Top 10 Influential Persons In The Global Islamic Financial Services Industry

This chapter presents the 10 most prominent and influential personalities of the Islamic finance industry, which are spearheading the industry forward. These are leaders who have pioneered leading Islamic financial institutions; who have trail-blazed the development of Islamic finance in their respective countries and beyond, and whose ideas and policies shape corporations, governments and economies. We have focused on people who matter right now rather than those who have been influential over the course of a long career, although some clearly meet both criteria.

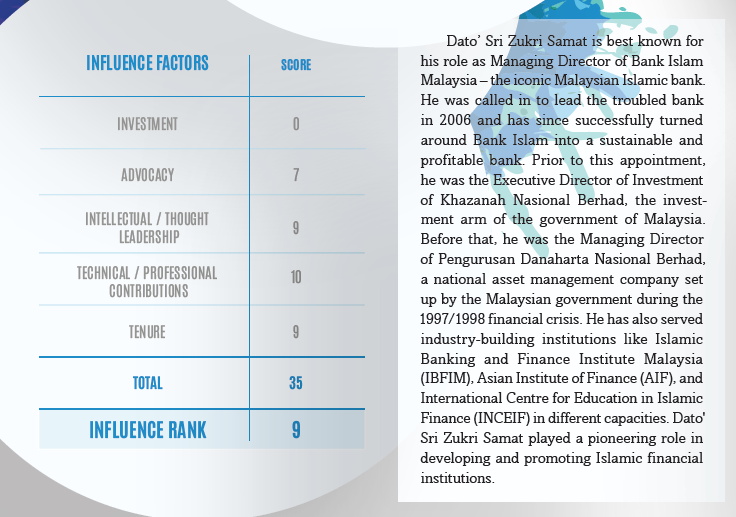

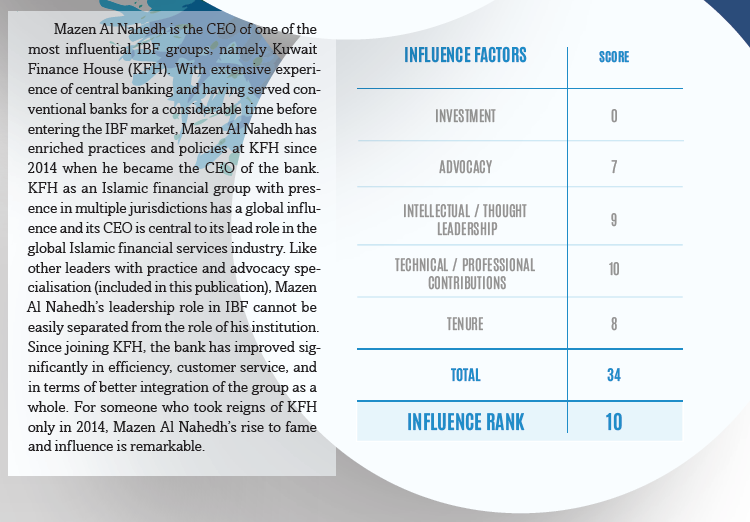

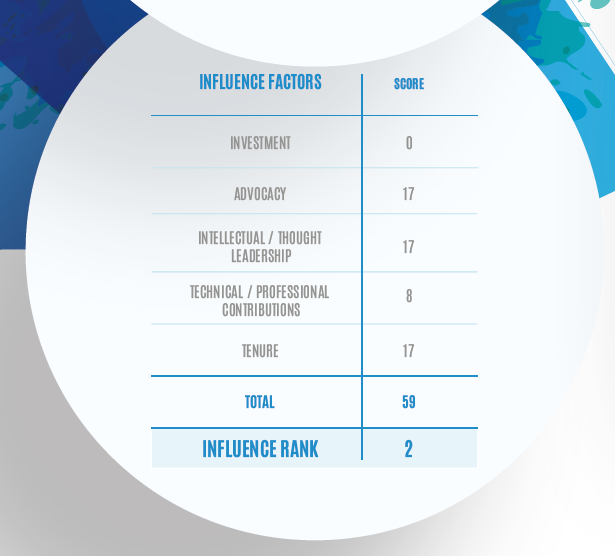

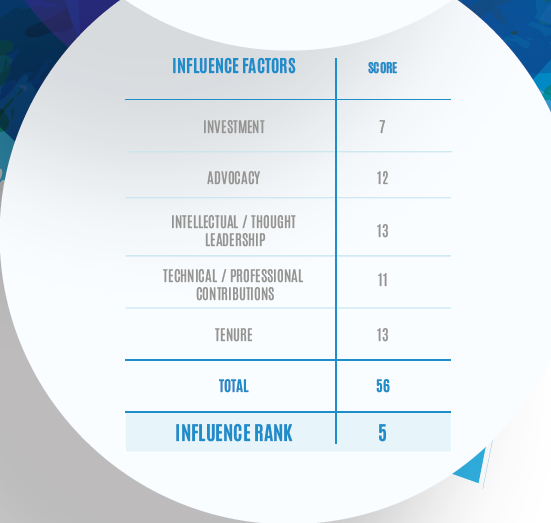

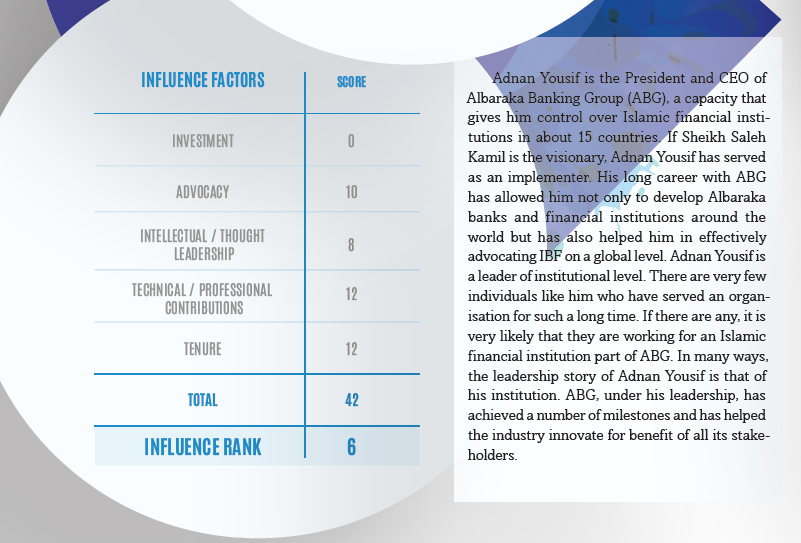

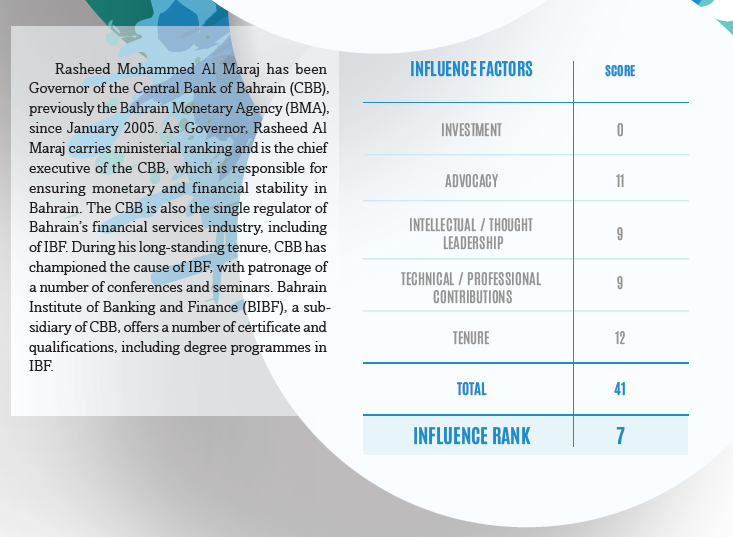

These leaders are ranked based on GIFR Influence Index (developed by Cambridge IF Analytical). The GIFR Influence Index rank top leaders in IBF on the basis of 5 factors, namely, investment, advocacy, intellectual/thought leadership, technical/professionals contribution and tenure. These five factors are equally weighted to give rise to a maximum value of 100.

There is certainly room for more influential personalities to stand out and further help progress the Islamic financial industry forward. Due to the rise in the outstanding achievements that the industry has made so far across the various sectors there needs to be more visionary leaders involved in promoting and advancing the industry. It is hoped that this list of global leaders in Islamic finance will serve as a source of inspiration for future leaders to lead and develop global Islamic finance to its true potential.

