The concept of charity is central in Islamic emphasis on developing a society which is mutually cooperative, cohesive and conducive to voluntarism. The mechanism of charity provides an interface between the resourceful and resource-deficient units of the society to facilitate the transfer of monetary and non-monetary values from the former to the latter on a voluntary basis. From an Islamic perspective, the reward of charity is not confined to the material or social returns only; rather it has another dimension, i.e. spiritual reward. In an Islamic society, it is envisaged that the spiritual element of charity is the key constituent of all charitable practices. In the Islamic literature, the concept of sadaqah (charity) and infaqa fi sabilillah (spending in the way of Allah swt) comprehensively cover the spiritual, material and societal aspects of a charity.

The institution of waqf serves the diverse socio-economic needs of the community. The nature of waqf is widely flexible and the institution can function in different socio-legal environments with a range of underlying objectives. Due to the inherent flexibility of its concept, mechanism and functional structure, waqf is unique in terms of serving a multitude of objectives simultaneously including, framework of waqf, the religious, spiritual, temporal and socio-economic dimensions.

In historical terms, among the Muslim societies, much of the public goods have been channeled through the philanthropic sector, which was mainly spearheaded by waqf. Since as early as the ninth and tenth centuries, waqf grew and flourished in such a great magnitude among the Muslim societies that it essentially superseded zakat as the main channel of financing for the society.

In this background, it is argued that at the institutional level, the role of waqf has been revolutionary in bringing about an inclusive socio-economic development in Muslim societies. Unlike other forms of non-obligatory charities endorsed by Shari’a, waqf engendered ever-last- ing impacts and implications on societies. The countless reminiscences of waqf and its glorious role in the development of Islamic civilization could hardly be over-emphasized as the contribution of waqf to the given societies has been ubiquitous throughout the Islamic history.

In a nutshell, the institution of waqf played multi-dimensional roles; serving simultaneously both the spiritual and socio-economic needs of the community. Waqf meticulously provided the voluntary mechanism of wealth redistribution, a model of social enterprise, a framework for sustainable charity and a prototype for the third sector of the economy. The scope of awqaf extended as wide as to encompass the welfare of birds, animals and environment within its range. Concisely, the classical awqaf participated in deploying funds for the purposes, which may easily qualify for the modern concept of social finance. In the contemporary scenario, by virtue of its underlying massive potentials, the institution of waqf can prove a catalyst towards the sustainable development of Muslim and non-Muslim communities.

The modern waqf is in the process of re-evolution as a leading institution of the third sector in many Muslim countries. Since last one decade, the pace of evolution in the Fiqh al-Awqaf (the jurisprudence of Waqf) has been considerably fast. Due to the consistent momentum of evolution, the modern waqf is ready to embrace the structure of corporate waqf, temporary waqf, cash waqf and waqf of intangible assets such as waqf of intellectual rights and other copyrights. Similarly, the domain of waqf management has been duly expanded with the recognition of waqf as a legal entity, and shifting the trend of individual mutawalli to the institutional mutawalli. In view of these developments in the modern waqf, the institution seems well poised to regain its historical glory in the coming years.

