Since it first made its debut some thirty years ago, tawarruq has gain popularity as a liquidity management instrument. Its wide usage is due to ease of execution and is regarded as a flexible way of acquiring liquidity. Tawarruq is heavily practiced in most countries where Islamic finance has a presence, especially in Malaysia and the Middle East. To date, half of Islamic banking transactions in Malaysia falls under tawarruq concept either as assets or liabilities. The latest 2015 data released by Bank Negara Malaysia on financing by concepts revealed that murabaha in which category tawarruq falls under, constituted more than 50% of total financing. Similarly, the annual report of Al Rajhi Bank in Saudi Arabia showed parallel findings. This shows the significance of tawarruq as a liquidity instrument in serving the investment opportunity and liquidity needs of the Islamic financial industry.

However, the banking practice of tawarruq as a key financial structure has been subject to fiery debates between Securities Commissionholars who many opined it as resembling interest-bearing loans. Pronouncements by some Securities Commissionholars on the impermissible of tawarruq arrangement is based on the pre-arranged structure inherent in the transaction, which is therefore judged as not a genuine economic transaction. The ruling by the International Fiqh Academy on tawarruq as impermissible took the debate to another level. Many industry observers saw this as a blow to Islamic banks, which were heavily relying on tawarruq for lending as well as liquidity management.

Proponents of tawarruq, on the other hand, argued that tawarruq is so far the best option to facilitate the bank’s liquidity management as well as to assist individual in obtaining cash via trading of commodity. Hence, if tawarruq were suddenly withdrawn, it would have a dramatic effect to those Islamic financiers who rely on tawarruq as a means of liquidity management as well as to provide working capital. The fact that there has never been a consensus on its permissibility highlights the need to revisit the Securities Commissionope of usage and its application.

Tawarruq: Definitions, Forms and Practices

Tawarruq is derived from the word al-wariq, which means minted silver (dirham) that was issued as a medium of exchange.Under this concept, tawarruq is designated to someone who has abundance of silver coins. From the juristic point of view, tawarruq refers to the buyer (mustawriq) who purchases an asset on deferred payment in order to sell it to a third party for cash albeit at a lower price than the deferred price. Under the contemporary definition of tawarruq as practiced by Islamic financial institutions, a customer undertakes to purchase an item from the bank on deferred payment and subsequently sells the item to a third party for cash. Hence, tawarruq consists of two sale and purchase contracts where the first involves the sale of an asset to a purchaser on a deferred basis and the subsequent sale involves sale of the asset to a third party on a cash basis.

“Tawarruq can be defined as a person (mustawriq) who buys a merchandise at a deferred price, in order to sell it in cash at a lower price. Usually, he sells the merchandise to a third party, with the aim to obtain cash. This is the classical tawarruq, which is permissible, provided that it complies with the Shar’ia requirements on sale.”

According to Accounting and Auditing Organization for Islamic Financial Institution (AAOIFI) Shari’a Standard, tawarruq is defined as the process of purchasing a commodity for a deferred price determined through musawamah (bargaining) or murabaha (mark-up sale), and selling it to a third party for a spot price so as to obtain cash. Resolution 179 by the International Fiqh Academy reads “Tawarruq can be defined as a person (mustawriq) who buys a merchandise at a deferred price, in order to sell it in cash at a lower price. Usually, he sells the merchandise to a third party, with the aim to obtain cash. This is the classical tawarruq, which is permissible, provided that it complies with the Shar’ia requirements on sale.” Although tawarruq shares the same objective as inah as both are meant for extending cash, the former is technically distinguishable from inah. Under inah, assets bought are resold to the original seller, whereas in tawarruq the assets are sold to a third party. Inah is a buy-back arrangement, whilst in tawarruq the mustawriq is free to sell the assets acquired to anybody for cash. Under the classical definition, tawarruq is permitted by Shari’a insofar as it is used as a last resort in pursuit of liquidity. On the other hand, many jurists argued that inah is prohibited because the contract incorporates the element of riba. According to Ibn Taimiyyah, inah is haram because it is unjustified to receive a monetary advantage without giving a counter value. This view is supported by Imam Malik as inah transaction is deemed to resemble disguised riba since the price of inah is normally hiked up neither for a consumption nor trading purpose.

