The United Arab Emirates (UAE) consists of a federation of seven emirates: Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah and Fujairah. Historically, the UAE’s economy has been reliant on oil revenues with the UAE being the sixth-largest producer of oil in the world. In 20a15, however, the oil revenue’s contribution to GDP was 35%, indicating that the government’s revenue diversification efforts have borne fruit. The sharp drop in oil prices since mid-2014 had put an end to the commodities super cycle that started a decade ago.

The UAE ( in particular, Dubai) has ambitious plans to be a global hub for Islamic finance within the next few years. The UAE Vision 2021 “sets the key themes for the socio-economic development of the UAE” and calls for “a shift to a diversified and knowledge-based economy”. Dubai’s Islamic Economy Strategy rests on 7 key strategic pillars of finance, halal industry, tourism, digital infrastructure, art, knowledge and standards. The objective is to position Dubai as the Capital of the Islamic Economy aligned with the Dubai Plan 2021 and interwoven with the UAE Vision 2021. A new strategy for 2017-2021 was launched in January 2017, based on three pillars – Islamic finance, Halal sector, and Islamic lifestyle that includes culture, art, fashion and family tourism. Based on a two-pronged approach, this new strategy concentrates on the development of the Islamic economy system, which includes identifying new key performance indicators for monitoring the growth of important sectors and measuring their contribution to the national economy. The second part focuses on enhancing Dubai’s status as a global reference for Islamic finance, industry, trading standards and culture, and as a prime destination for Halal trade and family tourism.

Economy at a Glance

The UAE’s phenomenal growth has depended largely on the discovery and exploitation of oil. Massive oil revenues have enabled the UAE to short-cut the usually difficult and lengthy process of saving and capital accumulation necessary for economic development. Although the UAE’s economy is more diversified and less dependent on the oil sector than the surrounding Gulf states, it was strongly affected by the decreasing oil price since the second half of 2014. In response to falling oil prices, governments in the UAE have proposed series of reforms to restructure their energy and financial sectors and to attract foreign investment and development. Successful efforts at economic diversification have reduced the portion of GDP based on oil and gas output to 25%.

The UAE’s economy strengthened in the last few months of 2016 with GDP growth of 4%, underpinned by improving economic conditions in the non-oil sector and an uptick in exports. A recovery in oil prices combined with growing public and private sector activity boosted by Dubai’s preparations for the Expo 2020 are expected to boost growth in 2017. Nonetheless, headwinds will remain in the form of the country’s tight fiscal stance and a strong currency, as the UAE will be forced to increase interest rates in lockstep with the US Federal Reserve.

Islamic Banking

The UAE has historically played a pioneering role in the development of Islamic finance. In 1975, Dubai Islamic Bank (DIB) became the world’s first Islamic commercial bank in the world. The second Islamic financial institution, Abu Dhabi Islamic Bank, was established in 1998. Meanwhile, Sharjah Islamic Bank, formerly known as National Bank of Sharjah, was the first bank in the world to convert from a conventional bank to a full-fledged Islamic bank in 2002. Other institutions offering Islamic banking services started operation from 2005 onwards.

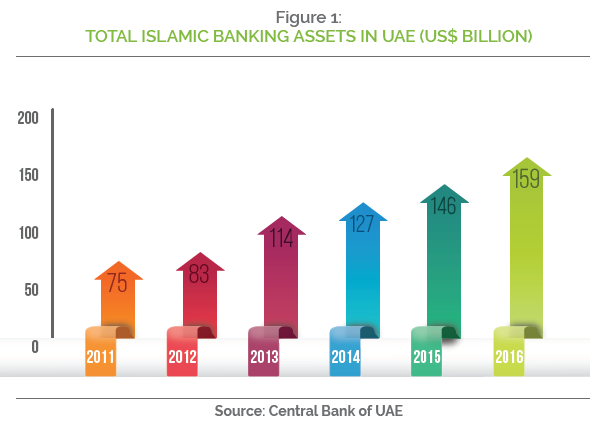

At present, there are 8 full-fledged Islamic banks and 26 Islamic windows of conventional banks (13 local banks and 13 foreign banks). Total Islamic banking assets in 2016 registered at US$159 billion, an increase from US$146 billion in 2015 (Figure 1). Although the asset size of Islamic banking industry registered a year-on-year growth, the pace of growth had been decreasing against the background of a challenging operating environment. Islamic banking assets grew at 9% (2015: 15% and 2014: 11%) compared to 4.5% of the conventional banking. Together Islamic banking assets constituted 19.4% (2015: 18.7%) of banking assets and lending was 17.4% (2015: 20.6%) of the total banking system lending.