Thomas Edison revolutionized the world by inventing and commercializing electric bulb. Bill Gates comes to mind when one thinks about making information technology accessible to individuals. Steve Job is acknowledged and celebrated for humanizing technology. In financial inclusion, Professor Muhammad Younus made it possible for the underprivileged and financially excluded to gain access to finance. These were and are some of the movers and shakers of the world who have paved the way for us today.

But who comes to mind when one thinks about Islamic banking and finance (IBF)? Who are the pioneers of IBF? Who are the “movers and shakers” in IBF? Who had contributed immensely in shaping the scope and reach of IBF? Dr. Ahmed Elnaggar is accredited with the setting up of the world’s first Islamic financial institution – a microfinance house set up in Egypt. The founder of Dubai Islamic Bank – Saeed Lootah, although has not attracted as much universal acclaim as Dr. Ahmed Elnaggar, is one of the pioneering leaders in Islamic finance whose far-sightedness and fortitude has elevated the industry to a global level.

There are quite a few substantial key leading personalities that really shine out in the Islamic finance industry. One such leader is Dr. Ahmed Mohammed Ali, former President of Islamic Development Bank (IDB). He stands tall as someone who played pioneering roles in developing a number of Islamic financial institutions around the globe. Another influential personality in Islamic finance was the late Prince Mohammed Bin Faisal Al Saud, who developed Islamic banks as part of his pan-Islamic vision for business and finance.

His most significant investments are in the fields of banking and finance and he is one of the pioneers in Islamic banking.

Sheikh Sulaiman Bin Abdul Aziz Al Rajhi, another prominent Saudi businessman, was the mastermind behind the establishment of Al Rajhi Bank, the largest Islamic bank outside Iran. Dr. Zeti Akhtar Aziz, former governor of Bank Negara Malaysia, has made countless unprecedented achievements in the Islamic finance industry for years. Malaysia today has the most developed and systemic Islamic financial architecture in the world and this is influenced by Dr. Zeti Akhtar Aziz’s key contributions to the sector. She has definitely left an impressive legacy of services to IBF when she retired from her governorship of the central bank in 2016. These four pioneering leaders are highlighted in the Leadership Note of this chapter.

If we do not include Dr. Zeti Akhtar Aziz, whose leadership is distinctively different from the other three personalities mentioned above, in our analysis of global pioneering leaders in IBF, one might conclude that IBF and Saudi Arabia are closely linked. This is why many industry observers and analysts and the Western media tend to conclude that IBF is an outcome of petrodollars. However, the 10 leading personalities showcased in this chapter come from a number of countries other than Saudi Arabia, implying that the leadership in IBF is much more diverse than what a petrodollar-centric approach may otherwise suggest.

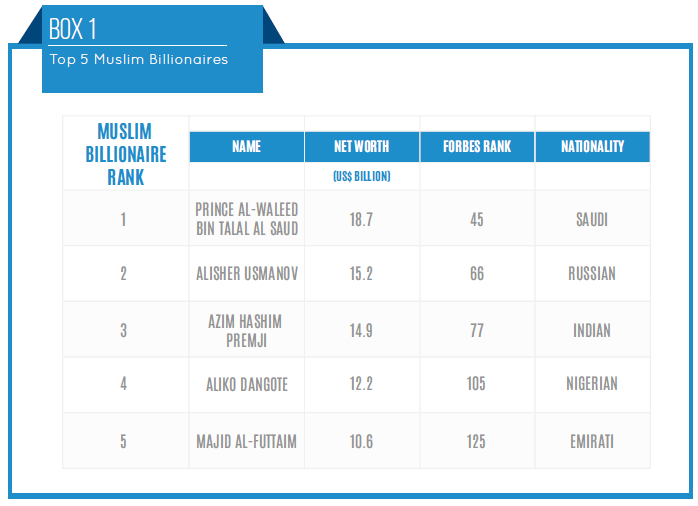

It is interesting to note that, IBF has not benefitted significantly from a Rothschild-like family that could have developed it on a global level as a bigger industry in a relatively shorter span of time. For example, the top 5 richest Muslims in the world have nothing to do with IBF (see Box 1).

