Islamic finance has gained significant grounds in Qatar as it continues to play a major role in shaping the future of the country’s economy. Qatar’s growth rate for Islamic finance continues to outstrip that of conventional finance. Over the years, Qatar has seen a faster and consistent growth of Islamic finance assets as infrastructure development and the general economy as a whole continues to grow together. However, the fall in oil prices has had a deep financial impact on Qatar, which is an oil-depending nation. Although the continuous decline in oil prices since mid-2014 has taken a toll on the country’s economy, Qatar has best weathered the storm of instability in the global energy markets comparatively better than other GCC countries.

Economy at a Glance

Qatar has been in the process of diversifying its economy for some time, with the aim being to reduce its reliance on the oil and gas sector as oil and natural gas account for about 55% of the country’s gross domestic product (GDP). However, in recent years, growth has been mainly driven by large-scale projects set by the government as part of the Qatar National Vision (QNV) 2030. These included major infrastructure projects to meet Qatar’s hosting requirements for the 2022 FIFA World Cup. In 2016, the construction sector continued to lead economic growth at a growth rate of 18%, followed by the service sector, which grew by 11%. Qatar’s economy is expected to grow 3.4% in 2017 after achieving a growth rate of 3.2% in 2016, which will be driven by planned investments up to QAR46 billion in major infrastructure projects as part of the government’s strategy to achieve sustainable development and economic diversification.

In a bid to transform Qatar into an advanced country by the year 2030, the government launched the QNV 2030 in 2008. The QNV 2030 rests on four pillars which are Human, Social, Economic, and Environmental Development. In this regard, a series of targets have been set, to be achieved in five-year periods, known as the Qatar National Development Strategies (QNDS). Planning of the second QNDS 2017-2020 has begun and like the first QNDS 2011-2016, it will include initiatives designed to push Qatar towards the long-term objectives laid out in QNV 2030.

Regulations Governing Islamic Banking and Finance

Although Islamic banking and finance made its first debut in Qatar as early as 1982 through the establishment of Qatar Islamic Bank (QIB), it was not until a decade later that Islamic banking was formally defined through legislation. The Central Bank Law, Law No 13 of 2012 (QCB Law), came into effect in January 2013, 2 years after the Qatar Central Bank (QCB) prohibited the operations of Islamic windows by conventional banks in 2011. This was seen as a bold step to restrict Islamic finance to standalone entities and effectively mandating that all Islamic banks must be standalone. The affected banks were given until the end of that year for full compliance. This impelled several conventional banks such as HSBC to close their Islamic businesses in Qatar. The Law No 13 of 2012 clearly dictated the scope of Shari’a-compliant banking and states that Islamic banks are governed by QCB and shall be subject to the same regulatory regime as their conventional counterparts. The Law also called for the formation of a Shari’a Supervisory Authority by each Islamic financial institution.

Islamic banks operate under two regulatory regimes: the QCB and the Qatar Financial Centre Regulatory Authority (QFCRA). Islamic banks that are listed on the Qatar Stock Exchange (QSE) are subjected to Qatar Financial Markets Authority (QFMA). In December 2013, a three-year strategic plan for financial sector regulation was launched by QCB, QFCRA and QFMA. The three regulatory authorities came together to develop a common approach to legal issues and harmonies regulatory and supervisory practices in order to foster the continued development of Islamic finance. The plan established a framework for regulating the financial sector including Islamic finance with a view of building “a resilient financial sector… that operates at the highest standards of regulation and supervision.” The strategic plan also sets out a roadmap containing six strategic priorities: (1) enhance regulation, (2) expand macro-prudential oversight, (3) strengthen market infrastructure, (4) protect consumers and investors, (5) promote regulatory cooperation, and (6) build human capital.

The promotion of Islamic financial institutions and markets is among the critical goals under the strategic plan. With the increasing scale of operations of the Islamic financial services industry, QCB has undertaken a wide variety of initiatives including enhancing the licensing criteria for Islamic financial institutions, strengthening corporate governance, enhancing prudential standards, and reporting on capital adequacy, solvency, and liquidity. It is also developing the framework for the liquidation of Islamic institutions. In 2014, Qatar regulators announced their intention to establish a deposit insurance framework that will include a Shari’a-compliant equivalent scheme. This is part of the strategic plan to modernize the country’s financial industry by 2016. The scheme was deemed necessary by regulators as Islamic banks now hold nearly a third of total banking assets in Qatar.

