. In accordance with the tenets of Shari’a, SEDCO Capital does not invest in companies and products that could hurt societies, human beings or the environment.”

- General Public

A significant number of Islamic banks are publicly listed companies, and hence directly owned by general public through stock exchanges (see Boxes 12 and 13).

REGULATORY AND ADVOCACY BODIES

Although there are a number of regulatory bodies on a global level to bring discipline to IBF, but none can be considered as controlling the Islamic financial services industry. Most of the financial regulators treat Islamic banks and financial institutions on par with the conventional banks and financial institutions, with no separate regulatory framework for the former. Exceptions do exist, e.g., in Malaysia where separate laws and regulatory regimes exist for Islamic banks, takaful companies and Islamic capital markets players. In other countries like Pakistan, Islamic banks, takaful companies and other Islamic financial institutions are regulated by State Bank of Pakistan (SBP) and Securities and Exchange Commission of Pakistan (SECP).

There are five international bodies that actively influence practices of IBF on the global arena:

- Accounting & Auditing Organisation of Islamic Financial Institutions (AAOIFI)

- Islamic Financial Services Board (IFSB)

- International Islamic Financial Market (IIFM)

- General Council for Islamic Financial Institutions (also known as CIBAFI)

- Islamic Research and Training Institute (IRTI)

The first two can be considered as the most influential in terms of control and their influence on the global Islamic financial services industry; while the other three are at best advocacy bodies aiming at promoting IBF and are primarily involved in capacity building. Nevertheless, their role cannot be ignored.

- AAOIFI

AAOIFI is an Islamic international autonomous non-for-profit corporate body that prepares accounting, auditing, governance, ethics and Shari’a standards for Islamic financial institutions and the industry. It has also for some time started focusing on developing human resources for the Islamic financial services industry something that has been seen by many as a major deviation from its aforementioned core objectives. AAOIFI is supported by institutional members (200 members from 40 countries, so far) including central banks, Islamic financial institutions, and other participants from the global Islamic financial services industry. It has to date issued 88 standards, including 48 on Shari’a, 26 on accounting, 5 on auditing standards, 7 related to governance, and 2 codes of ethics.

Through these standards, AAOIFI attempts to influence IBF practices globally. The Kingdom of Bahrain, Dubai International Financial Centre, Jordan, Lebanon, Qatar, Sudan and Syria have officially adopted many of these standards. In addition, the relevant authorities in Australia, Indonesia, Malaysia, Pakistan, Kingdom of Saudi Arabia, and South Africa have issued guidelines that are based on AAOIFI’s standards and pronouncements.

- IFSB

IFSB is an international standard-setting organization that promotes and enhances the soundness and stability of the Islamic financial services industry by issuing global prudential standards and guiding principles for the industry, broadly defined to include banking, capital markets and insurance sectors. The IFSB also conducts research and coordinates initiatives on industry-related issues, as well as organises roundtables, seminars and conferences for regulators and industry stakeholders.

There are 184 members of the IFSB comprise 59 regulatory and supervisory authorities, eight international inter-governmental organizations, 112 financial institutions and professional firms as well as 5 self-regulatory organizations (industry associations and stock exchanges) operating in 44 jurisdictions. Through this wider and growing recognition, IFSB has emerged as a major player in the global Islamic financial services industry, influencing regulatory frameworks and prudential guidelines for Islamic banks and other financial institutions. Since its inception in 2003, IFSB continues to strengthen Islamic financial stability and solidify the industry’s infrastructure.

- IIFM

IIFM is a standard-setting organization for the global Islamic financial services industry, focusing on development of capital and money markets. Its primary focus lies in the standardization of Islamic financial products, documentation and related processes at the global level. Although its progress has been rather slow and its influence is significantly less than AAOIFI and IFSB, it remains an important body for the development of IBF globally. In 2010, IIFM and the International Swaps and Derivatives Association (ISDA) launched the ISDA/IIFM Tahawwut (Hedging) Master Agreement, which was hailed as a breakthrough in Islamic finance and risk management. The master agreement is the first globally standardized documentation for Shari’a-compliant hedging transactions and hence, is applicable across jurisdictions where Islamic finance in practiced.