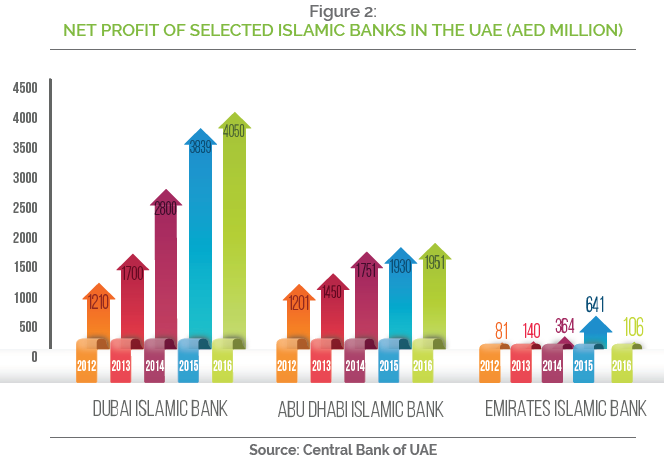

After years of rapid growth in which Islamic banks outpaced conventional banks, outgrowth is slowly waning. Soon, growth in Islamic banking could match the general market, suggesting that Islamic banks may have exhausted their natural share. Profits of Islamic banks has either been declining or increasing at a declining rate. Dubai Islamic Bank, the largest Islamic bank in the UAE, recorded a 6% increase in net profit in 2016 as compared to 37% in

2015 and 63% in 2014 (Figure 2). Similarly, net profit for Abu Dhabi Islamic Bank increased a mere 1% in 2016 as opposed to 10.5% in 2015 and 20.7% in 2014. Emirates Islamic Bank, on the other hand recorded a sharp decline in net profit by 76% in 2016 even as gross income remained stable, amidst challenging market conditions.

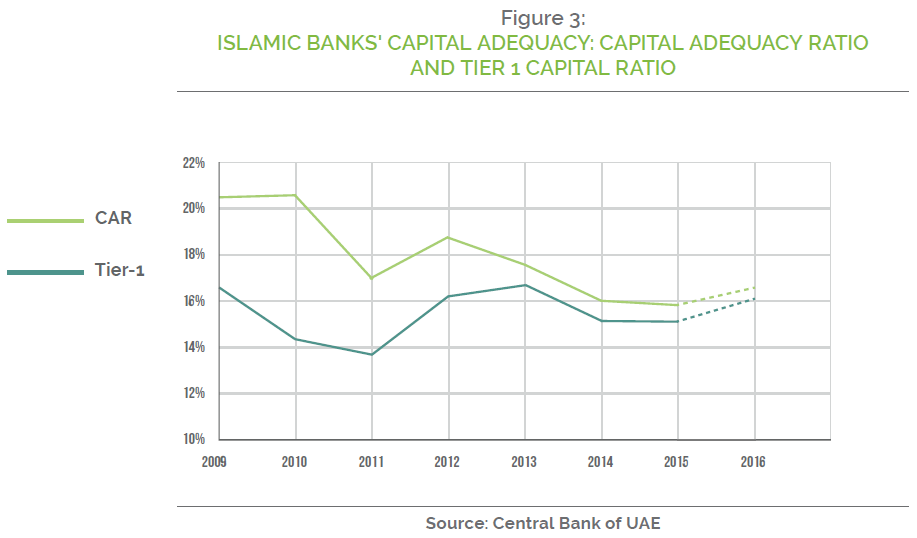

Deposit mobilized rose by 5% (2015: 16.6%) to reach AED348.7 billion and accounted for 22.3% (2015: 22.6%) of the overall banking system deposits. The capital adequacy ratio (CAR) of Islamic banks experienced an increase to 17.1% at the end of 2016 (2015: 15.6%) and the Tier-1 capital ratio also increased to 16.5% in 2016 (Figure 3). Although at a satisfactory level, they are below the levels recorded by conventional banks, which recorded CAR of 19.4% in 2016 and 18.9% in 2015.