However, the second view argues that the key factor to the legality of inah does not rely on price differential but rather on the intentions or the motives behind the sales.

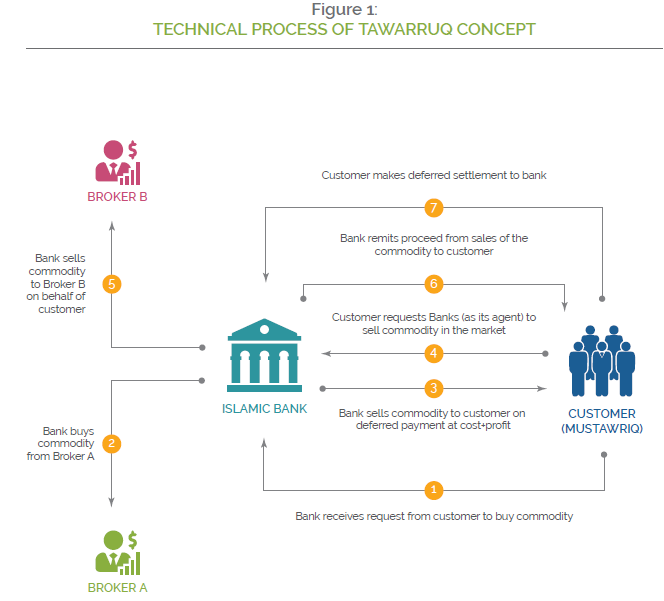

Operationally, tawarruq in current practice by Islamic banks (see Figure 1) is referred to as a concept in which the customer who is in need of cash, undertakes to purchase a commodity from a bank. The bank subsequently purchase the commodity from a supplier (Broker A) in cash and sells it to the customer at cost plus profit on deferred payment basis. Upon completion of the purchase, the customer will ask the bank to act on his behalf to sell the commodity at a lower price to a buyer (Broker B) for immediate cash. Towards the end, the customer obtains cash from the commodity market with an obligation to pay the debt to the bank. This is referred as organized tawarruq as the purchase and sale transactions are carried out simultaneously and there is no risk to the bank. In most transactions, organized tawarruq is done on local commodities such as iron, crude palm oil, rice motor vehicles etc.

Similar definition is given by the Islamic Fiqh Academy when it defined organized tawarruq by referring to the mechanics where a person (mustawriq) buys a merchandise from a local or international market on deferred price basis. The financier arranges the sale agreement either himself or through his agent. Simultaneously, the mustawriq and the financier execute the transactions, usually at a lower spot price. Another form of tawarruq is the reverse tawarruq, which is also practiced by some Islamic banks to manage their liquidity. This is similar to the organized tawarruq, but here the bank act as the customer seeking liquidity.

In both types of tawarruq, classical and organized, the buyer (mustawriq) has no intention to use the commodity bought but rather is seeking for liquidity or cash. But there are several major distinctions between them as highlighted below:

- In an organized tawarruq, the customer does not receive the commodity and is not engaged in selling it, while customer of the classical tawarruq has the option to either keep or sell the commodity himself.

- Mustawriq receives cash directly from the end buyer in classical tawarruq. But in organized tawarruq, mustawriq receives cash from the original seller of the commodity to whom mustawriq is indebted to and in this case it is the financier.

- In classical tawarruq, no pre-arrangement is made between the original seller of the commodity and the end buyer. In an organised tawarruq, there exists a possibility that the original seller of the commodity and the end buyer have entered into a pre-arrangement agreement.

| Deposit Commodity Murabaha Deposit Facility and Placement | |

| Financing | Personal financing, asset financing, cash line facility, contract financing, commodity murabaha financing, education financing, revolving credit facility, working capital financing, home financing, project financing facilities |

| Liquidity Management and Debt Restructuring | BNM Islamic accepted bills (IABs), Islamic private debt securities (IPDSs), interbank commodity murabaha |

| Government and Corporate Sukuk Financing | Sukuk ijarah, sukuk murabaha |

| Risk Management and Hedging Purposes | Ijarah rental swaps, Islamic cross currency swap, Islamic profit-rate swap |

SOME COMMON ISLAMIC FINANCE INSTRUMENTS BASED ON TAWARRUQ

Product Structures Based on Tawarruq

Within the Islamic banking and finance industry, tawarruq is widely used in deposit products, financing, asset and liability management as well as risk management (see Table 1). In the case of Malaysia, especially for Current and Saving Accounts (CASA), few banks adopt reverse tawarruq concept to attract fixed deposit customers. In tawarruq-based deposit products, the customer (in this case the depositor) appoints the bank as his/her agent to purchase a commodity from a recognized commodity house such as the London Metal Exchange or Bursa Suq Sila’ in Malaysia.

