Given Indonesia’s large Muslim population, status as an emerging economy in Southeast Asia and recent growth in its Islamic banking assets; Indonesia is primed to become a global player in Islamic finance. In recent years, Islamic finance in Indonesia has shown significant development. Indonesia’s position in the global Islamic finance industry market has also improved as the country is now well recognized as a significant player amongst other renowned players such as the GCC countries and Malaysia. Placed amongst countries that offer substantial lessons in the development of Islamic finance along with the likes of the United Arab Emirates (UAE), Saudi Arabia, Malaysia and Bahrain; Indonesia is also projected to be the driving force behind the next big wave in Islamic finance at the global front together with other countries such as Qatar, Saudi Arabia, Malaysia, UAE and Turkey. Together with 10 other countries, Indonesia was also included in the list of countries with the systematically important Islamic banking industry. Indonesia’s ranking in the Islamic Finance Country Index improved from 7th position in 2015 to 6th in 2016 and was grouped amongst the emerging leaders along with UAE, Kuwait, Bahrain and Qatar. In short, Indonesia is fast emerging as a global influence in Islamic finance.

Islamic Financial Assets

The Islamic financial industry in Indonesia has unique characteristics compared to that of other countries such as Malaysia and the GCC countries, which tend to focus more on investment banking and the Islamic financial market. Fundamental differences are in its retail segment-focused orientation and industry complexity, which includes various types of Islamic financial services institutions. Furthermore, Islamic rural banks, known as Bank Pembiayaan Rakyat Syariah (BPRS) and Islamic microfinance institutions also play a part in establishing the country’s unique characteristics of its Islamic financial industry.

In Indonesia, Islamic rural banks and microfinance institutions play an important role in financial inclusion. Being a vast archipelago state, the Indonesia’s geography presents a challenge for Islamic financial institutions to reach the country’s remote areas. High investments requirement coupled with the uncertainty associated with opening new grounds does little to appeal and interest investors and Islamic financial institutions to open branches in remote areas. This, in turn, led to low levels of financial literacy and financial inclusion. As a solution to this, Islamic rural banks and microfinance institutions mostly operate in their local areas and target the lower-income segments of the population. It is worthy to note the existence of microfinance institutions that is unique to Indonesia known as Baitul Maal wat Tamwil.

Baitul Maal wat Tamwil or BMT is an Islamic microfinance institution that operates on the principle of profit-sharing and apply Islamic moral values and group solidarity. With the combined economic and socio-religious objectives, BMT provides financial services to poor people and helping the needy participate in economic activities through small and micro businesses. Structurally, BMT functions as both a baitul maal and baitul tamwil. As a baitul maal, BMT collects and disburses social and religious funds such as zakat, infaq and sadaqah. In its role as a baitul tamwil, BMT conducts financial intermediations through deposit mobilizations and financing of commercial ventures.

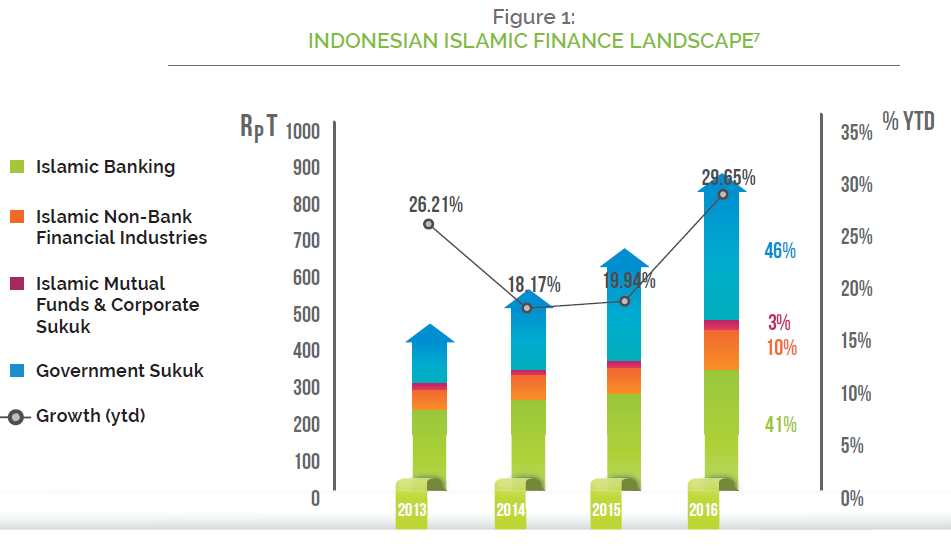

Indonesia, as the most populous Muslim country in the world, has huge potential for Islamic finance (87.19% of Indonesia’s 237 million population are Muslims). Accelerating collaborative efforts with various stakeholders are necessary to tap this enormous potential. Figure 1 exhibits growth of the Islamic finance industry and each sector’s (banking, capital market and non-bank financial sector) share of the total Islamic financial assets. As shown in Figure 1, the Indonesian Islamic financial assets (excluding Islamic stocks) reached IDR889.28 trillion or approximately US$66.18 billion, and this consists of:

- Islamic banking sector: 41.04% or IDR365.65 trillion or US$27.21 billion;

- Islamic non-bank financial sector which includes Islamic insurance, Islamic multi-finance and other Islamic non-bank financial institution: 9.7% or IDR85.48 trillion or

US$6.36 billion;

- Islamic mutual funds: 1.68% or IDR14.91 trillion or US$1.11 billion;

- Government sukuk and corporate sukuk: 47.59% or IDR423.25 trillion or

US$31.50 billion.

