The Kingdom of Saudi Arabia has a mature and developed Islamic finance industry where Islamic banking assets represent about 35% share of the global Islamic banking assets and two-thirds of the country’s total bank financing. It also has the highest penetration rate of 55%. The strong and historical presence of Islamic banking in Saudi Arabia is reflected in the long-established Islamic financial institutions such as Al Rajhi Bank, which is the largest Islamic bank in the world (outside Iran). The Kingdom is also home to Islamic Development Bank (IDB), which is a multilateral development financing institution aimed at fostering the economic development and social progress of its 57 member countries and other Muslim communities around the world. However, in the wake of a dramatic fall in oil prices, Saudi Arabia announced a new ambitious national vision aimed at diversifying its economy away from oil and transforming the country into a diversified global investment powerhouse.

Islamic Financial Policy in Saudi Arabia

Saudi Arabia adopts a single regulatory framework for all financial institutions under a parallel financial system. As such, its legislations make no reference to Islamic banking and finance nor does the existing regulatory and legal framework distinguishes between Islamic banking and finance and conventional banking. The use of interest is prohibited but interest-based transactions are practised in Saudi Arabia, where the term “commission” is used instead of interest. Islamic banking and financial activities are regulated and supervised side-by-side with conventional commercial banking businesses by the Saudi Arabian Monetary Authority (SAMA) under the Banking Control Law (BCL) of 1966, which was issued under

Royal Decree No. M/5 dated 11/6/1966. The BCL is considered the main legislation regulating all banking and financial services in Saudi Arabia, which governs conventional banking and Islamic banking alike. SAMA also regulates and supervises the insurance sector under the Law of Supervision of Cooperative Insurance Companies and its implementing regulations.

The Banking Disputes Committee (BDC) (formerly known as the Committee for the Settlement of Banking Disputes) was established by SAMA 1987 for the resolution of disputes concerning banking and finance matters. Prior to this, such disputes fell within the purview of the Shari’a courts being the ‘competent court holding original jurisdiction power’. Although Islamic financial institutions are governed by completely different principles than their conventional counterparts, they must arbitrate their disputes in the same form as conventional financial institutions. In the event that the Committee fails to reach a satisfactory settlement, the dispute shall be referred to the Shari’a courts, which generally enforces strict Islamic law. There is no specific set up for Islamic financial institutions or other Islamic banking and finance-related disputes.

The Capital Markets Law (Royal Decree No. M/30 dated 2/6/1424H, corresponding to 31/7/2003) established the Capital Markets Authority (CMA), which is the sole regulator and supervisor of capital markets in Saudi Arabia. In addition to the absence of regulatory policies and supervisory harmonisation, there is no independent central Shari’a board for overseeing Shari’a compliance of financial transactions and products at a national level. Hence, Shari’a-compliance supervisory rests largely on individual Shari’a boards of respective banks.

In 2012, the Real Estate and Financial Laws were enacted, marking a major reform of its finance law by introducing a system for the provision of mortgages as other financing arrangements by financial companies. These laws are the Mortgage Law, Enforcement Law, Real Estate Financing Regulations, Finance Licensing Regulations and Finance Companies

Control Regulations. The laws establish nationwide standards for mortgage issuance that are compatible with Islamic law, codify Shari’a principles in relation to mortgages. These reforms are expected to increase access to finance options for home ownership and further spur the progress of Islamic finance in the Kingdom.

Shari’a Governance

Saudi Arabia is an Islamic orthodoxy, governed by Shari’a law. It is also the largest market for Islamic financial services. However, the government and financial regulator have by and large shied away from formally recognising Islamic banking and finance in the country. The country neither has any specific regulation on Shari’a advisory nor has it adopted a popular demand of setting up a Shari’a board at the central bank. The Islamic financial institutions have their own Shari’a boards comprising mostly local Shari’a scholars, with a few exceptions where foreign Shari’a scholars have also been included in the institutional Shari’a boards. Hence, the Shari’a advisory bodies of the respective institutions act independently in advising and supervising their Shari’a-based activities. In the recent past, SAMA has taken a more explicit approach to Islamic banking and it is expected that some kind of regulation of Islamic banking and finance will follow.