First Generation of Islamic Economists

The first generation of Islamic economists was by and large a close group of Muslim economists who decided to promote research in economics within the wider framework of Islamic economic doctrine. The movement has failed to receive recognition from the mainstream community of economists. On the contrary, it has received more criticism than appreciation. Some Western Muslim economists like Timur Kuran and Mahmoud El-Gamal have emerged as its staunch critics. The likes of John Presley, Rodney Wilson and Volker Nienhaus are among the few European economists who have associated themselves with the discipline of Islamic economics. A list of selected Islamic economists who collectively have all the necessary expertise and intellectual that IBF needs for its growth and further development are as below:

Dr. Umar Chapra, Saudi, Winner of IDB Prize in Islamic Economics, 1989.

Professor Khurshid Ahmad, Pakistani, Winner of the IDB Prize in Islamic Economics, 1988.

Professor Mohammad Nejatullah Siddiqi, Indian, Winner of King Faisal Award 1982.

Dr. Muhammad Anas Zarka, Syrian, Winner of the IDB Prize in Islamic Economics, 1990.

Dr. Abdul Rahman Yousri, Egyptian, Winner of the IDB Prize in Islamic Economics, 1997.

Dr. Monzer Kahf, Syrian/American, Winner of the IDB Prize in Islamic Economics, 2001.

Dr. Rafiq Younus Al Misri, Syrian, Winner of the IDB Prize in Islamic Economics, 1997.

Dr. Abbas Mirakhor, Iranian, Winner of the IDB prize in Islamic Economics, 2003.

Dr. Zubair Hasan, Indian, Winner of the IDB Prize in Islamic Economics, 2009.

Mohamed Ariff, Malaysian.

Leadership Note 1

Dr. Ahmed Mohammed Ali – Former President of Islamic Development Bank

Dr. Ahmed Mohammed Ali is a Saudi national who served as President of Islamic Development Bank (IDB) since it was set up in 1975 until 2016 – a period of 40 years. During his long career as President of IDB, he remained central to development of IBF in the member countries of the Organization of Islamic Conference (OIC), renamed as Organization of Islamic Cooperation in 2011.

Under Dr. Ahmed Ali’s presidency, IDB emerged as the strongest multilateral financial institution in the OIC block. The bank provided infrastructural support to the member states to develop vibrant IBF sectors – Islamic banking, asset management, takaful, trade finance, and capital markets.

IDB also developed a number of industry-building initiatives and set up subsidiaries that helped the industry to grow globally. In this respect, the Islamic Corporation for the Development of the Private Sector.

As a personal example of discipline, perseverance and a true believer in the value of IBF, Dr. Ahmed Ali will be remembered and respected for his support, advocacy and leadership.

Leadership Note 2

– Founder of the DMI Trust and Faisal Banks

Prince Mohammed Bin Faisal Al Saud (1937-2017) was a visionary leader who thought well ahead of his time. He must be accredited as the founder of the modern Islamic banking, as even Dr. Ahmed Elnaggar (more widely known as founder of Islamic banking and finance) worked closely with him before the two gentlemen parted ways. Moazzam Ali, another visionary leader who set up Institute of Islamic Banking & Insurance (IIBI) in London also worked with Prince Mohammed Bin Faisal.

In its first phase of development, IBF owed a lot to the support and patronage of Prince Mohammed Bin Faisal Al Saud, the founder of DMI Trust – technically a trust but in effect a holding company, which owns banks, investment companies and insurance companies in Pakistan, Egypt, Sudan, Pakistan, Niger, Bahrain, Yemen and Saudi Arabia.

Even before his death in January 2017, his son, Prince Amr Mohammed Al Faisal, emerged as the new face of DMI Trust that continues to hold interests in 55 Islamic banks and financial institutions around the world.

Prince Mohammed Bin Faisal was one of the most revered Muslims in the world. His pioneering role in the development of IBF will be noted with respect in the history of IBF.

