Bangladesh is an important jurisdiction for Islamic finance as it is the third largest Muslim country in the world, with a population of 160 million of which 90% are Muslims. The history of Islamic banking and finance in Bangladesh can be traced back to 1974 when Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganising its economic and financial system as per Islamic principles. As a consequence, the first Islamic bank, Islami Bank Bangladesh Limited (IBBL), was established in 1983. Since then, eight more full-fledged private Islamic banks and a number of conventional banks with Islamic banking windows and Islamic branches have been established.

Economy at a Glance

The Bangladesh’s economy has grown at an average growth rate of 6% per annum since 2004, making it one of the fastest-growing economies in the world. The current phase of economic growth appears to be largely driven by strong growing domestic demand. Today, the Bangladeshi economy stands at about US$180 billion and is expected to rise to US$322 billion by 2021, according to World Bank forecasts. In 2016, foreign direct investment (FDI) surpassed US$2 billion, representing a 44% increase from the year before. Top sectors for FDI included oil and gas, banking, telecommunication, garment industry and power generation. With its positive economic outlook, the World Bank had recently ranked Bangladesh as a lower middle-income nation. Bangladesh, together with India, are poised to be the region’s fastest-growing economies in 2017 with expansions of 7.3% and 6.8% respectively, followed by China.

Regulations in Islamic Banking and Finance

Bangladesh does not have a specific Islamic banking act. However, some Islamic banking provisions have been incorporated in the amended Banking Companies Act, 1991 (Act No. 14 of 1991). Hence, Islamic banks are regulated and supervised by the Bangladesh Bank (which is the central bank) according to the same regulations set down for conventional banks. However, in view of the lack of Islamic financial markets and instruments in the country, the Bangladesh Bank granted some preferential provisions for the development of Islamic banking .in Bangladesh. For example, Islamic banks are allowed to fix their profit-sharing ratio and mark up independently, corresponding to their internal policy and banking environment while at the same time abiding to the interest rate spread of the central bank. Islamic banks were also permitted to reimburse 10% of their proportionate administrative cost on a part of their balances held with Bangladesh Bank as a means to enhance Islamic bank’s profit base.

In addition to this, the central bank issued “Guidelines for Conducting Islamic Banking”, which supplement the existing bank laws, rules and regulations to cover the following topics:

The licensing of full-fledged Islamic banks and Islamic banking branches of conventional banks, and the transformation of a conventional bank into an Islamic bank.

Principles of Shari’a–compliant deposits (Wadiah-based current accounts and mudaraba-based savings, short notice and term deposits.

Investments principles and products (murabaha , istisna, ijara etc) in general and for imports and exports in particular.

The maintenance of the cash reserve ratio (CSR) and statutory liquidity rate (SLR) as prescribed by Bangladesh Bank.

Fit and proper criteria for members of the Shari’a Board of an Islamic bank (Shari’a Supervisory Committee) rules for accounting and reporting.

Applying the International Financial Reporting Standards (IFRS) and The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) standards for accounting and reporting.

Similar to Islamic banks, takaful companies are operating without any specific regulations for takaful but they operate under the Insurance Act, 2010. The Act defines “Islamic insurance business” but is silent as to how the Shari’a principles will be applied in the case of insurance business, the criteria determining the exact application of Shari’a and how the regulatory body will be supervising Shari’a issues. The Insurance Act 2010 allows conventional life insurance companies to set up takaful windows but non-life conventional companies are barred from operating takaful windows. One of the biggest challenges facing takaful companies is the regulatory requirement to invest 30% of their investable funds with government securities and bonds.

While the government securities provide interest from 8% to 10% depending on the period, the Bangladesh Government Islamic Investment Bond issued by the central bank provides profit between 2% to 4% only and thus resulting in an investment return of about 70% less for takaful companies compared with the conventional insurance operators. Although the Insurance Development and Regulatory Authority (IDRA) circulated draft takaful rules in October 2013, no tangible development has taken place. Among others, the draft addresses the operational models of takaful operators, segregation of funds in takaful undertakings, surplus sharing, solvency margin requirements, and the formation of a Shari’a Council.