Islamic Banking

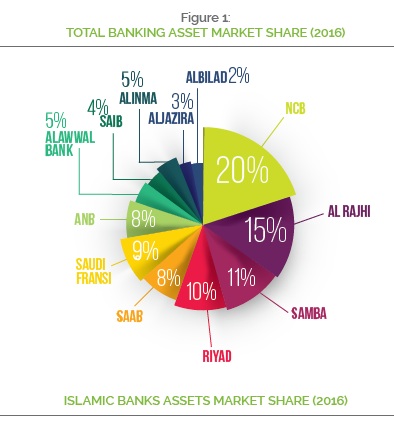

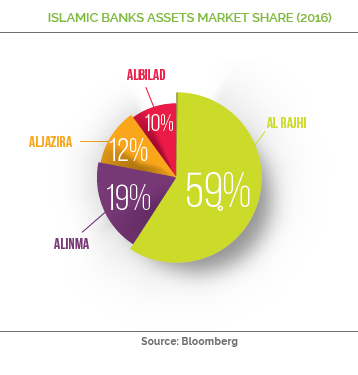

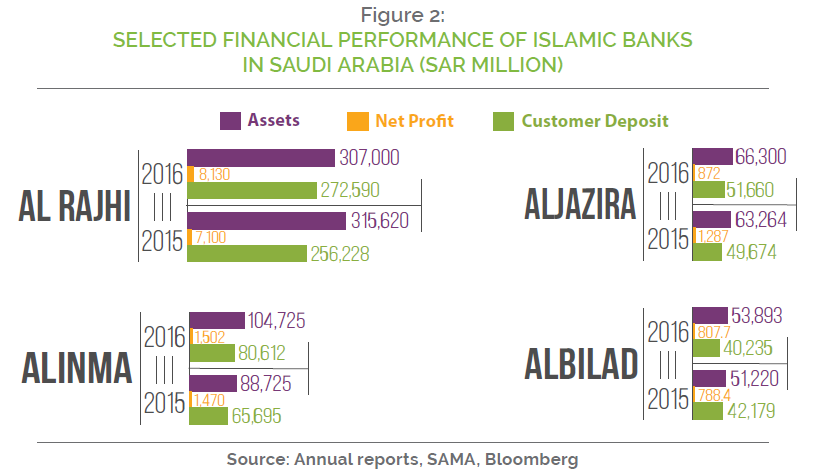

Currently, there are 12 domestic commercial banks operating in Saudi Arabia, out of which four are full-fledged Islamic banks and the rest are conventional banks offering Islamic banking services through the Islamic windows. These four Islamic banks (Al Rajhi, Alinma, Albilad, Aljazira) together hold about 25% of the domestic banking system assets with Al Rajhi controlling 59% market share of the Islamic banking industry (Figures 1 and 2). In terms of deposits, full-fledged Islamic banks accounted for 28% of total deposits in the banking sector in 2016 as compared to 26% in 2015.

Would easily become one of the world’s largest Islamic banks once it is fully converted and thus, replacing Al Rajhi as the biggest Islamic bank in terms of assets and market share. It should be noted that all of NCB’s retail branches provide Shari’a-compliant financial products and services. In February 2016, Social Islami Bank of Bangladesh received approval from SAMA to open branches in Makkah and Jeddah where there is a large Bangladeshi business community. The move was taken by SAMA to widen remittance inflow through formal channels. The inflow of remittance from Saudi Arabia recorded US$181.2 million as at December 2016.

In terms of digital banking, users from Saudi Arabia showed the highest rate of mobile banking adoption in the GCC at 75%, making the Kingdom the most developed banking market in the region. It also reflects the maturity of the Islamic financial services industry in the

country as well as the high penetration rate of Islamic banking. The adoption of fintech by Islamic banks provides significant opportunity to gain greater market as Saudi Arabia is a market with 50% of the population below the age of 25 and has 9 million expats from countries like India, Bangladesh and Egypt, which are largely financially underserved.

Sukuk Market

Saudi Arabia is one of the world’s largest sukuk issuers although its Islamic capital market is not as developed as other jurisdictions like Malaysia (leader in sukuk issuance). As at end of Q3 2016, the Kingdom had issued sukuk worth SR12,275 million. In November 2016, Islamic

Development Bank (IDB) issued a five-year US$1.25 billion sukuk with a 2.263% profit rate and a five-year term. Bank Aljazira and Bank Albilad issued riyal sukuk worth U$533 million each in May and August 2016, respectively. Other notable issuance was the US$267 million sukuk by Vallianz in February. The issue was offered to private investors in Saudi Arabia. As shown in Table 1, Saudi Arabia has been the dominant player in domestic issuance in the GCC region in terms of value, commanding almost 51% of the total domestic sukuk market in the region. A total of 49 domestic sukuk worth US$36,246 million had been issued out of the Kingdom in 15 years.