Leadership Note 3

Sheikh Sulaiman Bin Abdul Aziz Al Rajhi – Founder of Al Rajhi Bank

Sheikh Sulaiman Bin Abdul Aziz Al Rajhi is a Saudi billionaire who founded an Islamic bank in his native country and gradually built it to become the largest Islamic bank in the world (outside Iran). Without the pioneering role played by Al Rajhi Bank, it would have been difficult for IBF to assume importance and significance in the Kingdom of Saudi Arabia. While the other two prominent investors – Prince Mohammed Bin Faisal and Sheikh Saleh Kamil – chose to develop IBF as a pan-Islamic business, with a primary focus outside Saudi Arabia; Sheikh Sulaiman Al Rajhi is accredited with introducing Islamic banking in Saudi Arabia when it was considered a taboo to do so. The government and other authorities in Saudi Arabia were very sensitive to the use of the term “Islamic” banking – and to a large extent remain so to-date. Al Rajhi Bank emerged as an Islamic bank without explicitly calling itself as an Islamic bank*.

Outside Saudi Arabia, the family owns Al Rajhi Bank Malaysia Berhad and a number of companies (industrial as well as financial) throughout the world.

Leadership Note 4

Dr. Zeti Akhtar Aziz- Former Governor of Bank Negara Malaysia

Dr. Zeti Akhtar Aziz remained a global champion of IBF for more than a decade before she left Bank Negara Malaysia (BNM) as its longstanding governor in 2016. During her tenure (2000-2016), BNM developed a comprehensive regulatory framework for Islamic banking and takaful. She was also instrumental in the government of Malaysia’s decision to set up and host Islamic Financial Services Board (IFSB). Other important establishments that must be accredited to her include International Centre for Education in Islamic Finance (INCEIF) and International Shariah Research Academy for Islamic Finance (ISRA) in 2006 and 2008, respectively. She was also instrumental in setting up the Royal Award in Islamic Finance, a prestigious Islamic finance awards programme that aims at honoring leading personalities in IBF for their works and contribution to IBF.

The most remarkable development in the field of IBF during her tenure was the promulgation of Islamic Financial Services Act (IFSA) 2013, a Malaysian legal and legislative framework enacted to provide for the regulation and supervision of Islamic financial institutions, payment systems and other relevant entities and the oversight of the Islamic money market and Islamic foreign exchange market to promote financial stability and compliance with Shari’a and for related, consequential or incidental matters.

It was Dr. Zeti Akhtar Aziz’s vision and commitment to IBF that she set up Malaysia International Islamic Financial Centre (MIFC) to encourage global players to set up their IBF businesses in Malaysia. Founded in 2006, MIFC is a network of the country’s financial sector regulators, including BNM, Securities Commission Malaysia, Labuan Financial Services Authority and Bursa Malaysia (formerly Kuala Lumpur Stock Exchange), Government ministries and agencies, industry players from the Islamic banking, takaful, re-takaful and Islamic capital market industries, human capital development institutions as well as professional ancillary services companies ranging from legal firms and Shari’a advisories to tax and audit firms and research companies.

As a champion of IBF, Dr. Zeti Akhtar Aziz gave hundreds of speeches and keynote addresses at IBF-related conferences, workshops, symposia and fora. These speeches in themselves make up a great literary treasure on the topic.

Sheikh Saleh Kamil is indeed a stalwart advocate of IBF. He is a leader that has committed himself to promotion of IBF through personal investments, financial support to academic institutions for setting up research and instruction in IBF, founding of Shari’a discussion platforms, and advocacy of Islamic business and finance.

As founder and chairman of Dalla Albaraka Holding Company and its financial sector subsidiary, Al Baraka Banking Group (ABG), he owns Al Baraka banks in 15 countries. There is no other Islamic banking group in the world matching its global outreach.

Born in Taif, Saudi Arabia, in 1940, Sheikh Saleh Kamil has since the late 1970s taken a strategic position to develop IBF as part of a pan-Islamic business movement. With an estimated net worth of US$2.1 billion, he has financial resources, strategic vision, and a network of organizations and institutions, which he has helped develop to promote IBF. Two of his industry-building initiatives include: (1) General Council for Islamic Banks and Financial Institutions (commonly known as CIBAFI); and (2) Islamic Chamber of Commerce, Industry and Agriculture (ICCIA). The former is an umbrella organization for the institutions offering Islamic financial services, and the latter aims at creating linkages to promote intra-OIC business and trade. CIBAFI is headquartered in Bahrain, while ICCIA is based in Karachi, Pakistan.

Sheikh Saleh Kamil is also known for his philanthropy. He has funded a number of research centers and academic institutions to promote Islamic economics, banking and finance. The most notable is Islamic Economics Institute at King Abdulaziz University Jeddah, his alma mater. The Institute has spearheaded research in Islamic economics, a study area close to Sheikh Saleh Kamil’s heart.

