In recent years, Bahrain has rapidly become a global leader in Islamic finance, playing hosts to the largest concentration of Islamic financial institutions in the Middle East. Bahrain is also home to a number of important infrastructure and standard-setting institutions for Islamic finance including the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), International Islamic Financial Market (IIFM), Islamic International Rating Agency (IIRA) and General Council for Islamic Banks and Financial Institutions (CIBAFI).

Bahrain’s emergence as a pre-eminent Islamic financial centre in the Middle East may be attributed to some strategic factors including its strategic location in the Middle East and the Gulf region; it benefits from the critical mass of international banks and other financial institutions operating in the country; and as an international financial centre Bahrain offers a wide range of supporting facilities in the areas of specialised staffing, information and communication technology, legal advice, accounting and auditing needs, office space and facilities.

Bahrain’s Economy

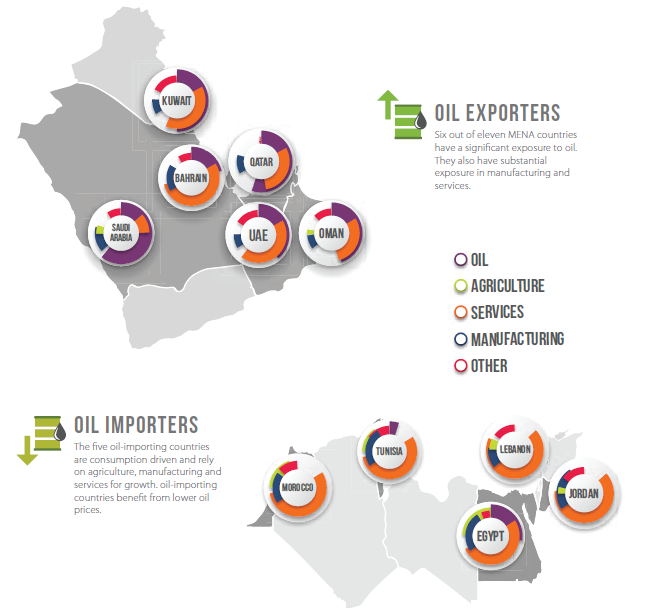

Bahrain has an open economy with heavy reliance on oil as oil revenues account for over 80% of government income. Hence, the oil market downturn has had a strong impact on Bahrain’s public accounts, which have been in deficit since 2009. In 2016, the public deficit remained high despite the fiscal effort agreed by the authorities. Apart from Oman, Bahrain is one of the GCC countries that are most susceptible to lower oil prices, due to its low oil reserves. Bahrain has reserve assets of about US$5.4 billion, including gold and foreign currencies, compared with US$745 billion for Saudi Arabia.

In response to lower oil revenues and the subsequent growth slowdown, the Bahraini government begun introducing a mix of spending cuts and revenue-boosting initiatives to reduce its fiscal deficits. Revenue-enhancing measures include increasing tobacco and alcohol taxes and increasing fees on some government services (primary health care). Meanwhile, cost-cutting programmes entailed the removal of the meat subsidy in 2015, the raising petrol prices by 60% in January 2016, the gradual phasing-in of price increases for electricity, water, diesel and

kerosene by 2019; and the increase and unification of natural gas prices for industrial users at US$2.5 per million BTUs beginning April 2015. Bahrain is expected to introduce a broad Valued Added Tax (VAT) at a rate of between 3-5% in January 2018, thus giving the government access to a significant and stable revenue stream.

However, Bahrain’s economy proved resilient faced with the sluggish oil market, as a result of the expansionary and counter-cyclical fiscal policy it has implemented. Aid amounting to U$5.7 billion granted through the GCC development assistance fund has also enabled the Kingdom to maintain substantial investment in the construction of a pipeline project with Saudi Arabia and in the extension of the Manama airport.

