Retail banking products: An evolution in the offering

The GCC is the nesting ground for Islamic banking and finance. The region has seen robust growth in Islamic banking since its inception in 1975. Islamic retail banking has witnessed product introductions on both the asset and liability sides of bank balance sheets. However, these remain limited and concentrated on a few contracts.

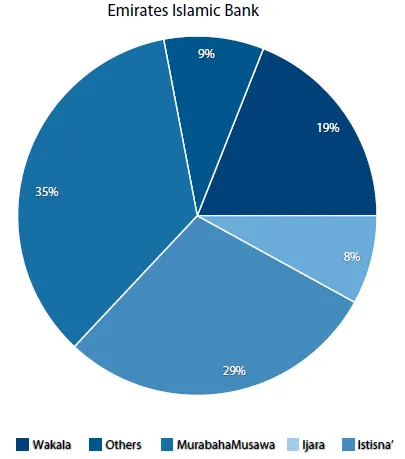

To take account of product range and concentration a survey was conducted of ten leading Islamic banks in GCC. The focus was on financing products, as the inter-bank market is known to be dominated by commodity murahaba.

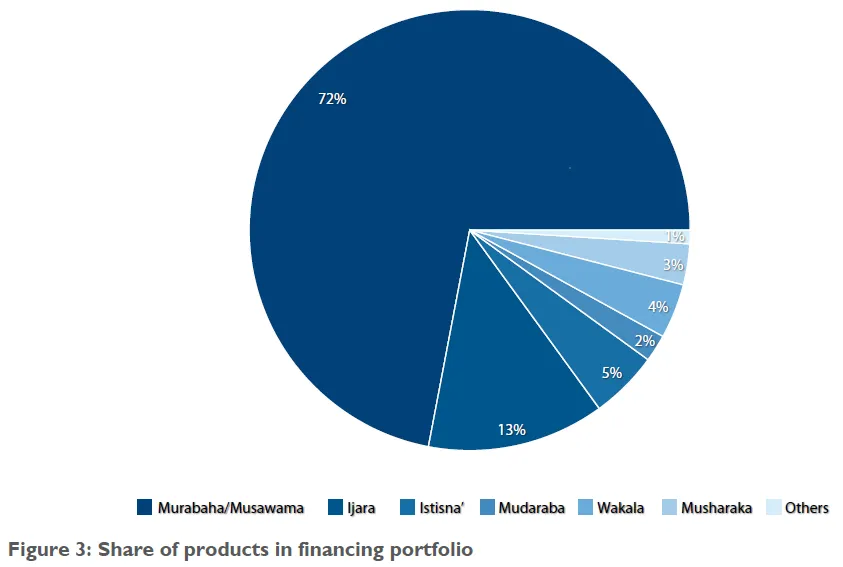

Over the years Islamic banks came to rely on murahaba and ijara products for their assets and murahaba and wakala products for their liabilities. The survey was conducted to understand any shift in this trend and the use of Islamic financing contracts in the banks’ overall financing strategies. All data pertains to the financial year of 2008.

Figure 3 illustrates that banks within GCC typically follow the same trend mentioned previously, and murahaba is still leading the financing product range offering (72% of total financial portfolio). It is followed with wide margins by ijara and istisna’ (13% and 5%) respectively.

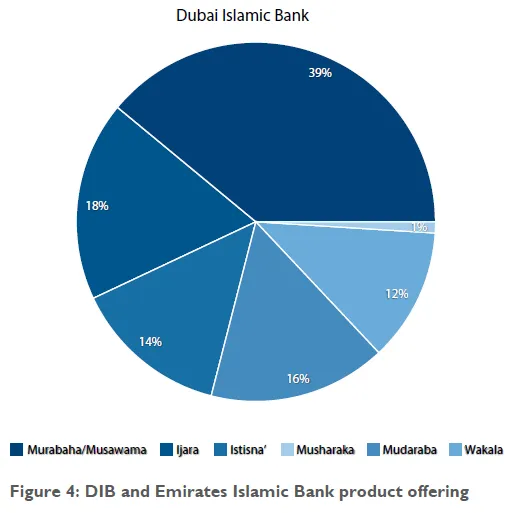

However, underlying trends are emerging in different jurisdictions. Just as in the case of the UAE, all three leading banks exhibit a greater range of diversity in their product portfolios and despite murahaba’s dominating presence, other products are also emerging indicating a maturing market and a growing expertise in using products of alternate risk/return profiles. In part, this is also an indicator of a corporate and commercial sector which has the appetite and understanding of sophisticated products. The UAE economy is comparatively more diversified than various other regional markets as illustrated in figure 4.