The establishment of the Qatar Financial Centre (QFC) in 2005 was consistent with the government’s drive to diversify the economy by attracting financial institutions and multinationals to establish businesses in international banking, financial services, insurance, corporate head office functions and related services. The QFC is regulated by the QFC Law (Law No. 7 of 2005) and the QFMA by Law No. 33 and establishes four different independent bodies namely the QFC Authority, the QFCRA, the Appeals Body and the QFC Tribunal. In 2007, the QFCRA issued the Islamic Finance Rule Book 2007 (ISFI) that provides rules and regulations pertaining to Islamic financial business. These include the endorsement of Islamic financial institutions and Islamic windows, disclosure requirements, constitutional documents, systems and control, conduct of business standards and Shari’a board. With the issuance of the ISFI, all Islamic financial institutions and Islamic windows shall comply with the ISFI and they are subjected to the supervision of the QFCRA.

The QFCRA introduced a new Islamic Banking Business Prudential Rules 2015 and a revised version of the Conduct of Business Rules 2007. The new Rules, which came into force in January 2016, apply to authorized Islamic banks or Islamic investment dealers and replace those related to Islamic banking activities as per the current Banking Business Prudential Rules 2014. Meanwhile, the revised Conduct of Business Rules 2007 amended three aspects of the Rules: the definition of business customer, re-classifying customers and the Customer Dispute Resolution Scheme.

In April 2016, a new law governing insurance companies including takaful as well as branches of foreign companies in the country came into force, pursuant to the provisions of Qatar Central Bank Act and the regulation of financial institutions promulgated by Law No. (13) of 2012. Decision No. (1) of 2016 on executive instructions for the insurance sector and principles of governance of insurance companies is the first of their kind which provides a comprehensive regulation of Qatar’s insurance industry. The new law stipulates that listed insurance companies must have a capital of above QAR100 million or a risk-based capital, while unlisted insurance companies must have a capital higher than the figure set by the QCB or the risk-based capital. Meanwhile, branches of insurance companies must deposit QAR35 million.

Shari’a Governance Framework

There are two regulatory frameworks of Shari’a governance system in Qatar: one for Islamic financial institutions under the auspices of QCB, and the other under QFC. In 2008, the QCB issued the prudential regulation for banking supervision – Instructions to Banks (the Instructions), and Part Seven of the Banking Supervision Instructions. The QFC, on the other hand, has its own rules and regulations pertaining to Shari’a governance system as stipulated in the ISFI. As per the Shari’a governance framework of the QCB, Islamic financial institutions are required to establish their own Shari’a board, which must consist of not less than two qualified Muslim members appointed by BOD and approved by the general assembly.

It further stipulates that Islamic financial institutions are required to implement the AAO- IFI governance standards. In order to ensure independence of the Shari’a Board and avoid any conflict of interest, Shari’a board members are prohibited from receiving credit facilities for both personal and commercial purposes. The Shari’a governance framework also specifies the requirement for Islamic financial institutions to appoint their directors and senior management who are highly qualified, experienced and trained in the field of Islamic financial services.

Under the Shari’a governance framework in the Islamic Financial Services Institutions (IFSI), Islamic financial institutions operating in the QFC are required to establish their own Shari’a board, which should have a minimum of three members appointed by the governing body of the institution. It does not, however, specify the qualifications of the Shari’a board members. In addition, the ISFI restricts the Shari’a board members to be appointed as a director or controllers of IFIs. Although there is no centralized Shari’a board at both the QCB and QFC, the government of Qatar has established the Supreme Shari’a Council attached to its Ministry of Awqaf and Islamic Affairs, which is the highest Shari’a authority that is responsible to deal with Shari’a matters. Hence, where clarification is needed on Shari’a application matters, Islamic financial institutions have recourse to the Supreme Shari’a Council.

