Waqf is a financial charitable instrument established by withholding one’s property or properties (either immovable or movable) to perpetually spend its revenue on fulfilling various socio-economic needs, depending on the founder’s condition. Once the property is created as waqf, it can never be given as a gift, or to be inherited or sold. It belongs to Allah (swt) and the waqf property always remains intact. Only its generated revenue is channeled to the specified need. Hence, a waqf property has three main features: irrevocability, perpetuity and inalienability.

There are two motives behind the establishment of waqf for the founder. The first is to attain righteousness as clearly stated in the following: “By no means shall ye attain righteousness unless ye give (freely) of that which ye love; and whatever ye give, of a truth God knoweth it well” (Surah Al-i’-‘Imran 3:92). Secondly, is to gain continuous rewards even after the found- er’s death as stated in the following hadith: Abu Hurairah (ra‘) reported Allah’s messenger (pbuh) as saying: “When a man dies his acts come to an end, except three things, recurring charity, or knowledge (by which people benefit), or pious offspring, who pray for him.” (Sahih Muslim). Based on these two inspiring motives, waqf is indeed a unique and everlasting financial instrument that not only fulfils the various socio-economic needs of different Muslim societies but it also provides endless goods and services for generations to come. Beneficiaries of waqf are not only restricted for the use of the Muslim community and religious activities, but cover broader scope of activities aimed at improving and strengthening the development of social and economy of a country.

Undoubtedly, the institution of waqf played an instrumental role in addressing a range of socio-economic issues in the Muslim societies of the past, throughout Islamic history from the time of the Prophet (pbuh) to the beginning of the 19th century. Essential services such as health, education, basic infrastructure, municipal services, etc. were all provided at no cost whatsoever to the government. This has had many important implications. This chapter will take readers on a historical tour of waqf with a view to appreciate its socioeconomic role.

Role of Waqf Since the Beginning of Islam

The history of waqf (plural awqaf) can be traced to the early period of Islam, i.e the time of the Prophet (pbuh) and his companions. Waqf was frequently created during the Prophet’s (pbuh) lifetime. Whenever the Prophet (pbuh) identified any need in his society, he would either (pbuh) fulfil the needs himself or would encourage his companions to fulfil those needs through the creation of waqf.3 For example, when he felt the need for a regular place for Muslims to perform their daily prayers and to teach Islam, the Prophet (pbuh) built the Quba’ Mosque on his arrival to Madinah, which marked the first waqf in Islam. Similarly, to cater for the increase in the number of converts, the Prophet (pbuh) built al-Masjid al-Nabawy. Moreover, the Prophet (pbuh) dedicated the entrusted seven gardens in al-Madinah, given to him by a Jewish man, Mukhayriq banu al-Nadir; for all Muslims to eat and to benefit from. In another occasion, in providing shelter for migrated Muslims, the Prophet (pbuh) dedicated his piece of land in Khaybar for the building of a guesthouse for them.

The Prophet (pbuh) also encouraged his companions to create waqf to support their children and relatives, in addition to supporting the poor and the needy. Following the Prophet’s (pbuh) advice, the companions created numerous awqaf in the form of land and properties. For example Abu Bakr (ra’) endowed his house, ‘Omar b. al-Khatab endowed his land at Thamgh as waqf, ‘Uthman b. ‘Affan endowed Bi’ru Rumah (a well), ‘Ali b. Abu Talib endowed his land in Yanbu‘, Sa‘d ibn Abu Waqqas endowed his house in Madinah and Egypt, al-Zubair ibn al-‘Aw- wam endowed his houses in Makkah and Egypt, Khalid ibn al Walid endowed his sword and horse, ‘Omar b. al-‘As endowed his house in Makkah, and Hakim b. Hizam endowed his houses in Makkah and Madinah. The Prophet (pbuh) also encouraged all his wives to create waqf. ‘Aisha, Umm Salamah, Umm Habibah, Safiah and Hafsah endowed their jewelery and properties as waqf for the benefit of their kin as well as for the poor and needy.

As time passed, the creation of waqf did not only cover waqf properties in the form of mosques, houses, agriculture land, wells and jewelry; but expanded during the Ummayah and Abbasid period to cover almost all social services. With the spread of Islam came the increasing demand for Islamic knowledge. This encouraged Muslims to increase the number of places for the teachings of Islam. So instead of using mosques as educational centers in which teaching circles usually existed, extensions were made to the mosques to house katatib, which resemble today’s primary schools. In these katatib, students were taught reading and writing skills; including Arabic language, mathematics and science.