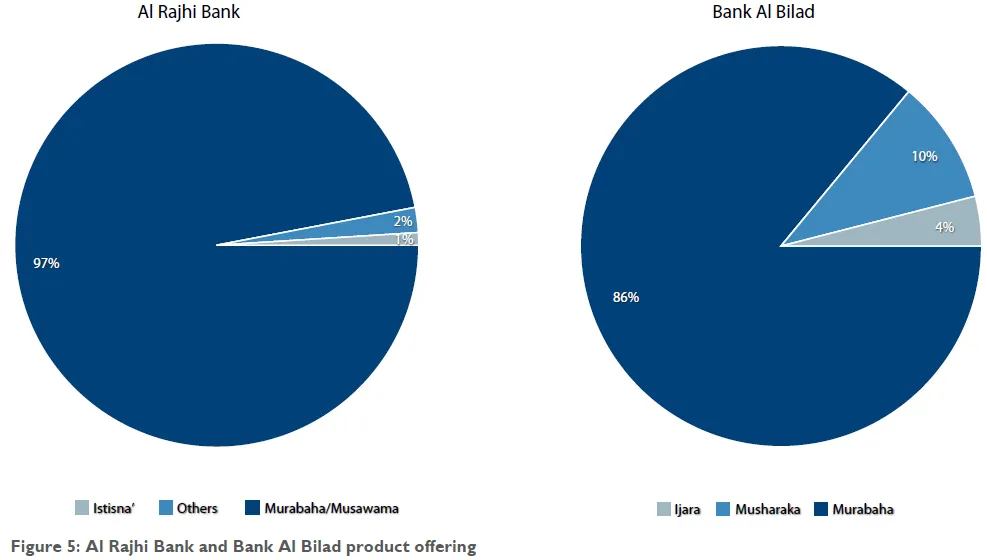

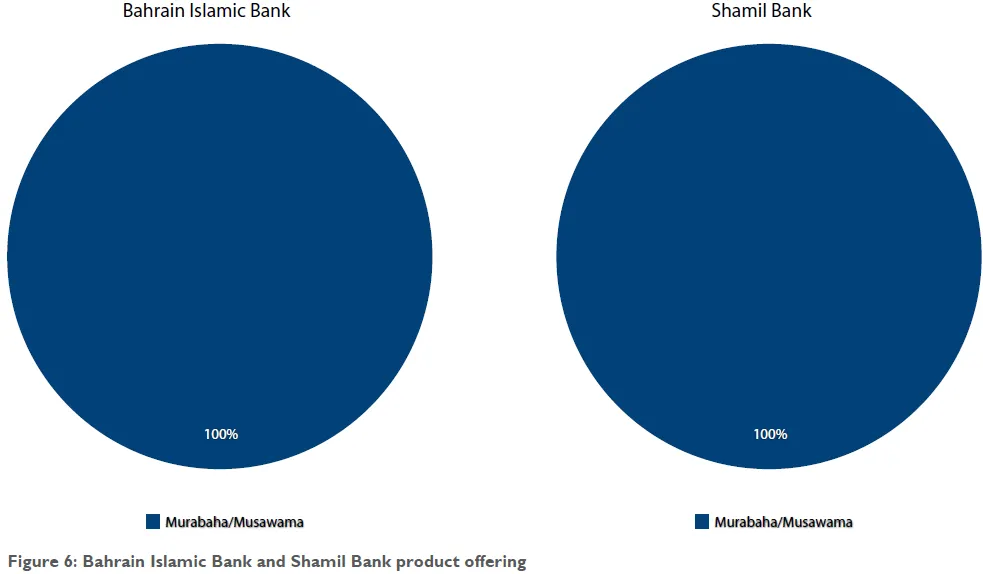

Islamic banks in Saudi Arabia are still overly reliant on products structured on murahaba and its derivate contracts like mutajara and instalment sales. Both Al Rajhi and Bank Al Bilad are using murahaba as their prime mode of financing. Mutajara and instalment sales collectively represent 97% and 86% financing of Al Rajhi and Bank Al Bilad, respectively. Considering the size and diversity of Saudi market, reason for this concentration appears to be the presence of other conventional banks that fill the gap relating to sophisticated and diversified products. It also reflects a situation where customers of Islamic banks have locked-in banking relationships and show a passive attitude in demanding a broad range of products. The third important reason that contributes to this trend is the fact that the Islamic banking market in the Kingdom of Saudi Arabia (KSA) has not yet reached a level where competition stimulates innovation or product offering diversity. Another interesting case is Bahrain, home to a large number of banks, only a few of which offer Islamic re- tail banking services due to the small retail market size. Banks that were covered in our survey show heavy concentration of their portfolio in murahaba financing. These banks are channelling most of their assets in investment activities that target real estate projects. A comparatively small industrial base in the country and limited retail banking customer base compel the banks to focus on investment activities rather than developing their financing book. Though there are signs of change and recently some banks like Bahrain Islamic and Shamil Bank have rolled out retail market products the shift is slow as can be seen by looking at their financing portfolio that is a small portion of their overall asset book. Comparably, Kuwait Finance House Bahrain has been offering a comprehensive retail banking offering available for the last several years and maintains a dominant position in the Bahrain banking sector.