Dalla Albaraka Group has also for last 35 years been organizing an annual symposium on Islamic economics at Jeddah, which is attended by a vast number of Shari’a scholars and Islamic economists from around the world. The proceedings of these symposia have served as compendia of Shari’a opinions issued by the prominent contemporary jurists.

Sheikh Muhammad Taqi Usmani is considered as the most influential hanafi jurist of the present times. Although his intellectual contributions go beyond IBF, he is known for his deep understanding of fiqh al-mu’amalat al-maliya (jurisprudence of financial transactions). As Chairman of Shari’a Board of Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), he has been involved and has supervised development of scores of Shari’a standards governing Islamic financial transactions. In recognition of his services to IBF, he was awarded the prestigious IDB Prize in Islamic Finance in 2014.

Born in Deoband, India, in 1943, where his parents lived at that time, his family migrated to Pakistan after the division of India in 1947. He graduated from Darul Uloom Karachi where he now serves as a Vice President. Darul Uloom Karachi has produced thousands of graduates, a large percentage of whom has lately started specializing in fiqh al-mu’amalat al-maliya. Consequently, there is hardly any Islamic financial institution in the country, where graduates of Darul Uloom Karachi are not employed either as Shari’a advisors or in mainstream banking roles.

As a judge of Federal Shariat Court of Pakistan and of the Shariat Appellate Bench of Supreme Court of Pakistan, he was involved in some of the most historic Shari’a judgments of the present times, the most notable being a detailed judgment on the prohibition of interest. This judgment has paved way for possibility of complete elimination of interest from the Pakistan economy.

Although his Shari’a advisory appointments are not as many as of his other contemporary Shari’a scholars, he has been very strategic in the choice of his engagements. Through AAOI- FI’s Shari’a Board (as Chairman) and OIC Fiqh Academy (as Vice Chairman), he holds a unique position to influence Islamic juristic thought. His writings have had huge impact on finance practitioners to understand how to structure interest-free products and services for an Islamic financial lifestyle. He has also played an instrumental role in introducing teaching of Islamic finance within the curriculum of traditional religious institutions.

Comparing Sheikh Taqi Usmani with Sheikh Saleh Kamil, these are two very different types of leaders. The former has provided much needed intellectual leadership, while the latter has contributed with capital and investments to establish IBF as a pan-Islamic business.

Professor Rifaat Abdel Karim is arguably the most influential architect of IBF. He has set up, run, and built a number of industry-building institutions. His most notable contribution, however, has been the setting up of AAOIFI, which he founded in 1990-91. It is not an exaggeration at all to claim that IBF would not have developed to what it has emerged today, without the regulatory, accounting and Shari’a frameworks developed by AAOIFI.

Amongst its most remarkable achievements is the issuance of 94 standards in the areas of Shari’a, accounting, auditing, ethics and governance. Its standards are adopted by central banks and regulatory authorities in a number of countries, either on a mandatory basis or as basis of guidelines. AAOIFI is supported by numbers of institutional members, including central banks and regulatory authorities, financial institutions, accounting and auditing firms, and legal firms, from over 45 countries. Its standards are currently followed by the leading Islamic financial institutions across the world and have introduced a progressive degree of harmonization of international Islamic finance practices.

Professor Rifaat Abdel Karim remained its founding Secretary General until 2002, when he was asked to become founding Secretary General of another path-breaking institution, namely Islamic Financial Services Board (IFSB). Under his leadership, IFSB emerged as a premier standard-setting body for regulation of IBF.

Malaysia – a global leader in IBF – set up another institution of immense importance for providing required liquidity to Islamic financial institutions, namely, International Islamic Liquidity Management Corporation (IILM) in 2010. In the beginning, the institution was slow in developing innovative tools for liquidity management, and Professor Rifaat Abdel Karim was asked to become its second CEO in 2012. Since then, under his leadership, IILM has emerged as an institution of international repute for providing liquidity management tools to the Malaysian institutions as well as other institutions seeking Islamic liquidity management solutions. He left IILM at the end of 2016.