Shari’a Governance

There is no Shari’a advisory council or board at the central bank. However, Islamic banks and conventional commercial banks having Islamic branches may form an independent Shari’a Supervisory Committee. In Bangladesh, it is the responsibility of the board of directors of the respective banks to ensure that the activities of the banks and their products are Shari’a-compliant. Hence, the Board is responsible for any lapses/irregularities on the part of the Shari’a supervisory committee.

Islamic Banking

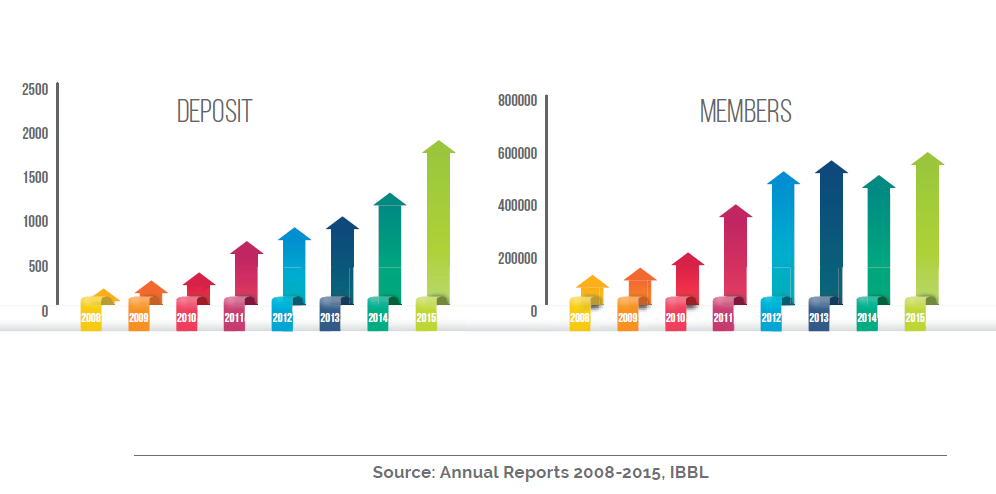

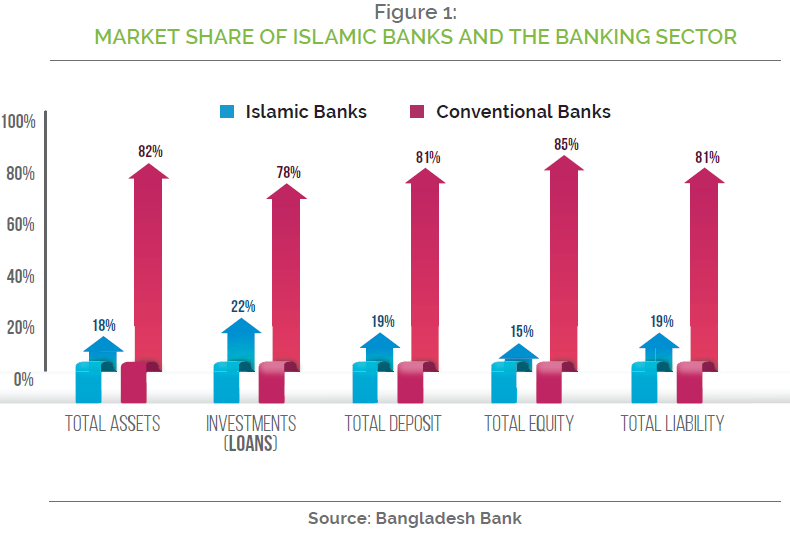

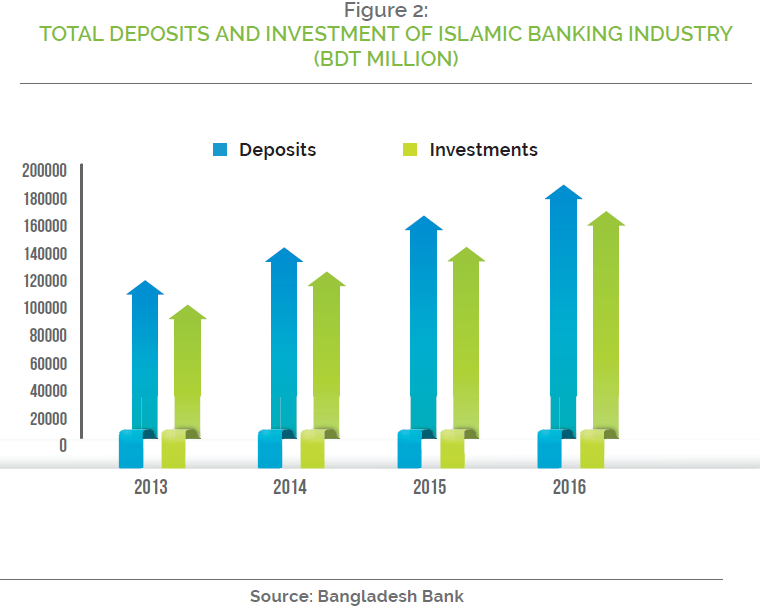

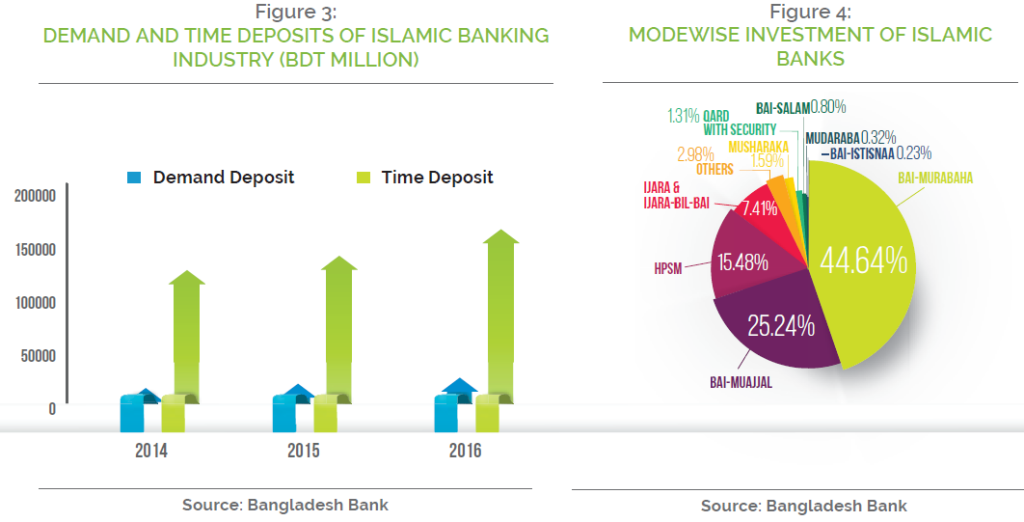

The Islamic banking industry in Bangladesh is represented by 8 full-fledged Islamic banks, 18 branches and 25 Islamic banking windows of conventional banks (Table 1). The Islamic banking industry continues to show strong growth since its inception in 1983 in line with the growth of the economy, as reflected by the increased market share of the Islamic banking industry in terms of assets, financing and deposits of the total banking system (Figure 1 and Figure 2). Although the Islamic banking industry has been growing at a faster rate than the conventional banks, Islamic banks only make up nearly 20% of the total banking sector. As at end of 2016, the share of total deposits and total investments of Islamic banks accounted for 22% and 24% respectively of the overall banking sector. The total deposits of Islamic banks, Islamic banking branches of the conventional banks and Islamic windows stood at BDT187,694.9 million (US$2.3 billion) as at end of December 2016. Demand deposit and time deposit have also exhibited increasing trends as shown in Figure 3. Demand deposits increased from BDT162,68.37 million in 2015 to BDT21,384.09 million in 2016. Meanwhile, time deposit rose to BDT166,310.8 million in 2016 from BDT127,880.6 million in 2015.

