The global halal industry is currently growing at 8% year-on-year and valued at US$3.2 trillion (excluding Islamic finance). Assuming that this growth trend continues, the value of the halal economy is expected to reach US$13.11 trillion by 2025. The growth outlook reflects how halal economy has over the years established itself within the global economic system, which is driven primarily by fast-growing global Muslim demographics. According to a study by the Pew Research, the global Muslim population is expected to rise from 1.8 billion in 2015 to 2.2 billion by 2030 – rising by 26.4%. As Muslim population is projected to grow twice the rate of non-Muslims over the next two decades, Muslim demographic is increasingly influential in shaping market demands. The global halal market is not confined to food only, but encompasses the entire value chain – from production and manufacturing to shipping, logistics, export and retail. With the rise of affluent middle-class Muslim consumers worldwide, the halal industry has expanded into lifestyle offerings including modest fashion, cosmetics, halal travel and hospitality services. Two notable phenomena that have triggered this development are change in the Muslim consumers mindset and rise of ethical consumerism worldwide.

The Halal Concept

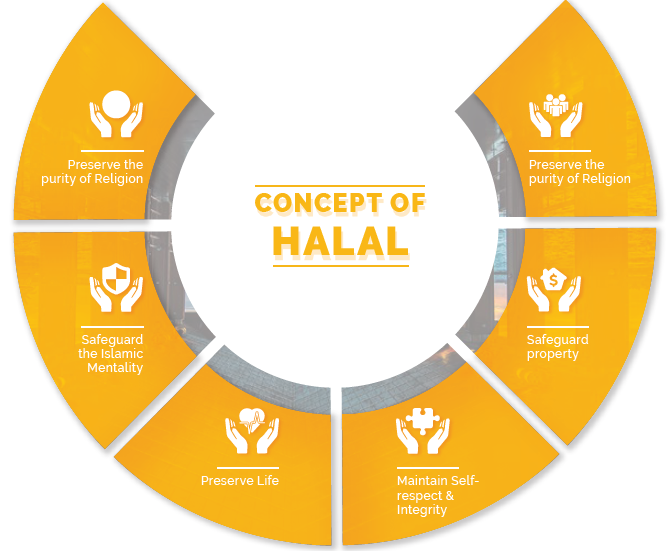

Halal is now a universal concept although the term “halal” used exclusively in Islam means permitted or lawful in accordance to Shari’a. The concept of halal is an essential way of life for Muslims and provides a framework to assess the “Dos and Don’ts” applicable to all facets of life. Hence, halal covers all spectrums of their lives to include food and beverages, cosmetics, travel and tourism, pharmaceuticals, media and recreation, logistics, fashion, business and financial services. Within the economic context, halal refers to business conducted in a manner deemed permissible in Islam. But when halal is used in relation to food preparation and consumption, it refers to food which is in compliance with Shari’a. Muslims are supposed to live the life following aspects of halal; abiding to its philosophy of self-discipline, integrity and cleanliness. The concept of halal in Islam has very specific motives, which includes:

To preserve the purity of religion

To safeguard the Islamic mentality

To preserve lifeTo safeguard property

To safeguard future generations

To maintain self-respect and integrity.

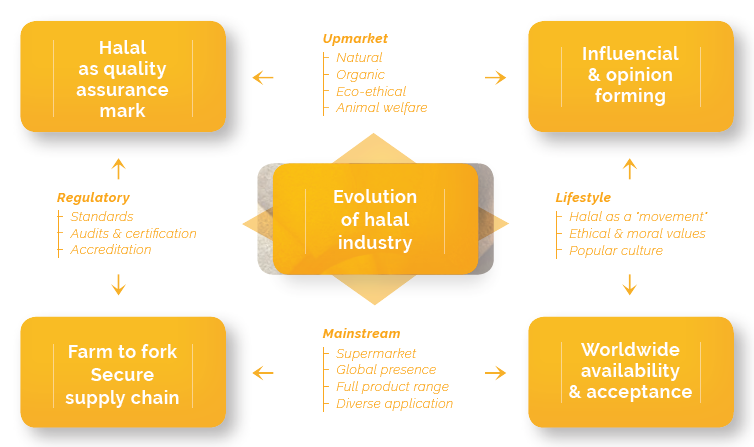

The concept of halal has changed in line with the emergence of a new Muslim lifestyle to extend beyond mere religious obligations or observations. Today, the concept of halal is fast expanding into non-traditional areas such as fashion, hospitality, travel and media. The values promoted by halal-social responsibility, stewardship of the earth, economic and social justice, animal welfare and ethical investment – have gathered interest beyond its religious compliance. More and more consumers (including non-Muslims) are increasingly conscious on environmental responsibility and health issues; attaching importance to food safety, health, naturalness and ethical issues like sustainability, animal or environmental friendliness in the products they consume.