Waqf: Nature, Mechanism and Paradigm

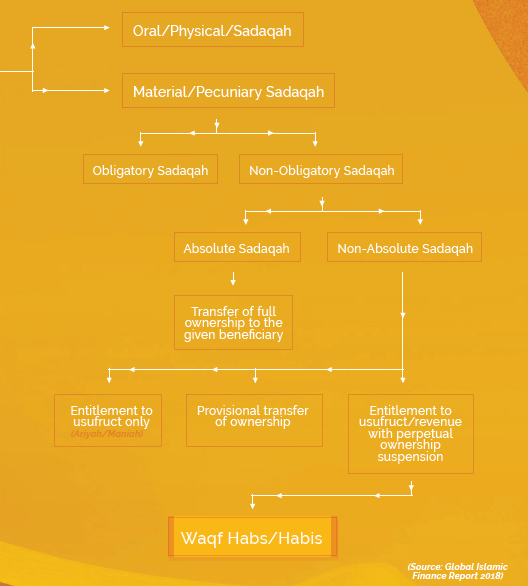

Waqf is distinguished from other forms of Islamic charities in several counts. First, waqf constitutes a non-obligatory charitable institution and, thus, it is different from obligatory charities such as zakat and sadaqah al-fitr. There are many obvious implications of this difference in the nature of waqf compared to obligatory charities. For instance, the institution of zakat has its own framework and jurisprudential limitations in terms of specific rulings prescribed for the zakat-giver and the beneficiaries. In contrast, for waqf, the framework is remarkably flexible for both the donors and the beneficiaries. Any individual can exercise a charity through the mechanism of waqf in any amount provided the purpose is Shari’a-compliant. Alongside being a non-obligatory form of charity, waqf is further distinguished from other non-obligatory charities due to its peculiar jurisprudential rulings. While in a general charity, the donor is necessarily required to transfer the ownership of the given subject matter to the beneficiary, waqf differs in this aspect. According to the jurisprudential requirement, the ownership of the subject matter of a waqf is not transferred to the beneficiary but is suspended. Due to the suspension of ownership in a waqf, the perpetuity of waqf-based charitable benefits is maintained so long as the given subject matter lasts.

Waqf embodies the concept of sadaqah jariyah (perpetual charity), which is unique due to the comprehensiveness of its framework. The framework allows the waqif (donor) to donate flexibly for a multitude of purposes with his/her own stipulated guidelines. Due to the combination of its flexible nature and the associated perpetual reward, the mechanism of waqf has been significantly attractive for the various categories of donors.

The role and contribution of waqf has been central in the history of Islamic civilization. Historical accounts are replete with stories of how the institution of waqf played a cardinal role in almost every aspect of development in Islamic societies. In other words, right from the first century after Hijrah (AH) to the beginning of the thirteenth century AH, involvement of waqf has been indispensable in financing a plethora of social as well as developmental needs of Muslim communities.

There are huge possibilities of fine-tuning a waqf deed in accordance to the specific needs and necessities of circumstances. This provision offers a leeway for a waqif to exercise charity in a well-defined manner. To simplify this, a waqf can be established for financial assistance of the poor, building a mosque, establishing an educational institution as well as for provision of financial protection to the immediate relatives of the waqif. Perhaps, this underlying flexible nature of waqf explains why waqf remains one of the most preferred formats of charity in Muslim societies.

As per the given purpose and beneficiaries of a waqf deed, classical Islamic jurists categories it into waqf khayri (for philanthropic purposes), waqf ahli (for private purpose) and waqf mushtarak (for a mix of philanthropic and private purposes). If the purpose of a waqf is to serve philanthropic causes exclusively, it is termed as a philanthropic waqf (waqf khayri). In contrast, if a waqf is set for private purposes such as benefitting the family or friends of the waqif, the given waqf is described as family waqf (waqf ahli). Compared to these two kinds of waqf, a third possibility is that a given waqf is for serving both purposes, i.e. family and philanthropy. Such a waqf deed can be categorized as mixed waqf or waqf mushtarak. Though the motivational factors may vary for different kinds of endowers, the Shari’a governance of the institution remains consistent for all categories of waqf. The stipulations of waqif with respect to his/her waqf enjoy special sanctity i.e. the purpose of waqf, its beneficiary and the method of management is dependent on the discretion of the waqif.