During that time, the number of primary schools built by waqf totaled 300 in the city of Saqaliah alone, which accommodated thousands of students.6 With the increasing number of people converting to Islam, the need for more schools to teach Islamic education emerged. This encouraged wealthy individuals and rulers to build schools as waqf and establish waqf to finance students, teachers and researchers. The institutions of waqf also supported the education sector. Historical records show that 70 libraries in Cordoba were financed from waqf revenues during the 366 A.H.7 Almost all academic positions and scientific researches in the Muslim world were financed by awqaf institutions. Scientific centres such as Dar Al-‘llm, Dar al-Hekmah, and Jami‘al-Azhar in Egypt were built in 400-405 A.H. from awqaf revenues.

Beyond the education sector, the institutions of waqf played a great role in financing basic infrastructure and transportation facilities as well as the health sector. For example, the wife of Harun al-Rashid created waqf to construct the first highway from Iraq to Makkah and to supply water for pilgrims who travelled to Makkah for their hajj.8 In healthcare, many waqf properties were established either to build hospitals and health centers or for the purchase of medical equipment’s and drugs or even to pay salaries of medical doctors and staff.9 Such awqaf benefits soon spread beyond the Islamic world to other European cities.

It was estimated that 50 hospitals in Cordoba alone were built and financed through awqaf. Revenues generated from awqaf were also used to finance medical publications such as the famous publications of ‘Kitab al-Hawi fi al-Tib’ of Ibn Sina and ‘Kitab al-Kiliyat fi al-Tib’ of Ibn Rushd, which were translated into different languages and became the main medical books in Europe. In addition, the institutions of awqaf also showed great concern for taking care of animals since many awqaf were created to provide food for the animals and building of hospitals to cure them.

Awqaf institutions reached its peak during the Ottoman Empire, where three-quarters of all arable land had waqf status10. During this time, Sultans and rulers established waqf in different forms for the benefit of the people including building of mosques, building schools to provide education for the mass, building hospitals in order to ensure health care for all and dedicating agricultural lands to provide food for all. Thus, the awqaf system had contributed significantly to employment. It was reported that the ratio of persons employed by the waqf system to those employed directly by the state in Turkey in 1931 was 8.23% to 12.68%.

This motivated many princes, ministers and their wives to establish immovable and movable waqf known as ‘Al-Awqaf al-Salatiyn. Most of the awqaf created were in the form of immovable waqf such as agriculture land and farms; which contained palaces, stables, various types of fruit trees such as grape vines and olive trees, bee hives, livestock and agricultural tools. In addition, these also included buildings such as houses for farmers and their families, shops, stables, small stores and warehouses.

For immovable awqaf in the form of buildings, they are usually of three types: residential houses, government houses and commercial buildings. Residential houses such as houses, beach villas and apartments were used to shelter various categories of people whilst government waqf houses were rented to ministries. Commercial buildings included offices, general stores, pharmacies, clinics, money changers, restaurants, bakeries, hotels, public baths, factories manufacturing a variety of goods and waqf-based mills, which provided people with ground corn and wheat for bread making.

Awqaf in the form of movable assets have also contributed to the betterment of the Muslim societies. For example, movable waqf in the form of animal skins, boats, fishnets, iron mines and money had resulted in trade enhancement and subsequently empowered societies. Movable waqf such as crops and water pipes fed and watered the masses. In addition, revenue generated from these awqaf supported various goods and services including mosques expenditure and financing of elementary schools, secondary schools, universities, hadith schools, Qur’anic schools, libraries and tekyes/Sufi places of worship.

However, towards the end of the 19th century, the role of awqaf deteriorated for various political reasons including colonialism, government interventions and mismanagement; which is beyond the scope of this chapter. Almost all awqaf properties were either left idle, neglected or unproductive and eventually became a burden to governments. This situation forced governments to be responsible in providing all goods and services, a matter which exhausted their budget and ultimately, forced them to borrow with interest. Unfortunately this worsened the situation even more as poverty, disease, illiteracy, poor infrastructure facilities were widespread in almost all Muslim countries. Since then, waqf has declined to the point of being abolished in several Muslim countries.