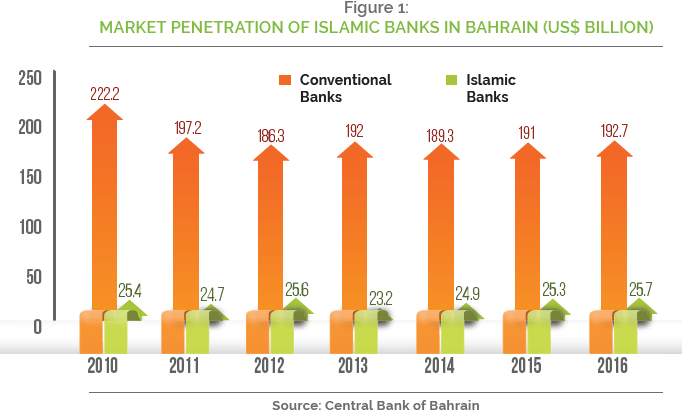

Islamic Banking Bahrain’s banking and financial services sector, particularly Islamic banking, has benefited from the regional boom driven by demand for oil. The financial services sector remains the most important non-oil economic sector in Bahrain, constituting 17.2% of the country’s GDP. Having served as a regional offshore hub since 1975, Bahrain is the most established financial centers in the Gulf with about 404 licensed financial institutions as opposed to 190 in 1991. Bahrain has a dual banking system, where Islamic banks operate side-by-side with their conventional counterparts. The first Islamic bank, Bahrain Islamic Bank, was established in 1978 to provide commercial banking services. There are currently 25 Islamic banks which are licensed to operate in Bahrain, making the Kingdom the highest concentration of Islamic financial institutions in the Middle East. The consolidated assets of Bahrain-domiciled Islamic banks have risen from US$1.9 billion in 2000 to US$25.7 billion in September 2016 (Figure 1). Their share of total banking assets has increased from 1.8% to 13.3% over the same time period.

The establishment of the Bahrain-based Liquidity Management Centre (LMC) in February 2002 was in response to the need for an intermediary agency to underwrite Islamic financial trading. The basic aim of the LMC was to provide a local and international stimulus to the Islamic banking industry by providing liquidity management in line with Shari’a principles. Hence, the wholesale Islamic bank enables Islamic financial institutions to manage an asset–liquidity mismatch, creates a pool of quality assets for Islamic financial institutions and creates liquidity for conventional players.

The growth of Islamic finance in Bahrain has benefited from the proactive role of the Central Bank of Bahrain or CBB (known from 1973-2006 as the Bahrain Monetary Agency), which has operated as a unified regulator for all types of financial services since 2006. One of the recent initiatives by CBB in the Islamic finance space is the framework on Shari’a governance of institutions offering Islamic financial services. At present, the Shari’a governance framework in Bahrain is limited to the requirement of setting up a Shari’a board on an institutional level, which must follow the Shari’a Standards issued by AAOIFI. The framework for Shari’a compliance also comprises of internal Shari’a Review and internal Shari’a Audit. Although there exists a Shari’a Board at the CBB, its role is rather limited to advising the central bank for its own transactions and products and is in fact not used as a Shari’a supervisory body for the Islamic financial institutions.

A proposed centralized Shari’a Committee at the national level was mooted in 2015 with a view to harmonies practices of issues relating to fatwas and Shari’a operational practices as embraced in several countries around the world including, Malaysia, Pakistan and Sudan. It is expected that such a country-level approach would reduce the level of inconsistency in product offerings and fatwas in the industry, help expedite product innovation and boost investor confidence. In addition, the new Shari’a governance rules will expand the internal Shari’a review and audit functions, while making it mandatory for banks to have an independent external Shari’a audit. This represents a shift away from the long-held practice of self-regulation.