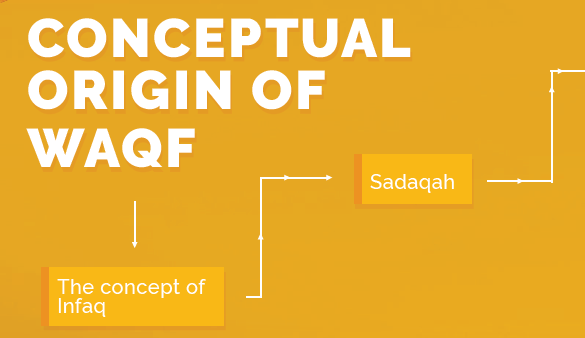

The concept of waqf represents a branch of the Quranic term ‘infaq’ (spending), which covers all forms of sadaqah. The term sadaqah can be subdivided into material and non-material forms, which is further categorized into obligatory and non-obligatory ones. This phenomenon can be further explained through the following diagram, which provides a conceptual sketch of waqf and its jurisprudential status:

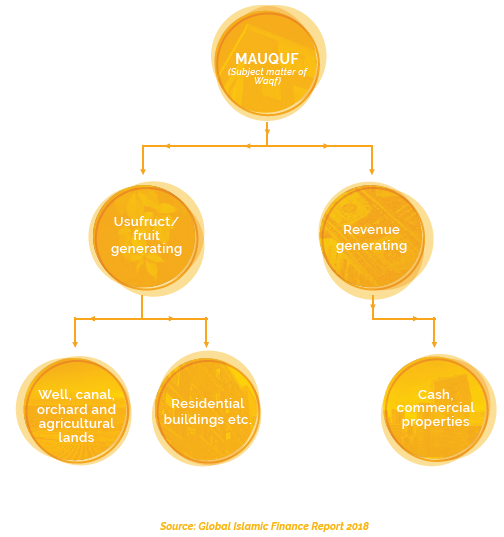

The subject matter of a waqf may vary in form and scope. It can be a commercial building, residential house, agricultural land, cash and other non-consumable properties. The following diagram further explains this possibility in a waqf:

From the jurisprudential perspective, the fundamental difference between a waqf and other forms of obligatory and non-obligatory charities lies in the flexibility of who can exercise it and who can benefit from the same. For example, while a zakat cannot be given to anyone other than the explicitly defined eight categories of beneficiaries, a waqf can benefit any person or purpose provided the same is consistent with basic tenets of Shari’a. The following table summarizes the core jurisprudential variations in the nature of waqf compared to other obligatory and non-obligatory charities.

| CHARITY | STATUS | BENEFICIARY | REQUIREMENT |

| ZAKAT | Obligatory | Eight categories of beneficiaries | Transfer of full ownership |

| ZAKAT AL-FITR | Obligatory | Specific individuals only | Transfer of full ownership |

| SADAQAH | Non-Obligatory | Individual/institution/purpose | Transfer of full ownership |

| WAQF | Non-Obligatory | Individual/institution/purpose | Suspension of ownership (full freedom for waqif to stipulate) |

Source: Global Islamic Finance Report 2018

The mechanism and jurisprudence of waqf evolved over the centuries. In the early Islamic societies, the concept of waqf remained specifically attached with immovable properties, i.e. the means of waqf-donation was limited to immovable properties only. Later on, as the practices of waqf-donation increased in size and scale, the domain of its jurisprudence also extended to cover both movable and immovable properties. The premises of the permissibility of cash waqf lie in the permission of movable as a valid object of waqf. Owing to the acceptability of cash as a permissible means of waqf, the role of waqf increasingly broadened particularly in terms of financial intermediation.

Contextualising the Role and Relevance of Waqf

In the history of Islamic civilization, waqf has had a crucial role. Despite being a voluntary institution of charity, waqf received an overwhelming response from the wealthy as well as middle-class individuals throughout the Islamic history. Waqf gained momentum right from the beginning of the prophetic time, and it has been playing a crucial role in bridging the existing gaps in the demand and supply of public goods. The list of waqf beneficiaries includes spiritual, educational, developmental and environmental aspects of the human societies. One of the most significant aspects of waqf is that it provided the means and mechanism for permanent charity, which ensured the sustainability of the waqf-based services. For instance, a huge number of educational institutions throughout the Muslim countries were established, funded and run by waqf-based donations. Perhaps, without the substantial contribution of waqf in the provision of socio-economic security and welfare schemes throughout the Muslim territories, it might have been difficult for Islamic civilization to achieve the heights of glory that it actually did.