IIFM was founded with the collective efforts of the Central Bank of Bahrain, Islamic Development Bank (IDB), Monetary Authority of Brunei Darussalam, Bank Indonesia, Central Bank of Sudan and the Bank Negara Malaysia (delegated to Labuan Financial Services Authority) as a neutral and non-profit organization.

Besides the founding members, IIFM is supported by other jurisdictional members such as State Bank of Pakistan (SBP), Dubai International Financial Centre (DIFC), Indonesian Financial Services Authority as well as a number of regional and international financial institutions and other market participants.

- CIBAFI

CIBAFI is a non-profit organization, set up primarily due to efforts of Sheikh Saleh Kamil, Chairman of Dallah Albaraka Group. It was strategically established and hosted in the Kingdom of Bahrain in 2001 and is an affiliated organ to the Organization of Islamic Cooperation (OIC). Its membership includes a large number of banks and financial institutions registered in various countries around the world regulated by central banks.

An important objective of CIBAFI is to play an advocacy role for IBF on the global level. It’s focus so far, however, has been on enhancing capacity building in the Islamic financial services industry particularly on the development of training and human resources, information dissemination and limited financial analysis, in addition to offering advisory services for institutions and governments to develop and promote IBF.

- IRTI

IRTI is the research and training arm of Islamic Development Bank (IDB), which has been instrumental in producing applied research to aid development of Islamic financial system. Its overall impact has been on the macro level, with very little contribution to product development and innovation. It was the main architect of the 10 Year Plan (Islamic Financial Services Industry Development: 10 Year Framework and Future Direction), which it developed in collaboration with IFSB.

IRTI’s most significant contribution has been its role to promote IBF on an academic level that has helped in human resource development for the industry. Its flagship conference, Islamic Economics and Finance Conference, which it has been holding since the inaugural conference in 1976 is the largest gathering of academics and professionals involved in research in this field.

- Shari’a Scholars

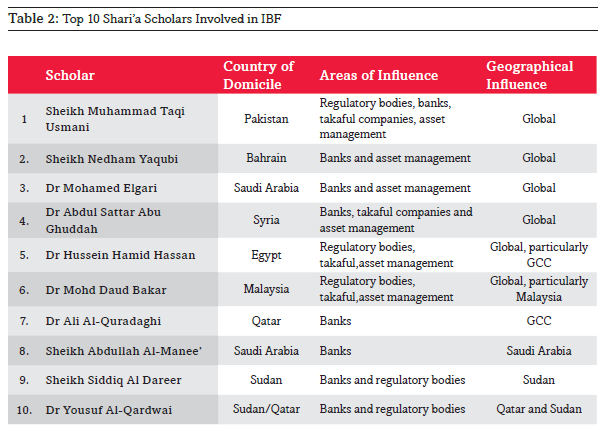

Perhaps the most influential Shari’a scholar in the global Islamic financial services industry is Sheikh Muhammad Taqi Usmani, a Pakistani cleric who represents the dominant Hanafi school of Islamic jurisprudence. There is no denial of the fact that Shari’a assurance remains central to IBF but it is important to underplay any sensationalisation of the power of fatwa. There is nothing sinister about the involvement of Shari’a scholars in IBF – they just happen to provide technical advice on Shari’a matters related with banking and finance. In most of the countries where the role of Shari’a scholars is emphasised upon in IBF, it is restricted to the advisory services on Shari’a matters.