| NUMB | ER OF BRANCHES | NUMB | ER OF BRANCHES | ||

| FULL-FLEDGED ISLAMIC BANKS | ISLAMIC BANKING WINDOWS OF CONVENTIONAL BANKS | ||||

| ISLAMI BANK BANGLADESH LIMITED | 318 | SONALI BANK LIMITED | 5 | ||

| ICB ISLAMIC BANK LIMITED | 33 | AGRANI BANK LIMITED | 5 | ||

| SOCIAL ISLAMI BANK LIMITED | 125 | PUBALI BANK LIMITED | 2 | ||

| AL- ARAFAH ISLAMI BANK LIMITED | 140 | TRUST BANK LIMITED | 5 | ||

| EXIM BANK LIMITED | 113 | STANDARD BANK LIMITED | 2 | ||

| SHAHJALAL ISLAMI BANK LIMITED | 103 | BANK ASIA LIMITED | 5 | ||

| FIRST SECURITY ISLAMI BANK LIMITED | 158 | STANDARD CHARTERED BANK | 1 | ||

| UNION BANK LIMITED | 57 | ||||

| ISLAMIC BANKING BRANCHES OF CONVENTIONAL BANKS | |||||

| THE CITY BANK LIMITED | 1 | ||||

| AB BANK LIMITED | 1 | ||||

| DHAKA BANK LIMITED | 2 | ||||

| PREMIER BANK LIMITED | 1 | ||||

| PRIME BANK LIMITED | 5 | ||||

| SOUTHEAST BANK LIMITED | 5 | ||||

| JAMUNA BANK LIMITED | 2 | ||||

| BANK ALFALAH LIMITED | 1 |

ISLAMIC BANKS IN BANGLADESH

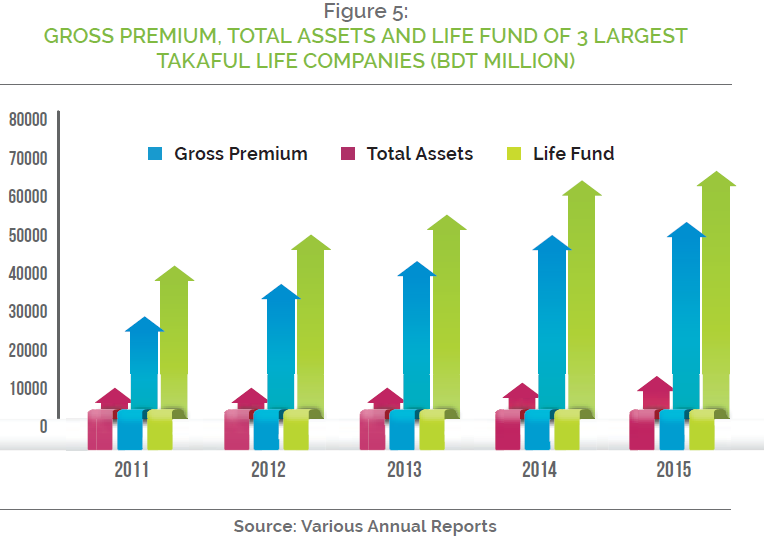

Total investment in Islamic banking sector stood at BDT168,957.48 million (US$2.1 billion). Among total investments, 95% was made by full-fledged Islamic banks, 3.1% by Islamic banking branches and the rest 1.9% was accumulated by Islamic banking windows. Both deposits and investments registered a compound annual growth rate (GAGR) of 16% and 18%, respectively from 2013 to 2016. The distribution of investment by mode as presented in Figure 4, shows that Islamic banks’ investment is mainly concentrated in the mark-up and rental-based modes of financing, which occupied 77.3% of total investments (bai-Murabaha, bai-muajjal and ijara). Their orientation is mainly towards short term financing of trade transactions for which bai muajjal/murabaha appear to be more convenient devices compared to the system of profit-loss sharing. Highest investments were made through the bai-murabaha mode (44.6%), followed by bai-muajjal (25.2%) and hire purchase under Shirkatul Melk (HPSM) (15.5%). Profit and loss sharing based investments are not popular and negligible in terms of size. The total share of mudaraba and musharaka is only 0.3% and 1.6%, respectively.

Since Shari’a-compliant Statutory Liquidity Requirement (SLR) eligible instruments are not widely available in the market, Islamic banks are allowed to maintain their SLR at a concessional rate compared with that of the conventional banks. Islamic banks are required to maintain 6.5% and 5.5% of their total time and demand liabilities as cash reserve ratio and statutory liquidity ratio, respectively. At the end of December 2016, surplus liquidity in the Islamic banking sector was BDT10,412.44 million. In order to assist Islamic banks in managing their liquidity more efficiently, a number of tools have been developed by the central bank.