Role of Waqf in Present Time

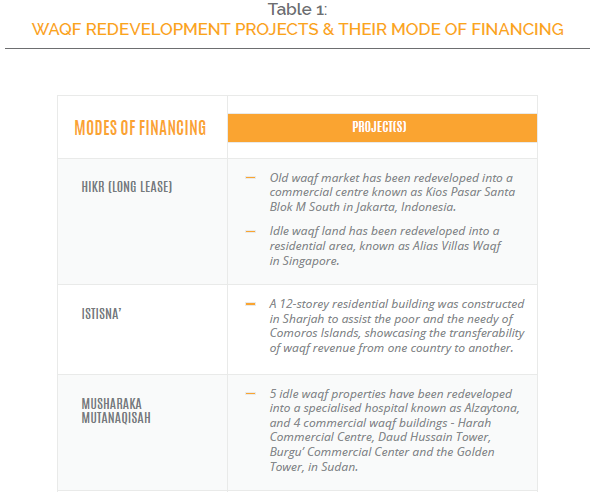

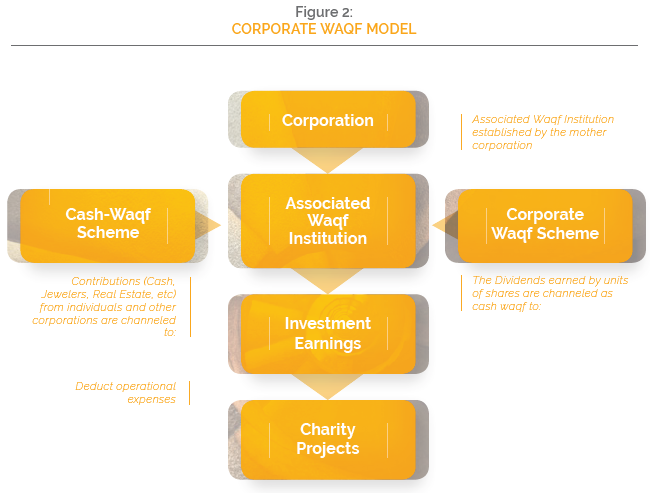

In recent years, there has been an upsurge interest for the resurrection of waqf from Muslim communities around the world including individuals, foundations, financial institutions and governments alike. This was spurred by the realization that waqf is an important resource mobilization mechanism. The recent call for the revival of both immovable and movable waqf signifies optimism in the approach taken to revive the role of waqf. In the case of immovable waqf, its revival was initiated through redeveloping old waqf properties and converting them into income generated properties by means of classical and innovative modes of financing (Table 1).

The revival of the institution of waqf through the creation of movable waqf, i.e. cash waqf has gained widespread popularity in almost all Muslim countries as it offers great potential as a catalyst in socio-economic development and an important engine of economic growth. Although the history of cash waqf can be traced to the Ottoman Empire in the fifteenth century, its use as a financial instrument is indeed a new innovation in Islamic banking. Cash waqf models such as waqf-share, direct cash waqf, corporate waqf and cash waqf deposit have been widely used to finance different developmental projects in addition to humanitarian financing.

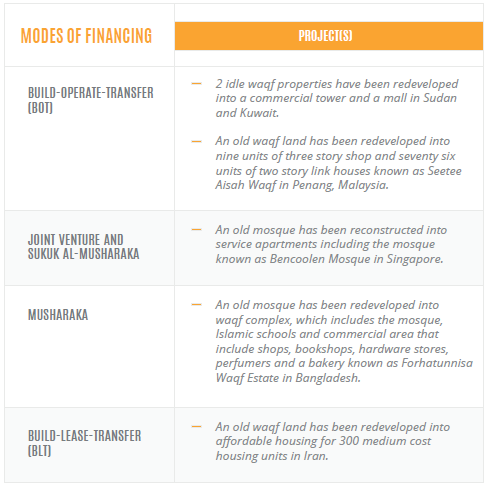

The introduction of waqf-shares as a fundraising effort in many countries have been instrumental in the economic development of Muslims in these countries. In Malaysia, waqf- shares are used to redevelop some of the existing idle waqf lands; finance the construction of buildings for religious activities such as mosques, Islamic centres and religious schools; provide physical amenities to the Muslim community and the maintenance of religious infrastructure; provide scholarship; finance medical facilities; finance commercial development and assist in purchasing vehicles for the use of da’wah (preaching of Islam). In Kuwait, waqf-shares contributed directly to the provision of global humanitarian aids through the establishment of various schemes, which carried different mottos aimed at encouraging people to contribute to the cause (Table 2).