| COUNTRY | |||||||

| DOMESTIC SU | KUK ISSUANCE | INTERNATIONAL | SUKUK ISSUANCE | T | OTAL SUKUK ISSU | ED | |

| NO. OF ISSUES | AMOUNT (US$ MILLION) | NO. OF ISSUES | AMOUNT (US$ MILLION) | NO. OF ISSUES | AMOUNT (US$ MILLION) | % OF TOTAL VALUE | |

| BAHRAIN | 241 | 12,552 | 99 | 7,860 | 340 | 20,412 | 12.1% |

| KUWAIT | 1 | 332 | 13 | 2,127 | 14 | 2,459 | 1.5% |

| OMAN | 2 | 777 | – | – | 2 | 777 | 0.5% |

| QATAR | 10 | 13,665 | 11 | 9,685 | 21 | 23,350 | 13.9% |

| SAUDI ARABIA | 49 | 36,246 | 39 | 23,218 | 88 | 59,464 | 35.5% |

| UAE | 14 | 8,251 | 81 | 53,816 | 95 | 62,067 | 36.8% |

| TOTAL | 317 | 71,823 | 243 | 96,709 | 560 | 168,529 | 100% |

SUKUK ISSUANCE IN THE GCC AND MIDDLE EAST

(JAN 2001 – DEC 2015)

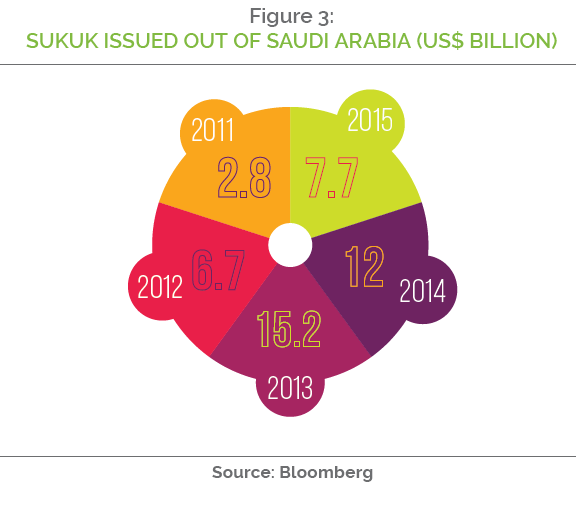

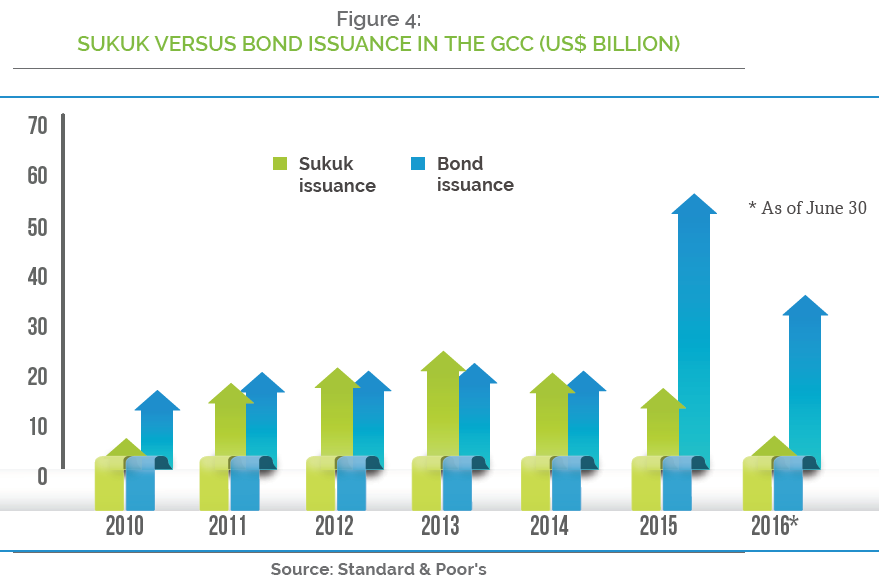

With the fall in oil prices in 2014, many market observers predicted a boom in the sukuk market driven by the demand from governments in oil-exporting countries including Saudi Arabia to tap the sukuk market to cover budget deficits and fund expansion plans. This fell short of market expectations as issuance of sukuk only increased marginally in 2015 and 2016 but exhibited a declining trend since 2014 after reaching an all-time high in 2013 (Figure 3). The subdued issuance volumes were mostly motivated by the drive of the Saudi government to tap conventional sources of liquidity. Like many other governments in the GCC, the preference to issue conventional bonds stems primarily from the desire to tap conventional liquidity from international investors, as quantitative easing has driven yields to zero or even negative rates in various markets (Figure 4). Adding to this is perhaps the relative ease of conventional bond issuance vis-à-vis the complexity of structuring Islamic debt, which has prompted many regional sovereigns to tap the bond markets instead of sukuk markets.