Takaful

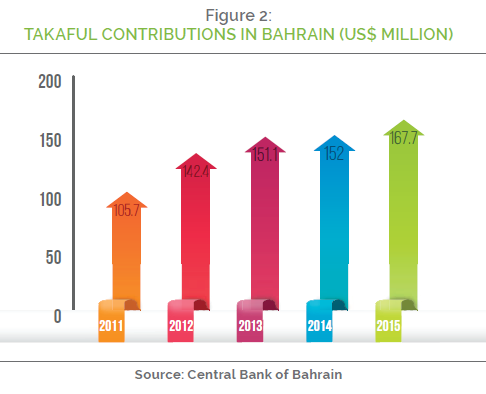

There are 8 takaful and retakaful companies operating in Bahrain. Together, their gross contributions represent around 23% of total gross premiums of the domestic insurance market as compared to 3% in 2001. Bahrain has a takaful penetration rate of 23% compared with the Middle Eastern average of 9%. Premiums for the segment have registered annual increases to reach US$167.7 million in 2015 – the most recent year for which results are available (Figure 2). The growth in the takaful market is mainly due to greater public awareness and increased demand for Shari’a-compliant insurance. Over the years, the mix of takaful contributions has shown positive changes with the share of family takaful rising to 14.5% of total takaful contributions in 2015 compared to 10% in 2009. This growth in the share of family takaful is mainly due to an increase in public awareness about the importance of family takaful, while also indicating a growing appetite in the Kingdom for investment-based life products. However, like many other jurisdictions in the GCC, the challenges facing the takaful industry in Bahrain include corporate governance, standardization of accounting standards, lack of takaful talent and a limited range of Islamic investment instruments.

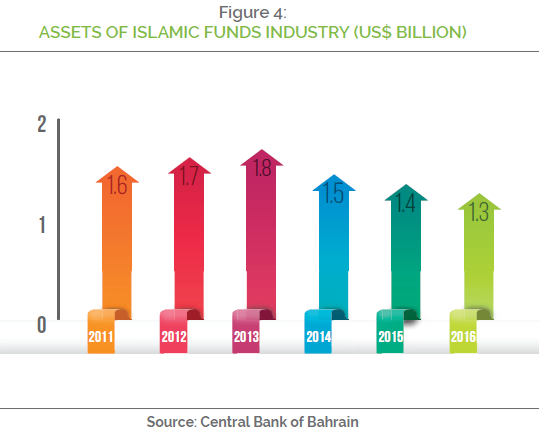

Islamic Asset Management

Despite the rise and fall in asset prices in Bahrain and the tightening of liquidity due to the fluctuation of oil prices, the Islamic asset management sector remains well-regulated and continues to show strong growth during the past five years. Overall, the prospects for growth of Islamic assets management industry in Bahrain are likely to be positive. This positive trend can be attributed to the rapid expansion and increasing sophistication of the financial markets, and the enhancement to the existing regulations governing assets management and capital markets.

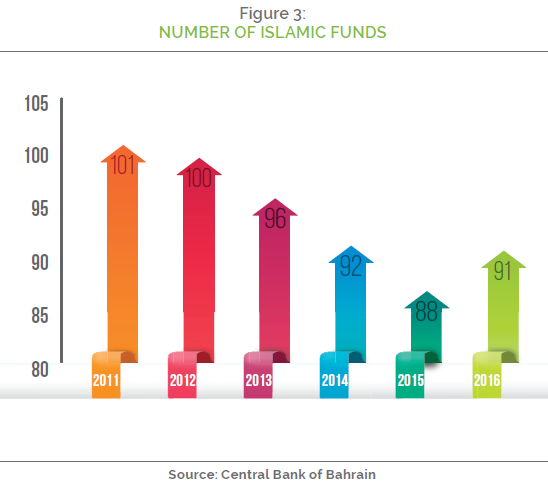

The mutual funds industry is one of the fastest-growing segments of the asset management sector. With approximately US$7.59 billion in assets under management through 2,600 funds, the industry has been growing at steady base in recent years. Overall, there are 94 Islamic funds (2016: 91) that are incorporated and registered in Bahrain with total assets amounting to US$1.24 billion as of January 2017 (Figures 3 and 4). The CBB has introduced regulations governing the authorization and supervision of Shari’a advisory services companies, as a part of Ancillary Service Providers Module under Volume 5 Rulebook. This new regulation will help small Islamic investment institutions and collective investment schemes to outsource their Shari’a review to these entities in order to enhance their operations and reduce the costs of such services. The services of those companies include the evaluation of financial institutions level of compliance to the Shari’a principles as well as the issuance of Shari’a pronouncements on any aspect of the Islamic financial institution’s activities and operations.