Similarly, in the United Kingdom waqf-shares play an important role in the advancement of Muslims in various social and economic sectors. For example, through Islamic Relief the Waqf Future Fund (WWF) was established for various long-term projects such as Education Waqf scheme, Water and Sanitation Waqf scheme, Orphans Waqf scheme, Qurbani Waqf scheme, Healthcare Waqf scheme, Emergency and Relief Waqf scheme, and Income Generation Waqf scheme.

In the same way, direct cash waqf model has been used to finance various sectors. In Singapore, for example, direct cash waqf is used to finance different needs such as financing the burials of poor Muslims; giving aid to Muslim orphans; giving aid to the Islamic schools and financing other charity projects. In the United Arab Emirates, programmes providing aid to orphans; healthcare; financing the construction of houses and renovation of old mosques have benefitted from this model. In Muslim minority countries like India, direct cash waqf has succeeded in supporting Muslims in different ways. For example, it is used to finance the expenditure of deserving Muslim students; distribution of books and stationeries to poor school children; financing the cost of marriages of poor girls; financing the medical expenses of poor Muslims; giving donations to orphanages and Islamic schools; repairing and maintenance of mosques and Islamic schools all over India; giving monthly allowances to needy widows and poor women and financing their children’s education; and maintenance and support of the mutawallis and their family in case of unforeseen circumstances.

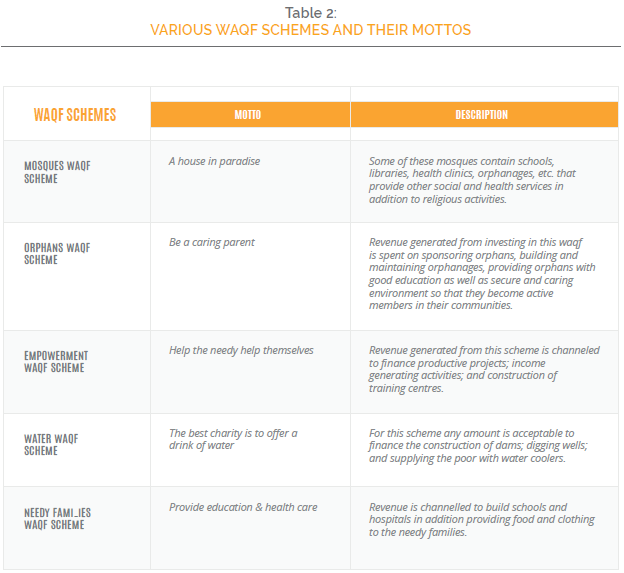

The rise of corporate waqf (see Figure 2.) has provided a new dimension to waqf practices as it combines the dynamics of both the corporation as a business powerhouse and waqf as a virtuous Islamic institution. In India, the establishment of corporate waqf model dates back to 1906 with the incorporation of a family waqf foundation known as Hamdard National Foundation, which later spread to Pakistan and Bangladesh. It played a significant role in the financing of different goods and services including building mosques, schools, libraries, universities, clinics, hospitals, laboratories; providing training programmes and scholarships; promoting research and publication besides; promoting various charities and providing relief to the poor and needy.

Likewise in Turkey, corporate waqf model has been successfully practised by the Sabanci Waqf Foundation. With a clear mission of promoting social development and social awareness among current and future generations, the Foundation has played a significant role in developing Turkish economy through its involvement in philanthropic activities in the areas of education, arts, sports and culture. Sabanci Waqf Foundation has also been directly involved in many charity projects such as financing the construction of mosques and universities; providing scholarships and establishing recognition programmes for students, teachers, artists and athletes.

Unlike in India and Turkey where corporate waqf was established through the creations of family waqf, Malaysia’s corporate waqf – Waqf an-Nur Corporation Berhad, was initiated by the state government of Johor. The success of Waqaf An-Nur Corporation Berhad has been realized in financing various needs such as human capital development projects, charitable projects, entrepreneurial development projects and providing scholarships to the needy. In addition, it also funded the building of mosques, clinics, hospitals and dialysis centers.