Halal has become a global symbol for safety, hygiene and quality assurance. This is evident by the participation and involvement of non-Muslim countries and organizations who are fast catching the halal wave by playing a major part in the production of halal products. Many Western countries have now recognized the emerging global trend in consumerism towards halal products and services and view halal as an important value proposition that can potentially contribute to their respective economies.

For example, Australia and Brazil are the biggest exporters of halal meat. The popularity of, and demand for, halal certified products among non-Muslim consumers have been on the rise as more consumers are looking for high-quality, safe and ethical products. The emerging and significant halal food markets that are developing in the UK, Europe and across the US reflect the international appeal of halal products. With the halal industry now expanding well beyond the food sector, this has further widened the economic potentials for halal products and services.

Halal Ecosystem

The halal market has now expanded and evolved into an end to end halal-ecosystem that consists of various infrastructure components such as dedicated industrial areas, testing laboratories, research institutes, knowledge reference centers, policies, incentives, financing instruments, standards, certification systems and human capital development programmes. The halal ecosystem can be defined as a dynamic system that encompasses complex network of business and institutions comprising of components of production, services, infrastructure, government support and human capital. An integral part of the ecosystem is quality control, standardization and certification. But as halal standards are set by the respective religious authorities of a particular country, they vary across different countries.

In order to ensure a comprehensive and efficient halal ecosystem; more emphasis must be placed on areas such as research and development, innovation, human capital development, government support mechanisms, as well as Islamic banking and finance to develop a seamless point-to-point halal supply chain. Within the ecosystem, government agencies and the academic community have an important role as promoters of innovation.

Current State & Development

The two largest economic pillar of the halal economy is Islamic finance and halal food, accounting for 52% and 30% of total expenditure, respectively.1 However, other sectors within halal economy such as modest fashion, tourism, pharmaceuticals, media and cosmetics are catching up; fuelled by demand in Asia Pacific, which has the highest market share in terms of revenue. With increasing Muslim population and growing consumer awareness on halal; Pakistan, Indonesia, Malaysia, Singapore and India are expected to drive the market. Total halal market spending was estimated at US$2,006 billion in 2016 and is expected to reach US3,081 billion in 2022.2 The growth of halal industry based on market spending in 2015, 2016 and extrapolation for 2022 is illustrated in the following chart.3 The chart clearly illustrates that consumption of halal products and services is on the rise and will become a powerful market force across global markets. By the year 2022, halal market spending is expected to increase from 11.9% in 2016 to 13.5% of total market spending.

The halal industry possesses a huge potential to make it big in the world economy today. The industry is now an important contributor to the GDP’s of Muslim and non-Muslim countries such as Australia, Brazil, China, the UK, the US and many more. The global market value of halal products in 2016 was US$45.3 billion and is expected to reach US$58.3 billion in 2020.4 In recent years, more non-Muslim countries such as China, Thailand, Korea and Japan are looking for opportunities to export and improve their products in the halal industry. Meanwhile, Australia and Brazil have built their entire food-based industries to be the main suppliers of halal food to the Middle Eastern markets. While leading players in halal industry are the United Arab Emirates (UAE) and Malaysia.

China

Although a relatively small player, accounting for only 0.1% of global halal food exports5, China is seeking to enhance its global presence in the halal food industry. For instance, China’s investment in the One Belt One Road initiative is expected to accelerate the growth of the global halal consumption, as it will reduce the cost of mass production and overland transport costs across Europe, Middle East, Africa and Asia – the world’s largest halal market. Aimed at recreating the Silk Road routes (land and maritime), China has sought opportunities for halal trade with Muslim and Arab countries through bilateral trade agreements. For example, in Linxia city located in the Gansu province; several companies have struck trade agreements with Turkey and Kazakhstan to export manufactured food products. China has also created infrastructure to support the halal trade, including the construction of halal food and Muslim supplies manufacturing hubs such as the Wuzhong Halal industrial park, which has attracted 218 companies. China also has a strong domestic demand for halal foods, estimated at US$21 billion coming from its 26 million Muslim consumers. With the establishment of halal industrial parks, and a certification scheme in the country; China has the potential to become a major player in the global halal food industry.