In the last few decades, the institution of waqf has received a significant amount of fresh interests from different stakeholders. The stakeholders of awqaf include individuals, institutions, corporates and governments. Awqaf contains within its financial capacity and scope, huge potential and possibilities for the wider sections of the society as a whole. Importantly, the ability of awqaf to materialize its potentials in delivering its promises in the modern context is highly dependent on the attitude of its stakeholders towards the institution. A proactive approach towards awqaf and its innovative utilization is vital for the sustainability of the institution.

There are multiple factors which corroborate in inducing the importance of waqf to be acknowledged and contextualized. For instance, mounting pressure on fiscal budgets of states due to the increasing demands of public goods constitutes one of the major impetuses why economies have started looking towards charities and social enterprises more favorably. Waqf, particularly, in the context of Muslim-majority countries promises a huge role in supply of public goods efficiently. According to available statistical data, the worth of total assets under global awqaf exceeds US$1 trillion.

Countries such as Saudi Arabia, Malaysia, Indonesia and India have a large amount of waqf properties. Thus, the potential contribution of awqaf in development of infrastructure as well as in the socio-economic empowerment of communities particularly in these countries is remarkably significant. Though a substantial number of waqf properties still lie dormant in many Muslim and non-Muslim countries, the revival of fresh interest in developing them is encouraging and promising. Awqaf enjoy inbuilt sustainability mechanism, which is critical in terms of long-term planning.

Awqaf in the contemporary world has received a great many innovative reformations. For instance, the domain of Fiqh has extended to accommodate some new trends and developments in the waqf governance paradigm. In comparison to the traditional awqaf, which mainly constituted real estates; new trends in awqaf allow waqf of cash, stock and other liquid and illiquid financial instruments. The following table contains the list of possible modes of waqf, which are applicable in the contemporary time. Additionally, it provides an overview of the distinctive qualities and management features of different modes of waqf.

In a nutshell, in the contemporary context, a mix of different modes of awqaf can be employed for a plethora of schemes and policies. Precisely, awqaf can be deployed to facilitate, inter alia, eradication of poverty, provision of financial security, supply of basic necessities, training and education of unskilled, propagation of religion, creation of employment opportunities, dispensation of various social benefits, development of infrastructure, promotion of charitable causes, preservation of social justice, and empowerment of communities.

| MODES OF WAQF | MANAGEMENT | FEATURES |

| REAL ESTATE | Traditional mode of waqf. Individually appointed mutawalli, institutional mutawallis (new trend). | Illiquid, immovable, permanence, ideal for infrastructure and housing. |

| CASH | A combination of traditional and contemporary mechanism of waqf. Mostly managed by international charities. | Liquid, movable, perpetual and temporary, investable, economies of scale. |

| STOCK | New model. Mostly management by corporate and institutional mutawalli. | Liquid, perpetual cash flow, risk of fluctuation in the value of the capital as well as in cash flow. |

| SUKUK | New mechanism of perpetual donation. Generally, management by corporate and institutional mutawalli. | Tradable, relatively less liquid, less fluctuation, continuous cash flow. |

| WAQF-SHARE | New model of perpetual charity. Mostly managed by charities. | Project-oriented, subscription-based donation, investable lump sum. |

| INTELLECTUAL PROPERTY | Innovative model and specific to contemporary world. Managed by both individuals and institutions. | Intangible asset, continuous revenue generating, non-tradable. |

Similarly, the role of global awqaf can also be critical in advocacy for righteous causes, protection of environment, promotion of human rights and equality, facilitation of inter-faith dialogue and rehabilitation of refugees and displaced. To this end, the relevance of waqf remains as applicable to the contemporary world as it was in the past. Rather in the modern context, due to the multiplicity of new challenges, risks and needs of communities; the significance of awqaf has increased more than ever.