Sukuk Market

The sukuk market in Bahrain is governed by the Regulatory and Supervisory Module on Issuing and Offering of Securities and Shari’a Compliant Sukuk (OFS Module) of the CBB Rulebook. The OFS Module, which officially came into force on 1 January 2014, contains the CBB’s new rules on the offering of securities in Bahrain and provides comprehensive regulatory guidance for the sector. The main purpose of the OFS Module is to regulate the issuing, offering, floating and subscription of securities, both conventional and Shari’a-compliant.

Although Malaysia saw its first domestic sukuk issuance in 1990, the first global sovereign sukuk was issued by the government of Bahrain in 2001 as an alternative method of raising funds. It was a 5-year maturity ijara sukuk amounted to US$100 million. Since then it has been active in the sukuk market and issued short and long-term instruments at regular intervals. Nearly a quarter of the Bahraini government’s financing needs are being met through sukuk. Hence, we can expect the government to continue developing a vibrant sukuk market to raise money to finance its budget deficits and fund its infrastructure projects.

In comparison with conventional bonds, sukuk market is less liquid than the former’s secondary market. Secondary market development rely on the development of the primary market (issuance market), namely sukuk demand should be met by sufficient supply. Hence, in order to develop a liquid secondary market, the CBB issues three-month and six-month maturity al-salam and ijara sukuk. To date, CBB has issued 190 sukuk al salam since it was first introduced in 2001. Sukuk al salam are an instrument based on sale and purchase contracts and are collateralized by a commodity (Residue Gas). Sukuk ijara was first issued in August 2005 and to date the CBB has issued a total of 138 sukuk. Sukuk ijara, which are issued monthly with a 182 days maturity, takes the form of Islamic leasing contracts and are based on the government’s assets. Both types of sukuk are issued through a fixed-rate tender procedure, the rate of return is set by the CBB Monetary Policy Committee. In 2015, the CBB developed a short-term liquidity product for Islamic retail banks based on IIFM Unrestricted Wakalah standard by using sukuk portfolio. This instrument, (which has been approved by the Shari’a Board of the CBB), is designed to absorb excess liquidity in the local Islamic retail banking market and place it with the central bank.

An interesting development of the sukuk market was the decision by the Bahrain Bourse in 2015 to allow retail investors (Bahraini and non-Bahraini investors, both individuals and institutions), to directly subscribe to government sukuk in the primary market through registered brokers at the bourse. Previously, government debt was mostly sold to a group of qualified banks, which could then sell the debt on to other investors, although little secondary market trading took place. The new system is part of efforts by the central bank and the bourse to develop Bahrain’s capital markets and increase their contribution to economic development in light of the sliding oil prices that has put government finance under pressure.