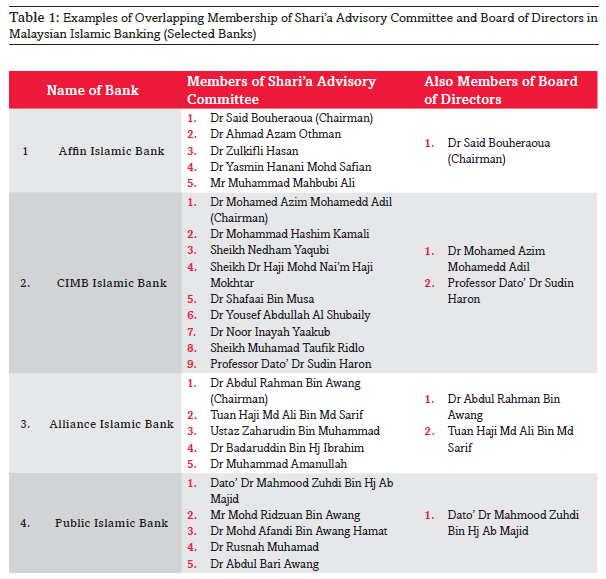

Perhaps Malaysia is the only country where the banking regulator, BNM, is pushing for a role of Shari’a scholars in the corporate governance of Islamic financial institutions. There are a few Islamic banks in Malaysia, where Shari’a scholars sit on the boards of directors of the banks as well as being members of the Shari’a advisory committees. However, it is important to note that such scholars in Malaysia do not come from the pure madrasa backgrounds. For example, the recently restructured Shari’a advisory committee of CIMB Islamic comprises of the following members:

- Dr Mohamed Azim Mohamed Adil (Chairman and also an independent director of CIMB Islamic Bank)

- Dr Mohammad Hashim Kamali

- Sheikh Nedham Yaqubi

- Sheikh Dr Haji Mohd Nai’m Haji Mokhtar

- Dr Shafaai Bin Musa

- Dr Yousef Abdullah Al Shubaily

- Dr Noor Inayah Yaakub

- Sheikh Muhamad Taufik Ridlo

- Professor Dato’ Dr Sudin Haron (also an independent director of CIMB Islamic Bank)

Out of the nine members of Shari’a Advisory Committee of CIMB Islamic, two are also independent members of the Board of Directors of the bank. This is a clear indication of the growing importance of Shari’a compliance in the Malaysian IBF. CIMB Islamic Bank’s Shari’a Advisory Committee is perhaps the largest such committee of an Islamic bank anywhere in the world. It comprises traditionally trained Shari’a scholars as well as those who attended contemporary universities, possessing either formal education in or practical experience of IBF and Shari’a.

Other Malaysian Islamic banks with overlapping membership of Shari’a Advisory Committee and Board of Directors are given in Table 1. Not all Islamic banks in Malaysia have such overlapping memberships but it is a trend being followed by an increasing number of institutions. It is interesting to note that full-fledged standalone Islamic banks like Bank Islam, Bank Muamalat and Bank Rakyat have so far not opted for overlapping memberships, perhaps because such institutions already have a strong commitment to Shari’a assurance and that the senior management are already deemed fully committed to Islamic banking. The Islamic banking subsidiaries of conventional banks use overlapping memberships to indicate to the market that there is strong and full commitment at the shareholders level to uphold Shari’a principles.

Another interesting feature of appointment of Shari’a Advisory Committees at the bank level is that such committees are restructured very frequently to ensure that no individual Shari’a scholars are too strong and influential at the bank level. The influence of individual Shari’a scholars at the bank level is further diluted by the centralized Shari’a Advisory Council (SAC) of Bank Negara Malaysia (BNM), which has the final word in matters related with Islamic banking and takaful in the country. Under the IFSA 2013, BNM is empowered to specify standards to give effect to the rulings of the SAC, which are binding.

Each country has its own approach to Shari’a advisory. For example, the Middle Eastern countries have right from the beginning opted for a market-based approach to Shari’a advisory, allowing individual Islamic banks and financial institutions to appoint their own Shari’a Advisory Committees. It is perhaps because of this allowance that the individual Shari’a scholars are deemed more influential in the Middle East than in other parts of the world.