Japan

The halal movement in Japan has been gaining traction in recent years as the country responds to the exponential growth of Muslim travelers to Japan, particularly from Southeast Asia. In 2016 alone, more than 394,000 Malaysians visited Japan and some 271,000 Indonesians had travelled to the country.6 Japan as a tourist attraction has gained similar interest from the UAE and other Middle Eastern countries. Further heightened by the upcoming Olympics 2020 that Japan is set to host, the demand for a strong and reliable halal infrastructure has become a relevant issue and the government is now looking at ways to cater to the growing demand for halal products, especially in terms of food, accommodation and services. To aid the industry’s growth, the Japanese government has provided small businesses with subsidies that would help them offer halal products and services and obtain necessary certifications.

South Korea South Korea is looking to tap the burgeoning halal tourism industry as the government sets to diversify its tourism industry that has been long dependent on Chinese and Taiwanese tourists. The number of Muslim tourists visiting Korea has been increasing over the years, from 540,000 in 2012 to 980,000 in 2016,7 and is projected to reach 1.2 million in 2019. Many of them are majority-Muslim countries like Indonesia, Malaysia and the Middle East. Despite being home to only 150,000 Muslims, its halal-related food exports have grown rapidly over the past decade, with exports to Organization of Islamic Cooperation (OIC) countries rising from US$795 million in 2012 to US$864 million in 2014.8 At present, 299 Korean companies have received halal certification so far, with most of them earning domestic certification from the Korea Muslim Federation (KMF) and some from Asian countries with significant Muslim populations such as Singapore, Malaysia and Indonesia.9 In efforts to boost halal tourism in the country, the government announced plans to expand services to Muslim visitors. For example, the Korea Tourism Organization said it would boost the number of restaurants for Muslims from 135 to 170 in 2017. The Korean government has expanded its scale of support for the cost of halal certification, from KRW 117 million in 2013 to KRW 2 billion in 2016 (Figure 1).

Thailand

Thailand, one of the world’s largest halal producers, has formulated a 5-year plan (2016-2020) to position the country as one of the top five exporters of halal products and services in the world. At present, Thailand’s halal food export is valued at about US$5.7 billion.10 The growth of the domestic halal food market is registered at about 20% a year with more than 8,000 companies involved in halal food production. To accelerate the development of the halal industry, a total of US$224.2 billion is being invested with US$93.3 billion allocated to the Ministry of Industry and other organizations to drive development especially in obtaining halal certification for more Thai products and strengthening the industry through more research and development. In 2016, a total of US$11.5 million was allocated to various organizations in Thailand to carry out projects to develop and enhance halal businesses. Emphasis is also placed on developing sufficient, high-quality raw materials for use in the manufacturing of halal products and adding value to halal exports. In a push to strengthen Thailand’s position in the global halal industry, the government introduced the ‘Thailand Diamond Halal’ brand, under which all halal products and services sourced in Thailand will be marketed and exported. Under this brand, Thailand hopes to boost its halal exports locally, regionally and globally.

Thailand’s venture into halal business started in 1997. Since then Thailand has developed several key strategies to further strengthen the country’s halal industry, particularly in meeting world standards, promoting competitiveness of entrepreneurs, increasing capability in halal certification and formulating standards, and upgrading research and development. The establishment of the Halal Standard Institute of Thailand (in 2002), and the Halal Science Centre (in 2003) demonstrate the government’s commitment in establishing Thailand as a recognized halal center of excellence in science and testing. Meanwhile, the first halal standard, mainly for food products, was developed in 2007 and is now being expanded to cover other sectors. To further position Thailand as a halal food hub and a center for halal tourism, the southern border provinces comprising of Satun, Songkhla, Yala, Pattani, and Narathiwat are being developed as major production bases for halal products in Asia, linking Thailand with other Muslim countries in the ASEAN region.