The depositor will appoint the bank as an agent to buy specified commodities from Broker,

A on the spot, by using the deposit amount (Figure 2). The depositor sells the commodity to the bank at a mark-up price on deferred basis. Subsequently, the bank sells the commodity to Broker B on spot basis to get cash. The bank will pay the deferred sale amount to the customer at pre-agreement period either lump sum or on periodical basis. Alternatively, Islamic banks may also structure the investment accounts using tawarruq in dealing with risk averse investors. The structure is very similar with CASA tawarruq account, however the duration for investment account is normally longer.

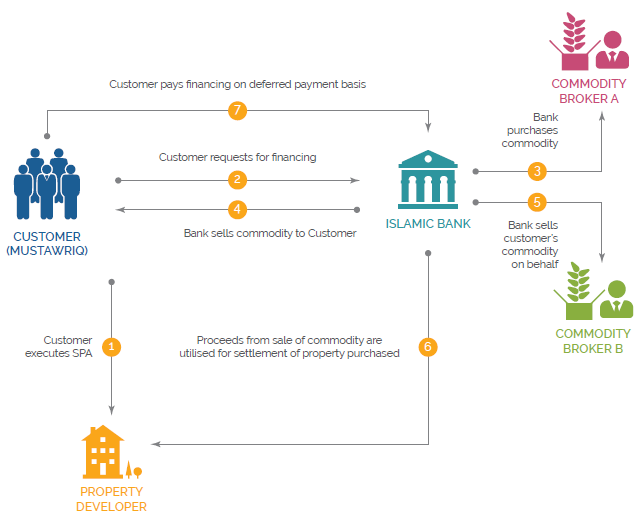

Similarly, in a tawarruq-based financing, the bank provides financing to the customer to meet his/her needs via a mode of commodity trading. In home financing (see Figure 3), for example, a customer wishing to buy a specific house would execute the sale and purchase agreement with the property developer. He/she then applies for financing with the bank for the purpose of settlement of the property purchased with the developer. Upon receipt of tawarruq transaction documents from the customer, the bank purchases the commodity from Commodity Broker A.

The bank then sells the commodity acquired to the customer at sale price (principal + profit) on deferred payment basis. The bank, acting as a sales agent of the customer, sells the commodity to Commodity Broker B on behalf of the customer. The proceeds from the sale of commodity are utilized for the settlement of the property purchased to the developer and the bank will charge the asset as collateral for the financing. As a result from this arrangement, the customer is liable to pay the sales price of the house in the specific pre-agreed period. Hence, customer pays the sale price (principal + profit) of the commodity by way of an agreed deferred payment term. In extreme practices of tawarruq, the concept has been use as an enabler for paying fee for wa’d (promises) in derivatives products of hedging activities when the contracted parties intentionally conducts additional tawarruq contract to give counterparty the profit as a replacement of the fee, as practiced by conventional derivative products. Normally, Shari’a Advisors would allow this kind of practice under the virtue of willing seller and buyer permissibility, though the willingness was inauthentic but related directly to previous undertaking performed by their counterparties.

Legitimacy and Views of Securities Commissionholars

Tawarruq is a somewhat a controversial product. Because the intention of the commodity purchase is not for the buyer’s use or ownership, certain Securities Commissionholars believe that the transactions are not Shari’a-compliant. Generally, tawarruq is considered a ruse (hila) to circumvent riba prohibition. They further argued that the absence of any real economic activities create interest, which is prohibited in Shari’a. Securities Commissionholars who accept this contract as valid, note that it is based on two valid legal contracts – murabaha and sales. Despite the controversy with regards to its permissibility, many Islamic banks, including the United Arab Bank, QNB Al Islamic, Standard Chartered of United Arab Emirates and Bank Muamalat of Malaysia, use banking tawarruq products.