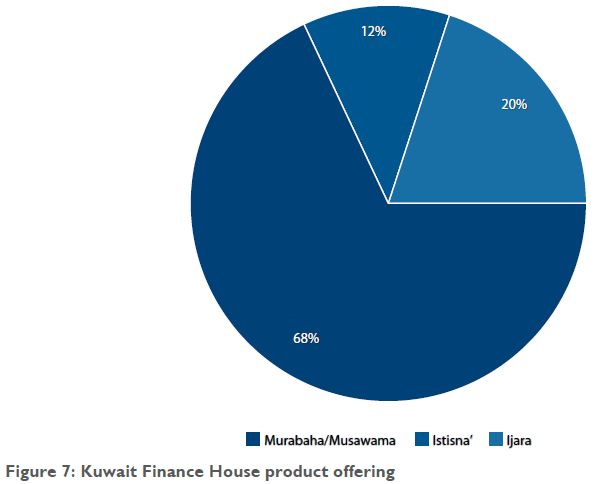

Like banks in the UAE, leading banks in Kuwait also show a diversification in the use of products for their financing portfolios. Kuwait Finance House Kuwait is a noted example that is using multiple products for its financing portfolio.

There are several reasons for the continued preference on the use of murahaba by Islamic banks. The most important reason is its similar features to debt, which makes it easier for bankers to manage as they are familiar with the structure from conventional banking. Another reason is the limited expertise of several institutions to involve the participatory type of financing arrangements which is also the reason why Islamic venture capital financing has not seen much growth in the GCC region. Additionally, participatory financing requires a supporting environment of transparency and friendly regulations including a sound legal system. These critical factors are slowly evolving and greater experimentation with Islam- ic financial products and structures along with increasing demand will help in achieving greater product diversity. Finally, willingness to share returns on profitable venture by businesses is an important demand side variable that requires a societal shift in thinking. Despite this situation, competition and desire to increase market share is forcing Islamic banks in the UAE increase product diversity. Other markets with the right mix of enabling environment and competitive market space can also achieve this state which would not only minimize risk at the institutional level but will also contribute in the creation of stronger financial systems.

Product offering by leading Islamic banks

Islamic banks in the GCC have different product availability profiles. After understanding the portfolio distribution on product types, we move on to review the product categories that are on offer by key institutions.

Deposit accounts are bank relationship initiators and the main source of funds for investment and financing activities. Various Islamic banks have a wide spectrum of account offering that reflects their funding strategy. The wider the range, the more sophisticated the liquidity management approach.

Differentiated deposit accounts also reflect a bank’s strategic choice to raise deposits of a particular type and make it easier to predict the impact of their customers’ financial behaviour on their deposit pools.

A broad range of deposits also enables a bank to structure innovative financing products that are aligned with deposit behaviour.

A sample of 11 banks in the GCC shows that almost all banks offer basic accounts to their customers. How- ever, the way individual deposit products are packaged differ significantly. Most of the accounts now provide access through alternative banking channels, i.e. internet banking, phone banking, ATM and such features as free chequebook, debit card and monthly statements. Despite such common offerings the differentiation occurs in service and delivery quality. We have explored the quality of alternative banking channels of selected banks in our subsequent section.

It is important to note that out of the 11 banks only 4 offer value-added accounts to their customers. There are different reasons for this practice. In the case of older Islamic banks the need for new account types is not felt due to their established customer base. Several studies have shown slow and passive customer behaviour in switching banking institutions in the GCC and the UAE. Some banks were simply awash with liquidity and had easy access to the money market until the financial crisis hit the region. Moreover, several of these banks are directly or indirectly owned by governments and in cases where economies are less affected by the financial crisis banks have received support in different forms.

