The concept of Islamic insurance, which is known as takaful was first introduced in Sudan in 1979. Since then, takaful has seen much of its growth in countries with high Muslim populations including Saudi Arabia, Malaysia, Egypt, Bangladesh, Pakistan and Indonesia. Though currently underpenetrated, few disagree as to the potential market share that exists, even in countries with a lower percentage of Muslim citizens such as the UK, Sri Lanka and South Africa where takaful companies have already made their entry. While the industry is still a long way away from attaining an equal footprint with conventional insurance, it is undeniably rising as the growing feature of the insurance landscape and is now entrenched in the global insurance industry.

Takaful has seen a substantial growth both in terms of new companies and contribution (premium). And this growth story continues, with source highlighting its size to be north of US$25.5 billion of premiums by 2020. Over the past 10 years, the number of takaful companies has climbed nearly four-fold, reflecting the growing global popularity of the sector and its increasing importance to the development of Islamic finance. As of 2014, there were 215 takaful companies and 96 takaful windows worldwide, and more establishing since, especially in Africa and Asia. This is a great achievement for takaful, considering it had to find its place within the larger conventional system, facing tough practical challenges of competition, pricing and differentiated products and services.

State of the Global Takaful Industry

The global insurance inclusive of takaful stood at US$4.7 trillion in 2014. If we were to look at only the countries where takaful made in-roads, the total of such markets was approximately US$73 billion compared to takaful estimated at US$14 billion. This translates to an average takaful market share of approximately 20%. The penetration rate varies by markets and lines of business especially between retail and corporate lines. Even though 20% is a decent market share, it ought to be much higher than that. Takaful industry has gone from zero to estimated US$14 billion by 2014 within a space of some 38 years, standing alongside conventional insurance that had a head start of some 380 years. Nevertheless, US$14 billion in 2014 or even US$25.5 billion forecasted by 2020 is not reflective of where takaful should be at present. It has not done as well as its counter part in the financial services industry, the Islamic banking and finance. The takaful industry has not kept pace with growth in Islamic banking and finance, which stood with assets of US$2.1 trillion as of 2014 and projected to grow to US$3.4 trillion by 2018.

The global takaful industry grew 16% in 2012 and continued its double-digit growth momentum of about 14% in 2014. This is however a noticeable moderation from a 22% compounded annual growth rate (CAGR) over 2007-2011. Even in core markets of Southeast Asia and the GCC countries, growth pace has slowed down, achieving less phenomenal rates than

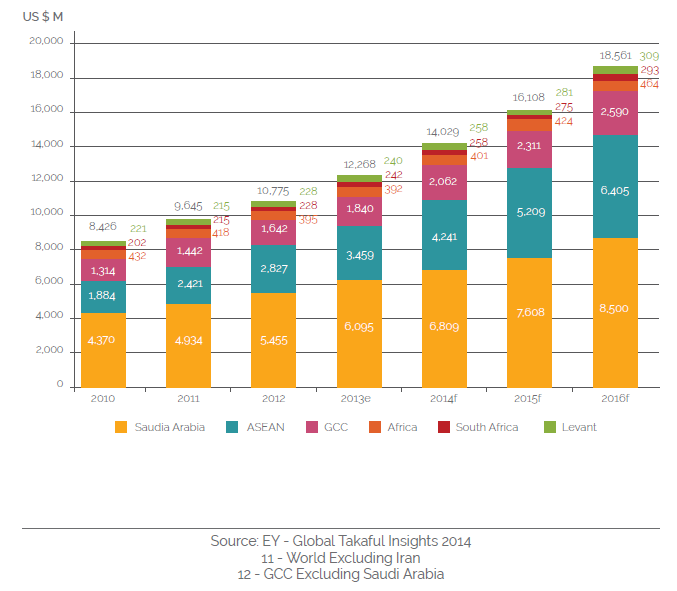

those witnessed in the past decade. The markets of Saudi Arabia, the UAE and Malaysia continue to enjoy the lion’s share of the global takaful markets (Figure 1). These are countries with stable and strong governance and regulatory support, which are conducive to increasing demand for takaful products. But in recent years these markets seem to be entering a more mature stage. Regulatory pro-activeness and good supervision and control has contributed a great deal towards better success of takaful in countries like Sudan and Malaysia, but other markets have been lagging behind at varying degrees, especially in the Middle East. A number of countries have been introducing and implementing regulatory changes with a view to further enhance the effectiveness of regulatory controls and improve the overall financial strength of insurance and takaful companies. Notwithstanding strong growth potentials, takaful penetration continues to remain below the global average of insurance penetration rate.

The GCC Takaful Market

The GCC takaful market continues to dominate the global takaful industry, exhibiting strong growth since 2010 (Figure 1). Although takaful market is expected to register strong growth for the next five years, the extent of the growth is largely dependent on the performance of the GCC’s economy. Continued volatility in oil prices have the potential effect of slowing down the region’s economy, resulting in spending cuts or restrictions by some of the member nations, in particular in infrastructure projects. Such curtailed spending could impact the performance of the insurance and takaful market. Moreover, the region’s stock market may remain under pressure until the oil prices stabilize in the long term. This could result in low investment returns for insurers, given their high exposure to the equity markets.