Majority of jurists from the four Sunni Securities Commissionhools of thought (Hanafi, Maliki, Shafi’i and Hanbali) permit the practice of tawarruq as it falls under the general permissibility of sale purchase from the Quranic verse which means: “Allah permits sale purchase and prohibits usury (interest)” (al-Baqarah: 275). It was also supported by the tradition of the Prophet Muhammad (PBUH) as narrated by al-Bukhari (no. 2201) when he ordered his representative in Khaybar to sell less quality of dates with cash and then to purchase good quality of dates with cash as to avoid the prohibition of selling the same kind of food at different quantity.

Although tawarruq is said to be permitted in the Shafi‘i Securities Commissionhool of thought, there is no explicit mention of tawarruq among their treatises. However, Imam Shafi’i supported the permissibility of the inah and concluded his argument by saying “why can I not sell my property for whatever I and the buyer want?” Inah is permitted for the reason that there are two separate transactions involved and hence, the two executed contracts for each transactions are independent of each other. Since tawarruq involves the buyer selling the commodity to a third person for a lower cash price instead of the first seller, it is more appropriate to be ruled as permissible compared to inah. Therefore, the practice of tawarruq is much less controversial and has been considered by jurists among permissible contracts in Shafi’i Securities Commissionhool of thought.

As for inah, Imam Shafi’i only approved inah in the case where the intention of contracted parties was unknown. Consequently, similar justification can be used in determining his view towards tawarruq. Therefore, in banking product, the intention of contracted parties can be known upfront, Hence, it is not an adequate interpretation to relate the permissibility of the transactions with Imam Shafi’i.

Nonetheless, some of the later Shafi’i exponents dislike inah. Zakariya Al-Ansari (d.926 AH) when commenting on inah said, ‘inah sale is disliked because it imposes burden upon the person who is in need since it puts him in a situation where the seller will sell a property at an enormous delayed price, and then buy it from him for an insignificant cash price’. Correspondingly, Al-Sharbini (d.977 AH) and Al-Ramli (d.1004 AH) orated that inah sale is disliked.

While tawarruq is not mentioned explicitly in Maliki jurisprudence, substantive statements of Maliki exponents point to its permissibility. Imam Malik forbadeinah transactions since there was an arrangement between the first seller and the third party for which the third party is considered as a covering for inah sale. Al-Qarafi (d.683 AH), a Maliki Securities Commissionholar, asserts that if the second contract is from the initial seller then it is prohibited. Hence, it may be concluded that tawarruq appears to be permissible by Maliki Securities Commissionholars so long as there is no interference by the first seller in the second sale. Similar to Maliki, the Hanafi Securities Commissionhool considers tawarruq within the definition of inah. There are two divergent positions amongst Hanafi jurists. Majority of them preferred the view of Ibn Humam (d.861 AH) whom did not consider it preferable, although allowed it. Some of them admitted that it is repugnant, such as Al-Sarkasi (d.1090) whom expressed his disliking for inah when he said that he hates the man who when asked for a loan by his brother, responds by selling a good for delayed payment, instead of lending.

Tawarruq is generally more acceptable under the Hanbali Securities Commissionhool, which is popular in Saudi Arabia. However, to some Hanbali Securities Commissionholars such as Ibn Taymiyah and Ibn Qayyim who prohibited the tawarruq concept, the practices of inah and tawarruq is part of forced sale (bay al-muttar or taljiah) and contain a trick or hilah in taking riba. Their argument is on the basis that the intention of the buyer in purchasing the commodity was not because of it, but to obtain cash and paying interest as additional payment because of the deferment of the repayment.

According to them, hadith related to Khaybar was meant for riba al-fadl, which is a kind of riba where the exchange of the same kind of staple food or currency shall be performed at the same quantity and on spot. However, the leniency was given for certain things in riba al-fadl and not on riba nasiah whereby the latter was derived from definite prohibition from the Quran and caused war declaration by Almighty Allah on those whoever eats riba. Riba nasiah is an additional amount of repayment because of extending the period of the repayment of a loan or a debt.