Born in Sudan, and educated in the UK, Professor Rifaat Abdel Karim has been a leader of significance and professional of influence in the global Islamic financial services industry. His services have been acknowledged and celebrated with numerous awards and accolades. Among other awards and prizes, he received IDB Prize in Islamic Finance (2010) and the Royal Award in Islamic Finance (2016).

Professor Rifaat Abdel Karim is distinct in his leadership from the likes of Sheikh Saleh

Kamil and Sheikh Taqi Usmani, who contributed to the development of IBF with investments and Shari’a intellectualism, respectively. Professor Rifaat Abdel Karim is perhaps the most celebrated professional in the global Islamic financial services industry, who also holds impeccable academic credentials.

When it comes to IBF in the USA, there is no person other than Dr. Yahia Abdul-Rahman who comes to one’s mind. However, Dr. Yahia Abdul-Rahman’s contribution to IBF goes well beyond the USA, as his influence is felt and understood throughout the Muslim world where IBF is either thriving or is in the process of getting introduced. LARIBA American Finance House, the interest-free Islamic financial institution he founded and developed in the USA has served as a role model for developing IBF in the countries where Muslims are either in minority or of less influence.

Apart from the practical example he showed to develop IBF from scratch, his writings and Friday sermons have served as guiding principles for developing Islamic financial communities. His recent book, The Art of RF (Riba Free) Islamic Banking and Finance, is a widely read and cited book on the subject. Through his lectures and khutbas (sermons) in the USA and abroad, Dr. Yahia Abdul-Rahman has educated Muslims and non-Muslims alike on how the integration of the divine teachings of Islam into our lives provides the greatest of benefits and blessings. The relevance of the leaders like Dr. Yahia Abdul-Rahman becomes even more profound in the present context of friction and the general adverse attitude towards Islam and Muslims, especially in his adopted country. As a devout advocate of IBF, he also founded LARIBA Awards that honor and celebrate contributions and success of leading personalities in the field of IBF. He also sits on the Awards Committee of Malaysia’s Royal Award for Islamic Finance.

Iqbal Khan belongs to a breed of IBF leaders whose influence is multi-faceted. As a practitioner, he developed one of the most formidable teams of IBF professionals (when he was CEO of HSBC Amanah) who went on to become leaders running Islamic financial institutions on their own. As a passionate advocate of IBF, his speeches and presentations on the topic around the world have stirred great interest in the industry. As a supporter of good causes in IBF, he has been instrumental in helping to introduce IBF at some of the most prestigious seats of learning in the world (e.g., Harvard University). As an active investor and business leader, he managed to found and develop an impressive Islamic private equity house (e.g., Fajr Capital).

The likes of Rafe Haneef (currently serving as CEO of CIMB Islamic) and Afaq Khan (former CEO of Standard Chartered Saadiq) have either been Iqbal Khan’s colleagues or worked for him. There are scores of others who directly and indirectly got influenced by the impressive acts of leadership of Iqbal Khan.

Born in India in 1957 and educated at Aligarh Muslim University, Iqbal Khan now shuttles between London and Dubai where Fajr Capital is headquartered. For his immense contribution and service to IBF, he was awarded The Royal Award for Islamic Finance in 2012. A number of governments and multilateral institutions have sought his advice on matters related with IBF.

Dr. Adnan Chilwan is the Group CEO of Dubai Islamic Bank (DIB). He is one of the two younger global leaders included in the list of top 10 most influential personalities in IBF. CEO of the oldest Islamic bank in the world is an interesting job. So, it would need a bit of imagination for someone to guess what comes first, Dr. Adnan Chilwan as the youngest leader in the global Islamic financial services industry or DIB. He is certainly ahead of many of his peers in IBF.

According to him, it is not the individuals who are defined by the organization they work for but rather it is the individuals who build organizations. He cites examples of Steve Jobs, Bill Gates and Richard Branson whose organization are identified with their respective per- sonalities. He is perhaps right because his reference point is the most successful individuals on the planet. He is not like those bankers who would like to identify themselves as “Citi bankers” or “HSBC boys” rather he is like those who would like their organizations to be identified with their personalities.

Dr. Adnan Chilwan is a leading authority in IBF, but more importantly he is a driver of change and innovation in the industry. Prior to joining DIB, he served a number of reputed conventional and Islamic banks in the gulf region. With the group assets of DIB of nearly US$46 billion, a market capitalization of US$7 billion, and workforce of more than 8,000 employees within the group as well as a strong presence across all emirates in the UAE, with growing international operations in Asia, Middle East and Africa, he leads an organization, which is fast being recognized as a formidable force in IBF. He is accredited with making DIB as one of the most progressive Islamic financial institutions in the world.