Russia

The halal market in Russia has expanded tremendously with the segment seeing more than a 100% growth in size in 2017. The domestic halal food sector is estimated at US$35 billion with growth between 30% and 40% annually. This is driven primarily by the over 20 million Muslims making Russia their home and greater awareness of the necessity to consume only halal products. Similar with many other halal-producing countries, meat is one of the halal market’s key drivers. It is estimated that about 1.3 million tons of halal meat is produced annually in Russia and the sales of halal meat is expected to grow at an average rate of 15-20% per year to reach about US$1.1 billion by 2026.12 Growth is also supported by the increasing number of businesses registered to produce halal meat together with greater popularity of halal products amongst non-Muslim consumers who perceive them to be of better quality products. There are over 200 certified producers in the country, with certification awarded by the International Centre for Halal Standardization and Certification of the Russian Mufti Council.

Australia

Australia is a world leader in the processing and preparation of halal meat and meat products. It exports halal meat to over 100 countries including the US, UAE, Indo- nesia, Malaysia, Saudi Arabia, Singapore, Bahrain and Egypt. Australia’s exports about US$13 billion halal food of which about US$2.36 billion worth of halal meat is exported to OIC countries. Saudi Arabia, for example, imports about 17% of its beef and 62% of its sheep meat from Australia. However, the industry suffered a setback in 2014 when a social media campaign to name and shame halal-certified companies escalated and ultimately forced a number of companies to ditch its halal certification. It was claimed that halal certification pushes up prices and alleged that the money goes towards funding terrorism. The Boycott Halal movement took on further resonance when it sparked parliamentary inquiry into halal food. In 2015, the Senate Economics References Committee noted in a report on third party certification of food that ‘evidence received by the committee overwhelmingly suggests that Halal certification does not result in increased food prices’. The report also found no evidence of any direct link between halal certification in Australia and terrorism funding.

Indonesia

The halal industry in Indonesia is expected to witness significant growth owing to rising Muslim population along with large untapped potential. Indonesia is home to about 220 million Muslims or 13% of the world’s Muslims, making the country a potential market for halal products. In 2016, Indonesia’s halal food market was valued at US$169.7 billion.13 Despite its status as the world’s most populous Muslim country, Indonesia has yet to fully develop its halal industry and lags behind other Muslim-majority countries in creating an ecosystem that supports Islamic economy. In a recent development, the Religious Affairs Ministry established the Halal Products Certification Agency (BPJPH) in 2017 as the sole halal certification body under the Law No. 33/2014 on Halal Product Assurance. The establishment of the agency ends the Indonesian Ulama Council (MUI’s) authority to administer halal certificates. However, MUI will continue to play a role in the halal certification process by providing religious decrees to determine the halal status of a product. Such decrees must be submitted to the BPJPH as the basis for the issuance of a halal certificate. The Law No. 33/2014 on Halal Product Assurance also requires all food, pharmaceutical, and cosmetic products that are consumed in Indonesia to be halal-certified and labelled by October 2019. The objective of the law is to assure the security, safety and certainty of the available halal products for public consumption and utilization.

Brazil

Brazil has carved a niche for itself in the halal market. The country is one of the largest suppliers of halal products to the GCC including corn, meat and sugar. Brazil’s halal trade and exports to OIC countries is estimated at US$16 billion. About 40% of beef produced in Brazil are exported to Arab countries with the three biggest importer of Brazilian beef are Egypt (US$479.5 million), Saudi Arabia (US$161 million) and UAE (US$88.1 million).14 Brazil is not only the biggest exporter, but also the world’s leading halal poultry-producing country. The biggest buyers of poultry products from Brazil are Middle Eastern countries. In 2017, a total of 1.326 million tonnes were shipped to the region, which is 34% of total exports. Saudi Arabia topped the list at 542,000 tonnes purchased (13.8% of total sales from Brazil). This was followed by the UAE at 230,000 tonnes (5.9%); Egypt at 138,000 tonnes (3.5%); Iraq at 108,000 tonnes (2.8%) and Kuwait at 106,000 tonnes (2.7%). Even though the Middle East remains the biggest importer of poultry from Brazil, its imports slid by 5% in 2017 due to the hike in the local import tax, which moved up from 5% to 20%. Brazil’s halal industry took a hit in 2017 from a food safety scandal over alleged bribery of health officials to forgo inspections and overlook practices including processing rotten meat. Allegations also included falsification of documentation for exports to Europe, China and the Middle East by meatpackers. The scandal triggered bans on Brazilian meat exports.