In Indonesia, Majelis Ulama Indonesia (MUI) or the Council of Indonesian Ulama is a body recognized by the central bank, Bank Indonesia, as a competent authority to issue fatwas and Shari’a rulings on Islamic financial matters. Established in 1975, its basic stature describes the council as the forum for consultation among Muslim leaders and scholars in Indonesia. The council was also to serve the function as the interface between the government and the Muslim community at the national level, which can be seen as an attempt by the government to involve the Ulama in its developmental policy in an institutionalized way. However, MUI retains its independence from the central bank or any other government departments to ensure Shari’a authenticity. Through this independence, MUI has emerged as the most influential body for development and growth of IBF in Indonesia. Without explicit approval of MUI, no institution in the country is allowed to offer any Islamic financial products in the country. This places MUI in a unique position to control IBF in its jurisdiction – a power that no other Shari’a body enjoys in other parts of the world.

Table 2 lists top 10 Shari’a scholars who have great influence in Shari’a matters related with banking and finance.

IBF AND TERRORISM

After an analysis of influence of mainstream institutions, families and individuals in IBF, a brief note on its possible link with terrorism is essential to wrap up the discussion.

Following the terrorism attacks in New York city on September 11, 2001, there was an extensive scrutiny of the activities and operations of Islamic banks and financial institutions by the US government as well as other agencies and authorities in Europe and the OIC countries. Although a few charities run by Muslims were put on the blacklists of the US and European authorities, no credible links were found suggesting any systematic associations of such charities with the Islamic financial institutions. In fact, the scrutiny of Islamic financial institutions helped in understanding the nature of the IBF business, and many Western financial institutions started having more confidence in doing Islamic financial business.

While a number of Western financial institutions decided to start their IBF activities following the 9/11 attacks, many extremist Islamic groups started distancing themselves from IBF. A major reason behind this growing distance between extremism and IBF is the view taken by extremist groups that IBF is not sufficiently Islamic.

WHY ARE NON-MUSLIMS INVOLVED IN IBF?

As IBF is purely a business phenomenon, it is not surprising to see many non-Muslims involved in the industry. Conventional financial institutions are engaged in IBF purely for opportunistic reasons. IBF is a US$2 trillion industry with huge growth potential, and a number of Western financial institutions want to strategically position themselves in the industry for prospective business opportunities.

Amongst non-Muslim individuals who have assumed importance in IBF for academic as well as industry involvement, the following persons deserve special mentioning:

- Professor John Presley

- Professor Rodney Wilson

- Professor Simon Archer

- Stella Cox

- Neil Miller

Professor John Presley

Professor John Presley is the first non-Muslim recipient of the prestigious IDB Prize in Islamic Finance. As a professor of economics and head of economics department at Loughborough University, he played an instrumental role in developing Islamic economics, banking and finance as an academic discipline in the Western hemisphere. He, along with his colleague Humayon Dar, co-founded the first-ever master’s programme in Islamic economics, banking and finance offered by a university in the Western world.

Professor Rodney Wilson

In 2014, Professor Rodney Wilson became the second non-Muslim to receive an IDB Prize in Islamic Finance. He has the distinction of supervising the largest number of PhD students in the areas of Islamic economics, banking and finance, and has a huge following and influence in the Muslim world, especially in the Middle East where his former students hold key positions in government departments and Islamic financial institutions. After retiring from Durham University, he is now serving as an Emeritus Professor in Islamic Finance at INCEIF.

Professor Simon Archer

Professor Simon Archer supervised Professor Rifaat Abdul Karim (the founding Secretary General of AAOIFI and IFSB) for his PhD research, and subsequently participated in developing an accounting and auditing framework for Islamic financial institutions through AAOIFI. He has also been involved in developing a regulatory framework for Islamic financial institutions through his association with IFSB.