Similarly, the reason of offering value-added accounts differ from bank to bank. Banks in the UAE are facing a more competitive environment and one way to compete is to focus on market niches. As the UAE have the largest expat population in percentage terms, focusing on their investment and salary management needs appeared to be a sound strategy. Banks such as Bahrain Islamic Bank (BIsB) offered reward-based accounts to raise capital which had considerably dried up at the peak of the financial crisis. KFH in Kuwait is focused on developing and capturing a loyal customer base which has prompted it to offer special accounts targeted to a younger demographic.

The review of financing products in the following section will further highlight how banks with value-added deposit accounts are able to offer a wider range of products.

| BANKS | CURRENT ACCOUNTS | SAVINGS ACCOUNT | TIME DEPOSITS | VALUE ADDED ACCOUNTS | ||

| Bahrain Islamic Bank | Savings Account | Investment Deposit | Iqra | Tejori | ||

| Shamil Bank | Current Account | Savings Account | MudarabaInvestment Account | |||

| Kuwait Finance House | Current Account | Savings Account | Bara’em | Shabab Al Deera | Electron Account | |

| Al Rajhi Bank | Current Account | Salary Package | Pension Account | |||

| Bank Al Bilad | AlBilad Account | Ithmar | ||||

| Dubai Islamic Bank | Current Account | Savings Account | Investment Account | |||

| Dubai Bank | Current Account | Savings Account | Value Account | Recurring Investment Account | Payroll Account | |

| Qatar Islamic Bank | Current Account | Savings Account | Time Deposit | |||

| Qatar International Bank | Current Account | Savings Account | ||||

| Noor Islamic Bank | Noor Current | Noor Savings | Noor Term Deposit | Noor Saving Plus | Noor Dual | Noor Payroll |

| Al Hilal Bank | Al Hilal Current / Al Hilal Privileged | Al Hilal Saving | Term Deposit |

Residential Financing

During the last ten years, the GCC markets have seen tremendous growth in domestic mortgages. The real estate boom was the main driver for this activity, where almost all Islamic banks took on huge exposure to real estate. In the case of Islamic investment banks, this investment preference, at least until recently, had its reasons as no bank wanted to miss out on the windfall profits generated by financing real estate assets.

Retail housing finance has two demand drivers in the GCC: a higher birth rate and migration. Population growth in the GCC is amongst the highest in the world and the region also had an increasing expatriate population increasing the demand for housing. For the aforementioned reasons, real estate was generally considered a low-risk / high-return investment class, and attracted both genuine and speculative investors.

To support this burgeoning demand, Islamic banks de- vised different housing finance products that fulfil the demands of different customer groups. It is interesting to note that the most diversified use of Islamic finance contracts has only been observed in housing finance products. Some contracts used to structure housing finance products throughout the GCC are ijara, forward ijara, musharaka, murahaba, musawama and istisna’.

The figure 9 below provides a snapshot of the financial products available for residential real estate purchase All the Islamic banks in our sample, offer housing finance products to their retail clients. Positioning a product requires an easy and relevant name that will attract customer attention. Most of these banks it appears, have not given their product a catchy name for customer reference. In the absence of a product name and effective product marketing, customers associate a particular service with their perception of a financial institution. Although it can be an effective strategy when the bank itself is an established brand name in the market, it would most likely limit the promotion of a product that is not aligned with the bank’s overall image.

Banks are using a multitude of underlying contracts for their products. The most favoured contract is ijara, be- cause it provides banks with more flexibility in terms of structuring and restructuring financing arrangements. It also allows banks to charge for the depreciation of financing assets and to receive tax advantages. Forward ijara, a modified version of ijara, has also been adopted by financial institutions by facilitating their clients to re-serve properties under construction. Istisna’, murahaba and musharaka, though offered by several banks at a retail level, are mostly used for project financing.

In recent years, banks have adopted the features of pure mortgage type products, i.e. long mortgage tenors with the mortgaged property serving as a primary security on the finance. Until recently, in Bahrain, due to various political and legal issues residential financing was structured as a personal finance product, not as a pure mortgage product. Shamil Bank, Bahrain Islamic and Kuwait Finance House however have each developed competitive, true mortgage products.