Furthermore, the market capitalization of Shari’a-compliant equities in Indonesia, which is not included in the graph, reached IDR3,170.06 trillion or US$235.94 billion as of December 2016. Islamic financial industry in Indonesia has shown favourable developments in recent years. Strong support and commitment from the government and regulatory authorities to further promote Islamic finance in Indonesia has yielded encouraging results. Otoritas Jasa Keuangan or Indonesian Financial Services Authority (OJK), as the regulatory and supervisory authority, has given considerable attention to the development of Islamic finance industry through the launching of several initiatives, among others, new regulatory frameworks and the relaxation/simplification of existing regulations, stimulus measures, and codification for product enhancement. Thus, in the last ten years, the industry has marked significant progress with increased in financial assets, greater product variations, higher level of awareness and understanding of Islamic finance, and the development of comprehensive regulatory frameworks.

Continuous growth in the Islamic finance industry in recent years has established Indonesia’s position as a recognized player in the global Islamic finance industry. This is evidence by the number of awards and accolades received as listed below:

OJK received an award as the Best Regulator in Promoting Islamic Finance (Islamic Finance News, Malaysia: 2014);

On September 30th, 2016, the President of the Republic of Indonesia, Joko Widodo received the Global Islamic Finance Leadership Award 2016 from the Global Islamic Finance Awards (GIFA) for his role in promoting Islamic finance in Indonesia. At the same event, the Indonesian Ministry of Finance received an award for Best Sukuk Deal of The Year 2016.

Islamic Banking

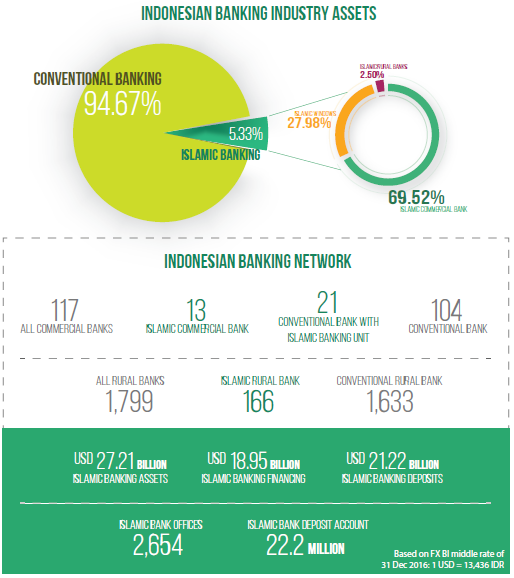

The Islamic banking industry plays an important role in Islamic finance development due to the industry’s relative size in the Islamic financial sector. The Islamic banking industry in Indonesia has experienced rapid growth, recording 19.95% average growth of assets in the last five years, despite slowing down in 2014 and 2015. Industry growth is also evident from the increase in its market share to more than 5% of the total Indonesian banking assets in 2016. Total Islamic banking assets registered IDR365.65 trillion (US$27.21 billion) or 5.33% compared to commercial banks total assets of IDR6,852 trillion or US$509.97 billion. From the overall Islamic banking market share, Islamic commercial banks dominated the market by 69.52% share compared to “Islamic windows” of conventional banks or Islamic Business Unit (IBUs) and Islamic rural banks which made up 27.98% and 2.50% shares respectively. Compared to previous year’s market share which remained less than 5% (4.88% or IDR304 trillion by December 2015), a 20.84% growth in market share is evidence that Indonesia is on the right track in developing its Islamic banking industry.

The establishment of Bank Muamalat Indonesia in 1992 as the pioneer Islamic financial institution in the country, paved the way for others to follow. Since then, the number of Islamic banking institutions have risen steadily. As of December 2016, the Islamic banking infrastructure consisted of 13 Islamic commercial banks, 21 IBUs, and 166 Islamic rural banks. The newest Islamic commercial bank is Bank Aceh Syariah, which was the result of the conversion of Bank Pembangunan Daerah Aceh, and started its operation as a full-fledged Islamic commercial bank on September 19, 2016. With respect to market penetration, third-party funds in the form of deposit accounts reached a total of 22.2 million accounts as of December 2016.