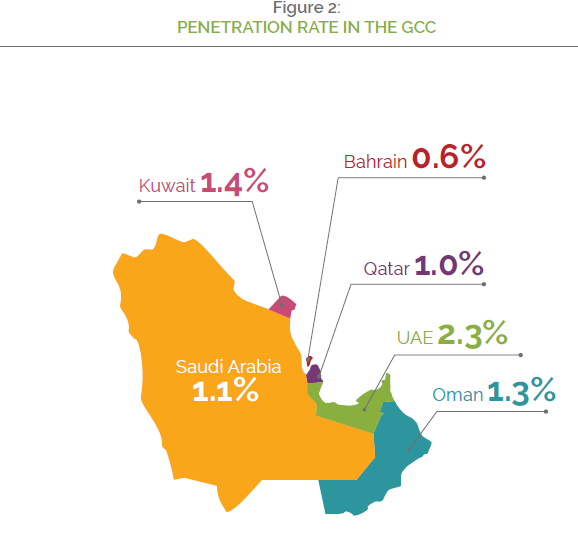

Despite high per capita income, penetration of takaful products in the GCC countries has remained low at not more than 2% (Figure 2). The healthy growth of the region’s insurance industry in the last couple of years can be traced back to compulsory insurance coverage enactments for residents, like medical insurance in Saudi Arabia (in 2004), Abu Dhabi (in 2006) and Dubai (in 2014); and motor insurance which was made compulsory in all GCC countries. Hence, growth was mainly due to the mandatory requirements imposed on certain types of insurance rather than due to the increasing popularity of insurance product as a tool for mitigating risk. In some of the GCC states, in addition to the takaful laws and regulations in their respective states, takaful operators are also required to apply the guidance provided by Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Despite huge untapped potential for growth, takaful has not seen the kind of growth that one would expect primarily due to lack or absence of specific legal framework for takaful. There are varying levels of regulatory requirements for takaful and retakaful across the region. Even Saudi Arabia, the largest market for Shari’a-compliant cooperative insurance, does not have any specific rules or standards for takaful and retakaful. The Saudi Arabian Monetary Agency (SAMA) applies the Kingdom’s laws and regulations on conventional and takaful insurance equally. The insurance law doesn’t provide for separation of takaful funds and shareholder funds, qard hassan (interest-free loans to cover policyholders’ accounts’ deficits by shareholder funds), or for the appointment of a Shari’a Board to oversee the compliance with Shari’a law. All insurance companies apply these principles on their policies, but some companies have adopted closer Shari’a compliance. These companies have their own Shari’a Board and governance, and their distribution is focused on customer engagement driven by compliance to Shari’a principles.

The UAE enacted new prudential takaful regulations in 2015 aimed at improving the over-all capital condition of the sector. This would help to mitigate negative effects of market turmoil on insurers’ ability to meet their obligations by giving insurers and regulators early warnings if these disruptions could create an unwarranted level of risk. The UAE Insurance Authority Regulations are divided into capital adequacy, policyholder fund requirements and data-keeping. Other newly introduced measures include preventing conventional insurance companies from offering takaful products through windows, new corporate governance guidelines to ensure better Shari’a compliance and the entry of foreign players. There are 11 takaful operators in the UAE insurance market, which is home to 60 insurers overall.

Oman, a relatively newcomer in Islamic finance, is awaiting the final approval for the draft takaful regulation, which set out the regulatory code for takaful operators, including oversight and reporting requirements, product standards and liquidity levels. Once passed, the new takaful law is expected to give the much-needed impetus to the development of the Islamic financial industry in the country. The draft law also states that only dedicated takaful

- Hammad and Greenberg, 2015

companies can operate in the Omani market, which basically means that traditional insurers are not allowed to offer takaful complaint products. The takaful business in Oman constitutes about 6.5% of gross written premiums in 2015.

Bahrain introduced a new regulatory framework governing its takaful operators in 2015. The new Operational and Solvency Framework for the Takaful and Retakaful Industry imposes stringent requirements on takaful operators with greater emphasis on corporate governance, standardization in takaful accounting practice and disclosure and stronger consumer protection. It is envisaged that the new regulations are expected to attract new entrants to the market and foster competition. At present, there are 7 takaful and retakaful companies operating in the country. The takaful sector accounts for 2% of gross contributions in the GCC takaful market, with takaful contributions making up 22% of total gross premiums in Bahrain’s domestic insurance market.