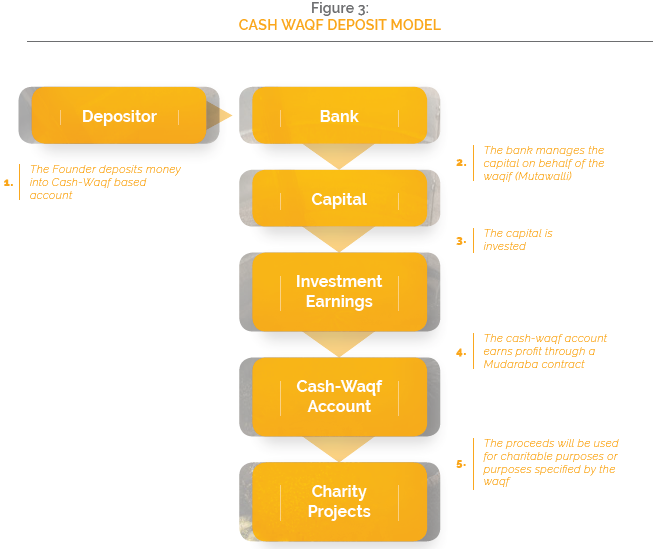

Cash waqf as a bank deposit product has been practiced in Bangladesh by Social Islamic Bank Limited (SIBL) and Islamic Bank Bangladesh Limited (IBBL). SIBL first issued its Cash Waqf Certificate in 1995. Since each certificate is issued in small denomination of Tk. 1000; it became affordable to a large section of the population. IBBL introduced the Mudaraba Waqf Cash Deposit Account in which deposited money is invested and the profit is spent in accordance with the will and wishes of the waqif.

Integration of Waqf in Socio-Economic Development and Future Prospect

The significance of waqf as a philanthropic institution throughout history and in modern economy with regard to social and economic growth cannot be over-emphasized. From employment creation to poverty eradication, microfinance empowerment and infrastructure development; waqf institution has an important role in the provision of public goods and services.

According to the World Bank, 57 members of the Organization of Islamic Cooperation (OIC) are home to one-third of the global population now living in extreme poverty (defined as those living on less than US$1.90 a day). The World Bank estimates that in 21 Muslim countries, fewer than half of the people have access to sanitation, only a handful of Muslim countries are able to provide their people with access to a safe water source and more than 4 infants out of every 100 die before the age of five. Meanwhile in 13 Muslims countries, over 4 out of every 1,000 women giving birth does not live to see her child grow up. Furthermore, most of Muslim-majority countries are generally poorer than other countries on average.

With the current crucial needs in both Muslim majority and minority countries, the integration of waqf in socio-economic development in the Islamic world should take centre stage as an important resource mobilization mechanism. Contribution can be through both immovable and movable waqf in creative and innovate ways. For example contribution in the form of immovable waqf can either be through reviving the old waqf properties or through creating new waqf properties to meet the needs of the current societies. And the contribution to movable waqf, which is in the form of cash and as a fundraising scheme, can either be through regular donations, through salary deduction scheme or on annual basis depending of the founder’s choice. For companies and financial institutions, contributions can be made from their annual profit or dividends as part of their corporate social responsibility.

Waqf in Health Sector

Healthcare is a very important sector in the economy. Much-needed investment needs to be focused not only in commercial healthcare, but also public healthcare for those who cannot afford it. The link between waqf and healthcare goes back to early Islam where hospitals and medical centres in the Islamic world were waqf-based. These institutions gave medical care to the poor and needy, those people who would not otherwise have been able to afford their treatment. In modern times, however, waqf is an underused resource when it comes to funding healthcare.

With the increasing cost of providing health services, the implementation of the waqf fund will assist the preparation of healthcare services that can meet the demands of patients, especially concerning quality and cost, while taking consideration of medical expertise, accommodation, medical centres, treatment costs and medical costs. In Malaysia, for example, Johor Corporation has pioneered waqf system in healthcare and medical services. Through a collaboration with KPJ Healthcare Berhad, Johor Corporation has developed 22 units of Klinik Waqaf An-Nur (KWAN) nationwide and a Waqaf An-Nur Hospital in Pasir Gudang, Johor. The outpatient treatment in KWAN is offered to all levels of the society with a minimum fee of only RM5. As at September 2016, a total of 1,373,403 treatments were carried out through KWANs including 110,730 treatments to non-Muslims. The chain of KWANs is also equipped with 66 dialysis machines.