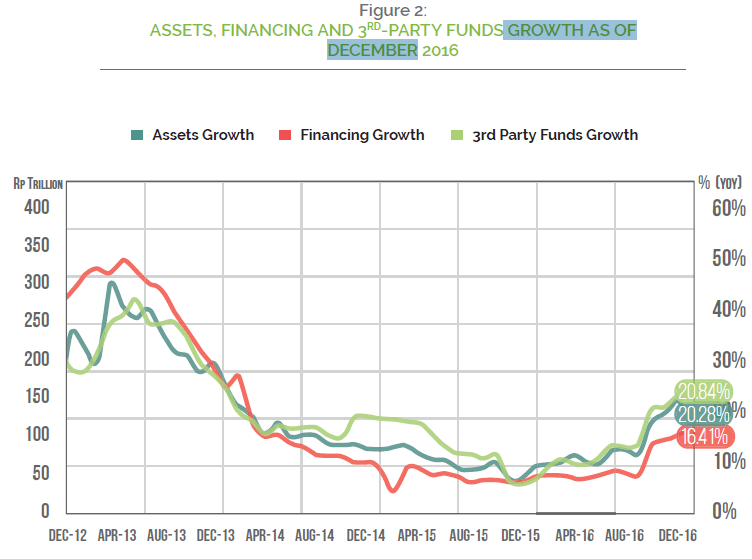

However, the number of Islamic commercial banks or IBUs’ branches declined during 2016 due to office consolidation of several Islamic commercial banks or IBUs into Islamic service counters. Islamic service counters are the delivery channels through which commercial banks provide Islamic banking products and services. Hence, for cost-efficiency purposes, Islamic service counters are located in conventional bank premises. This is one of the many examples of Islamic banking industry’s continued commitment to develop itself while placing great importance to cost optimization.In general, Islamic banking still showed good performance marked by effective intermediary function, along with higher funding and financing growth. Islamic banking recorded assets worth IDR365 trillion (US$27.21 billion), an increase of 20.28% during 2016 (Figure 2). Third-party funds also increased by 20.84%, from IDR236.02 trillion in December 2015 to IDR285.15 trillion (US$21.22 billion) in December 2016. Similar trend was also recorded in financing, which showed an increase from IDR218.72 trillion to IDR254.64 trillion (US$18.95 billion on 2016), registering a 16.41% growth during 2016. With the latest figures, the industry’s FDR was in the range of 80% to 90%. Pursuant to Bank Indonesia Regulation 8/23/PBI/2006 concerning statutory reserves, Islamic commercial banks and IBUs are not imposed additional statutory reserves if they fulfil 80% or more FDR, otherwise they will be subjected to additional minimum reserves of between 1% and 3%.

The resilience of the Islamic banking industry is also determined by capital and financing quality. Capital adequacy ratio (CAR), expressed as a percentage of a bank’s risk-weighted credit, is the main indicator which assesses the capital aspect of Islamic banking exposures. Ranging from 8% to 11%, depending on the individual bank’s risk profile, the minimum CAR is critical to ensure banks have adequate buffer to absorb losses before they become insolvent. It is used to protect depositors and promote the stability and efficiency of financial system. The capitalization of the Islamic banking industry remained sound with CAR of 15.95% as at end of December 2016, which was achieved through additional paid-up capital, issuance of subordinate sukuk and accumulated earnings during 2016. Non-performing financing (NPF) gross ratio and net ratio – indicators of financing quality, declined from 4.34% and 2.77% respectively in 2015, to 4.16% 2.07% respectively in 2016.

Islamic Capital Market

The development of Islamic capital market in Indonesia began in 1997 when the first Shari’a-compliant capital markets product was issued in Indonesia, a mutual fund sold by local financial services firm Danareksa. Since then, the industry has continued to evolve with the launch of the Jakarta Islamic Index in 2000, and the issuance of corporate and sovereign sukuk in 2002 and 2008 respectively. In the context of providing legal certainty and reinforcing the industry’s infrastructure, Bapepam-LK (now known as OJK) as the capital market authority issued the Islamic capital market regulation in 2006 and the official list of Islamic equities or known as Daftar Efek Syariah (DES) in 2007. Other Islamic capital market products such as Islamic equity and Islamic Exchange Traded Funds (ETF) have also been facilitated by Islamic online trading system introduced in 2011. The industry has grown steadily in terms of product creation, definition and regulation.

In 2016, the Islamic capital market industry experienced positive growth as indicated by the increased in the number of products, index level and number of Islamic equities included in the DES. At the end of 2016, the Indonesian Islamic Equity Index (IIEI) closed at 172.08 points, an 18.62% increase from its 2015 level. Index capitalization also rose 21.89%, from IDR2,600.85 trillion to IDR3,170.06 trillion (US$235.94 billion) in 2016, representing 55.1% of total market capitalization. The Jakarta Islamic Index, which contains thirty of the most tradable Islamic equities in terms of market capitalization and trading value, closed at 694.127 points, a 15.05% increase from its December 2015 position with a market capitalization of IDR2,035.19 trillion (US$151.47 billion) or 35.37% of total market capitalization.

As a fund placement guideline for Islamic mutual funds, the OJK periodically publishes the Shari’a Securities List, at the end of every May and November. The list serves as an investment guide for users, such as investment managers that manage Islamic mutual funds, Shari’a insurance products and investors interested in investing in Islamic securities portfolio. In its latest publication of November 2016, a total 347 securities were featured in DES, which is 57.56% of total listed companies. This represents an increase from 337 equities reported in the May 2016. The increased in the number of equities passing DES screening provides for more investment alternatives for investors who wish to invest in Islamic equity products.