Finally, in the modern scenario, the role and significance of waqf can be extremely crucial with reference to the United Nations-promoted Sustainable Development Goals (SDGs). The SDGs refers to an international developmental programme, which contains a list of 17 social, economic and environmental goals to be achieved globally by 2030. In achieving the SDGs particularly in Muslim-majority countries, the role of global awqaf is very significant. In fact, a survey of available literature on waqf reveals that long before the inception of the SDGs framework; waqf already has had a history of targeting similar social goals in Muslim societies, though in an unorganized way.

Synergies between Waqf and Islamic Finance

The fundamental norms, values and religious orientation of Islamic finance and waqf originate from the same religious sources. Thus, the natures of both the institutions; i.e. Islamic finance and waqf are Shari’a-oriented. Similarly, Islamic finance and waqf share the same ideological and conceptual underpinnings. For instance, the promotion of equity, social justice, financial inclusion and moral-plus-ethical socio-economic activities are included in the list of the targeted objectives of both waqf and Islamic finance. Though, compared to Islamic finance, the nature of waqf is charitable in socio-economic aspects, both the institutions endeavour to achieve similar objectives.

The significant size of cumulative global awqaf offers a huge opportunity for Islamic finance, both on the assets and liability sides of the balance sheet. Awqaf can provide massive avenues for Islamic finance in asset and liquidity management. Islamic finance has substantial opportunities to invest in the dilapidated/unproductive waqf properties on profit and loss sharing (PLS) basis. From the ethical perspective, Islamic finance can deploy its fund only in Shari’a-compliant avenues; and on this front, dilapidated waqf properties may offer an ideal opportunity for Shari’a-compliant investments.

During the pre-modern era, some of the early Islamic financial services in Muslim countries have noted the contribution of waqf. The collective pool of cash waqf constituted the base capital for financing the immediate needs of the communities during the Ottoman era. As early as the 16th century, Islamic financial intermediation was widely practiced by Muslim communities through the mechanism of cash waqf. Thus, the relationship of awqaf with Islamic finance is not a new phenomenon of this time and era but as old as the practice of Islamic financial intermediation.

In the current scenario, awqaf needs Islamic financial services to secure short and long-term financing as well as for asset management. In comparison, Islamic finance may need awqaf to tap the potential avenues of collaboration. The following table contains a list of possible avenues where the collaboration between awqaf and Islamic finance is needed to further the cause of both the industries. This collaboration between awqaf and Islamic finance can have a long-term impact on the overall growth of economies as well as the socio-economic empowerment of the masses, particularly in the Muslim countries.

SYNERGIES BETWEEN WAQF AND ISLAMIC FINANCIAL INSTITUTIONS

| WAQF | ISLAMIC FINANCIAL INSTITUTIONS (IFIs) |

| Need for efficient asset management | IFIs can provide Shari’a-compliant asset management services. |

| Need for financial investment | IFIs can provide services to awqaf on the asset and liability sides of the balance sheet. |

| Need for financial products | IFIs can facilitate the issuance of sukuk, equity (waqf share) and qard hassan. |

| Need for banking products | IFIs can provide safekeeping (wadiah) and mudarabah accounts for awqaf deposit and investment purposes. |

| Intermediation between waqif (endower) and waqf-beneficiary | IFIs can facilitate fund collection on behalf of awqaf (deposit). |

| Need for takaful of waqf properties | IFIs can provide takaful services to awqaf. |

The evolving trends in waqf have further strengthened the existing synergies between waqf and Islamic finance. In some countries such as Malaysia and Indonesia, according to recent trends and developments, cash waqf has become one of the preferred modes of waqf donation. To facilitate such transactions some Islamic banks have started offering waqf deposit account facilities. For instance, Maybank Islamic in Malaysia has been collaborating with Yayasan Waqaf Malaysia for the collection of cash waqf donations from the waqifs. The collected cash awqaf donations through the bank and its branches are employed to provide socio-economic benefits to the underprivileged sections of the society. In this scheme, a potential waqif can donate through the following methods: (1) by directly depositing the allocated sum at a branch

of the bank, or (2) by using the ATM facility, or (3) through online transfer by internet banking and (4) by subscribing to the auto debit service scheme. The bank invests the collected sum and the resultant revenues from the investment are deployed to fund charitable purposes. The involvement of corporate sector in waqf management is yet another very promising development, which the industry of waqf has recently witnessed, particularly in Malaysia.