United Arab Emirates

The United Arab Emirates (UAE) is aiming to become a global leader in the halal industry and has taken pioneering steps towards this end. The UAE’s halal import bill is estimated at US$20 billion, which is 40% of the GCC’s halal imports.15 As a strategic hub for halal products between the East and the West, UAE processed halal food products weighing a total of 16 million tonnes, where a sizeable proportion is exported and re-exported abroad. Food is the second biggest sector in the UAE, with total food sales in 2016 at US$329 billion. Due to a rising consumer base and growth in income, food consumption is forecasted to rise from 48.1 million tonnes in 2016 to 59.2 million tonnes by 2021. The UAE is also home to 5,000 importers, manufacturers and stockiest of halal products. In 2013, the Dubai government announced its ambition to become the capital of the global Islamic economy, which it plans to achieve by maximizing UAE’s position as a significant food importer and Dubai as a trade hub.

As part of its initiative to further promote halal products and services across Asia, Europe and Africa; Dubai Food Park signed a Dh1.35 billion agreement in 2017 to establish a UAE-China food industrial cluster in a bid to enhance the emirate’s competitiveness as the region’s leading hub in the food sector. This 4.38-million-square-foot Food Industrial Cluster will be home to 30 food plants, including two Chinese catering companies and two advanced manufacturing plants for food packaging materials. 2017 also saw the launched of a refreshed Islamic economy strategy (2017-2021) by Dubai Islamic Economy Development Centre (DIEDC) that focuses on identifying new key performance indicators (KPIs) for monitoring the growth of three core Islamic economy sectors – Islamic finance, halal products, and Islamic lifestyle encompassing culture, art, fashion and family tourism. Knowledge, standards and digital Islamic economy will serve as cornerstones to support these sectors.

United Kingdom

The halal market already plays a crucial role in the UK with some £31.5 billion being spent by UK consumers on halal food products.16 This growing market segment is now channelled through product ranges in supermarkets. A number of factors underpin this development, including an increase in the Muslim population, changes in consumer behaviour, identity reinforcement, and a general increase in meat consumption. The UK, which is home to around 3 million Muslims, is fuelling some innovative consumer trends in the halal domain. For example, modest fashion industry is a thriving industry in the UK as evident by the success of home grown brands such as Aab and Haute Elan as well as the launched of London’s first Modest Fashion Week in February 2017. Halal tourism in the UK has also been growing year-on-year. In 2014, Muslim tourists spend an estimated $3.3 billion in the UK.

Europe

The European halal market has been growing an average of 15% per annum while its halal food market is forecasted to grow at a CAGR of 13.91% during the period 2016-2020.17 Initially, ethnic stores constituted the major retail outlet for halal meat across Europe, but in recent years halal labelled meat and meat products are increasingly available in supermarkets and fast food restaurants. Strong demand for halal goods and services is the direct result of the growing Muslim population in Europe due to a surge in migration flows from majority-Muslim countries to Western Europe and favorable demographic dynamics of Muslim populations in Europe.

Malaysia

Malaysia continues to spearhead the global halal industry after being the first country to set a standard regulation for halal products in 1974. Since then Malaysia has developed one of the most comprehensive halal ecosystems that is equipped with comprehensive and proactive policies as well as frameworks to develop the halal industry. In line with its aspirations of becoming the world’s premier halal hub, the Halal Industry Development Master Plan (2008-2020) was introduced aimed at driving halal as a new source of economic growth. The country’s halal industry, which recorded a growth rate of 5% to 6% at the end of 2017, is projected to reach US$13 billion in trade exports by 2020. In 2016, Malaysia’s export of halal products amounted to US$11 billion with the main export items were food and beverage, followed by halal ingredients and palm oil derivatives. By 2020, the country’s halal exports are projected to contribute 8.7% to gross domestic product. To further cement its position as a global halal hub, Malaysia has developed a system to fully integrate online registration and management system. Introduced in 2017, the Malaysia International Halal Authorities and Bodies System (MyIHAB) is a fully centralized database under the Malaysian Islamic Development Department (Jakim)’s Halal Ecosystem Solution. It is said to be the first of its kind.