Asian Takaful Market

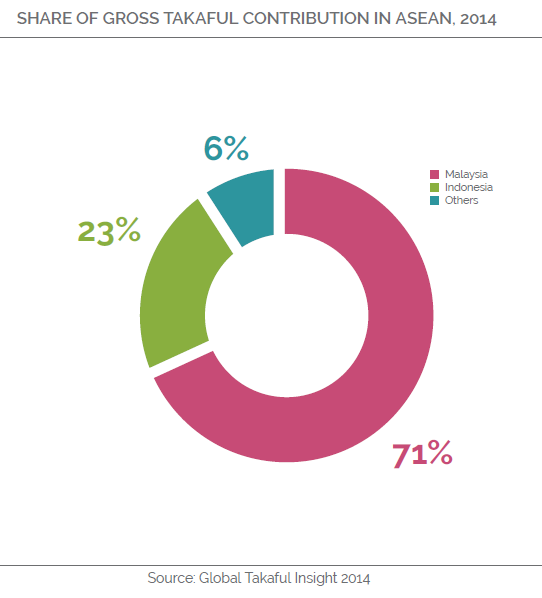

Within the Asian takaful market, Malaysia maintains its leadership role (73% of market share in ASEAN) with Indonesia, Bangladesh and Pakistan showing strong growth potential due to its large Muslim population. Malaysia’s dominance can be attributable to many factors including a progressive regulatory framework in place that has a two-pronged aim – ensuring efficient and sustainable takaful business operations and fostering strong consumer interest for protection. Some of the notable initiatives in this regard includes implementation of the Takaful Operational Framework (TOF) 2012, Islamic Financial Services Act (IFSA) 2013, Risk-Based Capital for Takaful (RBCT) and the issuance of the concept paper by Bank Negara Malaysia on the Life insurance and Family Takaful Framework. Under the IFSA 2013, the takaful sector in Malaysia will be undergoing one of the biggest policy change – separation of family and general takaful business lines by 2018, which will affect eight out of the 11 takaful operators. As a consequence, takaful operators will need to hold separate capital requirements for its general and family takaful businesses. Currently, a minimum capital requirement of RM100 million is applicable for the combined general and family takaful business under the composite structure. From July 2018 onwards, a separate capital requirement for each entity will be required, where a composite company would need RM200 million capital to support its general and life/family businesses.

The separation of takaful businesses under different managements is expected to result in stronger and sharper business focus due to some level of consolidation that is likely to happen in the market in the coming years leading to 2018. In addition, takaful operators are required to maintain capital-adequacy levels that are in line with the risk profiles of their operations under the RBCT, which basically means that some operators would require additional capital injections or borrowings to shore up their capital bases. Such additional capital and resource requirements would at best drive the sector’s consolidation further, particularly among smaller takaful operators with insufficient scale to justify the additional investment in separate licenses. It is anticipated that with the dedicated and separate general and family businesses, the takaful sector will see greater transparency in the financial strength of each operator as well as the introduction of new products by operators as they compete to strengthen each separate business line. Individual licenses are expected to boost growth of the general takaful market, which has largely been overshadowed by family takaful. In Malaysia, family takaful accounts for about two-thirds of takaful gross contributions.

BOX 9.1: KEY GROWTH DRIVERS IN THE GCC

ŀ Demographic factors like an expanding population base, large representation of foreigners, and increasing life expectancy are expected to have a positive impact on demand of insurance products in the Gulf.

ŀ Government investments in various sectors for promoting economic diversification are likely to provide new underwriting opportunities. Further, expansion of income levels and low median age of residents suggests a strong propensity for acquiring personal assets.

ŀ Implementation of compulsory health insurance programs in different jurisdictions is likely to create strong growth avenues for insurers. The impact of new vehicle sales growth is also expected to cascade on the insurance industry.

ŀ Recent political and catastrophic events are likely to create increased awareness about the benefits of insurance, and make enterprises more proactive in insuring their properties and personnel.

ŀ Regulatory framework and operational parameters of the Takaful market are expected to undergo positive changes as the practice evolves further. New and innovative offerings may generate higher demand for family Takaful products.

ŀ Business and financial hubs like Dubai International Financial Centre (DIFC) and Qatar Financial Centre (QFC) have significantly contributed to the growth of regional insurance/takaful industry. These centers are home to a number of insurance/takaful and reinsurance/retakaful companies.