The residential finance market after experiencing a slow period, is now enjoying an upward trend. Recent government measures and rescue efforts are recreating interest in real estate. Both banks in our sample from Qatar show a maximum mortgage tenor of 8 and 7 years, respectively. This information on their website needs some revision, as banks in Qatar are allowed to extend financing for up to 25 years. Qatar Islamic Bank enjoys a dominant position among Islamic banks with reference to housing products, and has the ability to accommodate customers with various degrees of residential countries has become a stringent criterion to avoid reoccurrence of a real estate bubble. Such regulatory measures will certainly impact the demand of housing products by discouraging speculative activity.

| BANKS | NAME OF PRODUCT | UNDERLYING CONTRACT | MAXIMUM TENOR | MINIMUM PROFIT RATE | MINIMUM DOWN PAYMENT | RECONSTRUCTION/ RENOVATION | LAND | MAXIMUM AMOUNT |

| Bahrain Islamic Bank | Property | Ijara/Musharaka | 25 yrs | 8.50% | 10% | Yes | Yes | BC 0.5 m |

| Shamil Bank | Shamil Home Finence | Ijara/Murabaha | 30 yrs | N/A | 10% | Yes | Yes | BC 0.5 m |

| Kuwait Finance House | Real Estate Finance | Murabaha/Ijara | 25 yrs | N/A | N/A | Yes | Yes | N/A |

| (Bahrain) |

Auto Finance

Auto finance is one of the most dynamic product categories in the GCC markets. Competition is intense with similar pricing strategy among the key players. The key

factors behind market share are quality of service and marketing. The figure 10 below shows that branding is an issue with several of the banks in our sample. Differentiating a product from the rest of the market offering is necessary, and catchy product names can help in achieving this goal.

Almost all auto finance products have been structured on the murahaba/musawama contract due to the rapid depreciation of vehicle values. Banks like to avoid repossession and prefer to convert their exposure into debt for better recovery. It further absolves them from assuming any responsibility relating to non-performance/ bad performance of the asset. Takaful covers protect customers against such risks.

Shamil Bank, Qatar International Islamic Bank, and Ku- wait Finance House lead in terms of offering long-term auto finance. It can be an attractive feature but exposes banks to higher risks as most auto assets lose a significant portion of their value by their fifth year.

Low down payment requirement is a motivating factor in sustaining the auto finance industry, as most of the vehicle purchases in the GCC have been financed this way. Several institutions offer financing on zero down payment. Such features have now increasingly become standardized as banks focus on adding value to delivery and services for their customers.

Kuwait Finance House in Bahrain with its Auto-Mall, and Al Hilal Bank with its Financial Mall branch have offered a new experience for their customers. Al Hilal Bank claims to process an auto finance request and delivery of a car in just one hour. Innovative product and delivery solutions will surely be the critical factors in determining leadership in the industry.

Islamic banks in Qatar resort to a strategy that is unique to the country. Banks in our survey offer amazingly large financing upper limits. In fact, in the case of Qatar Islamic Bank, there is no upper limit and its product offering perfectly suits the needs of the rich local population.

Banca takaful

Bancatakaful is defined as ‘the delivery and distribution of a suitable range of tailored ‘bankable’ protection and long-term savings and pension products designed to meet the lifecycle needs of the customer base of a bank or other financial institutions’. Takaful is considered to be the fastest-growing sector in the Islamic finance industry. This growth has been propelled by the fact that it presently has little penetration in Muslim countries where Muslims abstain from conventional insurance. The GCC region is no exception, and offers great potential for growth. On the other hand, Bancassurance is the selling of insurance and banking products through the same channel, most commonly through bank branches selling insurance. Bancassurance is a relatively