Key Drivers of Growth

Several factors are driving global growth of the halal industry. The main driver is the sizeable and growing Muslim population. The global Muslim population is expected to rise from 1.7 billion in 2014 to 2.2 billion by 2030, making up 26% of global population.18 This sheer size of demography has created universal appeal for the development of halal market. This coupled with the growing awareness among Muslims in ensuring that they consume halal products is increasingly driving lifestyle and business practices, which will ultimately further propel the demand for halal products and services. In recent years, non-Muslims are becoming more sensitive toward the hygienic foods for consumption and are increasingly expecting more stringent safety and quality guarantees in terms of food products. As a result, appetite for halal products among non-Muslim consumers have been on the rise as more consumers are looking for high-quality, safe and ethical products. In Europe and the US, halal occupies a small, but rapidly growing niche with huge potential. The increasing consumer appetite for halal products and services has resulted in the rapid development in consumer goods and retail services sectors. Demographics of Muslim consumers have drastically shifted from low to middle class due to improvements in economic conditions of Muslim countries. Based on the latest IMF growth projections as at April 2016, members of the OIC countries reported a GDP of US$17 trillion in 2015 and is expected to have an average projected growth of 4.19% compared to the rest of the world’s GDP growth between 2015 and 2021.19 Such economic development has led to an increase in the purchasing power and income levels of people in the Muslim countries. For example, disposable income of countries with the top five biggest Muslim-populations such as Indonesia and Pakistan have grown by 257%. The rising middle classes with higher disposable income are fuelling demand for new and differentiated halal products including halal tourism, modest fashion and halal cosmetics. Lifestyle changes of Muslims, especially in the young demographic of the Muslim countries, are being reflected in changes in their shop- ping habits and dietary habit. The participation of global multinationals has further spurred the development of halal economy and given halal brand a global appeal and credibility. Multinationals such as Unilever and Nestlé have aggressively expanded their halal-certified product lines. To date, Nestle is the biggest halal food producer manufacturer in the halal sector with annual sales of more than US$6 billion.

Halal Food

The global halal foods market was valued at US$436.8 billion in 2016 and is estimated to reach US$739.59 billion by 2025. Increasing Muslim population and their substantially increasing expenditure on food and non-beverages are considered as the main driving force of this market with Asia Pacific and Middle East Asia contributing to the growth of the global market. Rising concerns over health and hygiene are influencing consumption patterns of consumers. The health and hygiene benefits associated with halal foods are increasing the acceptance level and the demand for halal foods among non-Muslims.20 As the global market for halal foods grows, there will be increasing demand from countries that do not have the means to produce sufficient quantities for their own halal food consumption.

The halal food space is a global value chain and leading prayers are from OIC and non-OIC countries. Australia, Brazil, Canada, France, New Zealand and the US are the biggest halal suppliers in the West. In the East, countries like Malaysia, Indonesia, Thailand, Philippines, India and Singapore are the leading halal product suppliers to the world. One of the latest trends that has gained traction in the halal food market is the increased demand for convenience food. This comes with improvement in the living standards, lifestyles, and disposable incomes of consumers in Muslim countries. Hence, increased acceptance of pre-cooked items are expected to fuel growth in the medium term. Awareness of the relationship between diet and health, on the one hand, and the need for processed convenience foods, on the other, have given rise to new subsectors of the food market that have their counterparts in the halal market.

One of the biggest trade barriers facing the halal food economy is the variety of standards adopted by countries, certification bodies and groups of people. This issue has been discussed in all halal-related conferences and international events since long, but it seems no one has yet to come with a real solution that can be followed by the whole world. Recently, some initiatives have been adopted to resolve this issue. Finding out a clear common route should be followed to unify the standards or at least bring them closer. It is noteworthy to say that Malaysia has the upper hand in developing and implementing one of the first halal standards as a Muslim country. The Malaysian standards MS1500:2009, concerning halal food in Malay- sia, is particularly significant because it was the first halal-related standard to appear among MABIMS-member countries (Malaysia, Brunei, Indonesia, Singapore) and it is the only one to achieve ISO compliance. The first Malaysian halal food standard (MS1500:2000) was published in the year 2000 and revised four years later, which was formally recognized as MS1500:2004. Another issue faced by the halal food sector is lack of halal raw material and ingredients. By default, and due to the lack of resources in Muslim countries, most of the ingredients and raw materials are imported from western countries, where the concept of halal is not practiced.

Halal Fashion

Today, Muslim fashion is a profitable global industry. The rise of the new generation of millennial Muslimah has led to the rapid development of a burgeoning market for halal fashion. These consumers prefer to shop online and are driving the e-commerce for halal segment. In 2016, OIC countries accounted for 8.1% of total value sales of apparel and footwear.