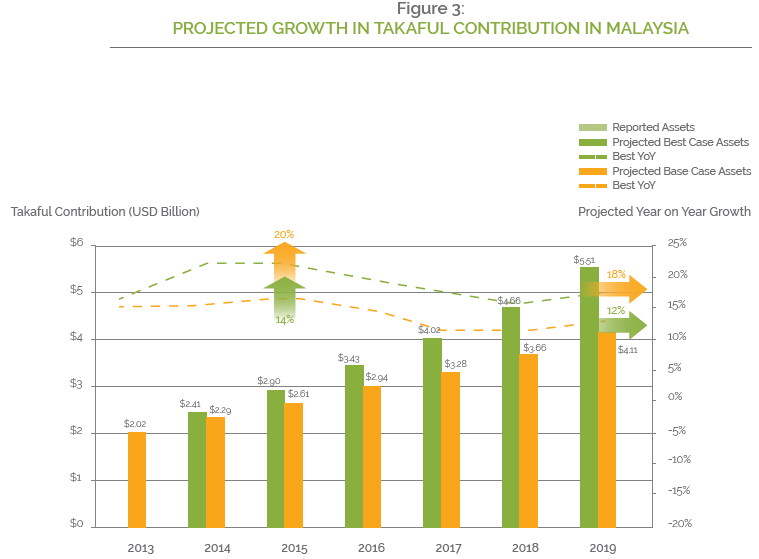

The proposed stratification of the motor and fire insurance/takaful, which is due to take place in 2016 will not only have a significant impact on the general takaful market, but will also be the starting point of intense competitive environment for takaful operators. This comes at a time when growth has seen a decline in particular in the motor insurance/takaful premiums. It is estimated that the automotive insurance premiums form 47% and 59% of total gross written premiums in general insurance and takaful, respectively. These wide-ranging reforms are expected to support the long-term sustainable growth of the sector as it focuses on enhancing operating flexibility, product disclosures, delivery channels and market practices for takaful operators. Takaful operators are placed under enormous pressure to have a more robust and effective way in managing the business and become more innovative in order to remain profitable in a lower-margin environment. With low penetration rate of only 5.2% of GDP and robust regulatory framework that is conducive for growth, the Malaysian takaful market is expected to see an average 12% year-on-year growth of its contributions for the next five years to reach US$4.11 billion by 2019 (Figure 3).

Meanwhile, Indonesia, home to the largest Muslim population in the world (population of over 250 million), contributed to 26% of the takaful market share in the ASEAN region. As at December 2015, the gross written premiums of the takaful sector expanded to 6.2% of the country’s insurance industry to reach IDR 10.5 trillion, from 2.6% in 2010. This is amid the slowdown in real GDP growth. Whilst still a niche product in Indonesia’s overall insurance industry, the takaful sector is poised for rapid expansion globally due to its large and young population with increasing affluence, low market penetration rate, robust economic growth and strong support from regulators. In 2014, a new insurance law was passed to provide greater clarity on regulations, strategic direction of regulation and the government’s policy focus with regard to the industry. This new law replaces the previous insurance law passed in 1992, which had a much broader and more general term written. Amongst the salient features of the new law are guidelines on key issues related to foreign ownership, policyholder protections, and takaful products.

Notably, is the requirement for conventional insurance and reinsurance companies to spin off their Islamic windows and establish fully-fledged takaful operations with a minimum capital requirement of Rupiah 50 billion rupiah (US$3.75 million) within 10 years or when the Shari’a component exceeds 50% of the total insurance portfolio, whichever is the earlier. In a market which is dominated by Islamic windows of conventional insurance companies where 38 out of the 43 takaful companies operate through a window operation, this new regulatory demand is set the change the landscape of the takaful sector in Indonesia driven by rising number of mergers and acquisition amongst players as well as some takaful window operators closing down their business to focus resources on their core conventional segments. Despite the very low takaful penetration rate of only 0.08%, market expansion remains a challenge in Indonesia as Muslims in the low to middle income, which constitute the largest market segment, have low level of awareness about takaful and lack the financial resources to buy takaful products. The challenge for takaful operators are to close the gap between the affluent market and the low to middle market through the introduction of wider range of takaful products and effective distribution channels that are suitable and meet the needs of this target market so as they have better risk protection.

Shari’a component exceeds 50% of the total insurance portfolio, whichever is the earlier. In a market which is dominated by Islamic windows of conventional insurance companies where 38 out of the 43 takaful companies operate through a window operation, this new regulatory demand is set the change the landscape of the takaful sector in Indonesia driven by rising number of mergers and acquisition amongst players as well as some takaful window operators closing down their business to focus resources on their core conventional segments. Despite the very low takaful penetration rate of only 0.08%, market expansion remains a challenge in Indonesia as Muslims in the low to middle income, which constitute the largest market segment, have low level of awareness about takaful and lack the financial resources to buy takaful products. The challenge for takaful operators are to close the gap between the affluent market and the low to middle market through the introduction of wider range of takaful products and effective distribution channels that are suitable and meet the needs of this target market so as they have better risk protection.

As in the case of Indonesia, Pakistan faces similar conundrum – very low market penetration rate which is translated into high growth opportunities; but public mistrust, low public awareness, non-availability of disposable income, lack of incentives from the government and narrow takaful product offerings continue to be a challenge for market growth. Being the second most populace Muslim country in the world, more than 70% of the people fall into the low to middle-income segment of the population. With their low levels of income, low levels of financial literacy, and overall unfamiliarity with formal financial services, the need for consumer education, awareness, and protection is magnified for potential Takaful customers. The insurance penetration in Pakistan as measured by total premiums to GDP has lingered at 0.7% of GDP for the last decade to record a slight growth to 0.9% of GDP with takaful contributing marginally. Total takaful premiums of the market remain very low, less than 1% of the total insurance market estimated at Rs108 billion whereas the takaful share of the total gross written premiums of the insurance industry stands at 5%. The takaful market is dominated by a few big operators where about 65% of the market share in gross written premium rests with the top three players.