Stella Cox

Stella Cox is a senior financial expert who has helped the Islamic financial services industry by operationalizing commodity murabaha. Her contribution into IBF is more than a practitioner as she continues to play an advocacy role through her speaking arrangements at conferences, seminars, symposia and workshops on IBF in the West as well as in the Muslim world. She is also engaged with different government bodies in the UK and advises them on matters related to Islamic finance.

Neil Miller

Neil Miller is one of the most recognized and awarded legal professionals in the Islamic financial services industry. He was a member of the UK Treasury committee of Islamic finance experts, a member of the FSA committee on Islamic finance and worked closely with the Muslim Council of Britain and other bodies to promote and develop Islamic finance in the UK. In January 2005 Neil was nominated as one of the “Hot 100” by The Lawyer in recognition of his work in developing the market-leading Islamic finance practice.

With an over two decades of involvement in IBF in different leadership roles, Neil Miller is one of the most influential opinion-makers in the Islamic financial services industry.

CONCLUSIONS

The above discussion demonstrates that there is no systematic effort to control the Islamic financial services industry for the benefit of any particular stakeholder group. The perception amongst some cynics that IBF is a religious phenomenon that aims at aiding Islamist movements is not substantiated by facts. There are certainly a few shareholder groups who have control over the industry to maximize their profits. This is, however, a legitimate business objective in pursuit of which IBF is not much different from other forms of business.

Started as a pan-Islamic phenomenon, IBF is now seeking business in the markets that have not been on the radar of Islamic banks and financial institutions. In the UK alone there are six Islamic banks set up by shareholders groups originating from the Middle East. Similarly, there is an ever-increasing presence of Islamic financial institutions in financial centers around the world. This clearly shows that IBF does not have a hidden agenda that movers and shakers of the industry may otherwise be pursuing. Any institution that puts forth itself for scrutiny from secular financial regulators cannot simply do so.

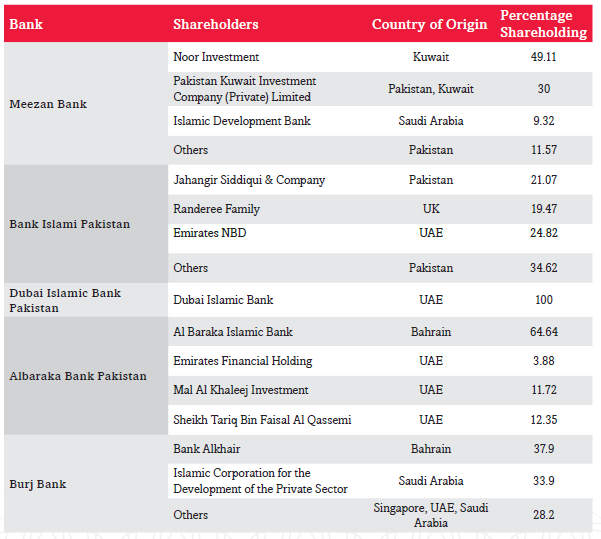

BOX 12: WHO CONTROLS ISLAMIC BANKS IN PAKISTAN?

There are five Islamic banks operating in Pakistan. It should be interesting to find out who owns and eventually controls them. It should not come as a surprise to any keen observer of Islamic banking that significant shares of paid-up capital actually come from the high net worth families and institutions in the Middle East, especially the six countries comprising the GCC. A non-academic investigation into the networks that control Islamic banks in Pakistan reveals that it is not only the shareholders but there are some other stakeholders as well who exert their influence and control.

The table below shows that there are six countries (Kuwait, Saudi Arabia, UAE, Bahrain, UK and Singapore) from where individuals and institutions have invested in the five fully-fledged Islamic banks in Pakistan. Although Malaysia’s Maybank has invested in MCB and through which, it can have an influence on the development of Islamic banking in Pakistan (especially in the wake of MCB’s awaited Islamic banking subsidiary), but overall Malaysian investors have shied away from investing in Islamic banks in Pakistan. This is an important exclusion, given that Malaysia otherwise is a major player in the global Islamic financial services industry.