In another development, the Dubai government has undertaken a study on the setting up of a Shari’a-compliant Islamic Export-Import (Exim) Bank as part of plans to make the Emirates a hub for Islamic finance. The aim of establishing an Exim bank is to create a world-class financial organization that focuses on supporting the global commercial flow in and out of the UAE, which is expected to double the trade flows in the next few years. This will, consequentially, play a significant role in positioning Dubai as a global center for Islamic finance.

In order to sustain profitable growth, Islamic banks must strategically revisit their positioning and seek greater efficiency across the value chain. So far, Islamic banks have purely emulated conventional bank’s offerings. Product innovation and technology are key enablers as Islamic banking progresses beyond plain vanilla offerings. A dedicated end-to-end Islamic banking system that facilitates and automates Shari’a-compliant banking operations would enable banks to scale up their operations to meet global competition, grow market share, retain the loyalty of their customers and of more importance, enhance their profitability.

According to the 2016 Islamic Banking Index report published by Emirates Islamic, Islamic banks in the UAE have succeeded in expanding their reach and penetration but the primary hurdle to industry growth remains their perceived poor service offering when compared to conventional banks. Based on their findings, the report proposed Islamic banking to put customer service at the heart of future growth strategies. Hence, Islamic banks must focus more efforts to address and reposition consumer opinion of their services and product offerings if they are to capitalize effectively on the growing willingness among UAE consumers to patronage Islamic banking.

Takaful

The UAE is the second largest takaful market in the GCC region but has the lowest penetration rate of only 6%. There are presently 9 takaful companies with gross takaful contributions of 16% of the total takaful contribution in the region. More than 70% of premiums written are general takaful premiums. However, family takaful’s share of total premium written has been increasing in the last 5 years due primarily to the mandatory health insurance imposed in Dubai and Abu Dhabi. Gross premium and reinsurance premium increased by 7% and 12% respectively, year-on-year as at end of March 2016. Abu Dhabi National Takaful Company also has the highest ratio of reinsurance premium as a percentage of gross premium at 58% as of 31 March 2016. For the same period, takaful companies in total have lower retakaful levels (33%) than their conventional counterparts (58%). Premium growth slowed in 2016 due to the sharp fall in hydrocarbon prices that had a direct impact on the economic growth across all sectors.

In 2016, 2 takaful companies reported net losses amounting to a total loss of AED216.96 million with Islamic Arab Insurance Co. (Salama) recording the largest net loss of AED179.86 million (Table 1). Despite tariff increases in 2015, only half of the listed takaful companies in the UAE reported profits whilst 4 takaful companies had recorded a total net loss of AED214.89 million, which was mainly from motor insurance segment. The net loss recorded by the takaful sector was driven mostly by an AED162.840 million net loss reported by Salama. Combined this with the motor insurance losses, the overall takaful market in the UAE recorded a total loss of US$43 million.

Abu Dhabi National Takaful Company is the only takaful company that has consistently recorded year-on-year profitable growth at an increasing rate. Profits were up by 18% in 2016 to AED49.07 million compared to AED41.59 million in 2015. Takaful Emarat also registered strong growth after reporting 3 years of consistent profitable growth, registering a 47% increase in net profit in 2016 to AED15.01 million compared to AED10.21 million for 2015. The strong growth across its core business (life and health) was underpinned by the rollout of mandatory health insurance by the Dubai Health Authority (DHA) in 2013 and supported by the on-going digitization of the company’s product portfolio, which further enhanced sales.