Waqf in Education Sector

Education is essential to produce a knowledgeable and intellectual society. Hence, there is a strong correlation between education and socioeconomic development. However, the ever-rising costs of education, in particular higher and tertiary education, is a major concern in the pursuit of excellence in educational services. In this regards, the concept of waqf can be applied for education development so as to ensure a more affordable and sustainable education sector in the country. Furthermore, the increased and improved provision of education funded through waqf can enrich the income-earning potential of beneficiaries.

Since the beginning of Islam in the early seventh century, education has been financed by waqf and voluntary contributions. From the perspective of the education sector, cash waqf has evidently proven to play an effective role in helping Islamic education institutions. Al-Azhar University in Cairo, which was founded in 972, is perhaps the most successful application of waqf in education and arguably the oldest waqf establishment. The Al-Azhar operational model combines economic waqf with education waqf to make its education facilities and services more accessible. Al-Azhar endowments provided stipends for scholars as well as free education, lodging, and daily bread rations for thousands of students.

In recent years, various models have been proposed on the application of the waqf concept for education development and the provision of education facilities that is more affordable and sustainable in the long run. In Malaysia, for example, the Ministry of Higher Education (MoHE) has highlighted waqf as one of the ten shifts in Malaysian Education Blueprint 2015-2025 (Higher Education). Additionally, MoHE launched the “University Transformation Programme” (UniTP) Purple Book specifically focusing on enhancing university revenue generation through waqf. The Purple Book highlights three possible waqf governance models to be adopted in public universities in the country, which the universities can choose depending their level of readiness and the state religious council.

Waqf in Agricultural Sector

During the Islamic civilization, waqf played a vital role in enhancing the agriculture sector and feeding the mass as one third of the agricultural land was under waqf. Linking waqf institutions to the agriculture sector through channeling of funds to buy farming equipment and machinery would result in the empowerment of poor farmers and the less privileged. Besides job opportunities, the link would also widen the accessibility of the less privileged to good quality food.

Waqf also has a great potential to be used as one of the Islamic instruments in activating idle agricultural land and thus shape the structure of Islamic agricultural finance. Agriculture waqf can be in the form of profit sharing with the farmers who cultivate the land. Creating both immovable and movable waqf will increase the agriculture products in rural and urban areas and hence enhance the agricultural sector in different ways through creating jobs for the farmers, sheltering the farmer’s family, acting as an engine for industrial and service sectors, enhancing exports and promoting agribusiness activities, ensuring self-sufficient in food and provide food security for all.

Waqf in Infrastructure Sector

Most of the world poverty resides in Africa and Asia, and the bulk of Muslim-majority countries are located in these continents. Thus, in a largely income-poor Muslim world, there is an enormous need for development spending and infrastructure. The institution of waqf provides a useful vehicle that serves all socio-economic sectors such as buildings of roads, railways, transportation facilities, supplying water and providing shelter. Hence, an infrastructure waqf can be established specifically for the purpose of providing basic facilities and services required for the development and growth of a society or country.

As discussed in the earlier section of this chapter, waqf played a vital role in enhancing the basic infrastructure sector during the Islamic civilization to include creation of building to shelter the mass, digging of wells to provide water for the mass and constructing highways to facilitate traveling. Similarly, in contemporary times, residential towers can be constructed on idle waqf land to shelter the masses. Moreover, huge funds can be collected from the creation of cash waqf to finance the construction of residential areas in rural areas to shelter the poor and needy. With reference to the transportation sector, financial institutions and governments can issue waqf sukuk to construct highways, roads and railways for easier transport from agricultural and industrial areas to the marketplace.

Waqf in Tourism Sector

Tourism is one of the important sectors that has a great impact on the economic development of a country. Having said that, waqf has played a vital role in enhancing the tourism sector through the current revival of idle waqf properties. Waqf can be established by financing the redevelopment of idle waqf lands into complex tourist area that includes hotels and guest houses, which in turn will enhance the Islamic tourism sector and support the different types of tourism visitations such as health tourism.

Conclusion

The historical creation of waqf and the recent revival of waqf properties shows an endless role of waqf based on its perpetual nature that makes it a significant vehicle for socio-economic development. Some Muslim countries have been successful in institutionalizing waqf resources for the greater welfare of the community. Although waqf in these countries are administered by their respective laws and regulations, there is a need to reform and modernize the institution of waqf so as to achieve its full potential in socio and economic development.