In comparison to the Malaysian experience, Singapore has already provided a model for the development of awqaf through a musharaka sukuk. The sukuk was issued to raise US$60 million to finance two projects in waqf properties. The successful management and execution of this Singaporean experience in developing waqf has several positive implications for the future collaborations between the waqf and Islamic finance in other countries as well.

In another example of how waqf and Islamic financial mechanism can collaborate and benefit each other, the experience of Zam Zam tower financing is exemplary. In this example, the waqf authority in Mecca leased the waqf land to Binladin Group for 28 years to develop the land through sukuk al-Intifa’a. The Binladin Group further subleased the property to Munshaat Real Estate Projects for the same tenure. Munshaat raised US$390 million by issuing sukuk al-Intifa’a (time-share bond) for 24 years. The underlying asset for the sukuk subscribers was the usufructuary rights in the proposed construction of the project, which comprised four towers, a mall and hotel.

Waqf: Prospects and Challenges

In order to promote the contemporary relevance of awqaf and to materialize its potentials, it is vital to highlight the religious as well as socio-economic merits of the institution among the masses. Similarly, emphasizing on the flexibility mechanism of waqf and its comprehensive framework can entail some positive results in the promotion of the institution. To this end, it is pertinent to underline that the model of waqf suitably matches the sketch of contemporary social enterprise, and there is a huge scope for transforming many existing and potential awqaf in the proper mould of modern social enterprises.

Compared to this, there is a noted amount of ambiguity pertaining to several aspects of awqaf among its stakeholders, which needs to be cleared for the purpose of securing the confidence of stakeholders in the institution. Some of these ambiguities are there due to the perpetuating status quo of awqaf globally. For example, whether a waqf is the property of the state or it remains under the control of waqif is one of the least clear dimensions of the contemporary awqaf. The ambiguity of its ownership status creates confusion about waqf among the potential endowers. There are also some blurred lines on whether the waqif and his family can become the exclusive beneficiaries of a given waqf or not. The list of some widely held misconceptions about awqaf also includes the possibility of non-Muslims becoming waqif, beneficiary or mutawalli of a given waqf.

On the macro level, there is a long pending call for further empirical researches on many aspects of global awqaf. For instance, there is a need for authentic research on the cumulative worth of global awqaf assets. Also, there is a limited reliable data on the total revenues generated by awqaf worldwide. Additionally, there is a need for the development of some measurement tools, which can assess the cumulative social impact achieved by global awqaf annually.

In addition, it is vital to emphasize that a potential waqif should consult with Ahl al-Ilm wa al-Taqwa (people of knowledge and integrity) prior to deciding and determining the nature of his waqf deed, its objective and the governing stipulations. As the creation of desultory awqaf i.e. without consultation and proper planning, runs counter to the vision of the institution and impinges on its overall effectiveness. Hence, it is imperative for the stakeholders of awqaf to develop a consultation mechanism for the potential waqifs. Given the essence of the higher objectives of Shari’a, seeking advice of experts on how to draft the deed to improve the scope of benefits out of a waqf is critically vital for the potential waqifs.

It is worth noting here that the first few known awqaf of Islamic history were set up with the consultation of the Prophet (pbuh). Be it the endowment of Byruha (the orchard) by the companion Abu Talha, or waqf of Rumah (the well) by Ottoman, in both cases the endowers endowed only after seeking the prophetic consultation. In the same vein, in waqf of Omar, who endowed his land in Khayber, as well as the endowment of Mukhayriq, who accorded the prophet the authority to endow his seven orchards, the role of consultation with the Prophet (pbuh) is evident. Importantly, since waqf is an institution, which ultimately reverses to the community, no matter whether it is a waqf khairi or ahli, the deed should be exercised with the consultation of ahl al-ray (experts) of the community to maximize its potential benefits.