For example, in October 2016, the Saudi government issued a US$17.5 billion debut conventional bond, which is said to be the largest debut debt capital markets transaction, the largest emerging markets bond issue and the largest syndicated sovereign bond. The bond, which was oversubscribed by US$67 billion, reflects the strong appetite for such papers. However, sukuk issuance is likely to rebound in 2017 as the Saudi Arabia 2030 is expected to spark more sukuk issuance as part of the ambitious transformation programme of reducing the Kingdom’s reliance on oil revenues and spur private sector investments by launching public-private partnership projects. The Saudi Finance Ministry had also announced their plans to raise about US$120 billion from the international markets by 2020 with consideration of issuing an international sukuk in the first quarter of 2017.

SUKUK VERSUS BOND ISSUANCE IN THE GCC (US$ BILLION)

Islamic Funds

Saudi Arabia has the largest number of Islamic investment funds in the world holding approximately 40% of the total Asset under Management (AuM). It is also home to 10 out of the 20 largest Islamic funds. As at February 2017, there were 199 Islamic mutual funds registered on Tadawul, the Saudi Stock Exchange. NCB Capital, Saudi Arabia’s largest wealth manager, manages the world’s largest Shari’a-compliant family of funds and the world’s largest Shari’a-compliant fund (US$3.93 billion). SEDCO Capital is another major Islamic fund manager originating from Saudi Arabia. Real estate funds are the most prevalent investment funds in the Kingdom. However, the CMA has been promoting equity funds including those established solely to invest in IPOs.

Two noteworthy developments within the fund industry were the real estate investment-traded funds instructions and the amended investment fund regulations (the New Funds Regulations). Both new regulations provide opportunities to investment banks, private equity firms and asset managers to expand their product offerings and access additional investor bases. The Real Estate Investment Traded Funds Instructions were issued by CMA in October 2016 with the aim of making the real estate market more liquid and investable specifically for Islamic finance instruments. The first REIT to be listed on Tadawul was the Riyad REIT, which is a Shari’a-compliant fund that focuses on generating a portfolio of income-generating real estate assets. A total of 50 million trading units of the Riyad REIT fund were listed on the exchange in November 2016. In January 2017, Aljazira Capital (a Shari’a-compliant brokerage house) received the nod from CMA to list units of its Aljazira Mawten REITs on Tadawul and was subsequently listed on the bourse in February.

The New Funds Regulations came into effect in November 2016 and govern the formation, offering and operations of all private and public investment funds in Saudi Arabia, except publicly offered real estate funds, which are governed by the REIT Regulations. The regulations were drafted to reflect a number of practices that the CMA had informally required of fund managers including the legal requirement for a fund manager to be licensed, provide clarity

on the type of services that may be delegated by a fund manager, the requirement for a fund manager to appoint an independent custodian and requirement for Shari’a-compliant funds to bear a statement to say that the fund has been certified by the Shari’a board appointed for the investment fund.

Takaful

Saudi Arabia has the largest takaful market after the mandatory requirement by SAMA that all insurance companies have to be based on a cooperative business model following the enactment of the Law on Supervision of Cooperative Insurance Companies in 2003 and its subsequent implementation a year later. The law was designed to provide clarity on Shari’a issues and increase market regulation where the legislative framework provided SAMA the responsibility for regulating the insurance sector. Under the law, insurance contracts must comply with the cooperative model, which provides for a Shari’a-compliant structure to be used whereby 10% of the net surplus of an insurer is to be returned to policyholders annually (either directly or in the form of a reduction in premiums for the following year). However, there are no requirements for individual companies to have Shari’a boards, and they are not restricted from investing in non-Shari’a-compliant financial instruments. All insurance companies in Saudi Arabia are listed on the Tadawul, and the CMA ensures that all insurance companies comply with Saudi capital markets law.