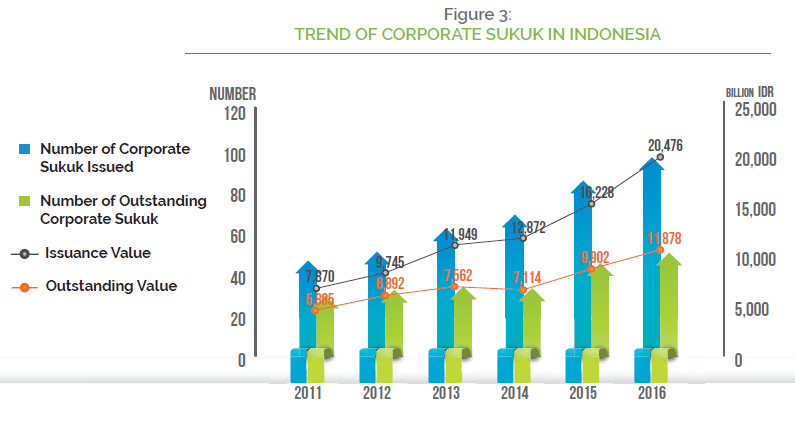

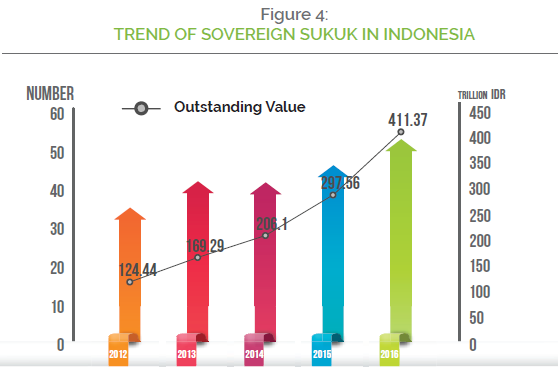

During 2016, a total of 14 corporate sukuk worth IDR3.82 trillion (US$3.82 billion) were issued and 6 sukuk with a total value of IDR1.002 trillion (US$74.58 million) matured. Hence, at the end of 2016, there were 53 outstanding corporate sukuk with a total value of IDR11.88 trillion (US$0.88 billion) or 3.79% of IDR313.39 trillion (US$23.32 billion) total tradable corporate bonds and sukuk outstanding. Since the first issuance in 2002, a total of 102 corporate sukuk have been issued with a total issuance value of IDR20.71 trillion (Figure 3). It is worth noting that Indonesia has issued IDR565. 74 trillion worth of sovereign sukuk both in the domestic (IDR-denominated) and international (US$-denominated) markets through auctions, book building or private placements. As of December 2016, the total outstanding value of sovereign sukuk was equivalent to IDR412.63 trillion (US$30.71 billion) or 15% of total sovereign bonds and sukuk outstanding (Figure 4).

As at end of December 2016, the country has launched a total of 136 Islamic mutual funds with total net asset value (NAV) of IDR14.91 trillion (US$1.11 billion), comprising 43 new issuances and one liquidation of an Islamic mutual fund. This represents an increase of 35.30% from previous year’s NAV of IDR11.02 trillion. Islamic mutual funds represent 4.4% of the total NAV of active mutual funds amounting to IDR338.75 trillion (US$25.21 billion).

Islamic Non-Bank Financial Industry

The Islamic non-bank financial industry supervised by OJK comprises of Islamic insurance (insurance, reinsurance and insurance brokerage), Islamic pension funds, Islamic financing (multi-finance, venture capital and infrastructure financing) and other Islamic financial services (credit insurance, fiduciary, export financing and microfinance). As with other Islamic financial sectors, Islamic non-bank financial industry has been making significant inroads, as indicated by the increase in the number of market players and total assets.

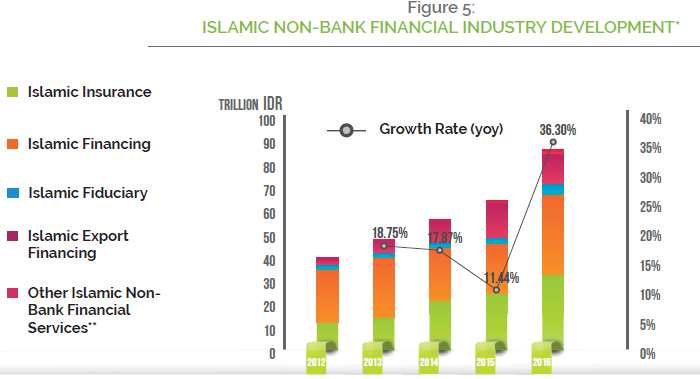

As at December 2016, there were 127 Islamic non-bank institutions registered with OJK, which include 58 Islamic insurance firms, Islamic financing firms (41 Islamic financing firms, seven Islamic venture capital firms and one infrastructure financing firms), six specialized Islamic financial services institutions (four Islamic credit insurance firms, one Islamic fiduciary firms and one Islamic export financing firms) as well as 14 Islamic microfinance institutions. The number of institutions increased by 13.39% from 112 total market players in 2015. In terms of assets, the industry’s total assets rose by 36.30% from IDR65.06 trillion in 2015 to IDR85. 48 trillion (US$6.36 billion) in December 2016 (Figure 5). The addition of new market players coupled with the enhancement of products and services generated asset growth, which drove the industry’s market share to 4.66% as of December 2016, representing a 0.75% increase compared to the previous year.