It should be obvious that Islamic banking in Pakistan is controlled by governments (e.g., Kuwait), institutions (e.g., Dubai Islamic Bank, Al Baraka

Bank, Bank Alkhair and Islamic Development Bank) and some individuals. The objective of this control function is purely commercial, as the shareholders would like to preserve their capital and ensure maximum return on their investments.

One thing that is not so explicit from the above information is the fact that almost all of these banks are advised by the graduates of Darul Uloom Karachi, Jamiatul Uloom Islamia Binnori Town Karachi and Jamiatul Rasheed Karachi – well-known religious seminaries of Deobandi school of thought. Overall, the Shari’a advisory input comes from local as well as foreign Shari’a scholars. Burj Bank is the only Islamic bank that has representation of Brelavi school of thought on its Shari’a board. Table above lists the Shari’a advisors of the five Islamic banks in Pakistan, and their religious affiliations.

It is clear from the above that Deobandi school of thought dominates Islamic banking in Pakistan. It is fair to say that State Bank of Pakistan (SBP) has adopted a Shari’a regime that tries to dilute the control of any particular school of thought or institution on Islamic banking. As a vast majority of Muslims in Pakistan belong to Brelavi school of thought, it is important to create more awareness of Islamic banking by way of engaging more of the seminaries run by Brelavi scholars. This is expected to expand the customer base of Islamic banks.

The above argument in no way should be taken against Darul Uloom Karachi or Sheikh Taqi Usmani, as both of them have played an instrumental role in the development of Islamic banking not only in Pakistan but also in other parts of the world.

Also, the argument here should not be deemed as an attempt to accentuate religious sectarian differences. In fact, Islamic banking and finance on a global level has helped in diluting the juristic divide across different schools of thought. Bringing more Brelavi scholars into the domain of Islamic banking will help in creating harmony across different religious sects.

One particular institution that has advocated Islamic banking on academic and intellectual levels is International Islamic University Islamabad (IIUI). Its exclusion from Shari’a advisory function at the level of Islamic banks can perhaps be explained with the geographical location of Pakistan’s financial district where SBP is located and all of the Islamic banks are headquartered. In Islamabad, on the other hand, where Securities and Exchange Commission of Pakistan is based, there is adequate representation of IIUI both at institutional and regulator levels.

Inclusion of courses on banking and finance into the curricula of religious seminaries should only be beneficial for the graduates of such institutions. Islamic banking is growing in Pakistan and any religious seminary that reforms its curriculum to accommodate teaching of Islamic banking and finance is poised to benefit from this growth story.

The employment opportunities in Islamic banking and finance are not limited to Pakistan. In fact, a considerable number of graduates of IIUI are serving Islamic financial institutions in other parts of the world, especially in the Middle East. Preparing students of religious seminaries for a vocation in Islamic banking and finance has far reaching economic, social and religious benefits. Therefore, it is important that the government initiates a nation-wide drive to create awareness of Islamic banking and finance in the religious seminaries. SBP in this respect can lead a drive for promoting Islamic financial literacy in religious educational establishments in general and amongst masses in particular.