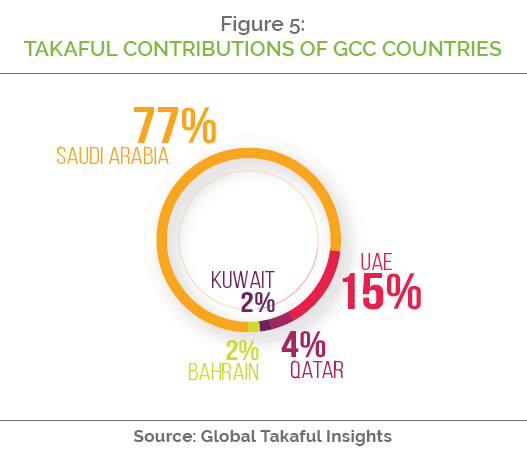

At present, the insurance sector comprises of 35 insurance companies, of which six are explicitly takaful insurers and 29 Islamic cooperative companies. As the world’s largest takaful industry, the sector commands about 48% of global takaful contributions and about 77% of contributions in the GCC (Figure 5). In 2016, the gross written premiums (GWP) reached SAR35.8 billion with an estimated.

Accumulated profits of around SAR2.5 billion or US$666 million. Collectively, the Saudi Arabian insurance industry has seen five years of double-digit growth in both revenue and net profit. The growth in the insurance industry has primarily benefited from mandatory motor and health insurance products imposed by the government and prudent actuarial reserve modelling introduced by the regulator in 2013, which has spurred rates hardening in the medical and motor lines.

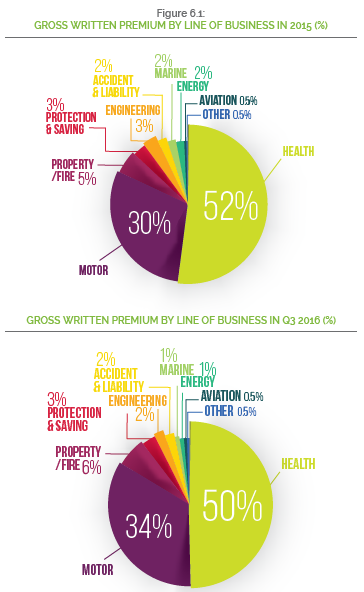

Despite this significant growth, Saudi Arabia has the lowest insurance density in the GCC and one of the region’s lowest penetration levels. At 1.5%, the insurance penetration level is the lowest compared with other GCC countries. The insurance industry in Saudi Arabia consists of general insurance, health insurance and protection and savings insurance. The majority of the direct insurance business is health insurance and motor insurance. In 2015, Saudi Arabia had 82% of its business in health and motor lines as compared to 78% in 2014. By Q3 of 2016, health insurance contributed 50% to GWP whilst contribution of the motor insurance segment was 34% (Figure 6).

The top five providers in terms of GWP remains Tawuniya, Bupa, Medgulf, Malath and Al Rajhi. Together, these companies control about 65% of the total market premium and 58% of profit before zakat (Table 2). In terms of GWP performance, all five companies reported mixed results. Al Rajhi Takaful registered the largest increase in GWP in 2016, an increase of 43%. Meanwhile Medgulf reported a fall of 20% from SAR4,002 million in 2015 to SAR3,194 million in 2016. However, it reported a net profit of SAR67.6 million compared to a loss of SAR261.27 million in 2015. Tawuniya, the oldest insurance company in the country, recorded an increase in its profit before zakat from SAR642 million in 2015 to SAR801 million in 2016.

| COMPANY | |||||||||

| GROSS WRIT (SAR | TEN PREMIUM MLN) | CHANGE | PROFIT BE (SAR | FORE ZAKAT MLN) | CON | CENTRATIO | N BY SEGM | ENTS | |