As shown in Figure 5, Islamic insurance and Islamic financing made up a substantial portion of total Islamic non-bank financial industry, 37.48% and 40.30% respectively. Consistent with industry growth, Islamic insurance assets also increased significantly, i.e. 24.56% from previous year to IDR33.24 trillion (US$2.47 billion) as of December 2016. With the entry of three new Islamic insurance providers in 2016, the Islamic insurance sector comprises of 58 institutions. In the last five years, asset growth and market share of Islamic insurance sector industry have reached 29.58% and 4.60% on average respectively. As the case with Islamic insurance, Islamic financing showed positive growth in 2016 with asset growth of 56.55% from IDR22.35 trillion to IDR35.74 trillion (US$2.66 billion).

For each sectors in Islamic finance (Islamic banking, Islamic capital market, and Islamic non-bank financial industry), OJK has developed their respective roadmaps that outlines several strategies to develop Islamic finance industry for the period of 2015-2019 including policy directions and priority programmes. Given the dynamic and fast-paced nature of the global financial industry, all three sectors are increasingly linked with global markets. Therefore, it becomes imperative to pay attention to cross-sectorial issues within the sectors. With this in mind, the OJK is currently developing a roadmap for the Islamic finance industry that address cross-sectorial issues, set policy direction and develop programmes to further advance Islamic finance industry as a whole.

The Indonesian Islamic Banking Roadmap for 2015-2019

In its effort to develop Islamic finance industry, Indonesia faces challenges brought about by both internal and external factors. Islamic banking as one of the major contributors to the Islamic finance industry, faces several strategic issues with significant impact on the national Islamic banking development. The strategic issues are follows:

Strategic Issues of Indonesia Islamic Banking Industry

1.Misalignment in the visions and lack of coordination between the government and authorities

The lack of integration in the development and implementation of strategies, plans, and priorities of various stakeholders can potentially hamper development of Islamic finance in the country. Coordinated efforts between related stakeholders in the Islamic finance industry are needed to ensure synergistic developments in building a sustainable industry, taking into account objectives of each stakeholders without losing sight of their end goals.

2. Capital remains inadequate, industry scale and individual banks remain small, with low of efficiency

Inadequate capital of Islamic banking industry is the biggest constraint to business expansion such as opening branch offices, developing infrastructure and expanding services and products segmentation. Furthermore, Islamic banking needs to increase its operational efficiency to improve profitability and market bargaining power.

3. High cost of fund limits financing

Stiff competition in the retail-consumer segment demands that Islamic banks have adequate infrastructure in the delivery channels, otherwise Islamic banks bear the risk of servicing the retail-consumer segment only. On the other hand, expansion into new segments such as commercial and corporate, may also be constrained by capital size and adverse selection risk due to inefficient funding structure.

4. Limited products and services that do not meet public expectations

One of the reasons for the unwillingness on the part of customers to switch to Islamic banking is lack of product diversity. Although a number of products and services have been introduced by Islamic banks over the years, their features and accessibilities are not as comprehensive as conventional banks. Additionally, uncompetitive pricing and low level of service quality of Islamic banks as well as low public literacy level have resulted in huge gap in customers’ expectation, hence resulting in the unwillingness to switch to and patronage Islamic banks.

5. Quantity and quality of Human Resources (HR) is not yet adequate and Information Technology (IT) is not yet capable of supporting products and services development

The primary problem related to human resources in Islamic banking is the limited understanding of Shari’a principles and how to perform transactions based on Islamic perspectives. Furthermore, limited resources imposed a constraint on Islamic financial institutions to develop and conduct comprehensive training programmes. On the other hand, the IT system of Islamic banks is currently not as equipped and accessible as conventional banks. Inflexibility of the IT systems to accommodate new products, system development speed, systems support, and IT development resources as among barriers to product innovation and service quality. Other issues include shareholders’ awareness of the vital role of the IT system, improper planning of IT requirement for current and future business development and surveillance of IT operations, including the availability of reliable IT auditors.

6. Low public understanding and awareness of Islamic banking

Perception and knowledge of Islamic banking is still low, resulting in low banking penetration. The industry also faces public misperception about Islamic banking and its distinction over conventional banking as well as misperception among customers in relation to the unique features of Islamic banking products and services. In addition, Islamic banking is also confronted by another challenge – lack of incentives for customers to switch to Islamic banking.

7. Regulation and supervision are not yet optimal

A dynamic and integrated global economy demands that the industry adapt faster to market changes. To remain current and relevant, regulatory framework must be updated consistent with global economic and industry changes. Regulating cross-sectorial issues as well as synchronization of regulation across financial services sectors are essential harmonious development in Islamic finance.