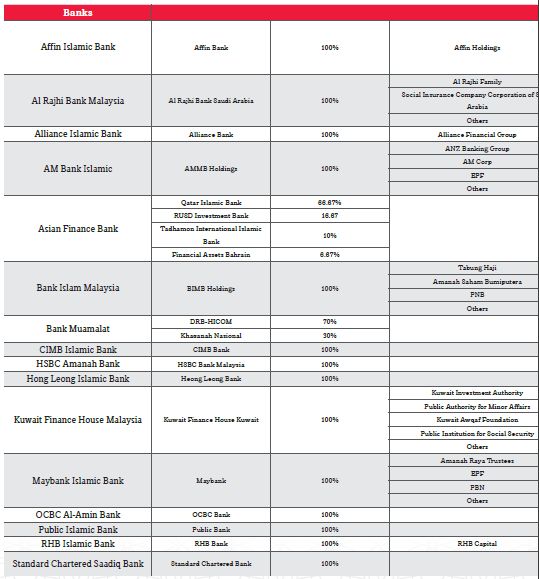

BOX 13: THE OWNERSHIP AND CONTROL OF ISLAMIC BANKS IN MALAYSIA

There are 16 fully-fledged licensed retail Islamic banks operating in Malaysia, out of which 6 are foreign-owned and the rests have local shareholdings. It should be interesting to find out who owns and eventually controls them. It should not come as a surprise to any keen observer of Islamic banking that significant shares of paid-up capital of locally-owned Islamic banks actually come from the government of Malaysia through what are known as government-linked companies (GLCs). Middle East institutions, especially the six countries comprising the GCC, own the foreign-owned Islamic banks in Malaysia. There is an exception to this general rule whereby OCBC Al- Amin Bank is owned by the ethnic Chinese investors hailing from Singapore. There are four local Islamic banks that are owned and controlled by the ethnic Chinese Malaysian private business groups. A non-academic investigation into the networks that control Islamic banks in Malaysia reveals that it is not only the shareholders but there are some other stakeholders as well who exert their influence and control.

Table on the next page shows that there are six countries (Kuwait, Saudi Arabia, UAE, Bahrain, UK and Singapore) from where institutions have invested in the six fully-fledged Islamic banks in Malaysia.

It should be obvious that Islamic banking in Malaysia is by and large controlled by governments (e.g., Kuwait and Malaysia) and institutions (e.g., Kuwait Finance House, Qatar Islamic Bank, RUSD Islamic Bank, HSBC and Standard Chartered Bank, etc.). The objective of this control function is purely commercial, as the shareholders would like to preserve their capital and ensure maximum return on their investments.

One thing that is not so explicit from the above information is the fact that Shari’a advisors (most of whom are associated with International Islamic University Malaysia (IIUM) and International Shari’a Research Academy for Islamic Finance) advise all of these banks and are restricted by Shari’a guidelines issued by Shari’a Advisory Council (SAC) of Bank Negara Malaysia (BNM). Admittedly, there is representation of foreign Shari’a scholars on Shari’a bodies, committees and SAC.

There is an increasing trend amongst Islamic banks to appoint members of their Shari’a Advisory Committees on their respective Board of Directors (see Table 1 in the main text of this chapter for a representative sample). Through this, Shari’a scholars are formally becoming part of the control function within corporate governance structure. Furthermore, this also shows that BNM as well as the individual Islamic banking players are treating Shari’a governance seriously.

One particular institution that has advocated Islamic banking on academic and intellectual levels is IIUM. Its dominance in the Shari’a advisory function at the levels of regulators (BNM and Securities Commission Malaysia) and Islamic banks should be understandable.

Inclusion of courses on banking and finance into the curricula of other universities has also benefited graduates of many other universities. Islamic banking is growing in Malaysia and the universities offering qualifications in this field are poised to benefit from this growth story. However, the lack of a national consensus on a standard education curriculum for Islamic finance remains a major concern. Towards this end, IIUM and BNM has established a task force known as the International Council of Islamic Finance Educators (ICIFE) with the sole aim of increasing the professionalism of Islamic finance educators and meeting the government’s aspiration to make Malaysia as the global hub and leading center for Islamic finance education.

The employment opportunities in Islamic banking and finance are not limited to Malaysia. In fact, a considerable number of graduates of IIUM and some other universities are serving Islamic financial institutions in other parts of the world, especially in the Middle East. Preparing university students for a vocation in IBF has far reaching economic, social and religious benefits. For example, through IBF a continuous process of empowerment of bumiputra has started showing results. The commitment of the government of Malaysia in this respect is commendable. The role of BNM is also very significant, which has invested heavily in developing talent for Islamic banking and takaful. However, there is a need being felt for a drive to promote Islamic financial literacy amongst masses.