| 2016 | 2015 | % | 2016 | 2015 | HEALTH | MOTOR | GENERAL | PROTECTION & SAVINGS | |

| TAWUNIYA | 8,055 | 7,545 | +6.76 | 801 | 642 | 60% | 22% | 18% | – |

| BUPA ARABIA | 7,939 | 7,328 | +8.33 | 631 | 645 | 100% | – | – | – |

| MEDGULF | 3,194 | 4,002 | -20.19 | 67.6 | -261.27 | 71% | 18% | 11% | – |

| MALATH | 2,168 | 1,863 | +16.3 | -150 | -2 | 4% | 91% | 5% | – |

| AL RAJHI TAKAFUL | 1,949 | 1,362 | +43.0 | 99.3 | 42.5 | 12% | 80% | 7% | 1% |

| TOTAL | 23,305 | 22,100 | +5.5 | 1,448.6 | 1,066.3 |

PERFORMANCE OF THE TOP 5 INSURANCE COMPANIES

Vision 2030: Moving Beyond Oil

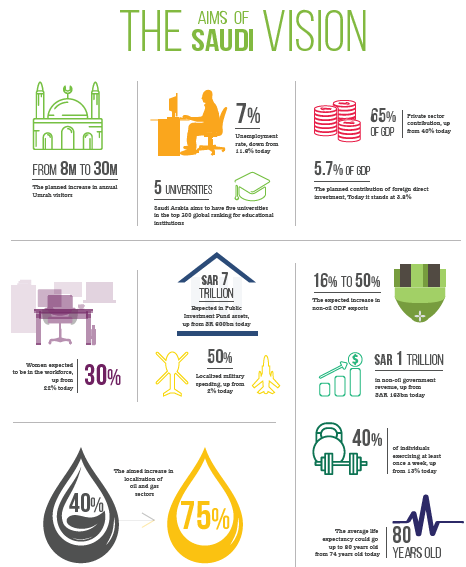

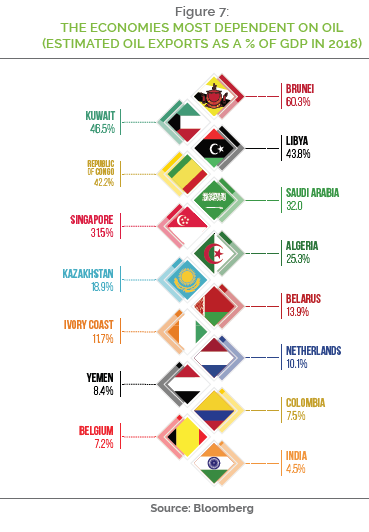

In 2016, the government of Saudi Arabia leadership launched ‘Vision 2030’, outlining the Kingdom’s strategy to reduce its excessive dependence on oil and diversify its economic base (Figure 7). At present, Saudi Arabia’s economy relies on crude oil exports for more than 70% of government revenues. The Vision was introduced against a backdrop of a ‘lower for longer’ oil price environment, rising external and fiscal deficits, and a sharp reduction in the country’s foreign-exchange reserves. With steep decline in oil prices creating fiscal pressure, the Saudi Arabia’s leadership recognised that they could no longer depend solely on the energy sector as its main source of revenue. Vision 2030 and the associated National Transformation Program accelerated reforms in 2016 and highlights fundamental changes that are needed to deal with the Kingdom, including privatisation, subsidy cuts, tourism and creating a more diversified economy.

Vision 2030 provides a long-term economic blueprint for diversifying the Kingdom’s economy away from the oil-centric economy with non-oil government revenues projected to increase six-fold to SAR1 trillion by 2030. Vital to this is diversifying the economy in all aspects including economic, human and social. The vision is targeting sustainable economic development based on three pillars namely, being the heart of the Islamic world, being identified as an investment powerhouse, and exploiting the strategic geographical location of the country. The cumulative outcome of the myriad programs is expected to increase the size of the domestic economy by almost twofold to achieve the target of being the 15th largest economy globally.

The Vision 2030 is based on three main themes. Each of these themes includes several subthemes. The theme on ‘A Thriving Economy’ focuses on diversifying the economy, improving the business environment, attracting the best local and international talent, as well as creating opportunities through encouraging investment. The ‘Ambitious Nation’ theme emphasises how central government can move to become an efficient, responsible, and accountable organisation. The ‘Vibrant Society’ theme touches on the Kingdom’s unique social and cultural values and includes targets and commitments aimed at promoting Saudi Arabia’s deep-rooted national identity.

THE ECONOMIES MOST DEPENDENT ON OIL (ESTIMATED OIL EXPORTS AS A % OF GDP IN 2018)

New Opportunities for Islamic Finance

Saudi Arabia continues to be one of the most active and influential markets in Islamic finance. Despite Saudi Arabia’s difficult current economic realities, its leadership has decided to carry out diversification programs and profound structural reforms. With landmark steps including the opening of Tadawul to foreign investors, booming asset classes including IPOs and various privatization and PPP initiatives in healthcare, education, transportation, housing and energy industries, it is expected that many of these projects will require Shari’a-compliant debt financing (including sukuk) in addition to participation of Shari’a-compliant funds. As part of Vision 2030, the government is planning to cut spending by US$98 billion a year. However, it is anticipated that the government will still maintain spending on strategic infrastructure projects, however, resulting in some growth opportunities for the financial sector.