The main challenge remains the lack of proper regulatory framework that is key factor for the continued development and growth of takaful. However, regulatory developments does not always gain the support from the industry, as the following examples show. In 2012, the Securities and Exchange Commission of Pakistan (SECP) revised the takaful rules to allow conventional companies to sell Islamic products through window operations, thus boosting competition and increasing the sector’s market share. This was received with much resistance by the takaful players and prompted a legal challenge. They later filed a petition in court contesting against the regulator’s decision quoting that the rules would result in cannibalization and give unfair advantage to conventional insurance companies. A two-year-long legal battle ensued which ended in an out-of-court settlement in 2014. The SECP and takaful companies came up with a compromise decree that has resulted in the high court lifting of the stay order while allowing Islamic insurance companies three months’ time to meet regulatory requirements. Since then, SECP has granted four window takaful licenses and is expecting at least half of Pakistan’s conventional insurers will eventually offer takaful products through their window operations. The regulator hopes that with conventional insurers entering into takaful business, the share of the industry will increase by 15% by 2018 from the present 5% as conventional insurers bring in the required resources and expertise into the takaful industry in terms of sales force and extensive network of distribution channels.

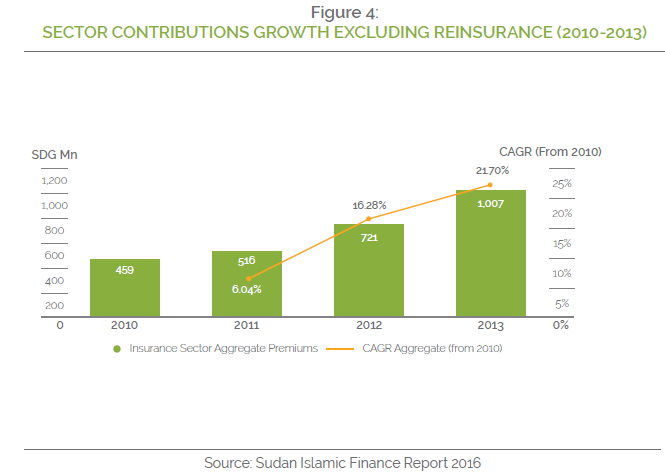

Rising Markets of Africa and the Levant Over the past 5 years, takaful has been making considerable headway in the Levant markets and Africa, registering astonishing growth of 40% and 26%, respectively. These rates are forecasted to remain on the rise fueled by low insurance penetration, young demographics, strong economy growth and an increasing awareness of the need for protection. In the African continent, Sudan is regarded as the pioneer in takaful with the establishment of the world’s first modern takaful company, the Islamic Insurance Company Limited in Sudan in 1979. Despite its pioneering status and having the longest track record in takaful, Sudanese takaful market remains relatively small and has yet to reach its full potential. Currently, there are 15 takaful operators comprising of 9 general takaful companies, 4 composite takaful companies and two retakaful operators. From 2011 – 2013, the takaful sector experienced strong growth with contributions growing at a 21.7% CAGR to reach SDG 1,007 million by 2013.

BOX9.2: SALIENTFEATURESOF2012TAKAFULRULESINPAKISTAN

The SECP introduced new takaful rules on July 16, 2012, replacing the 2005 rules. A special committee was set up to review and the takaful rules and recommend improvements. Some of the salient features are as follows:

Shari’a Compliance:

ŀ Shari’a advisor, Shari’a compliance officer and external Shari’a compliance audit at company level

ŀ Segregation of funds and requirement of Rs50 million

Market Development

ŀ Allowing window takaful separation

Authorization

ŀ Defined process of authorisation for takaful/window takaful operators

ŀ Revocation of authorisation

ŀ Transformation of general insurer into general takaful operator

Financial Soundness

ŀ Maintenance of solvency at Participants Takaful Fund (PTF) level

ŀ Compulsory segregation of funds

ŀ Qard hassan required in case of accounting deficit in PTF

The takaful markets of Kenya, South Africa and Nigeria are also steadily gaining prominence. Kenya entered the takaful market with the setup of Takaful Insurance Africa in 2011. Subsequently, another four takaful operators (Cannon Insurance, Metropolitan Life, Jubilee Insurance and UAP Insurance) have opened shop. In 2014, the Insurance Regulatory Authority introduced new takaful rules, which allow conventional players to offer Shari’a-compliant products through windows in its efforts to boost the takaful industry. Similar to Indonesia and Pakistan, the rules require separate financial reporting requirements on windows, and operators must also maintain separate takaful funds for their general and life businesses.