| NAME OF COMPANY | ||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||

| ABU DHABI NATIONAL TAKAFUL COMPANY | 49.07 | 41.59 | 35.8 | 35.2 | 27.1 | |

| ARABIAN SCANDINAVIAN INSURANCE COMPANY – TAKAFUL (ASCANA)* | 0.36** | 13.46 | – | – | – | |

| DAR AL TAKAFUL | 5.08 | (7.14) | 4.56 | 0.84 | (12.76) | |

| DUBAI ISLAMIC INSURANCE & REINSURANCE CO. (AMAN) | (37.1) | 1.85 | 0.49 | (55.20) | 6.02 | |

| ISLAMIC ARAB INSURANCE CO. (SALAMA) AND ITS SUBSIDIARIES | (179.86) | (162.84) | 36.7 | (60.25) | (382.46) | |

| METHAQ TAKAFUL INSURANCE COMPANY | 3.67 | (3.52) | (9.79) | (2.40) | 6.0 | |

| NATIONAL TAKAFUL COMPANY (WATANIA) | 0.39 | (41.39) | (9.8) | (2.39) | (17.63) | |

| TAKAFUL EMARAT | 15.01 | 10.21 | 7.18 | (17.3) | (15.9) |

NET PROFIT OF TAKAFUL COMPANIES IN UAE (AED MILLION)

Overall the takaful sector showed a slight improvement in earnings, with net losses of AED143.38 million in 2016 compared with AED147.78 million the previous year. A decrease in year-on-year profit is due to the losses recorded by Salama, which is the oldest takaful company in the UAE. Fierce competition and deteriorating loss ratios continue to pose serious challenges to the takaful sector and had directly contributed to the operating losses of takaful companies in the UAE. Net loss ratio increased to 84% as of 31 March 2016 versus 59% as of 31 March 2015.

Takaful products in the UAE are sold primarily through broker and agency distribution channels. About 85% of takaful products are sold via this distribution channel, which makes price the key purchase consideration for customers. This is in contrast to Malaysia where Islamic banks are being utilized for their existing customer base to provide a whole new distribution channel to takaful operators known as bancatakaful. In a move to increase its penetration rate, Noor Takaful had recently leveraged on its relationship with Islamic banks by selling its ‘Smart Save Plus’ and a ‘Single Pay Jumbo Plan’ through the bancatakaful distribution

channel.

Given the stiff competition and small takaful companies operating in the UAE, there is significant potential for consolidation among these takaful companies, which may boost growth prospects by instilling greater confidence among customers. Countries like Indonesia and Malaysia, for example, with significantly larger populations than the UAE, have achieved deeper penetration with fewer takaful operators. In addition, larger takaful companies, with larger financial resources will lead to greater financial stability and better ability to compete while focusing on improved risk pricing.

Sukuk Market

Sukuk are now a mainstream component of capital market in the UAE. Growing financing needs of the UAE government and its related entities, corporates and financial institutions are expected to increase demand for capital market issuance. In recent past, a significant share of capital market issuance have been dominated by conventional bond issuance and loan syndications. However, the demand for sukuk remains relatively high albeit market slowdown due to uncertainty, especially with the drop in oil prices and the expected increase in global interest rates.

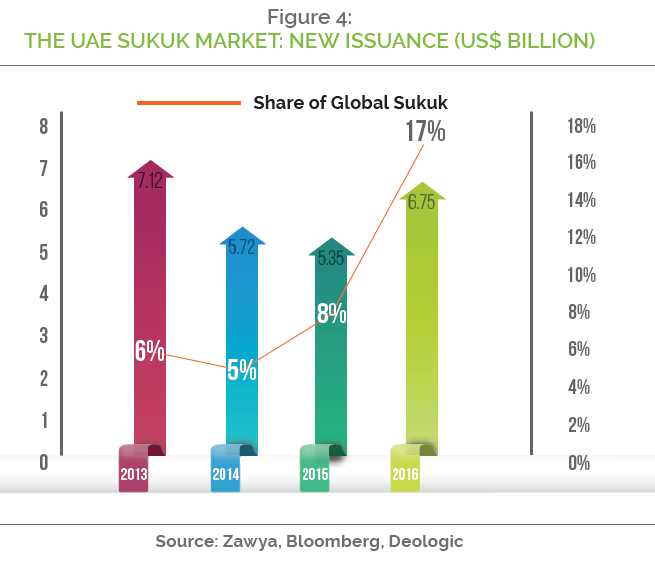

New sukuk issuance volume picked up in 2016 after recording 2 years of consecutive decline in 2014 and 2015. The UAE accounted for 17% of global sukuk issuance amounting to US$6.75 billion, making UAE the second largest sukuk issuer in 2016 after Malaysia. This is an increase of about 26% from the previous year where 10 sukuk worth US$5.35 billion were issued (Figure 4). Dubai is the world’s largest venue for sukuk listings by value, with the total value of sukuk listed on the Nasdaq Dubai as at February 2017 was US$47.81 billion. To date, there are 67 sukuk listed on the exchange. A total of 19 sukuk were listed on Nasdaq Dubai in 2016 (Table 2).