Islamic Banking

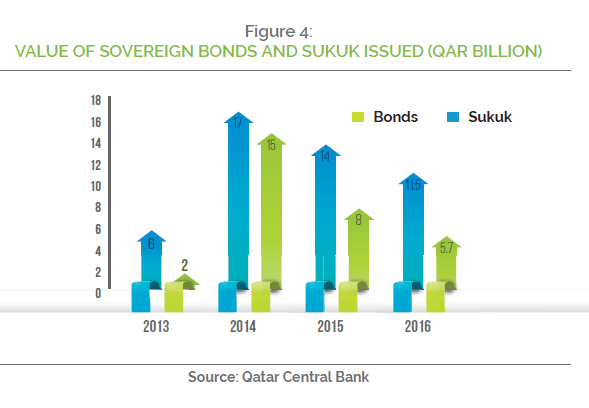

There are 4 national Islamic banks operating in Qatar – Qatar Islamic Bank (QIB), Qatar International Islamic Bank (QIIB), Barwa Bank and Masraf Al Rayan, which comes under the purview of the QCB. Together they account for about 25% of the country’s total banking assets, a decline from 27% in 2015. The largest Islamic bank in the country, QIB holds about 43.7% of the Islamic banking market share in Qatar and 11.1% of the overall market (Table 1). Assets growth of Islamic banks has been on a declining trend since 2014 on the back of falling oil prices and global economic uncertainty (Figure 1).

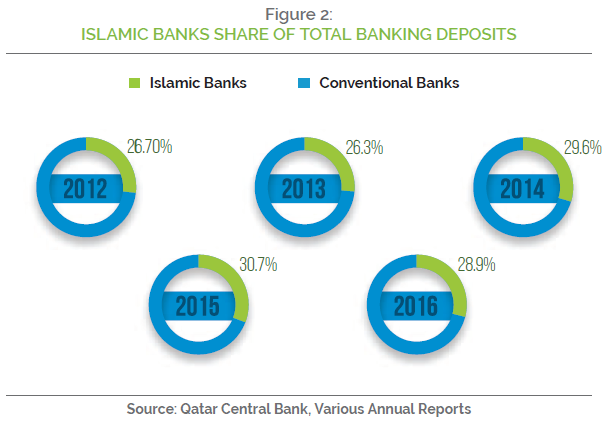

Islamic banking assets growth continues to outpace conventional banking, as demonstrated by a 21% compound annual growth rate of loans for Islamic banks between 2011 and 2016 compared with 14% for the conventional banks. Qatar’s Islamic banking assets have been growing at double-digit growth, except for 2016 when Islamic banking assets recorded an 8.2% growth. Total deposits in Islamic banking industry reached QAR209.9 billion by end of 2016. Market share of the Islamic banking industry’s deposits in the overall banking industry has grown steadily from 26.7% in 2012 to 28.9% in 2016 (Figure 2).

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| QATAR ISLAMIC BANK | |||||

| NET PROFIT | 2.2 | 2.0 | 1.6 | 1.3 | 1.2 |

| ASSETS | 139.8 | 127 | 96 | 77.4 | 73.2 |

| FINANCING | 98.2 | 87 | 60 | 47 | 43.1 |

| CUSTOMER DEPOSIT | 95.4 | 92 | 67 | 50.4 | 43.1 |

| QATAR INTERNATIONAL ISLAMIC BANK | |||||

| NET PROFIT | 0.79 | 0.78 | 0.83 | 0.75 | 0.679 |

| ASSETS | 42.6 | 40.6 | 38.4 | 34.4 | 28.6 |

| FINANCING | 27.2 | 25.0 | 21.8 | 19.0 | 14.7 |

| CUSTOMER DEPOSIT | 26.6 | 26.7 | 26.6 | 24.4 | 19.6 |

| BARWA BANK | |||||

| NET PROFIT | 0.74 | 0.73 | 0.71 | 0.50 | 0.35 |

| ASSETS | 46.0 | 45.0 | 38.0 | 33.6 | 25.3 |

| FINANCING | 29.8 | 28.5 | 23.0 | 19.3 | 15.3 |

| CUSTOMER DEPOSIT | 29.9 | 25.5 | 21.9 | 21.2 | 14.8 |

| MASRAF AL RAYAN | |||||

| NET PROFIT | 2.08 | 2.07 | 2.0 | 1.7 | 1.52 |

| ASSETS | 91.5 | 83.0 | 80.1 | 66.6 | 61.6 |

| FINANCING | 67.6 | 62.5 | 58.0 | 41.4 | 41.7 |

| CUSTOMER DEPOSIT | 58.0 | 55.6 | 62.6 | 48.3 | 45.01 |

FINANCIAL PERFORMANCE OF 4 NATIONAL ISLAMIC BANKS IN QATAR

(QAR BILLION)