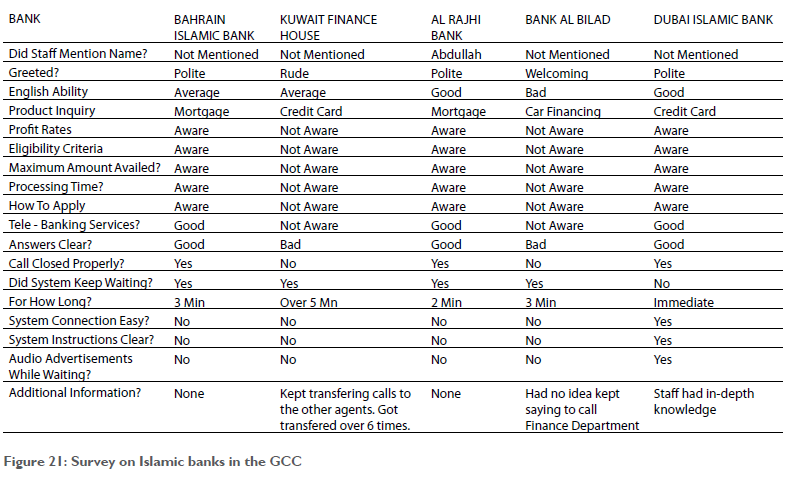

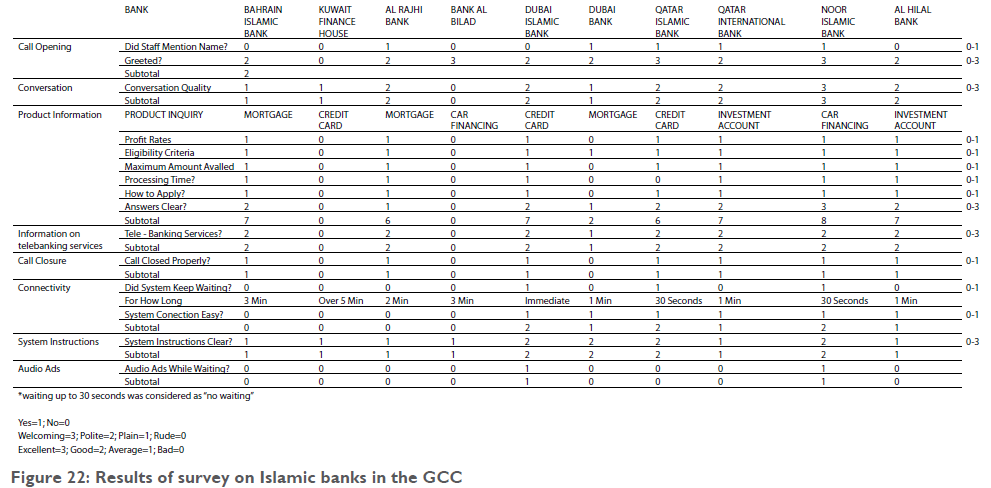

It was observed that the systems side of tele-banking was weak in the case of several banks in our survey. This is directly related to the choice of system and their inherent capabilities. As our survey was conducted with a user experience perspective, we have not investigated the technical capabilities of the system, but generally an impression was captured on the use of the system. In this competitive banking market, a good tele-banking system can certainly improve the competitive position of a bank. The survey result highlights the need to im- prove the user-friendly aspects of the systems.

Finally, it was observed that only two banks are using audio ads embedded in their tele-banking offering. This is an interesting observation, and indicates an overlooked opportunity by banks to market their products to their captive audience. The overall results of the survey indicate the need to improve human interface, as well as the systems aspect of tele-banking offering. Our selected banks are considered flagship entities in Islamic banking. Several of them however, still need to realize the enormous potential of this important delivery channel.

Evaluation of Islamic Banks’ websites

Islamic banks are presenting themselves as a Shari’a-compliant alternative to conventional banks. This position gives them the opportunity to attract an important market segment, which prefers Shari’a-compliant financial solutions, and also exposes them to the challenge of proving to be more or at least as efficient as conventional financial institutions.

So far Islamic banks were predominantly preoccupied with offering products which fulfil the needs of customers who are served by the conventional financial sector. However, in recent years, there has been an increase in awareness in offering technologically advanced solutions.

During the last decade, web presence has emerged as a key channel for service delivery. Websites have pro- vided convenience and flexibility to customers and cost saving and an alternative marketing channel to banks.

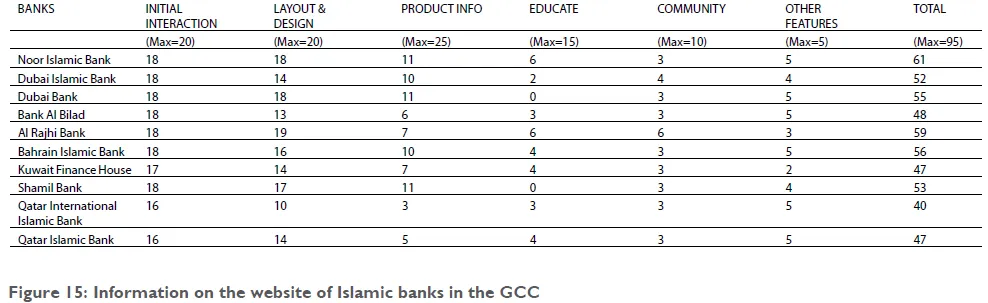

Considering the potential and promise of web-based service channels, we conducted a survey to evaluate the quality of websites managed by Islamic banks. This survey focused on the layout and content quality of web- sites and evaluated such features as initial interaction, layout and design, product-related information, social responsibility and education of users. This survey does not cover the internet banking offering of banks as that would have required access to their internet banking portals which are only available to their customers.

The survey has used websites of leading banks as a benchmark to ascertain industry best practices. Websites of Citibank, BNP Paribas, Standard Chartered Bank, and HSBC Bank were observed for this purpose.