Policy Directions to Drive Islamic Finance to the Next Level

In order to overcome the challenges discussed earlier, OJK as the regulator and supervisory authority has developed integrated policy measures to optimize the industry’s potential. These policy directions and implementation of priority programmes are discussed and highlighted in this section.

1. Strengthen policy synergy between the authorities and government and other stakeholders

The OJK together with the government and various stakeholders have taken several measures, commitments and efforts to boost the growth of the Islamic finance industry. However, efforts to develop Islamic finance have remained fragmented and managed independently as each stakeholder are restricted or limited based on their respective capacity. There is a necessity to create a comprehensive vision and objectives that synergies and optimize strategies, plans and priorities to achieve harmonization in the development of Islamic banking. Examples of priority programmes for this policy direction are as follows:

Promote the establishment of the Indonesian National Committee for the development of Islamic finance

The Islamic Finance National Committee (IFNC) was established by the issuance of President Decree 91/2016 signed by the President of the Republic of Indonesia, Joko Widodo on November 3rd, 2016. IFNC serves as a policy coordinator for government, authorities, market players and other related parties to boost the growth of the Islamic finance industry. OJK as the primary stakeholder in the development of Islamic finance in the country will play an active role in IFNC’s programmes including IFNC’s strategic initiatives in developing Islamic finance.

Establishment of Jakarta International Islamic Financial Center (JIFC)

During the Global Islamic Financial Awards 2016, the President of the Republic of Indonesia, Joko Widodo, emphasized in his speech that Jakarta, as the capital city of Indonesia and Indonesia as a country with the largest Muslim population, has a bright prospect to be an international center in Islamic economics and finance. In pursuant with the President’s directive, OJK is spearheading an initiative to establish the Jakarta Islamic Financial Centre (JIFC) in 2017 in the form of an Exclusive Economic Zones (EEZs), which will include not only all aspects related to Islamic finance but also other related Islamic economic aspects such as the halal industry.

2. Strengthen capital and business scale as well as enhance efficiency

Despite its enormous potential, Islamic banking continues to be confronted with issues and challenges that have hampered its growth potential. Among this are public perception that Islamic banking serves only certain limited segment of the society as well as the market size of the industry itself. Hence, accelerating and enhancing market outreach of Islamic banking products and services to the wider consumer segment are necessary steps that need to be taken to optimize economic benefits of Islamic banking. In achieving those objectives, capital base of Islamic banks needs to be strengthened in order to have adequate business scale for undertaking expansion and become the preferred financial solutions provider.

Development of a roadmap for Islamic Business Unit spin-off

Capital limitation to establish new Islamic banks or expand business of existing Islamic banks has hindered the development of Islamic banking industry in Indonesia. As a solution to this problem, the banking authority introduced the dual banking system to facilitate conventional banks in opening IBUs along its branch offices through the office channeling policy. However, dual banking system presents several issues related to IBUs’ ability in operating independently in the long-term from business perspective, as well as Shari’a-compliant issues as IBUs operate using conventional banks’ facilities including but not limited to the potential of co-mingling of funds.

Mitigating these issues, the Law No. 21 of 2008 concerning Islamic banking in Indonesia was established. One of the crucial issues in this law is related to the spinoff IBUs into full-fledged Islamic banks at the latest 15 years after the Act comes into force. The spinoff policy of IBUs was expected to enhance business volume and penetration of Islamic business services. In line with demand for conventional banks to step up their commitments in developing Islamic business subsidiaries, each conventional banks with IBUs is required to prepare a roadmap for such spinoff plans.

As of December 2016, one IBU – BTPN Syariah, has been spinoff to become a full-fledged Islamic commercial bank. Other banks such as Bank Victoria Syariah, BCA Syariah and Bank Aceh Syariah have converted into full-fledged Islamic commercial banks. The most recent one is the conversion of Aceh Bank into Aceh Islamic Bank (“Bank Aceh Syariah”), which was finalized in October 2016. At present, Jatim Bank and NTB Bank are undergoing talks with OJK with regards to their spinoff and conversion plans.

3. Improving funding structure to support expansion in financing segment

One of the measures to improve banks’ stability is to diversify its funding structure. Dominated by retail-consumer segmentation, Islamic banks are expected to balance its share of commercial and corporate segments, as well as stepping up the support for cross-country trading activities. Other funding sources should also be considered to strengthen liquidity and capital base of Islamic banks for credit expansion.

Optimization of hajj fund management through Islamic banking

Hajj deposit fund estimated to be around IDR90.60 trillion or US$6.74 billion, is managed by the Ministry of Religious Affairs through placement in sukuk, Indonesian sovereign bills and time deposits10. Since the regulation does not provide any provisions requiring the placement of hajj funds in the Islamic banking system, the funds were placed primarily in conventional state-owned banks prior to 2014.