In February 2017, Dubai Islamic Bank (DIB) announced the successful pricing of the largest senior sukuk issuance by a financial institution globally. The US$1 billion sukuk was issued with a 5 year tenor, maturing on February 14, 2022 and carries a profit rate of 3.664%. In the same month, the Investment Corporation of Dubai (ICD) listed a US$1 billion sukuk on the exchange with a profit rate of 5% and maturing in 2027.

Legal Framework Governing Islamic Banking and Finance

The UAE operates a parallel banking system in which there is no separate legislation within the UAE that codifies Shari’a law for commercial transactions. However, there are specific regulations and/or provisions under general financial market regulation for Islamic finance. In the UAE, Islamic financial institutions are regulated by the UAE Central Bank under Law No. 6 of 1985. The law states that Islamic financial institutions are permitted to carry out commercial, industrial and trade activities, acquire real estate, receive deposits and invest in funds all on their own account. Article 1 of Federal Law No. 6 of 1985 concerning Islamic Banks, Financial Institutions and Investment Companies defines Islamic banks, financial institutions and investment companies as “those companies whose Articles and Memorandum of Association include an obligation to apply the Islamic Sharia Law and that their operations would be conducted pursuant to Islamic Sharia Law”. While Article 2 of the Law No. 6 of 1985 provides that such institutions are subject to the provisions of the 1980 Law in addition to Law No. 8 of 1984 relating to Commercial Companies.

They are also required to have a Shari’a supervisory board of no less than three members. The appointment of the relevant Shari’a committee within each of these institutions is subject to the approval of a Supervisory Shari’a committee within the Ministry of Islamic Affairs. However, the UAE Civil Code has a strong Shari’a foundation which supports the proper regulation of Islamic financial mechanisms. There are also no separate Shari’a courts to hear disputes arising out of Shari’a financing transactions. As such, the courts are allowed to refer to Shari’a in the absence of clear legislation and established customary business practices. Although the law provides for a “higher Shari’a authority” to supervise financial institutions and investment companies (Article 5, Federal Law No. 6 of 1985), in practice there exists no such authority at either the Central Bank of UAE or the Ministry of Awqaf and Religious Affairs. A unified Shari’a supervisory board for Islamic banks and financial institutions (organised by some members of the Shari’a boards of the Islamic financial institutions in UAE) is in making but it has yet to receive formal recognition from the UAE central bank. In practice, individual Islamic financial institutions have their own Shari’a boards. The UAE government took a bold step in 2016 by approving the setting up of a national Shari’a board within the Central Bank of UAE to supervise the Shari’a boards of individual banks and financial institutions.