The National Insurance Commission (NAICOM) of Nigeria, the Apex body that regulates insurance business in Nigeria introduced takaful in 2008 in order to deepen insurance penetration. In 2013, NAICOM issued the “Operational Guidelines 2013 Takaful – Insurance Operation”, which is the first set of national guidelines for the country’s takaful market. The guidelines out-line and clarify takaful operator’s duties and responsibilities and set minimum operation and disclosure standards and requirements. The guidelines also require every operation to have a Shari’a Council or known as Advisory Council of Experts (ACE), which is responsible and accountable for all Shari’a decisions, opinions and views. In the absence of ACE, insurers in the initial stages of offering takaful are allowed to seek such services from NAICOM’s Takaful Advisory Council.

Takaful made its first debut in South Africa in 2003 with the establishment of Takafol SA but has largely remained underdeveloped. As the sole takaful operator in South Africa, Takafol SA provides short-term takaful solutions for business, vehicle, personal and household cover. In a bid to further develop its personal lines and commercial business, Takafol SA made Absa Insurance Company (AIC) its underwriting partner in 2008 and subsequently saw its business growing by more than 66% over the next two years. As a result of this successful partnership, Absa Group, the parent company of AIC, acquired Takafol SA in 2011 and merged their operations into Absa’s own Islamic banking, which saw Takafol SA operating under the newly-re- branded Absa Takaful. For Absa Group, which already has its own Islamic banking business, this acquisition would provide the company to expand its service offering beyond banking and provide customers with an unparalleled Islamic value proposition.

Many industry observers believed that this acquisition would potentially expand market reach of takaful beyond the borders of South Africa to Southern, Central, West and East Africa. However in December 2015, after unsuccessful attempts to curb the losses on the product for premium segment customers, Absa Group decided to suspend the sale of its short-term takaful products. Retail and business banking customers who benefitted from risk cover under the Absa Takaful offerings were migrated to conventional policies. As with Islamic banking, since there is no separate regulation dealing specifically with takaful, all Islamic financial institutions in South Africa are regulated by the laws governing conventional players.

| FY | 2009-2010 | 2010-2011 | 2011-2012 | 2012-2013 | 2013-2014 |

| Gross Contribution | 378 | 539 | 701 | 947 | 1,202 |

| Investments | 540 | 713 | 969 | 1,205 | 1,646 |

| Gross Claims | 85 | 159 | 238 | 363 | 445 |

| Insurance Surplus | 10 | 34 | 30 | 46 | 61 |

| Net Profits | 01 | 04 | 20 | 48 | 86 |

TAKAFUL PERFORMANCE (EGP MLN)

Opportunities for takaful growth in Africa rides on the back of the realization of oil and gas potentials in some African countries, increasing awareness of takaful among Muslim communities and low penetration rate. However, the insurance industry in African countries remain underdeveloped as most Africans cannot afford insurance premiums. With most Africans still just struggling to meet their basic food and other day-to-day needs, insurance is still a long way off for the majority of them. The inclusion of micro takaful have the potential to deepen financial access and inclusion among lower-income Africans.

In the past decade, takaful market in the Levant countries Turkey, Jordan and Egypt has evolved and transformed on the back of global financial crisis, waves of natural catastrophes, dangerous political risks and the heavy burden of complying with stringent market regulations. The takaful industry in Egypt is expected to grow around 20% in 2016 as more players enter the market to meet robust demand for takaful products and services. At present, there are nine takaful companies (six general and three family takaful) accounting for 12% of Egypt’s insurance, compared with a share of 8.75% for 2014. Meanwhile, premiums of new and existing life takaful insurance certificates rose 38.7% to US$1 billion at the end of October 2015, compared with US$900 million the previous year. Over the years, takaful contributions have been registering significant growth with family takaful contributions reaching EGP485 million between January to May 2015, representing 11% of life premiums. On the general side, within the first five months of 2015, contributions reached EGP425 million, 16% of the EGP2.6 billion property insurance (Table 1).

- Middle East Insurance Review, October 2015

While takaful industry in Jordan and Turkey is still in its infancy, it has been exhibiting tremendous growth relative to conventional insurance in recent years. There are currently two takaful companies in Jordan (Islamic Insurance Company and First Insurance Company) after the Insurance Commission of Jordan (IC) decided to liquidate one of the country’s three takaful providers, Al Baraka Takaful, in early 2014. The decision was taken following a one year suspension due to financial challenges. The Islamic Insurance Company is the oldest takaful operator in Jordan and has a market share of 4.1% in total industry premiums. In April 2015, the First Insurance Company expanded into the life insurance market by acquiring a majority stake (76%) in Yarmouk Insurance Company for US$15 million. The merger is expected to increase the company’s competitiveness and utilize all its capabilities to achieve its strategic objectives. Takaful providers in the country are governed by regulations issued in 2011 by the IC.

Takaful or participation insurance also has a minimal profile in the Turkish market. At present, there are only two firms offering Islamic insurance products, Neova Sigorta and Asya Emeklilik. Together they account for 0.5% of the insurance sector’s assets. However, takaful is expected to develop in tandem with the increasing success and growth participation banking sector and sukuk market in Turkey.