In addition to the four Islamic banks, Islamic finance companies – Al Jazeera Finance2, First Finance3 and Qatar Finance House, also operate under the supervision of QCB. Although they do not hold banking licenses, these finance companies have traditionally competed with Islamic banks in the retail segment through their car financing and other small tickets- deals. However, due to the cap on consumer financing at 6% by QCB, retail financing has been made unattractive to finance companies because of the low margins and high risk involved. As such Islamic finance companies have thus increased their involvement in the financing of small and medium-sized enterprises (SMEs). Qatar is also hosts to Bank Saderat Iran and Abu Dhabi Islamic Bank, foreign Islamic banks operating within the regulatory ambit of the QFC. Another two banks that obtained licenses from QFC are Qatar First Bank (QFB) and QInvest. The QFB is an investment bank and was listed on the Qatar Stock Exchange (QSE) in 2016. QInvest is an Islamic investment bank set up in 2007 with a declared capital of US$1 billion. QIB holds a 47.15% stake in the bank.

In a recent development, three Qatari banks—Masraf Al-Rayan, Barwa Bank and International Bank of Qatar have been in talks for a possible merger. This tripartite merger would result in an Islamic megabank that would have total assets amounting to around US$48 billion and a market share of about 14%.5 The new entity, if approved by QCB and successfully completed, would create the largest Islamic bank in Qatar and the fourth largest Islamic bank in the GCC.

Takaful

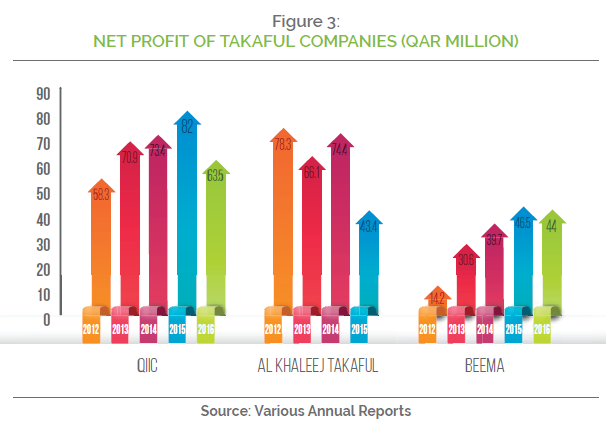

The takaful industry in Qatar is relatively small as compared to its neighbouring countries with 3 takaful operators and 3 takaful subsidiaries owned by conventional companies. There are a number of foreign takaful companies that have set up branches in the QFC including MedGulf Takaful, Takaful International, t’azur and Allianz Takaful. Gross takaful contributions of the 3 takaful operators in Qatar have grown steadily from QAR638.1 million in 2012 to QAR940 million in 2015, representing a growth of 47%. The Qatar Islamic Insurance Company (QIIC), founded in 1995, was the first takaful operator established in Qatar. QIIC has a track record of strong operating and technical profitability, with a five-year weighted average combined ratio of 80%, reflecting consistently strong profitability in medical and family takaful (life) lines of business. In 2016, the company recorded a net profit of QAR63.5 million and gross contributions of QAR313 million.

The Al Khaleej Takaful Group became the second market entrance when Al Khaleej Insurance and Reinsurance Company converted its entire operations into a fully Shari’a-compliant business in 2010 and rebranded to the present name. It is the largest takaful company in Qatar with gross contributions of QAR226.9 million as at September 2016. Damaan Islamic Insurance Company (or known as Beema) was founded in 2009 with an authorized and paid-up capital of QAR200 million. It is the second largest takaful company in Qatar with gross contributions of QAR328.6 million as at December 2016. Both QIIC and Beema have maintained steady growth in profit from 2012 to 2015 against the backdrop of negative changes in the international economy resulting from the drop in oil prices and its negative impact on growth ratios of both local economy and the international economy (Figure 3). In the case of QIIC, the decrease in net profit in 2016 was against a 7% growth in the underwritten contributions.