Arguably, awaqf if settled without consulting the ahl al-ray, may become inimical to the security of moderation between spiritual and temporal needs of the community. For example, if numerous awqaf are allocated for establishing a number of madrasa (Islamic seminary) in a given locality while neglecting the need of conventional educational centers and schools or vice versa, the equilibrium between the religious and vocational education might be distorted. The efficiency and effectiveness of a waqf is highly dependent on how the clauses of its deed are defined. The mode of endowment, methods of management and the given structure of governance of a waqf deed may have serious implications for the overall effectiveness. Similarly, a clearly articulated purpose, precisely determined management paradigm and categorically explained roadmap for the implementation of waqf objectives can play a crucial role in making a particular waqf efficient and effective.

While setting up new awqaf is highly appreciated, the practice of adding up over the existing awqaf should also be encouraged. This, as a result, can entail the benefits of the economies of scale on the one hand, while ensuring long term existence of older awqaf.

Finally, although in recent years awqaf industry has already witnessed a great deal of sophistication and innovation, there is still a yawning gap between the actual size of the industry and its practical socio-economic impact. To bridge this gap, an integrated approach and concentrated efforts of all stakeholders of the institution is required. Similarly, awqaf critically need the development of infrastructure as well as fit and proper mutawallis to maintain its progressive momentum uninterruptedly. To achieve the optimum benefits of waqf, the institution requires a good number of experts who can manage awqaf properties in a systematic and professional manner. Services such as Islamic trust management by specialized institutions can better facilitate the management of waqf properties according to the peculiar nature of the institution.

In addition to this, there is an existing gap in the literature on how awqaf and Islamic finance can achieve greater collaboration. Awqaf and Islamic finance can mutually contribute to the promotion and progression of each other, provided a better canvas of communication and pitch for knowledge-sharing is deployed between the two institutions.

Conclusion

The institution of waqf has substantially contributed in shaping the direction of Islamic civilization. Waqf has various dimensions of application and it addresses the needs of individuals, groups, institutions and society as a whole. In the contemporary time, the concept and mechanism of waqf has received fresh interest from different stakeholders.

The role of waqf in the current scenario has been no longer limited to a classical institution of charity only. Rather waqf has evolved as an instrument of finance as well as a mechanism of financial and non-financial contract. On one hand, the concept of waqf is being employed in the takaful industry as a mechanism of contract and on the other; waqf is serving the role of financial product in waqf-based micro-financial schemes.

The contemporary awqaf has huge potential to contribute to the overall socio-economic upliftment and empowerment of communities. Awqaf can play crucial role in poverty alleviation, infrastructure development and in provision of education to all. By adopting effective and efficient policies towards the third sector of economy, governments particularly in Muslim countries can provide a space for the institutions such as awqaf to fill the existing gap between the demand and supply of public goods.

In the light of its historical accounts, it may be contended that the early awqaf were successful in playing the effective role due to their proper and efficient application. Hence, the effectiveness of a waqf, be it for public or private purpose, depends on the appropriate employment of its concept, mechanism, and terms and conditions.

The modern relevance of awqaf is dependent on its contextualized approach and strategic application. Theoretically, due to being a flexible philanthropic institution, the conceptual framework of waqf is undisputedly relevant across various societies and jurisdictions. However, whether the practicalities, as well as the functionalities of waqf, conform to the essentials of the modern socio-economic needs is the only parameter to weigh the contemporary relevance of waqf.

As asserted earlier, the institution of waqf has a proven track record of social welfare and development, and it is best suited to patronize the causes that can be served through philanthropy. Waqf combines and displays all what is required in an ideal philanthropic institution. It has a glorious history, flexible framework, pro-development agenda, financial capacity, pragmatism in approach, sustainability mechanism, value-based paradigm, inclusive character and comprehensive programme. Finally, Islamic finance industry can be a catalyst for the development and revitalisation of awqaf. Waqf and Islamic finance have many commonalities and they have a shared underlying religious paradigm. Thus, the two industries can mutually support and complement the promotion of each other.