The maximum score on this survey was 95, however almost all websites maintained by Islamic banks lags far behind this maximum point. Only one bank; Noor Is- lamic Bank was able to reach the mark of 60 points, closely followed by Al Rajhi Bank with 59 points. These two banks may be considered industry leaders in the effective use of web-based banking among the Islamic banks in GCC covered in this survey.

All three banks (Noor Islamic Bank, DIB and Dubai Bank) from the UAE market in our survey performed better indicating the competitiveness and maturity of the region’s banking sector. Banks from Bahrain also exhibited greater sophistication in managing their web- sites. Banks operating in Qatar are lagging behind in the sample group. Qatar Islamic Bank and Qatar International Islamic Bank both require major initiatives to bring their websites to industry standards.

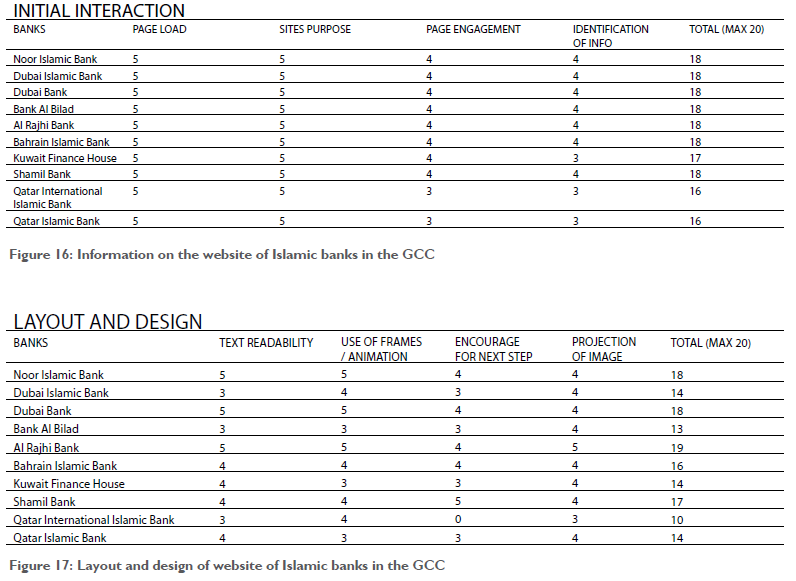

Almost all the banks in our sample performed well in the areas of basic website functioning like page loading, website purpose, page engagement and identification of required information. This section covers the initial interaction of the visitor with the website. Research has shown that the initial few minutes on the website controls the decision of a visitor to explore the website further or close the window. We observed an across-the-board good performance by all the websites. However, for a few of the banks there is still room for improvement.

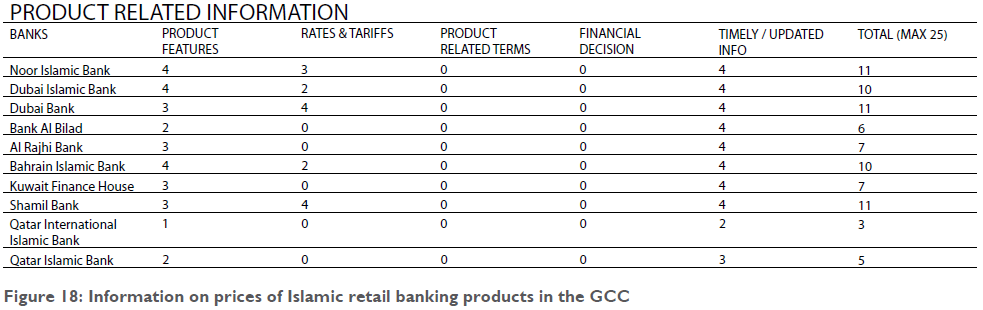

Layout and design of websites are important in capturing perspective client’s attention. Interestingly, it is once again the Islamic banks from the UAE who are in the lead and have obtained the highest ratings.

Al Rajhi Bank’s website can be categorized best in terms of layout and design and indicates the prowess of the developer and IT team.

The heart of a bank’s website is usually the information that covers its products and services. Product-related content actually plays instrumental part in customer decision-making. The benchmark group in the survey has shown a high level of creativity in the content creation and the level of information being disseminated. The component of product information on the web- sites of Islamic banks appears weak a compared to other variables. Even the highest ranking that Noor Is- lamic and Dubai banks were able to secure is not comparable. Islamic banks need to appreciate the power of this alternative delivery channel and learn from their conventional counterparts. Information content should be presented in levels of detail that will assist customers to make their financial decision. Several websites of these banks have given inconsequential information sim- ply introducing customers to products and eventually requiring them to contact them through a call centre or visit the branch for further information. Ideally, a good website should provide a complete solution and minimize utilization of other service channels.