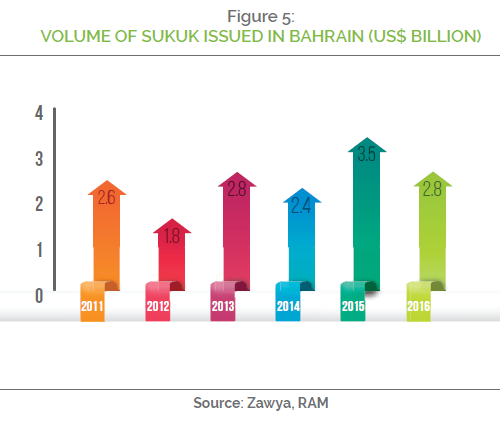

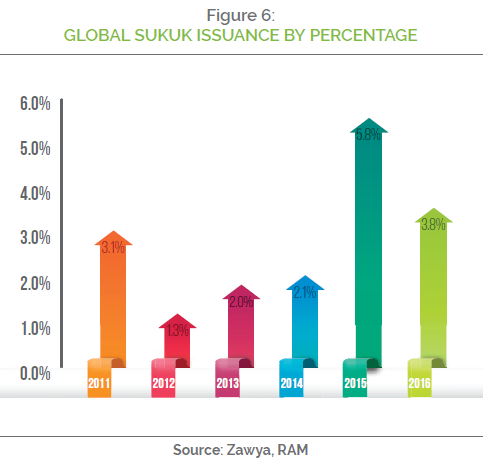

Bahrain was the third largest sukuk issuance in terms of value in the GCC after UAE and Saudi Arabia with 3.8% of the total sukuk issued globally in 2016 amounting to US$2.77 billion was issued in the Kingdom (Figure 5). This was a sharp decrease from 2015 where sukuk volume issued for the year registered at US$3.5 billion, representing 5.8% of total global sukuk issued for the year (Figure 6). Sukuk outstanding in 2015 stood at US$4.8 billion.

Legal and Regulatory Framework

Islamic banks in Bahrain are governed under the Prudential Information and Regulatory Framework for Islamic Banks of CBB. The implementation of this regulatory framework began in 2002 and it has been repeatedly updated and refined. Through this framework, CBB has sought to equalise the operating environment facing conventional and Islamic banks. The CBB’s rulebook for Islamic banks covers areas such as licensing requirements, controllers’ requirements, capital adequacy, risk management, business and market conduct, financial crime and disclosure/reporting requirements, as well as reflecting the requirements and guidance related to Basel regulations. As home to many international standard-setting bodies in Islamic finance, Bahrain has incorporated these standards into its Islamic banking regulations. In 2015, the CBB launched a new Shari’a-compliant liquidity management instrument for Islamic retail banks, known as wakala with the aim of helping local Islamic retail banks park their surplus liquidity with the CBB. This wakala instrument is based on a standard contract of the International Islamic Financial Market (IIFM).

A comprehensive regulatory framework specific to takaful and re-takaful companies was introduced in 2005. As with the banking sector, this Rulebook provided a comprehensive regulatory framework in the international Islamic finance industry. Over the years, continuous updates of the regulations were done to reflect regulatory development and industry best practices. A decade later, CBB released a new regulatory framework for the takaful sector with a view of reaffirming Bahrain as the jurisdiction of choice for all takaful and retakaful companies globally. This new Operational and Solvency Framework for the Takaful and Retakaful Industry has stronger protection for customers and stricter solvency requirements at its core as it imposes more stringent requirements on firms to ensure they can generate a capital surplus through operational efficiencies. Takaful operators are also required to establish a policy governing the return of surplus. The framework sets out explicitly the need to use the wakala model for underwriting and the mudaraba model for investment. Putting corporate governance at the forefront, the revised rules are expected to encourage new takaful operators to enter the market, while existing policy writers should be better placed to compete against their peers and conventional counterparts.

Bahrain’s Collective Investment Undertakings (CIUs) regulations provide for the establishment of Shari’a-compliant funds. The CIUs provide for a full range of investment funds catering to various types of investors, from retail to high-net-worth individuals and institutional investors. In order to further enhance the existing CIUs framework, the CBB issued the ‘Volume 7 Rulebook’ in 2015, which provides comprehensive regulations on the authorization and super-vision of CIUs domiciled or offered for sale in Bahrain. The new regulation also expands the variety of funds that can be established in Bahrain by introducing rules governing Real Estate Investment Trusts and Private Investment Undertakings (PIUs). The PIUs are a new breed of investment funds with a high degree of flexibility in structuring, aimed basically to facilitate private investments, like family-held investments, single investor or single investment type.