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| AL KHALEEJ TAKAFUL | 226.9* | 333.1 | 313 | 290 | 272.9 |

| DAMAAN ISLAMIC INSURANCE COMPANY | 328.6 | 313.8 | 254.5 | 204.1 | 158.1 |

| QATAR ISLAMIC INSURANCE COMPANY | 313.0 | 293.1 | 236 | 212.3 | 206.5 |

| NOTE: * AS AT SEPTEMBER |

GROSS CONTRIBUTIONS OF 3 TAKAFUL COMPANIES IN QATAR

(QAR MILLION)

Doha Takaful, General Takaful and Qatar Takaful Company are subsidiaries of other groups. In January 2017, Doha Insurance announced its plan to convert its Islamic branch ‘Doha Takaful’ into a full-scale takaful company as part of its overall restructuring. This is in line with the company’s expansion plans both locally and regionally. Doha Takaful reported a surplus amounting to QAR770,000 in 2016 against a deficit of QAR784,000 in the previous year. In December 2015, the government announced its decision to suspend the compulsory Social Medical Insurance Scheme (SEHA). First launched in 2013, SEHA was run by the National Health Insurance Company, a government-owned entity. The new national health insurance scheme will be launched in 2017 with private insurance companies expected to compete against each other to provide health insurance under the new scheme. This is in line with the National Health Strategy 2017 – 2022 under QNV 2030.

Islamic Asset Management

The Al Rayan Islamic Index was launched in 2013 by the Qatar Stock Exchange (QSE) and Al Rayan Investment (a subsidiary of Masraf Al Rayan). This Index is a total return index reflecting both price performance and dividend income of Shari’a-compliant stocks listed on the QSE (as approved by Al Rayan’s Shari’a Supervisory Board). It was established to create Qatar’s first Shari’a-compliant benchmark to advance the Islamic asset management industry. To further enhance overall liquidity in the market, an Islamic exchange-traded fund (ETF) is expected to make its debut on the QSE in 2017. The Masraf Al Rayan ETF, which will track 17-stock Al Rayan Islamic index, will be managed by Al Rayan Investment Company.

Sukuk Market

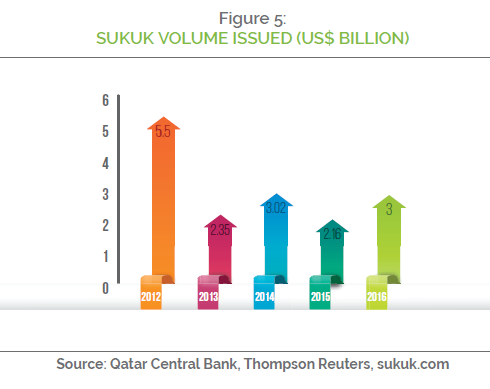

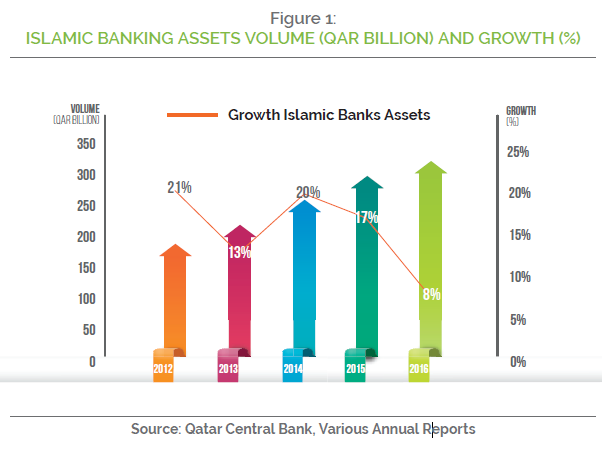

The QCB has been the main force in driving the sukuk market in the country. Between 2010 and 2016, a total of 30 sovereign sukuk worth QAR35.75 billion had been issued. Prior to 2013, the QCB issued single issuances sukuk but later changed its approach to regular issuances of between three- and ten-year tenors. The QCB remained an active sukuk issuer although the total value of sukuk issued had declined significantly since 2014 in preference for sovereign bonds issuance (Figure 4). In 2016, a total of 12 sukuk valued at QAR5.7 billion were issued by QCB vis-à-vis 13 sovereign bonds worth QAR11.5 billion. A total of US$3 billion new sukuk were issued in Qatar as compared to US$2.2 billion in the previous year (Figure 5). However, new sukuk issuance remains low after reaching its peak in 2012 when a total of US$5.5 billion sukuk were issued, representing 12% of the overall global sukuk issuances. Corporate issuers in 2016 included QIB’s sukuk worth QAR2 billion, QIIB’s sukuk worth QAR1 billion, Barwa Bank’s sukuk worth US$100 million and Ezdan Holding’s sukuk worth US$500 million.