This includes the introduction of the Bangladesh Government Islamic Investment Bond in 2004. In 2012, Bangladesh Bank initiated the Islamic Inter-bank Fund Market with the objective of helping Islamic banks manage their short-term funding. Almost a decade later, the government revised the Islamic bond rules for allowing Islamic banks and Islamic financial institutions to opt for alternative investment options. In line with the revised rules, the bond will be traded in line with Shari’a and redemption periods fixed at three and six months. The bond will be auctioned on profit sharing ratio instead of interest. The ruling states that investments by banks and financial institutions in these bonds are considered as fulfilment of SLR.

Takaful Sector

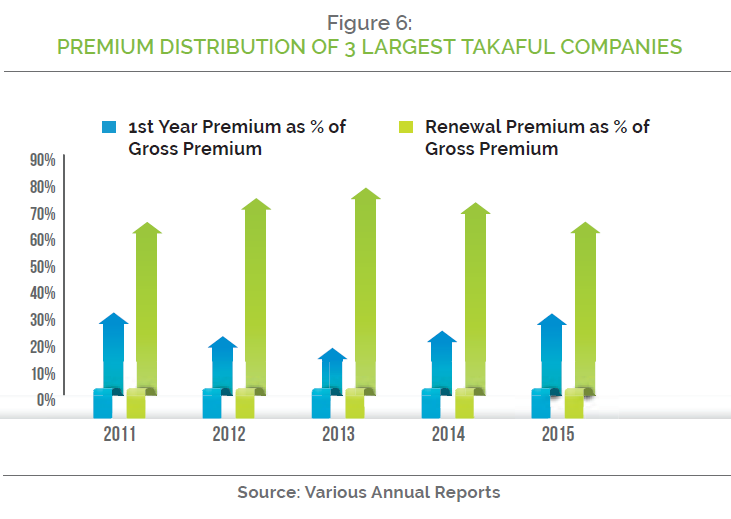

Takaful has been growing steadily in Bangladesh since its inception in 1999. At present, there are 11 (eight life and three non-life) takaful companies and 13 window operations of conventional operators. The asset base of the takaful industry stood at US$929 million, which is around 17% of the entire insurance industry in Bangladesh. The total gross premium of the 3 largest life takaful companies was BDT12,553.87 million in 2015, an 8.8% increase from the previous year (Figure 5). In terms of total assets, takaful companies have exhibited a year-on-year increase registering BDT52,365.68 million at the end of 2015, from a 2011 total of BDT29,082.39 million. This represents a CAGR of nearly 15.8%. Life Fund, on the other hand, recorded a CAGR of nearly 13% from 2011 to 2015. At the end of 2015, life fund of the 3 largest life takaful companies amounted to BDT66,934.55 million.

Figure 6 shows the contribution of 1st year premium and renewal premium to gross premium. In 2015, 68% of gross premium was generated from renewal premium and the rest from first year premium. Between 2011 and 2013, the contribution of 1st year premium to gross premium exhibited a decreasing trend, while contribution of renewal premium was increasing. The reverse trend was observed post-2013. According to the existing rule, 95% of 1st year premium is allowed as management expense whereas only 19% of the renewal premium is allowable in this regard (for companies of seventh to tenth years of operation). Thus, life takaful companies having higher renewal premium are more profitable.

Sukuk Market

Since 2004, the central bank has a small short-term sukuk programme, which issues six months paper to help Islamic banks manage their liquidity. A decade later, the central bank made amendments to the existing guidelines. Under the new guidelines, known as Islamic Investment Bond Guidelines 2004 (Amended 2014), the maturity period of Islamic bonds is now at 3 months and 6 months. Previously it was 6 months, 1 year and 2 years. The Islamic bonds are issued based on the profit-sharing ratio through open auction. In order to boost Islamic finance further, the central bank launched a weekly sukuk programme in 2015, thus providing local lenders with a new short-term liquidity management tool. The biggest issuance of Islamic corporate bonds, amounting to BDT3 billion (US$38.12 million), was first issued by IBBL in 2007. This mudaraba perpetual bond facility has a market capitalization of BDT2.92 billion.