Dr. Adnan Chilwan is being hailed by stakeholders across the globe as a key spokesperson spearheading the progression, development and growing acceptance of Islamic finance across the world. His cutting edge perspectives and progressive outlook are already creating waves in strengthening the world-wide appeal of this fast emerging industry. According to him, his steadfast efforts will only show true results when Islamic banking globally becomes “the norm of banking” rather than seen as an alternative form of banking.

“With solid repute in the industry, Dr. Adnan Chilwan has been recognized by notable international organizations for his efforts in driving the globalization of IBF to the reliable standing it has today. Dr. Chilwan has been ranked amongst the top 10 at the Top CEO Awards, which also awarded him the prestigious 6th ranking amongst top 100 CEOs in the GCC region. In addition, he was named the “Most Social Executive” at the LinkedIn Talent Awards, honoring his immense contribution on the professional platform. He was also bestowed the “Best Strategic Vision” title at the Banker Middle East 2016 Awards, for his exceptional business leadership acumen. In 2016, Forbes Middle East ranked Dr. Chilwan in the Top 5 of the coveted Top Indian Leaders in the Arab World, recognizing distinctive leadership driving excellence in business performance.

In 2015, Entrepreneur ME honored his innovative feats with the exclusive “Banking Innovation” Award at the Indian Innovator Awards 2015 ceremony. As a testament to the influence he wields in the business and financial sector, he was recognized by Forbes for two consecutive years, in the top 10 of the much sought-after list of Top Indian leaders in the Arab world, honoring outstanding leadership in the Middle East. He was awarded the 4th ranking amongst the top 100 CEOs in the GCC region across all sectors, at the renowned Top CEO 2015 awards ceremony. His vision and dedicated efforts to make Islamic finance the norm of banking has been acknowledged by CPI Financial at the 2015 BME Industry Awards with the coveted “Outstanding Contribution to the Islamic Economy” distinction. In recognition of his unique leadership style, UK-based Global brands awarded him the distinguished title of the “Best Islamic Banking CEO, Middle East”, in their annual Leadership Awards category. Dr.

Chilwan has also been ranked in the Forbes “Global Meets Local 2015” list for his exemplary efforts in the financial services industry. In 2014, Dr. Adnan Chilwan received several accolades honoring his numerous outstanding achievements. His leading feats in the industry were noted by the prestigious Indian CEO Awards which bestowed him with the highly acclaimed title of “Banking CEO of the Year”. In the same year, he was awarded the exclusive Official Scarf Golden Medallion of “Wise Leadership” at the Tatweej-Arab Business & Finance Leaders and Leading Islamic Banks Grand Finale Ceremony, and was also presented with the 2014 “Islamic Banker of the Year” award by Global Islamic Finance Awards (GIFA). A claim to his unmatched regional standing, he was ranked in the top 15 distinguished list of the 2014 GCC’s 100 most powerful Indians, published on MSN and was recognized by The Banker, Financial Times London, as one of the “Movers and Shakers in the Middle East Banking Industry in 2013.”

Dr. Chilwan represents DIB on boards of various strategic investments, subsidiaries and associates. He holds the prestigious position of Chairman at Panin Dubai Syariah Bank and at DIB Bank Kenya Ltd. He is also associated with a number of strategic boards including Tamweel PJSC (Mortgage Finance Company listed on DFM); DIB Capital (Investment Bank of DIB); Deyaar PJSC (Real Estate Company listed on DFM); Liquidity Management Centre.

(Investment Centre in Bahrain); Dar Al Shari’a (Legal and Shari’a Consultancy). He is also a member of the DIB’s Investment Committee, Asset & Liability Committee, Management Credit Committee, Automation Committee and Executive Committee as well as on the advisory council of Higher Colleges of Technology (HCT), UAE.

Dr. Chilwan has a PhD and a MBA in Marketing to his credentials. He is a Certified Islamic Banker (CeIB), a Post Graduate in Islamic Banking & Insurance and an Associate Fellow Member in Islamic Finance Professionals Board.”