This figure is forecasted to rise to 9.1% by 2018 (Figure 3). The global expenditure of Muslim consumers on clothing and footwear sector grew 4% in 2016 to reach US$254 billion (11% of global expenditure) in 2016 from US$243 billion the year before. Meanwhile, expenditure on halal fashion alone is forecasted to grow to US$373 billion by 2022 with CAGR of 7% from 2016. The size of market and growth of halal fashion has led many of the global fashion brands such as H&M, Uniqlo and Nike to introduce modest fashion lines as they wake up to the tremendous opportunities of the worldwide Muslim market. For example, Nike announced their interest to venture into the sports hijab line. Other brands such as DKNY, Tommy Hilfiger, Zara, Oscar de la Renta and Mango have brought out special collections of modest wear during Ramadan in recent years. These brands are riding the wave of a phenomenon called “modest wear” that is sweeping the world. Modest wear aligns with contemporary fashion but is geared to the needs of Muslim women, offering style and diversity. The kick-start of Istanbul Modest Fashion Week, London Modest Fashion Week and Singapore Modest Fashion Week has helped modest fashion to boom.

Halal Pharmaceuticals

Increasing awareness among Muslims regarding health and medicines as well as rising purchasing power parity of Muslims worldwide are paving the way for growth in the halal pharmaceutical industry. In 2016, the industry was valued at US$83 billion, representing a 6% growth compared to 2015. Growth is expected to register a 8% year-on-year to reach US$132 billion by 2022. However, the industry is shrouded in ambiguity over certification and compliance factors. The development of the world’s first halal pharmaceuticals standard according to ISO guidelines – the MS2424: 2012 Halal Pharmaceuticals General Guidelines by the Department of Standards Malaysia has served as a reference for the pharmaceutical industry. The global halal pharmaceuticals market is concentrated in Middle East, North Africa, and Asia Pacific, which is home to over 70% of world’s Muslim population. The three leading countries in the halal pharmaceutical markets are Malaysia, Indonesia, and Singapore with Malaysia being one of the most lucrative markets in terms of production of halal medicines and consumption. Malaysia is set to propel itself as a global halal hub with plans to develop a halal-vaccine manufacturing center in 2018.

Halal Cosmetics

Halal cosmetics, personal care and beauty products are taking off and are seen as the next emerging sector. Muslims spending on cosmetics increased to US$57 billion in 2016 from US$56 billion in 2015 (7.3% of global expenditure), and is expected to reach US$82 billion by 2022. The rising demand for halal cosmetics is attributed to higher awareness among Muslims on the ingredients used in cosmetic and personal care formulations. Concerned about the halal aspects of the ingredients used in these products is pushing the mainstream beauty-care industry to also concentrate on product offerings that are halal-certified. To the extent, consumers are willing to pay a premium price for these goods keeping in view of ethical beliefs. These driving factors are not exclusively to Muslims only as they are associated with ethical consumerism and can appeal to all races and religions. Countries such as Malaysia, Thailand, and Indonesia offer tremendous opportunities for growth as a result of Islam being a predominant sect as well as the simultaneous socio-economic growth of individuals. Malaysia and Indonesia together accounted for nearly 60% of the Asia Pacific revenue in 2016, with skincare and makeup being the dominant products consumed.

Halal Tourism & Hospitality

The halal travel segment is gaining popularity and is becoming a fast-growing segment within the halal economy space. The global Muslim spending on halal tourism (excluding hajj and umrah) increased to US$169 billion in 2016 from US$151 billion in 2015, representing a 11.8% of global expenditure. Muslim spending on halal tourism is expected to reach US$283 billion by 2022, which is about 14% of global expenditure with a CAGR of 9%. Among the top source regions of Muslim tourist based on 2016 expenditure were Saudi Arabia (US$20.4 billion), the UAE (US$15.8 billion), Qatar (US$12.4 billion), Kuwait (US$9.6 billion), Indonesia (US$9.7 billion) and Iran (US$7.4 billion). Globally, halal travelers are anticipated to spend around US$155 billion in 2017, and this figure is expected to reach a staggering US$220 billion by 2020 and US$300 billion by 2026, respectively.22 In recent years, we have seen strong growth in halal tourism within the Asian region. This growth is driven by the increased pres- sure to diversify their visitor arrivals as well as the number of international sports events scheduled to take place in Korea (Winter Olympics in 2018) and Japan (Tokyo Olympics in 2020). This development has resulted in the acceleration of improved halal-friendly services that will benefit travelers and the overall growth of the industry.