| VALUE (US$) | PROFIT RATE | MATURITY DATE | |

| AHLI UNITED SUKUK | 200 MILLION | 5.5% | 2049 |

| APICORP SUKUK | 500 MILLION | 2.383% | 2020 |

| BOUBYAN TIER 1 CAPITAL SPC LIMITED | 250 MILLION | 6.75% | 2049 |

| DIB SUKUK LIMITED – 2016 | 500 MILLION | 3.6% | 2021 |

| DP WORLD CRESCENT LIMITED – 144A | 33.06 MILLION | 3.908% | 2023 |

| DP WORLD CRESCENT LIMITED – REGS | 1.17 BILLION | 3.908% | 2023 |

| EL SUKUK COMPANY LIMITED | 750 MILLION | 3.542% | 2021 |

| EL SUKUK COMPANY LIMITED 2021 | 250 MILLION | 3.542% | 2021 |

| EMAAR SUKUK LIMITED TRUST CERTIFICATES 2026 | 750 MILLION | 3.635% | 2026 |

| HILAL SERVICES LIMITED | 300 MILLION | 2.468% | 2021 |

| IDB TRUST SERVICES LIMITED TRUST CERTIFICATES 2021 | 1.5 BILLION | 1.775% | 2021 |

| IDB TRUST SERVICES LIMITED TRUST CERTIFICATES DEC 2021 | 1.25 BILLION | 2.263% | 2021 |

| NOOR TIER 1 SUKUK LIMITED | 500 MILLION | 6.250% | 2049 |

| PERUSAHAAN PENERBIT SBSN INDONESIA III – 2016 – SERIES 5 144A | 17.4 MILLION | 3.4% | 2021 |

| PERUSAHAAN PENERBIT SBSN INDONESIA III – 2016 – SERIES 5 REGS | 732.6 MILLION | 3.4% | 2021 |

| PERUSAHAAN PENERBIT SBSN INDONESIA III – 2016 – SERIES 6 144A | 126.46 MILLION | 4.55% | 2026 |

| PERUSAHAAN PENERBIT SBSN INDONESIA III – 2016 – SERIES 6 REGS | 1.62 BILLION | 4.55% | 2026 |

| SHARJAH SUKUK (2) LIMITED | 500 MILLION | 3.839% | 2024 |

| SIB SUKUK COMPANY III LIMITED – 2016 | 500 MILLION | 3.084% | 2021 |

SUKUK LISTED ON NASDAQ DUBAI IN 2016

Over the last seven years, UAE’s regulatory framework has undergone many changes to align the insurance industry with global standards. The UAE’s insurance market regulator, the Insurance Authority (IA) introduced a comprehensive set of regulations in 2010 to regulate the local takaful industry. The Resolution No. 4 of 2010 concerning takaful regulations for takaful operators distinct from the regulations governing conventional insurers. The Takaful Regulations expressly identified the policies that should be adopted by takaful companies to be either a pure wakala model or the combined mudaraba/wakala structure. The Law was further supplemented by new financial regulations issued in 2014, which included separate rules for takaful insurers, recognizing the “special nature of the Takaful insurance business”. These new rules include the distribution of surplus funds to policyholders and stress the importance of separating the assets of policyholders and shareholders into separate accounts. This marked another significant change in the financial regulation of both takaful and insurance companies alike.

With the implementation of the Financial Regulations, takaful operators are now subject to new solvency requirements, based on the EU’s Solvency II regime. Restrictions on the type of assets into which a takaful company may invest as well as limitations on the percentage of each type of asset that may be held with a single counterparty are also imposed. The aim of the latter is to address concentration risk. The investment restrictions came into effect on 29 January 2017; albeit, the limitation on real estate will only be effective from 29 January 2018. Here, investments in real estate are restricted to 30% of a takaful operator’s total portfolio and investments in UAE equities are limited to 30% of the portfolio and not more than 10% of the portfolio may be held in a single issuer. Takaful operators are also not allowed to hold more than 50% of total invested assets outside of the UAE and 100% of technical provisions must be held in assets within the UAE. These changes are likely to require a number of takaful operators to adjust their investment holdings. The Financial Regulations also set the requirement on the segregation of the life (family takaful) business from the general business.

In the capital market, the Securities and Commodities Authority of the UAE approved a new regulation for sukuk and published ‘Standard for Issuing, Acquiring, and Trading Sukuk’ in 2014. The regulation deals with sukuk as an ownership tool as opposed to debt. Several areas of application are covered including compulsory listing of companies and approval; issuance and listing rules; procedures and documents required for approval of listing; a record for applications for listing and issuance of sukuk; listing, trading, clearance and settlement of sukuk; suspension and cancellation of listing; and many other related issues. Rules requirements are eased in some areas and strict requirements are imposed in others. For example, the minimum size of a sukuk listing is now AED10 million (US$2.72 million), down from AED50 million (US$13.61 million) previously. The regulation also specified that although listed sukuk may be traded outside the market; the trading must follow market procedures and any sukuk issuances must be approved by a Shari’a committee accredited by the regulator of the issue.

The Standard for Issuing, Acquiring, and Trading Sukuk complements the ‘Standard for Issuing, Acquiring, and Trading of Shares’ published by DFM in 2007. The new standard sets a new limit on the allowable percentage of cash and debt, from 70% to 90% of the total underlying sukuk assets. In addition, the standard outlines how sukukholders’ rights should be protected, and the financial liability attached to special purpose vehicles that are treated as separate entities. However, the standard does not indicate the governing law for sukuk contracts. At present, UK law is often used for international sukuk deals.