In order to strengthen Islamic banking funding sources, the government Act number 34/2014 allows it to invest in Islamic banking products, sukuk, gold, direct investments, and equity placements. With this, the government hopes to optimize hajj fund management through Islamic banks. The law issued also requires hajj fund to be deposited with either Islamic banks or Islamic business units of conventional banks. The Act states that placement or investment of hajj fund should correspond with Shari’a principles. The Act also requires the establishment of the Hajj Fund Management Agency (Badan Pengelolaan Keuangan Haji), thus creating a clear demarcation between fund management and pilgrimage management where the Hajj Fund Management Agency will manage the funds while the Ministry will be responsible for pilgrimage management.

Optimisation of the management of waqf, zakat, and sadaqah funds at the same time enhancement of the integration of social function into Islamic bank business activities

Social funds such as waqf, zakat and sadaqah funds are often disregarded due to their non-commercial nature. It is unfortunate because the potential cash waqf as calculated by the Indonesian Waqf Board is estimated at IDR120 trillion (approximately US$8.93 billion) annually. The government decree related to waqf states that cash waqf should be deposited into Islamic financial institutions. Other provisions of the law include the requirement for cash waqf to be invested in Islamic financial institutions’ products and/or Islamic financial instruments. Given the restriction that limits Islamic banks from becoming a nadzir or endowment manager, collaborations with various waqf managements should be strengthened with a view of maximising potential waqf benefits for the Islamic banking industry.

In November 2016. BNI Syariah launched its Wakaf Hasanah savings account, specifically designed for waqf purposes. BNI Syariah claimed that the product has collected IDR3.2 billion as of January 2017 and is targeting to collect some IDR20 billion by the end of 2017. A specific feature that could attract high growth of waqf fund in a relatively short-time period is customers’ ability to choose available projects to be financed through their cash waqf.

Expansion of productive financing in corporate and long-term (infrastructure) sectors

National infrastructure financing has been dominated by conventional banks due to its large financing capacity. Examples of infrastructure financing are power plant projects, highway and rail construction projects, and fibre optic network procurements that fall under strategic sector for strengthening national economy. As infrastructure projects usually involve high amount of financing, it limits the participation of Islamic banks. Although, individually, the ability of Islamic banks in providing large-scale financing is still relatively limited, Islamic banking has the potential to contribute to economic development, including infrastructure development through syndicated financing. A recent example of infrastructure financing by Islamic banks is the toll road development project connecting Soreang and Pasir Koja in Bandung, West Java worth IDR834 billion or approximately US$63.5 million.

4. Improve service quality and product diversity

In overcoming fast-paced and dynamic global challenges, Islamic banking needs to step up in service quality enhancement to maintain and further expand its market share. With majority of customers already banking with conventional banks, customer will need incentives to switch to Islamic banks beyond religious reasons. Otherwise Islamic banks will continue to face public misperceptions that Islamic banking is mainly for Muslims. Enhancement and diversification of product features and services provided by Islamic banks as well as price and service quality advantage will be Islamic banks’ bargaining power in customers’ acquisition.

Enhancement of regulations concerning new products and activities As the regulatory authority, OJK periodically reviews and amends Islamic banking regulation, specifically concerning products and activities, consistent with the needs and challenges facing the industry. In 2015, the OJK finalized the codification guide of Islamic banking products which allow Islamic banks to launch new products without undergoing licensing process from OJK. The codification rule was included in the Fifth Policy Package issued by the government at the end of October 2015.

Launch of Islamic savings deposit product for students

In efforts to increase financial inclusion to the wider consumer segment in correspond to the National Strategy for Financial Literacy, the Simpel iB (Islamic savings account for student) was launched on June 14th, 2014 by the President of the Republic of Indonesia, Joko Widodo. Launched nationally by the Indonesian banking industry in a bid to encourage savings at an early age, some of the salient features of Simpel iB’s are easy and simple requirements, low administration fee and minimum deposit.

5. Improvement of the quantity and quality of HR & IT as well as other infrastructure

The need for quality human resources in Islamic banking industry has encouraged multiple efforts from relevant stakeholders. Various trainings and professional certifications are available through licensed institutions. Several universities have also introduced Islamic finance programmes in their curriculums. However, the scope of these efforts are at present limited to basic knowledge in Islamic banking. Accelerating efforts to enhance the competency level of Islamic banking professionals are necessary to produce human resources with comprehensive knowledge of both banking and Shari’a.

In the banking industry, IT is no longer viewed as merely supporting the bank’s infrastructure but more as a business driver. A good IT infrastructure and support helps improve banks’ competitiveness, enhance their customer service and attract new customers. Other benefits include lowering operational cost and raising fee-based income through the use of delivery channels. Serious efforts taken in a sustainable manner are required to achieve the needed levels of both quantity and quality in human resources and IT to ensure that development of products and services is in line with public expectations.

Competency mapping and competency standards of Islamic bankers

Competency mapping based on structural level and operational functions is needed to achieve competency at the highest level in Islamic banks. Based on this, competency standards of Islamic banker for each levels and functions are being developed and adopted in developing certifications programmes as well as other HR quality enhancement programmes in Islamic banking. In 2016, OJK conducted a review on the competency standards of rural banks personnel. The draft has been through public hearing in the form of convention in December 2016 and has been submitted to the Ministry of Labor for review and subsequently, adoption in 2017.