The banks from the UAE and Bahrain stand ahead in terms of product information and design. Saudi Arabian banks appear in the middle whereas banks from Qatar lag behind the other players in the GCC market. Prod- uct information on the websites of Qatari banks is very basic limiting users’ ability to make financial decisions based on website information. The power of web media has yet to be unleashed and requires a fresh focus. This will not only result in a better image of the banks but would also assist in decreasing operational costs.

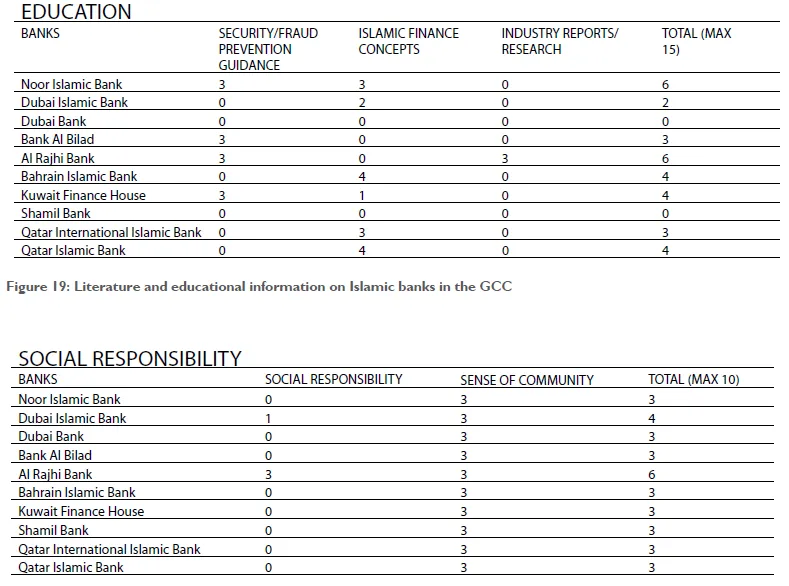

All leading conventional banks use their websites to educate their customers. Financial products are complex in nature. Educating customers is in the best interest of banks as better-informed customers can easily appreciate the features of new and improved products and can compare these products with other products available in the market. It also strengthens the relationship between banks and customers as customers start to perceive their bank’s trusted advisors and source of financial information.

The websites of the Islamic banks in our sample are poor performers in this important feature. Either they do not educate at all or do it inadequately. The situation becomes more severe due to the fact that Islamic products are relatively new and complex in their structures. Al Rajhi and Noor Islamic Bank have received the highest points in the group but even these higher points are low compared to the overall score in this category.

During the last two decades corporate social responsibility has emerged as a key factor in determining the overall performance of organizations. Banks and other financial institutions are no exception. Almost all the leading conventional banks show their understanding and commitment to the idea of corporate social responsibility. Banks in the conventional finance sector have chosen social causes to support, and run well-structured programs for fulfilling their corporate social responsibility agendas.

In recent years, several conventional financial institutions have endorsed and adopted “Equator Principles, a set of environmental and social benchmarks for managing environmental and social issues in development project finance globally”. It is worth noting that none of the Islamic banks from GCC have adopted these principles.

Green banking is also an emerging trend and several banks have shown their commitment in supporting business initiatives that deal in sustainable technologies and solutions. Moreover, these institutions also adopt an organizational structure which makes them an environment-friendly place to work. Unfortunately, so far no Islamic bank has shown commitment to any such cause.

Not surprisingly, Islamic banks were unable to achieve significant rankings on this feature of their websites. Almost all of them fail to provide any information related to their commitment to social causes or their stand on corporate social responsibility. They have received an average ranking on the feature of their ability to develop a ‘sense of community’ in the visitors. In fact these websites in their appearance and structure closely resemble websites of conventional banks. A key factor is the background of top management which has come from conventional banks and misses the potential of creating a strongly differentiated image.

Other factors in the survey focus on tools such as Search, Careers, Site Map, News and Terms & Condition for the use of site. Banks have generally covered these features on their websites and hence have received better points.

The results strongly indicate that Islamic banks are not fully benefiting from the potential of web-based delivery channel. Their websites requires improvement, particularly, in the areas of product-related information, effort to educate their customers and information related to their commitment of social reasonability. A renewed focus and strategy to offer excellent alternative delivery channels can also enable Islamic banks to reap the benefits of technology revolution in the banking industry.