What’s Holding Takaful Back?

The game changers for takaful industry for the coming 15 years (by 2030, when the industry will have passed the 50-year milestone of its existence) are the mobilization factors it needs, ranging from self-introspection of what each company must do to improve its chances in securing a greater market share, to the challenges of how to harness the tremendous opportunities arising, firstly from Halal industry initiatives in all areas of the economy, and secondly to embrace digital ways of doing business which can facilitate the “social media savvy” customers to approaching companies “to buy from them” rather than takaful companies “selling to them”. Some of the reasons why takaful companies did not do as well as they were expected to, are explained below. There are examples of success where many of the factors below did not apply to such companies, but in majority of cases things have been off track.

Brand and Image

Several takaful companies have been conducting their services and operations more like “insurance” companies, creating confusion amongst customers about the authenticity of takaful proposition. There has been a lack of understanding about the ethical dimension of takaful amongst the back-office and front office staff and intermediaries. Such lack of understanding watered down the real meaning of takaful to prospective customers. Most customers don’t really get the difference between conventional insurance and takaful except for the label that it is based on Shari’a principles, that it is Shari’a-compliant and that there is a Board of Shari’a Scholars to make sure that everything is Shari’a-compliant.

The cooperative principles are understood as a concept but how this relates to their product remains hazy. The only point that saves the day is the surplus distribution because customers donate their contributions into this cooperative fund, and this “belongs” to them for claims payment and surplus. Surplus distribution is a big differentiator between takaful and conventional insurance, and with this idea firmly embedded in the customers mind, he or she understands this as the difference between takaful and insurance, until of course when the time comes for surplus to emerge; there is none, especially when the absence of surplus continues from one year to the next and the next.

Questions then arise about the promises made and expectations built. This then takes a different turn when the service is poor and when the staff is unable to satisfy the customer with so many questions. This leads to mistrust, and taints the image of Shari’a-based solution compared with conventional insurance because the customer sees no difference between the two. And when this happens, the conventional option available next door turns out to be better on the basis of better customer care provided by companies who have had much longer period to stabilize, have efficient optimum resources, have scale of business and reserves, and have tried and tested systems. Several takaful companies, being relatively new, are behind the curve on all these areas. As per A.M. Best, in 2013 in the UAE, the average expense ratio of takaful companies was 30%, compared with 20% for conventional companies.

IT Legacy

Takaful mostly developed out of new start-ups, and in only handful of cases conventional companies were converted into takaful. As new start-ups, the companies had a golden opportunity to develop state of the art new IT systems keeping pace with e-commerce. This could have given them tremendous edge over legacy systems of their competing conventional counterparts. But in most cases, takaful IT systems were merely tweaked legacy systems with few differences here and there. IT systems are not easy to change and converting existing systems to keep pace with new digital ways of doing business can be a costly affair.

Misalignment of Shareholder Expectations

A major disconnect exists at the Shareholder and Board level in not quite understanding the nature of takaful as a business that is very different from other businesses like banking or trading. The expectations of reaching early break-evens and dividend payouts, especially for new companies floated on the stock market without any track record, created all kinds of strategy shortcuts in hiring resources and building top lines only to end up in equity erosion. Established players, mostly conventional insurance companies could afford to play the “price game” comfortably enough and live on thinner margins. This drove the smaller players to run combined ratios much in excess of 100 for long periods of time.

The performance of several takaful companies tells the tale of weaker equity position, and bottom-line losses, only to be wrapped up with investment returns to provide positive returns to the shareholder. One would argue that in a wakala model, a portion of wakala fee is an element of return to shareholders, but then we get caught up in the qard spiral; qard is needed to cover underwriting deficits, mostly triggered by mix of inadequate pricing in the face of competition and lack of scientific assessment of risk. All of this dents the overall effective returns to the shareholders.

Lack of Product Innovation

Although there is a slow but positive change, but not enough has been done so far in developing savings and protection business, especially in the Middle East where family takaful is mostly less than 5% of total takaful (exceptions are Malaysia, and to lesser extent Indonesia, Pakistan, Bangladesh, Sri Lanka, Egypt). The growth of family takaful has had better success in Malaysia, while Indonesia and Pakistan are biding time to allow market realities of “real” demand for takaful to boost growth through windows of established players. Africa is now getting into takaful, more actively since the last 5 years, and looks towards established takaful players and takaful consultants in other markets to help them set up start-ups and seek advice for existing operations to function more efficiently.

Sudan, Saudi Arabia and Iran are by definition takaful markets, but are markedly different in the application of takaful models that are generally applied in other markets. Europe, with much better appetite for anything ethical, has been in the start-stop mode for several years for Shari’a-compliant ethical offerings. The one and only takaful company in the UK had to be closed in 2009 after only one year of operations but the reasons for it were nothing to do with the demand for takaful but it was rather about strategy to enter the market with the most capital-intensive product, motor. Not much has happened in North America in takaful, but Islamic finance in its various forms has grown there at a wholesale level.