Evaluation of policies/regulations related to the joint use of IT facilities (IT sharing) between parent and subsidiary companies

The IT capacity of Islamic banks is still far below its conventional counterpart, resulting in differences in operational and services quality provided to customers. In light of this, the OJK issued regulation concerning implementation of risk management in utilizing IT in banking in 2016, where one of the clauses state that banks are allowed to provide IT services (limited to data center and disaster recovery center) to other financial services institutions under certain conditions. The regulation also states that banks can provide application only for other banks under certain conditions. OJK will also conduct a study on policies concerning joint use of facilities, IT and non-IT, between parent and subsidiary companies related to Islamic banking. This study will identify the benefits and challenges as well as risks related to facilities sharing in the context of groups, both in the short-term as well as the long-term.

6. Enhancement of public literacy and preference

The use of Islamic financial products is strongly influenced by public understanding of functions, types, and characteristics of the products themselves. Educating public on Islamic financial products through events and publications can be done through collaborations with various stakeholders. In this regards, there is a need to further accelerate efforts in enhancing public literacy of Islamic banking in order to be at par with conventional banking in terms of financial literacy. Apart from public understanding of Islamic banking, public preference also needs to be enhanced in order to increase the market share of Islamic banking.

Strengthen collaboration with Consumer Education and Protection (CEP) department and main stakeholders for Islamic finance literacy enhancement In 2016, the CEP department conducted a survey on financial literacy and inclusion level in several cities in Indonesia. The survey, which is conducted once every three years with the last one in 2013, for the first time included a component on Shari’a in its 2016 questionnaire. Findings from the survey showed that the Islamic finance literacy rate stood at 8.11%, whereas financial inclusion rate in Indonesia was at 11.06%, with Islamic banking sector achieving 6.63% and 9.61% in financial literacy rate and financial inclusion rate, respectively.

Some of the reasons cited for the low rates in Islamic finance literacy and financial inclusion included low understanding or limited knowledge of banking and finance, inaccessible bank locations and misperception of Shari’a products such as complexity of agreement, unfamiliarity of terms, and perceived high cost. In comparison, the conventional finance sector’s financial literacy and inclusion was at 29.66% and 67.82% respectively, with its banking sector registering 28.94% and 63.63% rate of financial literacy and inclusion.

7. Strengthening and harmonising regulations and supervision

The current dynamic global economy and integrated financial sector’s products and activities have heightened competition within the global financial industry. In order to withstand these global challenges and remain relevant, regulators and supervisors must adapt to global shifts while at the same time create fairness to market players and harmonize cross-sectorial regulations.

Harmonization of Islamic rural banks regulatory framework with regulatory frameworks of conventional rural banks, commercial banks, and Islamic microfinance institutions

Fair level playing field in Islamic banking industry is necessary to ensure that the industry is not concentrated with only a few entities. In the current environment, 37.78% of the industry’s market share is dominated by two biggest Islamic banks in Indonesia. In light of this, a harmonious regulatory framework is needed to create a level playing field for medium, small and microfinance institutions to include conventional banks’ commitment to enhance their Islamic banking subsidiaries/business units to reach a minimum of 10% share of the parent/primary companies’ (conventional banks) assets.

Islamic Banking Prospect for 2017-2018

Based on positive performance of Islamic banking industry during 2016 and growth forecasts based on Islamic banks’ business plan for 2017, the Islamic banking industry is projected to grow between 12% and 15% in 2017. Several factors that influence the development of Islamic banking in the future are as follows:

A number of Islamic banks have announced plan to increase their capital to expand their business coverage through additional paid up capital and issuance of subordinate sukuk amounting to IDR1.7 trillion. Increased capital is expected to boost Islamic banks’ financing.

Spinoff of several IBUs such as IBU of East Java Regional Development Bank (“BPD Jawa Timur”) and IBU of Sinarmas Bank.

Conversion of West Nusa Tenggara Regional Development Bank (“BPD Nusa Tenggara Barat”) into a full-fledged Islamic bank by 2018.

To increase the market share, some Islamic banks are exploring opportunities to manage endowment funds or waqf assets including product innovation that has unique characteristic such as cash waqf.

Commitment and support from conventional parent banks to develop its Islamic banking subsidiaries to attain between 10% and 15% minimum share of the parent bank’s assets.Participation of Islamic banks in financial inclusion programmes, such as branchless banking (“Laku Pandai”), students’ savings account (“Simpel iB”), and Islamic microfinance (“Kredit Usaha Rakyat Syariah”) as well as other government priority programmes such as sustainable finance programme through organic farm financing pilot project (“Aksi Pro-Salam”).

. Act Number 34/2014 concerning Hajj Fund Management.

. Using assumption that there are 100 million people deposit cash waqf amounted 100 thousand IDR per month. Article source: http://bwi.or.id titled “Wakaf Perlu Didukung untuk Perkuat Perekonomian Nasional” on February 21, 2017.

. OJK Regulation Number