Inah is rejected by majority of Islamic Securities Commissionholars whom considered it to be invalid. This prohibition is based on the principle of sadd zari’ah that aims to prevent practices that can lead to forbidden acts such as, in this case, riba. The prohibition of inah is reported in a hadith narrated by Ibn Umar who is reported to have said that heard the Prophet (PBUH) saying: If you transacted by using al-’inah, and you took tails of cow (busy with material life), and you are satisfied with your job as farmer, and you left al-jihad, Allah (al-mighty) would overload on you humiliation which would not be removed from you unless you return back to your religion. In this hadith, the Prophet (PBUH) clearly warned that those who practiced inah would suffer Securities Commissionorn.

Islamic jurists also based their opinions on a narration pertaining to Aishah’s disapproval of Zaid bin Arqam’s practice of inah. As narrated by Ibn Ishaq al-Shabi’i, from his spouse al-‘Aliyah bint Anfa’ bin Shurahbil that Aishah said: I and mother of Zayd bin Arqam’s son (umm walad) entered (and met with Aishah). The Umm Walad said (to Aishah): I sold my slave to Zayd bin Arqam at eight hundred dirhams in credit. Then I bought back the slave from him at six hundred dirhams (in cash). She (i.e. Aishah) told her: What a bad sale, and what a bad purchase. Tell Zayd bin Arqam that his jihad (holy sacrifice) were void except he repents. According to them, Aishah’s assertion clearly indicated that inah was an unlawful contract. The above two hadiths are strong justifications that support the arguments of the Securities Commissionholars who condemn the transaction of inah.

However, Imam Shafi’i and his followers approved inah transaction because the intention is not a significant element in determining the validity of a contract. According to Shafi’i jurists, the unlawful intention (niyah,qasd) of the parties is immaterial and it does not invalidate their act, unless it is explicitly expressed. Hence, they rejected the deductive of hukm using the above hadith because of a few reasons. Firstly, this hadith is criticized as not being confirmed (thabit) from Aishah. Secondly, Shafi’i considered that both Aishah and Zayd bin Arqam to have differed in determining the legality of the “double sale” contract and hence, viewed it as a disagreement between companions. Finally, Shafi’i presumed that Aishah prohibited the contract not because of the double sale contract rather because of unspecified period for delayed payment. He further commented that “even if it is true that this hadith emanates from Aishah, she actually criticized the selling of the slave without knowing the duration to pay the deferred payment.”

Pronouncements by Various Fatwa Bodies and Regulators

The controversial of tawarruq continues to exist in contemporary age and definitely as a continuity of the debates on the permissibility of inah and tawarruq from the classical days. This subsection examines pronouncements related to tawarruq that have been issued by several fatwa bodies and regulators and examine them in light of the historical diSecurities Commissionourse and subsequently, compare with the practice of the transactions in the Islamic financial industry.

In a nutshell, those pronouncements by various institutions agreed on one main issue, i.e. the permissibility of classical tawarruq. It can be seen that the OIC Islamic Fiqh Academy and the Islamic Fiqh Council of Muslim World League declared the permissibility of the classical tawarruq, however they rejected the organized tawarruq that have been practiced in modern Islamic finance products and institutions.

On the other hand, AAOIFI as a standard-setting body where its standards have been ratified as mandatory in a few Islamic countries such as Bahrain, Jordan, Qatar, Qatar Financial Centre, Sudan, and Syria; accepted the permissibility of tawarruq but with very stringent requirements. Other jurisdictions including Malaysia, Saudi Arabia, United Arab Emirates, Brunei, Dubai International Financial Centre, Egypt, Kuwait, Lebanon, France, South Africa, and United Kingdom as well as in Africa and Central Asia, who have been using AAOIFI Shari’a Standards voluntarily as basis of internal guidelines by their regulators and leading Islamic financial institutions, agreed on the practice of tawarruq with few modifications to AAOIFI Standards.