The Bahrain Chamber of Commerce and Industry has finalized a draft law for investment, which aims “to reinforce the competitiveness and attractiveness of the Bahraini market, remove impediments for foreign and domestic investments and enhance trust in the investment and business climate of Bahrain”. This new law is meant to eliminate obstacles for foreign and domestic investors and boost competition in the market and stimulate the flow of investments into the country. It is envisaged that the enactment of this law will put Bahrain on the map of attractive investment destinations in line with economic reforms initiated under Bahrain’s Vision 2030.

The Commercial Companies Law was amended in 2016 that saw 100% foreign ownership in residency, food, administrative services, arts, entertainment and leisure, health and social work, information and communications, manufacturing, mining and quarrying, water supplying and professional, scientific, technical and real estate activities. In addition, foreign entities wishing to establish a branch in Bahrain would no longer need a Bahraini sponsor, under Article 347 of the New Companies Law. The new law is meant to spur growth, generate rewarding jobs for citizens, and attract businessmen to invest in various economic sectors.

Driving the Development of New Standards

Bahrain, in collaboration with the IDB and other various stakeholders, has established various supporting institutions for the progress of the Islamic banking and finance industry internationally. Bahrain is presently the host of four major international Islamic finance bodies, namely the Accounting and Auditing Organizations for Islamic Financial Institutions (AAOIFI), the International Islamic Financial Market (IIFM), the Islamic International Rating Agency (IIRA) and the Council for Islamic Banks and Financial Institutions (CIBAFI). Hence, with the presence of this standard-setting and supporting institutions, Bahrain is continuing to drive innovation in the development of new standards in Islamic finance.

In June 2016, the IIFM and the International Swaps and Derivatives Association (ISDA) published two new standards for Islamic forward foreign exchange products for use in Islamic hedging transactions. The ISDA/IIFM Islamic Foreign Exchange Forward (IFX Forward), which falls under the ISDA/IIFM Tahawwut (Hedging) Master Agreement, is intended to help minimize the exposure of Islamic financial institutions to foreign exchange volatility. The standards can be used to mitigate currency risk associated with capital markets instruments, as well as trade finance and corporate banking activities.

A gold standard was launched by AAOIFI in December 2016 in collaboration with the World Gold Council. The gold standard covers Shari’a-compliant mechanisms for dealing and investing in gold in a present-day setting. The new standard could potentially set grounds for the development and structuring of new investment products in conformity with Shari’a rules and precepts and open up a new investment asset class that would facilitate the creation of a broader range of saving, hedging and diversification products.

Thought Leadership Initiatives

Bahrain is recognized as a hub for Islamic scholars and institutions because of its history and institutions. Bahrain’s Islamic finance ecosystem is supported by 17 providers offering Islamic finance-related education but in terms of degree it offers 4 across the country.1 The Bahrain Institute of Banking and Finance (BIBF) offers a number of Islamic finance courses with a global appeal, while the University of Bahrain offers a bachelor’s programme in Islamic banking and finance that combines Shari’a studies with business, banking, accounting, economics and law.

In 2006, the CBB and some Islamic financial institutions came together to create an endowment in order to support the industry by way of training, education and research. The Waqf Fund, an industry initiative operating under the auspices of the CBB, has been instrumental in many Islamic finance training, education and research initiatives over the last decade. These initiatives are executed through partner organizations such as BIBF. Today it is a US$7.5 million fund and has 22 member institutions including the CBB. The endowment generates returns which are used to pay for the various programmes designed to enhance the capacity of the human resources working in the industry. Beyond forums convened by standard-setting bodies, Bahrain also hosts a number of regular and occasional conferences and events in the area of Islamic finance, including the World Islamic Banking Conference (WIBC). For 2017, the Fund has allocated some US$1 million to fund various Islamic finance human capital development initiatives.