Halal Media & Recreation

Halal media and recreation can be defined as Islamic themed media that portrays Islamic values. There is a misconception that halal media is limited to religious education media only. Today halal media includes, but is not limited to, entertainment products such as Islamic music, news, videos and comic books aligned with the taste and needs of modern Muslims. There have been great advancements in Islamic digital content due to technology development, ease of internet access, online content and video publishing platforms such as YouTube, which has collectively contributed to the remarkable growth of the global Islamic media and recreation market. In 2016, the combined spending of Muslims around the globe on media and recreation grew by 5% to reach US$198 billion, representing 5.2% of total global spending in the industry.23 Estimates are that by 2022, Muslims expenditure on media and recreation will reach US$281 billion, making up 5.7% of global expenditure. The compounded annual growth rate is estimated at 6% from 2016 to 2022. It is projected that demand will continue to grow with particular increase in production of TV shows, music, books, films, videogames and mobile apps that reflect and observe the Muslim cultural and religious values. Demand will be more in Western countries with large Muslim populations followed by OIC member countries and Asia. With Muslim spending on media and entertainment growing year-on-year, the halal media and recreation sector will continue to attract investment on the back of a young and diverse Muslim population.

Islamic Finance

Islamic finance sector, the leading sector in Islamic economy, offers financial products and services that are in compliance with Islamic law. Here, Islamic banks play a major role in meeting the funding and banking needs of the halal industries for further growth and expansion. For halal industries, the provision and availability of Islamic financing is of paramount importance to support their daily operations by providing ethical financing. This is also beneficial for Islamic financial institutions as they have an opportunity to encourage halal companies to utilize Islamic financing facilities and achieve a wholly integrated Shari’a-compliant status. Halal industries in all sectors have various financial needs such as trade finance, risk management, liquidity management, working capital needs, and other corporate financing solutions. Islamic finance has the opportunity to provide suitable financing requirements throughout the value chain within the halal economy.

Halal Certification

Certification of halal goods and services through a mark or logo is essential for consumer to easily segregate the halal and non-halal goods or services. The certification is a stamp of approval and builds trust amongst consumers; which signifies wholesomeness, safety and high quality by ensuring rigorous controls and checks throughout the supply chain. Halal certificates are generally issued by a designated certification body for a fee and differs from country to country. For the issuance of halal certificates, countries such as Malaysia and other Southeast Asian countries appoint a sole religious authority to assure the certificates’ authenticity. Unlike in non-majority Muslim countries such as in Europe, the issuance of halal certification in these countries is performed by non-governmental organizations (NGOs). The lack of a global halal standard is creating a challenge for expansion of domestic halal industry to expand into overseas market and may cause confusion amongst the consumers. At present, each country has its own halal standard and may have reservations in accepting the halal accreditation of another country. For instance, Indonesia has 40 approved halal certification bodies, while the GCC countries have 52 such agencies. International halal organizations are calling for a single certification body that would unify standards and bring about awareness and training on proper halal methods.

Conclusion

The halal industry is huge, diversified and expanding from halal food to Islamic banking, serving end-to-end needs with universal appeal. There have been global interest and various initiatives taken by governments of the OIC and non-OIC countries to strengthen the halal industry further as there is huge potential market with high growth and profitability rate. The establishment of a halal ecosystem can further provide major opportunities for producers and marketers across the globe. This includes setting up of a halal ecosystem supported by proper halal certification system, infrastructure, tax incentives and human capital development programme. The implementation of a halal ecosystem would not only help in establishing the halal industry, but also bring efficiency and welfare to consumers and promote ethical and environmental-friendly products and services.

However, the global halal ecosystem is currently fragmented with differing schools of thought, halal standards and certifications. For the halal market to reach its full capacity to serve the benefit of Muslims and non-Muslims alike; we need to bring these differences to a common ground and harmonies the various halal standards. This requires industry experts and thought leaders to bring forth transformational knowledge and new ideas to innovate, evolve and drive the halal ecosystem forward. As we step into the next phase of growth in the halal industry, there needs to be more sophistication in the halal narrative to moderate the issues and challenges in the halal ecosystem.