View of OIC Islamic Fiqh Academy

The International Council of Fiqh Academy is an initiative of the Organization of Islamic Conferences (OIC), and had conducted numerous meetings to diSecurities Commissionuss various issues related to Islamic countries. The Fiqh Academy in its 19th session which was held in Sharjah, United Arab Emirates, from 1 – 5 of Jamadil Ula 1430 AH, corresponding to 26 – 30 April 2009, ruled that both organized and reversed tawarruq are not permissible. This ruling is based on the following with regards to the involvement of the bank with the second sale:

It is not permissible to execute both tawarruq (organised and reversed) because simultaneous transactions occurs between the financier and the mustawriq, whether it is done explicitly or implicitly or based on common practice, in exchange for a financial obligation. This is considered a deception, i.e. in order to get additional quick cash from the contract. Hence, the transaction is considered as containing the element of riba.

The Academy then recommended that Islamic financial institutions adopt investment and financing techniques that are Shari’a-compliant in all its activities by avoiding all dubious and prohibited financial techniques and thus, ensuring the realization of the Shari’a objectives (maqasid Shari’a). This according to the Academy “will also ensure that the progress and actualization of the socioeconomic objectives of the Muslim world.” The Academy also encouraged Islamic financial institutions to provide qard hasan (benevolent loans) to needy customers and to set up special qard hasan funds in order to diSecurities Commissionourage them from relying on tawarruq.

Pronouncements by Islamic Fiqh Council, Muslim World League

In its 15th meeting, the Islamic Fiqh Council resolved that the trade of tawarruq is permissible, as per the opinion of the majority of Securities Commissionholars, because the original ruling of trade is permissible. After thorough diSecurities Commissionussions and deliberations on Shari’a evidences and principles as well as views of the Muslim Securities Commissionholars on this issue, the Council decided on the followings (Resolutions of Islamic Fiqh Council, p395):

- Tawarruq sale is a purchase of a commodity, which is in possession of the seller, at a price to be paid later by the purchaser, who sells it, in turn for cash to a person other than the seller so as to get cash.

- According to majority of Muslim Securities Commissionholars, tawarruq sale is per- missible in the Islamic Shari’a, because all types of sales are permissible as mentioned in the Quran: “Allah permits trading and prohibit riba” (Surah al-Baqarah 2:275). More- over, there is appearance of usury, either implicitly or explicitly or otherwise, and there is a need for this sale in order to pay back the debt or for marriage etc.

- This sale is permissible on the condition that the buyer shall not resell the commodity to the first seller at a lower price, whether directly or through an intermediary. But if the buyer did so, the sale will be classified as inah, which is prohibited because it is associated with usury that makes it a forbidden sale contract.

- The Council, while adopting this resolution, advised Muslims to adopt qard hasan (interest-free easy loan) from their legally acquired wealth, seeking the pleasure and blessing of Allah, but not following their gifts with reminders of their generosity or with injury. This kind of loan is considered one of the greatest means of spending one’s wealth for the sake of Allah, because such behavior promotes cooperation and mutual sympathy among Muslims and relieves them of their distress. It also helps them meet their needs and saves them from the burden of debt and from committing the prohibited transactions. Furthermore, there are many Islamic injunctions and commandments that encourage Muslims to give interest-free loans, which are bountifully rewarded.

The second pronouncement by The Islamic Fiqh Council was issued during its 17th session held in Makkah Mukarramah between 19-23 Shawwal 1424H (13-17 December 2003) after reviewing the application and practices of the tawarruq concept by some banks. The Council resolved that organised tawarruq as practiced by banks is not permissible. The basis of the resolution was made based on the following factors and reasons:

- The seller’s commitment in tawarruq to sell commodity by proxy to another buyer or pre-arrange, makes it the commodity similar to inah, that is prohibited by Shari’a, whether the commitment is clearly stated in the contract or follows the common practice.

- Such a transaction leads in many cases to a violation of the legal possession, which is essential for validity of the transaction.

- Such a transaction is actually built on the basis of granting financing with some additional amount as a return. The bank’s objective here is to gain additional money from the disbursed financing. In fact, such a transaction is not the real tawarruq as recognised among jurisprudence Securities Commissionholars.