Islamic Capital Market

The Islamic capital market of Bangladesh is one of the smallest markets in Asia with two full-grown automated stock exchanges – the Dhaka Stock Exchange (DSE) and the Chittagong Stock Exchange (CSE). Each of them have established a Shari’a Index. In 2014, DSE launched its Shari’a index named DSEX Shariah Index (DSES). The Index is constructed as a subset of the DSE Broad Index (DSEX) and includes all stocks in the parent index that pass rules-based screens for Shari’a compliance. In the same year, CSE launched the CSE All Shariah Index, which comprises of all Shari’a-compliant companies listed on the CSE. The CSE All Shariah stocks represent about 48.6% of the total market capitalization and around 41.35% of float-adjusted market capitalization of the CSE listed companies. The total number of listed securities in CSE All Shariah Index stood at 105 at the end of October 2016. A total of three Islamic mutual funds are listed on the DSE with market capitalization at BDT2.75 billion, which is 7.7% of the total mutual fund market. The recent Islamic fund approved by the Bangladesh Securities and Exchange Commission is the SEML IBBL Shariah Fund, a closed-end mutual fund. The size of the Shari’a mutual fund is BDT1 billion with an offer price of the units at BDT10 each.

Islamic Microfinance

Bangladesh is recognised for its poverty alleviation programmes and microfinance institutions as it was one of the earliest countries to adopt microfinance with the establishment of the Grameen Bank in 1976. Today, an estimated 697 microfinance institutions (licensed with the

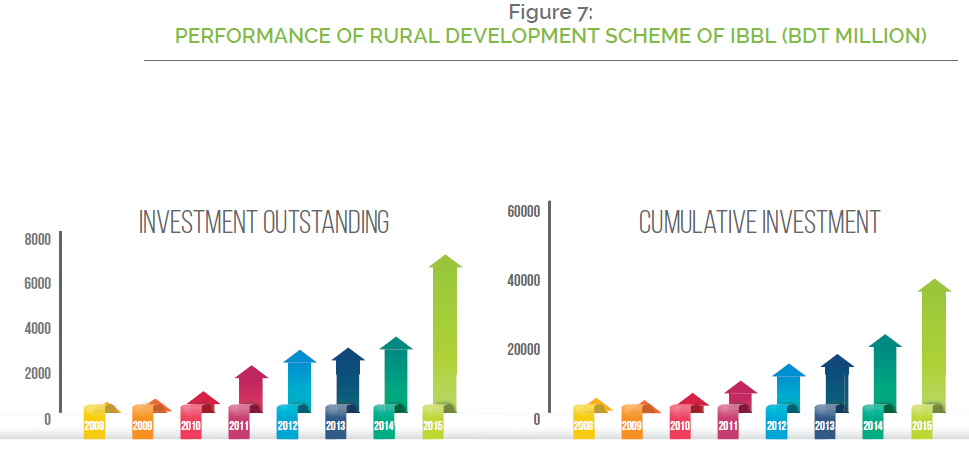

Microcredit Regulatory Authority) are operating in Bangladesh. Out of this, about 13 of them are offering Islamic financing. In addition, three Islamic banks, i.e. Islami Bank Bangladesh (IBBL), Social Islami Bank and Al-Arafah Islami Bank offer Islamic microfinance through specialized divisions. IBBL, being the largest Islamic bank is also the largest provider of Islamic micro financing. Islamic microfinance activities of IBBL are run via the Rural Development Scheme (RDS), which is an Islamic microfinance programme established in 1995 with the objective of eliminating rural poverty through small and microcredit products or schemes. Although the RDS is not a microfinance institution by itself, it uses the infrastructure and branch network of IBBL for its microfinance operations. In 2012, the Urban Poor Development Scheme (UPDS) was introduced. Since then, IBBL have been providing Islamic microfinance under the umbrella of RDS and UPDS.

RDS operates from the existing branch networks of IBBL, which selects suitable villages within 16 kilometers radius of the branch. RDS has full outreach nationwide in all 64 districts in the country through 252 branches of IBBL, which have been handling the scheme in their respective areas. Since 1995, the cumulative disbursement of microfinance under RDS is BDT42,285.23 million with a rate of recovery more than 99.58% (Figure 7). Out of the 608,703 members, 83% are women. Cumulative investment was BDT42,285.23 million in 2015 against which the outstanding was BDT7,072.02 million.