GROWTH FUNDAMENTALS

The 380 years of head start by the conventional insurance over takaful should not mean that it would take 100 years or more for takaful to catch up to be at least equal to conventional market. Takaful has all the head start of technology and technical knowhow to make it work successfully at least in the first 50 years of its existence. Equally, whilst takaful structures, products, services and assets under management need to be built on sound ethical footings with watertight Shari’a compliance, it has to be part of the global insurance industry as principles of cooperation work better in large numbers. Takaful industry needs capacity and rated security to be able to provide secure and stable protection to big-ticket risks in oil, energy, marine, engineering etc, and that comes from sharing these risks in consortium with the global insurance capacity. Hence, the success of the industry lies in its ability to collectively position itself strategically to meet the needs of the economy and the ability to be competitive and innovative.15 Some of the growth fundamentals of takaful are:

Demographic

As demographics play an important role in takaful demand generation, demographic fundamentals infer significant future demand in many existing takaful markets. A large young, educated and under-insured population who are primarily Muslim, have helped to develop a strong

- Idris, 2011

market for takaful despite a challenging global economy. As this young population matures, it is reasonable to expect that the demand for takaful products, especially family takaful, would see a tremendous increase. It is projected that population in the GCC will increase at a 2.4% CAGR between 2014 and 2020 to reach 59.2 million, of which almost 57% are aged between 25 and 64. This large working population, with access to education, media, and new technologies, is expected to push the demand for insurance. Similarly, Malaysia’s young population and expanding middle-income bracket combined with low takaful penetration presents a huge untapped market. In Malaysia, youth constitutes 43% of the total population.

Increase Awareness of Takaful Benefits

The awareness for savings and protection products is likely to increase in future as socio-economic and demographic factors impact positively on the demand for takaful products. The socio-economic pressures have changed the cultural norms in several Muslim societies, as smaller family units are no longer a safety net for financial protection. The emphasis has been more on the need for self-actualization and esteem for family protection, but financial protection through insurance is gaining more awareness and acceptance in several countries such as Malaysia, Indonesia, Pakistan, India, Bangladesh, Iran, Egypt. This trend is beginning to translate into improvement in insurance penetration in the Middle East, Asia and Africa.

Bright Future for Takaful?

How does the future look like for takaful Industry? The future looks bright, but with caveats. There has been a process of introspection by industry practitioners, regulators, Shari’a advisors and shareholders in fixing a range of areas , biggest of all being the one that was the very reason why Islamic finance and takaful came into being; that, takaful “is a system”, “not a product”. The ethical meaning and impact of this system must be understood and effectively applied to the daily lives of people, businesses and investors. The will and purpose to promote ethical financial solutions should start from markets where majority of people prefer such products (these being the Muslim majority countries). For takaful to become a game changer, it must appeal to a large enough audience to make a difference and stand out in the crowd as a viable alternative. This requires amongst others, correctly profiling target markets and crafting a regulatory framework for takaful which are important strategies takaful companies need to take at the outset.

The governments in Muslim countries ought to be more supportive and pro-active for this industry to grow and even be the mainstream. This is beginning to gather momentum in the United Arab Emirates. Saudi Arabia, by definition, has all financial dealings on Shari’a-com- pliant basis, but takaful is structured there quite differently from what we know of takaful in other markets. Sudan of course has Shari’a-compliant system since 1984. OIC and IDB would do great service to this cause in building a consensus for enlarging the ethical system of Islamic finance. This would bring a sea-change in how the conventional reinsurance entities respond to setting up takaful and retakaful structures in accommodating takaful cessions and retrocessions. In its absence, if the current laid-back approach continues, customers, being used to the conventional products, will continue to have a perception that Shari’a-compliant products are simply a label.

Looking forward, it is not just Asia and Africa but also Europe, Turkey in particular, that are expected to see greater activity in new takaful structures coming up and existing markets going through rationalization of mergers and strengthening of their operations. The Islamic

- International Monetary Fund (IMF) data

- GCC Insurance Industry, 2015

Insurance Association of London is a welcome addition for the global takaful industry and is likely to be actively involved in helping to find takaful solutions in the UK and elsewhere. The lead taken by the United Arab Emirates and Dubai in becoming global hub for Islamic economy adds a tremendous weight to halal initiatives around the world.

If all of the above factors are adequately harnessed by takaful industry, covering savings, protection and long term retirement products, as well as commercial and corporate lines with opportunities created by the growth and development of Halal industry, it should add at least another US$100 billion of premiums to takaful industry by 2030, on the assumption that half of the US$3.4 trillion assets under management by the Islamic finance industry are insured as takaful. After all, with its ethical DNA, takaful should have an appeal for all, unlike conventional insurance that is reluctantly bought by only a small number of 2 billion Muslims. But this universal appeal will only work if takaful industry makes is ethical DNA a reality.