View of AAOIFI

The AAOIFI in its meeting on 3-9 June 2006 approved its Shari’a Standards No. 30, which details out the requirements on the practice of permissible tawarruq. The key clause in Shari’a Standard 30 is Article 4/5, which states: “The commodity (object of monetisation) must be sold to a party other than the one from whom it was purchased on deferred payment basis (third party), so as to avoid inah which is strictly prohibited. Moreover, the commodity should not return back to the seller by virtue of prior agreement or collusion between the two parties, or according to tradition.”

With regards to agency problem, AAOIFI, in Article 4/7 to 4/10, concluded that the bank or its agent should not sell the commodity on the customer’s behalf if the customer initially bought that commodity from the bank; neither should the bank arrange a proxy third party to sell this commodity. Instead, the client should sell the commodity either himself or through his own agent.

View of Bank Negara Malaysia and Securities Commission of Malaysia

The Shari’a Advisory Council (SAC) of Bank Negara Malaysia (Bank Negara Malaysia), in its meeting in 2005, approved the tawarruq concept as an alternative to inah, which was used earlier as the underlying concept to obtain cash liquidity from financial products or instruments. Also known as commodity murabaha, tawarruq is widely used by Islamic banks in Malaysia in deposit products, financing, asset and liability management as well as risk management. Between 2006 and 2018, Bank Negara Malaysia issued several resolutions on the tawarruq concept for issuing sukuk and its used in the interbank money market through the Shari’a-compliant tawarruq commodity market platform of Bursa Suq al-Sila’. Crude palm oil has been chosen as the underlying commodity in commodity murabaha transactions through registered participants as an enabler for the tawarruq concept. Tawarruq-based time deposit account is now being offered by Islamic banks in Malaysia since the enactment of the Islamic Financial Services Act (IFSA) 2013, which does not allow Islamic banks to use mudaraba and wakala as underlying contracts for principal guaranteed deposit account.

During its 146th meeting on 29 April 2014, the SAC of Bank Negara Malaysia diSecurities Commissionussed the Shari’a Standard on tawarruq. Several resolutions were made, which included: (1) the arrangement of “dual agency” in tawarruq must be supported by proper evidence of murabaha transaction between the principal and the agent; and (2) hiwalah al-dayn (transfer of debt to third party) releases the buyer’s obligation to settle the debt arising from murabaha under the tawarruq arrangement.

In 2015, Bank Negara Malaysia issued a tawarruq concept paper that provides both the Shari’a and the operational requirements of a tawarruq contract. This was part of a series of policy documents on Shari’a contracts to be issued by Bank Negara Malaysia to support its initiative to develop a Shari’a-based regulatory framework. The policy document on tawarruq is expected to come into effect on 1 July 2016. It outlines mandatory Shari’a requirements to ensure the validity of tawarruq as well as permissible optional practices; and operational requirements of tawarruq implementation on governance and oversight, structuring, risk management, financial diSecurities Commissionlosure, and business and market conduct.

Following the same, the Shari’a Advisory Council (SAC) of the Securities Commission (Securities Commission) of Malaysia also endorsed both inah and tawarruq to be used for liquidity management purposes, without resorting to conventional riba for the public interest consideration (maslaha). In the context of modern capital markets, the Securities Commission of Malaysia defines tawarruq as “The purchase of a commodity on deferred payment basis through a direct sale or murabahah. The commodity is then sold for cash to a party other than the original seller.”

Issues Related to Modern Tawarruq Practices

There is no consensus when it comes to the application of modern tawarruq practice of of many Islamic financial institutions. While some proponents felt that tawarruq has played a major role in the growth and development of Islamic finance, others strongly believe that tawarruq presents risks to the Islamic banking paradigm. The critics over modern practices of tawarruq typically relate to the issue of agency problem, pre-arrangement and the characteristics of merchandise or contracted items.

Agency in Tawarruq Contract

As diSecurities Commissionussed earlier, there exist an agency element in current tawarruq practices where the customer appoints the bank as the agent to conduct transactions on his behalf at various legs of transactions. By doing this, any customer interaction is being removed during the transaction. However, such agency element may create other issues such as how to avoid conflict of interest and how to ensure the transfer of liability of the asset (intiqal daman) in which yad al-daman can be seen for the new owner in the occurrence of damage or total loss of the asset. The ability to confirm the transfer of liability over the asset may help to curtail the allegation that this arrangement is merely a trick to take riba from the back door.

The SAC of Bank Negara Malaysia (SAC), during its 146th meeting on the 29th April 2014, diSecurities Commissionussed issues relating to the Shari’a Standard on Tawarruq, and concluded that the arrangement of ‘dual agency’ in tawarruq must be supported by proper evidence of murabaha transaction between the principal and the agent. According to the view of the SAC, hiwalah al-dayn (transfer of debt to third party) releases the buyer’s obligation to settle the debt arising from murabaha under the tawarruq arrangement.

The issue of hiwalah al-dayn (transfer of debt to third party) has been extensively debated by Securities Commissionholars when diSecurities Commissionussing juristic rules including on al-kharaj bil daman which means “the gains by holding liability” or al-ghun bil ghurm which means “the gains with risk”. It is not merely the issue of ownership, as one may say that the ownership is completed by declaring the amount of a sold asset in a piece of paper. However, in terms of transfer of daman, such matter is still an ongoing debate.

Pre-arrangement issue in tawarruq

An obvious element that differentiates between classical tawarruq and modern tawarruq is the pre-arrangement structure which explicitly crystalized through various purchase under-takings by future purchasers for each leg of transactions. Definitely this arrangement of the undertaking is concurrent with the agency problem, the issue of facing liability to justify the mark up price or profit, and fictitious sale accusation to obtain cash.

From this study point of view, pre-arrangement is not an independent element that could prohibit tawarruq as almost all modern financial transactions need some kind of pre-arrangement in minimizing risk. However, because of the intention to obtain cash prevails over the structure, the indictment of back door riba exists. Hence, Islamic financial institution may be able to minimize this element by giving an option to the purchaser of the asset to keep the asset without selling it to a third party with reasonable additional charges. This approach may help in breaking the chain of pre-arrangement.

Impractical contracted item

It is clearly stated by jurists that the contracted item (i.e. the commodity) is an integral element in a contract. It should be something which is of value from Shari’a point of view, can be sold and purchased, and can be delivered to the customer. Commodities used in any transactions must meet all the specifications and conditions of good commodities. As such Shari’a Securities Commissionholars emphasize that the evidence, valuation and good order of commodities must be aSecurities Commissionertained before any transaction. However, in many instances banks and transitioning parties are said not to be interested to verify whether the commodity really exists in its current form in the stated commodities location. This is because the commodities are bought for the purpose of making the contract Shari’a-compliant. Another major concern of Shari’a Securities Commissionholars with regards to the use of commodities in a tawarruq transaction is the practice of selling and reselling the same commodities without them ever leaving their place of origin.

Assets typically transacted in classical tawarruq have been normal daily item which can be easily transferred. However, as for modern tawarruq practice, commodities used in transactions are generally barrels of crude palm oils or tones of metals, where the logic of purchasing those assets by a retail customer seems impractical and not useful. On the other hand, legally, the trading of crude palm oil, metal, and iron was meant for licensed purchaser and not for a retail customer. In the case of organized tawarruq as practiced Islamic banks, commodities are most often not intended to be delivered to the customer. In some cases, the documents are embedded with clauses that state, whether explicitly or implicitly, that the customer has no right to take delivery. This is evidently against the inherent nature of a sale contract, which clearly states that ownership of the commodity must be transferred from the seller to the buyer.

Conclusion

The topic of form versus substance is at the center of the debate pertaining to tawarruq. Historical diSecurities Commissionaires on tawwaruq has shown diverse views. Some Islamic jurists have pointed out that although tawarruq was only mentioned directly in the Hanbali Securities Commissionhool of thought, its substance under various names can be drawn in all Securities Commissionhool of thought. Contemporary Islamic jurists are also divided on the issue of Shari’a permissibility of tawarruq. The OIC Islamic Fiqh Academy and the Islamic Fiqh Council ruled that organized tawarruq as practiced by banks is not permissible. However, the SAC of Bank Negara Malaysia approved the tawarruq concept in deposit products, financing, asset and liability management as well as risk management. Though many agreed on the permissibility of tawarruq from a Shari’a point of view, many also established that the Securities Commissionope of usage and its application should be revisited.